Free Accounts Receivable Memo

Date: [Month Day, Year]

To: [Your Client / Subscriber / User Name], [Title]

From: [Your Name]

Subject: Update on Receivables Management and Policies

Dear [Your Client / Subscriber / User Name],

This communication is to present an overview of accounts receivable's status, policy changes and the processes we follow at [Your Company Name]. Our focus is on an effective, efficient, and transparent accounts receivable function that underpins the overarching goal of maintaining optimal cash flow and fostering healthy customer relations.

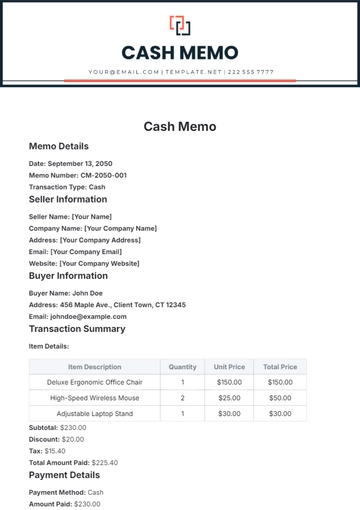

Current Status of Accounts Receivable

Metric | Current Status |

|---|---|

Total Outstanding Receivables | $[Amount] |

Average Days Sales Outstanding | [Number] days |

Percentage of Current Receivables | [Percentage]% |

Percentage of 30-60 Day Past Due | [Percentage]% |

Percentage of Over 60 Day Past Due | [Percentage]% |

We take this opportunity to update you on the current standing and performance of our accounts receivable. We commend the department for ensuring timely and effective revenue collection, which has positively reflected on our cash flow. Continuous monitoring enables us to quickly identify any irregularities and initiate the necessary corrective measures.

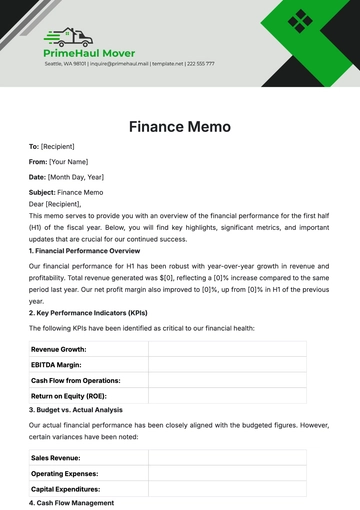

Conforming to the best industry practices, we have revised certain policies of our accounts receivable management. It's essential to familiarize ourselves with the modifications to ensure consistent compliance, promoting efficient operations and safeguarding our organization's financial health.

Policy Changes

Policy Area | Old Policy | New Policy | Effective Date |

|---|---|---|---|

Payment Terms | Net 30 | Net 15 | [Date] |

Late Payment Penalties | [Old Penalty Rate] | [New Penalty Rate] | [Date] |

Invoice Dispute Window | [Old Timeframe] | [New Timeframe] | [Date] |

Credit Limit Adjustment | [Old Policy Details] | [New Policy Details] | [Date] |

Write-off Procedures | [Old Procedures] | [New Procedures] | [Date] |

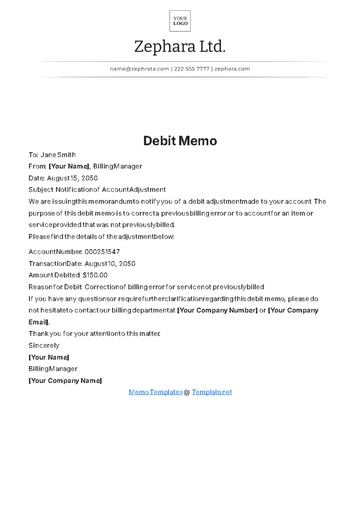

Accounts Receivable Processes

Process Step | Description | Responsible Department |

|---|---|---|

Invoice Generation | Generating and sending invoices within 24 hours of sale | Sales / Billing |

Payment Processing | Recording and reconciling payments upon receipt | Finance / Accounting |

Reminder and Follow-up | Sending reminders prior to due date and follow-ups post due date | Accounts Receivable |

Dispute Resolution | Handling invoice disputes within [Specified Timeframe] | Customer Service |

Reporting and Analysis | Monthly reporting on receivables status and analysis for trends | Finance / Accounting |

The introduction of escalation protocols guarantees quick responses and effective issue resolution. We anticipate this to further strengthen our servicing capabilities, directly improving customer relations and our overall performance.

We continuously monitor performance metrics to benchmark our progress and recalibrate our goals. This practice will help maintain the robustness of our accounts receivable function and keep us on track to meet our financial objectives.

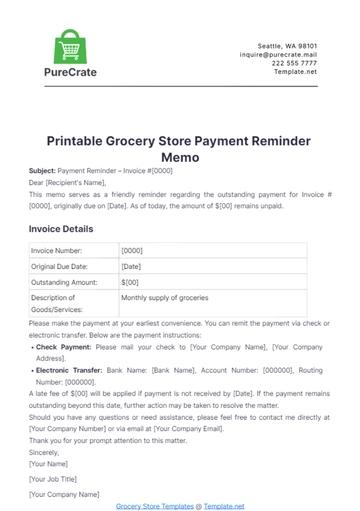

Focus Areas for Enhancing Effectiveness and Efficiency

Focus Area | Strategy |

|---|---|

Technology Integration | Implementing automated billing and payment processing systems |

Customer Communication | Improving clarity and frequency of communication regarding invoices and payments |

Staff Training | Regular training for staff on new policies and systems |

Performance Metrics Analysis | Regular review of key performance indicators like DSO and collection effectiveness index |

In our commitment to continuous improvement, we are formulating an extensive training and development program catered towards empowering our staff with the latest financial strategies and technologies. This will ensure our growth and preparedness in the ever-evolving fiscal landscape.

Customer Relationship Management Strategies

Strategy | Description |

|---|---|

Flexible Payment Options | Offering multiple payment methods and flexible plans |

Customer Feedback Surveys | Regularly collecting feedback on the billing and payment process |

Account Management | Assigning dedicated account managers for key clients |

Proactive Communication | Engaging with customers before due dates and resolving issues early |

At [Your Company Name], we are committed to maintaining a robust Accounts Receivable function. The new policies and processes are designed to streamline operations, enhance customer satisfaction, and ensure the company's financial stability. We appreciate the cooperation of all departments in implementing these changes.

For further inquiries or additional information, kindly contact me at [Your Company Email] or [Your Company Number].

Thank you.

Warm regards,

[Your Name]

[Your Job Title]

[Your Company Name]

[Your Email]

[Your Number]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline finance operations with Template.net's Accounts Receivable Memo. This editable and customizable asset enables quick, accurate financial recording. Our Ai Editor Tool ensures effortless edits. Ditch painstaking manual inputs, embrace innovative financial solutions. For accuracy, convenience and proficiency, choose Template.net's Accounts Receivable Memo. You control your financial narrative.