13+ Company Financial Analysis Templates – PDF

It would be hard to argue that money is the cornerstone of all business operations. You’re in business because you want to keep making money and you’re still in business because you have been successful in making some, be it just a small chunk of what the industry big boys are getting or something closer to the figures they make when you’re extremely lucky and outperforming yourself and the rest of your competitors.

From hiring the right people to make up your team, to production, marketing and promotional efforts, and when the product hit the racks or when you’re selling services, a simple business cannot survive without money. However, keeping tabs over profit ad returns, taxes and overhead costs and being able to analyze all of them in figures, is always a tad overwhelming for most business owners, especially startup ones.You may also see Analysis Templates.

Financial Analysis Template

Financial Needs Analysis Template

Financial Impact Analysis Template

Financial Statement Analysis Template

Analysis of Company Financial Statements

ncert.nic.in

ncert.nic.inPrintable Company Financial Analysis

elany.org

elany.orgAnalyzing Financial Statements

digilib.k.utb.cz

digilib.k.utb.czImportance of Financial Statements

Things such as your cash flow, inventory, income statements, balance sheet and investment capital and other financial statements make up the financial information that investors, shareholders, stakeholders, creditors, consultants and analysts use to check or evaluate the business’ financial standing or performance. Most of the details found in a financial reports are not only important for the company’s record-keeping and decision-making, it is also required by government accounting standards as well as by the law.

Financial statements are crucial in the management of a company since it also communicates past achievement and future expectations across the organization. The publication of sample financial statements allows the management to communicate better with external interested parties regarding its successes in running the business.

While a lot of entrepreneurs prefer to outsource the creation of simple financial statements to experts such as bookkeepers and accountants, learning to analyze them offers better control of a company’s financial health. Analysis of financial statements should be conducted every year at least if you do not have the means to do it on a quarterly basis, in order to use the information they offer as a business advantage.

Company Financial Analysis

mngt.waikato.ac.nz

mngt.waikato.ac.nzFinancial Ratio Analysis Sample

pdfs.semanticscholar.org

pdfs.semanticscholar.orgFinancial Analysis

Financial analysis is the aspect of a company’s overall finance function which deals with checking or examining historical data to understand the current and future financial position of a business. Financial analysis can be conducted for different situations to give the management or leadership team the necessary information for critical decision-making, because the ability to understand the figures and interpret financial data is very important for business managers.

As stated, business operations revolves and ends in finance, making finance the language of business, as it should. Business plans, its goals and objectives are set on financial terms with their results also being measured in financial terms. Among the skills needed to manage and speak the language of business is being able to not only speak and understand but also be fluent in the language of finance, which means the ability to read, analyze and interpret financial information and present in through well-organized financial reports.

Finance In Business

The finance side of business also requires the evaluation of economic trends, setting financial policy and developing long-term business plans for future activities. It also involves the application of internal controls system for cash flow management, sales and distribution of expenses, inventory valuation and the approval of capital costs. Additionally, reports on finance also needs the application of internal control systems by getting financial statements ready and organized. These would be your income statements, balance sheets and cash flow paperwork.

Lastly, finance involves the analysis of information found in your financial statements so that you can get valuable information to aid you in management decision-making processes. This way, financial analysis would still make up only a part of finance’s overall function but it would probably be the most important. You may also like financial analysis samples.

A business’ accounts, statements and other financial records contain a great deal of information necessary for the interpretation of the figures presented, making it the center of financial statement analysis. Another part which would make up your financial analysis requires the use of numbers found in company statements to reveal trends of activity that may not be visible on the surface.

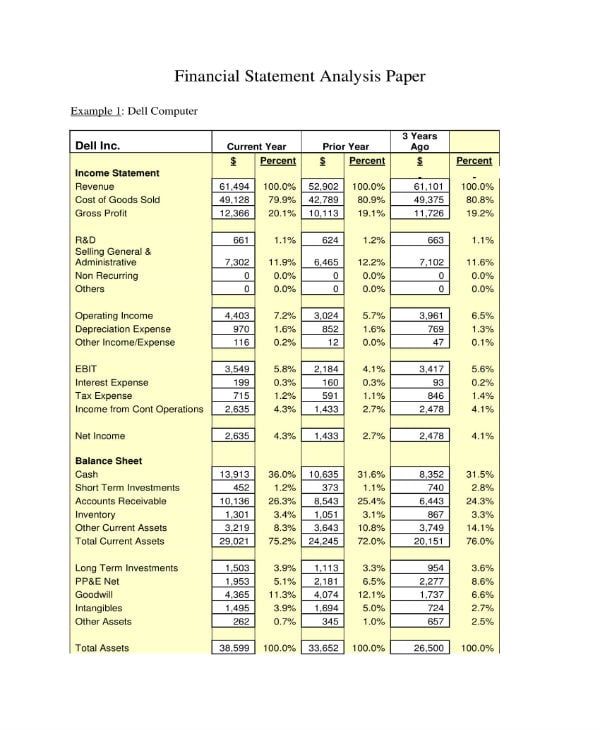

Financial Statement Analysis Example

ohiodominican.edu

ohiodominican.eduImportance of a Financial Analysis

For small and medium businesses, it is a constant challenge to produce a clear picture of their current business models, how it’s turning out and whether or not it is profitable. This cannot be better supported by anything else but through financial statements. As a business owner or manager, it is therefore important to constantly analyze your company’s financial standing which would is possible when you have financial statements on record.

Most small businesses employ accountants and tax consultants who are able to run the company figures and ensure their accuracy as well as vouch that they are free of any errors when it’s time to file or report taxes to the government. Even if majority of the work for your financial statements would fall on the experts you hired, being able to analyse them on your own is still necessary as a businessman since this gives you the chance to verify the accuracy of the information according to your knowledge of the overall financial aspect of your company.

Keeping record and monitoring cash flow, inventory, capital expenses or overhead costs and issues in payroll as a small business owner or manager helps ensure coming up with a more organized and accurately put-together financial analysis and reporting.

Accountability

Conducting of a quarterly or at the very least, an annual financial analysis helps enforce and encourage accountability among front liners or your employees, especially the ones who takes part in the completion of the company financial statements. By being able to evaluate your statements and ultimately, your financial standing gives you the opportunity to confirm that there are no misappropriation of funds and that business finances, especially profit and returns are properly accounted for, thereby giving little to no room for fraud. You can also read sample company analysis templates.

Depending on the type of business you manage, or whether you hire third-party accounting firms to crunch the numbers, doing a preliminary analysis on your own or with the rest of the management team can also help ensure a great sense of accountability.

Financial Statement Analysis

nacm.org

nacm.orgFinancial Analysis Example

is.mendelu.cz

is.mendelu.czFinancial Analysis of the Real Estate Companies

content.knightfrank.com

content.knightfrank.comFinancial Decisions

While getting your financial statements ready ad organized would be far from being able to make the most important business decisions needed for the growth and success of your company, they do give a clear view of your business’ overall health and survival. You may also like business case analysis templates.

Business owners will then be able to carefully think about the steps and leadership decisions to make as to the information revealed by your financial statement and the analysis conducted such as when your cash flow statement is pointing to an overlap of areas in your business cutting or interrupting the bottom line of your business. When that happens, you may want to consider laying off some people who aren’t necessary or consolidating the functions of these areas departments.

Financial Health

This is pretty obvious but let’s still spell it out. The success of a business depends on the ability of those who are in charge of its financials. If the financials fails, the business fails. The analysis of your company’s financial statements will offer a better insight into your current and future financial standing. It would also help you perform better to maintain financial health for your business.

This type of financial perspective would typically include details about liquidity, advantage and profitability and will drive the course of your business strategy so that you can reach your company goals and answer your business objectives.

Company Financial Ratio Analysis

dspace.bracu.ac.bd

dspace.bracu.ac.bdComparative Financial Statement Analysis

digi.lib.ttu.ee

digi.lib.ttu.eeIdentify Trends

Company financial analysis from quarter to quarter or annually helps businessmen keep up with economic trends and see their growth. A startup business might experience losses in its early years while it is still trying to develop products and a customer base. At the same time, analysis and statements themselves show whether the manager is achieving its projected estimates.

If a company is anticipating a 15 percent growth but is only reaching half of that percentage, organization leaders need to find ways in either cutting costs or adding revenues. Without the financial analysis, it would be nearly impossible to explore such a case further and realize greater business opportunities. You may also like business analysis templates.