Table of Contents

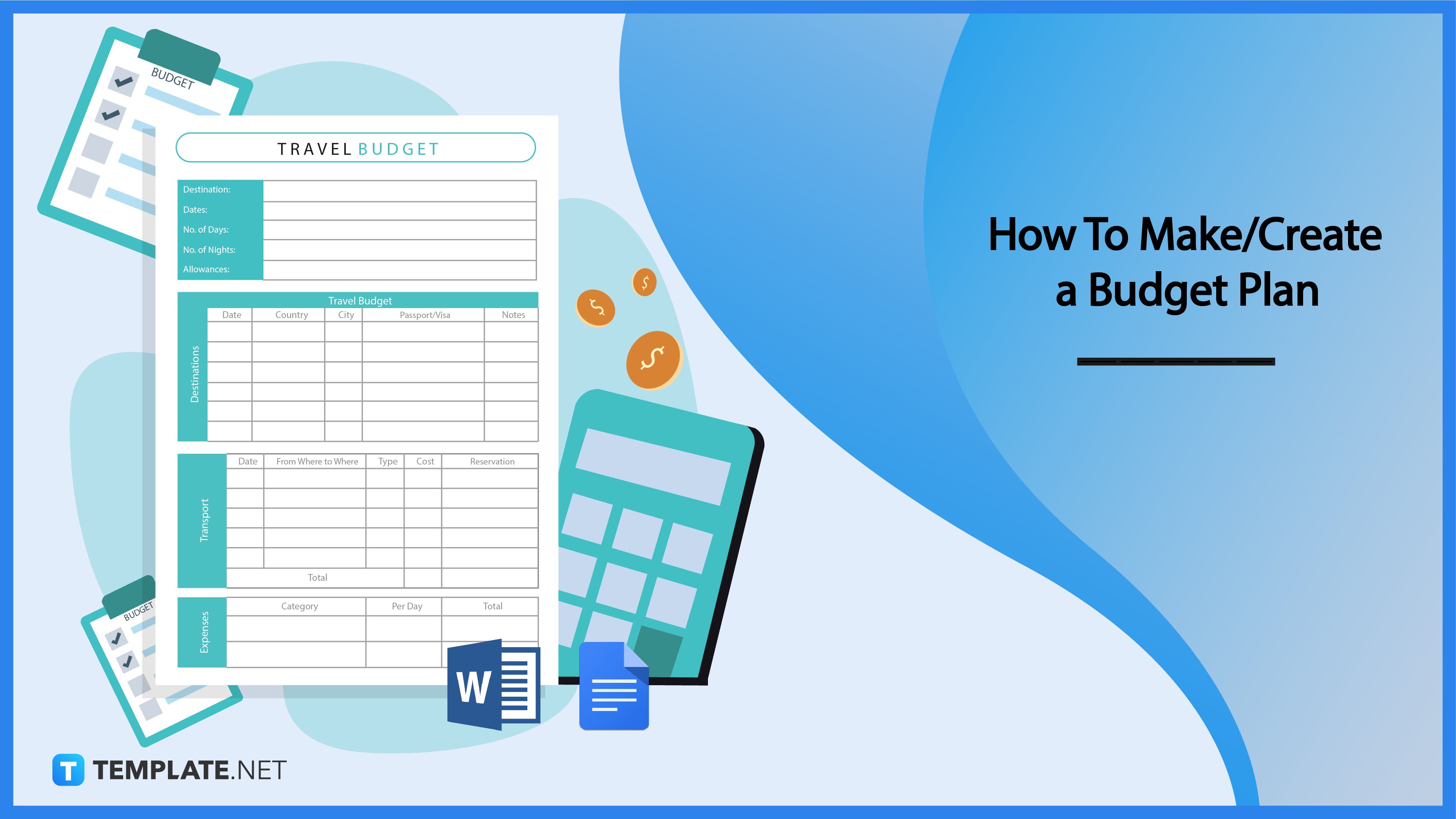

How To Make/Create a Budget Plan [Templates + Examples] 2023

Budget plans or budgets are business documents containing information using a chart or table, showing cash flow in different aspects of your life, from personal to professional. Use your budget plans well to distribute your money on where it needs to go, determine if you overspend your money, and make adjustments for bad spending habits.

Build a Budget Plan Template – Step-by-Step Instructions

Use different budget plan templates for your business or organization to record and monitor cash flow and spending using multiple devices on PC, Mac, or mobile devices. You can choose from word processing programs like Microsoft Word and Google Docs or spreadsheet applications like Google Sheets and Apple Numbers.

-

Step 1: Generate the Title and General Information

Construct the title of the budget plan at the center of the document, making it easier to identify the purpose of creating the document. Write the client’s name, their family members, the allotted budget for the plan, and when the financial adviser or accountant develops the budget, including its coverage date.

-

Step 2: Compose the Income table

One way to assess your financial health is through the income table, which determines how financially stable you are and how easy it will be to obtain things like a mortgage. It also helps you assess your level of readiness for significant financial milestones like retirement.

-

Step 3: Fill the Expense Table

The cash flow section of the budget plan details where and how much money an individual or business makes from their income and where these funds go. Understanding the cash flow enables the organization or the person to better create budgets for their expenditures according to their revenue.

-

Step 4: Compute the Net Balance

The analysis section of the budget plan determines the correlation of an individual’s or business’s income with their expenses, showing whether variances exist in the budget. Having a positive net budget variance means that the client did not go over budget and can make adjustments to their future budget plans.

-

Step 5: Search for the Budget Plan Template

Visit the Template.net website using your device’s web browser and navigate to the budget plan templates landing page to browse through different sample templates you can edit and revise for personal or business use. Select a template to represent the client’s net worth and cash flow in a table to sort out their monthly or annual budget.

-

Step 6: Select the Budget Plan Template to Use

Click on the image of the budget plan template you want to use; for this example, select the budget plan template. Choose from available file formats from the selection on the product window by clicking the Edit This Template button to access the online editor tool or the Download Now button for Template.net PRO accounts.

Budget Plan Templates & Examples

Budgeting helps individuals and organizations to develop a sense of financial stability for their cash flow by monitoring expenses and following the budget plan their financial advisers set for them. Construct budget plans to help you with budgeting and tracking expenses and revenue, maximizing your savings and annual net worth.

12-Month Budget Plan Template

A 12-month budget plan covers an individual’s or company’s annual revenue and expenses, creating a budget plan to best utilize their resources to produce worthwhile projects.

Startup Budget Plan Template

Startup budget plans are valuable documents for many startups as it helps them to plan for their capital expenditures and other business expenses.

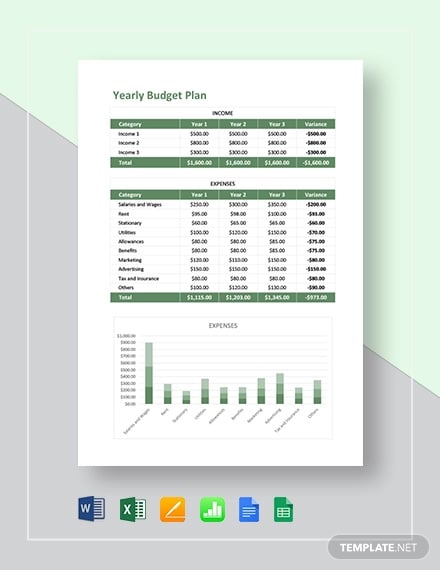

Yearly Budget Plan Template

Financial Budget Plan Template

Restaurant Budget Plan Template

Budget Marketing Plan Template

This is the reason why people need to come up with their own personal budget plans so that they can keep track of both their earnings and expenses. This article is going to focus on how you can create a budget plan that will help ensure that you do not overspend, so you can focus on your financial goals.

FAQs

How do you write a budget plan?

When writing budget plans, identify your net income, list SMART goals, track your spending, and create the plan.

What is the 50 30 20 budget rule?

The 50 30 20 budget rule divides your income into three parts, with 50 percent going to needs, 30 percent to wants, and 20 percent to savings.

What is the 70 20 10 money rule?

Similar to the 50 30 20, the 70 20 10 rule encourages individuals to portion their income into 70 percent for needs, 20 percent for savings, and 10 percent for wants.