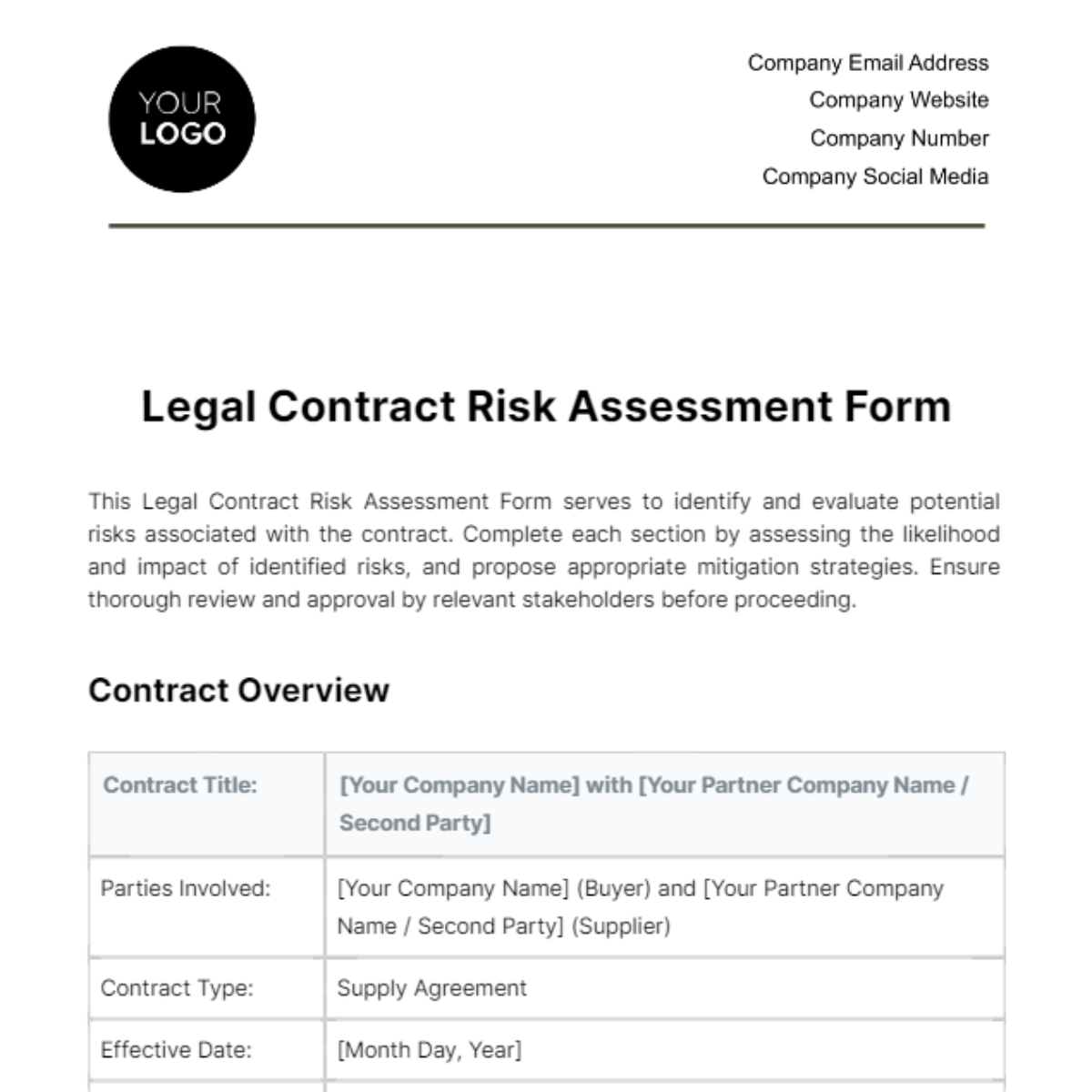

Free Legal Contract Risk Assessment Form

This Legal Contract Risk Assessment Form serves to identify and evaluate potential risks associated with the contract. Complete each section by assessing the likelihood and impact of identified risks, and propose appropriate mitigation strategies. Ensure thorough review and approval by relevant stakeholders before proceeding.

Contract Overview

Contract Title: | [Your Company Name] with [Your Partner Company Name / Second Party] |

|---|---|

Parties Involved: | [Your Company Name] (Buyer) and [Your Partner Company Name / Second Party] (Supplier) |

Contract Type: | Supply Agreement |

Effective Date: | [Month Day, Year] |

Duration: | [0] years |

Risk Identification

In this section, identify various types of risks associated with the contract, including legal, financial, operational, and reputational risks. Provide specific details for each risk to enable accurate assessment and effective mitigation strategies.

Legal Risks |

|

Financial Risks | |

Operational Risks | |

Reputational Risks |

Risk Assessment

Here, assess the likelihood and potential impact of identified risks. Use a structured approach to assign risk levels based on their probability and severity. Ensure thorough evaluation to prioritize mitigation efforts and inform decision-making regarding the contract.

Risk | Likelihood | Impact |

|---|---|---|

Non-compliance with delivery schedules | Medium | High |

Breach of confidentiality clauses | ||

Dispute resolution procedures | ||

Price fluctuations in raw material costs | ||

Currency exchange rate fluctuations | ||

Non-payment or late payment by the buyer | ||

Supplier's inability to meet demand due to capacity issues | ||

Quality control issues in production process | ||

Transportation delays | ||

Product recalls due to quality issues | ||

Negative publicity regarding environmental practices | ||

Supplier involvement in unethical business practices |

Mitigation Strategies

In this section, outline specific actions to reduce or manage the identified risks effectively. For legal risks, consider incorporating indemnification clauses, ensuring compliance with relevant laws and regulations, and establishing clear dispute resolution mechanisms. Financial risks can be mitigated by establishing robust financial controls, securing appropriate insurance coverage, and negotiating favorable payment terms. Operational risks may require the implementation of contingency plans, regular monitoring of performance metrics, and diversification of suppliers to minimize dependencies. Reputational risks can be managed through proactive stakeholder engagement, transparent communication strategies, and swift resolution of any issues that may arise. Continuously review and update mitigation strategies to adapt to changing circumstances and emerging risks throughout the contract lifecycle.

Risk Owner

Assign responsibility for managing each identified risk to specific individuals or departments within the organization. Clearly define the roles and responsibilities of each risk owner, including monitoring for early warning signs, implementing mitigation measures, and escalating issues as necessary. Encourage collaboration between risk owners and relevant stakeholders to ensure a coordinated approach to risk management. Provide adequate resources and support to enable risk owners to fulfill their duties effectively. Regularly review risk ownership assignments to ensure alignment with organizational objectives and capabilities. Foster a culture of accountability and transparency to promote effective risk management practices across the organization.

Review and Approval

Prepared By: Legal Department

Reviewed By: Supply Chain Manager, Finance Department, Procurement Manager

Approved By: Chief Legal Officer, Chief Financial Officer

Date: [Month Day, Year]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover peace of mind with the Legal Contract Risk Assessment Form Template from Template.net. Our editable and customizable template streamlines risk evaluation processes, empowering you to identify, assess, and mitigate potential legal, financial, operational, and reputational risks efficiently. With our intuitive AI Editor Tool, crafting comprehensive risk assessments has never been easier.

You may also like

- Rental Contract

- Contractor Contract

- Contract Agreement

- One Page Contract

- School Contract

- Social Media Contract

- Service Contract

- Business Contract

- Restaurant Contract

- Marketing Contract

- Real Estate Contract

- IT Contract

- Cleaning Contract

- Property Contract

- Supplier Contract

- Partnership Contract

- Food Business Contract

- Construction Contract

- Employment Contract

- Investment Contract

- Project Contract

- Payment Contract

- Student Contract

- Travel Agency Contract

- Startup Contract

- Annual Maintenance Contract

- Employee Contract

- Gym Contract

- Event Planning Contract

- Personal Contract

- Nursing Home Contract

- Law Firm Contract

- Work from Home Contract

- Software Development Contract

- Maintenance Contract

- Music Contract

- Amendment Contract

- Band Contract

- DJ Contract

- University Contract

- Salon Contract

- Renovation Contract

- Photography Contract

- Lawn Care Contract