Table of Contents

- Policy Template Bundle

- 9+ Nonprofit Investment Policy Templates in DOC | PDF

- 1. Nonprofit Investment Policy Template

- 2. Investment Policy Statement for Nonprofits Template

- 3. Sample Investment Policy for Nonprofits Template

- 4. Investment Policy for Nonprofit Organisations Template

- 5. Nonprofit Organisations Investment Policy Statement

- 6. Non-Profit Housing Association Investment Policy Template

- 7. Investment Returns & Distribution Policies of Nonprofit

- 8. Investment Disclosure for Nonprofit Funds Template

- 9. Nonprofit Investment Policy Template in PDF

- 10. Nonprofit Investment Policy Template in DOC

- How to Design a Non-Profit Investment Policy?

- How Can a Non-Profit Organization Invest in Stock?

9+ Nonprofit Investment Policy Templates in DOC | PDF

A non-profit investment policy is a particular statement that is referred to as a client-specific document that is designed to address the objectives, some unique circumstances, and constraints. It also lays out the overall oversight procedures that govern the investment-related activities of a non-profit organization. It also helps in presenting the portfolio’s financial objectives within the context of how much risk the trustees will be able to bear.

Policy Template Bundle

9+ Nonprofit Investment Policy Templates in DOC | PDF

1. Nonprofit Investment Policy Template

councilofnonprofits.org

councilofnonprofits.org2. Investment Policy Statement for Nonprofits Template

russellinvestments.com

russellinvestments.com3. Sample Investment Policy for Nonprofits Template

npccny.org

npccny.org4. Investment Policy for Nonprofit Organisations Template

gocabe.org

gocabe.org5. Nonprofit Organisations Investment Policy Statement

suntrust.com

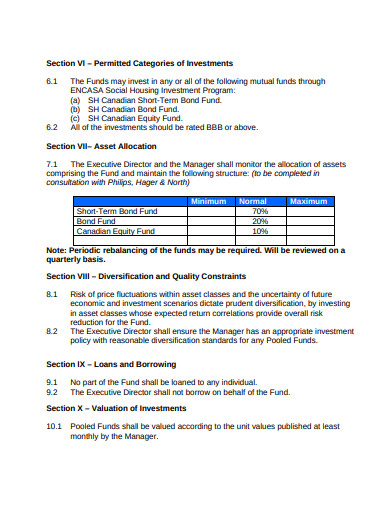

suntrust.com6. Non-Profit Housing Association Investment Policy Template

bcnpha.ca

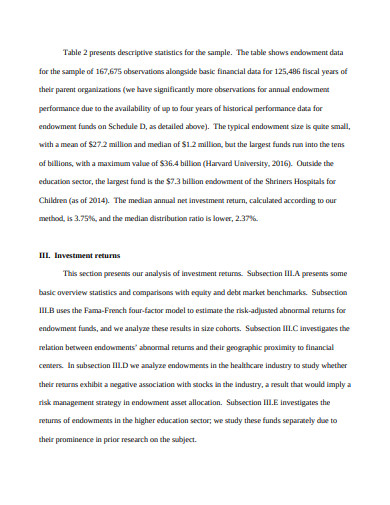

bcnpha.ca7. Investment Returns & Distribution Policies of Nonprofit

ecgi.global

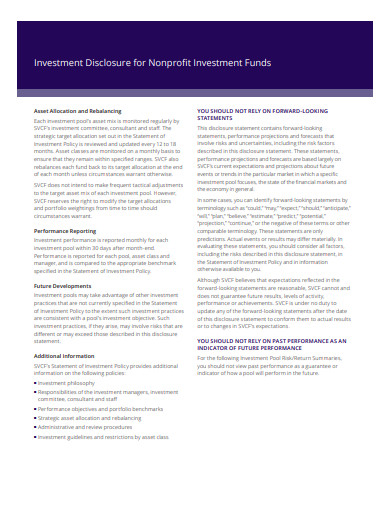

ecgi.global8. Investment Disclosure for Nonprofit Funds Template

siliconvalleycf.org

siliconvalleycf.org9. Nonprofit Investment Policy Template in PDF

files.eric.ed.gov

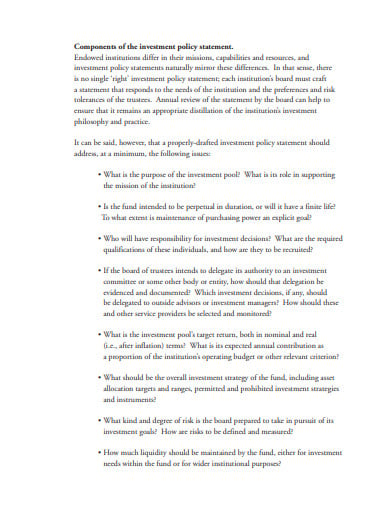

files.eric.ed.gov10. Nonprofit Investment Policy Template in DOC

boardsource.org

boardsource.orgHow to Design a Non-Profit Investment Policy?

The following are the steps that will be required for developing a non-profit investment policy along with its accompanying objectives and strategies.

-

State the Objectives and Philosphy

What are you hoping to achieve in your investment policy? The general objectives should be about return and risk. To order to achieve long-term goals, you may want to provide information such as spending rate, expected inflation rate, investment management fees, and any desired actual portfolio growth. Furthermore, how much pressure does your charity experience?

-

Mention the Constraints

Cash flow and time limitations will probably top your list. For example, does your company rely on investments to throw off a certain percentage of revenue every year to meet the needs and expenditure? For instance, your policy might stipulate that your company can withdraw 5 percent of its investment income for procedures annually. And, what is your investment’s time horizon? Is it largely their purpose to support endowments?

-

Mention Your Return Measurement Objectives

This is how the investment policy achieves its goals, and how they are calculated. The strategy can simply state that “assets are invested to produce an appreciation and/or dividend and interest income” and the company must diversify its assets to achieve its purpose.

-

State the Organized Risk and Volatility

Volatility is defined as the trailing three-year difference in investment returns. The risk is mentioned as the failure to meet the return goal. What are the variables that you will be considered to minimize your risk? For instance, there are typical factors that include inflation as well as asset allocation.

-

Identify Your Spending Rate

You can only define the total return after identifying what will likely be a percentage of total return. Many organizations adopt an average of 36 months.

-

Provide Asset Allocation

Asset allocation is one of the major decisions that you can make on your investment committee. Base on the allocation on all of the above-mentioned factors — it should be in line with your acceptable amount of risk and expected return. Make sure that the allocation plans are reviewed and updated periodically. Given the uncertainty of the US economy, many organizations may have updated their strategies to transfer their investments into more safe properties, such as fixed-income securities.

-

Layout Permissible Investments

This section would generally include the real estate investment trusts or REITs. It will also involve cash equivalents or domestic large-capitalization equity securities. These investments should be consistent with your mission.

-

Present Your Policy on Portfolio Rebalancing

Your investment department will periodically rebalance the portfolios to realign with the distribution of the fund. Many policies say that there must be re-equilibrium every fifth. Some say that when there is a certain percentage deviation from the asset allocation plan, rebalancing will take place.

-

Produce Performance Goals

Notice in particular in which circumstances consultants and managers will be terminated, for instance, in case the investment is regularly out of line with the asset allocation strategy.

How Can a Non-Profit Organization Invest in Stock?

As the non-profit organization serves an important role in society along with most such entities that have a religious, charitable, scientific, or educational purpose that qualifies them for exceptions from the income tax. Still, even an organization that is set as up nonprofit can invest all its financial resources in most of the same investments. It is set up with certain limitations that ensure that the organization’s generous purpose is fulfilled.

Importance of Financial Funds

Many nonprofit organizations rely upon much or all of their financial support on regular contributions from outside donors. The income that they earn from the donations in any given year is hardly sufficient to cover their employing budget, leaving them unable to set aside some financial funds for future use. However, some of them can start thinking for the future once nonprofits get larger. It requires some judicious investment for taking money and putting it toward longer-term goals such as capital spending or a permanent endowment.

Non-Profits Doing Business

Nevertheless, since nonprofit organizations have wholly-owned for-profit businesses, it is where things get trickier. This is popular in the healthcare industry, where public hospitals or any other healthcare organization may own for-profit businesses such as medical professional practices or real-estate holding firms.

The key question for the charity, in such situations, is whether the for-profit affiliate would endanger its tax-exempt status. The IRS has also drawn the line at the point where the for-profit parent company’s business activities are the key elements of the nonprofit parent’s operations. Luckily, remaining on the right side of the line is generally fairly straightforward for nonprofits. As long as the for-profit business remains in a separate corporate entity with separate boards of directors and officers, challenging the separation of the two will be difficult for the IRS. It is only when there is no clear differentiation that the charity will likely lose its tax-exempt status. The idea of a non-profit not holding stock makes some sense, but such a ban will prevent the non-profit from making intelligent investments to further its business purpose.