Free Law Firm Requirement Analysis

I. Introduction

In the rapidly evolving and highly competitive environment of the legal sector, understanding and meeting the demands of an efficient law firm operation has become of paramount importance. This document presents a comprehensive Law Firm Requirement Analysis which evaluates the fundamental areas of a law firm's operations. The main objective is to identify areas that need improvement and recommend strategies to enhance efficiency, streamline operations, and improve client service.

In today's legal landscape, law firms face increasing pressure to adapt to technological advancements, regulatory changes, and client expectations. By conducting a thorough analysis of key aspects such as practice areas, technology infrastructure, staffing, client management, compliance, finance, and risk management, this document aims to provide actionable insights for optimizing firm performance and maintaining a competitive edge in the legal market.

II. Methodology

To conduct this analysis, we employed the following methodology:

Practice Areas Evaluation: We assessed the firm's practice areas to understand the scope of legal services provided and identify areas of specialization.

Technology Infrastructure Review: An in-depth examination of the firm's technology tools and systems, including case management software, document management systems, and communication platforms.

Staffing and Human Resources Assessment: Analysis of staffing levels, skill sets, workload distribution, and training needs to optimize human resources within the firm.

Client Relationship Management (CRM) Analysis: Evaluation of client intake processes, communication strategies, and client satisfaction measurements to enhance client service and retention.

Compliance and Regulatory Compliance Review: Examination of legal and regulatory obligations, including data privacy laws, professional standards, and industry regulations, to ensure compliance.

Financial Analysis and Budgeting: Assessment of the firm's financial performance, budgeting processes, billing practices, and revenue streams to improve financial management and profitability.

Risk Management and Security Audit: Identification of potential risks and vulnerabilities related to data security, confidentiality, malpractice, and other legal liabilities to implement measures for risk mitigation and enhanced security.

III. Practice Areas Assessment

The firm operates in various practice areas, including corporate law, litigation, intellectual property, real estate, and family law. Each practice area is characterized by a distinct set of legal issues and client needs. By assessing the volume of cases, client demographics, and specialization level within each practice area, the firm gains insights into its core areas of expertise.

A. Client Needs Analysis

Understanding the diverse needs of the firm's client base is essential for delivering effective legal solutions. By analyzing the industries served by the firm and the specific legal challenges faced by clients, the firm can tailor its services to address client expectations effectively. This analysis enables the firm to provide targeted legal advice and representation that aligns with client objectives.

B. Market Trends and Opportunities

The legal landscape is constantly evolving, influenced by regulatory changes, industry developments, and shifting client demands. By monitoring current market trends and identifying emerging opportunities, the firm can stay ahead of the competition and capitalize on new business prospects. This analysis enables the firm to adapt its service offerings and strategic priorities to meet evolving client needs.

C. Competitor Analysis

Assessing the competitive landscape within each practice area provides valuable insights into the firm's position relative to key competitors. By examining competitor market share, service offerings, and client satisfaction levels, the firm can benchmark its performance and identify areas for differentiation. This analysis informs strategic decision-making and helps the firm identify opportunities to enhance its competitive advantage.

D. Strategic Priorities and Growth Strategies

Based on the findings of the practice areas assessment, the firm outlines strategic priorities and growth strategies for each practice area. This includes identifying areas of specialization, expanding service offerings, targeting new client segments, and leveraging technology to enhance efficiency and client service. By aligning strategic initiatives with market opportunities and client needs, the firm positions itself for sustainable growth and success in the legal marketplace.

IV. Technology Infrastructure Review

The Technology Infrastructure Review evaluates the firm's existing technological tools and systems, aiming to optimize efficiency, security, and client service.

A. Case Management Systems

Evaluation of Current System: This mini sub-section assesses the firm's current case management system, including its functionality, user interface, and integration with other software solutions.

User Feedback and Satisfaction: Gathering feedback from users regarding the strengths and weaknesses of the case management system provides valuable insights into user satisfaction and areas for improvement.

B. Document Management Systems

Review of Document Storage and Retrieval: Examining the firm's document management system to ensure efficient storage, organization, and retrieval of legal documents.

Security and Access Controls: Assessing the system's security protocols to protect sensitive client information and ensure compliance with data privacy regulations.

C. Communication Platforms

Evaluation of Email Systems: Reviewing the firm's email platform for reliability, security, and integration with other communication tools.

Assessment of Collaboration Tools: Examining collaboration tools such as video conferencing and messaging platforms to facilitate seamless communication among team members and with clients.

D. Legal Research Tools

Utilization of Legal Databases: Analyzing the firm's use of legal research databases to ensure access to comprehensive and up-to-date legal information.

Training and Support: Providing training and support resources to help staff effectively utilize legal research tools and maximize their value in legal practice.

E. Cybersecurity Measures

Vulnerability Assessment: Conducting regular vulnerability assessments and penetration testing to identify and address potential cybersecurity threats.

Employee Training on Cybersecurity Best Practices: Educating staff on cybersecurity best practices to mitigate the risk of data breaches and unauthorized access to sensitive information.

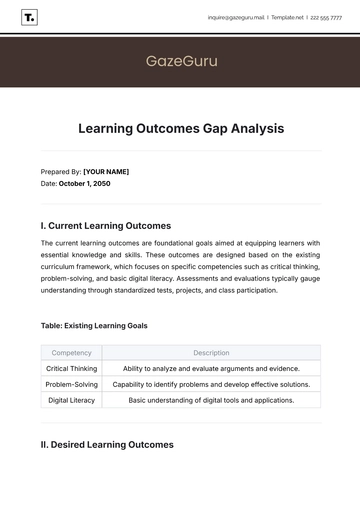

V. Staffing and Human Resources Needs

Ensuring an optimal staffing and human resources strategy is essential for the effective functioning of a law firm. This section assesses the firm's current staffing levels, skill sets, workload distribution, and training needs to optimize human resources within the organization. By aligning staffing decisions with business objectives and client demands, the firm can enhance productivity, employee satisfaction, and overall performance.

Aspect | Description | Action Plan |

|---|---|---|

Current Staffing Levels | Assess the number of attorneys, paralegals, administrative staff, and support personnel within the firm to determine if staffing levels are adequate. | Conduct a comprehensive review of current staffing levels in each department and practice area. Identify areas with potential understaffing or overstaffing. |

Skill Sets | Evaluate the skills and expertise of existing staff members to identify gaps and areas for training or professional development. | Administer skills assessment surveys and performance evaluations to identify skill gaps and training needs. Develop training programs to address identified gaps. |

Workload Distribution | Review workload distribution among staff members to ensure equitable distribution of tasks and prevent burnout. | Conduct workload assessments to analyze the distribution of tasks among staff members. Adjust workload allocation as necessary to promote a balanced workload. |

Training Needs | Identify training needs and opportunities for staff members to enhance their skills, knowledge, and capabilities in relevant practice areas or technologies. | Collaborate with department heads to identify training needs based on emerging trends and technological advancements. Develop a training calendar and allocate resources accordingly. |

Recruitment Strategy | Develop a recruitment strategy to attract top talent, including attorneys with specialized expertise and support staff with relevant skills and experience. | Conduct targeted recruitment efforts through online job postings, networking events, and referrals. Collaborate with recruiting agencies to identify and attract qualified candidates. |

VI. Client Relationship Management (CRM)

Effective client relationship management is paramount for law firms to maintain strong client connections, foster loyalty, and drive business growth. This section examines the firm's approach to managing client relationships and outlines strategies to enhance client satisfaction and retention.

A. Client Intake Process

The client intake process is the initial stage of establishing a relationship with a new client. This subsection evaluates the firm's procedures for onboarding new clients, including intake forms, conflict checks, and engagement agreements.

B. Communication Strategies

Clear and consistent communication is essential for building trust and ensuring client satisfaction. This subsection assesses the firm's communication channels, responsiveness to client inquiries, and frequency of updates throughout the legal process.

C. Client Feedback Mechanisms

Gathering feedback from clients provides valuable insights into their experiences and satisfaction levels. This subsection explores the firm's methods for soliciting client feedback, such as surveys, feedback forms, and post-engagement reviews.

D. Client Retention Initiatives

Retaining existing clients is often more cost-effective than acquiring new ones. This subsection discusses the firm's initiatives to enhance client retention, such as loyalty programs, personalized service offerings, and proactive relationship management.

E. Conflict Resolution Procedures

Despite best efforts, conflicts may arise during client engagements. This subsection examines the firm's procedures for addressing conflicts, resolving disputes, and maintaining professional relationships with clients.

VII. Compliance and Regulatory Requirements

Compliance with legal and regulatory requirements is crucial for maintaining the integrity and reputation of the law firm while ensuring the protection of client interests. This section outlines the firm's approach to adhering to applicable laws, regulations, and professional standards.

A. Data Privacy and Security

The firm prioritizes the protection of client information and compliance with data privacy regulations, including:

Data Protection Measures: Implementation of robust data protection measures such as encryption, access controls, and regular security audits to safeguard sensitive client data.

Compliance with Data Privacy Laws: Adherence to data privacy laws such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) to protect client confidentiality and privacy rights.

B. Professional Standards and Ethics

The firm upholds high ethical standards and compliance with professional regulations, including:

Bar Association Rules: Adherence to rules and guidelines set forth by relevant bar associations, ensuring ethical conduct and professional responsibility in legal practice.

Conflicts of Interest Policies: Establishment of comprehensive policies and procedures for identifying and managing conflicts of interest to maintain client trust and confidentiality.

C. Anti-Money Laundering (AML) Compliance

The firm is committed to preventing money laundering and terrorist financing activities through:

Know Your Customer (KYC) Procedures: Implementation of robust KYC procedures to verify client identities and detect suspicious activities in compliance with AML regulations.

Transaction Monitoring: Ongoing monitoring of client transactions and reporting of suspicious activities to regulatory authorities as required by AML laws.

D. Regulatory Reporting and Compliance

The firm ensures adherence to regulatory requirements by:

Timely Reporting: Fulfillment of reporting obligations to regulatory authorities, including filing required documents and disclosures accurately and punctually.

Regulatory Audits and Reviews: Cooperation with regulatory audits and reviews to demonstrate compliance with applicable laws and regulations and address any identified issues promptly.

VIII. Financial Analysis and Budgeting

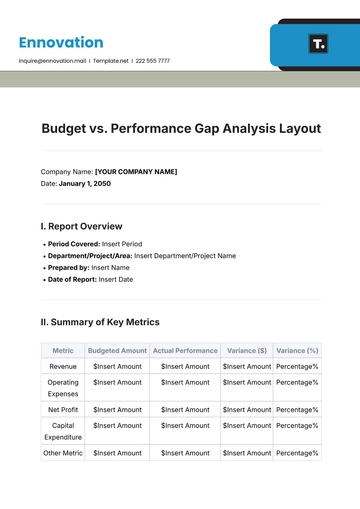

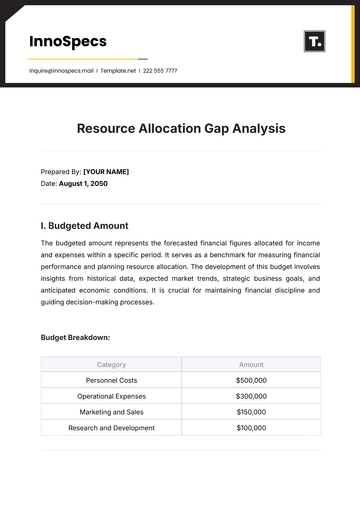

Sound financial management is essential for the sustainable growth and success of a law firm. This section evaluates the firm's financial performance, budgeting processes, revenue streams, and expenditure to ensure prudent financial decision-making and long-term viability.

Aspect | Description | Action Plan |

|---|---|---|

Financial Performance | The firm's financial performance is evaluated through a comprehensive analysis of key metrics such as revenue, profitability, and cash flow. This includes reviewing financial statements, profit and loss statements, and cash flow statements. | Conduct a thorough review of financial statements and key performance indicators. Identify trends, strengths, and weaknesses in financial performance. Develop strategies to address areas of concern and capitalize on strengths. |

Budgeting Processes | The firm's budgeting processes are assessed to ensure alignment with strategic objectives and effective cost management. This involves reviewing current budgeting practices, involving key stakeholders in the budgeting process, and setting clear budget targets. | Review existing budgeting practices and policies. Involve key stakeholders in the budgeting process to ensure buy-in and alignment with strategic goals. Set clear budget targets based on historical performance, market trends, and growth objectives. |

Revenue Streams | The firm's revenue streams are analyzed to identify opportunities for diversification and maximization of profitability. This includes assessing billable hours, retainer agreements, and alternative fee arrangements. | Identify opportunities to diversify revenue streams by expanding service offerings, targeting new client segments, and exploring alternative billing arrangements such as fixed fees or subscription-based models. |

Expenditure Management | Expenditure patterns and control mechanisms are reviewed to optimize resource allocation and reduce unnecessary costs. This may involve renegotiating contracts with vendors, optimizing staffing levels, and investing in technology solutions. | Implement cost-saving measures such as renegotiating contracts with vendors to secure better terms, optimizing staffing levels to match workload demands, and investing in technology solutions to automate repetitive tasks and streamline processes. |

Financial Reporting | Timely and accurate financial reporting is crucial for maintaining transparency and accountability to stakeholders. This includes developing standardized financial reporting formats and schedules, establishing clear procedures, and utilizing accounting software. | Develop standardized financial reporting formats and schedules. Establish clear procedures for financial reporting and dissemination of financial information. Utilize accounting software to automate reporting processes and ensure compliance with regulatory requirements. |

IX. Risk Management and Security

In order to ensure the integrity of operations and protect sensitive information, comprehensive risk management and security protocols are indispensable for our law firm. This section delves into the firm's strategies for identifying, assessing, and mitigating potential risks and vulnerabilities.

A. Risk Identification

The firm maintains a rigorous process for identifying both internal and external risks. This encompasses cybersecurity threats, regulatory compliance issues, and operational challenges.

B. Risk Assessment

Upon identification, risks are thoroughly assessed to gauge their potential impact and likelihood of occurrence. Prioritization of risks is conducted based on severity, enabling the development of effective mitigation strategies.

C. Security Measures

The firm upholds stringent security measures to safeguard sensitive data and prevent unauthorized access. This includes robust access controls, encryption protocols, and comprehensive employee training programs.

D. Incident Response Plan

Despite preventive measures, incidents may still arise. The firm has a meticulously outlined incident response plan in place, detailing protocols for detecting, reporting, and addressing security breaches or emergencies promptly and effectively.

E. Regulatory Compliance

Adherence to legal and regulatory requirements is paramount. The firm ensures compliance with relevant laws, regulations, and industry standards, such as data privacy regulations and professional ethics guidelines.

F. Continuous Monitoring and Improvement

Risk management is an iterative process. The firm maintains a commitment to continuous monitoring of risk factors, evaluating the effectiveness of security measures, and adapting to emerging threats to maintain robust security posture.

X. Conclusion

This comprehensive analysis highlights the critical importance of strategic planning and diligent execution in the operations of our law firm. By addressing key areas such as practice areas assessment, technology infrastructure, staffing needs, client relationship management, compliance with regulatory requirements, financial analysis, risk management, and security, we are poised to enhance efficiency, ensure regulatory compliance, and deliver exceptional client service. With these insights, we are well-positioned to navigate the evolving landscape of the legal industry and achieve sustainable growth and success.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline case preparation and client service with the Law Firm Requirement Analysis Template from Template.net. This editable and customizable template helps you systematically identify and document client needs and legal requirements, ensuring that every case is handled with precision and tailored strategy. Editable in our Ai Editor Tool, it’s essential for enhancing client satisfaction, improving case outcomes, and optimizing resource allocation within your law practice.