11+ Budget Summary Templates – PDF

Keeping track of your finances in business, no matter what industry you are in, should always be a priority, although anything that involves money, has never been really easy. Especially if you’re the new kid in the corporate community and just learning the ropes of becoming a bonafide businessman. Even small business owners and people who are self-employed recognize the need for monitoring profit, payments, expenses, and transactions while making sure that they still have enough left to get them through in the industry. There’s nothing like proper budgeting that would allow you to streamline the process of keeping a record and close monitoring of your business finances.

Budget Summary Template

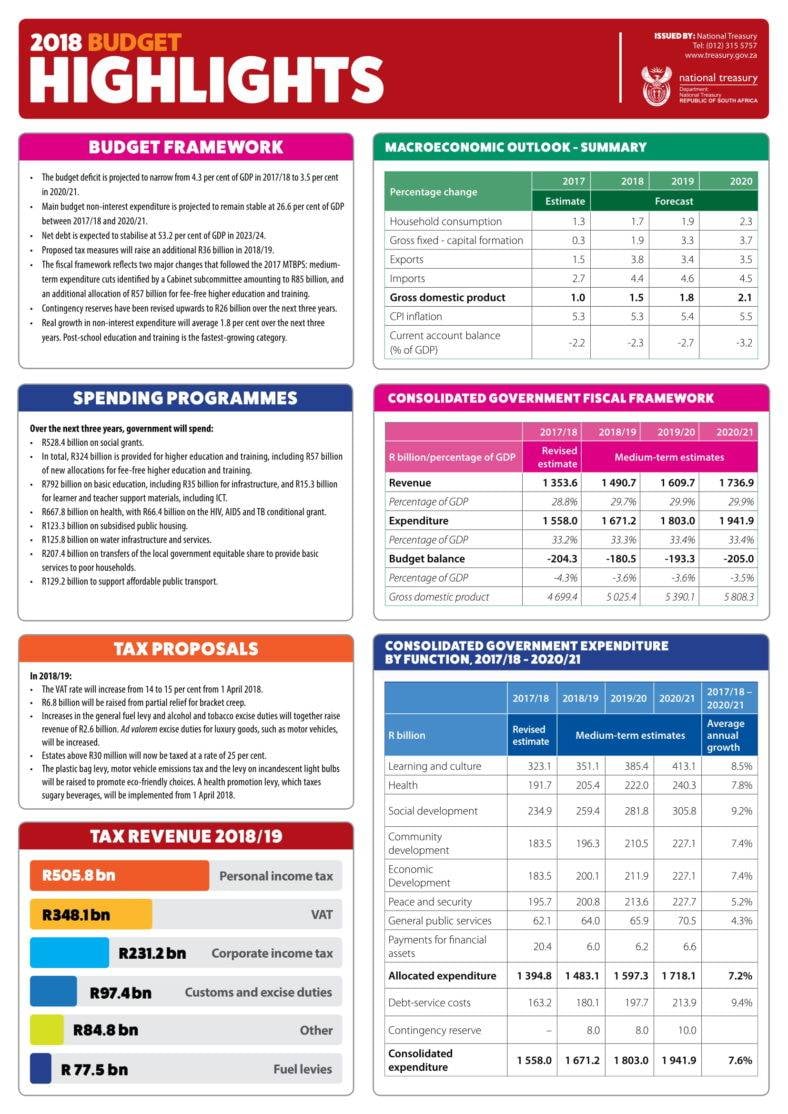

Budget 2018 Highlights

treasury.gov.za

Budget Blueprint

whitehouse.gov

Budget Executive Summary

das.nh.gov

Budget Fiscal Year 2019

whitehouse.gov

Budget for Current Year

regents.universityofcalifornia.edu

Budget in Brief 2017-18

finance.gov.pk

Budget-Planning

Trying to manage the financial aspects of your company is enough to give you a headache. Some people make it look so easy and you wonder how they do it. Generally, it’s not that difficult. Keep up with the trends, especially when it comes to monitoring your income and expenses. A small business owner who wants to grow would use every tool he needs, especially if technology and the skills of his team can provide it. We’re talking budgeting and having your finances recorded well and organized so that when the filing of taxes comes, you will also be well-prepared.

Think about the possible consequences if a company doesn’t meet its financial responsibilities just because of poor budgeting. Failure to account for paychecks would have employees leaving the company. Mishandling of business expenses would result in debt and not having insurance would make the company vulnerable to liability. Being unable to pay mortgage or rent for commercial space used, means you would be sent packing along with your assets, and so on.

Indeed, a business that doesn’t have a clue about profit or where it is headed, wouldn’t be in a position to commit to partnerships with other entities like suppliers or clients, let alone grow, enjoy, and make use of endless possibilities for expanding. It is also bound to lose deals when worse comes to worst, like delayed shipments or power being turned off. Without accurate financial documents stored would cause a denial of existing loans, the buying of supplies or the power to submit bids for government contracts. You may also see resume summary statements.

Developing a budget plan doesn’t just equate to the added workload that the CEO gives to managers and supervisors on top of their team duties. A budget is not an exercise but a financial plan that needs to be as comprehensive as it is demanding in order to achieve and satisfy an organization’s goals. When done and followed correctly, a budget is considered as the mapping out of a company’s strategic business planning. By creating a budget, the company also justifies its positions on objectives towards the acquisition of its resources or assets. And when a budget summary is established, it plays a key role in evaluating the strategies set by the company to ensure the attainment of the objectives set. For it is only through clearly exercising an efficient method of budgeting that the responsibilities and chain of command at various levels that an organization is properly established.

Budget System

Having an effective budget system provides a greater chance to reach smart goals and business objectives since they are quantified, maximized, and clearly defined. Not only does it offer a way for better allocation and utilizing resources within the means of the company thereby supporting individuals to carry out their responsibilities, monitor and practice control, but it also helps in the alignment of a company’s mission, vision, strategies, and goals within the structuring long-term plans. Budgeting also offers more flexibility for managers to do other important aspects of their jobs effectively, as well as provide more accuracy in performance assessment and analysis. Being involved in budget processing encourages the right people in an organization to hit the level of efficiency needed in the annual budget briefing, proving the role that budgets play in steering a business towards success.

There are a lot of key benefits gained from exercising a proper budget plan and summary for a fiscal year. It further formalizes the alignment of activities by each department and sets it towards the bigger picture, which is the business’ strategic plan for the year. While it can be very daunting to start processing an annual budget summary trying to fit allocations within the company’s financial standing, it is a skill that isn’t necessarily limited to accounting professionals. Don’t be fazed by all the budget terminology and jargon. They’re just words and they are words that you will be able to understand given the proper training and dedication to be involved in the budgeting process, especially if you are part of the management team.

The Budget Summary

It is pertinent for any organization to produce an accurate and updated annual budget for them to keep control over their finances and to prove any funding party, business partner, shareholder, or investor exactly where the money is going and what the resources are being used for. The complexity of the document and its being as specific as possible will be based on the budget size and what the corresponding requirements, the number of activities or programs that the money is being accounted for, and many others. At some level, the summarizing the budget will need these things:

1. Allocation

Do the math. How much money do you expect to spend for the incoming fiscal year? Get a breakdown of your allocation from paychecks, office supplies, corporate activities, etc. You may also see bid summary templates.

2. Projected Income

The funds or figures your business expects to receive in the coming year with a breakdown of sources such as grants, profit, and donations from fundraising or charity efforts.

3. Expenses and Income

How would you compare the takeaway in figures versus the expenses? What gets funded from which sources? Usually, this is what happens with funding: Whatever or whoever the source is, if it is limited, it is important to develop the budget for the coming fiscal year according to those restrictions so that the business would not be debt-ridden and make sure to spend the money it has. You may also see meeting summary templates.

4. Adjustments to Reflect Actual Figures

Typically the budget summary will come from estimates and not the actual figures. As you progress through the year, those estimates have to be adjusted in the most accurate way possible to avoid losing track of what you have and what’s happening with the funds. You’ll be safer by following the reality of your budget. You may also see sample project summary templates.

Fiscal Year

The fiscal year is simply a shorter term for “financial year,” the calendar year an organization uses to estimate their sample annual budget allocation for when it closes books, file tax forms, get audited, and any other fulfillment of a legal or financial responsibility. Although there are various fiscal years you are allowed to use, companies usually find the calendar year, January 1 to December 31 more useful. On the other hand, the federal government’s fiscal year runs from October 1 to September 30. State governments and agencies funded by the state, as well as other charity and non-profit organizations receiving state funding usually use July 1 to June 30 although most organizations try to use a fiscal year according to that of their major sponsors or funders. Whichever works best for your organization, you would want to get your budget ready to cover your fiscal year. Most of the time, the budget is submitted to the Board of Directors for approval before a fiscal year begins just in case they would want to suggest any adjustment they would deem necessary.

Why Do You Need an Annual Budget?

1. It allows for better understanding of both short and long-term business goals – Having simple annual budget provides the business with clear objectives and parameters to work with, allowing them to know where the business stands in terms of financial growth and overall development.

2. It offers the bigger picture – A breakdown of an annual budget shows you the gaps in funding, therefore, it allows you to be better prepared in meeting your needs and make decisions that are based only on what you can afford to do in a given year. You may also see summary for an executive.

3. It encourages realistic ways of dealing with financial issues – By showing you the financial restrictions at hand, a budget motivates you to be resourceful, using only what you can afford and sing it in a creative and successful way, especially when looking out for other sources of funding. You may also see investment summary templates.

4. It fills the need for documentation – The completed budget, organized well, is an important element of financial reports, proposals for grant or fundings and reports and the business community.

5. It provides an open discussion. An organization needs to address and talk about its financial realities to open solutions of improving its financial standing.

Budget Summary

budget.house.gov

Department of Commerce Budget in Brief

osec.doc.gov

Executive Budget

www1.nyc.gov

F2019 Budget in Brief

whitehouse.gov

Developing a budget process that analyzes the priorities of an organization and using it as a means to come up with a balanced and accurate budget allocation rather than just straight up baseless figures will help you maintain control of your business finances and provide accurate reports to the board, your other business connections, and spend money, only as you have meant and promised to. You may also like project summary templates.