Free Real Estate Single Family Rental Pro-Forma

I. Property Information

Located at [Property Address], this single-family home boasts three bedrooms, two bathrooms, and a comfortable living space spanning 1,500 square feet. Built in 1995 on a quarter-acre lot, the property offers modern amenities and ample outdoor space. Its convenient location provides easy access to schools, parks, shopping centers, and major transportation routes, making it an attractive rental option for families and commuters alike. With a well-maintained exterior and interior, the property presents an inviting atmosphere for potential tenants seeking a cozy place to call home.

II. Market Analysis

The rental market in [State / Province], demonstrates a consistent demand for single-family homes, with rental rates averaging $[00] per month for similar properties in the area. Market trends indicate stable occupancy rates and steady rental growth, suggesting a favorable environment for property investment. With its desirable location and competitive rental pricing, [Property Address] is poised to attract quality tenants seeking long-term housing solutions. Moreover, the property's proximity to amenities and schools enhances its appeal, positioning it as a desirable rental option in the local market.

III. Income Projections

The property located at the specified address is forecasted to produce a monthly rental income amounting to $[00]. This will contribute to an annual yield equivalent to $[00] in rental income. Taking into account an assumed occupancy rate of [00]%, it is anticipated that this property will see a consistent cash flow for the entire year. At present, no additional income sources are expected to contribute towards the revenue generated by this property. That being said, the principal revenue stream for this investment prospect does indeed come from the robust and stable rental income that the property has the potential to generate.

IV. Operating Expenses

The yearly operating expenses for the property located at [Property Address] encompass several different costs. The first of these is the property taxes which amount to a total of $[00] on an annual basis. The expenses also include insurance premiums that total $[00] per year. Moreover, there are also property management fees that are set at a rate of [00]% of the rental income. Beyond these fixed costs, there is also a sum of $[00] that is set aside specifically for the purpose of addressing both maintenance and repair costs. This provision covers both the routine upkeep of the property and any unforeseen issues that may arise requiring maintenance. Another aspect of the operating costs is the cost of utilities. These utilities include the cost of water, sewer, trash disposal, electricity, and gas. The estimated cost for these utilities is figured to be around $[00] per month. This estimation ensures the ongoing operational needs of the property are met satisfactorily.

V. Capital Expenditures (CapEx)

In the face of anticipated capital expenditures, specific arrangements have been established to ensure the fundamental upkeep and enhancement of the property. The allocation of a budget of $[00] has been carried out to cater to the replacement of the roof, a procedure that is anticipated to become necessary roughly every decade and a half. Additionally, an amount of $[00] has been specifically reserved to cater to the improvements needed for the HVAC system, an upgrade which is predicted to be necessary approximately every decade. These measures, which have been instigated in a prescient manner, ensure that the property is perpetually maintained in excellent condition while also remaining appealing to prospective and current tenants. This is integral in securing its enduring worth while also preserving the potential it has to generate rental income over the long-term.

VI. Financing Costs

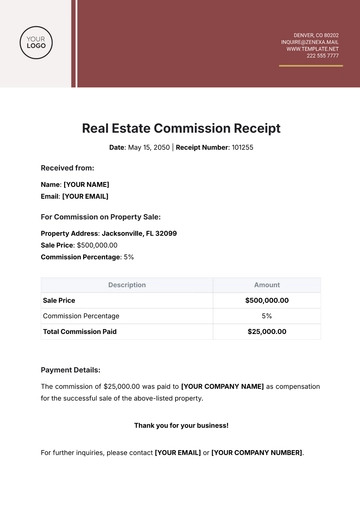

In order to secure the necessary financing for the investment, we have arranged for a mortgage loan of a specific amount, denoted as $[00]. This mortgage loan has been set up with a fixed interest rate of [00]%, extending over the span of a 30-year term. By having this setup, it results in monthly mortgage payments that amount to $[00], which is inclusive of both the principal and interest. Moreover, the financing costs do not end there as there are several additional components that contribute to the total sum. One of which includes closing costs, an expense which will amount to $[00]. Following that, there's also appraisal fees that come to a total of $[00]. Lastly, we can't forget about the loan origination fees. They are calculated at [00]% of the entire loan amount.

Putting all of the pieces together, it guarantees transparent and comprehensive financing arrangements that are dedicated towards the property acquisition.

VII. Cash Flow Analysis

Despite the costs associated with operations and financing that come with the property at [Property Address], calculations suggest that, on a monthly basis, the property is likely to yield a net cash flow of $[00]. When looked at in terms of the entire year, this translates to a cash flow deficit of $[00]. While this position of negative cash flow might seem financially unattractive at first glance, it is important to consider the other sources of investment value that the property presents. Specifically, the property's considerable potential for long-term appreciation and the accumulation of equity offer substantial offsets to the initial cash flow deficit.

Over time, these aspects are anticipated to contribute meaningfully to the property's overall investment value. Furthermore, the net operating income (NOI) attributable to the property is another key financial metric to consider. The NOI of $[00] signifies the property's ability to generate a positive income stream even after account has been taken of all associated operating expenses. This attests to the property's inherent income-generating ability. Therefore, initial cash flow challenges faced do not necessarily represent the long-term potential and overall value that this investment property brings.

VIII. Return Metrics

Despite the possibility of the initial cash flow turning out to be negative, the potential residential or commercial yield from an investment in the property located at [Property Address] exhibits positive signs in terms of future return on investment prospects. The potential returns calculated through certain key real estate investment parameters seem to indicate a future profitability. The estimated capitalization rate, which is a crucial indicator of the potential return on the initial investment, stands at an encouraging [00]%. This is calculated by dividing the annual net operating income by the property's current market value. Similarly, the internal rate of return, a common metric used to estimate the profitability of potential investments, is projected at [00]%. The internal rate of return allows for a calculation of the expected growth rate that the investment in [Property Address] will yield over the course of its investment horizon. Although the estimated return on investment, a measure of a property’s profitability, is currently observed at a less encouraging negative figure of [00]%, it is important to consider that these figures could shift positively in the long run. Given the current market trends, there is a high potential for future growth in rental rates, which could potentially increase the annual net income from the property. The prospect of property value appreciation in the future could also significantly contribute to enhancing the overall profitability of the investment in [Property Address]. This aligns well with a prudent investment strategy, seeking modest but consistent returns, over the attempt to realized exaggerated profits in a potentially unstable market context. Therefore, albeit a seemingly precarious proposition initially due to the negative return on investment, the investment in [Property Address] offers to be a smart move, considering the long-term utility and potential profitability.

IX. Sensitivity Analysis

When a sensitivity analysis is carried out, it becomes evident that the property has a robust resilience to alterations in vital assumptions. If the rental rates went through an increase or decrease by [00], it would initiate parallel modifications to the projections of cash flow. Such changes would clearly show the property's capacity to navigate the often unpredictable ebb and flow of the market. Further demonstrating the property's resilience, it is worth noting that changes specifically related to operating expenses or vacancy rates might have an impact on cash flow. Though these variations may cause some degree of fluctuation, they are unlikely to considerably interfere with the property's comprehensive investment viability.

This fact accentuates the property's solidity as a viable investment and emphasizes its potential for maintaining steady performance in the long term. Thereby, the enduring stability of the property is underscored, along with its considerable potential for continued strong performance as an investment.

X. Investment Summary

To conclude, the property located at the [Property Address], notwithstanding possible initial hindrances concerning cash flow, presents a potentially lucrative avenue to invest in. The strengths that give this property such a compelling appeal as an investment are its advantageous location, competitive pricing structure in regards to rent, and potential for value appreciation over a long period. It thereby provides a secure base for any investor looking to accumulate wealth through the investment in properties. It's important to note that the immediate returns may appear modest on the surface, but this is a long-term investment with substantial benefits.

The property possesses strong return metrics, displaying a high degree of resilience to fluctuations in the market. This makes it a particularly desirable prospect for inclusion in an investment portfolio. Investors who prioritise stable, consistently growing income and capital growth over a longer term would find this property to be an invaluable addition to their portfolios.

XI. Assumptions and Disclaimers

The projections that have been outlined in the document known as this Pro-Forma are fundamentally based on presently prevailing market conditions as well as assumptions. These circumstances and assumed factors could potentially shift and transform over a period of time. The possibility exists that the actual performance levels might deviate and differ from the projections that have been put forth. These variances may stem from factors that exist outside the sphere of control of the investor or even the property manager.

Therefore, it becomes essential and critical to exercise due diligence. It is also advisable to seek the expertise of professionals before you proceed to make any major investment decisions. The presentation of this Pro-Forma is done merely for the purpose of providing information and should not be misunderstood or misconstrued as being financial advice. Furthermore, it should also not be interpreted as being a guarantee of any sort with regard to the performance of the investments.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Real Estate Single Family Rental Pro-Forma Template from Template.net. This editable and customizable tool empowers investors to tailor financial projections effortlessly. With the intuitive AI Editor Tool, analyzing and adjusting forecasts becomes seamless. Stay agile in the market and make informed decisions with this versatile template, designed for maximizing returns in single-family rental investments.