How to Deal with Late Invoice Payments

With today’s modern digital marketing, there are a lot of entrepreneurs who prefer running a business online. This is especially true for entrepreneurs who still cannot afford to build his own brick-and-mortar company. With an online business, all you have to do is have an official business website developed for you so that you can sell your products and/or services to your customers.

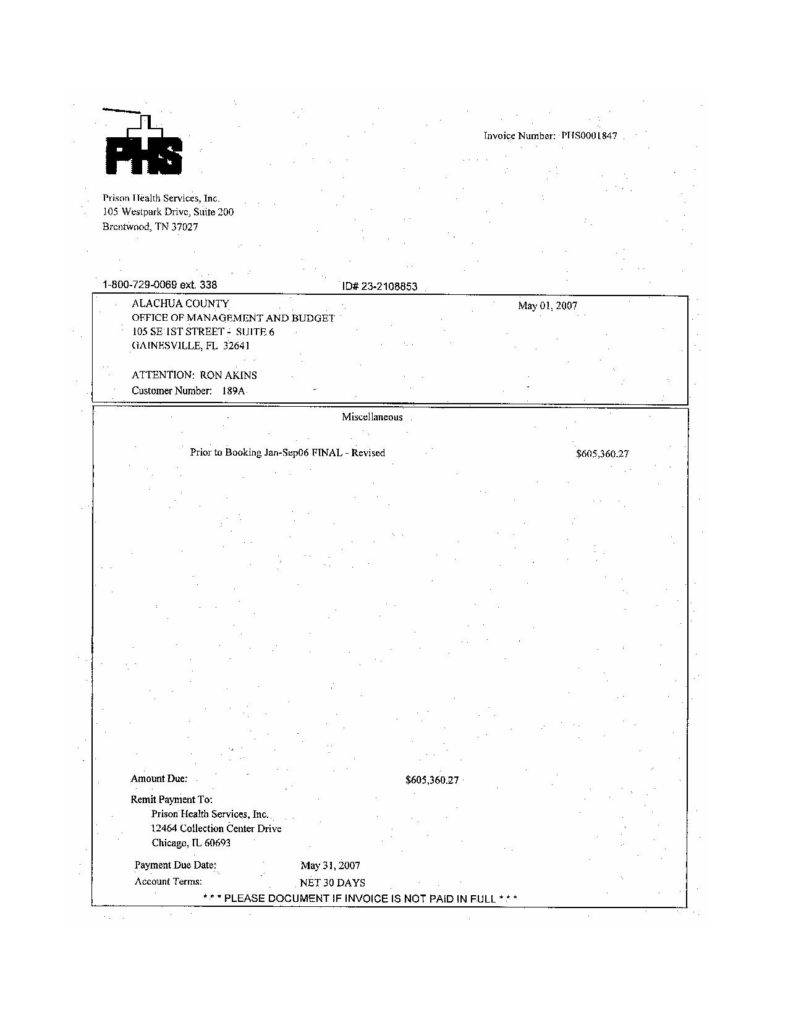

When it comes to payment, invoices are considered to be the easiest and most efficient way to get paid. While generating and sending invoice can be a tedious and time-consuming process, one cannot simply skip or ignore the importance of invoicing. Since your customers virtually purchase goods and/or services from you, issuing invoices is a great tool that you can deliver and collect their payment electronically. The whole process of the transaction is oftentimes completed with just a couple so clicks of a button and customers can choose from the various payment methods that are offered by the seller. However, invoicing is also commonly used by businesses with physical stores. However, some of these businesses have a different process for generating and sending invoices since most of their customers visit their physical brick-and-mortar stores to transact business with them.

Invoice Template Bundle

Construction Invoice Template Bundle

All About Invoices and Its Uses

According to an article published at Investopedia.com, “an invoice, also known as a bill or sales invoice, is a commercial document that itemizes a transaction between a buyer and a seller. If goods or services were purchased on credit, the invoice usually specifies the terms of the deal, and provide information on the available methods of payment”. Additionally, the invoice bears crucial information that indicates the name of the product, the number of purchased items, the corresponding prices of the products and/or services that were sold, as well as the date the product has been sent or the date the service has been rendered to the customer.

So how are invoices important for your business? In this section, we have gathered on how an invoice can benefit you and your company.

1. Record Keeping

You can use your invoice to effectively track your business earnings and spending. With the use of the computer, Internet, and e-invoicing system, you can easily monitor your previous and pending invoices; hence providing you an overview of where your money is coming from. It also allows you to easily calculate the total weekly or monthly earnings of your business.

2. Bookkeeping

Your retail invoice is a great tool that provides you with an overview of your company’s financial history because it allows you to monitor your sales and revenues. Keeping all your invoices is important for bookkeeping records as they are often used to tally the sales and expenses incurred in your company. The result of the computation shows the net profit of your company.

3. Inventory

Another purpose of an invoice is to help track the inventory records of your business. Whether you are using paper documents or an automated inventory system, an invoice is a great tool that provides information on the number of stocks that you have on had.

4. Getting Paid on Time

Using an invoice allows you to take control and manage the billing cycle. A professional invoice is a perfect way to reduce the payment time of projects with informal payment schemes and lets you collect the payment on time.

Dealing with Late Invoice Payment Without Being Rude

An invoice is practically considered as a type of business document that states an incurred debt. Let us face it. There will be times when the customer is not able to pay you back on time. While it is extremely tough and challenging to chase late payments from customers. This is often one of the awkward tasked faced by small-scale business entrepreneurs. And since it is never easy to send an email or phone late paying customers and ask them for your money, we will provide you a rundown of the list on how you can deal with late invoice payment without being rude.

1. Know Your Customers

Although it may sound like a cliche, as an entrepreneur, it is always crucial to building a good relationship with your customers. If you are able to establish a good relationship with them, you make sorting out payment terms a little easier on your part and reduce the possibility of chasing outstanding payments from customers.

2. Being Rude is Not an Option

Although chasing late payments can be a major headache for most business owners, make sure not to allow your frustration ruin your relationship with your customers. You can ask them politely for the payment and find ways to make loose ends meet. If you are running a start-up business, you cannot afford to lose customers just because you failed to control your emotions.

3. Setting Terms and Expectations

Oftentimes, there is a valid reason behind customer late payment. That is why it is important for business owners to set terms and expectation on late payments. As a business owner, you have the right to set your own rules. Say, you can charge an additional 2% after 30 days or 5% after 60 days for delayed payments.

4. Take Legal Actions

If all your efforts failed, then you can always take legal actions to set things straight between you and the customer. Usually, the lawyer will send the customer a demand letter stating that you will take legal actions if the customer fails to pay his outstanding balance within the given time period.

Property Rental Invoice Template

SEO Invoice Template

Transport Bill Invoice Template

Medical Bill Format Template

Charity Invoice Template

House Rental Invoice Template

Real Estate Agent Invoice Template

Free Gym Invoice Template

Sample Invoice Templates that You Can Download and Use

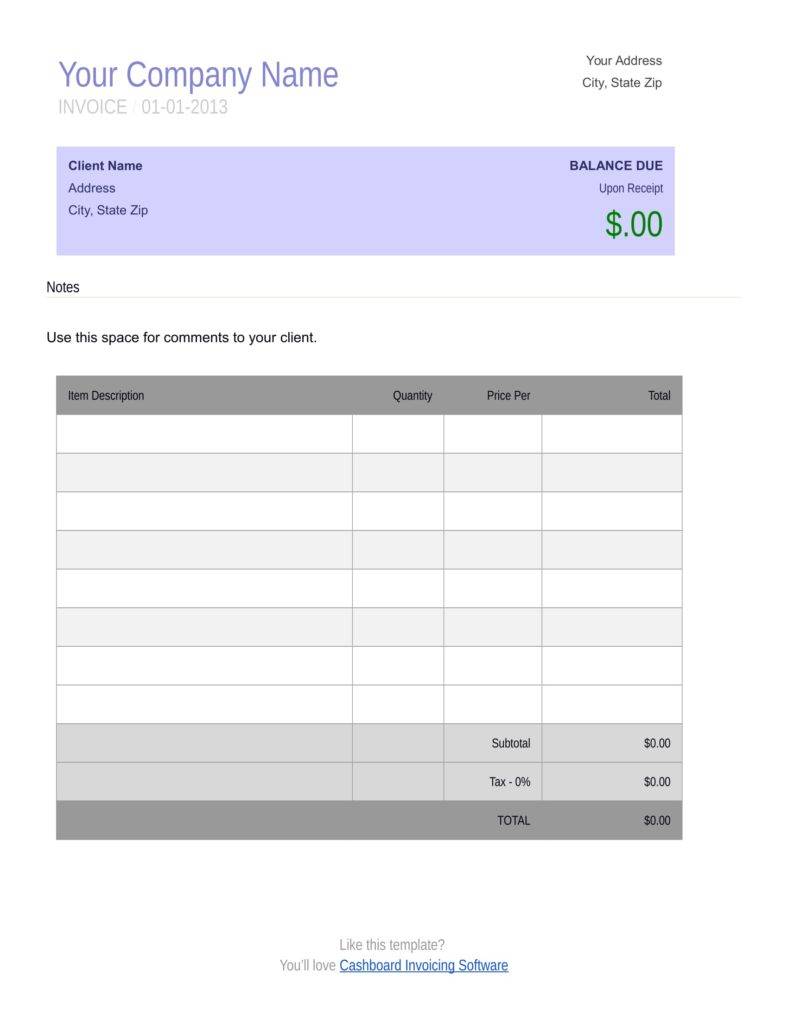

Free Blank Invoice Template for Microsoft Word Download

cashboardapp.com

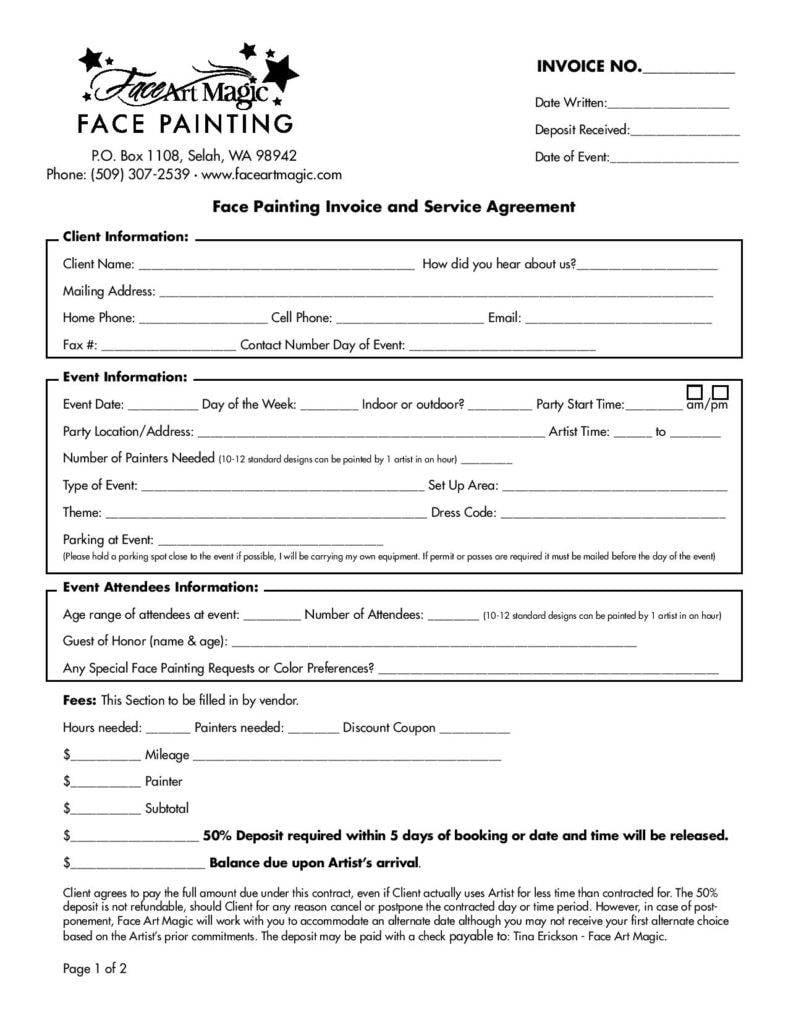

Face Painting Invoice and Service Agreement

faceartmagic.com

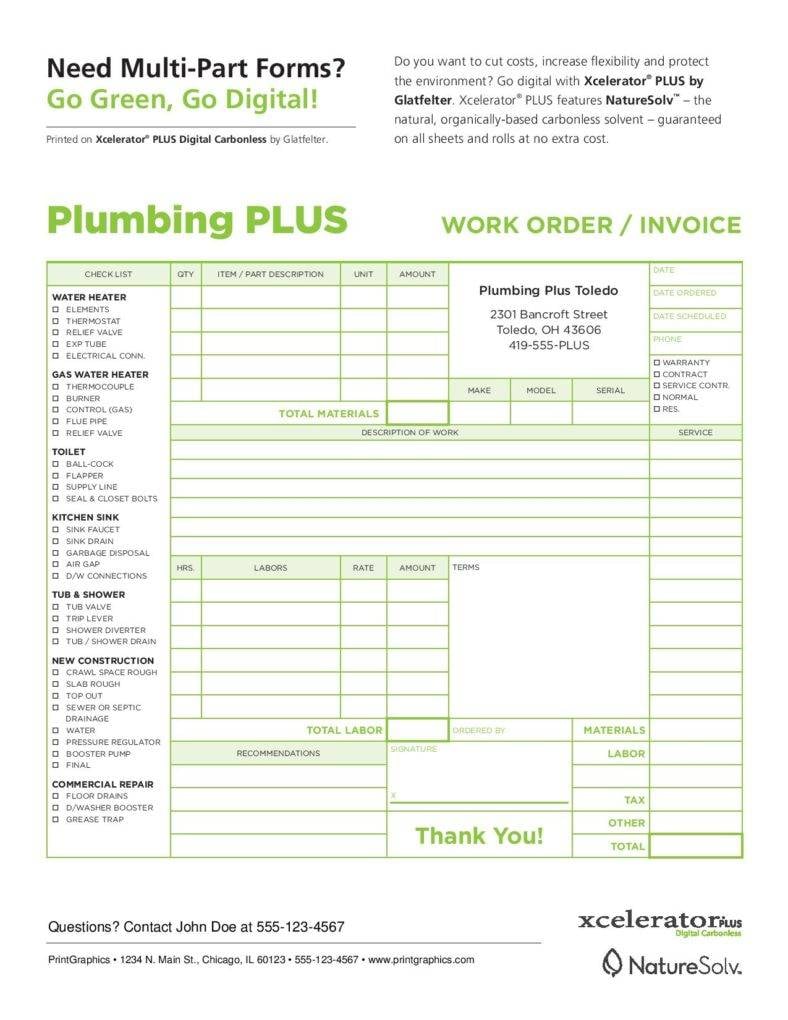

Plumbing Invoice Form Download Free

naturesolvcapsule.com

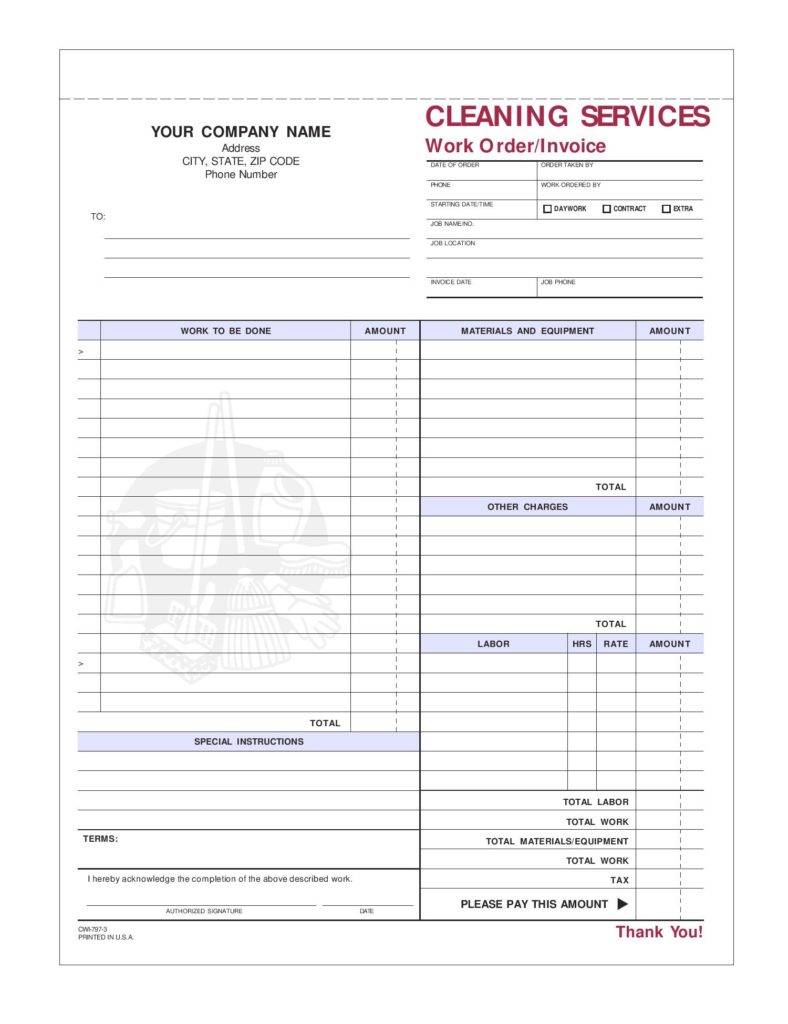

Cleaning Company Invoice Template

dmcorp.com

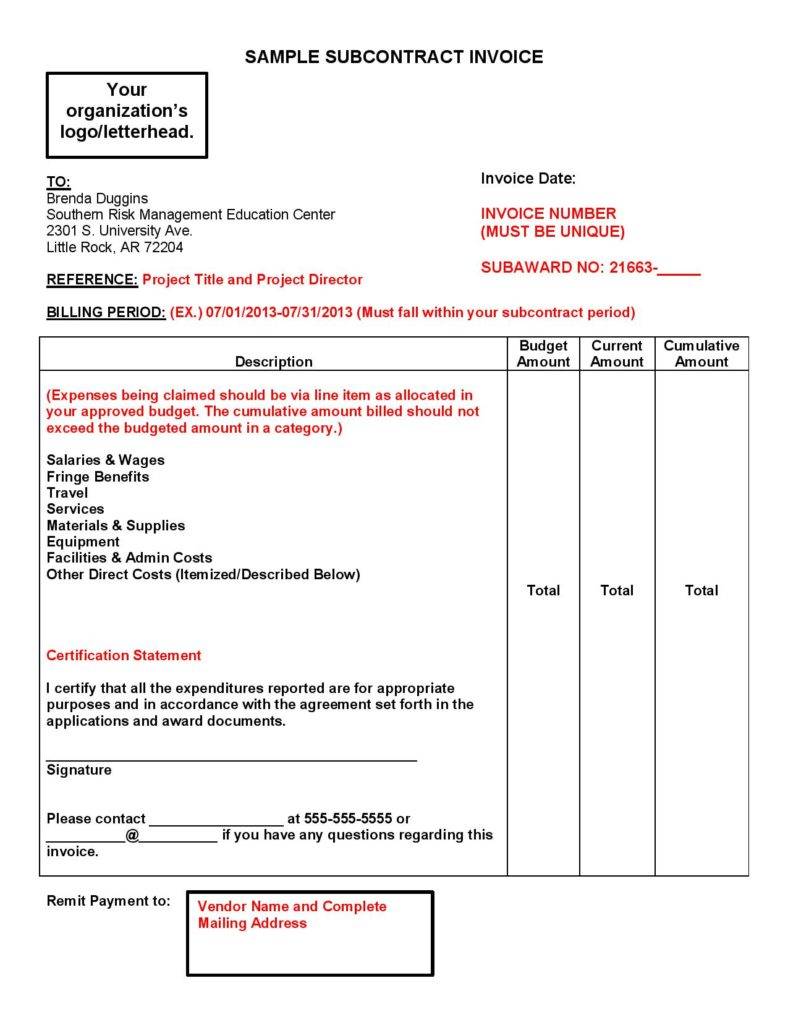

Subcontractor Invoice Template

srmec.uark.edu

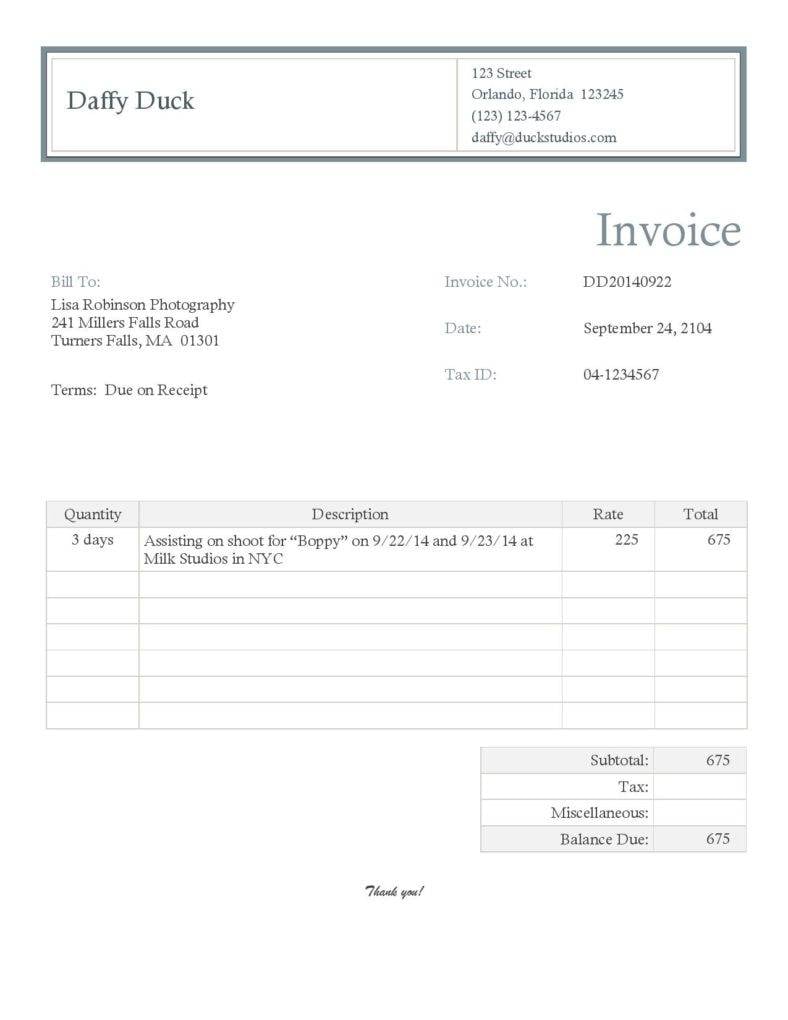

Photography Invoice Template PDF

hallmark.edu

Customizable Web Design Invoice Template

vesess.com

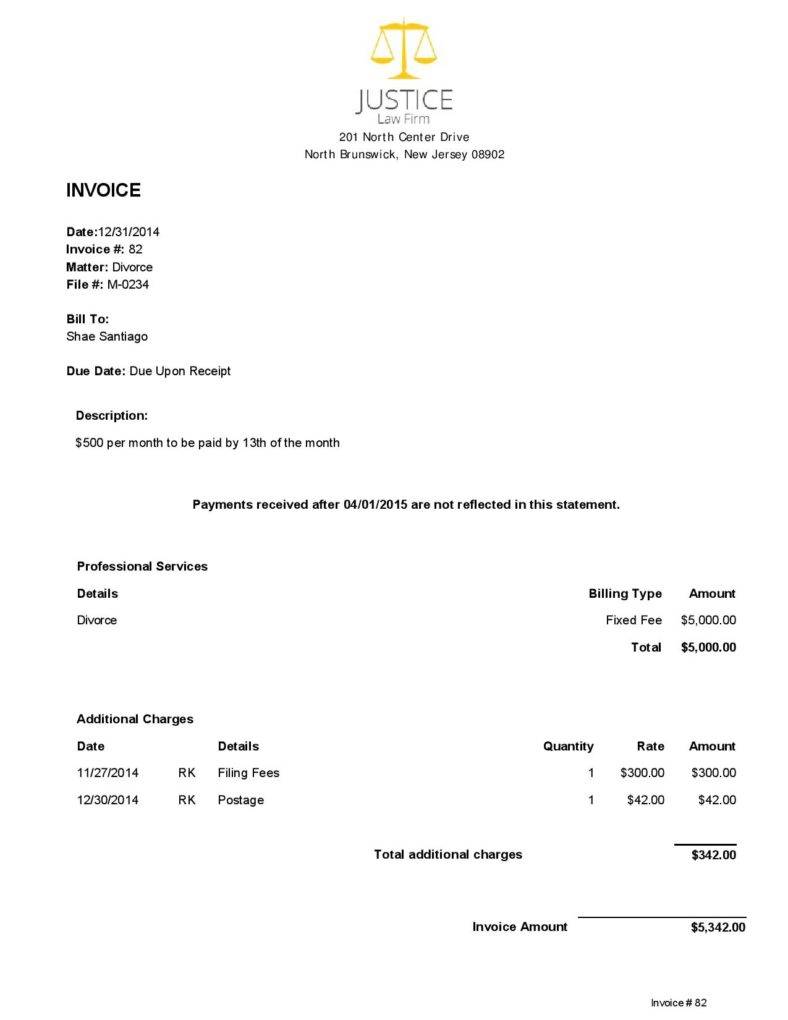

Legal Invoice Sample

cosmolex.com

Medical Billing Invoice Template Free

worksafebc.com

Final Thoughts

Late payments can potentially affect the cash flow of your business. That is why it is important to protect your business by not selling your product and/or services to late paying customers. And now that we have reached the end of this article, we hope that these tips can help you get back your hard-earned money without affecting your relationship with your customer.