Free Strategic Internal Audit Accounting Planning Document

1. Executive Summary

The Strategic Internal Audit Accounting Planning Document serves as a foundational blueprint aimed at fortifying our internal audit capabilities, ensuring stringent adherence to regulatory standards, and enhancing overall financial governance. In pursuit of elevating our audit operations to a pinnacle of excellence, we have delineated specific, measurable targets to be attained within the upcoming fiscal year:

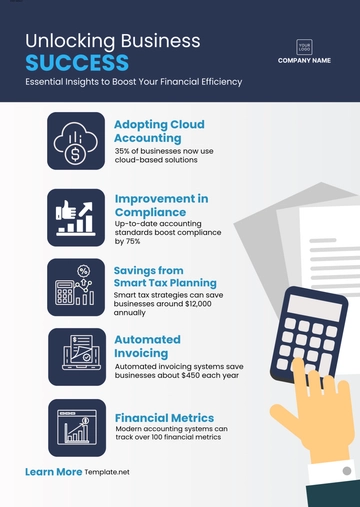

Reduction of Audit Cycle Time: Streamline audit processes to achieve a 20% reduction in the average audit cycle time, from initiation to report finalization. This acceleration will enable more agile responses to audit findings and faster implementation of corrective actions.

Improvement in Compliance Rates: Elevate compliance rates with local and international accounting standards by 15%, as measured by the number of compliance issues identified in audit reports year-over-year. This target underscores our commitment to maintaining the highest standards of financial integrity and accountability.

Financial Savings from Identified Efficiencies: Identify and implement audit-driven efficiencies projected to result in at least a 10% reduction in operational costs related to audited processes. These savings will be realized through the optimization of internal controls, streamlined workflows, and the elimination of redundant or non-value-adding activities.

These quantifiable goals are designed to enhance the value delivered by the audit function, driving continuous improvement and fostering a culture of excellence and accountability across the organization.

2. Objectives

To ensure the successful attainment of our audit plan objectives, specific methods and initiatives have been outlined for each goal:

Enhancing Audit Process Effectiveness and Efficiency: Implementing advanced audit software solutions and data analytics tools to automate routine tasks, thereby allowing auditors to focus on more complex areas of the audit. Training programs will be introduced to upskill the audit team in these technologies, ensuring they can leverage these tools to conduct more thorough and efficient audits.

Ensuring Compliance with Standards: Regular training sessions will be conducted to keep the audit team abreast of the latest local and international accounting standards. A compliance checklist will be developed and updated regularly to ensure all audits comprehensively cover the necessary compliance requirements, minimizing the risk of non-compliance.

Minimizing Potential Audit Risks: A dynamic risk assessment framework will be employed, utilizing real-time data to continuously update risk profiles of various departments. This proactive approach allows for the timely identification and mitigation of emerging risks before they can impact the audit process or the organization at large.

Improving Audit Report Quality: Establishing a peer review process for audit reports to ensure accuracy, clarity, and actionable insights. This process will involve senior auditors and subject matter experts reviewing reports to provide constructive feedback, thereby elevating the quality and utility of audit findings.

Supporting Strategic Decision-Making: Creating a structured process for the translation of audit findings into strategic insights for management. This involves not just identifying issues but also proposing informed, actionable recommendations that align with the organization's strategic objectives and risk management framework.

3. Scope

While our Strategic Internal Audit Plan is designed to be all-encompassing, covering every facet and function within the organization, it is important to delineate certain exclusions and special considerations to tailor our audit approach effectively:

Exclusions: Activities that are subject to external audits by statutory auditors or regulatory bodies may be excluded from the internal audit scope to avoid duplication of efforts. However, internal audits may review these areas for internal control purposes and to ensure that external audit recommendations have been effectively implemented.

Special Considerations: Certain departments with unique operational complexities or regulatory requirements, such as Research and Development (R&D) and Compliance departments, will receive special consideration. These areas may require audits by specialists with specific expertise to ensure that the unique risks and controls in these areas are adequately addressed.

Third-Party Operations: Operations conducted by or in partnership with third parties, including vendors and contractors, will be included in the audit scope to ensure that their activities align with our organizational standards and contractual obligations. However, the audit approach may be adapted to respect contractual boundaries and leverage any audits or assessments conducted by or on behalf of these third parties.

By clearly defining these exclusions and special considerations, our Strategic Internal Audit Plan ensures a focused and efficient audit process that aligns with our organizational needs and strategic priorities, while also respecting the boundaries and unique requirements of different areas within the organization.

4. Audit Strategy

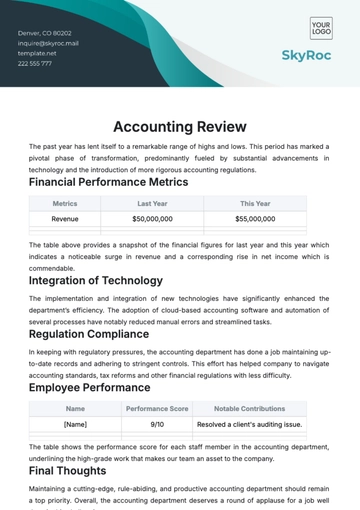

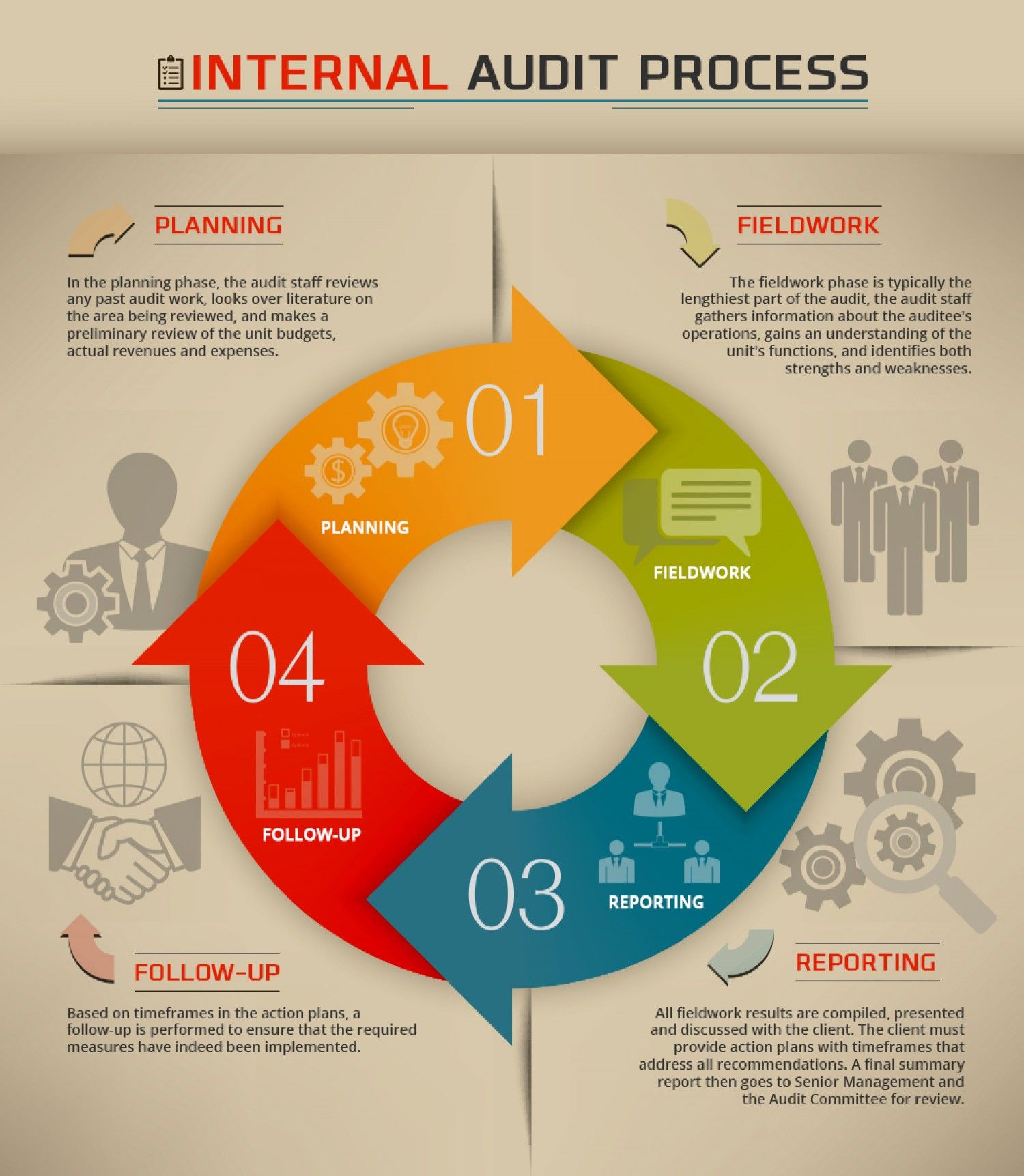

Fig 1: Example of Accounting Audit Strategy

Our audit strategy is centered around a risk-based approach, ensuring that resources and efforts are strategically directed towards areas of greatest potential impact and vulnerability. This approach is dynamic, allowing for the flexible allocation of audit resources in response to emerging risks and organizational changes.

Key Components of the Audit Strategy:

Risk Identification and Prioritization: Utilizing a combination of qualitative and quantitative methods, risks across all departments will be identified and ranked based on factors such as likelihood, impact, and the effectiveness of existing controls. This prioritization ensures that audit efforts are focused on areas that could significantly affect the organization's financial reporting, compliance posture, and operational efficiency.

Periodic Risk Assessments: Conducted semi-annually, these assessments will involve a comprehensive review of the organization's risk landscape, considering changes in the external environment, new regulatory requirements, and internal operational shifts. The findings will be documented in a Risk Assessment Report, which will guide the audit planning process.

Alignment with Standards: Regular reviews of organizational policies and procedures will be conducted to ensure they are in alignment with local and international accounting and auditing standards. This will include a comparison of current practices against standards such as the International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP), along with industry-specific regulations.

Integration with Business Processes: The audit strategy will be closely integrated with business processes to ensure that auditing is a value-adding activity, providing insights and recommendations that support operational efficiency and strategic decision-making.

Stakeholder Engagement: Engaging with key stakeholders, including management, department heads, and external auditors, to align the internal audit strategy with organizational goals and external expectations.

5. Resource Allocation

To execute our audit strategy effectively, we are committed to allocating adequate resources across various dimensions of the audit function. This allocation not only covers the immediate needs for audit execution but also supports the ongoing development of the audit team and the enhancement of audit tools and methodologies.

Breakdown of Resource Allocation:

Staffing:

Number of Auditors: Planning to increase the audit team by 15% in the next fiscal year to address the expanded scope and depth of audits.

Specialized Roles: Allocation for specialized roles such as IT auditors and forensic auditors to address specific risk areas.

Training:

Annual Training Budget: A dedicated budget to cover professional development, certifications, and specialized training in areas such as data analytics, cybersecurity, and regulatory compliance.

Continuous Learning Program: Implementation of a continuous learning program, including webinars, workshops, and conferences.

Technological Tools and Audit Software:

Investment in Advanced Audit Software: Allocation for the procurement and implementation of advanced audit software capable of handling complex data analytics, continuous monitoring, and automated risk assessment.

Technological Upgrades: Regular upgrades to hardware and software to ensure the audit team has access to state-of-the-art tools.

Operational Resources:

Audit Planning: The results of the risk assessment will directly inform the development of the annual audit plan, ensuring that audit resources are focused on high-risk areas.

Continuous Monitoring: Implementation of continuous monitoring mechanisms to identify and assess new risks as they emerge.

Risk Assessment Output:

The output of the risk assessment process will be documented in a comprehensive Risk Assessment Report, which will include detailed risk profiles for each department or business unit, a prioritized list of audit areas, and recommendations for mitigating identified risks. This report will be a key input for the annual audit planning process and will be shared with key stakeholders to ensure transparency and alignment with organizational risk management strategies.

6. Audit Schedule

The annual audit schedule is a cornerstone of our internal audit strategy, ensuring a structured and systematic approach to our audit activities throughout the fiscal year. This schedule is meticulously planned to align with organizational priorities, risk assessments, and resource availability, ensuring comprehensive coverage across all departments and functions.

Development and Communication:

Planning Phase: The audit schedule is developed at the beginning of each fiscal year, taking into consideration the results from the latest risk assessments, input from department heads, and the strategic objectives of the organization.

Flexibility: While the schedule is comprehensive, it retains flexibility to accommodate unscheduled audits triggered by emerging risks or significant changes in the business environment.

Distribution: Once finalized, the schedule is communicated to all departments and key stakeholders through various channels, including email, the company intranet, and departmental meetings, to ensure everyone is informed and can prepare accordingly.

Structure of the Audit Schedule:

Chronological Sequence: The schedule outlines the timing and sequence of audits, ensuring a logical flow that minimizes disruption to business operations.

Responsibilities: Clear assignment of responsibilities to internal audit team members, detailing who will lead each audit and the composition of the audit team.

Audit Scope: For each scheduled audit, a brief overview of the audit scope, objectives, and expected outcomes is provided to give departments a clear understanding of what to expect.

7. Audit Procedures

Standardized audit procedures are the backbone of our audit process, ensuring a consistent and rigorous approach to auditing across the organization. These procedures are designed to cover all aspects of the audit process, from planning to execution and reporting.

Development and Implementation:

Best Practices: Our audit procedures are developed in line with industry best practices and standards, incorporating insights from professional auditing bodies and regulatory guidelines.

Comprehensive Coverage: The procedures cover various types of audits, including financial audits, operational audits, compliance audits, and IT audits, ensuring that auditors have clear guidance for every scenario.

Key Components:

Planning: Detailed steps for audit planning, including risk assessment, audit scope definition, and resource allocation.

Execution: Guidelines for conducting audits, including evidence collection, testing procedures, and interview techniques.

Documentation: Standards for audit documentation, ensuring that all audit evidence and findings are properly recorded and organized.

Reporting: Templates and guidelines for audit reporting, ensuring clear, concise, and actionable audit reports.

Training and Reference:

Training: New auditors undergo comprehensive training on these procedures, ensuring they are well-equipped to conduct audits in line with organizational standards.

Continuous Reference: The documented procedures serve as a continuous reference point for auditors, ensuring consistency and quality in audit activities.

8. Reporting and Communication

Effective reporting and communication are vital to ensure the impact of audit activities is fully realized. Our approach ensures that audit findings are communicated clearly and effectively to all relevant parties, facilitating informed decision-making and timely action.

Reporting:

Audit Reports: Comprehensive audit reports are prepared at the conclusion of each audit, detailing the audit scope, findings, and recommendations.

Regular Updates: In addition to the final audit reports, regular updates are provided to management and stakeholders throughout the audit process, ensuring transparency and keeping all parties informed of progress.

Communication Channels:

Formal Presentations: Key audit findings and recommendations are presented in formal meetings with senior management and relevant department heads.

Internal Communication Platforms: Audit reports and updates are also shared through internal communication platforms, such as the company intranet, ensuring wide accessibility.

Feedback Mechanism:

Stakeholder Feedback: A formal feedback mechanism is established to gather input from management and auditors on the audit process and findings, fostering a culture of continuous improvement.

9. Review and Improvement

Our strategic audit plan is designed to be a living document, evolving in response to internal and external changes, feedback from stakeholders, and lessons learned from previous audits. This ensures that our audit function remains agile, relevant, and aligned with organizational needs.

Continuous Review:

Biannual Review: The audit plan and procedures are reviewed biannually to assess their effectiveness and relevance. This review considers changes in the organizational environment, emerging risks, and feedback from auditors and stakeholders.

Ad Hoc Reviews: In addition to scheduled reviews, ad hoc reviews are conducted in response to significant changes in the business environment or the regulatory landscape.

Improvement Process:

Incorporation of Feedback: Feedback from auditors, management, and external stakeholders is a key input into the review process, ensuring that diverse perspectives are considered in the improvement of the audit plan and procedures.

Best Practices: The review process also includes benchmarking against industry best practices and adapting to new auditing techniques and technologies to enhance the effectiveness and efficiency of audit activities.

Documentation and Communication of Changes:

Updates to Documentation: Any changes to the audit plan or procedures are thoroughly documented and communicated to the audit team and relevant stakeholders to ensure alignment and understanding.

Training on Updates: Where changes introduce new processes or requirements, additional training sessions are conducted to ensure the audit team is fully equipped to implement these changes effectively.

Through this structured approach to scheduling, procedures, reporting, communication, review, and improvement, we ensure that our internal audit function is not only aligned with our organizational objectives but also positioned to proactively address risks and support continuous improvement across all aspects of the organization.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing Template.net's Strategic Internal Audit Accounting Planning Document Template! This meticulously crafted template streamlines your audit planning process. With our user-friendly editor tool, you can easily customize and edit it to suit your unique needs. Enhance your internal audit efficiency and accuracy today. Simplify your financial assessments with this indispensable resource. Get started now!