Table of Contents

- Statement Template Bundle

- What is a Wage and Tax Statement?

- How to Write a Wage and Tax Statement?

- 6+ Wage and Tax Statement Templates in DOC | PDF

- 1. Wage and Tax Statement (IRS Form W-2) Template

- 2. Wage and Tax Statement Template

- 3. Group’s Wage and Tax Statement Template

- 4. W-2 Wage and Tax Statement Template

- 5. Transmittal of Wage and Tax Statement Template

- 6. W-2 Wage and Tax Statement Sample

- Conclusion

6+ Wage and Tax Statement Templates in DOC | PDF

A wage and tax statement refers to a form that is usually provided by an employer to an employee every year that will indicate the employee’s wages, salary or tips along with the amount of tax withheld over the year. This form helps the employee to calculate his/her income tax liability. In the United States, it is the most common tax form and every employer must provide this to every employee. Our wage and tax statement templates will be of some help while making this official document.

Statement Template Bundle

What is a Wage and Tax Statement?

The wage and tax statement is also known as Form W-2 is commonly used in the United States to make reports of the wages that are paid to the employees and the taxes that are retained from them. This W-2 form must be completed by the employer for each employee to whom they pay a salary, wage or other compensation as part of the employment relationship. This wage and tax statement must be filed by the employer with the Social Security Administration to the Internal Revenue Service.

How to Write a Wage and Tax Statement?

Step 1: Provide the Employer Information

For each wage and tax statement in Word, you are going to prepare, you will have to include the information about your business that will also include the employer ID number along with the employer name and address.

Step 2: Mention the Control Number

Make sure you add an internal control number on each W-2 form in case you are paying many employees. You can also generate the number yourself, or your payroll preparation software may generate this number.

Step 3: Provide Employee Earnings

You can give total wages, tips, and mention another compensation in Box 1 and this is gross pay for all hourly and salaried employees. Also, provide the total amount of withholding in Box 2 and total social security wages in Box 3.

Step 4: Other Payments

Step 5: Check for Errors

You can check the whole document starting from each information provided in the statement and revise it for any errors. Make the required corrections and take a print of the final copy.

6+ Wage and Tax Statement Templates in DOC | PDF

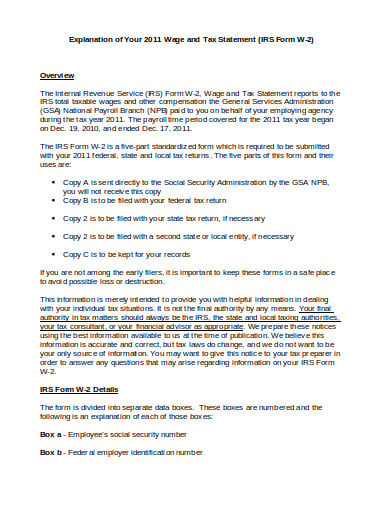

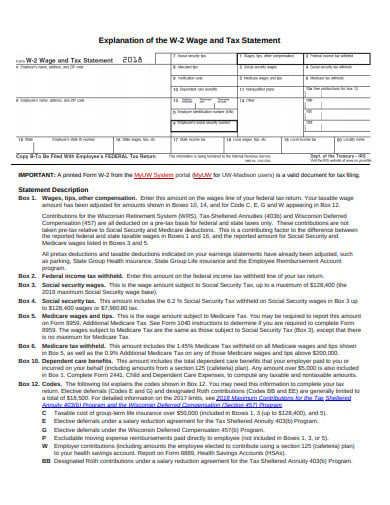

1. Wage and Tax Statement (IRS Form W-2) Template

gsa.gov

gsa.govThis statement in Google Docs consists of an explanation of the 2011 Wage and Tax Statement i.e IRS Form W-2. The information provided in this document is merely intended to provide you with some helpful information in dealing with your tax situations. The information provided in this document intends to give some helpful information to you dealing with your tax situations.

2. Wage and Tax Statement Template

rfsuny.org

rfsuny.orgA W-2 form that is also known as a wage and tax statement is commonly used to report wages that are paid and the taxes withheld from those wages for a particular calendar year. It is made by the employer, and the employee is given a copy of this form along with the IRS and the state taxing authority every January of the prior calendar year. Check out this wage and tax statement template that contains a well-written Income Tax Information for Employee payments. You can even edit the content and download it in Pages format as well.

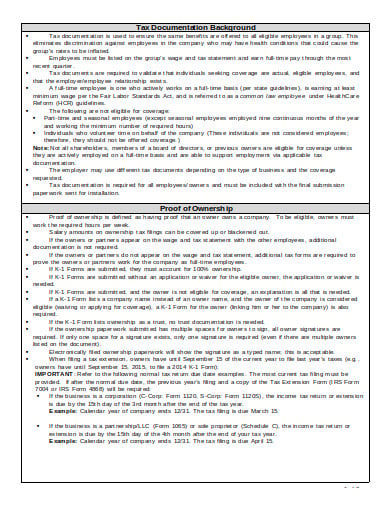

3. Group’s Wage and Tax Statement Template

broker.uhc.com

broker.uhc.comAt the time of tax payment, a wage and tax statement is a crucial document. A W-2 statement discloses your taxable income for the year and this form is generally provided for full-time employees of a company. This can also be used for contractor depending on the employment agreement arrangement. This template consists of the tax-documentation background followed by proof of ownership and type of company and length of time in business.

4. W-2 Wage and Tax Statement Template

wisconsin.edu

wisconsin.eduAre you in need of a proper explanation of a wage and tax statement? We have just the perfect template prepared to meet your needs. Have a look at this detailed statement description of a wage and tax statement laying out all the important elements that are involved in a W-2 form. This is a document that an employer is required to send to all of their employees and the Internal Revenue Service (IRS) at the end of the year. Someone whose employer deducts taxes for and submits to the government is considered to be a W-2 employee.

5. Transmittal of Wage and Tax Statement Template

rrb.gov

rrb.govIt is better to take some help from the instructions that will guide you regarding reports related to service and compensation. You can check this standard and professional template that consists of Rail Employer Reporting Instructions including a chapter about Form W-2 i.e Wage and Tax Statement and Form W-3 i.e Transmittal of Wage and Tax Statements. It describes where and when to file the W-2/W-3, explains the duplicate earnings and how to avoid those duplicate earnings. If you want to know more about how to complete Form W-2/W-3 for Railroad compensation then download this template now!

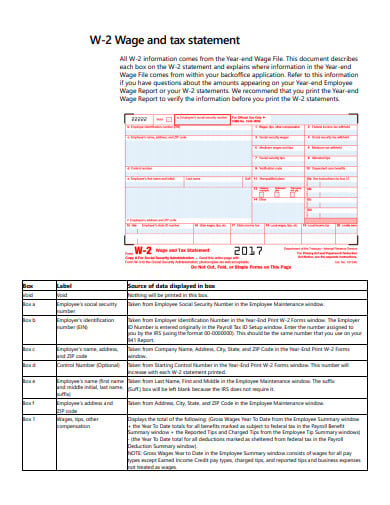

6. W-2 Wage and Tax Statement Sample

ewsgroup.com

ewsgroup.comThis template deals with W-2 Wage and tax statement data source guide that describes each on the W-2 statement and explains where information in the Year and Wage File comes from within your back-office application. In case you have any questions about the amounts that are appearing on your Year-end Employee Wage Report or your W-2 statement, then you can refer to this information. We suggest that you print this wage report to verify the information before you print the W-2 statements so get this template right now!

Conclusion

It is a must for a full-time employee to have a wage and tax statement before February with everything correctly reported in it. In case you did not get it from your employer, then double-check your desk or your e-mail and if you still don’t get it, contact the Internal Revenue Service. Make sure that everything is correct as it will for your good to keep account of the wages that you get and the taxes that you pay.