Table of Contents

- 4+ Audit List Templates in PDF

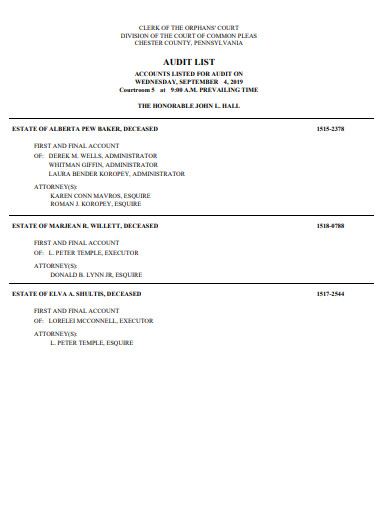

- 1. Audit List Template

- 2. Sample Audit List Template

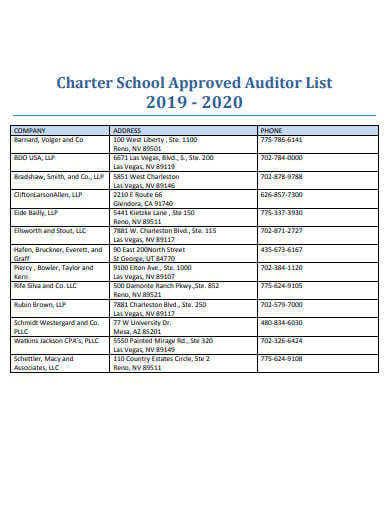

- 3. School Audit List Template

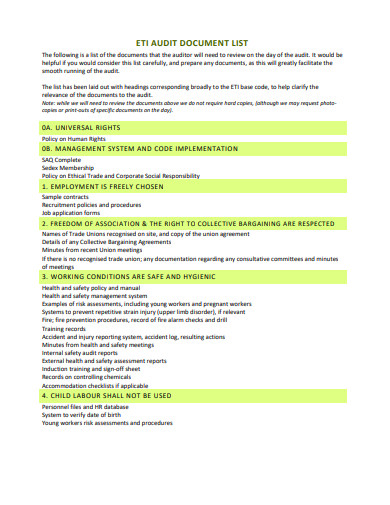

- 4. Audit Internal List Template

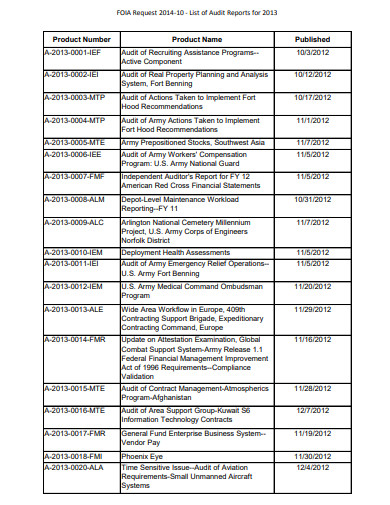

- 5. Audit Report List Template

- How to Prepare an Audit Checklist?

- What is Audit planning?

- What do You Understand by Audit Strategy?

- Why is an Audit system Important in an Organization?

4+ Audit List Templates in PDF

The audit list can be anything that is related to the audit process. It can be the organizations that will be audited, the departments that will be an audit, the names of the auditors, the important essentials for a successful audit process, etc. Hence an audit list is a list that is prepared for the important informations that are related to the audit that is going to happen or the audit that has already been performed.

4+ Audit List Templates in PDF

1. Audit List Template

chesco.org

chesco.org2. Sample Audit List Template

singletonclark.com

singletonclark.com3. School Audit List Template

nv.gov

nv.gov4. Audit Internal List Template

vwa.co

vwa.co5. Audit Report List Template

governmentattic.org

governmentattic.orgHow to Prepare an Audit Checklist?

Step 1: The Heading

The first thing that you need to do is to list down all the main subject headings that you need to audit. The headings include “management”, “finance”, “operations”, etc. You can make use of the computer spreadsheet to prepare the checklist. You can first put the headings and then put the related aspects as of the headings under their respective headings.

Step 2: The Management Section

Under the management section, the topics will be related to employee management, business planning. You can write the subheadings as a sales plan, annual budget, pricing policy, recruitment, employee job description, disciplines, and procedures, etc. Therefore all the subheadings will be the areas that are related to the organization’s management and are handled by the management.

Step 3: The Finance Section

Under this section, the topics will be related to financial planning for business, accounting practices, the types of accounting systems, verifications of the accounting statements, taxation planning, credit policies, etc. Therefore this section will only include the areas that are concerned with finance and financial management.

Step 4: The Operations Section

The topics under this section will include the areas related to production, marketing and promotions. The subheadings include evaluation of the supplier relationship, the measures to control the inventor, the training programs, customer needs, competitors, etc. Hence this is the section that will have the areas that impact and affects the operations of the whole organization.

Step 5: Review the Checklist

The next thing that you need to do is to review the whole checklist that you have prepared. This will ensure that you have jotted down all the topics that you need to audit and the topics are in their respective sections. Your task is to make the checklist error-free. This will help you to conduct a smooth audit and help you to get better results.

What is Audit planning?

An audit process is divided into three phases, the planning phase, performing phase and the reporting phase. The audit planning is the phase where the strategies are developed, clients and businesses are understood, the risks are deciphered, etc.

Audit planning is required to reduce any kind of audit risk. Audit planning includes:

- Identification of risks.

- Designing the audit procedures to address the risk and gain sufficient pieces of evidence.

- To keep the cost of the audit reasonable.

- Avoiding misunderstanding.

What do You Understand by Audit Strategy?

An audit strategy can be defined as the approach that will be used for auditing, management of resources and allocation, the time of the audit and the ways the audit engagement will be managed. The strategy is prepared after the audit objectives are set. The audit strategy is developed to successfully carry out the audit process and to achieve the set goals and objectives.

Why is an Audit system Important in an Organization?

-

Achieving the Business Objectives

An auditing system is important in an organization as it will help the organization achieve the various objectives that the organization has as its goal. The business process includes different types of internal controlling. This may include the monitoring, supervision, detection, and prevention of irregular transactions. Therefore to achieve that an audit system is of extreme importance.

-

Assessing the Risk of Misstatement

There can occur a problem in the material misstatement in the financial report of an organization. Therefore it is necessary to make an audit so that the auditor can assess the risk in it. With the help of the auditing system, an organization can prepare a proper financial report.

-

Prevention and Detection of Fraud

The continuous analysis of the operations of the company prevents the organization from any kind of fraud or irregularities in the accounting system. The professional of audit assists in the designing of the internal control system hence preventing fraud activities.

-

Cost of Capital

Be it the large or small cost of capital is important for every corporation. The cost of capital factor comprises of risks that are associated with investments. In case an investment has more risks, the investors will have to make an investment that has a higher rate of return. A strong audit system will reduce all the kinds of risks that are associated with the cost of capital.