29+ Amortization Schedule Templates

A borrower and a lender need to form a formal agreement when it comes to loans. One stipulation on the agreement pertains to how the payment is made by the borrower. Similar to organizing workload through a work schedule, loan payments are arranged based on the agreed payment terms through an amortization schedule. You may also see Schedules Samples.

Certain elements cover the preparation of an amortization schedule similar to how a vesting schedule is created. The agreement between the lender and the borrower is the sole basis of amortization schedules for particular loans. In this regard, look into the following amortization schedule templates for references with similar formats of your amortization schedule to have a better understanding of the values.

Schedule Template Bundle

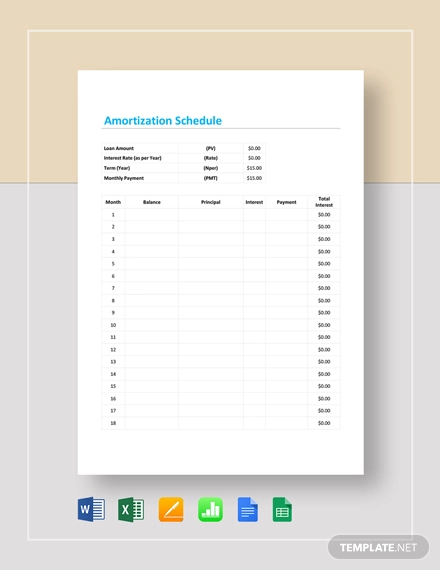

Amortization Schedule Template

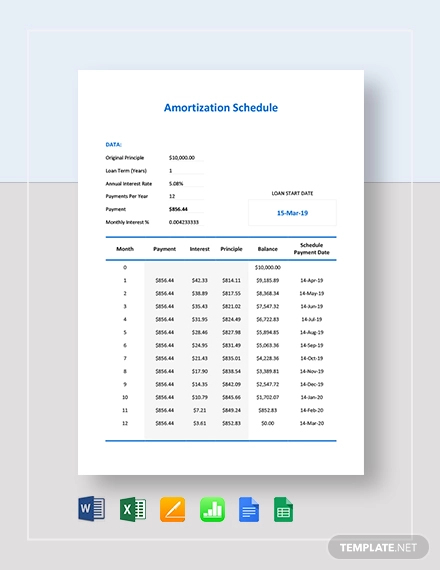

Simple Amortization Schedule Template

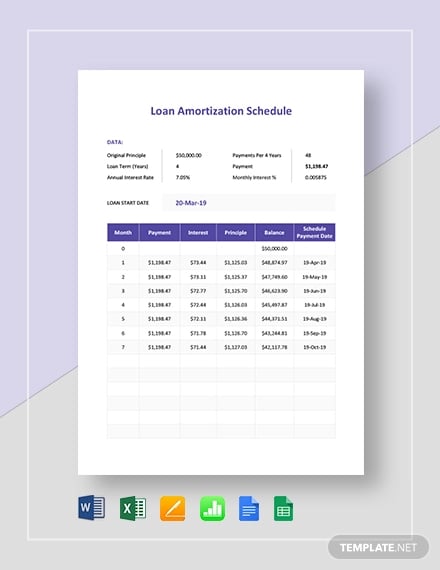

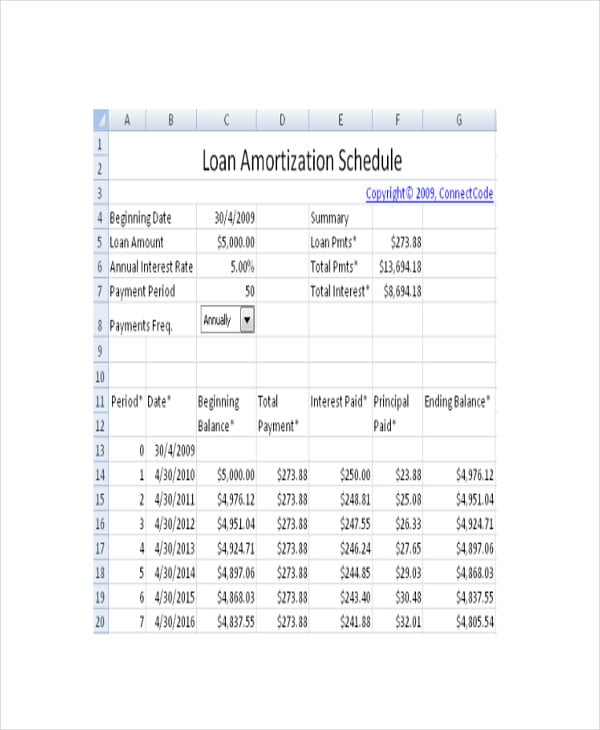

Loan Amortization Schedule Template

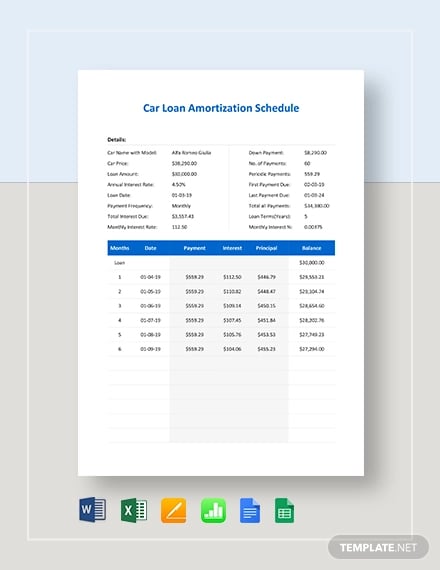

Car Loan Amortization Schedule Template

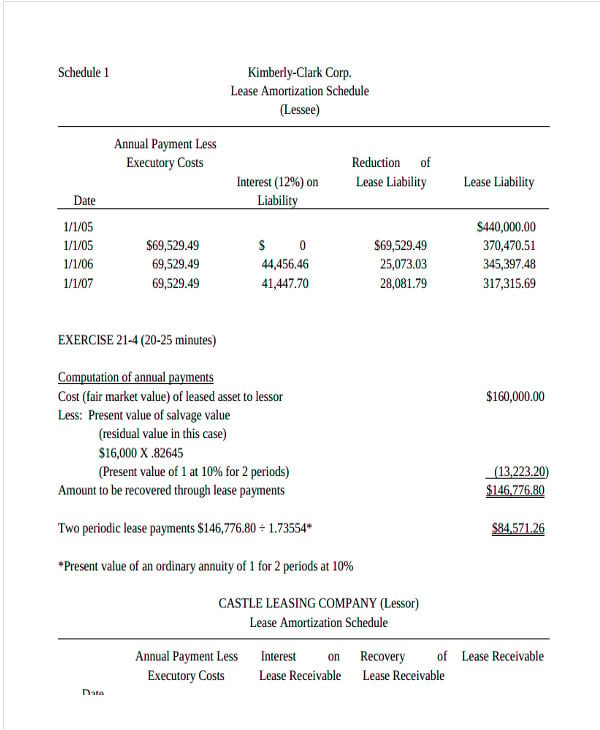

Lease Amortization Schedules

Capital Lease Amortization

business.illinois.edu

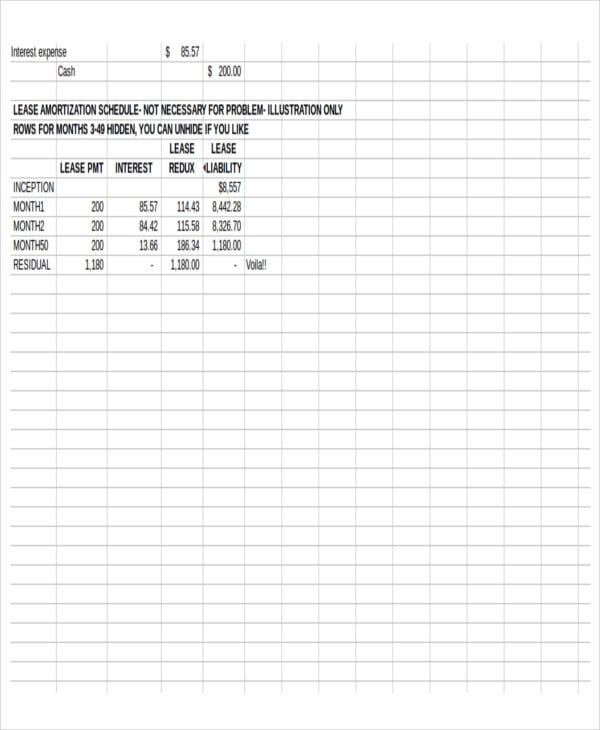

business.illinois.eduCar Lease

econ.ucsb.edu

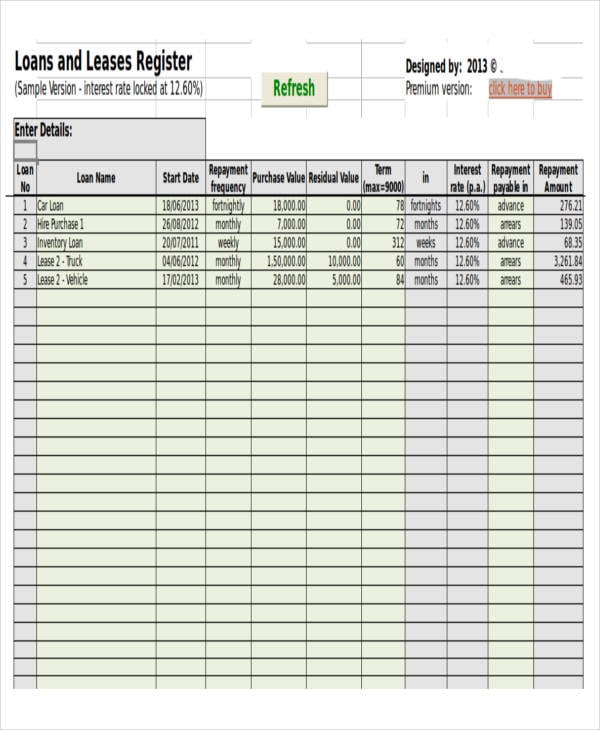

econ.ucsb.eduLoan and Lease

unclefinance.com

unclefinance.comLoan Amortization Schedules

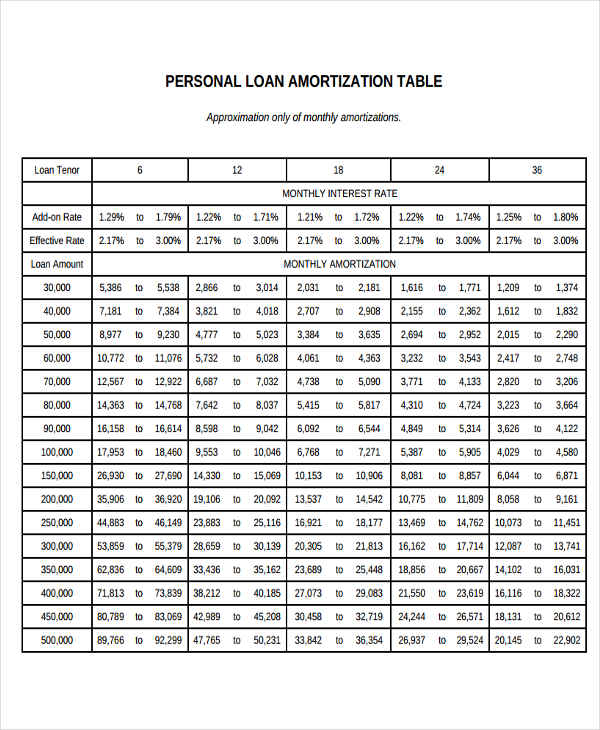

Personal Loan Amortization

hsbc.com.ph

hsbc.com.phStudent Loan

mccann.edu

mccann.eduVehicle Loan Amortization

freddiemac.com

freddiemac.comWhat Is an Amortization Schedule?

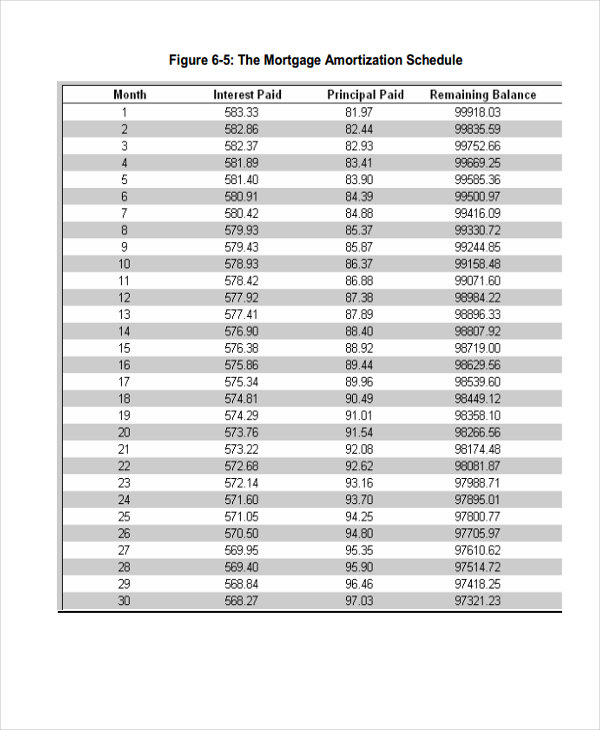

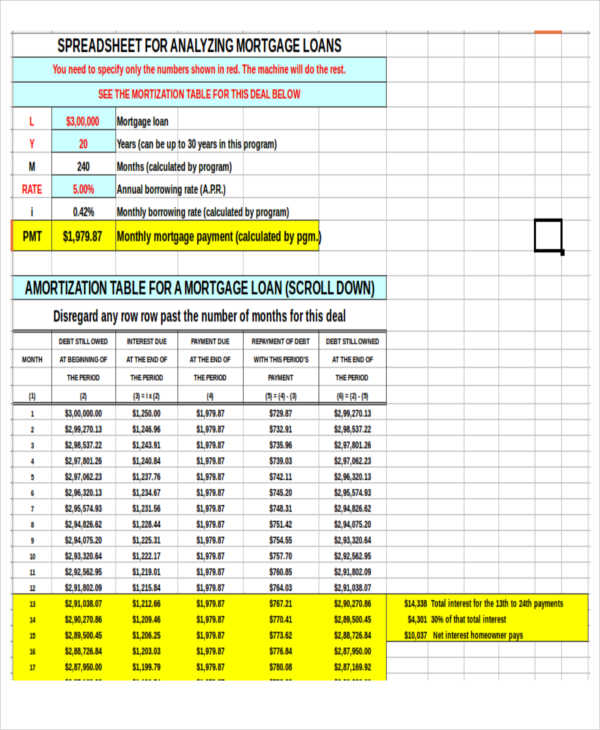

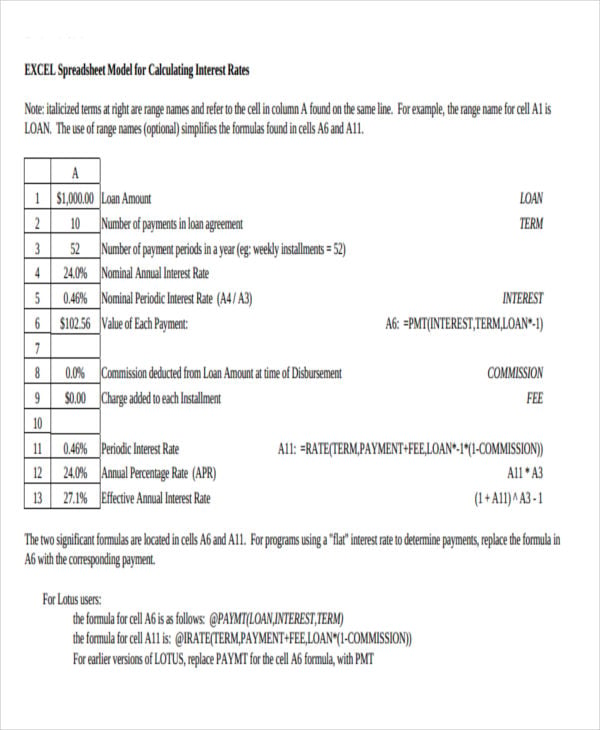

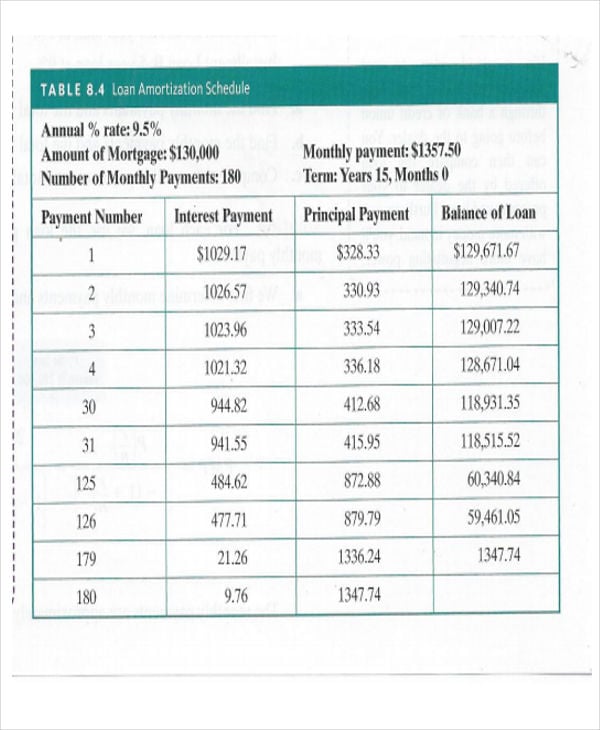

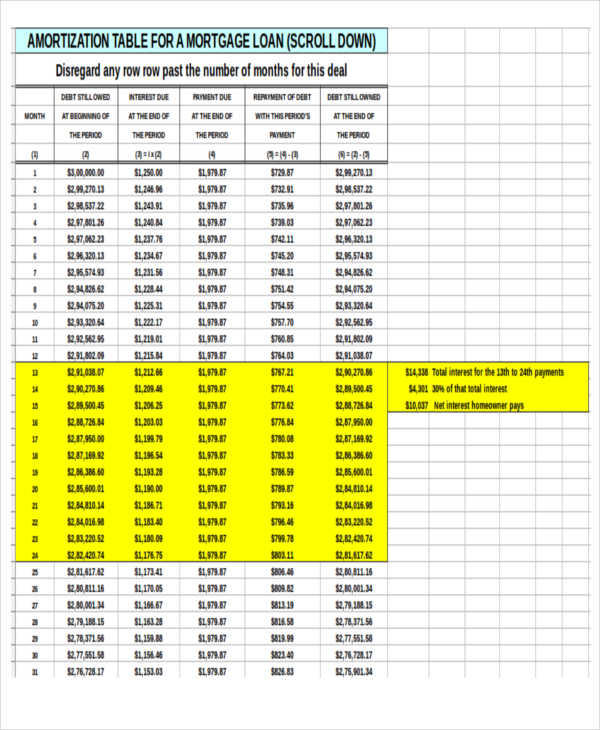

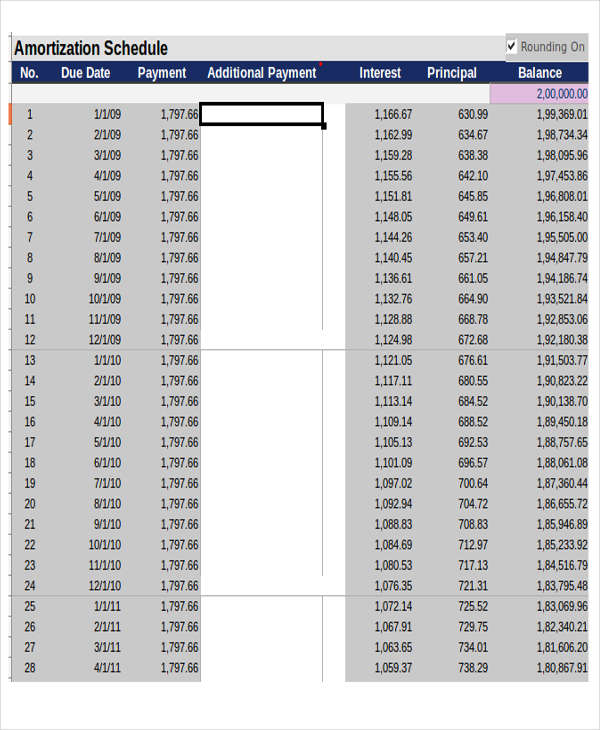

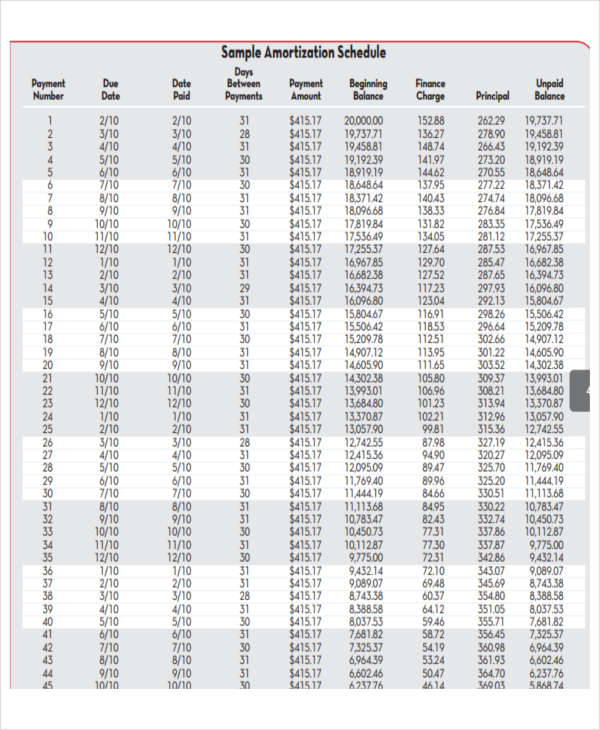

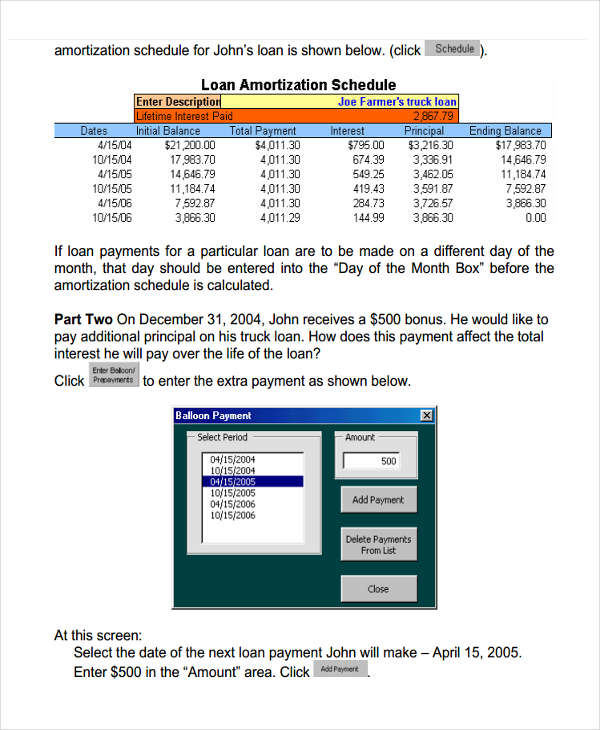

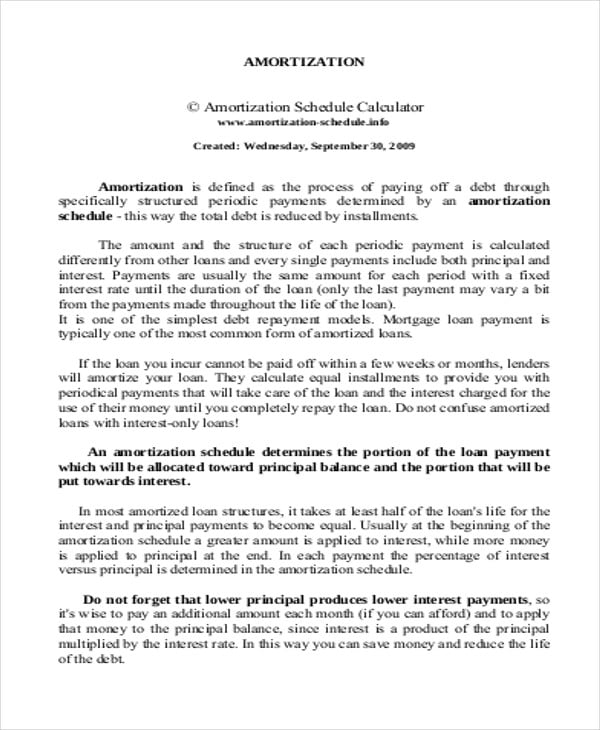

An amortization schedule possesses payment of loan details with specifications on how much of the principal amount and the interest is paid periodically. This schedule differs from a payment schedule since a payment schedule only shows the amount of payment due and the date it is to be paid. An amortization schedule is the tabular form of the regular payment process of clearing a debt called amortization. There are different formats of this schedule as shown on the sample printable schedule template on amortization of this website.

Key Elements of an Amortization Schedule

Similar to practice schedule templates, an amortization schedule contains elements used in providing the required information to aid both the lender and the borrower. Here are the key elements of amortization schedules as seen on the sample amortization schedule templates:

- Principal Payments – A small portion of the principal amount is added at the start of the payments and it increases until the latter stages of the period.

- Interest Payments – Contrary to the principal payment portion of the periodic payments, the interest covers a large amount until it diminishes at the latter parts of the amortization period.

- Total Amount due – The sum of the portions of principal and interest payments is the total periodic payment the debtor must pay.

- Amortization Period – This pertains to the duration of the payment period presented on the amortization schedule. Most periodic payments are monthly payments.

- Balances after Payment – After deducting the payments each month, the remaining balance is computed until it reaches zero.

Annual Amortization Schedules

Annual Payment Amortization

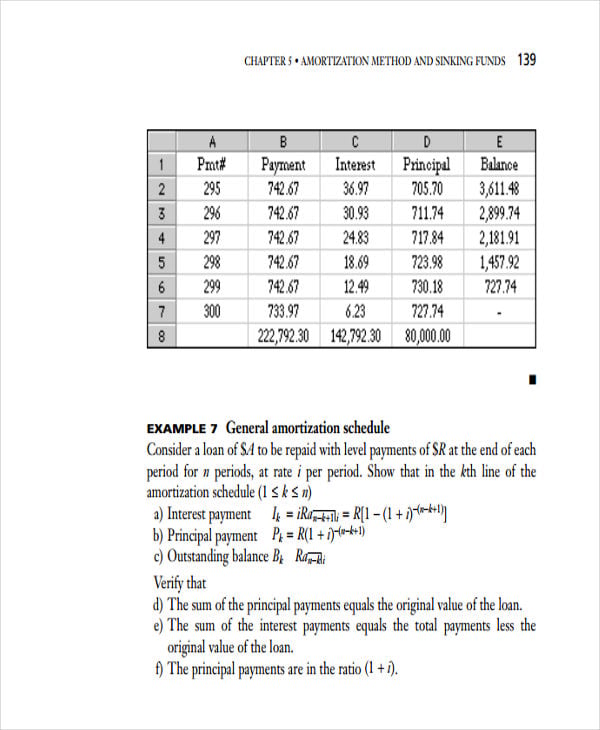

mheducation.ca

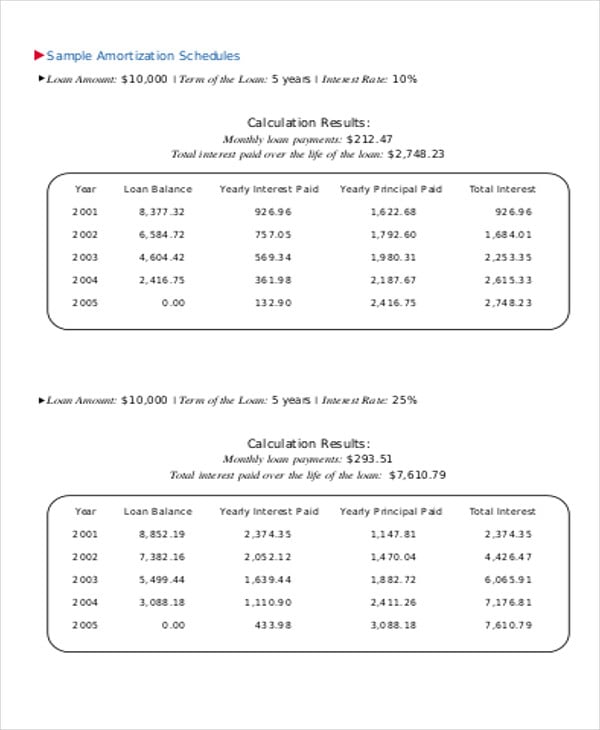

mheducation.caAnnual Loan

spreadsheetml.com

spreadsheetml.comAnnual Mortgage Amortization

nku.edu

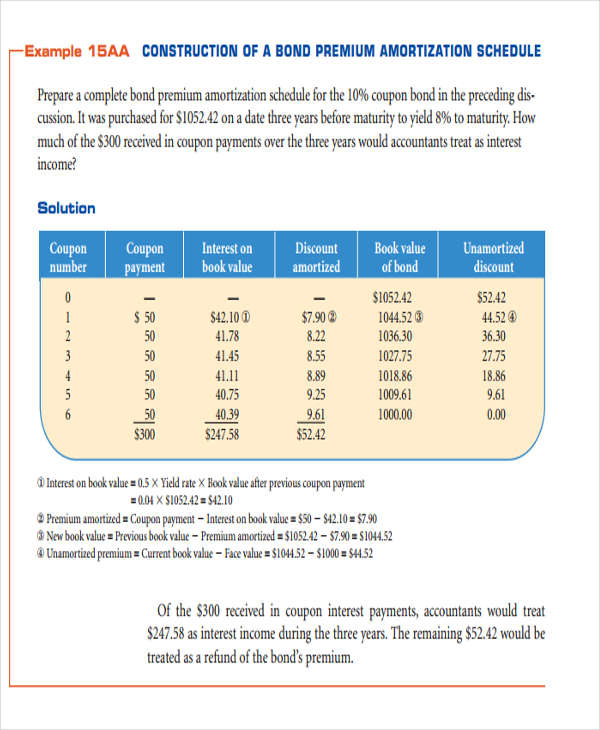

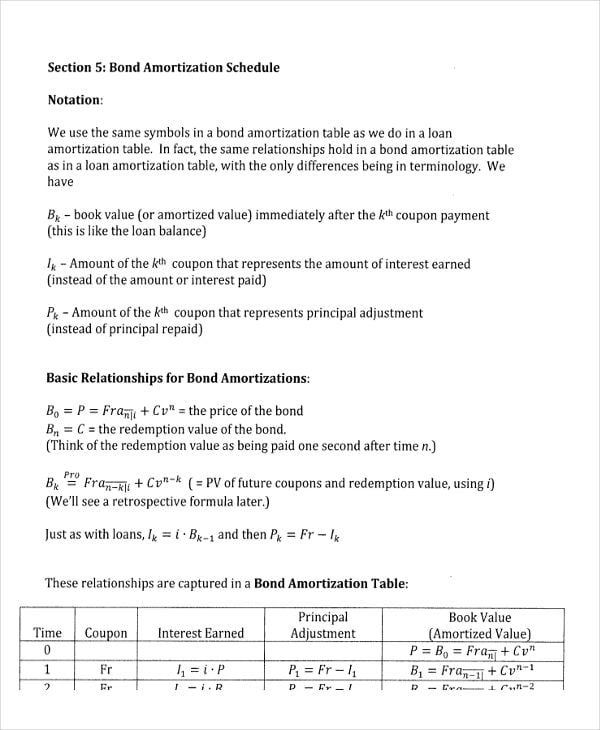

nku.eduBond Amortization Schedules

Bond Discount Schedule

highered.mheducation.com

highered.mheducation.comBond Premium Amortization

math.fsu.edu

math.fsu.eduMortgage Loan

princeton.edu

princeton.eduTypes of Amortization Schedule Templates

In order for you to easily sift through the various amortization free schedule templates on this website, here are the types of amortization schedule templates divided according to:

Nature of Amortization Schedule Templates:

- Loan Amortization Schedule – Loans particularly mortgage loans are subject to amortization of the mortgaged assets such as a residential property of the debtor as depicted on this schedule template.

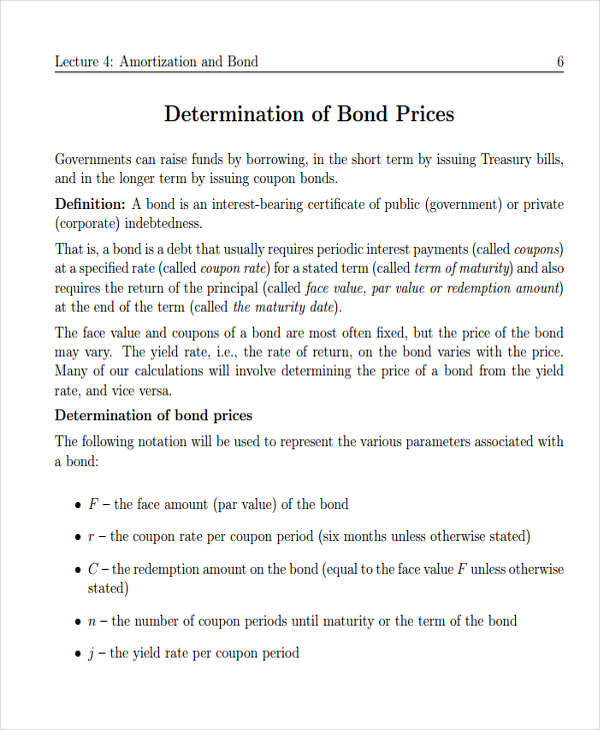

- Bond Amortization Schedule – Bonds are issued by the indebted individual or business as an instrument of payment to the lenders. This schedule template may involve payments on bond premiums, bond discounts, and bond mortgage.

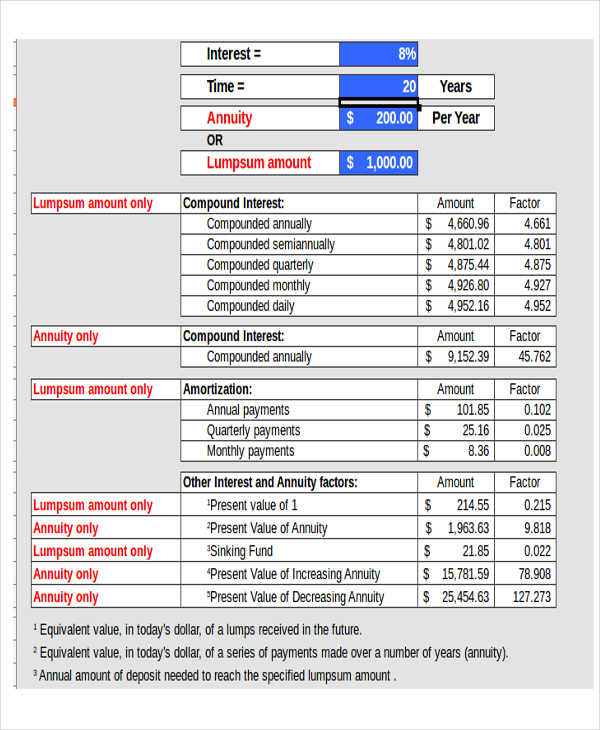

- Interest Amortization Schedule – Loan interest in this schedule template is provided in either simple or compounded interest. Most often the loan interest is paid at the early stage of the period as defined on the schedule.

Format of Amortization Schedule Templates:

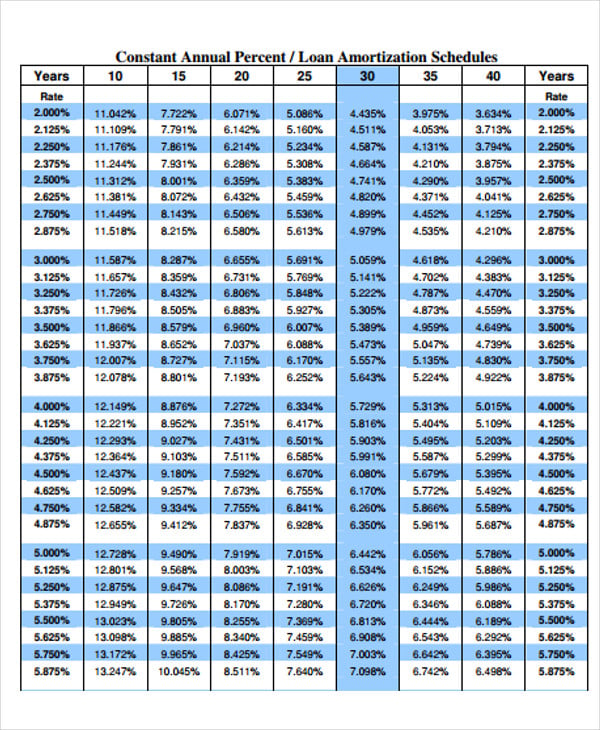

- Annual Amortization Schedule – As stated on the name of the schedule template, the amortization schedule is arranged using the annual format following the terms of the amortization specified on the parties’ agreement.

- Daily Amortization Schedule – This schedule template shows how much a debtor pays everyday if he opts to fulfill his obligation to the lender on a daily basis. The interest and the principal amount is calculated following a daily format.

- Monthly Amortization Schedule – This amortization schedule spreads the amount of payment using a monthly format applicable to debtors who chose monthly payment terms.

- Weekly Schedule Templates – Schedules under this format are prepared in a weekly scenario showing the days of the week and the accumulated payment at the end of each week.

Daily Amortization Schedules

Daily Interest Amortization

jointokyo.org

jointokyo.orgLoan Payment Amortization

lomira.k12.wi.us

lomira.k12.wi.usMortgage Loan Amortization

princeton.edu

princeton.eduInterest Amortization Schedules

Daily Interest

cpa-coker.com

cpa-coker.comSimple Interest Schedule

sc.toyotafinancial.com

sc.toyotafinancial.comCompound Interest Amortization

nrcs.usda.gov

nrcs.usda.govHow the Amortization Schedule Works

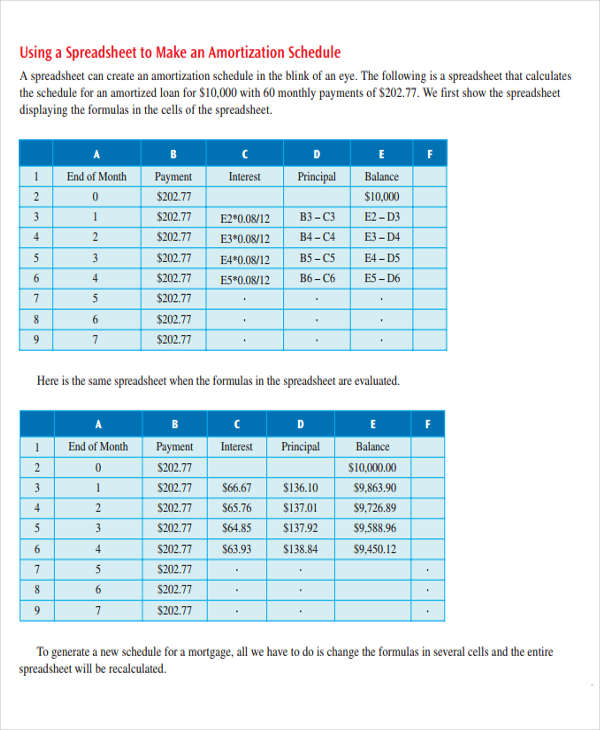

A schedule has its certain functions just like the payment schedule templates created to function as a guide for payment details. Likewise, an amortization schedule, as shown on the schedule templates in Excel, is made as reference for both the lenders and the borrowers as to how much the borrower is paying until the loan is completely cleared. Here is a guide for you to know how the amortization schedule works:

- Defining the amortization period and terms. The amortization schedule is created based on the agreed amortization terms which covers the percentage of interest and the amortization period. Yearly schedule templates show examples on how schedules are formatted as defined by the terms.

- Computing the periodic payments. Once the period is set, payment is spread evenly on the amortization schedule. The difference lies in the composition underlying the payment as per the percentage of the principal and the interest on each periodic payment.

- Completing balances of the schedule. The schedule templates in PDF mostly present how payments are deducted from the loan balance and how balances are completed until it becomes zero in amount similar to how the amortization balances on the amortization schedule are completed.

Monthly Amortization Schedules

Monthly Loan Schedule

farmdoc.illinois.edu

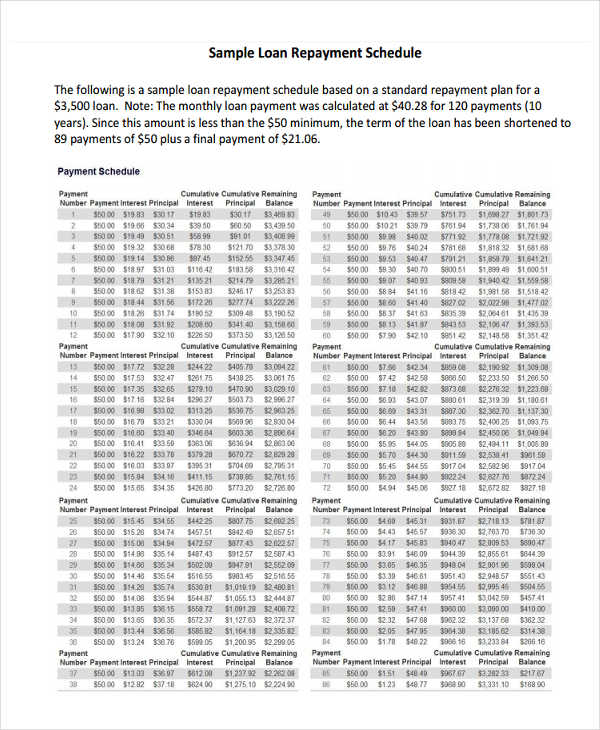

farmdoc.illinois.eduPayment Amortization

math.la.asu.edu

math.la.asu.eduMonthly Bond Schedule

mast.queensu.ca

mast.queensu.caPrintable Amortization Schedules

Printable Loan Amortization

fantane.com

fantane.comInterest Amortization

amortization-schedule.info

amortization-schedule.infoReal Estate Amortization Schedules

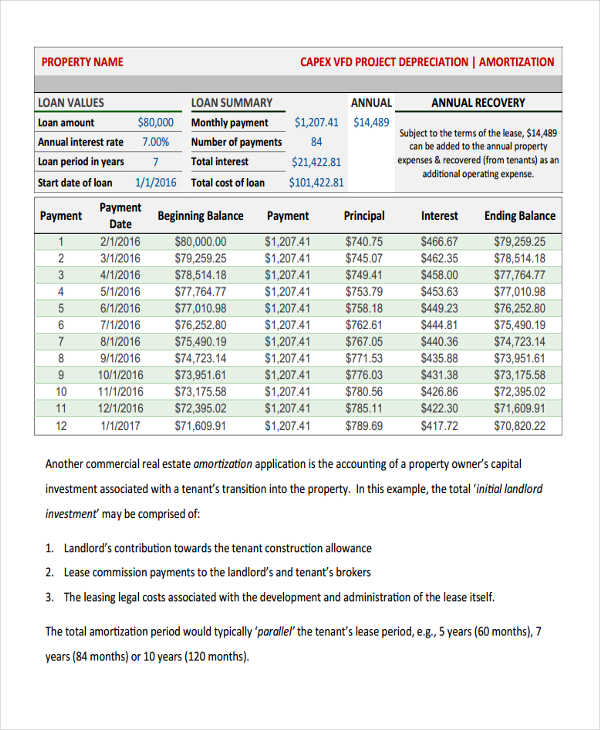

Commercial Real Estate Schedule

buildingsone.com

buildingsone.comFree Real Estate Amortization

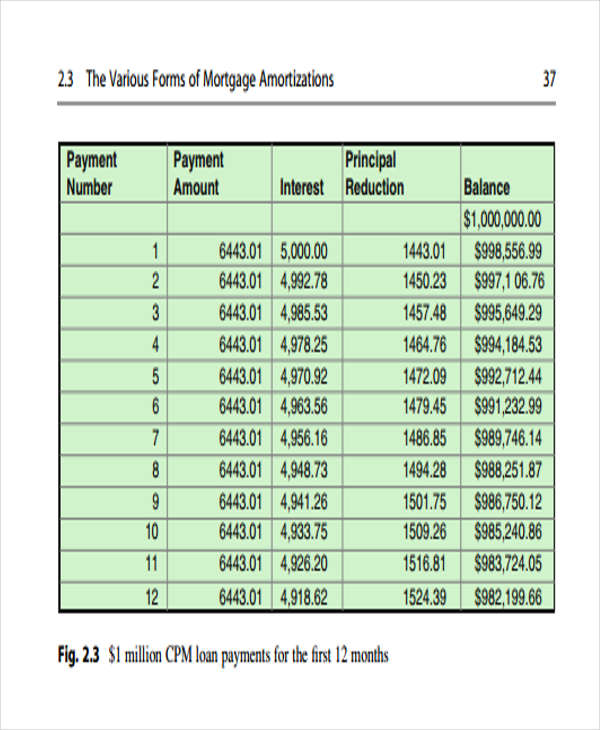

springer.com

springer.comReal Estate Loan

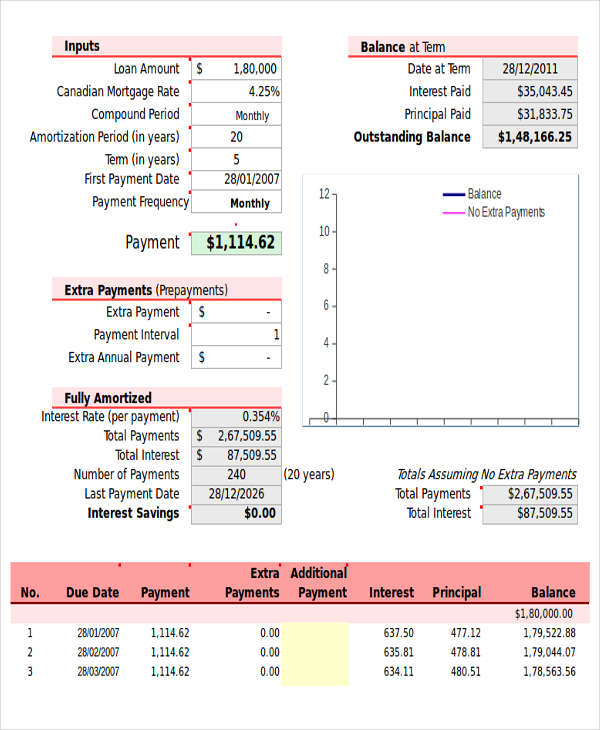

seltzerteam.com

seltzerteam.comPros and Cons of Amortization Schedules

The following are the pros and cons of amortization schedules like the loan amortization templates as depicted on the schedule templates of this website:

Pros:

- It presents a clear guide for the payments the borrower must comply.

- It aids in conforming the payments with the purchasing power of the borrower.

- It is a big plus for the borrower in the latter stages of the payment period where there is less interest to pay.

Cons:

- It entails the borrower’s payment of large payments in order to attain decrease on interest costs.

- It burdens the borrower because the earlier payments covers the interests more than the principal amount needed to be completed.

- It discourages borrowers who want to consolidate their loans to have only one payment since amortization schedules are conformed to the agreed terms of the loan.

Amortization schedules have their functions since they illustrate the agreement between the parties of the loan in the form of a table. Proper placing of information on these schedules is essential in order to aid the borrower on the loan payments. With this, seek the help of these amortization schedule templates as they cover various sample amortization schedules applicable to certain purposes.