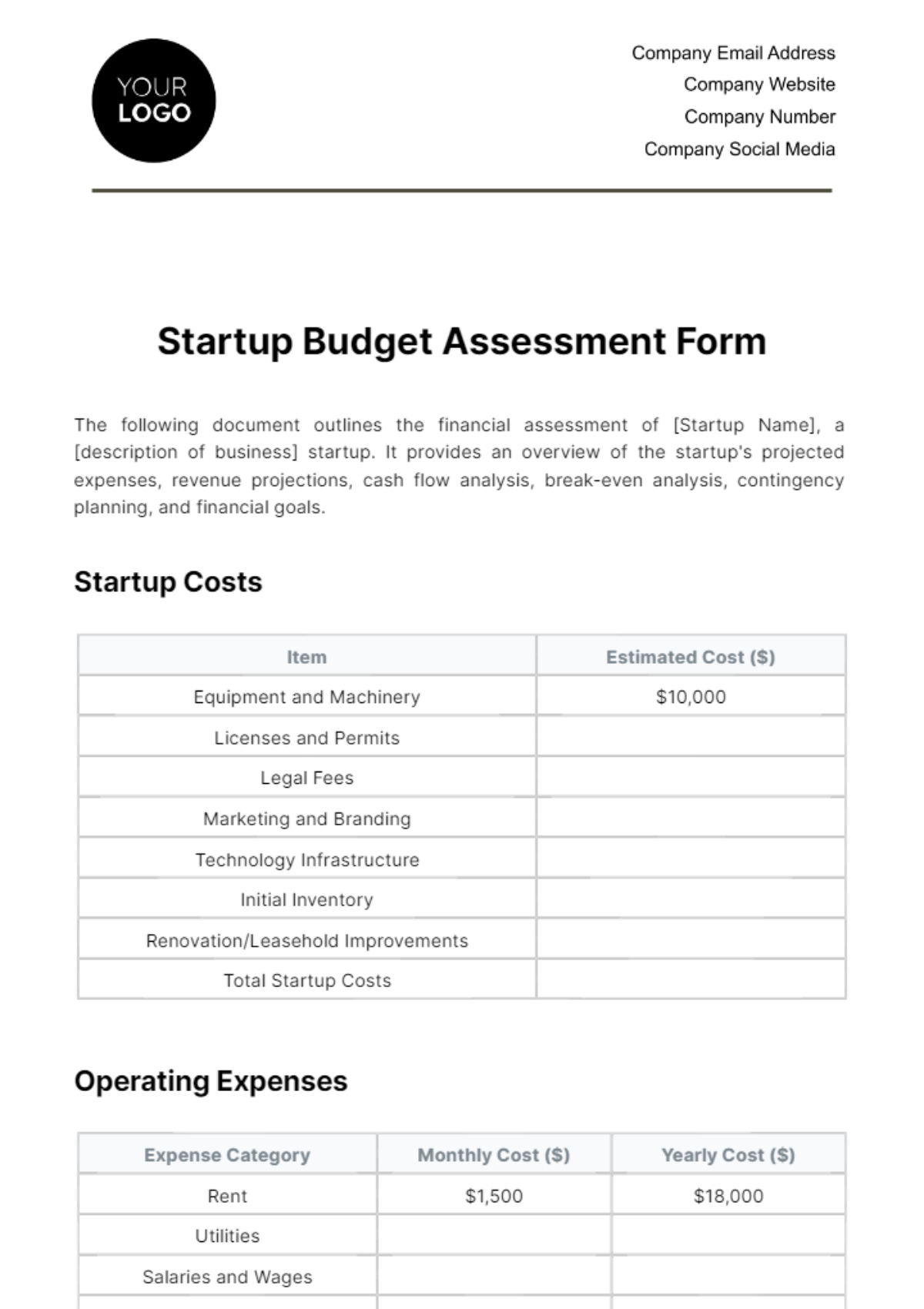

Free Startup Budget Assessment Form

The following document outlines the financial assessment of [Startup Name], a [description of business] startup. It provides an overview of the startup's projected expenses, revenue projections, cash flow analysis, break-even analysis, contingency planning, and financial goals.

Startup Costs

Item | Estimated Cost ($) |

|---|---|

Equipment and Machinery | $10,000 |

Licenses and Permits | |

Legal Fees | |

Marketing and Branding | |

Technology Infrastructure | |

Initial Inventory | |

Renovation/Leasehold Improvements | |

Total Startup Costs |

Operating Expenses

Expense Category | Monthly Cost ($) | Yearly Cost ($) |

|---|---|---|

Rent | $1,500 | $18,000 |

Utilities | ||

Salaries and Wages | ||

Employee Benefits | ||

Insurance | ||

Marketing | ||

Maintenance | ||

Professional Services | ||

Total Operating Expenses |

Revenue Projections

The revenue projections for [Startup Name] are as follows:

Month | Projected Revenue ($) |

|---|---|

[Month 1] | $5,000 |

Cash Flow Analysis

The cash flow analysis for [Startup Name] is crucial for understanding the inflows and outflows of cash over time. Below is a summary of the projected cash flow for the first year of operations:

Month | Cash Inflows ($) | Cash Outflows ($) | Net Cash Flow ($) |

|---|---|---|---|

[Month 1] | $10,000 | $8,000 | $2,000 |

Break-Even Analysis

Based on the provided revenue and cost data, the break-even analysis indicates that [Startup Name] will achieve break-even in the [insert timeframe] by generating a total revenue of [insert break-even revenue]. The detailed break-even analysis is as follows:

Total Fixed Costs: $[0]

Variable Costs per Unit: $[0]

Average Selling Price per Unit: $[0]

Break-Even Point (in units) = Total Fixed Costs / (Average Selling Price per Unit - Variable Costs per Unit)

Break-Even Point = $[0] / ($[0] - $[0]) = [0] units

At a production and sales level of [0] units, [Your Company Name] will break even.

Contingency Planning

A contingency reserve of $[0] has been allocated to cover unforeseen expenses and mitigate risks. This reserve will provide a buffer for unexpected costs such as equipment breakdowns, supply chain disruptions, or changes in market conditions.

Financial Goals and Milestones

The financial goals and milestones for [Startup Name] are aligned with its strategic objectives and growth trajectory. These goals include:

Achieving profitability within the first 18 months of operations.

Securing $[0] in funding from investors within the next [0] months to support expansion plans.

Reaching $[0] million in annual sales revenue by the end of Year 2.

These goals will be tracked and monitored regularly to ensure that [Startup Name] stays on course towards its financial targets.

Assumptions and Notes

The financial projections are based on the following key assumptions:

Market growth rate of [0]% annually.

Stable pricing and cost structures throughout the projection period.

No significant changes in regulatory or economic conditions affecting the industry.

Timely receipt of funding as planned.

Effective execution of marketing and sales strategies to drive revenue growth.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover financial clarity with the Startup Budget Assessment Form Template from Template.net. This editable and customizable tool, powered by an intuitive AI editor, empowers entrepreneurs to effortlessly assess startup budgets. Seamlessly plan costs, project revenues, and set milestones. Gain control of your financial journey with this essential resource for startup success.