Table of Contents

- 10+ IRA Rollover Templates

- 1. IRA Rollover Template

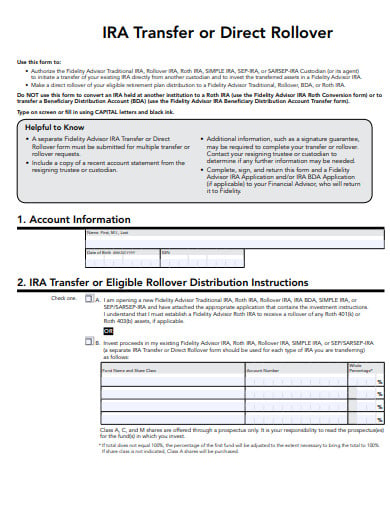

- 2. IRA Direct Rollover

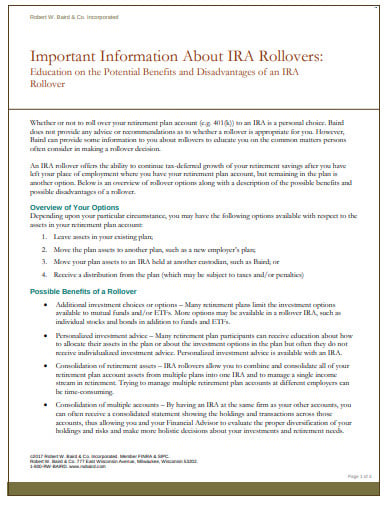

- 3. IRA Rollover Disadvantage

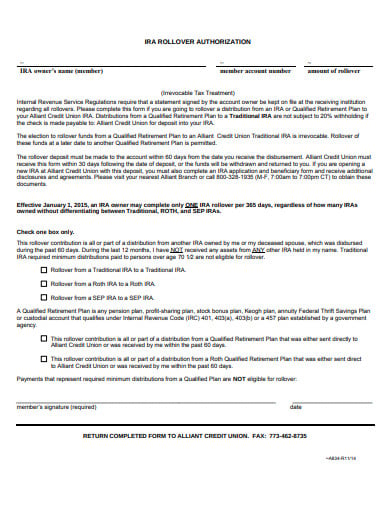

- 4. IRA Rollover Authorization

- 5. IRA Roth Rollover

- 6. IRA Rollover Review

- 7. IRA Rollover Election

- 8. IRA Rollover Certification

- 9. IRA Rollover Opportunity

- 10. IRA Rollover Requirements

- 11. IRA Charitable Rollover

- Steps to Rollover an IRA

- Why Do You Need To Consider an IRA Rollover?

- Major Benefit: Growth

- When Can You Roll Over?

- Indirect VS. Direct Rollovers

10+ IRA Rollover Templates in PDF | Word

An individual retirement account (IRA) rollover is an account that requires funds to be moved from an existing employer-sponsored retirement account to a traditional IRA. An IRA rollover aims to preserve the tax-advantaged status of those assets. Rollover IRAs are generally used for keeping 401(k), 403(b), or profit-sharing program funds that are converted from the funded retirement account or eligible plan of a former employer.

10+ IRA Rollover Templates

1. IRA Rollover Template

finra.org

finra.org2. IRA Direct Rollover

fidelity.com

fidelity.com3. IRA Rollover Disadvantage

rwbaird.com

rwbaird.com4. IRA Rollover Authorization

alliantcreditunion.org

alliantcreditunion.org5. IRA Roth Rollover

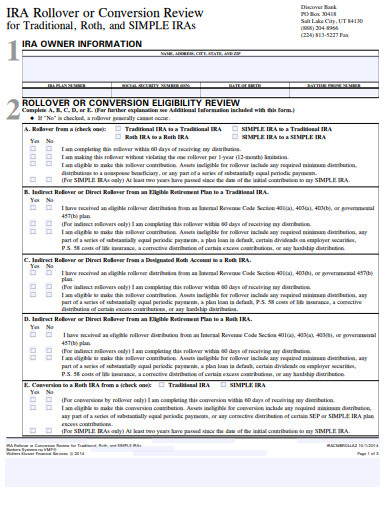

discover.com

discover.com6. IRA Rollover Review

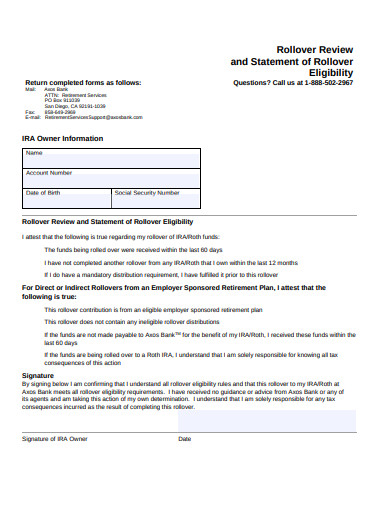

axosbank.com

axosbank.com7. IRA Rollover Election

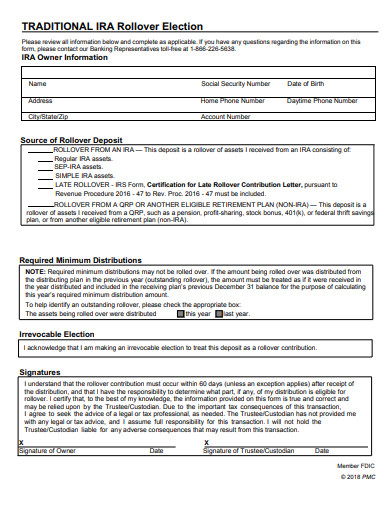

synchronybank.com

synchronybank.com8. IRA Rollover Certification

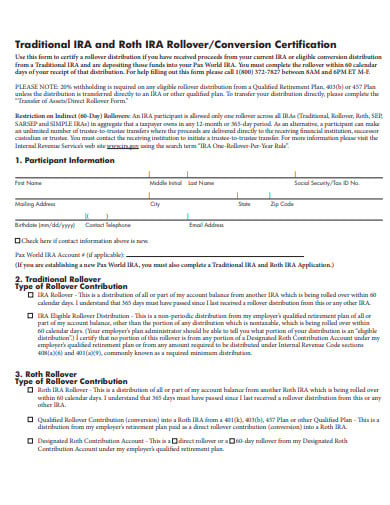

paxworld.com

paxworld.com9. IRA Rollover Opportunity

oliverwyman.com

oliverwyman.com10. IRA Rollover Requirements

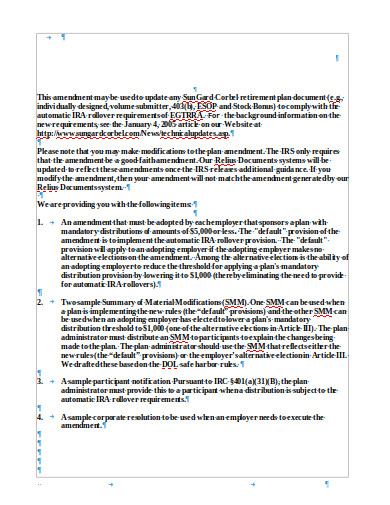

relius.net

relius.net11. IRA Charitable Rollover

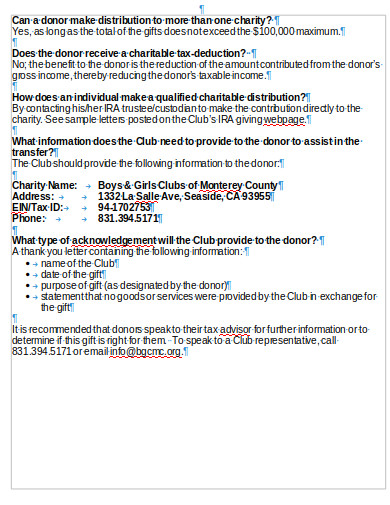

bgcmc.org

bgcmc.orgSteps to Rollover an IRA

Step 1: Communicate With Your IRA Provider

You can do that online or by email, whichever is better for you. In case you are transferring the funds electronically from the IRA to your bank account, then you can often complete the transaction quickly online. A representative will be able to help you set up the transfer or make any kind of arrangement for a paper check to be sent to you if you talk to a representative. However, if you’re speaking to a live person, he/she may likely offer some incentives to keep your business or just warn you that doing a rollover this way may result in taxes and penalties.

Step 2: Withdrawal Set Up

You can remove all the funds and close the account, or you could just make a limited transfer, to make a rollover. If you’re under 591?2, the insurer would probably refer to this as early termination or premature withdrawal, but this does NOT mean that you will get hit with taxes and penalties. For a distribution under age 591?2, it is the IRS jargon.

Step 3: Use the Right Account

To keep it simple, either you can have your old company deposit these funds directly into the bank account you have connected to Betterment, or you can simply deposit the check that your provider sends you to that linked account within 60 days, according to IRS guidelines.

Step 4: Do Not Withhold Taxes

Whether you’re doing the rollover remotely or with a live representative, you need to let your IRA provider know you don’t want to defer any taxes. You are not expected to withhold taxes, as you will reattempt the funds as soon as you receive them.

Step 5: Mind the Fees

Many companies might charge you a processing fee to wind up your account, a surcharge if you close your account or a paper check fee. Make sure you ask (or read the FAQ) so you know what you’re paying for. Typically, these costs apply when you do any kind of rollover, think of them as your old provider’s fond farewell.

Step 6: Claiming the Rollover on Your Tax Form

The old employer must inform the IRS that you have withdrawn funds from your IRA, which is a standard procedure, so be sure to report the sum at the time of tax on your return. If you have any questions about how to do this, consult a tax adviser, or familiarize yourself with the relevant guidelines in IRS Publication 590.

Why Do You Need To Consider an IRA Rollover?

A central question for employees to address when changing jobs is how to safeguard the tax-advantaged benefits they may have received from a retirement plan funded by the employer, such as a 401(k). An IRA rollover moving money to an IRA from another retirement account is one tactic that can help you avoid a heavy tax bill on that asset.

Major Benefit: Growth

An IRA rollover’s main purpose is to maintain the tax-advantageous status of retirement assets. Rollovers are commonly used to retain assets transferred from a retirement account funded by the former employer, such as a 401(k), 403(b) or a profit-sharing scheme. But they can also be used for other reasons, such as solidifying retirement accounts into a single asset, extending investment choices or, in some cases, shielding investors from a retirement asset. The IRA rollover is a tool that may come up with some flexibility. They often provide more investment options than a company 401(k) plan. IRAs also offer more investment choices than a 401(k) company plan, and there is no cap on how much cash could be moved from another retirement account to an IRA rollover for eligible assets, although the IRS restricts investors to one IRA-to-IRA rollover per the calendar year.

When Can You Roll Over?

Most people use IRA rollovers when they leave a job, but that’s not the only explanation why they should be used. Sometimes a holder of an account, even one whose assets are already in an IRA, wants to put their money into a new IRA with better benefits, lower fees or more investment choices. And in such a culture of regular job changes and a movement towards the sharing economy, people sometimes have 401(k) plans in a few different accounts, with fairly small amounts of money.

Indirect VS. Direct Rollovers

A rollover may be conducted by using a direct money transfer or a written check to the account holder, who can then deposit it into their IRA account, a process that comes with more potential risks. A potentially large tax penalty is the biggest downside to cashing out and depositing the funds into an IRA yourself is also known as an indirect rollover. The IRS maintains 20 percent of federal taxes on indirect rollovers, to be reimbursed only if the payment check is deposited into a retirement account within 60 days.

In case the check is not properly deposited within that time-frame, the account holder will not only pay 20 percent in taxes — since IRA distributions are considered taxable income — but they will also pay an extra 10 percent early withdrawal penalty if they are less than 591?2.

Moreover, no money is being deducted for taxes for direct IRA rollovers. Investors should ask their current plan manager to send a check to their home address or directly to the IRA where they want to invest their money to set a rollover in motion. When you plan to take the benefit of a direct rollover, it is recommended that you to use the word direct rollover so that the manager will not misinterpret the request as a cash-out.