Free Sales New Account Acquisition Feasibility Study

Prepared By: [YOUR NAME]

Company Name: [YOUR COMPANY NAME]

Executive Summary

Overview

The Executive Summary serves as a succinct overview of the Sales New Account Acquisition Feasibility Study, encapsulating critical findings and recommendations. This section allows decision-makers to grasp the essence of the study at a glance.

Key Findings

Market Growth: Our research reveals a promising outlook for the new account acquisition market in the banking sector. With an estimated market size of $[0] billion in [Year] and a projected annual growth rate of [0]%, there are significant expansion opportunities.

Target Customer Profile: The study identifies our target audience as small and medium-sized businesses (SMBs) with annual revenues ranging from $[0] million to $[0] million. These businesses represent a substantial portion of the potential market.

Competitive Landscape: A comprehensive competitor analysis indicates a robust and competitive landscape. We have identified key players in the market and assessed their market share, product offerings, and customer base.

Sales Strategy: Our proposed sales strategy is designed to capitalize on market opportunities. It entails the creation of a dedicated sales team and the implementation of a streamlined sales process.

Recommendations

In light of the study's findings, we present the following recommendations:

Invest in Sales Team Training: To maximize the effectiveness of our sales efforts, it is crucial to invest in continuous training and development for our sales team. This will enhance their skills and enable them to adapt to changing market dynamics.

Continuous Monitoring: Given the dynamic nature of the banking sector, we recommend establishing a mechanism for continuous monitoring of market conditions. Staying abreast of industry trends and customer preferences will enable us to adjust our strategy as needed.

Conclusion

In conclusion, the Sales New Account Acquisition Feasibility Study provides a solid foundation for decision-making regarding the expansion of our sales efforts in the banking sector. The study underscores the potential for growth in this market and offers clear recommendations for success.

Introduction

Background

The introduction section sets the stage for the Sales New Account Acquisition Feasibility Study by providing essential background information.

Banking Sector Overview: The banking sector is a cornerstone of the financial industry, serving a wide range of individuals and businesses. It plays a vital role in the economic well-being of a nation.

Market Dynamics: The banking sector is characterized by evolving market dynamics, including changing customer expectations, regulatory shifts, and technological advancements. These factors necessitate a proactive approach to business development.

Purpose of the Study

The purpose of this study is to thoroughly evaluate the feasibility of expanding our sales efforts to acquire new accounts within the banking sector. This expansion is motivated by the recognition of growth potential in the market and the desire to capitalize on emerging opportunities.

Scope of the Study: The study will encompass various aspects, including market analysis, competitive assessment, sales strategy development, financial projections, and risk assessment. The goal is to provide decision-makers with a comprehensive understanding of the landscape and potential outcomes.

Stakeholder Objectives: The primary objective is to ensure that stakeholders are well-informed and equipped to make data-driven decisions regarding the proposed expansion. Additionally, the study aims to identify potential challenges and mitigate risks associated with new account acquisition.

Methodology

Data Collection

Data collection is a critical component of this Sales New Account Acquisition Feasibility Study. Our methodology ensures that information is gathered from reliable sources to provide a solid foundation for our analysis.

Secondary Data: To gain an understanding of the market, we extensively researched secondary data sources, including industry reports, economic analyses, and banking sector publications. These sources provided valuable historical data and insights into market trends.

Primary Data: Complementing our secondary data research, we conducted primary data collection through surveys and interviews. Targeted surveys were distributed to potential customers within our defined market segment – small and medium-sized businesses. Additionally, in-depth interviews were conducted with industry experts and banking professionals to gather qualitative insights.

Analysis Approach

Our analysis approach is structured to extract meaningful insights from the collected data. By employing various analytical techniques, we aimed to provide a comprehensive understanding of the feasibility of new account acquisition in the banking sector.

Statistical Analysis: Quantitative data, such as market size and growth rates, were subjected to rigorous statistical analysis. This allowed us to identify trends, correlations, and patterns that are vital for decision-making.

Qualitative Analysis: Qualitative data from interviews and open-ended survey questions were analyzed thematically. These qualitative insights provided context and depth to our findings.

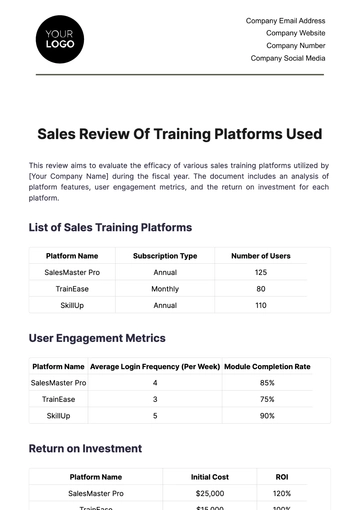

Market Analysis

Market Size and Growth

Our comprehensive market analysis reveals crucial insights into the size and growth potential of the new account acquisition market within the banking sector.

Market Size: In [Year], the estimated market size stands at approximately $[0] billion. This figure is a result of our thorough examination of historical data and projected growth rates.

Projected Growth: Over the next five years, we anticipate a compound annual growth rate (CAGR) of [0]%. This growth rate reflects the dynamic nature of the banking sector and the emerging opportunities it presents.

Factors Driving Growth: Several factors contribute to this growth, including an increase in the number of small and medium-sized businesses, a growing economy, and a heightened demand for banking services tailored to the needs of these businesses.

Target Customer Profile

Understanding the characteristics and preferences of our target customers is essential for developing an effective sales strategy.

Target Audience: Our target customer profile centers on small and medium-sized businesses (SMBs) with annual revenues ranging from $[0] million to $[00] million. These businesses form a significant segment of the market and have unique banking needs.

Demographics: Within this segment, we have identified demographic traits such as industry type, geographic location, and company size that can guide our marketing efforts.

Needs and Preferences: Through surveys and interviews, we have gained insights into the specific banking needs and preferences of our target customers. These insights will inform product development and marketing strategies tailored to meet their requirements.

Competitive Landscape

Competitor Analysis

A robust competitor analysis is essential for understanding the competitive landscape in the new account acquisition market within the banking sector.

Key Competitors: We have identified key competitors operating in this market, including well-established banks and financial institutions. These competitors have a substantial presence and a history of serving businesses.

Market Share: Chart 1 below illustrates the market share of key competitors as of [Year]. This data is based on market research and industry reports.

Product Offerings: A comprehensive analysis of competitor product offerings reveals the range of services and features they provide to attract new account customers.

Customer Base: We have examined the customer base of key competitors, identifying the types of businesses they serve and their geographic reach.

SWOT Analysis

A SWOT analysis provides a strategic framework to assess our internal strengths and weaknesses, as well as external opportunities and threats in the context of the competitive landscape.

SWOT | Point 1 | Point 2 |

Strengths | Established reputation in the banking sector | Expertise in serving SMBs |

Weaknesses | Limited market presence in the new account acquisition segment | Need for additional investment in sales and marketing |

Opportunities | Growing market with increasing demand for banking services | Differentiation through innovative products |

Threats | Intense competition from established players | Regulatory changes impacting banking practices |

Sales Strategy

Sales Team Structure

Our sales strategy necessitates a well-organized sales team structure to effectively target and acquire new accounts within the banking sector.

Role | Responsibilities |

Account Executives |

|

Sales Managers |

|

Support Staff |

|

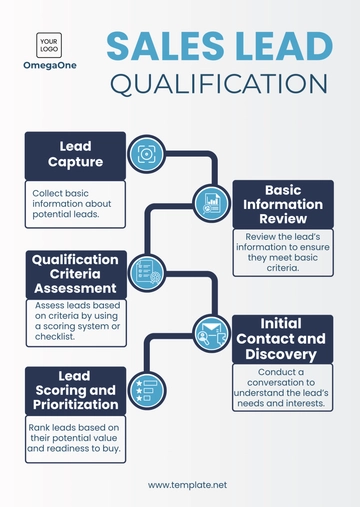

Sales Process

A well-defined sales process is essential for converting leads into new accounts.

Lead Generation: Prospective leads are identified through targeted marketing efforts, referrals, and industry events.

Lead Qualification: Leads are evaluated based on criteria such as business size, banking needs, and geographic location to determine their suitability.

Presentation: Account executives present our banking services to qualified leads, highlighting the value proposition.

Closing: Successful presentations result in closing new accounts. This involves the completion of necessary paperwork and account setup.

Follow-Up: Continuous communication and support are provided to new account holders to ensure satisfaction and retention.

Financial Analysis

Cost Projections

Comprehensive cost projections are crucial for assessing the financial feasibility of our new account acquisition strategy within the banking sector. We have meticulously analyzed and projected both initial setup costs and ongoing operational costs.

Initial Setup Costs: Table 3 below outlines the anticipated initial setup costs associated with expanding our sales efforts into the new account acquisition market. These costs encompass expenses related to staffing, marketing, technology, and infrastructure development.

Expense Category | Cost (USD) |

Staffing and Training | $1,200,000 |

Total | $[0,000,000] |

Ongoing Operational Costs: The ongoing operational costs include expenses associated with maintaining and running the sales and marketing efforts, as well as other operational aspects. Table 4 provides a breakdown of these costs.

Expense Category | Cost (USD) |

Staffing and Training | $1,200,000 |

Total | $[0,000,000] |

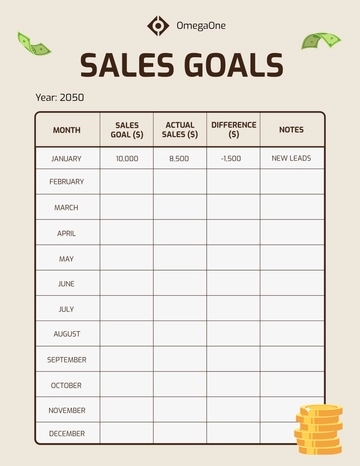

Revenue Projections

Revenue projections are based on a careful analysis of market trends, customer acquisition rates, and anticipated customer lifetime value. Table 5 presents revenue projections for the first five years of our expansion effort.

Year | Revenue (USD) |

2050 | $3,000,000 |

2051 | $4,500,000 |

Break-Even Analysis

A break-even analysis is essential to determine the point at which our new account acquisition efforts will cover both initial setup costs and ongoing operational costs.

Break-Even Point: Based on our cost projections and revenue estimates, we anticipate reaching the break-even point in the third year of operations, which is [Year].

Risk Assessment

A thorough risk assessment is a critical aspect of evaluating the feasibility of our sales strategy in the banking sector. This section outlines the key risks associated with our expansion efforts and strategies to mitigate them.

Market Risks

Changing Customer Preferences: The banking sector is highly influenced by evolving customer preferences. To mitigate this risk, we will continuously gather customer feedback and adapt our services accordingly.

Economic Downturns: Economic fluctuations can impact the financial sector. We will maintain a robust risk management strategy and diversify our offerings to withstand economic challenges.

Operational Risks

Staffing Challenges: Recruiting and retaining skilled sales personnel can be challenging. To address this, we will invest in training and development programs to nurture a competent sales team.

Unforeseen Expenses: Unexpected expenses may arise during the expansion. We will maintain a financial buffer to handle unforeseen costs and minimize their impact on operations.

Conclusion

The Sales New Account Acquisition Feasibility Study provides a comprehensive assessment of the potential for expanding our sales efforts within the banking sector. Key findings indicate a growing market with substantial opportunities, particularly among small and medium-sized businesses. The competitive landscape has been analyzed, and a well-structured sales strategy has been proposed.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Optimize your sales strategy with the Sales New Account Acquisition Feasibility Study Template from Template.net. Fully customizable, downloadable, and printable, this comprehensive template enables businesses to assess the viability of acquiring new accounts effectively. Editable in our AI Editor Tool, it offers flexibility to tailor the study to your specific needs.