Free Sales Lead Financial Analysis

I. Introduction

Welcome to the Sales Lead Financial Analysis prepared by [Your Company Name]. In today's dynamic business landscape, making informed decisions about pursuing sales opportunities is crucial. This analysis empowers marketing professionals like you to evaluate the financial potential of leads and align your strategies effectively.

In this document, we will dive into the financial aspects of a specific sales lead, providing insights into revenue projections, cost analysis, risk assessment, and ROI calculations. By the end, you'll be equipped to make data-driven recommendations that align with US sales legal and standard guidelines.

Let's begin the journey of maximizing your sales potential.

II. Lead Description

Welcome to the Sales Lead Financial Analysis prepared by [Your Company Name]. In today's dynamic business landscape, making informed decisions about pursuing sales opportunities is crucial. This analysis empowers marketing professionals like you to evaluate the financial potential of leads and align your strategies effectively.

In this document, we will dive into the financial aspects of a specific sales lead, providing insights into revenue projections, cost analysis, risk assessment, and ROI calculations. By the end, you'll be equipped to make data-driven recommendations that align with US sales legal and standard guidelines.

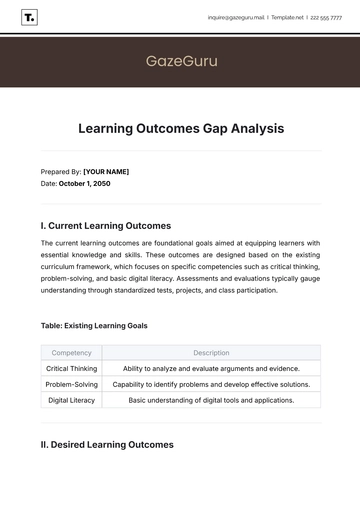

III. Market Analysis

Understanding the current market landscape is essential when evaluating the potential of a sales lead. In this section, we will provide a comprehensive analysis of the market conditions relevant to the opportunity at hand.

Market Overview | The healthcare technology sector has been experiencing robust growth in recent years, driven by advancements in digital health solutions and an increasing emphasis on telemedicine. It is a $200 billion market with a diverse range of players, from established giants to innovative startups. |

Competitive Landscape | Key competitors in this market include industry leaders such as MedTech Solutions, HealthConnect Innovations, and up-and-coming disruptors like HealthTech Innovate. MedTech Solutions dominates with a 30% market share, but our innovative approach sets us apart with a unique patient-centric platform. |

Customer Demand | The market research we conducted indicates a growing need for secure and user-friendly telehealth platforms, particularly among healthcare providers and patients in underserved areas. Our solution addresses these needs by offering seamless virtual healthcare experiences. |

Regulatory Environment | We have conducted a thorough analysis of US sales legal guidelines applicable to healthcare technology solutions. Our platform complies with the Health Insurance Portability and Accountability Act (HIPAA) and other relevant regulations to ensure data privacy and security. |

Market Growth | Based on historical data and forecasts from industry analysts, the healthcare technology sector is projected to grow at an annual rate of 12% over the next five years, driven by the increasing adoption of telemedicine and digital health solutions. |

IV. Financial Projections

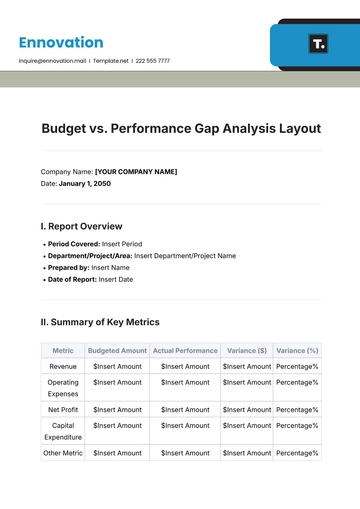

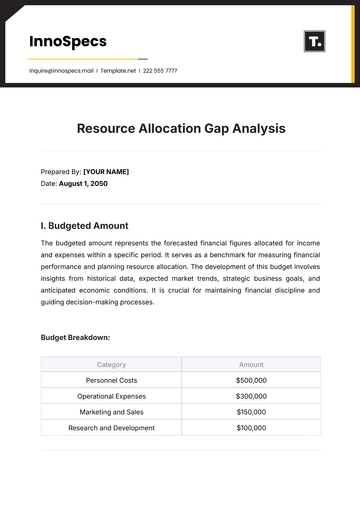

In the following section, we present a visual representation of our financial projections for the sales lead opportunity, beginning in 2053 and extending to 2058. This line chart illustrates the anticipated revenue growth over this six-year period, providing a clear snapshot of the opportunity's financial potential. Alongside this chart, we will detail the cost analysis and profit margin analysis to offer a comprehensive view of the opportunity's financial outlook. These projections are grounded in our market analysis and historical data, empowering marketing professionals to make data-driven decisions.

V. Cost Analysis

In this section, we outline the anticipated costs associated with pursuing the sales lead. A clear understanding of these expenses is essential for effective financial planning. The table below provides a simple breakdown of costs, including production expenses, marketing investments, salaries for the sales team, and miscellaneous outlays. These estimates offer valuable insights into the financial aspects of this opportunity, ensuring comprehensive decision-making.

Let's delve into the specifics of our cost analysis.

Cost Category | Estimated Cost (in thousands) |

Production Costs | $350 |

Marketing Expenses | $150 |

Sales Team Salaries | $200 |

Miscellaneous Expenses | $50 |

Total Estimated Costs | $750 |

VI. Revenue Estimation

In this section, we delve into the strategies and projections for generating revenue from the sales lead. Our approach is centered on a comprehensive understanding of pricing strategies, sales volume projections, and potential upsell and cross-sell opportunities.

Pricing Strategy

We will adopt a competitive pricing strategy that positions us favorably in the market. Our pricing model is designed to align with customer expectations and the value proposition offered by our product/service.

Sales Volume Projections

Based on our market analysis and historical data, we anticipate steady sales volume growth. Projections indicate year-over-year growth over the next six years, as illustrated in the chart below:

Upsell and Cross-Sell Opportunities

To maximize revenue, we have identified potential upsell and cross-sell opportunities. For instance, our comprehensive healthcare technology platform allows us to offer add-on services such as telemedicine consultations and data analytics tools. These strategies will not only enhance customer satisfaction but also boost the overall revenue stream.

By combining these elements, we aim to capitalize on the sales lead's potential and optimize revenue generation. The following sections will provide a deeper dive into the financial aspects to support your decision-making process.

VII. Risk Assessment

In this section, we identify potential risks and uncertainties that could impact the financial outcome of pursuing this sales lead.

Risk Category | Potential Risks | Mitigation Strategies |

Market and Industry Risks | Market saturation or declining demand | Diversify product offerings |

Regulatory changes | Stay informed about industry regulations | |

New competitors | Enhance marketing strategies | |

Economic downturn | Maintain a resilient financial position | |

Technological obsolescence | Invest in R&D for product innovation | |

Customer and Sales Risks | Customer churn | Improve customer support and engagement |

Lengthy sales cycles | Implement lead nurturing programs | |

Pricing pressure | Continuously monitor market pricing trends | |

Operational and Production Risks | Supply chain disruptions | Diversify suppliers and maintain safety stock |

Production delays | Implement efficient production processes | |

Quality control issues | Rigorous quality control checks and protocols |

Addressing these risks through proactive mitigation strategies is essential to minimize potential negative impacts on the financial outcome of pursuing this sales lead. This risk assessment serves as a vital component of our decision-making process, aligning with our commitment to prudent and informed business practices.

VIII. Investment Requirements

In this section, we outline the upfront investment required to pursue the sales lead opportunity. The following table provides a breakdown of the investment categories and their corresponding amounts:

Investment Category | Estimated Investment (in thousands) |

Capital Expenditures | $300 |

Marketing Expenses | $200 |

Working Capital | $250 |

Total Investment Required | $750 |

Capital Expenditures: These include investments in equipment, technology, or infrastructure necessary to support the sales lead's execution.

Marketing Expenses: This budget covers promotional activities, advertising, and other marketing initiatives tailored to capture the target market effectively.

Working Capital: Working capital is essential to fund day-to-day operations, including inventory procurement, payroll, and other short-term expenses.

The total upfront investment of $750,000 is critical to initiate and sustain the pursuit of this sales lead. Ensuring that these funds are readily available will be vital for a successful endeavor.

IX. Return on Investment (ROI) Analysis

In this section, we identify potential risks and uncertainties associated with pursuing this sales lead and provide straightforward mitigation strategies:

Risk Category | Potential Risks | Mitigation Strategies |

Market Risks | Market saturation or declining demand | Diversify product offerings |

Regulatory changes | Stay informed about industry regulations | |

Competition Risks | New competitors | Enhance marketing strategies |

Economic downturn | Maintain financial resilience | |

Customer Risks | Customer churn | Improve customer support and engagement |

Lengthy sales cycles | Implement lead nurturing programs | |

Operational Risks | Supply chain disruptions | Diversify suppliers and maintain safety stock |

Production delays | Implement efficient production processes | |

Financial Risks | Cash flow challenges | Maintain adequate working capital |

Fluctuating exchange rates | Hedging strategies for currency risk management |

X. Recommendation

Based on the comprehensive analysis presented in this Sales Lead Financial Analysis, it is recommended to pursue the identified sales lead opportunity. While acknowledging potential risks and challenges, the overall outlook appears promising, supported by robust market growth, competitive pricing strategies, and sound revenue projections.

The investment requirement of $750,000 is justifiable in light of the anticipated returns. The strategies outlined for mitigating risks, including market dynamics and operational challenges, are proactive and align with industry best practices.

Moreover, the identified upsell and cross-sell opportunities present avenues for maximizing revenue potential, while our commitment to compliance with US sales legal guidelines ensures regulatory alignment.

In conclusion, pursuing this sales lead is recommended, with diligent execution and ongoing evaluation being critical to realizing the full potential of this opportunity.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Maximize sales potential with Template.net's Sales Lead Financial Analysis Template. This editable and customizable tool enables thorough evaluation of lead profitability and financial viability. Tailor parameters effortlessly using our Ai Editor Tool to align with your business goals. Enhance decision-making and drive revenue growth with precision and ease.