Free Sales Financial Analysis Report

1. Executive Summary

This analysis report has been meticulously crafted to offer a holistic appraisal of [Your Company Name]'s sales performance for the fiscal year 2050. The primary objective of this report is not merely to summarize the company's financial data but to delve deeper into the numbers, identifying underlying trends, strengths, and areas of concern that could significantly impact the business in both the short and long term.

At the heart of the report is an in-depth evaluation of key financial metrics—ranging from revenue and expense breakdowns to profit margins. In addition to providing a monthly and quarterly analysis of these figures, the report draws comparisons with previous years to assess year-over-year growth or contraction. This enables stakeholders to understand not just the present health of the sales department but also its trajectory.

Understanding that a business does not operate in a vacuum, the report also includes an examination of the sales channel performance and product-specific revenue contributions. It aims to identify the most profitable sales channels and product categories, thus shedding light on where to allocate resources more effectively for maximized profitability.

Significant attention has also been devoted to the expense analysis. This part dissects the company's costs, linking them as a percentage of revenue, thereby offering insights into the operational efficiency of the sales department. Identifying which expenses are fixed and which are variable allows for a more nuanced understanding of cost control measures that can be enacted.

The ultimate value of this report lies in its actionable recommendations. Derived from the data analysis and observations, these suggestions are not merely theoretical but are backed by quantitative assessments. They serve as a roadmap for [Your Company Name] to build upon its strengths and address its weaknesses, equipping the management and stakeholders with the knowledge they need to make informed decisions.

2. Introduction

This report outlines the core objectives and the framework within which the study has been conducted. The primary purpose of this comprehensive document is to closely scrutinize and analyze the financial metrics of [Your Company Name]'s sales department for the fiscal year 2050. This examination is multifaceted, incorporating not only an assessment of revenue streams but also a detailed inspection of expense management and overall profitability. By delving into these critical areas, the report aims to provide an all-encompassing financial perspective that could serve as a valuable resource for decision-makers within the organization. In doing so, it seeks to identify potential avenues for growth, uncover areas requiring cost control, and generally offer insights into how the sales department can achieve its financial objectives more effectively. With a data-driven approach, this report strives to provide a roadmap for both short-term actions and long-term strategic planning.

3. Revenue Analysis

Here, we will provide a detailed overview of monthly sales revenue, capturing both the total revenue figures and the year-over-year growth percentages. This data is critical for understanding the sales department's overall performance and identifying trends or areas for improvement.

Month | Total Revenue | Year-over-Year Growth |

January | $[12,000] | [5%] |

February | $[14,000] | [6%] |

March | $[15,000] | [7%] |

April | $[13,500] | [4%] |

May | $[12,500] | [3%] |

June | $[16,000] | [8%] |

July | $[11,000] | [2%] |

August | $[13,000] | [5%] |

September | $[17,000] | [9%] |

October | $[16,500] | [8%] |

November | $[15,500] | [7%] |

December | $[18,000] | [10%] |

Observations

Highest Revenue Month: December with $18,000

Lowest Revenue Month: July with $11,000

From the table, it is evident that December was the most successful month, achieving the highest revenue of $18,000 with a year-over-year growth of 10%. On the flip side, July was the least successful month, with the lowest revenue at $11,000 and the lowest year-over-year growth at 2%. Understanding these monthly fluctuations can provide insights into the business's seasonality and help in future planning and resource allocation.

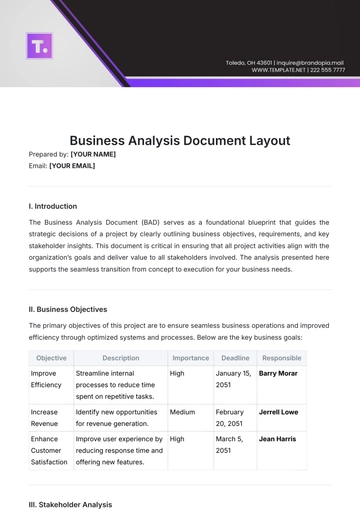

4. Expense Analysis

In this part, we break down the major types of expenses incurred by the sales department over the fiscal year 2050. Understanding how each type of expense relates to overall revenue is crucial for budgeting and making cost-effective decisions.

Type of Expense | Amount | Percentage of Revenue |

Marketing | $[8,000] | [10%] |

Employee Salaries | $[20,000] | [25%] |

Operational Costs | $[12,000] | [15%] |

Office Supplies | $[2,000] | [2.5%] |

Travel | $[4,000] | [5%] |

Utilities | $[1,500] | [1.8%] |

Software Licenses | $[3,000] | [3.7%] |

Miscellaneous | $[1,000] | [1.2%] |

Observations

Highest Expense: Employee Salaries with $20,000

Lowest Expense: Miscellaneous with $1,000

The table clearly shows that Employee Salaries are the most substantial expense, taking up 25% of the overall revenue. This expense type needs to be scrutinized to determine if staffing levels are appropriate for the sales department's goals and whether any efficiencies can be gained. On the other end of the spectrum, Miscellaneous expenses make up the smallest share of expenses at just $1,000 or 1.2% of revenue. Given its relatively small impact on the budget, this category may not require immediate attention unless these expenses start to grow disproportionately. By continually analyzing these expenses in relation to revenue, we can more effectively manage costs and optimize profitability.

5. Profit Margin Analysis

Profit margins are essential indicators of a company's financial health and operational efficiency. By breaking down various types of profit margins, we can better understand how each segment of the business contributes to its overall profitability. Below are the key metrics for understanding the profit margins within the sales department for the fiscal year 2050.

Observations

The Gross Profit Margin of 45% indicates that a significant portion of the revenue generated is retained after accounting for the cost of goods sold. This is a good sign of financial health and suggests that the company has strong pricing strategies and cost controls in place.

The Net Profit Margin of 30% is another strong indicator. It reveals that after all expenses, including operating costs, taxes, and interest, a healthy portion of revenue remains as net profit. A Net Profit Margin at this level is considered robust and suggests effective overall management.

The Operating Profit Margin at 38% signifies that the company is efficiently generating profit from its core business operations, excluding interest and taxes. This reflects well on operational effectiveness and cost management strategies.

The company maintained a healthy Net Profit Margin of 30%, which is an encouraging sign of profitability and effective expense management. High net profit margins can provide the company with more resources for potential reinvestment, growth strategies, or shareholder dividends. Given these strong metrics, the sales department appears to be in a strong financial position. However, continuous monitoring and optimization efforts are recommended to maintain or improve these levels of profitability.

6. Sales Channel Performance

Understanding the performance of different sales channels is crucial for allocating resources effectively and for strategic planning. By breaking down revenue and profit by channel, we can identify which channels are the most lucrative and which might require further investment or reevaluation. The table below provides a snapshot of the performance of each sales channel for the fiscal year 2050.

Observations

The Online channel has proven to be the most profitable, contributing $75,000 in profit. This suggests that e-commerce is a strong point for the company and might warrant additional investment in digital marketing and website optimization.

Retail brought in $40,000 in profit, indicating that brick-and-mortar stores still play a significant role in the company’s earnings. However, the lower profit margin compared to online sales suggests that operating costs for physical locations may be impacting profitability.

Direct Sales generated the least revenue and profit, with $20,000 in profit. This channel may require further analysis to determine if the costs of maintaining this sales avenue are justified by the returns it generates.

The most profitable channel was the Online channel, contributing $75,000 in profit. This finding is particularly significant for resource allocation in future sales and marketing initiatives. It suggests that investing more in the Online channel could amplify profits, but it's also a reminder to continually assess the profitability of all channels to ensure a diversified and resilient sales strategy.

7. Product Performance

Evaluating the performance of individual products is essential for identifying both stars and underperformers in your product line. This information helps in optimizing inventory management, setting pricing strategies, and planning marketing initiatives for specific products. Below is a table detailing the revenue and units sold for each product for the fiscal year 2050.

Product Name | Revenue | Units Sold |

Adv Gen | $[100,000] | [10,000] |

Adv Gen stood out as the best-selling product, contributing $100,000 to the total revenue. It also had the highest units sold, with 10,000 units moved. This suggests that Adv Gen has strong market demand and should continue to be a focal point in sales and marketing strategies. This is a clear indicator that Adv Gen resonates well with our customer base and should receive priority in future sales and marketing campaigns. The data also provides actionable insights into how we can tailor our strategies to capitalize on the strengths and improve the weaknesses of our product portfolio.

8. Seasonal Trends

The visual representation of the revenue per quarter is showcased in the chart below:

Observations

Sales peaked during Q4 2050, with a revenue of $300,000. This could be attributed to the holiday shopping season, where consumer spending typically increases. Special promotions or seasonal items may also have contributed to the spike in sales during this period.

Conversely, sales were lowest during Q3 2050, with $180,000 in revenue. This dip might be related to the summer vacation period when people are more focused on travel and leisure activities rather than shopping.

Q1 and Q2 show relatively stable performance but demonstrate room for growth. These quarters might benefit from targeted marketing campaigns or special promotions to boost revenue.

The information on seasonal trends provides valuable insights for planning future sales strategies. For example, extra marketing efforts and promotions could be scheduled for Q4 to capitalize on the holiday spending surge. Similarly, innovative marketing campaigns could be implemented in Q3 to counteract the seasonal dip.

9. Recommendations

Based on the comprehensive analysis of various facets of our sales financial performance, the following recommendations are proposed for actionable improvements:

Invest More in [Sales Channel] to Maximize Profitability: The analysis indicates that [Sales Channel] has been the most profitable route for us, contributing $[Amount] in profit. Investing more resources into this channel—be it through targeted marketing, better sales training, or improved customer service—could yield even greater returns.

Consider a Seasonal Marketing Campaign to Capitalize on Identified Sales Trends: Our data shows significant sales fluctuations depending on the season, with sales peaking notably in Q4. To make the most of this seasonal spike, a well-timed marketing campaign, possibly featuring special discounts or limited-time offers, could be highly effective. This strategy could also be adapted to tackle low-performing seasons like Q3 by incentivizing purchases through promotions or special offers.

Implementing these recommendations would require careful planning and additional resources, but the potential for increased revenue and profitability makes them worthy of serious consideration.

10. Conclusion

The report shows a robust performance in the fiscal year 2050, with areas for improvement identified. Following the recommendations can contribute to a more profitable year ahead.

For any questions or clarifications, please contact [Your Name] at [Your Email].

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Make informed financial decisions with the Sales Financial Analysis Report Template from Template.net! This report, fully editable and customizable, provides a detailed financial overview. Utilize our advanced AI Editor Tool for easier generation ensuring alignment with your sales and financial goals for a successful and profitable outcome! Edit right now!