33+ Stub Templates in PDF

An employee goes in to work everyday, provide his or her services, then expects compensation equal to the amount of work that was done. Receiving money is all well and good, but one also expects to know the details of why he or she receives that much.

This is the reason why employers have to hand out pay stubs to their employees. With a pay stub, an employee can get a full and detailed explanation regarding his or her salary. So this article will focus on what a pay stub is, what should be in it, and how you can go about making one.

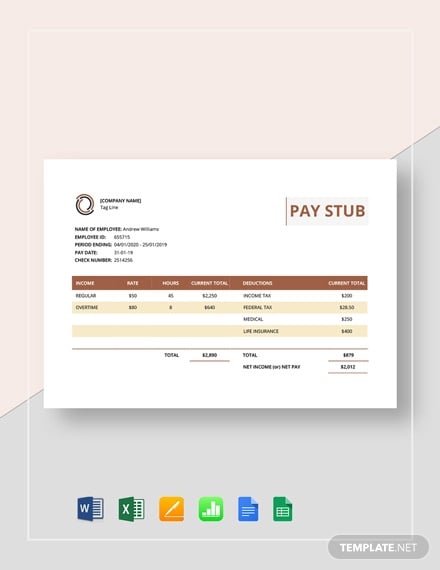

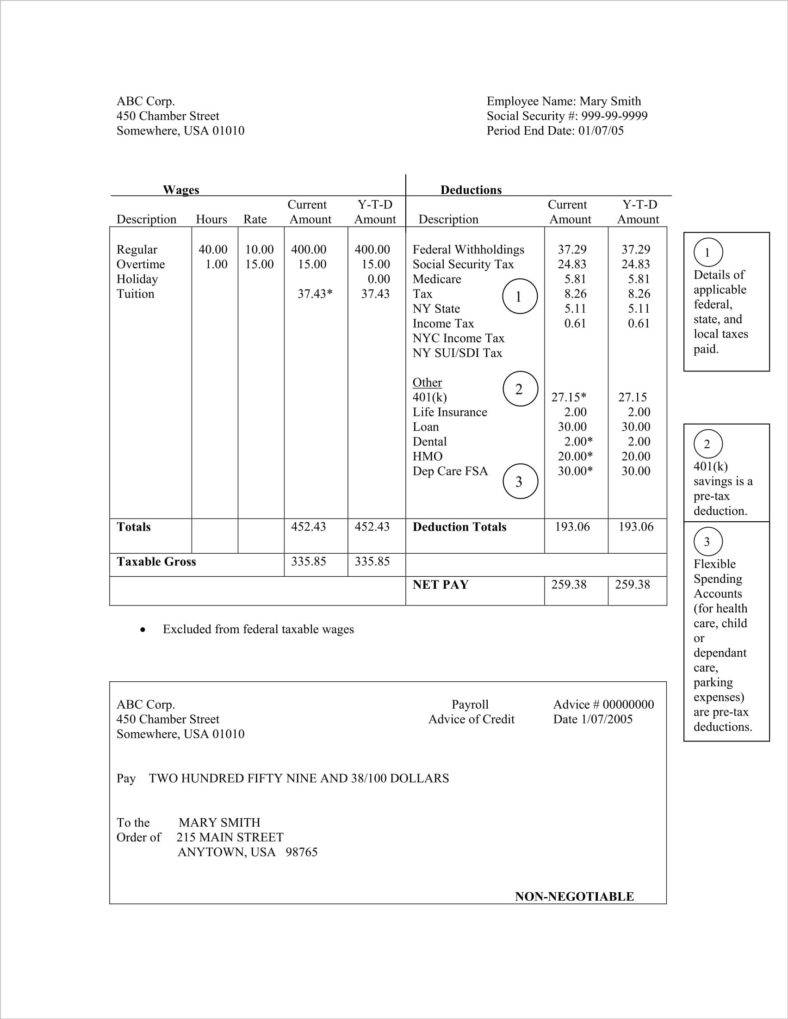

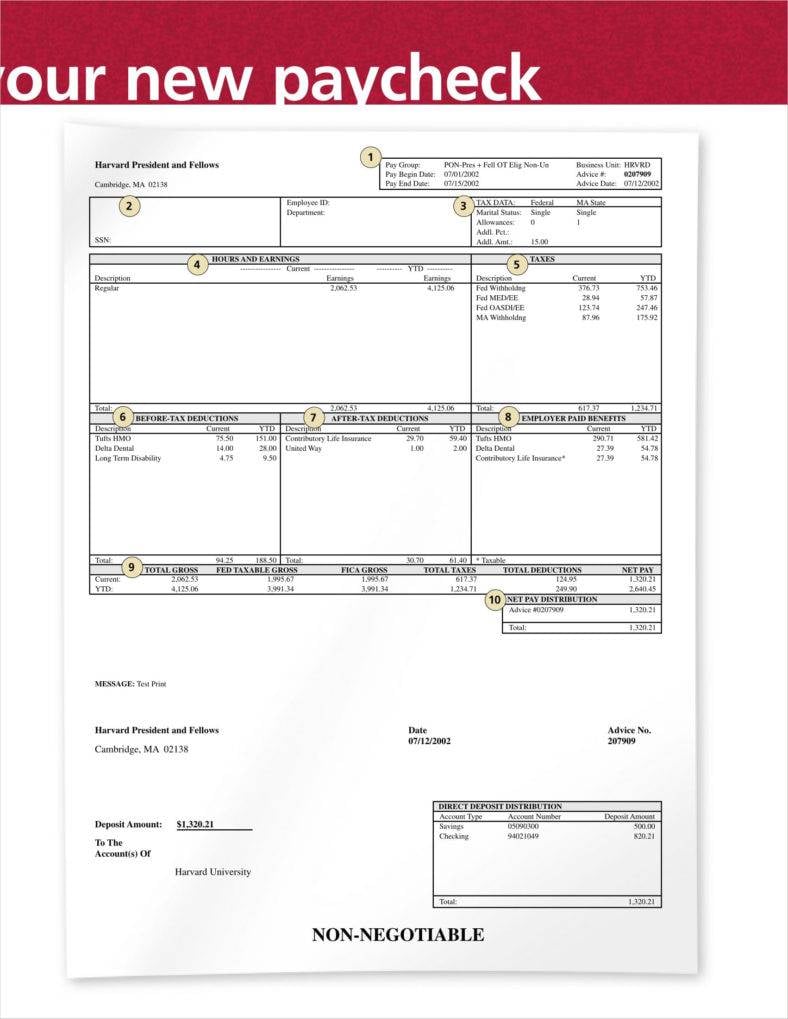

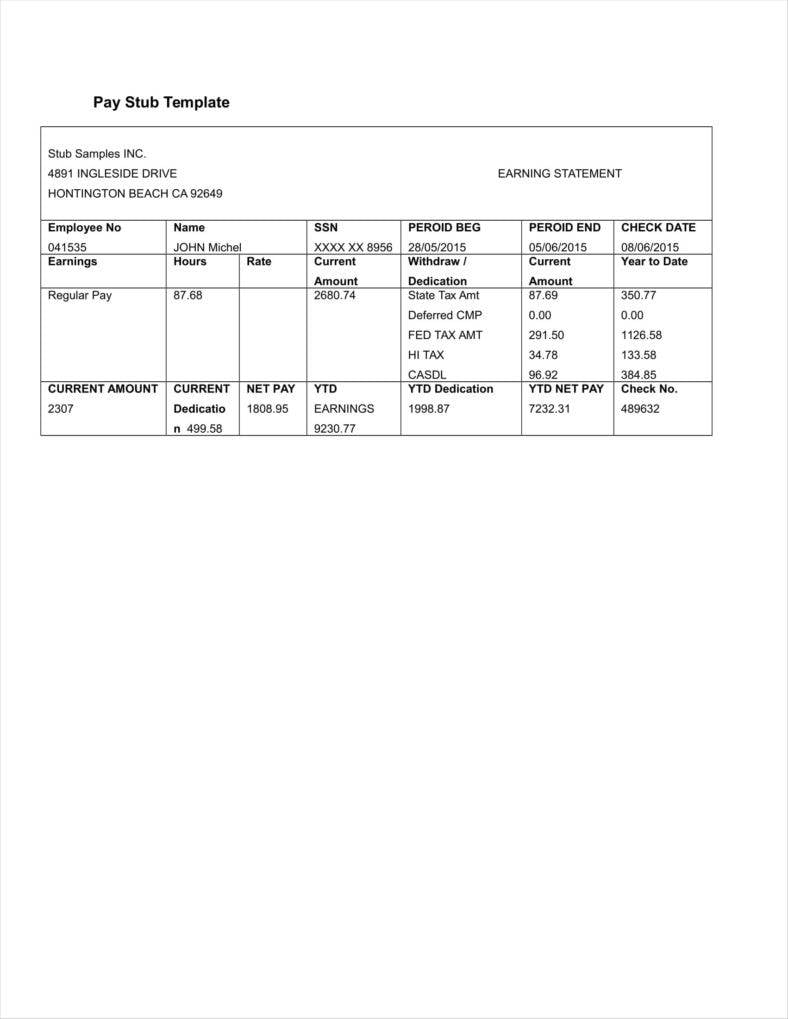

Sample Pay Stub Template

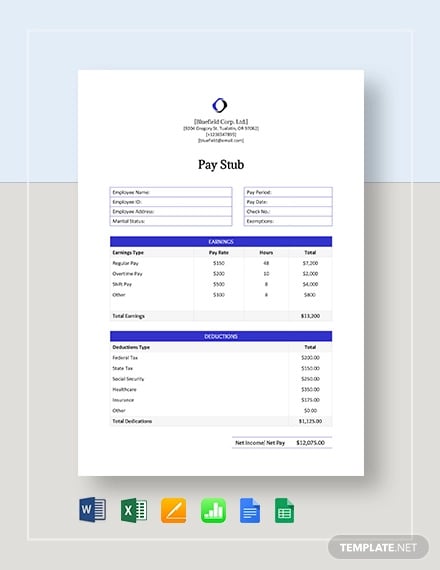

Basic Pay Stub Template

Employee Pay Stub Template

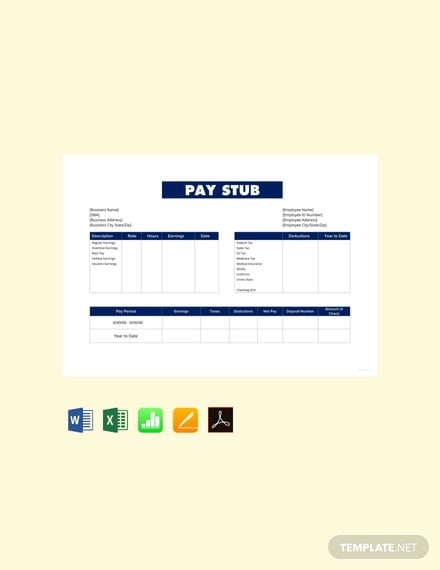

Company Salary Pay Stub Template

Free Simple Pay Stub Template

Free Sample Pay Stub Template

Free Basic Pay Stub Template

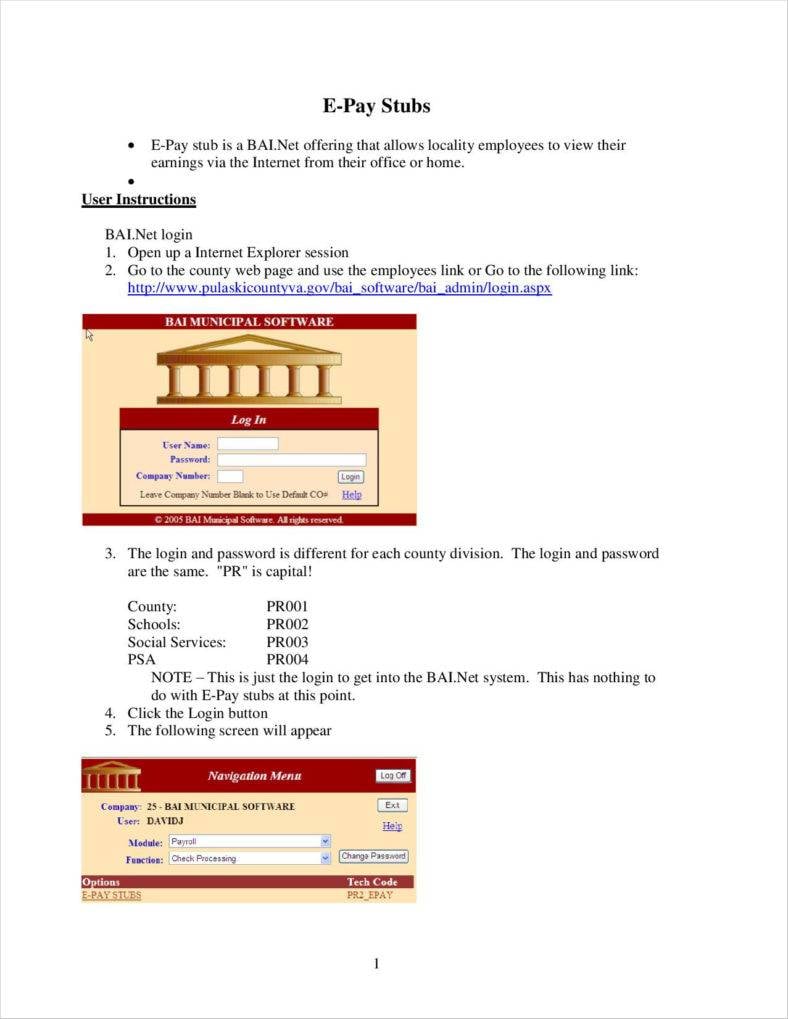

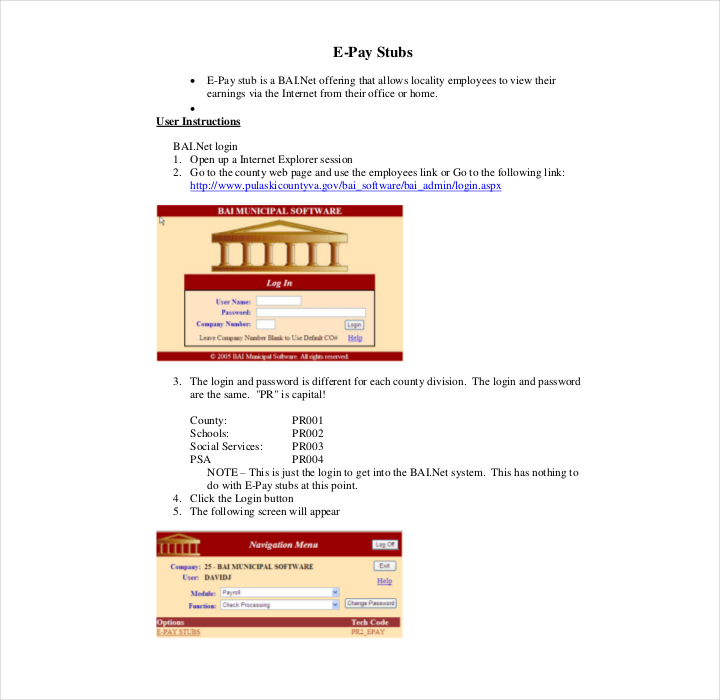

E-Pay Stub Template

pulaskicounty.org

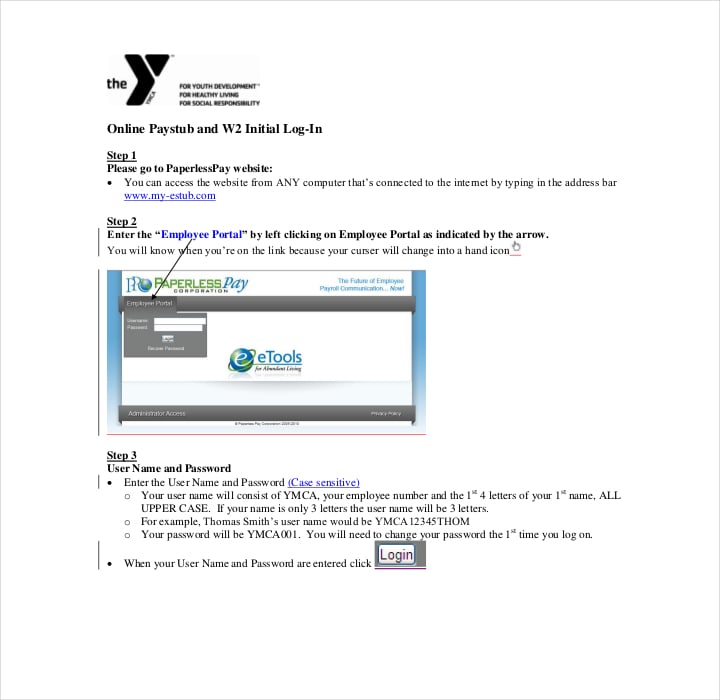

Simple Online Pay Stub

ymcaboston.org

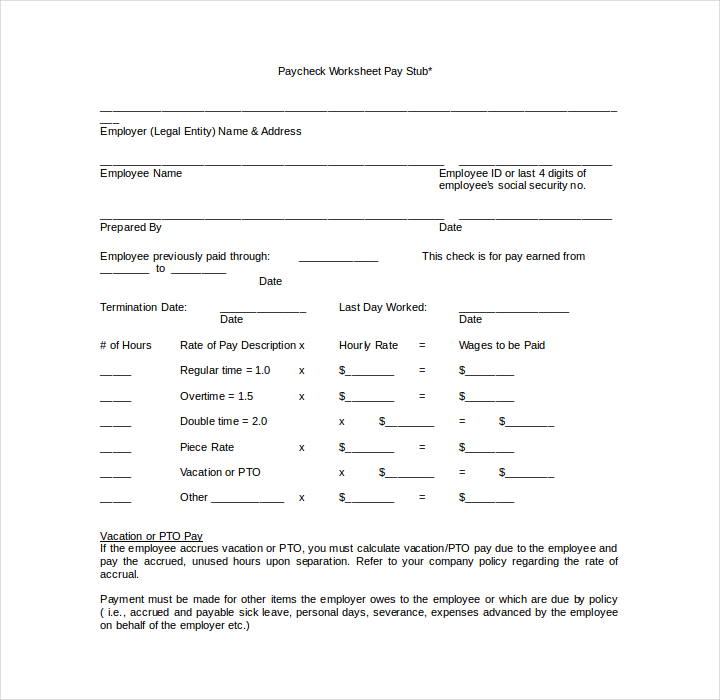

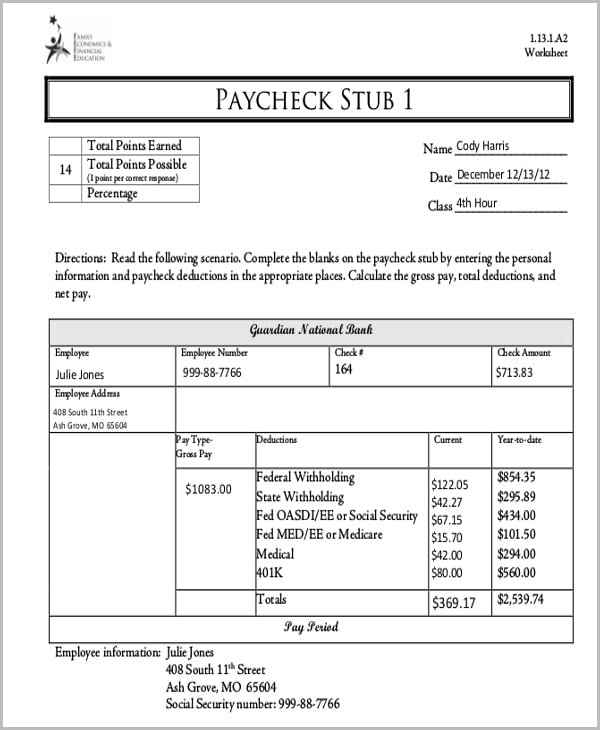

Paycheck Worksheet Pay Stub Template

silvershr.com

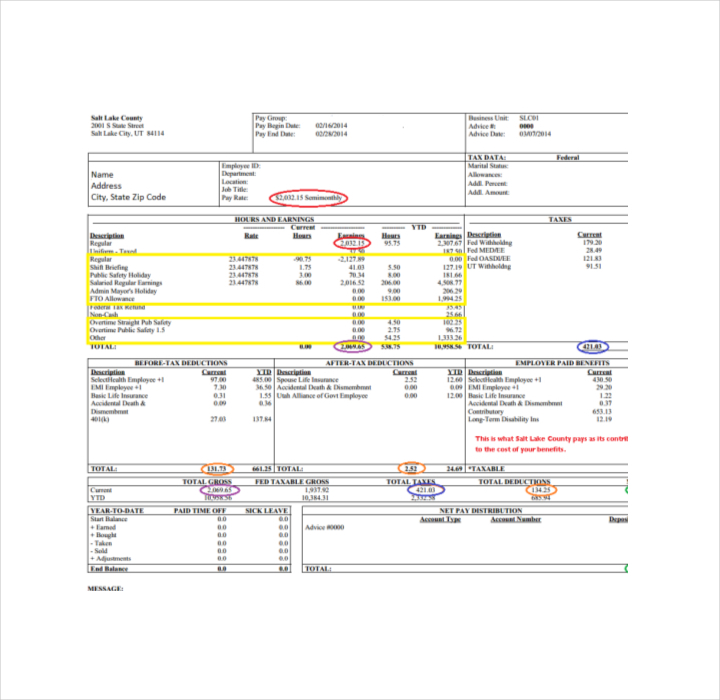

Pay Stub Example Template

thirteen.org

Salary Pay Stub Template

slco.org

Free Paycheck Stub Template

d3aencwbm6zmht.cloudfront.net

Blank Paycheck Stub Template

wikidownload.com

Printable Paycheck Stub Template

pdfimages.wondershare.com

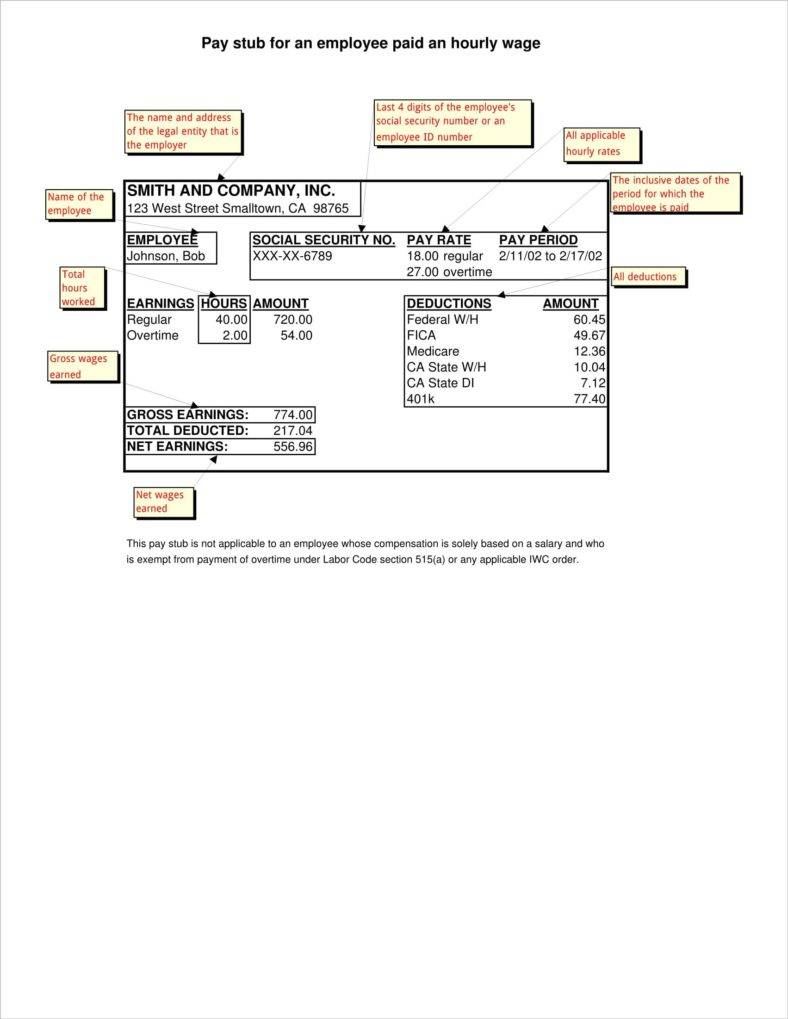

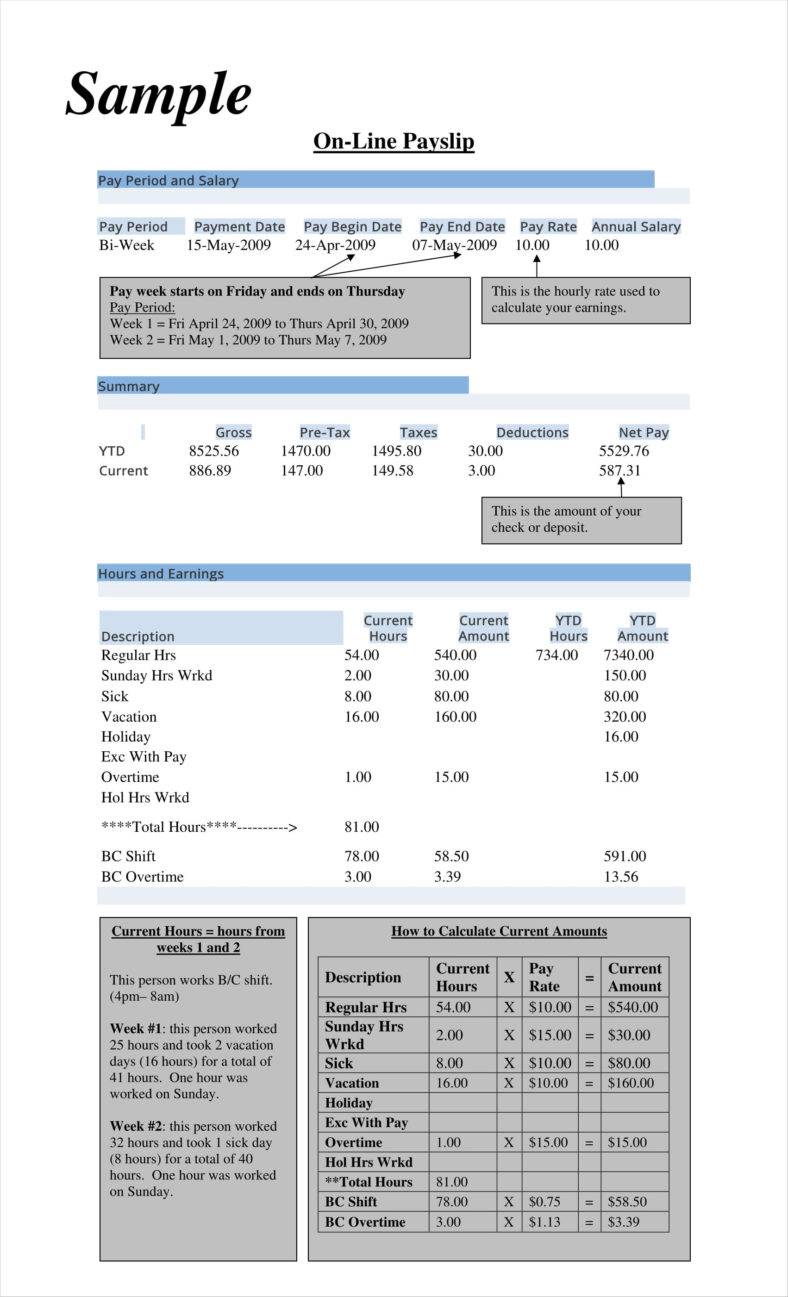

Pay Stub for Hourly Wage Employee

dir.ca.gov

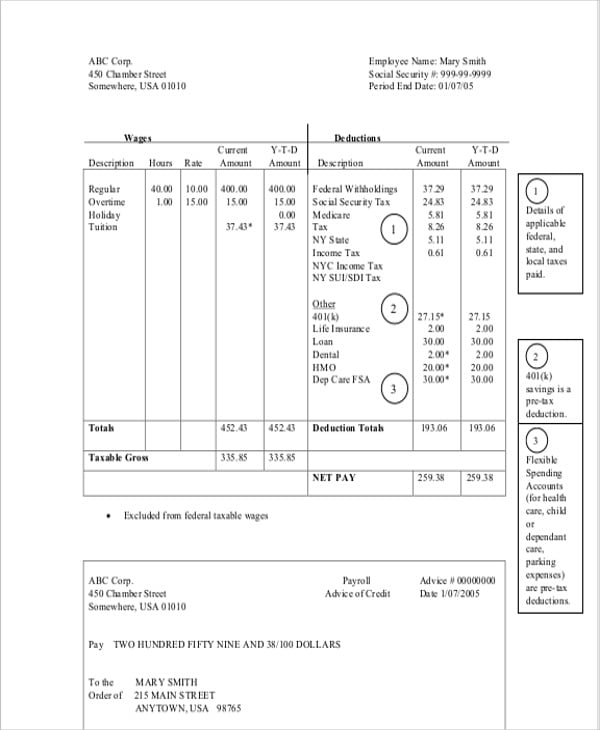

Pay Stub Example

thirteen.org

What are pay stubs?

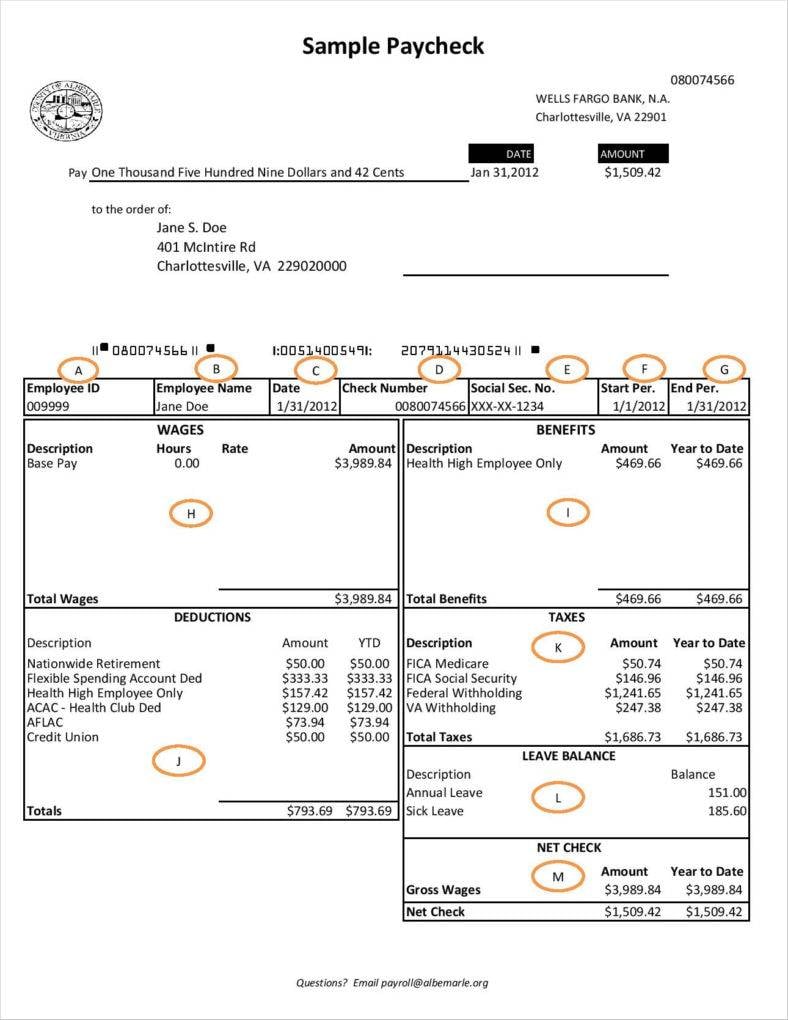

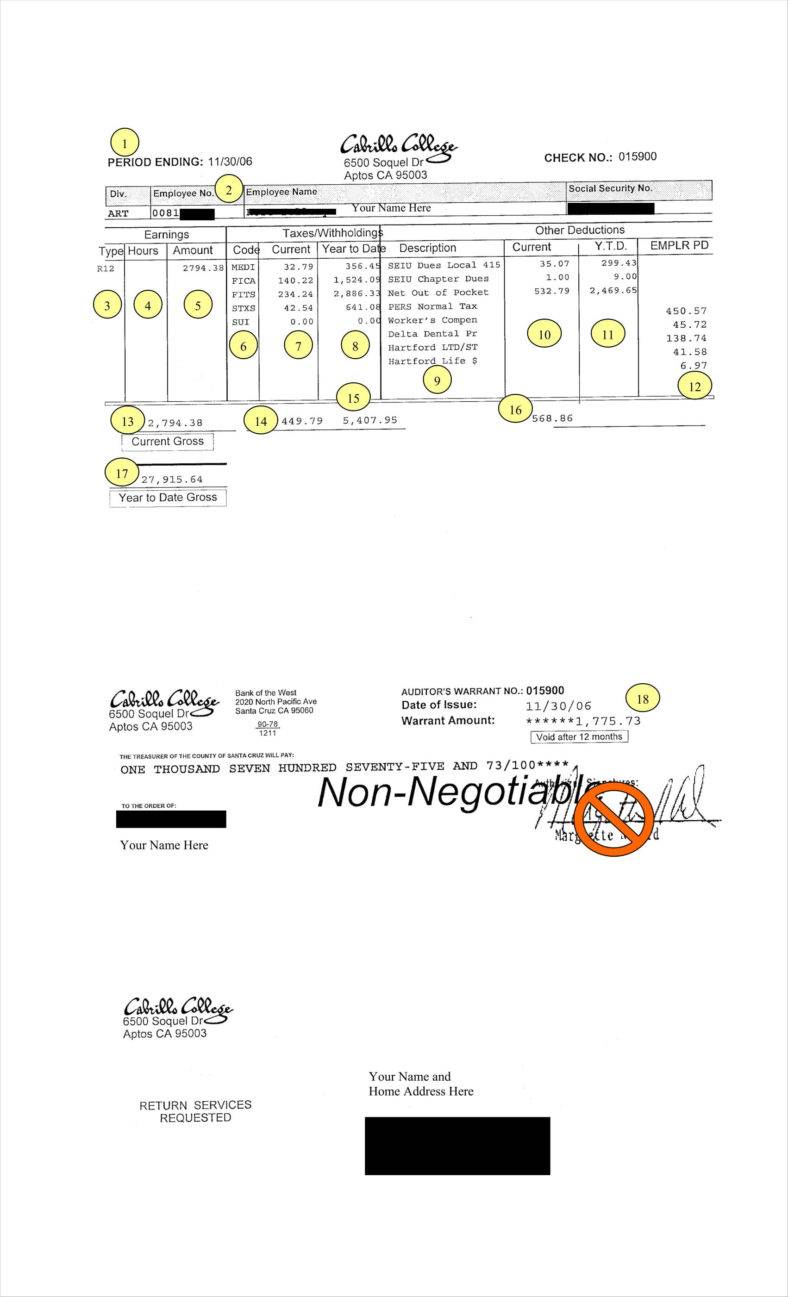

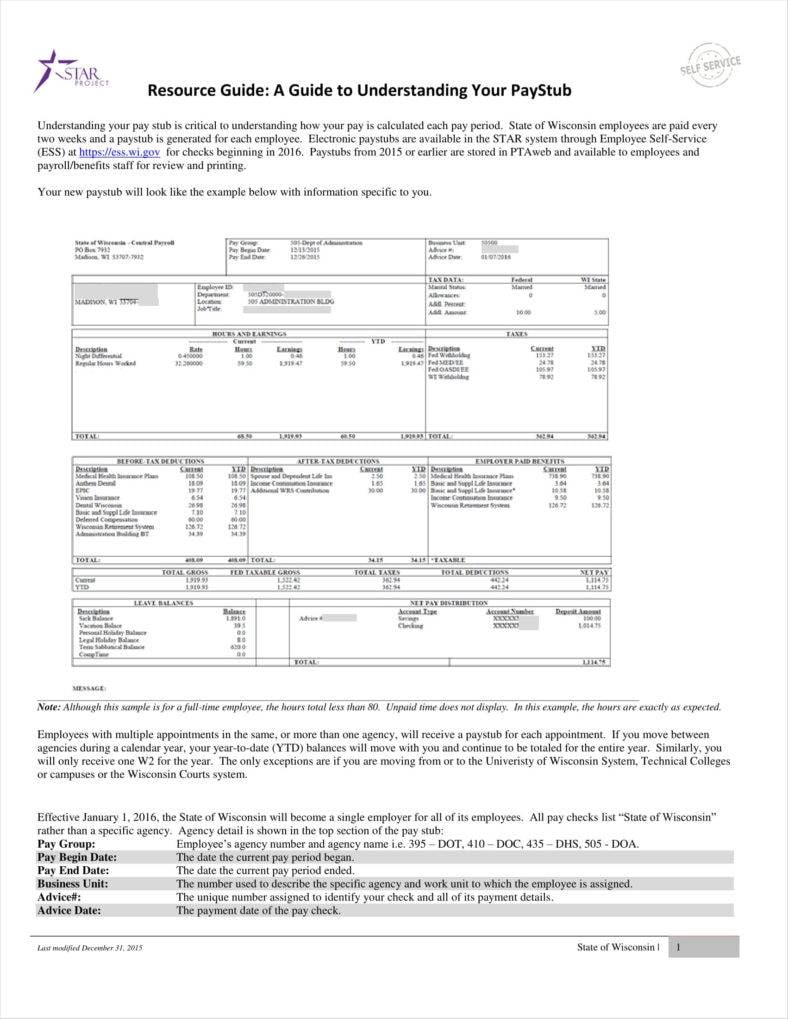

A pay stub lists all of the details regarding an employee’s pay. It itemizes the wages that an employee has earned for both the pay period and the year-to-date-payroll. The pay stub also shows the employee just how much of taxes and other deductions have been taken out of his or her paycheck.

The pay stub has information that’s useful for both the employees and the employers. Employees who receive the pay stubs can keep them in their records to help them out with their financial management. Not only does it help them in terms of financial management, but it also helps them for when they need to check if they were paid correctly.

With pay stubs, the employers can help settle any discrepancies that an employee may have note on his or her paycheck. So if there’s a question regarding an employee’s pay, managers can help solve these issues by going over the payroll pay stubs.

What should be included in a pay stub?

The following are details that have to be included in the pay stub, depending on one’s personal circumstances:

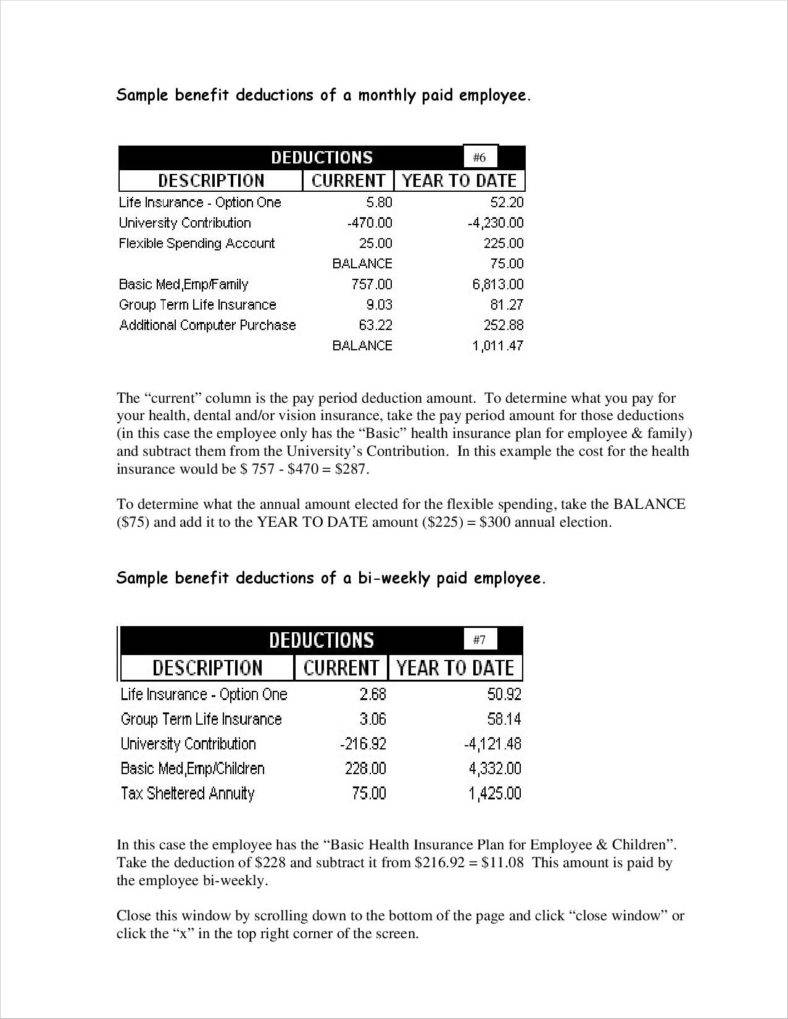

- Gross pay. This is the amount that an employee gets right before any taxes and withholdings take place within a particular pay period. The pay period is determined by your employer, so it can be anything from a weekly, bi-weekly, or monthly pay period.

- Net pay. This is the gross pay after all the necessary deductions have taken place. So basically, it’s the amount of money that you get to take home with you.

- Federal tax amount. This is how much taxes you pay to the federal government. When you were first hired by your employer, you were made to fill out a W-4 form. The point of this form is to cover what you may owe the federal government when tax time comes around. This tax is mandatory and it is deducted incrementally from each paycheck. The amount that’s deducted varies depending on the number of exceptions you have claimed in your W-4 form. If you would like to change these exceptions, then all you have to do is contact your Human Resources department and ask them for another W-4 form that you can fill up.

- State tax. Depending on where you reside, you may or may not have to pay this kind of tax. However, you have to know that most states require that you pay the state tax, so this amount is deducted from your paycheck. The amount of state tax will vary from state to state, so don’t be surprised if the amount you have to pay is more or less than other states.

- Social security tax. This tax is a federally mandated payment that goes straight to the social security system. This is the kind of tax that will help you out in the future because there will come a time when you will reach the point of retirement and will no longer be able to work. So when you reach the age where you’re eligible for social security, or if there are certain circumstances that allow you to be eligible for it, then you will be able to access social security funds in the form of monthly payments. Both you and your employer will contribute 6.2% of your income to social security payments.

- Medicare. The medicare program is what’s going to be helping you when you have to pay health care bills. However, you have to remember that these health care bills will only be taken care of once you are eligible for social security payments. Similar to federal taxes, this is mandatory for both you and your employer. Medicare payments are set at 1.45% for both you and your employer during every pay period.

You also have to know that not every pay stub is going to be the same. Different companies have their own ways of making their pay stubs. So here are those additional items that you have to look out for:

- Year-to-date. This is perhaps the most useful bit of information you’ll receive when it’s time for you to manage your finances. This shows exactly just how much money you have earned, how much of your money has gone into taxes and withholdings all the way up to the current date of that pay stub. So remember to use the year-to-date area of your pay stub to keep your financial records up to date as well as accurate.

- Insurance deductions. Your company may take money from your earnings and place it straight to your insurance policy statement. If this so, then you can keep an accurate record of just how much you have paid for insurance as well as the dates of when these payments were made. This takes away the need for you to go into your insurance company’s website and check whether these payments were made or not.

- Retirement plans. If you employer offers retirement plans, then you have the option to have automatic deductions taken from your paycheck and sent straight to your retirement plan. This is an easy way for you to save money for your retirement. If your pay stub has this item, then it will be easy for you to keep track of your contributions.

- Time off. There are some employers who place the amount of time off you have used and the ones that you have yet to use on the pay stub. Although this item isn’t exactly directly related to earnings, it will at least help you know just how many hours of pay were lost whenever you took time off from work. Also, this can really help solve problems in terms of attendance as there are times that your boss might label you as absent for a particular day even if you were actually present.

- Additional notices. This is useful for when an employer would like to share information regarding changes to the pay policy that are on the pay or paycheck stub. This will help you keep informed about any modifications that may just affect your net pay. So if you’re wondering why you aren’t making as much as you’re supposed to during a particular pay period, then check on the pay stub from the previous period to see if there may have been a notice that you weren’t able to go over.

Often times, your employer or the payroll company that your employer hired may just make use of abbreviations when writing your pay stub. The reason for this is because it saves them more time as well as space. By understanding these abbreviations, it’ll help you better understand the information that’s being presented on your pay stub. So here are a couple of examples of these abbreviations:

- YTD: Year-to-date

- FT or FWT: Federal tax or federal tax withheld

- SS or SSWT: Social security or social security tax withheld

- MWT or Med: Medicare tax withheld

- ST or SWT: State tax or state tax withheld

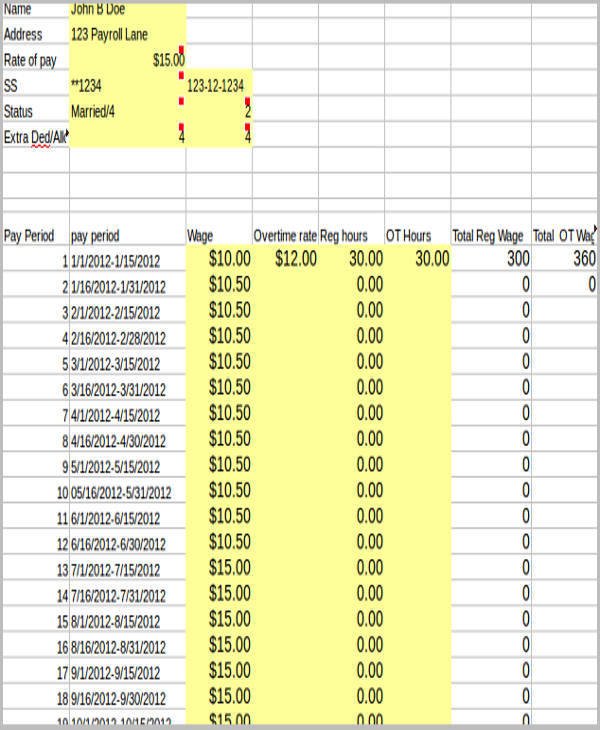

Pay Roll Paycheck Stub Template

templates.openoffice.org

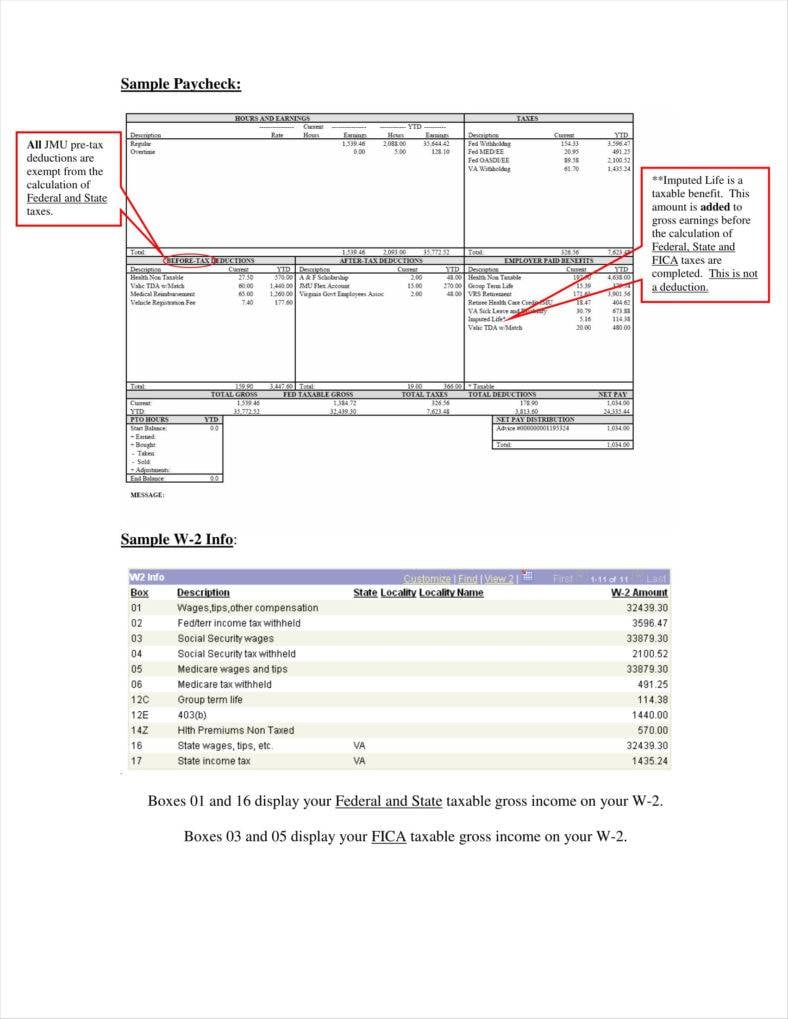

Sample Paycheck Stub Template

wikidownload.com

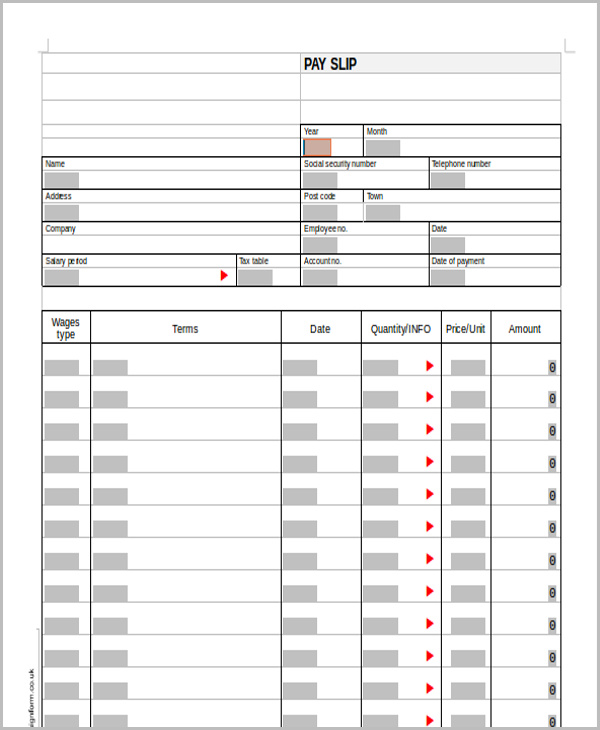

Simple Blank Pay Stub Example

jmu.edu

Basic Blank Pay Stub Sample

hls.harvard.edu

Sample Blank Online Pay Stub

rit.edu

Blank Pay Stub Template

cabrillo.edu

Blank Pay Stub Guide

dma.wi.gov

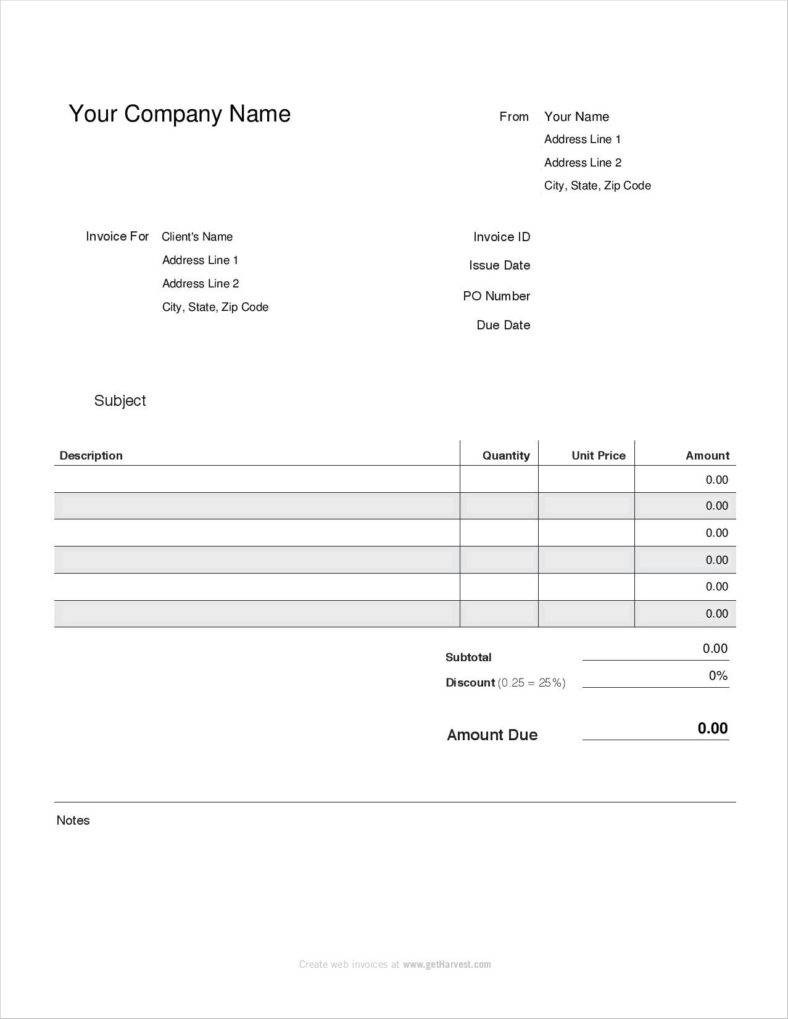

Editable Company Payroll Invoice Template PDF Download

harvestpublic.s3.amazonaws.com

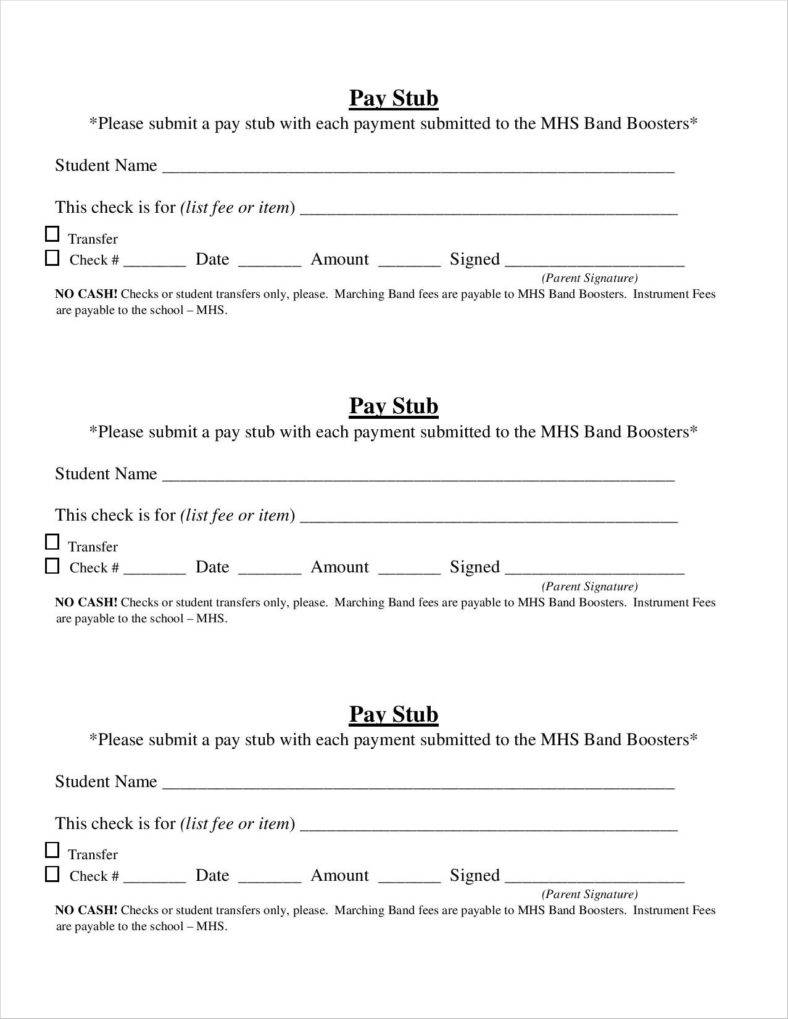

Simple Pay Stub Template

middletownband.com

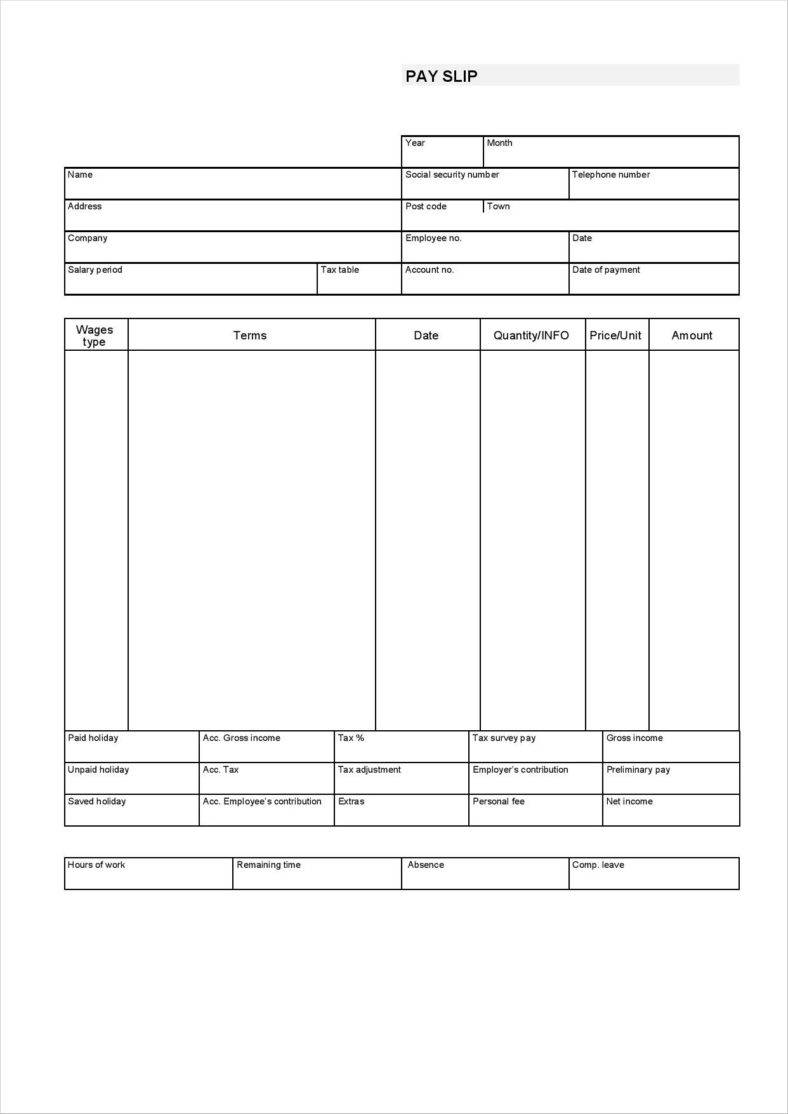

Blank USA Pay Stub Template PDF Printable Download

wikidownload.com

Free Download Company Pay Stub Template DOC

docspile.com

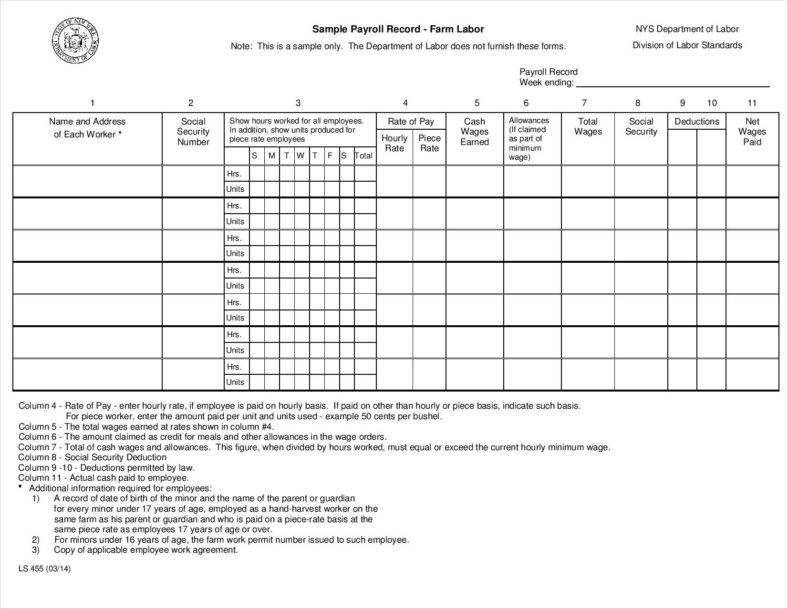

Employee Payroll Record Template

labor.ny.gov

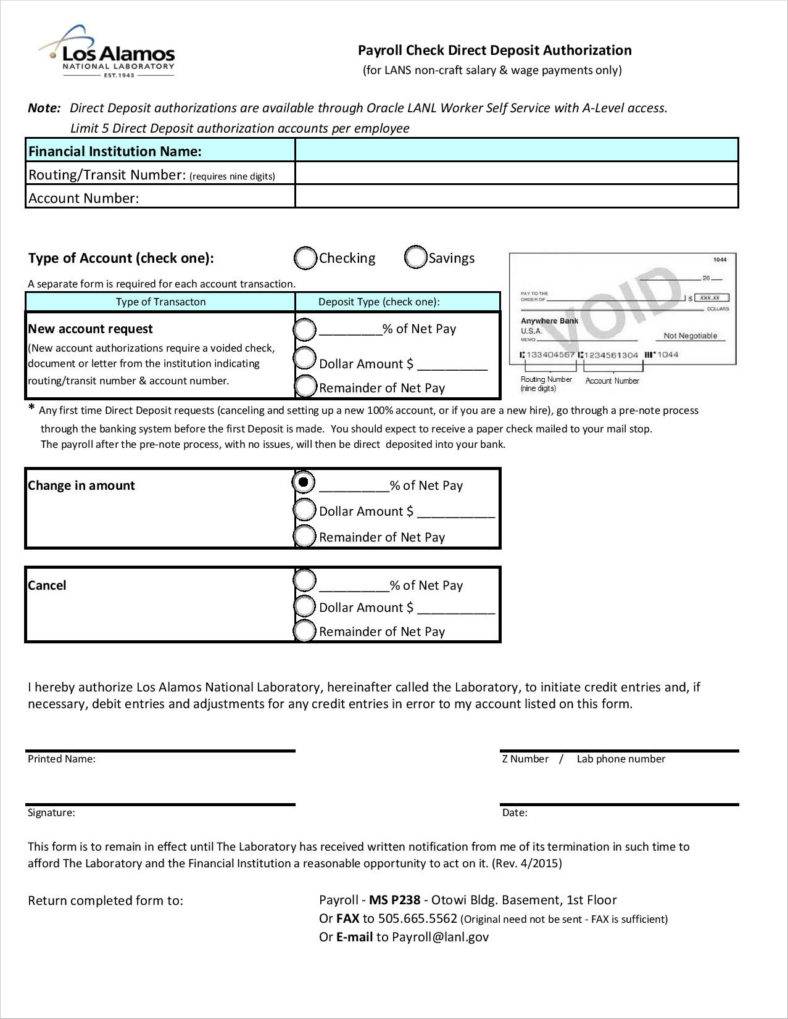

Blank Payroll Check Template

lanl.gov

How long should you keep your pay stubs?

While pay stubs can help you out, such as helping you verify your proof of income, they aren’t exactly the kind of documents that you need to hold on to for the rest of your life. As a general rule, it’s best that every employee holds on to their pay stubs for at least one year. Because every year, you’re going to need your paycheck stubs for when you have to pay your taxes. These are also really important for when you have to reconcile your W-2 form and your social security contributions. By keeping the pay stubs that you have, you’ll be able to make sure that you’re paying the right amount of taxes. Once you have finished paying off your taxes, your tax returns will serve as an accurate record of just how much money you were able to make within the year.

How to safely discard pay stubs

Whenever you’re ready to get rid of your pay stubs, you should make sure that they’re discarded properly. The reason for this is that if you don’t throw these away with utmost care, then there’s a chance that someone will be able to get hold of your personal information. The best way of discarding your pay stubs is by shredding them so that nobody will ever be able to grab any information it contains.

Best way to store your pay stubs

Technology today can really help you out when it comes to storing your pay stubs. With the help of technology, paycheck stubs can be easily stored without them having to take up any physical space. There are affordable cloud-based storage solutions that allow users to store large amounts of information for a cheap price. This way, you can store a ton of data that won’t take up your computer’s storage or make it run slowly. It also gives you the comfort of knowing that your pay stubs are safe in cloud storage and you can access them at any time you please. With the ability to scan documents and upload them to the web, you can actually hold on to your pay stubs for the rest of your life.

Rules for giving employees their pay stubs

For federal law overview

The Fair Labor Standards Act (FLSA) is what regulates issues such as payroll record keeping for employers. The act doesn’t exactly state that employers are required by law to provide pay stubs to their employees. However, federal law does have strict requirements when it comes to record keeping, so it’s best for employers to know what information must be kept in the event that they are required.

For state law overview

In spite of the fact that state payments aren’t exactly required by federal law, most states have still opted to pass state laws wherein it is required by the employers to provide the employees with regular statements regarding their pay and withholdings. The following information must be placed on these statements:

- The employee’s name

- Social security number

- The pay rate

- Pay period

- Deductions

So make sure that you follow these laws so that you will have no problems. Because if you don’t, then expect a lawsuit for withholding important information from your employees.

As mentioned before, both employers and the employees have something to benefit from using pay stubs. The employee can use it to help them keep track of their financial records while the employer can use it to keep track of their employees and their salaries. So if you would like to know more about pay stubs, we have other articles that can teach you how to create pay stubs, as well as having templates that you can choose from should you decide to make one. Be sure to read up on all the information to help you understand everything that you need to know.