Free Startup Incorporation Guide

Introduction to Incorporation

Incorporation marks a pivotal step in the journey of any startup, transforming an idea or a partnership into a legally recognized entity with its rights, liabilities, and obligations. This process not only shields personal assets from business liabilities but also opens avenues for tax efficiencies, investment opportunities, and enhanced credibility with customers, partners, and investors. By incorporating, we formalize the structure of our business, laying a solid foundation for governance, operational efficiency, and growth. It signifies our commitment to professionalism and establishes a framework for expanding our business operations and attracting capital. Through this guide, we aim to navigate the complexities of incorporation, providing clarity and direction to make informed decisions that align with our long-term goals and operational strategies.

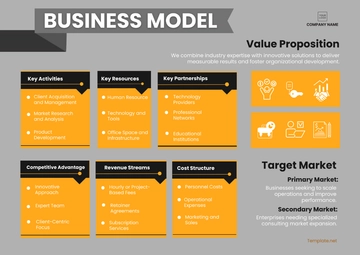

Choosing the Right Type of Corporation

Selecting the most suitable corporate structure is crucial for our startup's financial health, operational flexibility, and growth potential. The choice impacts tax obligations, the ability to raise capital, and the complexity of business operations. Understanding the characteristics of each type of corporation helps in making an informed decision that supports our startup's aspirations and business model.

Corporate Structure | Advantages | Disadvantages | Best For |

C Corporation | Limited liability for owners No limit on the number of shareholders Easier to raise capital | Double taxation (corporate and shareholder dividends) More regulations and compliance obligations | Startups planning to go public or seeking substantial external financing |

S Corporation | Limited liability for owners Taxed as a pass-through entity Avoids double taxation | Limits on the number of shareholders (100) Shareholders must be U.S. citizens or residents | Small businesses seeking pass-through tax treatment without the intent of going public |

Limited Liability Company (LLC) | Limited liability for owners Tax flexibility (can choose to be taxed as a sole proprietorship, partnership, or corporation) Less formalities and regulations | Self-employment taxes on profits May be more difficult to raise capital than a C corp | Flexible startups looking for a balance between operational simplicity and liability protection |

Understanding Incorporation Requirements

Incorporating a startup in the United States involves navigating a series of legal requirements that vary by state but share common elements across jurisdictions. Understanding these requirements is essential for ensuring compliance and laying a solid legal foundation for the business. The process requires careful preparation of documentation, adherence to state-specific procedures, and compliance with federal regulations. This section outlines the general legal requirements for incorporation in the U.S. and describes the necessary documentation to streamline the process, mitigate risks, and ensure that our startup is positioned for success from day one.

Legal US Requirements

Choose a Business Name: The name must be unique and not already in use or too similar to an existing business in the state of incorporation.

Appoint a Registered Agent: A registered agent must be designated to receive legal documents on behalf of the corporation.

File Articles of Incorporation: This fundamental document must be filed with the state's business filing agency.

Obtain Necessary Licenses and Permits: Depending on the business type and location, specific licenses and permits may be required to operate legally.

Compliance with Securities Laws: If issuing stock, compliance with federal and state securities laws is mandatory.

Necessary Documentation

Articles of Incorporation: Establishes the existence of the corporation, including the business name, purpose, corporate structure, stock details, and registered agent.

Bylaws: Internal document outlining the corporation's operating rules, including the governance structure, officer roles, and meeting procedures.

Operating Agreement: For LLCs, this document outlines the ownership and operating procedures. While not always legally required, it is highly recommended.

Initial Board Resolutions: Document decisions made by the board of directors during the initial meeting, such as officer appointments and authorization to open a bank account.

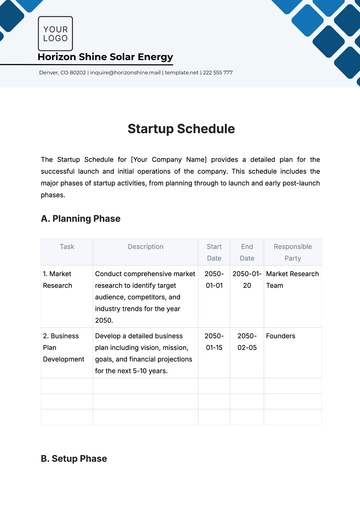

The Incorporation Process

The process of incorporating involves several steps, each with specific requirements and associated costs. Here’s a simplified overview:

Step | Where to File | Documents Needed | Associated Costs |

Choose a Business Name | State's Business Filing Agency | Business name availability check | |

Appoint a Registered Agent | Same as above | Registered Agent designation form | |

File Articles of Incorporation | Same as above | Articles of Incorporation | |

Obtain Licenses and Permits | Local and State Agencies | Varies by industry and location | |

Comply with Securities Laws | Federal and State Securities Agencies | Securities registration or exemption filings |

After successfully filing the necessary documents and paying the associated fees, the next critical step is obtaining an Employer Identification Number (EIN) from the IRS.

An EIN is essential for various business functions, including opening a bank account, hiring employees, and filing taxes. It acts as the federal taxpayer identification number for the corporation. Obtaining an EIN is a straightforward process that can be completed online through the IRS website, by mail, or by fax. The service is free of charge, and if applied for online, the EIN is issued immediately. This number is crucial for the operational and financial management of the business, ensuring compliance with tax obligations and facilitating transactions and payroll processing.

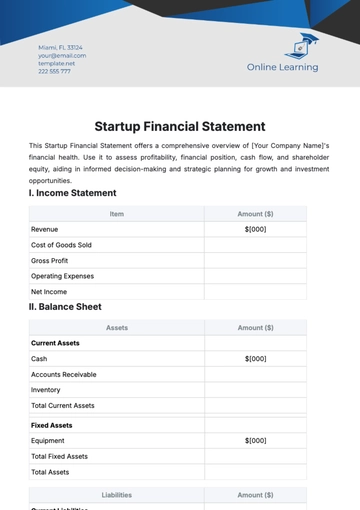

Tax Considerations

Navigating the tax implications of incorporation is a critical aspect of establishing and running a startup in the United States. Different corporate structures come with distinct tax responsibilities and opportunities for optimization. Understanding these nuances can significantly impact the financial health of the business. From the outset, startups must consider federal and state tax obligations, including income, employment, and sales taxes. Additionally, there are a variety of tax benefits and credits designed to support and incentivize startup growth. Proactive tax planning and compliance can help maximize these opportunities, reduce liabilities, and ensure the long-term sustainability of the business.

US Tax Considerations

Corporate Income Tax: C Corporations are subject to federal corporate income tax, whereas S Corporations and LLCs often benefit from pass-through taxation, eliminating the corporate level tax.

Employment Taxes: Startups must withhold and pay employment taxes, including Social Security, Medicare, and unemployment taxes.

Sales Tax: If selling goods or services, startups may be required to collect and remit sales tax in accordance with state and local laws.

R&D Tax Credit: Startups engaged in research and development can benefit from the federal R&D tax credit, which offsets income and, in some cases, payroll taxes.

Startup Costs Deduction: Startups can deduct up to $5,000 in startup costs in their first year of operation, with the remainder amortizable over 15 years.

Small Business Health Care Tax Credit: Eligible small businesses that provide health insurance to their employees can claim this credit to offset the cost of insurance.

Ongoing Compliance and Governance

Maintaining compliance and adhering to best governance practices are essential for the longevity and success of any startup. These responsibilities ensure that the startup operates within legal and regulatory parameters, minimizes risk, and upholds the trust of investors, employees, and customers. Effective governance structures and compliance strategies can also enhance decision-making processes and operational efficiencies.

Best Practices

Regular Board Meetings: Hold regular board meetings to review financial performance, strategic decisions, and compliance matters.

Annual Reports and Filings: Submit annual reports and necessary filings with state and federal agencies to maintain good standing.

Internal Audits: Conduct internal audits to assess compliance with laws, regulations, and internal policies.

Compliance Training: Provide ongoing compliance training for employees, focusing on relevant laws and regulations affecting the business.

Document Management: Maintain accurate and comprehensive records of corporate documents, financial transactions, and compliance efforts.

Raising Capital and Securities Law

Raising capital is a critical stage in a startup's lifecycle, necessitating a thorough understanding of securities laws to navigate the process legally and effectively. These laws regulate the offer and sale of securities to protect investors and ensure fair markets. Startups have several options for raising capital, each with specific legal and regulatory considerations.

Options for Raising Capital

Equity Financing: Involves selling company shares in exchange for investment capital. This option requires compliance with federal and state securities laws, including registration or exemption filings.

Debt Financing: Borrowing funds that must be repaid over time, typically with interest. This can be through traditional bank loans or issuing bonds.

Venture Capital: Receiving funding from venture capital firms in exchange for equity. This process often involves rigorous due diligence and negotiation of terms.

Crowdfunding: Utilizing platforms to raise small amounts of capital from a large number of people. There are specific regulations governing crowdfunding, including caps on the amount that can be raised and investor protections.

Angel Investors: Securing investment from wealthy individuals who provide capital for startups, often in exchange for equity or convertible debt.

Intellectual Property Protection

For startups, safeguarding intellectual property (IP) is crucial to maintaining competitive advantage, attracting investment, and ensuring long-term success. Intellectual property includes inventions, brand names, designs, and original works of authorship. Protecting these assets requires understanding the different types of IP protection available and implementing strategies to secure and enforce these rights. Effective IP management not only prevents unauthorized use of a startup's assets but also enhances the company's valuation and appeal to investors and partners.

Registration Guidelines

Trademarks: Register trademarks with the United States Patent and Trademark Office (USPTO) to protect brand names, logos, and slogans. This process includes conducting a trademark search to ensure uniqueness, submitting an application, and responding to any USPTO inquiries.

Patents: File for patents to protect inventions or processes that are novel, non-obvious, and useful. This involves preparing a detailed application with claims that define the scope of the invention's protection, followed by USPTO review and potential approval.

Copyrights: Secure copyright protection by creating original works of authorship, including software, written works, and artistic creations. Copyright is automatic upon creation, but registration with the Copyright Office provides legal advantages, such as the ability to sue for infringement.

Employment Laws and Hiring

Navigating employment laws is a critical aspect of managing a startup's workforce. The United States has a complex framework of federal, state, and local employment laws designed to protect workers while imposing certain obligations on employers. Understanding and complying with these laws ensure fair treatment of employees, mitigate legal risks, and foster a positive workplace culture.

US Laws Affecting Startups

Fair Labor Standards Act (FLSA): Governs minimum wage, overtime pay, and child labor.

Title VII of the Civil Rights Act: Prohibits employment discrimination based on race, color, religion, sex, and national origin.

Americans with Disabilities Act (ADA): Prohibits discrimination against individuals with disabilities and requires reasonable accommodations.

Family and Medical Leave Act (FMLA): Entitles eligible employees to unpaid, job-protected leave for specified family and medical reasons.

Occupational Safety and Health Act (OSHA): Ensures safe and healthy working conditions.

Creating clear and comprehensive employment agreements, nondisclosure agreements (NDAs), and employee handbooks is essential for outlining expectations, rights, and responsibilities.

Employment Agreements: Define the terms of employment, including roles, responsibilities, compensation, and termination conditions.

Nondisclosure Agreements: Protect confidential information by legally binding employees to secrecy regarding sensitive business information.

Employee Handbooks: Provide a detailed overview of company policies, procedures, and expectations, promoting transparency and consistency in the application of company rules.

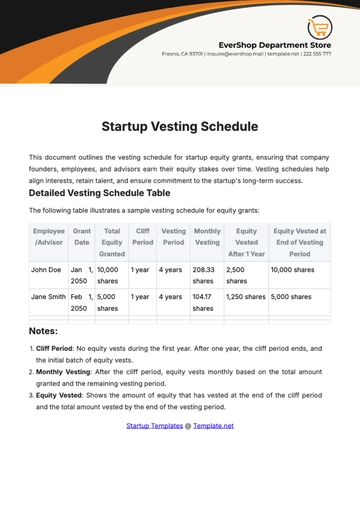

Exit Strategies

An exit strategy is a critical component of a startup's long-term planning, outlining how the founders and investors can realize a return on their investment. Whether aiming for a high-profile acquisition or passing the business to a new generation, having a clear exit plan in place can significantly influence business decisions and operational strategies. A well-defined exit strategy not only provides a roadmap for transitioning ownership but also maximizes the value of the business for its stakeholders. It's important to consider the most suitable exit option based on the startup's growth trajectory, market conditions, and the goals of its shareholders.

Acquisition: Selling the startup to another company. Often pursued by startups with unique technologies or market positions that are attractive to larger entities.

Merger: Combining the startup with another company to form a new entity. This can provide access to new markets, technologies, or efficiencies.

Initial Public Offering (IPO): Going public by selling shares of the company to the public on a stock exchange. Suitable for startups with strong financials and a clear path to sustained growth.

Management Buyout (MBO): Selling the company to its existing managers or employees. This can be an appealing option for ensuring the business's legacy and maintaining its culture.

Passing to Family: Transferring ownership to family members. Ideal for family-owned businesses looking to preserve the company within the family across generations.

Resources and Assistance

For startups navigating the complexities of incorporation, growth, and eventual exit, a wealth of resources and assistance is available to guide them through every stage of the journey. Leveraging these resources can provide valuable insights, reduce the risk of costly mistakes, and enhance the startup's chances of success. From legal and financial advice to mentoring and networking opportunities, accessing the right support at the right time is crucial.

Small Business Administration (SBA): Offers a range of services including funding options, planning tools, and legal requirements guidance.

SCORE: A nonprofit association providing free mentoring services from experienced business professionals and low-cost workshops.

Local Economic Development Offices: Can provide information about local grants, tax incentives, and other support for startups.

Startup Accelerators and Incubators: Offer funding, mentorship, and networking opportunities to help startups grow and succeed.

Legal Aid Organizations: Provide access to free or low-cost legal advice for startups, especially around incorporation, intellectual property, and employment law.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the Startup Incorporation Guide Template from Template.net, your essential roadmap to legally establishing your business. Fully editable and customizable, this guide simplifies the incorporation process, making it accessible and manageable. Perfectly tailored for new entrepreneurs, it's editable in our AI Editor tool, offering step-by-step instructions to ensure a smooth startup journey. A must-have template for every aspiring business owner.

You may also like

- Startup Agreement

- Non Profit

- Transport and Logistics

- Education

- IT Services and Consulting

- Startup Presentation

- Startup Business Plan

- Startup Proposal

- Startup Plan

- Startup Brochure

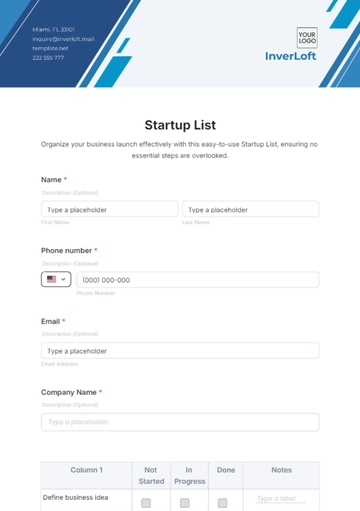

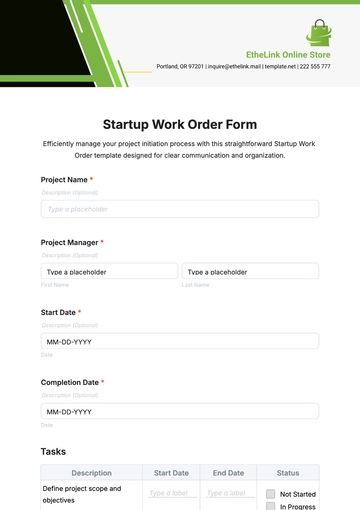

- Startup Form

- Startup Flyer

- Startup Checklist

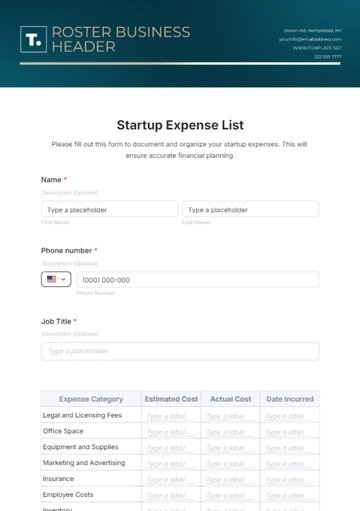

- Startup Budget

- Startup Poster

- Startup Contract

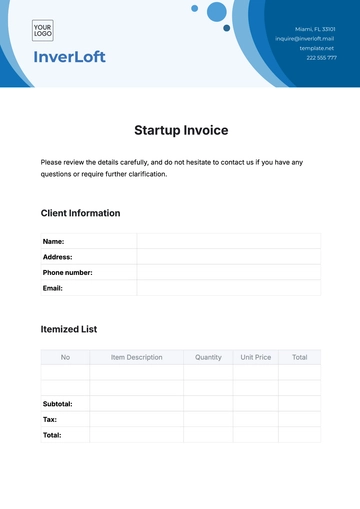

- Startup Invoice

- Startup Letterhead

- Startup Quotes