Free Real Estate Development Financial Analysis

Executive Summary

This detailed financial analysis report serves as a crucial tool for understanding the fiscal health and performance trends of [Your Company Name] Real Estate Development. Through the examination of comprehensive financial statements and the assessment of relevant economic indicators, the report facilitates strategic, data-driven decisions for stakeholders. The real estate sector is known for its complexity, marked by its unique challenges and inherent volatility. In this light, a nuanced comprehension of [Your Company Name]'s financial maneuvers within such a fluctuating landscape is imperative. Our analysis delves into various financial metrics, uncovering trends and insights that paint a holistic picture of the company's fiscal stability and growth prospects. By juxtaposing historical data with current financial realities, we aim to equip investors, management, and other key stakeholders with the intelligence necessary to make informed decisions, optimize operational strategies, and ultimately, enhance shareholder value in a competitive market environment.

Company Overview

Since its inception in 2045, [Your Company Name] Real Estate Development has cemented its status as a frontrunner in the realm of real estate, with a diversified portfolio that spans high-end commercial and residential projects. Focused primarily on urban metropolises, the company has been instrumental in shaping city skylines, delivering projects that not only exceed in aesthetic and functional quality but also in environmental sustainability and community value. Our strategic approach to development, characterized by meticulous planning, innovative design, and adherence to the highest standards of construction, has enabled us to navigate market fluctuations successfully. With a robust foundation and a forward-looking vision, [Your Company Name] is dedicated to continuing its legacy of excellence, driving urban development forward, and creating spaces that enhance the quality of life for communities and businesses alike.

Financial Performance Overview

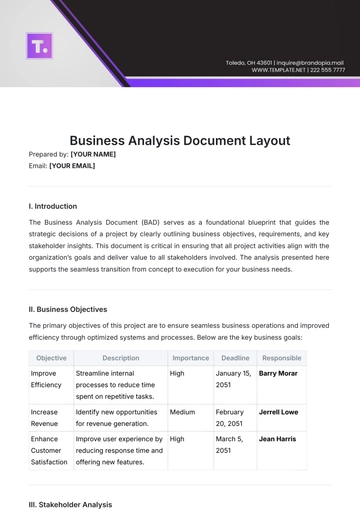

The financial trajectory of [Your Company Name] Real Estate Development from 2050 to 2054 underscores a pattern of consistent growth and strengthening profitability, reflective of strategic foresight and adept market navigation. The summarized financial data elucidates the company's robust revenue generation capabilities and its operational efficiency:

Year | Revenue ($M) | Cost of Goods Sold ($M) | Gross Profit Margin (%) | Net Profit Margin (%) |

|---|---|---|---|---|

2050 | 150 | 100 | 33 | 20 |

2051 | 170 | 115 | 32 | 23 |

2052 | 200 | 130 | 35 | 27 |

2053 | 220 | 150 | 32 | 26 |

2054 | 240 | 160 | 33 | 27 |

Revenue Growth: The progressive increase in revenue from $150 million in 2050 to $240 million in 2054 signifies not only the expanding scale of our projects but also our growing market share in the competitive real estate landscape. This revenue growth is attributed to strategic diversification, innovative project designs, and an unwavering focus on customer satisfaction and value creation.

Cost Management: The Cost of Goods Sold (COGS) has been meticulously managed, showcasing an operational strategy that emphasizes cost efficiency without compromising on the quality of development. The increase in COGS is proportional to our expanded project scope and the inflationary pressures on construction materials, yet our gross profit margins have remained robust, reflecting effective cost control measures and pricing strategies.

Profit Margins: The gross profit margin has consistently hovered around the 32-35% mark, while the net profit margin has seen an appreciable increase from 20% in 2050 to 27% in 2054. These margins are indicative of our operational excellence, successful risk management strategies, and the high demand for our real estate developments. Our ability to maintain healthy profit margins amidst fluctuating economic conditions and varying project costs is a testament to our strategic planning, market adaptability, and financial prudence.

This financial performance overview encapsulates [Your Company Name] Real Estate Development's fiscal resilience and upward growth trajectory. The consistent improvement in net profit margins, coupled with steady revenue growth, paints a promising picture of the company's financial stewardship and strategic market positioning. It underscores our commitment to not only sustaining growth but also enhancing shareholder value through meticulous financial management and strategic market engagement.

Key Financial Ratio Analysis

A comprehensive examination of [Your Company Name] Real Estate Development's financial health is encapsulated through the analysis of various critical financial ratios. These ratios are instrumental in evaluating the company's operational efficiency, financial resilience, and profitability.

Liquidity Ratios

Ratio | 2050 | 2051 | 2052 | 2053 | 2054 |

|---|---|---|---|---|---|

Current Ratio | 1.5 | 1.6 | 1.8 | 1.7 | 1.9 |

Quick Ratio | 1.2 | 1.3 | 1.5 | 1.4 | 1.6 |

These ratios highlight [Your Company Name]'s ability to cover its short-term liabilities with its short-term assets, indicating strong financial resilience and operational efficiency. The upward trend in both current and quick ratios suggests an improving liquidity position, enabling the company to meet its short-term obligations comfortably and seize growth opportunities as they arise.

Solvency Ratios

Ratio | 2050 | 2051 | 2052 | 2053 | 2054 |

|---|---|---|---|---|---|

Debt to Equity Ratio | 0.8 | 0.7 | 0.6 | 0.5 | 0.4 |

Interest Coverage Ratio | 4.0 | 4.5 | 5.0 | 5.5 | 6.0 |

These figures demonstrate the company's strong capacity to meet its long-term obligations, highlighting a healthy balance between debt and equity and an excellent ability to cover interest expenses. The decreasing debt to equity ratio across the years reflects a strategic reduction in debt reliance, enhancing financial stability and investor confidence.

Profitability Ratios

Ratio | 2050 | 2051 | 2052 | 2053 | 2054 |

|---|---|---|---|---|---|

Return on Assets (ROA) | 6% | 7% | 8% | 9% | 10% |

Return on Equity (ROE) | 10% | 12% | 14% | 16% | 18% |

Gross Margin Percentage | 33% | 32% | 35% | 32% | 33% |

The profitability ratios reveal [Your Company Name]'s ability to generate profit relative to its revenue, assets, and equity. The gradual increase in ROA and ROE underscores the company's growing efficiency in utilizing its assets and equity to generate earnings, while the consistent gross margin percentage indicates stable profitability despite market fluctuations.

Operational Highlights

[Your Company Name] Real Estate Development has achieved several milestones that significantly bolstered its financial performance:

Strategic Land Acquisitions: The company successfully acquired strategic parcels of land in key urban areas, laying the groundwork for future high-value projects.

Project Launches and Completions: The period saw the launch and successful completion of multiple flagship projects, each contributing to revenue growth and brand prestige.

Innovative Development Practices: Adoption of sustainable building practices and innovative construction technologies, enhancing efficiency and reducing costs.

Market Analysis and Strategy

Our market analysis indicates that demographic trends, such as urbanization and an increasing preference for sustainable living spaces, coupled with economic factors like interest rate fluctuations and regulatory changes, significantly influence the real estate sector. [Your Company Name]'s strategy focuses on leveraging these insights through:

Diversification: Expanding into emerging markets and sectors to mitigate risks associated with market volatility.

Innovation: Continuously evolving project designs to meet changing consumer preferences and environmental standards.

Strategic Partnerships: Collaborating with local authorities and communities to ensure project success and compliance with regulatory standards.

Risk Management

[Your Company Name] employs a comprehensive risk management framework to address various challenges:

Market Volatility: Implementing flexible pricing strategies and diversifying project portfolio.

Regulatory Changes: Engaging with policymakers and industry groups to anticipate and adapt to regulatory changes.

Project-Specific Risks: Conducting thorough due diligence and leveraging advanced project management tools.

Sustainability and Corporate Social Responsibility (CSR)

Commitment to sustainability and CSR is at the core of [Your Company Name]'s operations:

Environmental Stewardship: Integrating green building practices and technologies to minimize environmental impact.

Community Engagement: Actively participating in community development and supporting local initiatives.

Ethical Practices: Upholding the highest standards of integrity and transparency in all business dealings.

Conclusion

The financial analysis robustly demonstrates [Your Company Name] Real Estate Development's consistent growth, profitability, and strategic resilience. With a comprehensive approach to liquidity, solvency, and profitability management, the company is well-positioned to navigate both imminent and long-term challenges. This analysis not only reaffirms the company’s strong financial health but also underscores its promising future, grounded in strategic foresight, operational excellence, and a commitment to sustainability and community.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Maximize your real estate development projects' financial viability with our Real Estate Development Financial Analysis Template, found exclusively on Template.net. This comprehensive tool, editable and customizable using our AI editor, empowers you to conduct thorough financial assessments. Tailor inputs to project specifics effortlessly. Gain invaluable insights, mitigate risks, and optimize profitability to drive success in your real estate ventures.