Free Annual Sales Performance Report

I. Introduction

The purpose of this report is to present a well-rounded assessment of [Your Company Name]'s sales performance for the fiscal year [Year]. The document serves as a critical tool for management, investors, and stakeholders to gauge the effectiveness of sales strategies, financial health, and market responsiveness.

It is organized to provide a month-by-month breakdown of sales, revenue, and growth percentages, followed by a comprehensive analysis of departmental contributions, key financial indicators, and market influences. The final parts offer recommendations based on the collected data and outline future strategies for sales and revenue growth.

II. Executive Summary

The annual sales performance report for [Your Company Name] for the fiscal year [Year] offers an in-depth evaluation of the organization's sales functions, revenue streams, and growth patterns. A remarkable increase of [00]% in total annual revenue was recorded, marking it as a year of significant achievement. The intent of this report is to furnish stakeholders with actionable insights, detailed statistical data, and forward-looking strategies aimed at sustaining and enhancing the company's market position.

III. Methodology

The methodology employed for the compilation of this annual sales performance report is a multifaceted approach that ensures a holistic evaluation of the company's sales activities during the fiscal year [Year]. The data sources, data collection techniques, and analytical methods used are outlined below to maintain transparency and provide a basis for the conclusions reached.

Data Sources: Transactional data, customer profiles, and sales histories were pulled from the company’s Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) systems. Third-party market reports and databases were consulted to gauge market conditions, consumer spending trends, and industry benchmarks.

Data Collection Techniques: A numerical evaluation was performed to assess the volume of units sold, revenue generated, and Year-over-Year (YoY) growth percentages. Subjective elements like customer satisfaction, product quality, and employee performance were evaluated through customer surveys and internal performance reviews. The report covers sales performance from [Month Day, Year] to [Month Day, Year].

Analytical Methods: Metrics such as gross profit margin, net profit, and operating expenses were calculated to offer a snapshot of the company's financial health. The report integrates macroeconomic indicators and market research data to contextualize the company’s performance within the broader industry landscape.

By adopting this comprehensive methodology, the report aims to provide an accurate and in-depth evaluation of [Your Company Name]'s sales performance for the fiscal year [Year], thus equipping stakeholders with reliable data and actionable insights for strategic decision-making.

IV. Sales Overview

This part provides an exhaustive examination of [Your Company Name]'s sales activities for the fiscal year [Year], showcasing both the strengths and challenges encountered. By employing a range of metrics, including units sold, revenue generated, and Year-over-Year growth percentages, this aims to paint a vivid picture of the company's sales dynamics throughout the year.

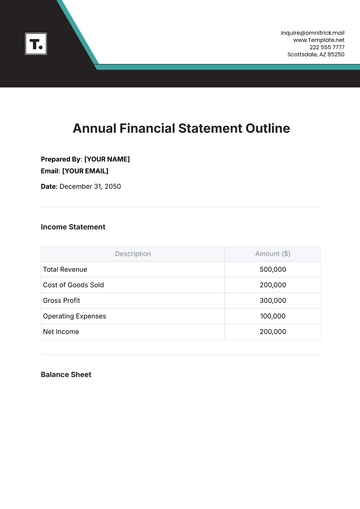

Monthly Sales Data for [Year]

The table below showcases the company’s monthly sales:

Month | Units Sold | Revenue | YoY Growth |

January | 5,500 | $220,000 | 12% |

February | |||

March | |||

April | |||

May | |||

June | |||

July | |||

August | |||

September | |||

October | |||

November | |||

December |

Key Insights:

Sales were highest in [Month, Month, corresponding with holiday seasons and promotional events.

February recorded the lowest sales, likely influenced by post-holiday sales decline.

The average YoY growth stood at [00]%, indicating a consistent and positive trajectory.

Annual Sales Metrics:

The company successfully sold a total of [00,000] units during the fiscal year [2050], marking a significant accomplishment in terms of volume.

The total revenue generated from these sales amounted to $[0,000,000], reflecting strong pricing strategies and consumer demand.

On a monthly basis, the company averaged [0,000] units sold, providing a consistent performance metric that can serve as a benchmark for subsequent years.

The corresponding monthly revenue averaged $[000,000], which serves as a reliable indicator of monthly financial health.

A Year-over-Year growth rate of [00]% was observed, signifying a positive trajectory and demonstrating the company's ability to scale its operations effectively.

Revenue Streams and Channels

The revenue for the company in the fiscal year [Year] was generated through a diversified portfolio of channels, detailed as follows:

Online Sales: A substantial $[0,000,000] was generated through online platforms, constituting 52% of the total annual revenue. This suggests a strong digital presence and effective online marketing strategies.

Retail Sales: Physical retail outlets contributed $[0,000,000] to the annual revenue, making up 36% of the total. This underscores the importance of having a balanced approach between online and in-person sales.

Wholesale: The remaining [00]% ($000,000) came from wholesale contracts, indicating the presence of B2B relationships that supplement the B2C revenue streams.

Product Category Performance Analysis

Different product categories demonstrated varied levels of contribution to the annual revenue, providing valuable insights for future strategic planning:

Electronics: This category generated $[000,000], making up [00]% of the total revenue. It represents a key area for potential growth and market expansion.

Consumer Goods: With $[0,000,000] in revenue and a [00]% share, this department stands as the highest contributor, reflecting its significant market demand.

Apparel: Contributing [00]% ($000,000) to the total revenue, this category also presents itself as a steady and reliable revenue generator.

Home and Kitchen: Although it made up the smallest proportion at [0]% ($000,000), it still represents a noteworthy addition to the total revenue pool.

By detailing monthly trends, summarizing annual performance, identifying primary revenue streams, and highlighting standout product categories, it offers a robust assessment that facilitates better understanding and strategic planning for future sales efforts.

V. Departmental Performance

This part aims to elucidate the contributions of individual departments to [Your Company Name]'s overall sales performance for the fiscal year [Year]. This detailed assessment allows for a nuanced understanding of the roles various departments play in achieving organizational goals, and thereby provides key insights for future strategic planning.

Departmental Sales Data for [Year]

The table below presents the departmental sales data:

Department | Units Sold | Revenue | YoY Growth |

Electronics | 16,000 | $800,000 | 13% |

Key Performance Metrics:

Consumer Goods led the way with [00]% contribution to the total revenue, indicating a high demand for these products.

Home and Kitchen contributed the least with [0]% of total revenue, signaling an opportunity for improvement and targeted marketing strategies.

Revenue Impact Analysis:

Electronics: Contributed significantly to high-ticket sales, with each unit sold generating an average revenue of $[000].

Consumer Goods: Drove consistent sales throughout the year, underpinning the company’s stable revenue stream.

Apparel: Although it only contributed [00]% to the overall revenue, it showed a promising YoY growth rate of [00]%.

Home and Kitchen: Despite the lower contribution, it serves a niche market that is integral to the company’s diversified revenue streams.

This offers a multi-layered analysis of the individual contributions made by each department, both in terms of sales and overall strategic significance. It further identifies areas of strength and opportunities for improvement, culminating in strategic recommendations tailored for optimizing future performance.

VI. Financial Indicators

The Financial Indicators provides an in-depth financial analysis of [Your Company Name]'s fiscal performance for the year [Year]. The metrics employed herein are intended to offer a comprehensive view of the company’s financial health and long-term sustainability.

Financial Indicators for [Year]:

Highlighted in the table below are the indicators with the respective values and percentage change:

Indicator | Value | Percentage Change From Previous Year |

Gross Profit Margin | 45% | +3% |

Operating Profit Margin | ||

EBITDA | ||

Return on Assets (ROA) | ||

Return on Equity (ROE) | ||

Current Ratio | ||

Debt-to-Equity Ratio |

Interpretation of Key Metrics:

Gross Profit Margin: An increase of [0]% from the previous year indicates an improvement in cost control measures or pricing strategies, or both.

Operating Profit Margin: A [0]% increase signifies an enhanced operational efficiency, owing to a decrease in operational costs relative to sales revenue.

EBITDA: The [0]% increase in Earnings Before Interest, Taxes, Depreciation, and Amortization implies greater profitability and operational effectiveness.

Return on Assets and Equity: A slight uptick in ROA and ROE points to improved asset utilization and shareholder returns, respectively.

Liquidity and Solvency Ratios: A Current Ratio of [0.0] suggests adequate liquidity, while a Debt-to-Equity Ratio of [0.0] indicates a conservative approach to leveraging.

Financial Performance Insights:

The Gross and Operating Profit Margins suggest a well-managed cost structure and effective pricing strategies.

The marked improvement in EBITDA suggests streamlined operations and potential for scalability.

An ROA of [00]% denotes effective asset utilization, warranting confidence in management capabilities.

A conservative Debt-to-Equity Ratio coupled with a healthy Current Ratio indicates financial stability and resilience against economic downturns.

By correlating these financial indicators with operational performance, this provides stakeholders with a multi-dimensional understanding of [Your Company Name]'s fiscal health. Such robust analytical depth is vital for guiding strategic decisions aimed at ensuring the company’s long-term viability and growth.

VII. Recommendations

The Recommendations aims to distill the findings from the preceding analysis into actionable insights for [Your Company Name] as it strategizes for the fiscal year [Year]. This is informed by the comprehensive examination of annual sales performance, departmental contributions, and critical financial indicators. These recommendations are designed to facilitate informed decision-making that aligns with the company's long-term objectives.

Sales and Revenue Generation: Given the significant contribution of online sales to overall revenue, it is advisable to further invest in digital marketing and e-commerce platforms for scalable growth.

Departmental Focus: Given the superior performance of the Consumer Goods department, reallocating resources to this area would likely yield further gains. For underperforming departments such as Home and Kitchen, introducing new product lines or services could stimulate sales and customer engagement.

Financial Management: While profitability margins are healthy, there is always room for improvement through smarter procurement and lean operational strategies. With favorable ROA and ROE metrics, it would be prudent to explore investment opportunities that align with the company’s core competencies.

Broad Organizational Objectives: Given increasing consumer awareness, a focus on sustainability could not only improve brand image but also potentially open new revenue streams. The existing financial stability and growth indicators suggest that the company could strategically consider international markets for expansion.

VIII. Conclusion

In summary, [Your Company Name] has demonstrated substantial growth in sales and revenue for the fiscal year [Year]. Strategic investment in high-performing departments and leveraging market trends could serve as key drivers for sustaining this growth in the upcoming fiscal year.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Gain comprehensive insights into your sales performance easily with the Annual Sales Performance Report Template from Template.net! This report is fully editable and customizable, providing a detailed overview. Leverage our AI Editor Tool ensuring the report aligns seamlessly with your sales goals! Empower data-driven decision-making for a successful year ahead!

You may also like

- Sales Report

- Daily Report

- Project Report

- Business Report

- Weekly Report

- Incident Report

- Annual Report

- Report Layout

- Report Design

- Progress Report

- Marketing Report

- Company Report

- Monthly Report

- Audit Report

- Status Report

- School Report

- Reports Hr

- Management Report

- Project Status Report

- Handover Report

- Health And Safety Report

- Restaurant Report

- Construction Report

- Research Report

- Evaluation Report

- Investigation Report

- Employee Report

- Advertising Report

- Weekly Status Report

- Project Management Report

- Finance Report

- Service Report

- Technical Report

- Meeting Report

- Quarterly Report

- Inspection Report

- Medical Report

- Test Report

- Summary Report

- Inventory Report

- Valuation Report

- Operations Report

- Payroll Report

- Training Report

- Job Report

- Case Report

- Performance Report

- Board Report

- Internal Audit Report

- Student Report

- Monthly Management Report

- Small Business Report

- Accident Report

- Call Center Report

- Activity Report

- IT and Software Report

- Internship Report

- Visit Report

- Product Report

- Book Report

- Property Report

- Recruitment Report

- University Report

- Event Report

- SEO Report

- Conference Report

- Narrative Report

- Nursing Home Report

- Preschool Report

- Call Report

- Customer Report

- Employee Incident Report

- Accomplishment Report

- Social Media Report

- Work From Home Report

- Security Report

- Damage Report

- Quality Report

- Internal Report

- Nurse Report

- Real Estate Report

- Hotel Report

- Equipment Report

- Credit Report

- Field Report

- Non Profit Report

- Maintenance Report

- News Report

- Survey Report

- Executive Report

- Law Firm Report

- Advertising Agency Report

- Interior Design Report

- Travel Agency Report

- Stock Report

- Salon Report

- Bug Report

- Workplace Report

- Action Report

- Investor Report

- Cleaning Services Report

- Consulting Report

- Freelancer Report

- Site Visit Report

- Trip Report

- Classroom Observation Report

- Vehicle Report

- Final Report

- Software Report