Table of Contents

IOU

An IOU is a simple document that serves as an acknowledgment of one’s existing debt to another party. It’s usually an informal agreement, but a more formal and legal agreement may follow when parties want to formalize things.

Download the IOU Infographic

File Format:

IOU Definition & Meaning

An IOU refers to a paper that has the letters “IOU” written on it, and it contains a stated sum and a signature that is given as an acknowledgment of debt.

Rather than being considered as a legally binding commitment, these documents, more often than not, are only often viewed by the parties, especially between friends and family members involved as an informally written agreement.

What Is an IOU?

An IOU is a written document that serves as an acknowledgment of debt to another party. Also known as an “I Owe You” document, these forms serve as a simple solution whenever two parties want to record a transaction without going through the hassle of a complicated documentation process. This document usually records the terms and conditions of the transaction and ensures that both parties have a thorough record of their deal and their intentions before they proceed with the transaction.

10 Types of IOU

Washington IOU

A Washington IOU form is a recognized document in Washington that serves as an acknowledgment of debt to another party. In this state, terms such as payment types and late settlements are covered. In this state, this document is usually enforceable in court as long as any of the parties involved can provide proof.

Texas IOU

A Texas IOU is one of the many forms of enforceable documents in the state of Texas. In this state, they do not need to be notarized, but should the parties involved want it to be enforceable, it has to be signed and dated by the borrower. Additionally, if there is a co-signer involved, they need to affix their signature in this form as well.

Virginia IOU

In the state of Virginia, the document that’s completed and signed by the parties involved during the borrowing of money is referred to as the Virginia IOU. By doing so, the lender of the money is essentially assured in good faith that the borrower will plan on paying back the money being borrowed. It is a simpler form of a promissory note, and here, the borrower’s signature is only what’s needed, but the lender may still sign it.

Utah IOU

A Utah IOU is a document that’s designed to ensure that both parties are clear regarding the loan and if the borrower guarantees to the lender that the money is going to be repaid. In this state, this document can also be presented in a court of law once the necessary signatures, such as the signature of the lender, have been affixed. Additionally, should the parties agree to an interest rate, the document will now become a promissory note instead of a simple IOU form.

Pennsylvania IOU

In the state of Pennsylvania, a Pennsylvania IOU is created to acknowledge that a party is financially indebted to another. This document acknowledges that a loan and the subsequent agreement that it needs to be repaid in good faith exists. Should the document be signed by both parties involved in this state, it’s now considered to be as good as a promissory note, only without its distinguishing parts.

Vermont IOU

A Vermont IOU is created in the state of Vermont as a written acknowledgment of a debt by the borrower to the lender. In this state, it’s usually thought of as an informal document, but it doesn’t mean that the promise should only be done verbally since having a written agreement will still benefit the parties involved in the transaction. In this state, an IOU form will also help give some form of legal validity to the transaction.

Oregon IOU

An Oregon IOU is an official document that serves as a debt acknowledgment form or certificate in the state of Oregon. By creating this type of form, the parties involved are aided in the structuring and details of the loan, whether it’s a simple loan or not. Similar to Pennsylvania, once this document has been signed, it’s as good as a promissory note, only without its bells and whistles.

Ohio IOU

An Ohio IOU serves as a written promise or a written record of an agreement between both parties of a loan in the state of Ohio. It also serves the same function as a promissory note in this area, since it can also be a legal promise made by the borrower that the loan will be repaid in good faith. Creating one in this state between family and friends will usually require a high degree of trust if they don’t want it to make a legal document.

New York IOU

A New York IOU form is a document that contains words of acknowledgment that a party is indebted to another party, and contains a promise that the loan will be settled in good faith. In this state, this document is more formally structured which will intend to ensure that both parties are clear on whatever terms and conditions are present in this paper. This document also proves that the lender has lent money legally to the borrower should this be used in court.

Nevada IOU

In the state of Nevada, a Nevada IOU form can serve the same purpose as a promissory note even without the distinguishing features that differentiate the two. This is because this document is drafted to ensure that the parties involved are clear with the terms regarding the borrowing of money. In other words, in this state, this document helps guarantee to the lender that the money will be returned/repaid.

IOU Uses, Purpose, Importance

OU templates are also known as debt acknowledgment forms, I owe you forms, and registered warrants. It’s the preferred option whenever the parties involved don’t want to enter formalities regarding the settlement of debts, depending on the place where they live. Here are some uses and importance of this document.

Sets Expectations

When an IOU document is created, one’s debt to the lender is acknowledged, and it, therefore, sets expectations that the debt is to be repaid someday by the lender. By setting expectations whenever money is involved, the lender’s interests are then protected. Setting expectations also reduces the chance of a strained relationship between friends or family members, as this is the situation in which IOUs are commonly used.

Serves as a Written Record

Verbal promises of debt repayment can easily be forgotten unless one has a very sharp and clear memory. With an IOU template created, a written record is made, which prevents any conflicts that can arise whenever a verbal promise is made and forgotten. In other words, having a written record and acknowledgment helps avoid any misunderstandings between the borrower and the lender.

Ensures Authenticity

Transactions can be done verbally and can be a simple “pay it and forget it” process. However, when debts are going to be involved, an IOU document can be important since the transaction won’t be easily forgotten when a written document is involved. As it is signed and provided with distinguishing marks, this acknowledgment document also ensures the authenticity of the transaction.

Bond Market Use

IOUs can also be used by financial institutions aside from between friends and family. One such instance is the bond market, in which bonds are technically classified as a form of an IOU. This transaction is different from a typical IOU situation since here, an individual loans an amount of money to a company or government and is given a contract promising to repay the money with interest by a certain date, which makes the IOU legally enforceable.

Bookkeeping Use

Bookkeeping is defined as the process of tracking and recording the financial transactions of a particular business, and, in some instances, bookkeepers can make use of an IOU template. They do so by recording an outstanding debt as an IOU in special considerations. Whenever this happens, the IOU will then be considered as an accounts receivable item and is considered an asset on a balance sheet.

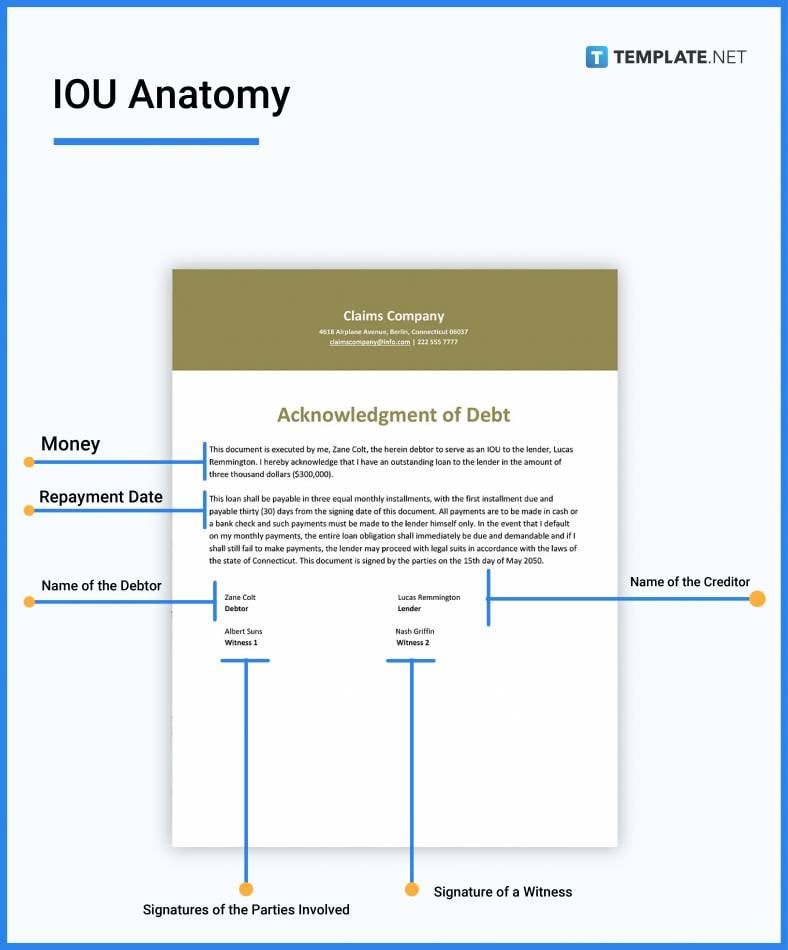

What’s In an IOU? Parts?

Name of the Debtor

This refers to the full name of the individual who borrowed the money.

Name of the Creditor

This part of the IOU document refers to the full name of the individual that has lent the money to the debtor.

Money

This part of the IOU refers to the amount of money in question and should be written out in word form and numerical form.

Repayment Date

As the name states, this part of the document refers to the date on which the repayment is to be expected.

Signatures of the Parties Involved

This part contains the signatures of the parties above their printed names and is necessary should they want the document to serve a legal purpose.

Signature of a Witness

In some states, this is considered necessary since it is a requirement for the document to be notarized in the presence of a witness.

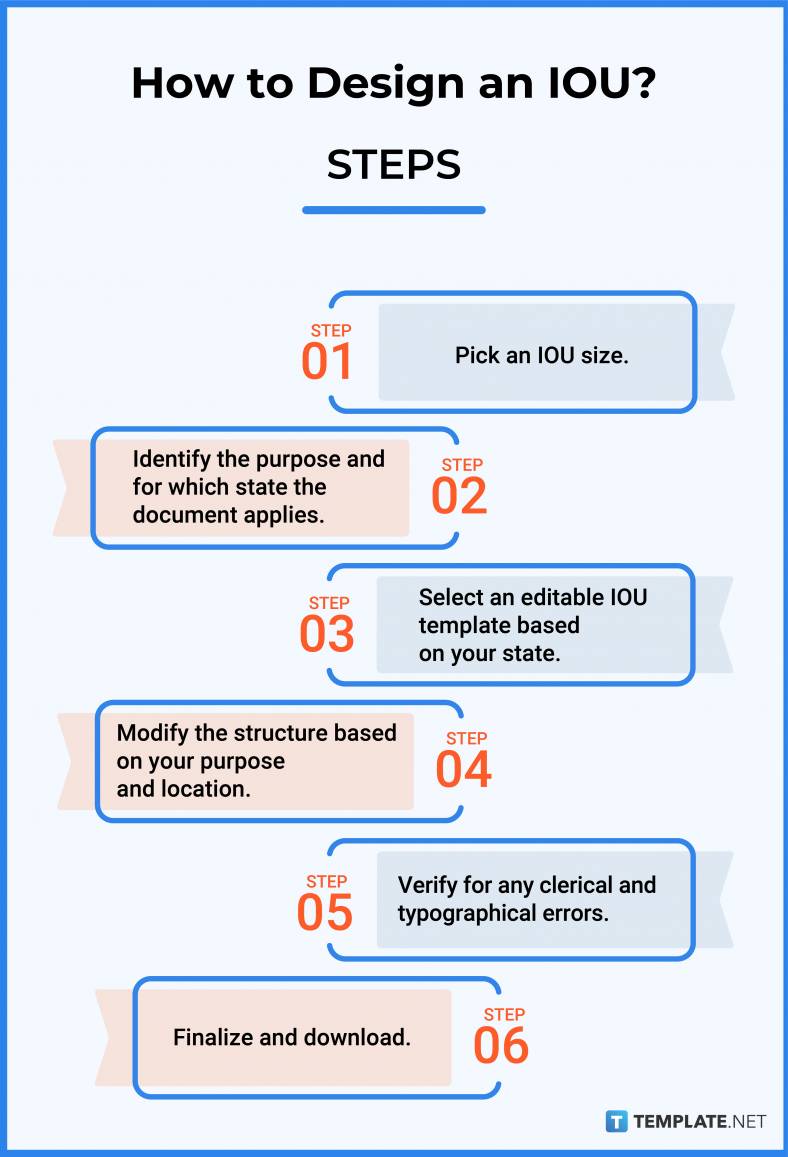

How to Design an IOU?

1. Pick an IOU size.

2. Identify the purpose and for which state the document applies.

3. Select an editable IOU template based on your state.

4. Modify the structure based on your purpose and location.

5. Verify for any clerical and typographical errors.

6. Finalize and download.

IOU vs. Promissory Note

An IOU form is a document that serves as a written acknowledgment of a debt that one party owes to another and is usually used when the parties involved need some sort of documentation that’s not too formal and usually only takes a few minutes to write up properly.

A promissory note is a more formal and complete document compared to an IOU since it usually outlines other details such as the interest rate of a loan (such as a personal loan), the payment schedule, the size of repayments, and penalties for late/non-repayment, and can usually be a formal payment contract between the parties.

What’s the Difference Between IOU, Mortgage, and Loan?

An IOU is a note, a sheet, or a document that is a written acknowledgment of a debt that a debtor owes to the creditor and is usually the less formal method of acknowledgment.

A mortgage is an agreement between a party and a lender that allows the borrowing party to purchase or refinance a home or a property and gives the lender the right to take the property back if the money is not repaid.

A loan refers to a thing that is borrowed, and the term is most commonly used for a sum of money that is expected to be paid back with interest.

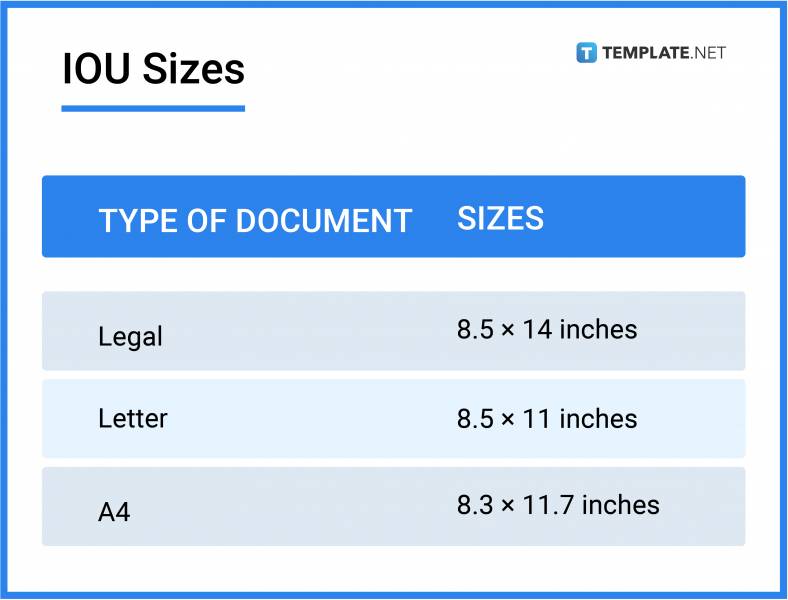

IOU Sizes

Though considered to be a less formal document compared to a promissory note, one should still adhere to the right size of this document when it is being drafted. Here are the standard IOU sizes that should be noted.

- Legal (8.5×14 inches)

- Letter (8.5×11 inches)

- A4 (8.3×11.7 inches)

IOU Ideas & Examples

Creating this document shouldn’t be too difficult and will only take a few minutes. However, depending on the state you live in, it may take a long time especially if the deal gets complicated, and should that be the case, these different IOU ideas and examples can be of great help.

- Louisiana IOU Ideas and Examples

- Maryland IOU Ideas and Examples

- Hawaii IOU Ideas and Examples

- Florida IOU Ideas and Examples

- Alaska IOU Ideas and Examples

- California IOU Ideas and Examples

- Alabama IOU Ideas and Examples

- Kansas IOU Ideas and Examples

- New Jersey IOU Ideas and Examples

- Minnesota IOU Ideas and Examples

- Delaware IOU Ideas and Examples

FAQs

What makes an IOU legally binding?

An IOU becomes legally binding when the signatures of both parties (and in some cases, a witness) have been affixed.

How do you ask for an IOU in a company?

You can simply ask for an IOU in a company by communicating to them that you want a written acknowledgment of debt in order to avoid any confusion and problems.

What is an IOU from an employee?

An IOU from an employee may be written whenever he/she borrows some change from a petty cash fund to account for the money being borrowed.

What are the legal implications of an IOU?

The legal implication of an IOU is that you are obliged to pay the amount due on the specific date that is stated in the document once it has been signed (or notarized in some cases).

Why do you need an IOU?

You would need an IOU because it’s much better to have a written acknowledgment of debt that both parties can refer to in the future compared to a verbal agreement that can be easily forgotten.

How to write an IOU form in PDF & Word?

To write an IOU form in PDF in MS Word, first, decide on the size of the document, then pick a template according to the purpose of your IOU, modify the structure according to your purpose and make it adhere to the laws of the place you’re in, and once you’ve finalized the template, hit the “Save As” button, then choose PDF as a file extension in the dialog box that pops up.

How to write an IOU loan?

To write an IOU loan, first, at the top of the sheet, state that it is going to be an IOU document, then write out a sentence that includes the borrower’s name, the amount that they borrowed, the full name of the lender, and the date on which the loan should be repaid.

How do you write an official IOU?

To write an official IOU, take note of the following elements such as the names of the debtor and the creditor, the amount of money being borrowed, the repayment date, and the signatures of the parties involved, which is the key element that makes the document official.

When do you need an IOU?

An IOU is usually needed when the creditor wants written acknowledgment from the debtor that he/she is indebted to the creditor by a particular amount.

What is a personal IOU?

A personal IOU is usually used between family members and friends whenever one is indebted to another and whenever they don’t want to go through the hassle of processing more complicated papers.