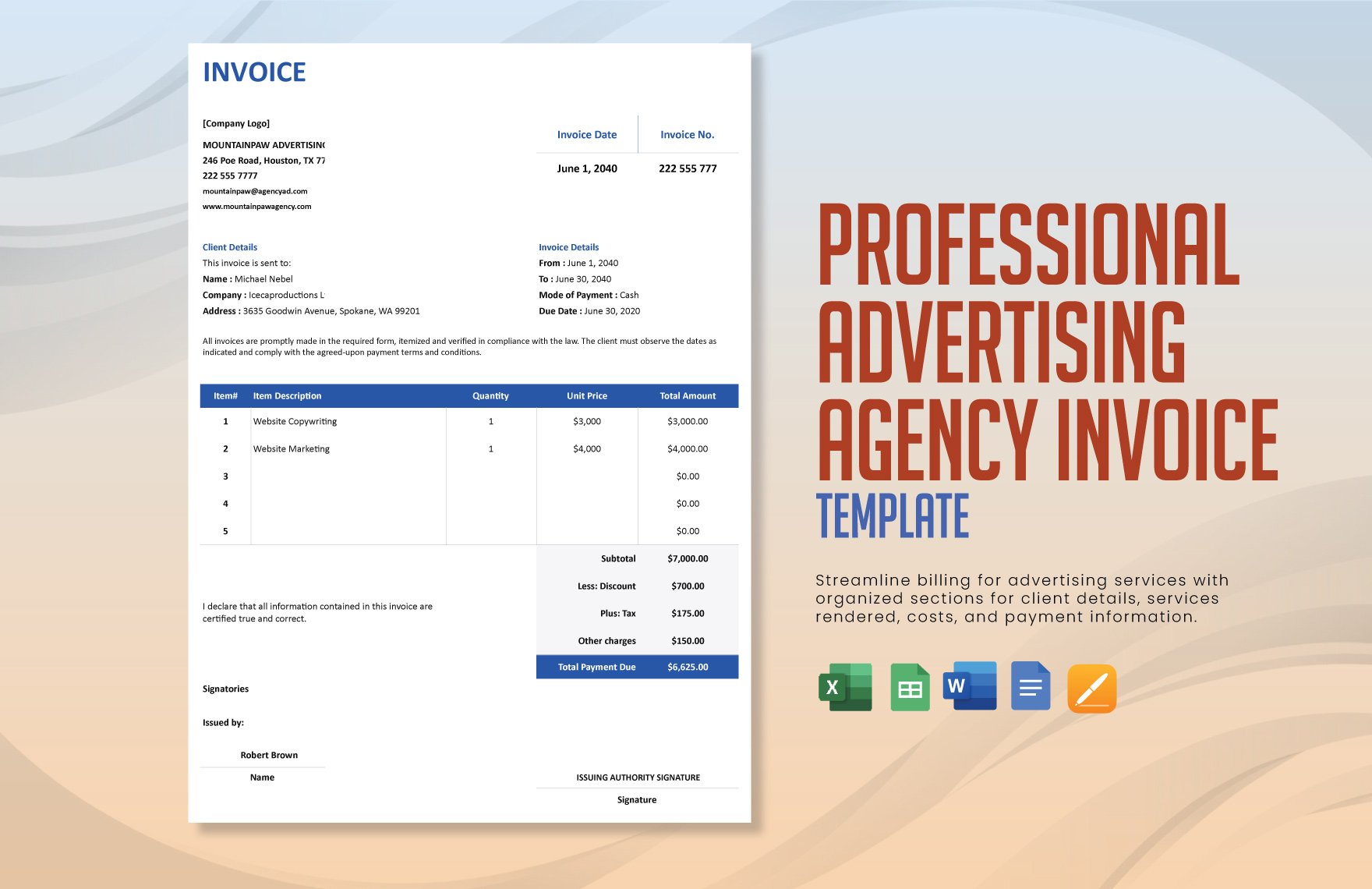

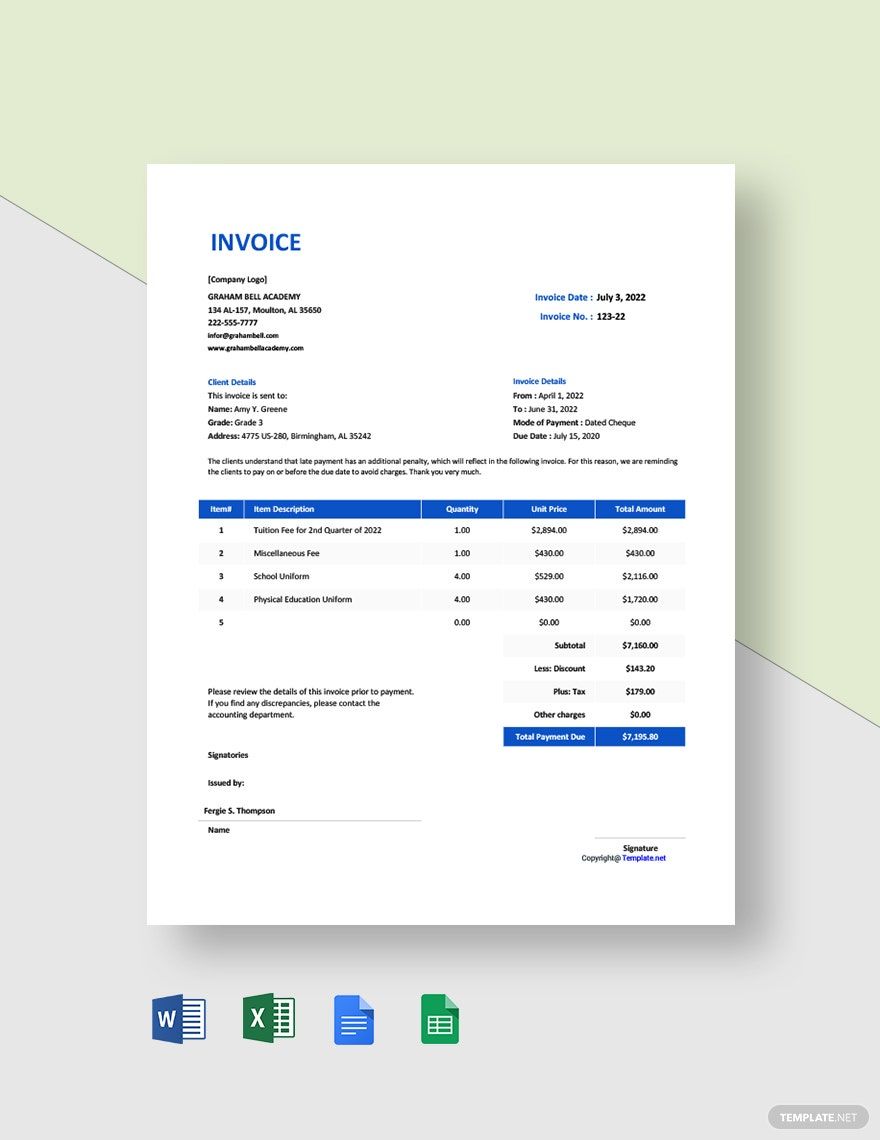

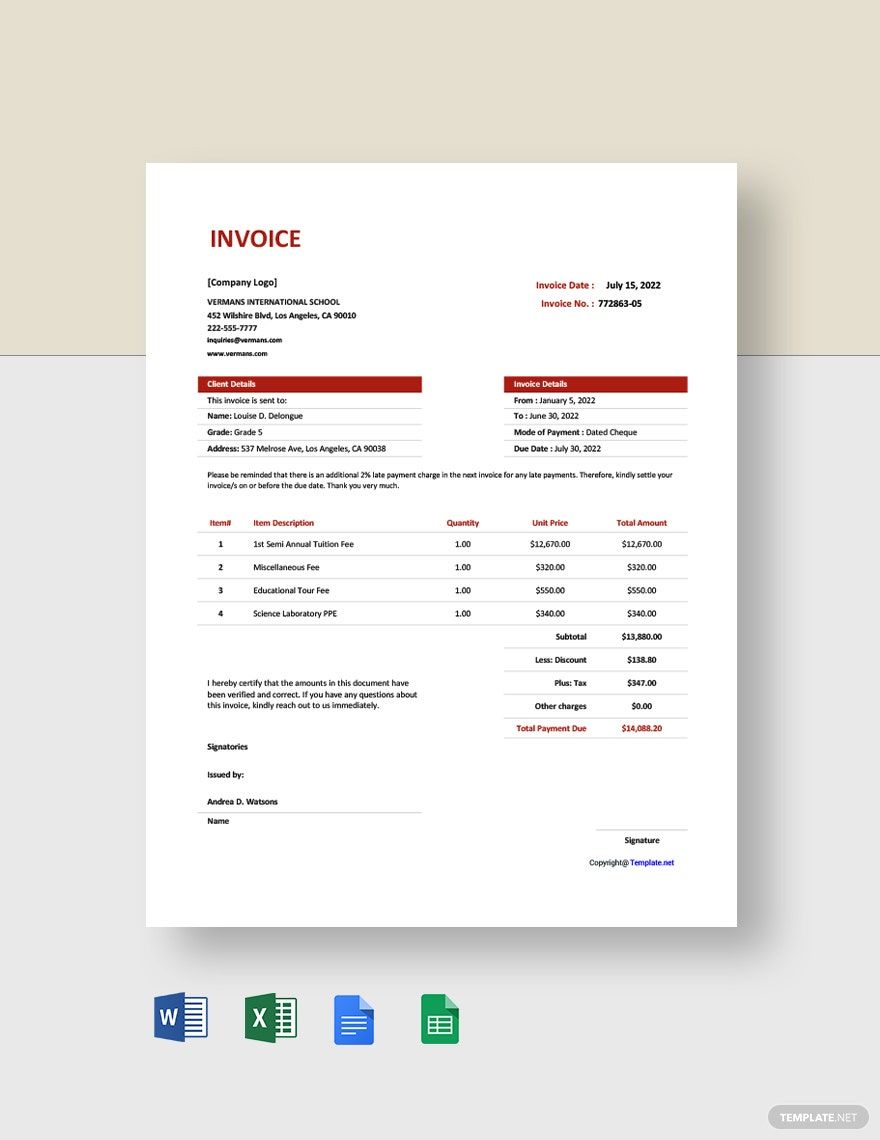

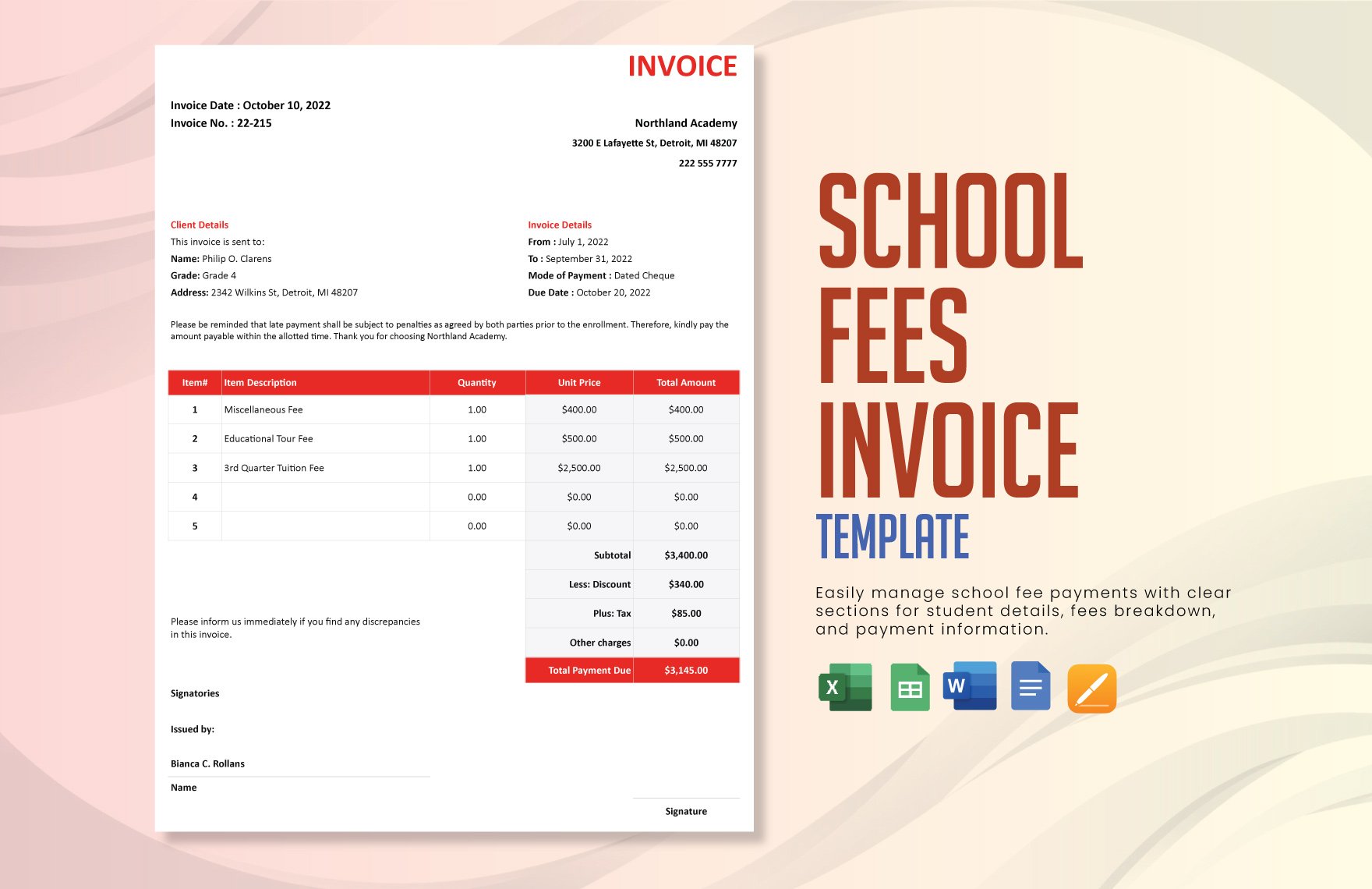

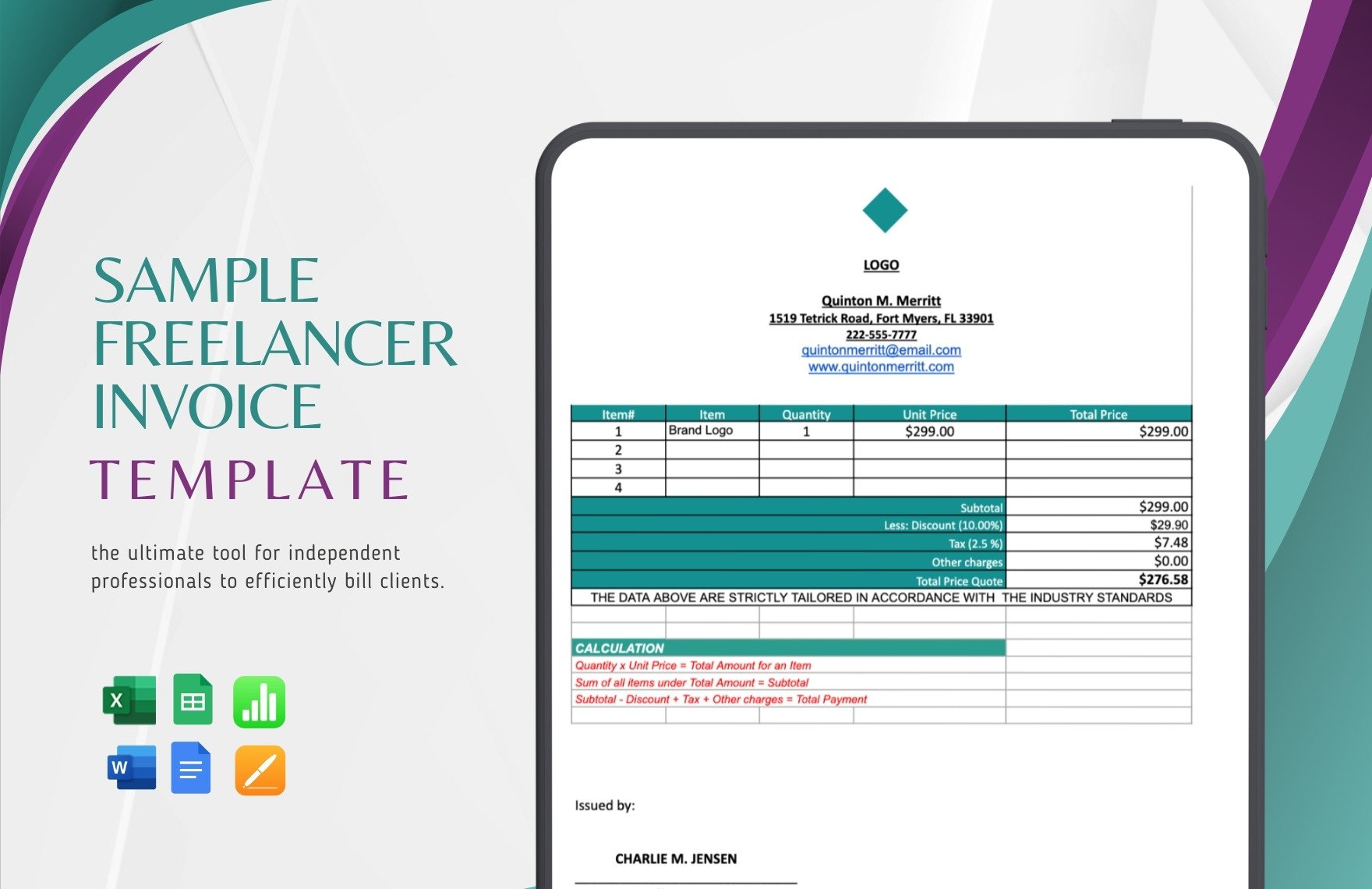

A sales invoice is sent by a product or service provider, showing a list of products or services, and an obligation on the part of the purchaser to pay. It serves as a written verification of the agreement between the buyer and seller of said goods and services. While the invoice seems like an informal document, it is an important part of the record-keeping system of your business as it records sales transactions. Our website offers numerous ready-made Blank Invoice Templates in Microsoft Word format for you to use. Simply go to our website, sign in, and download the template now.

How to Create an Invoice

An invoice is used to notify clients and customers that payment is due for products delivered or services performed. It should also include the amount that your customer owes, and where they should send the payment. Here are some tips to help you create your invoice:

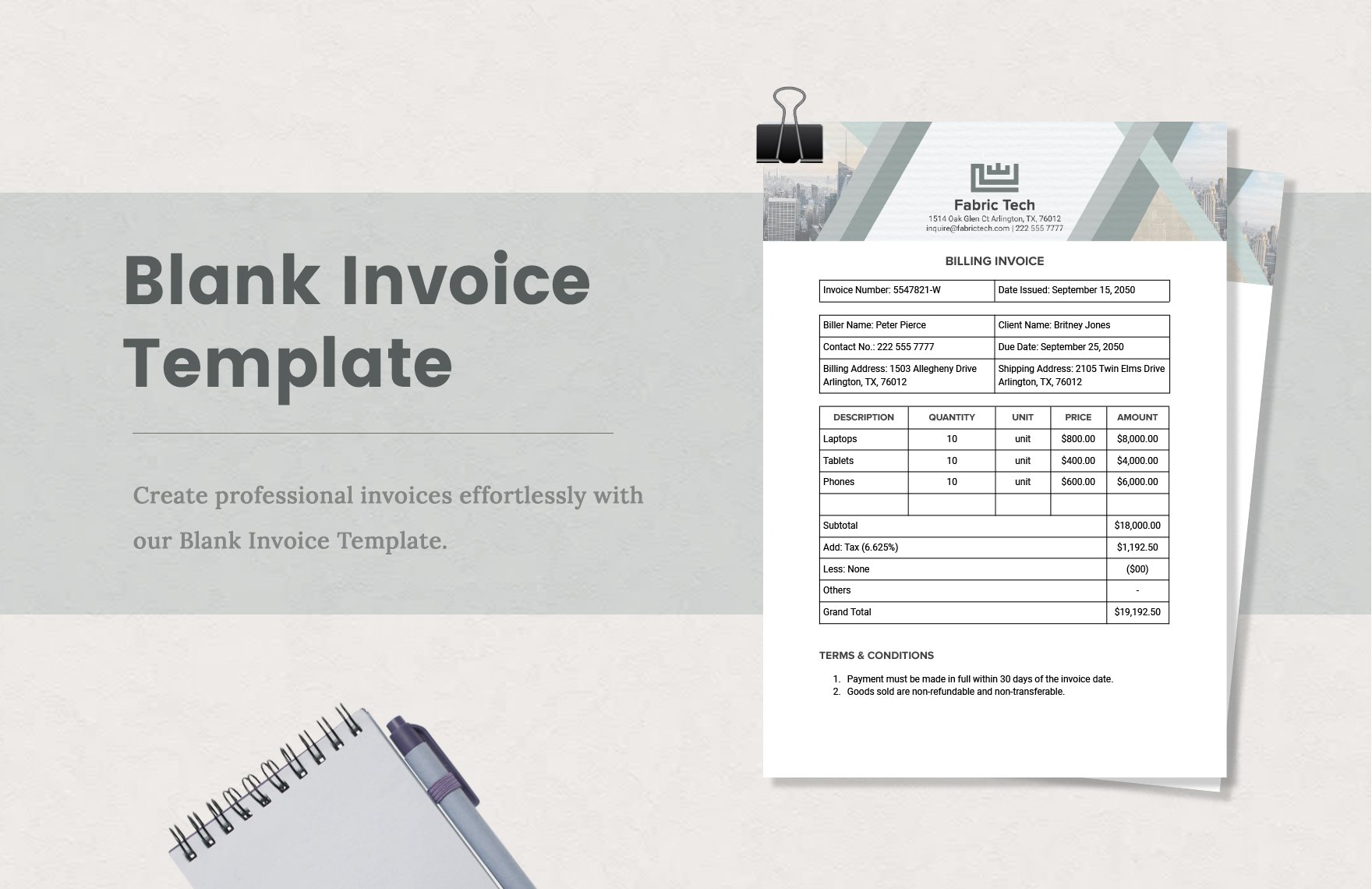

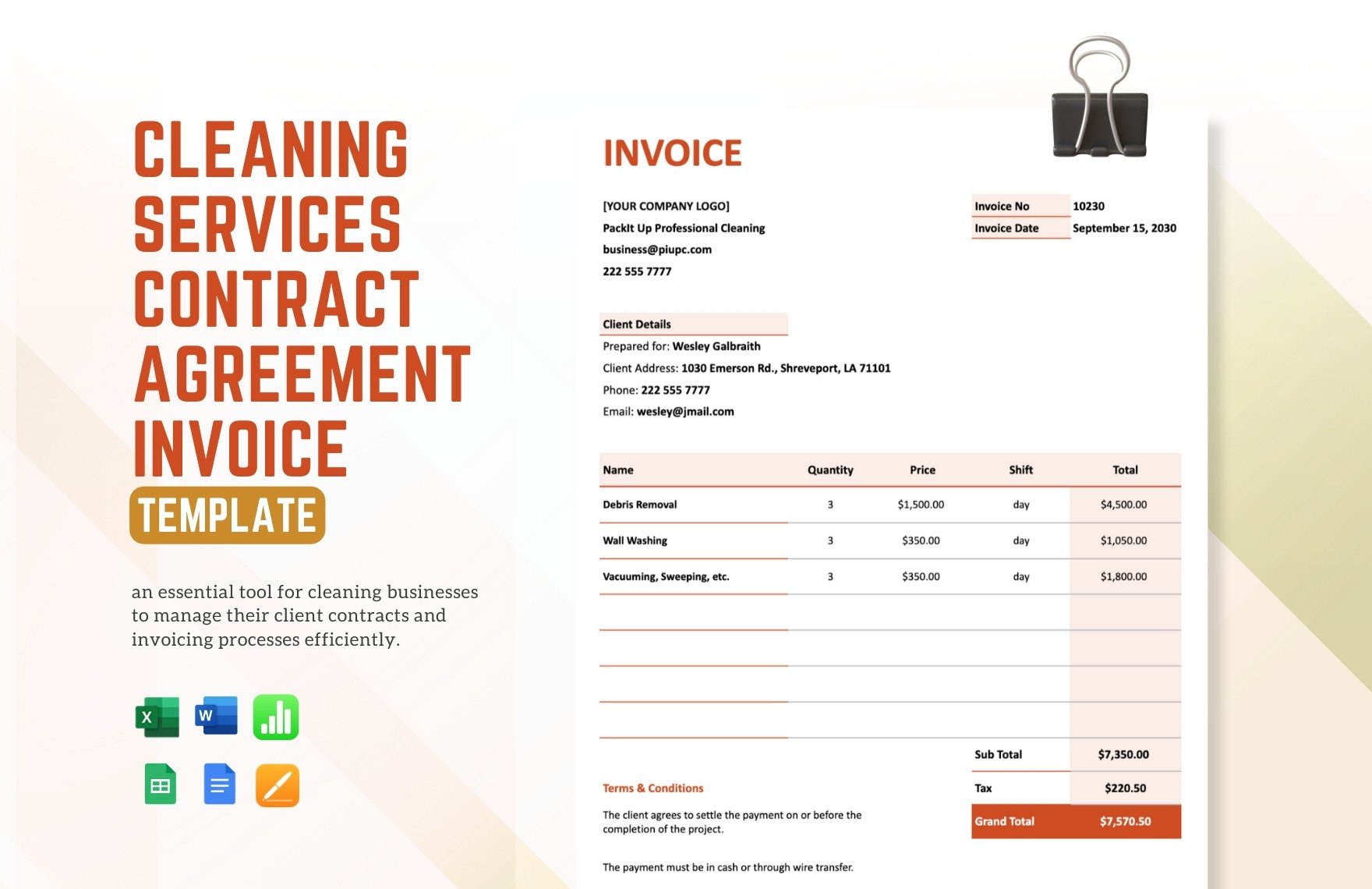

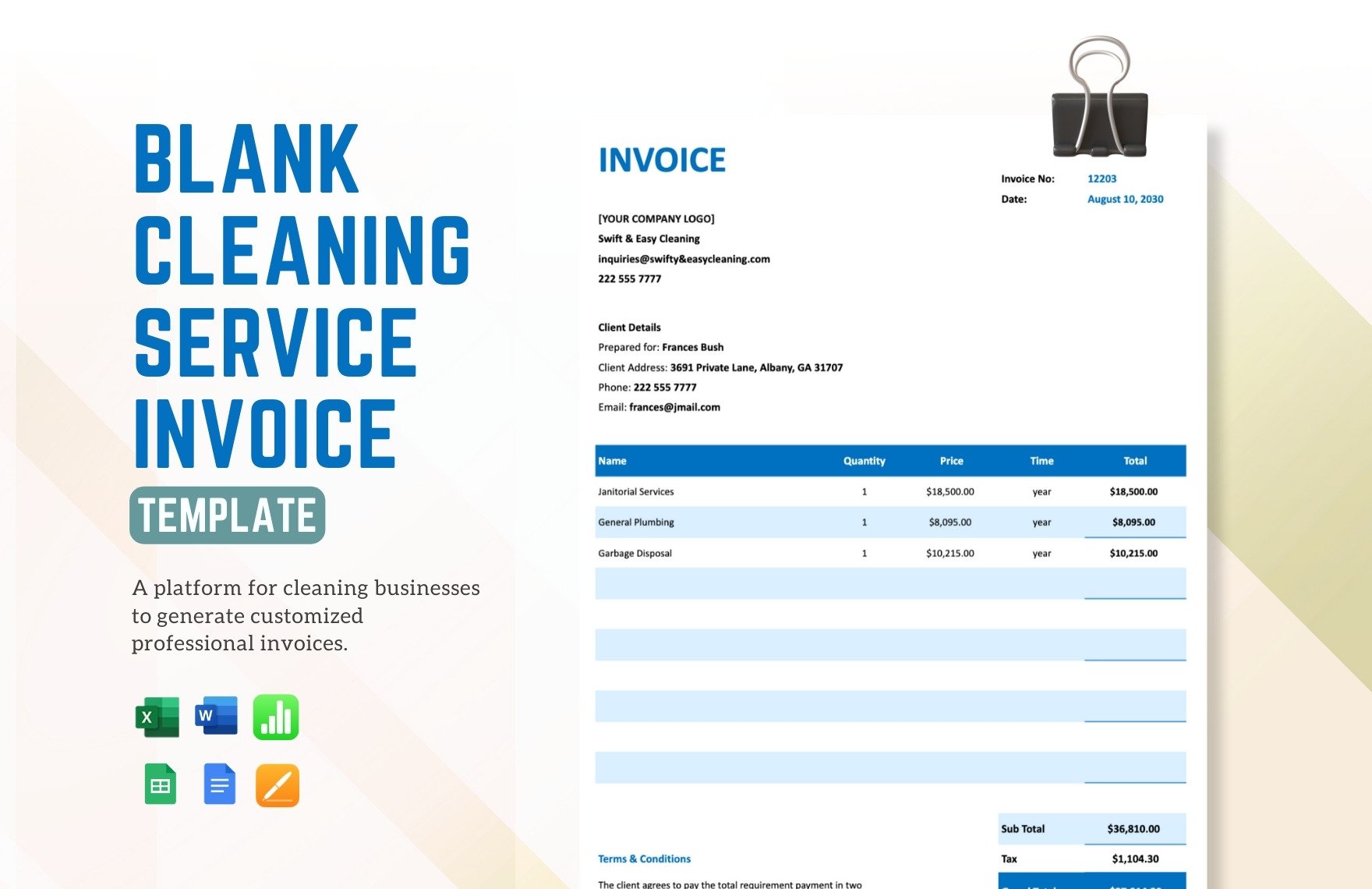

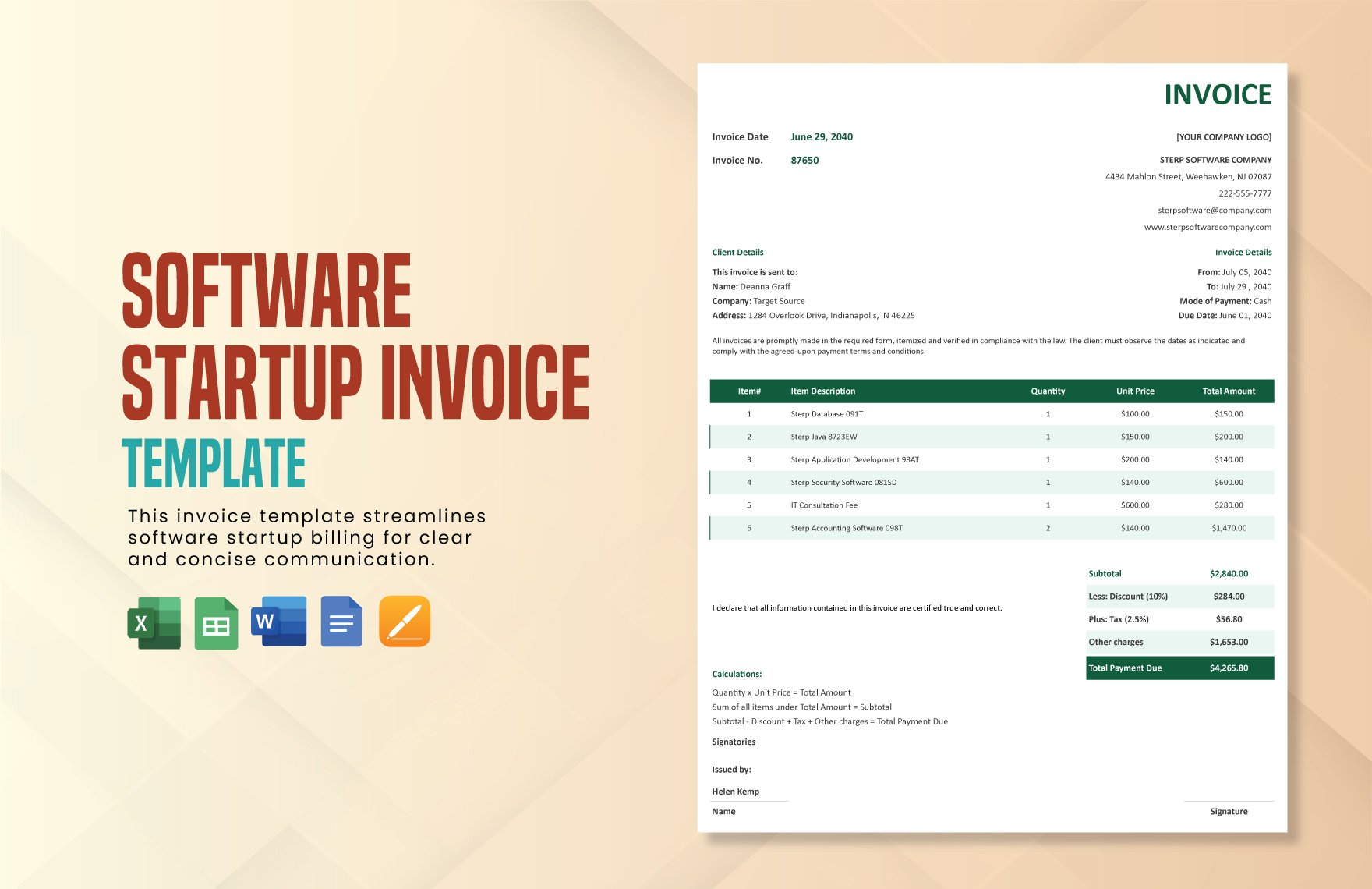

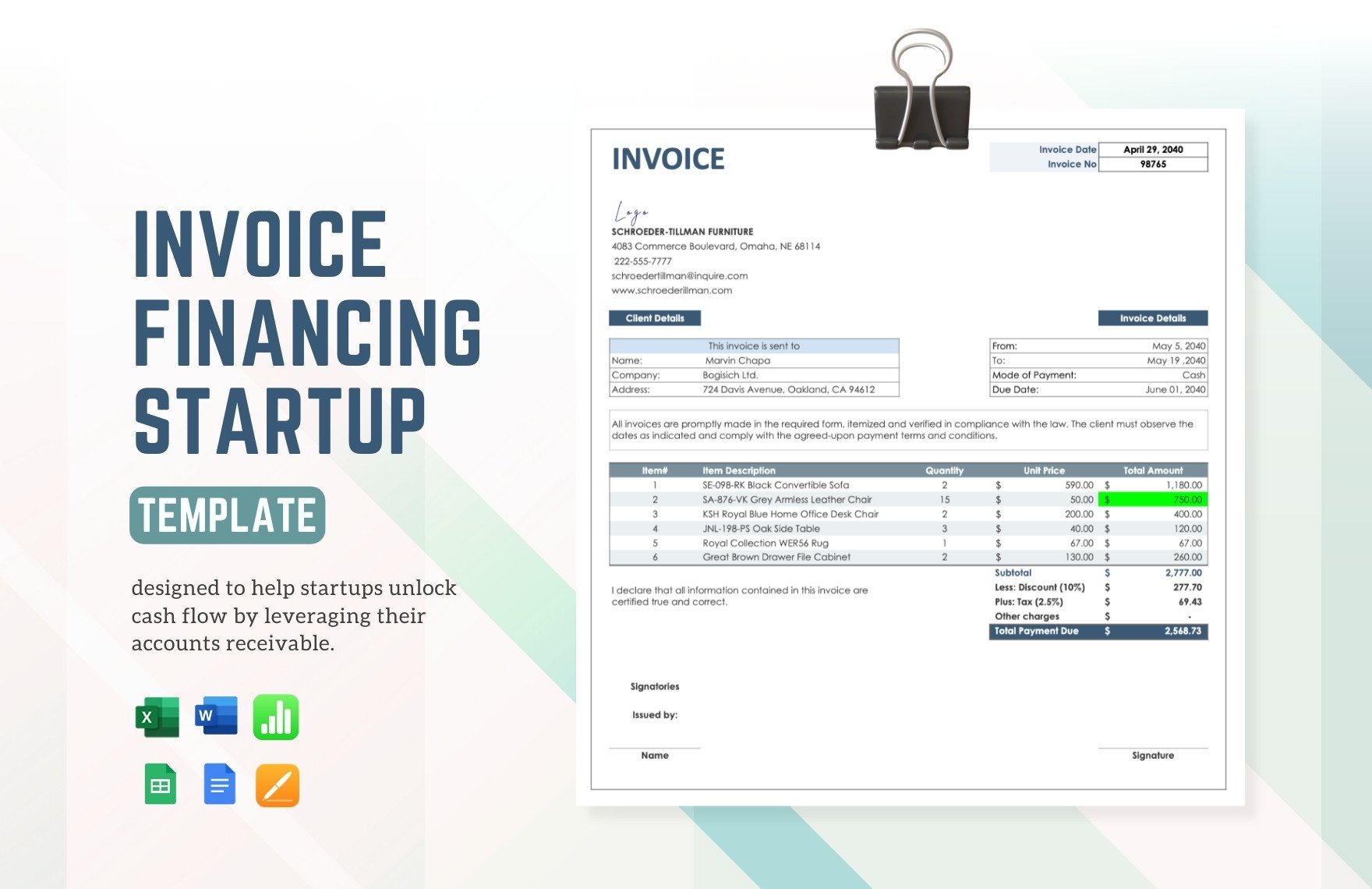

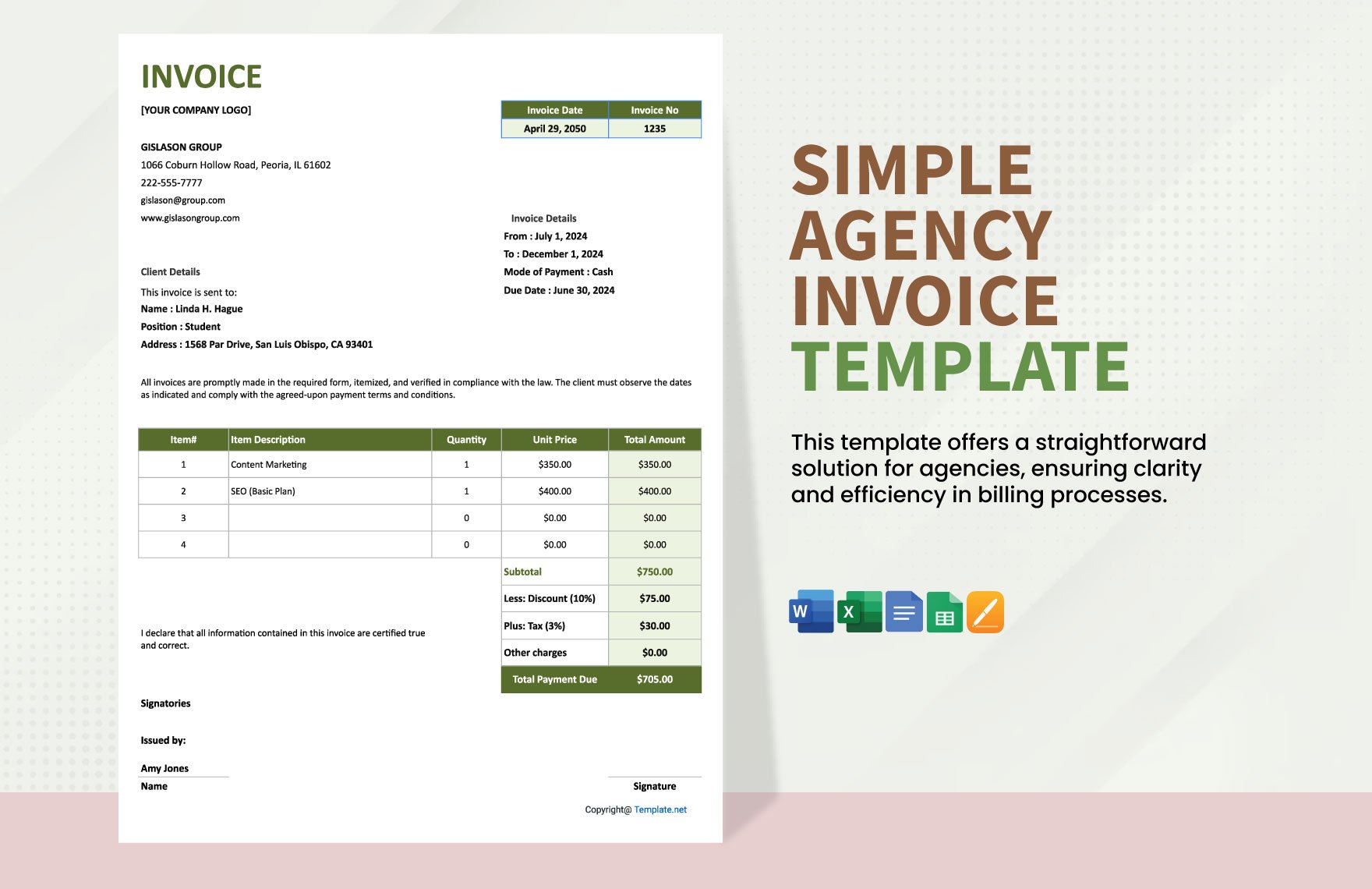

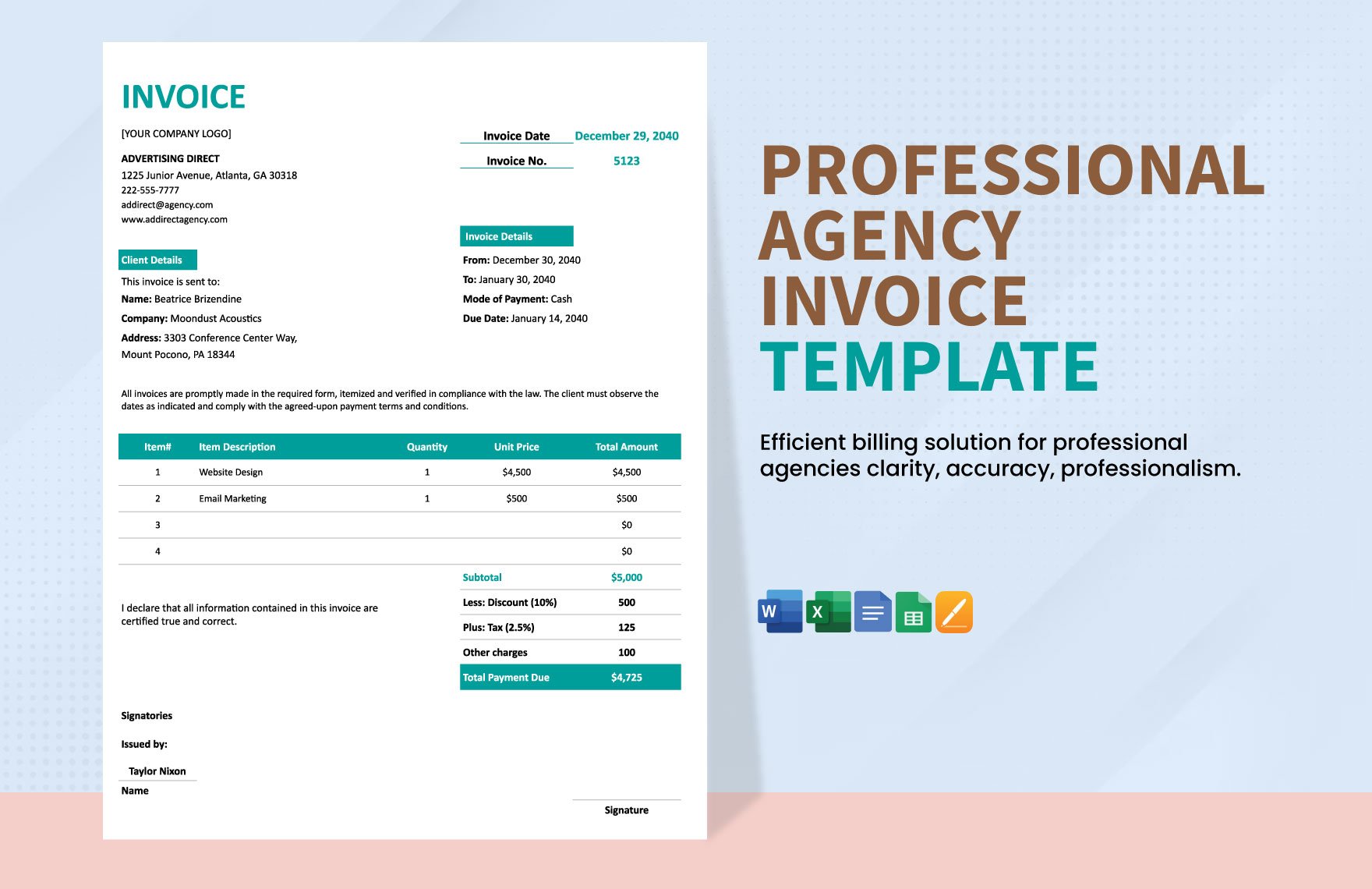

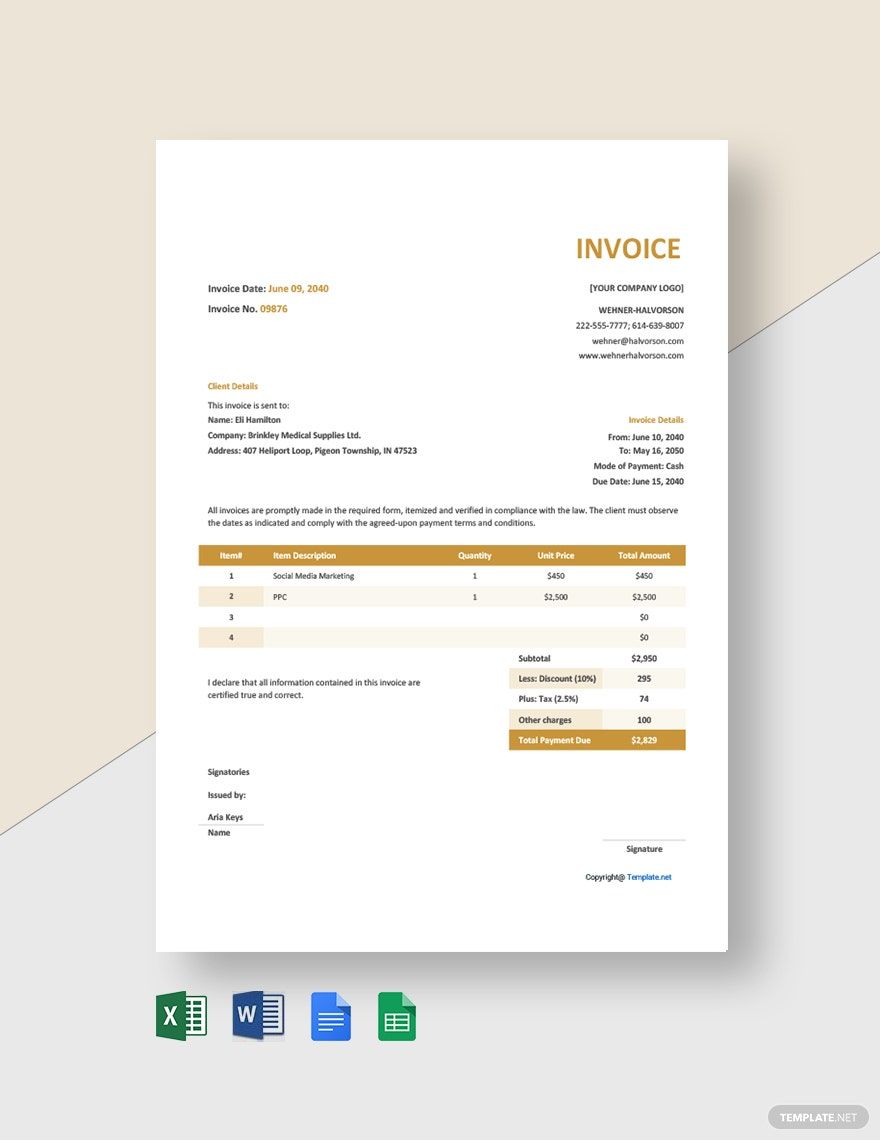

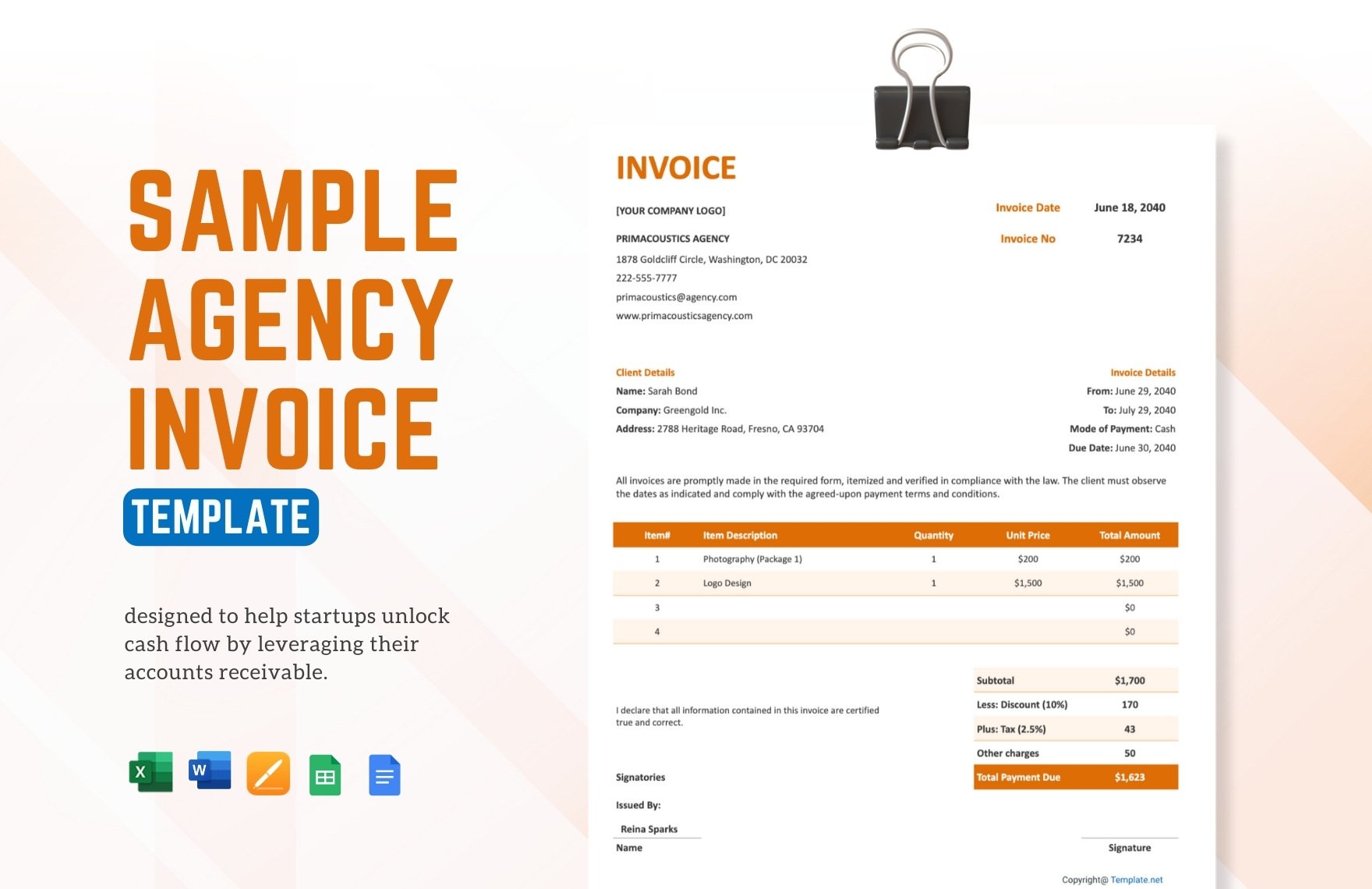

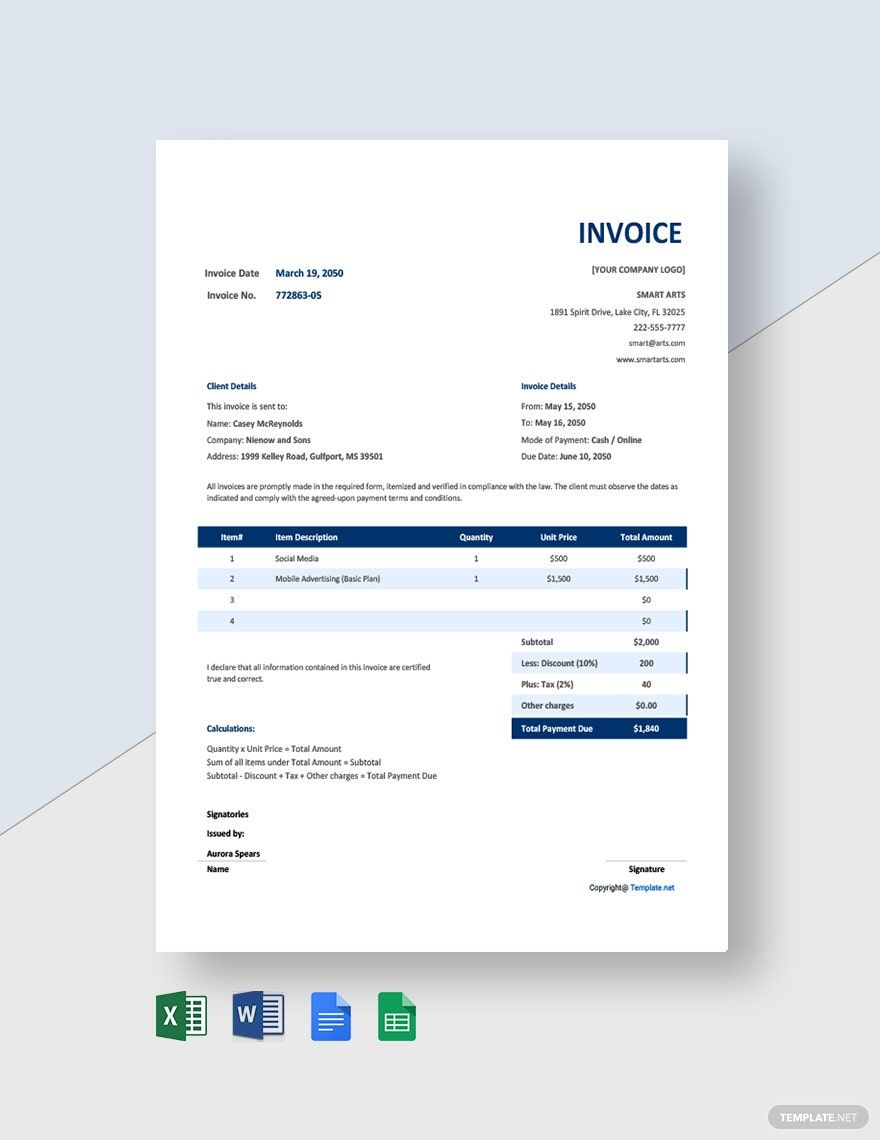

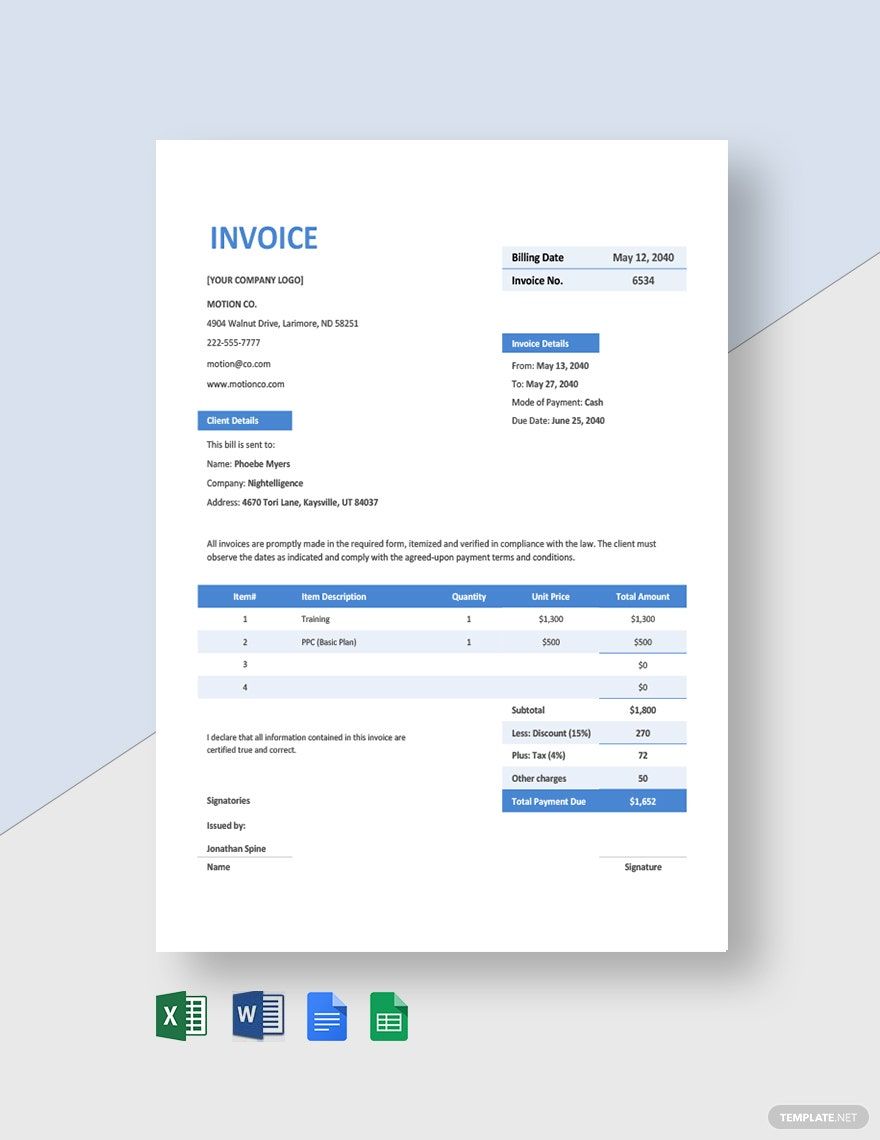

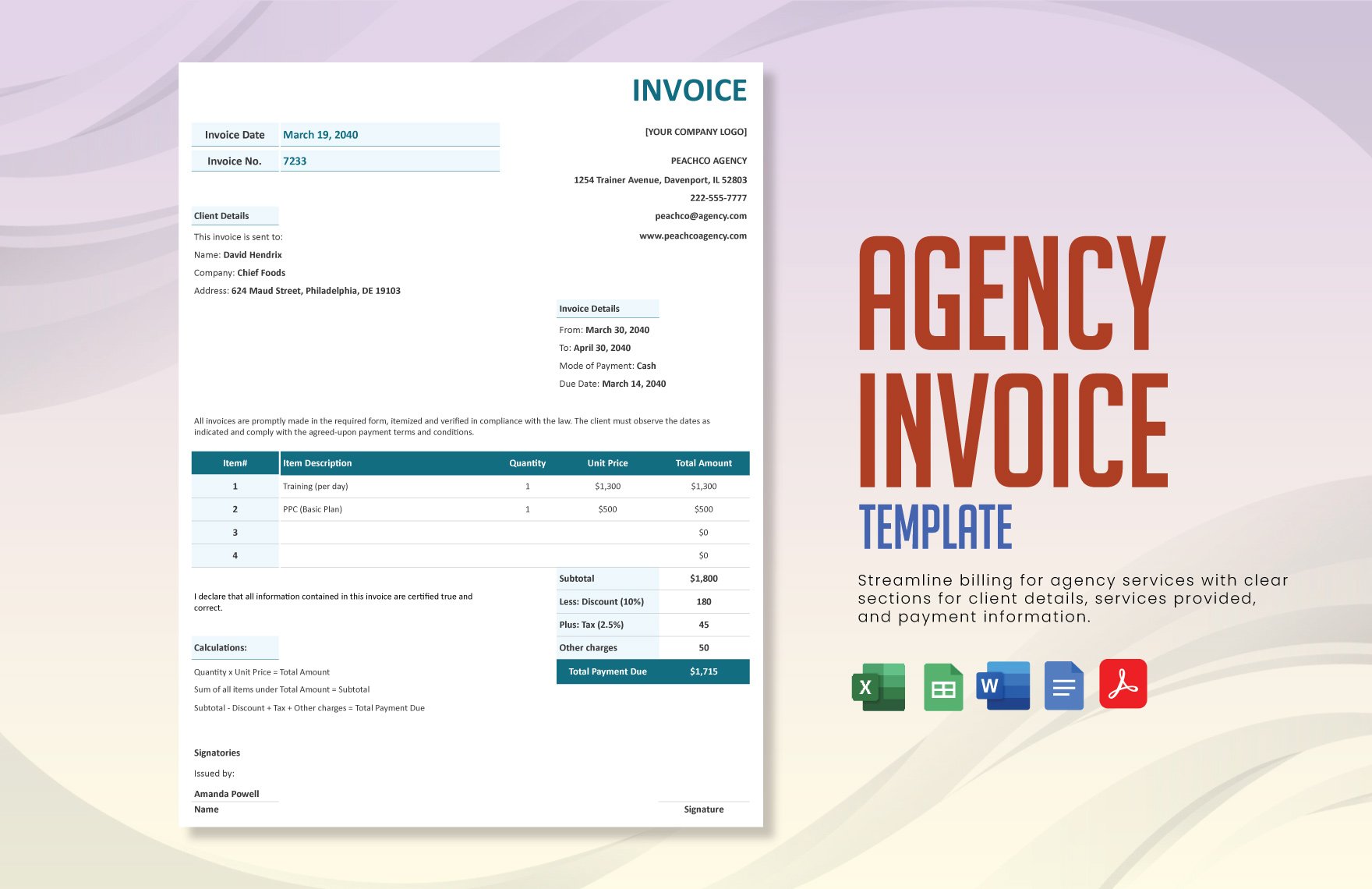

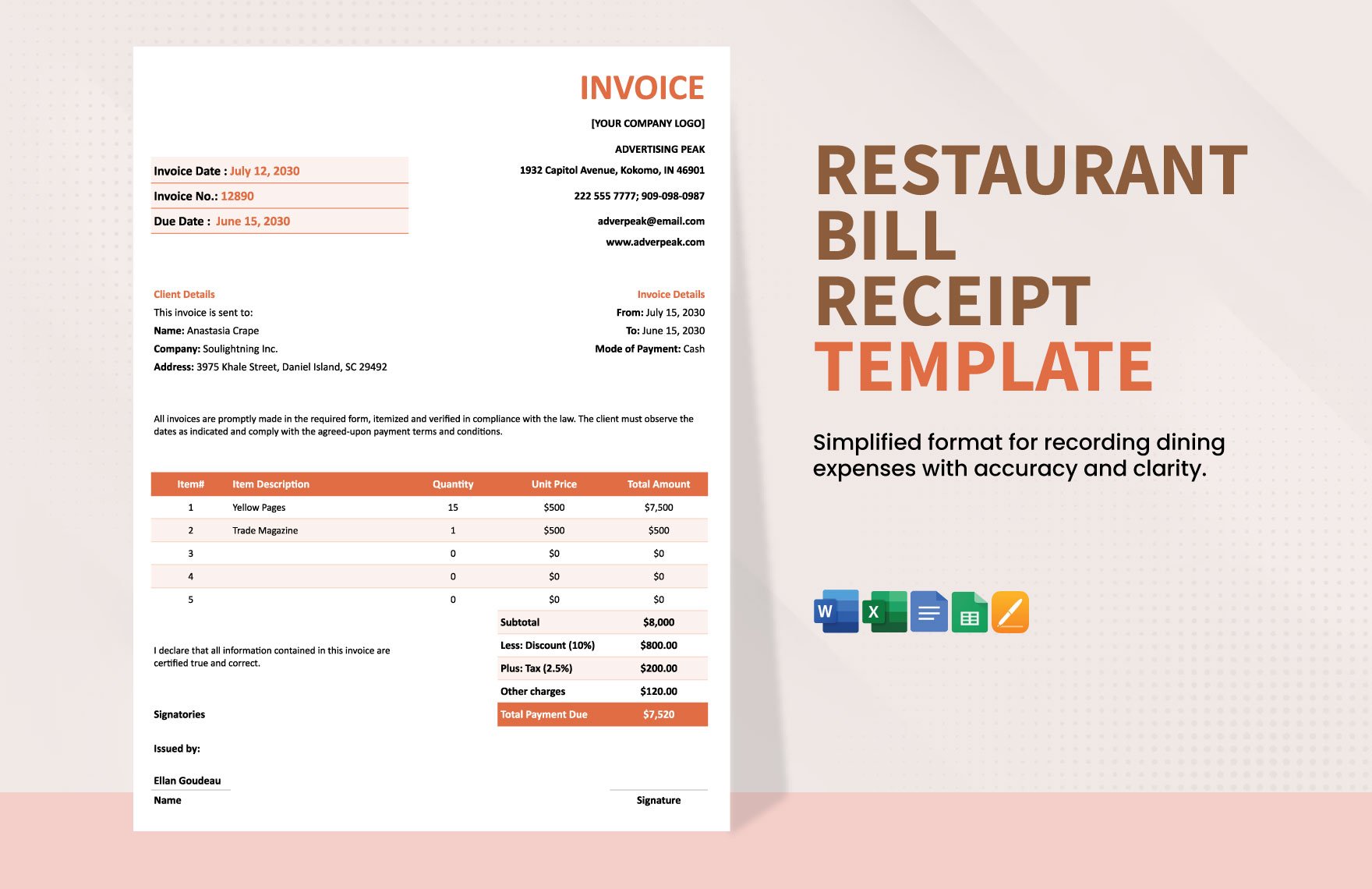

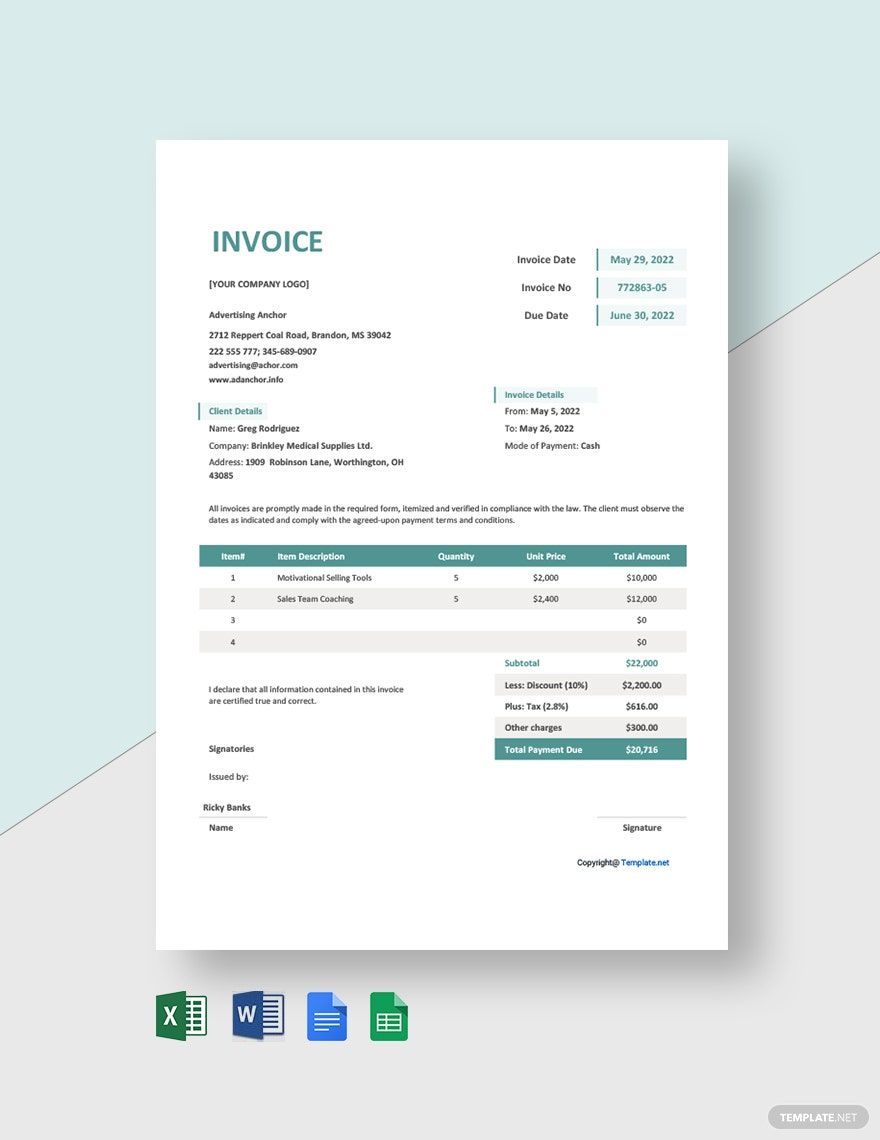

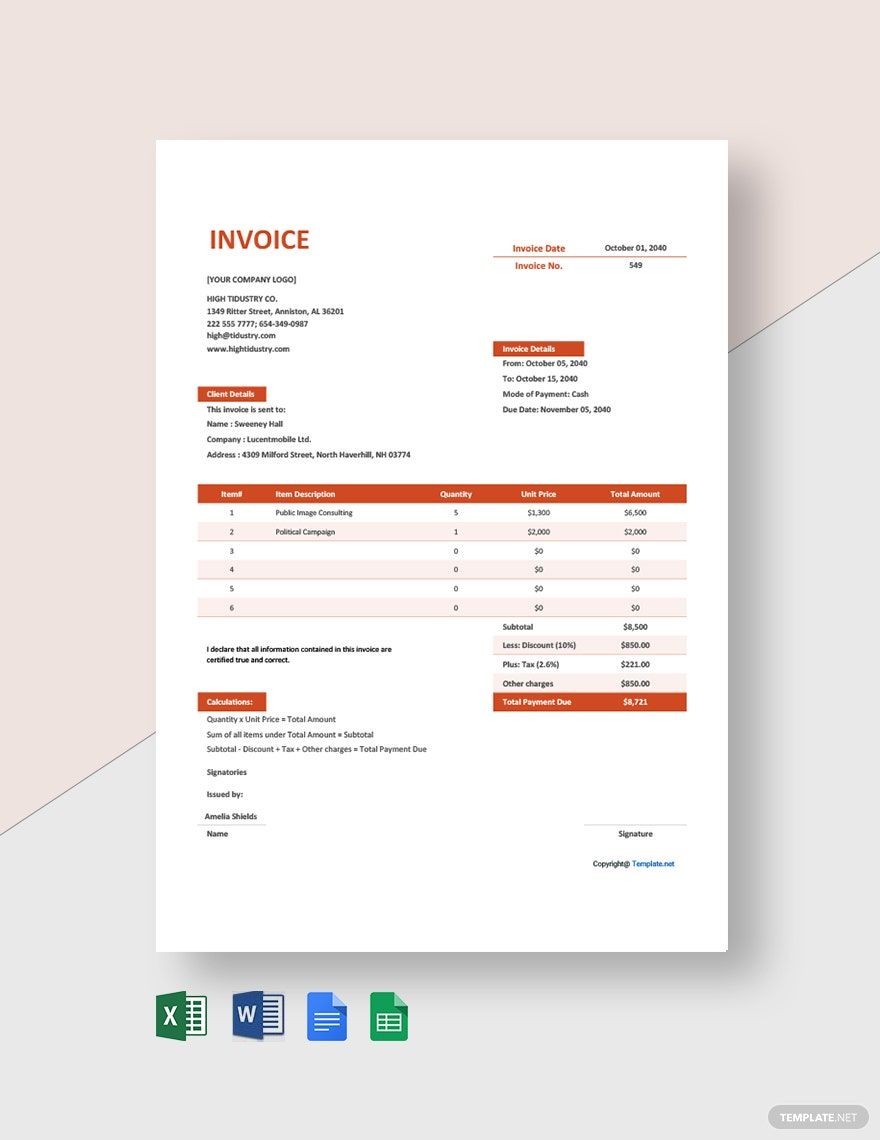

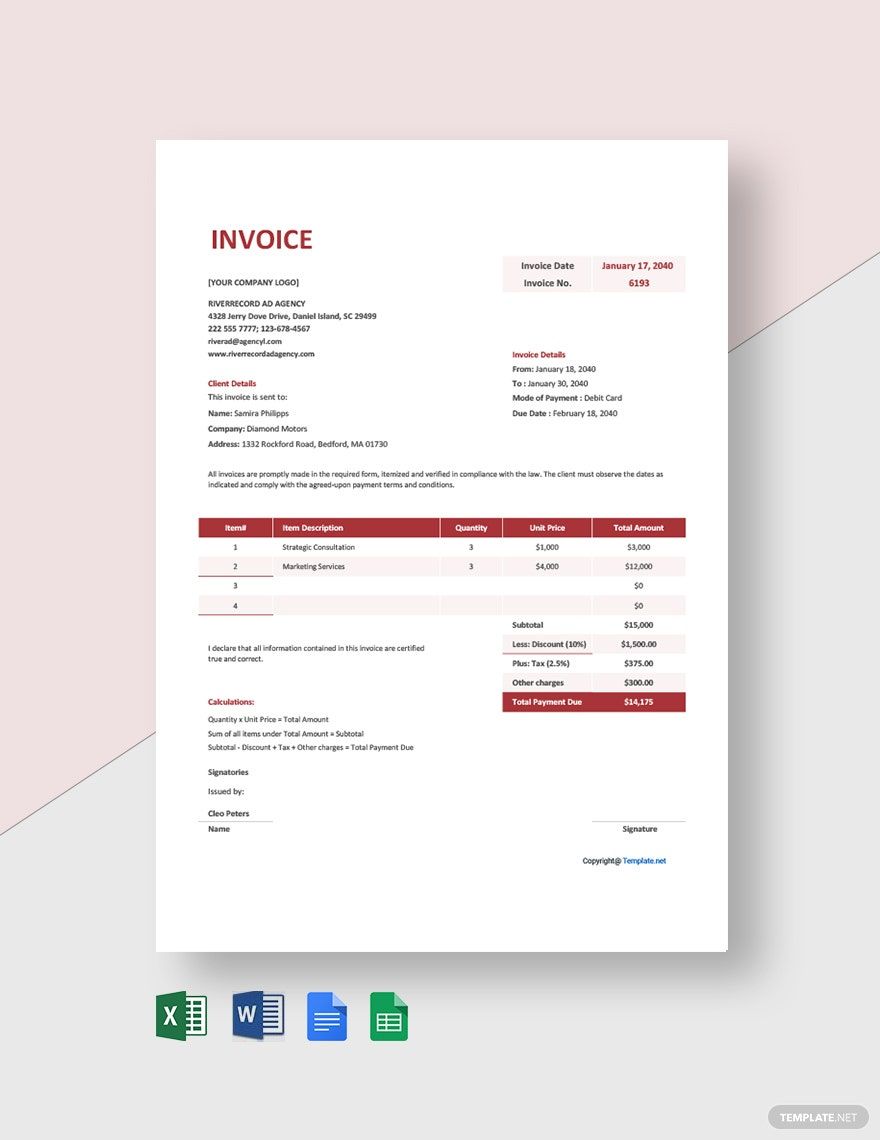

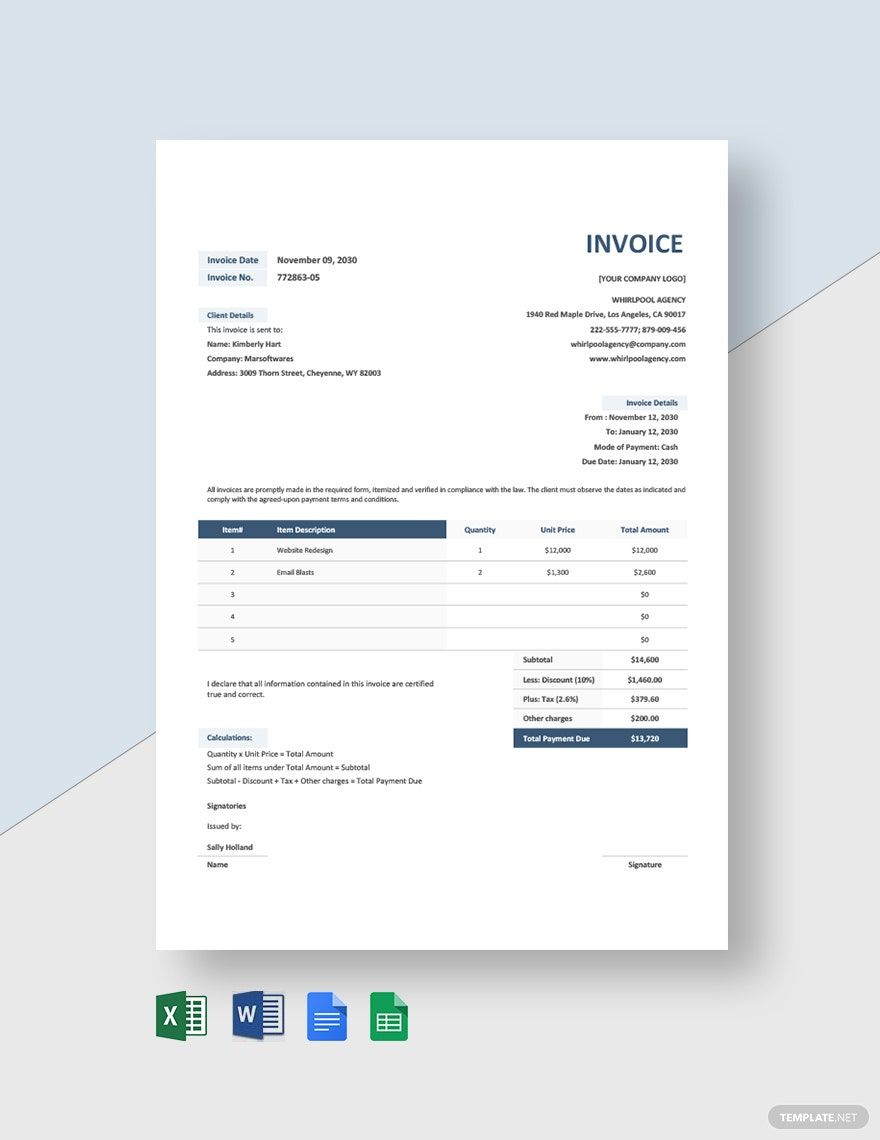

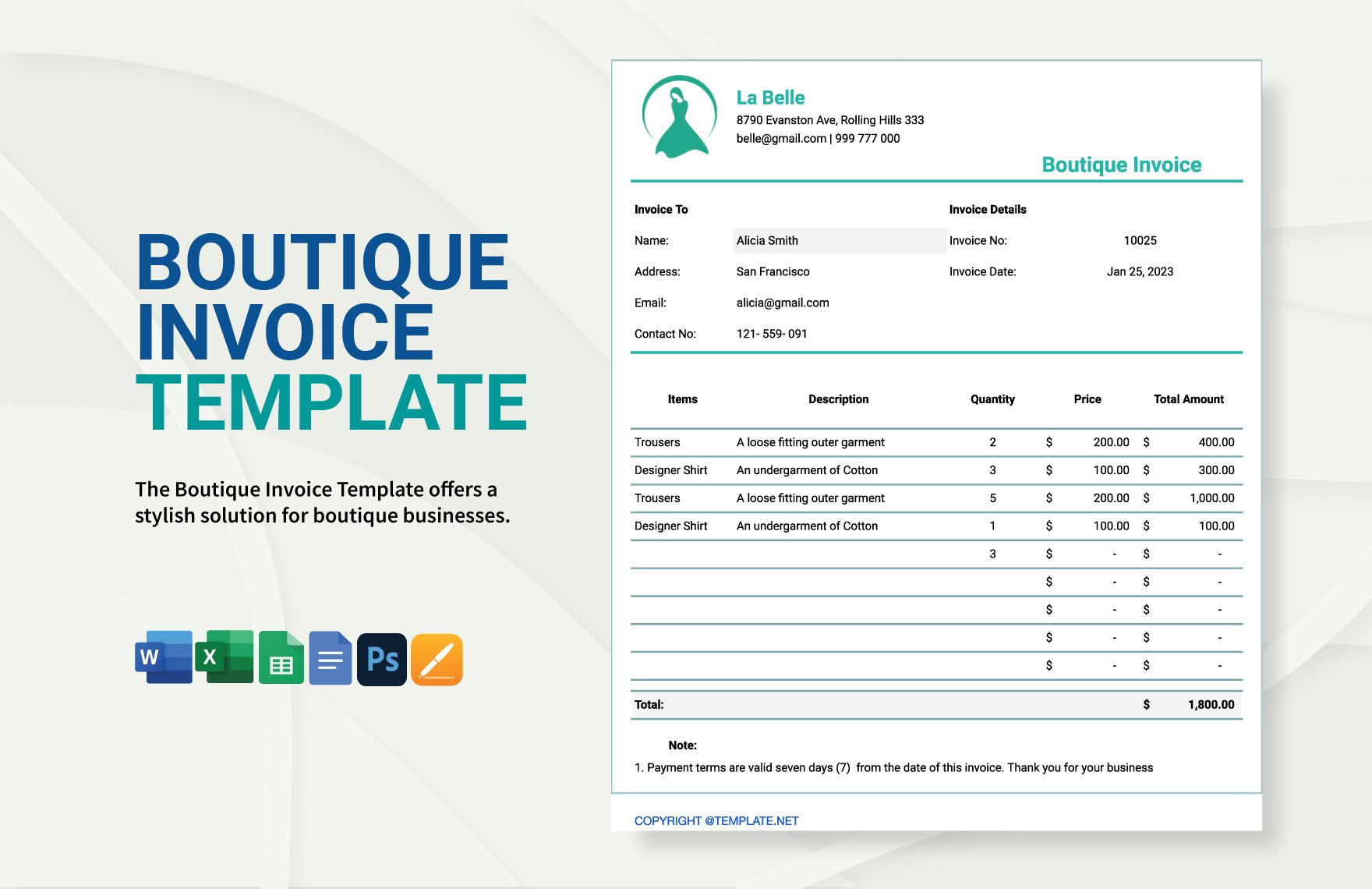

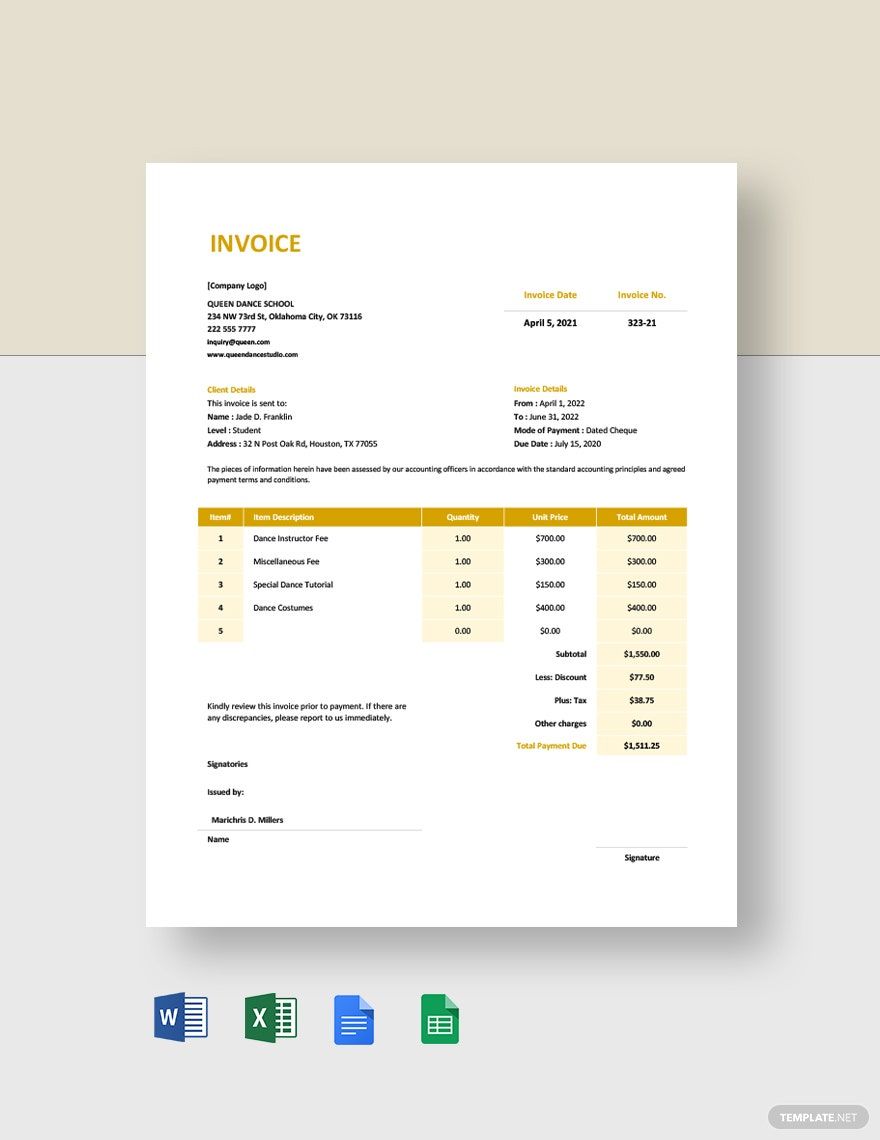

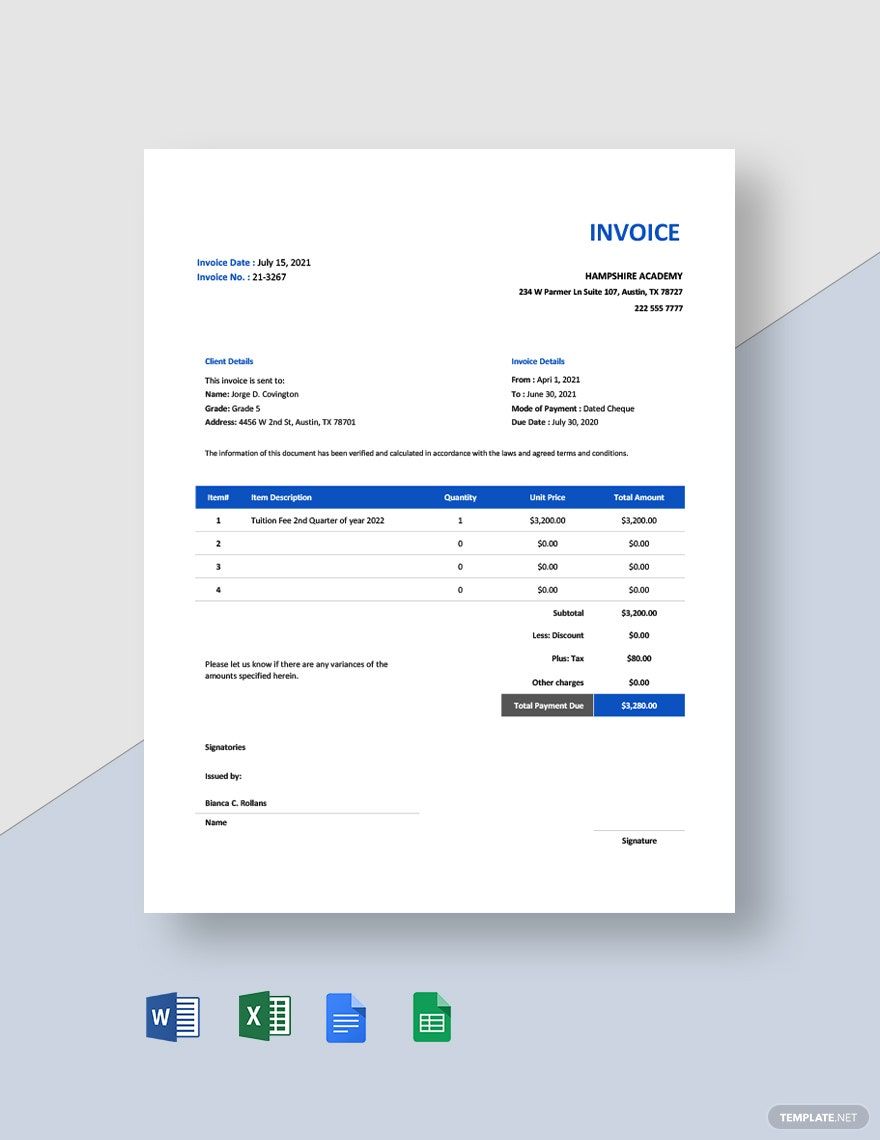

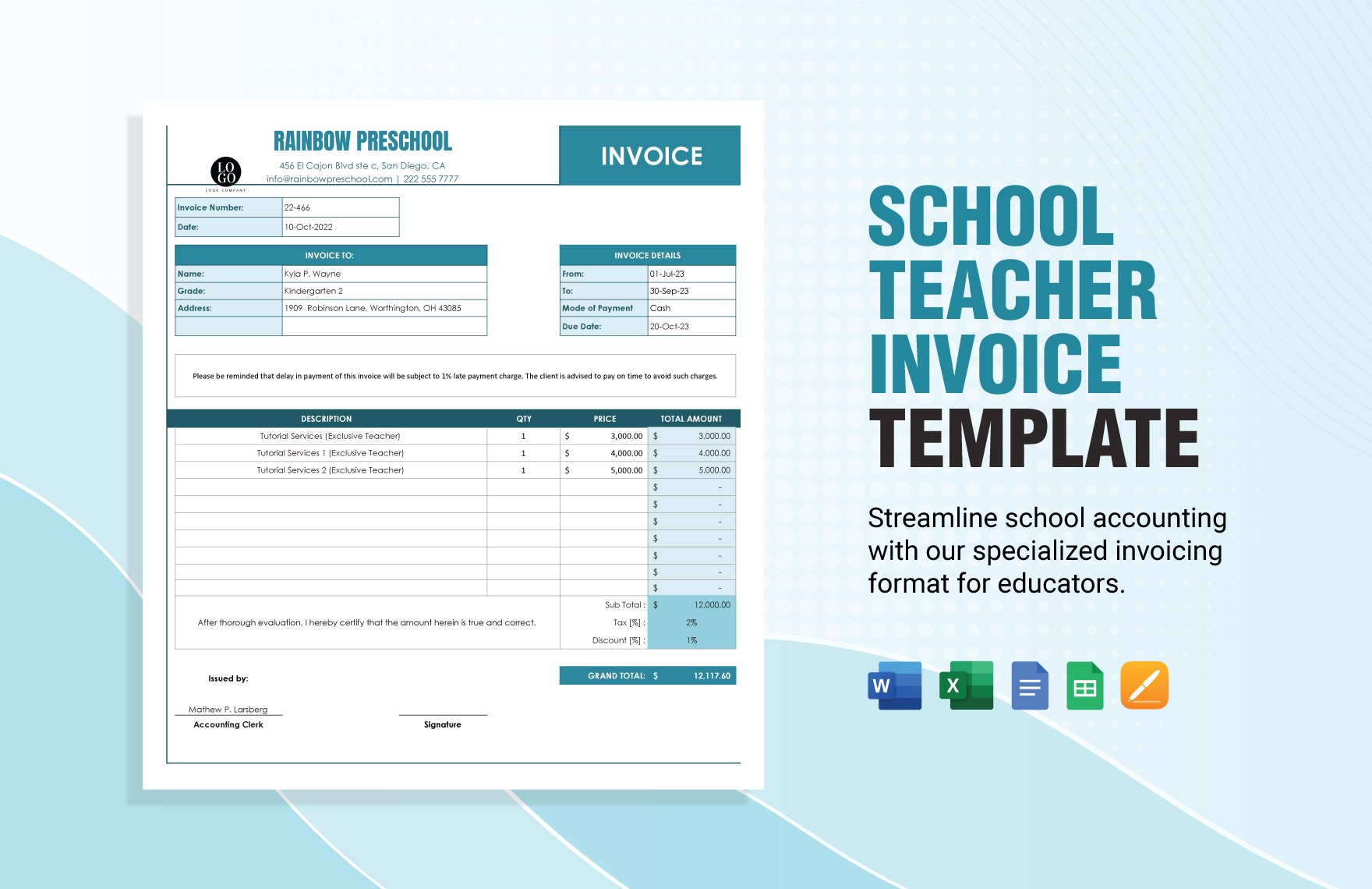

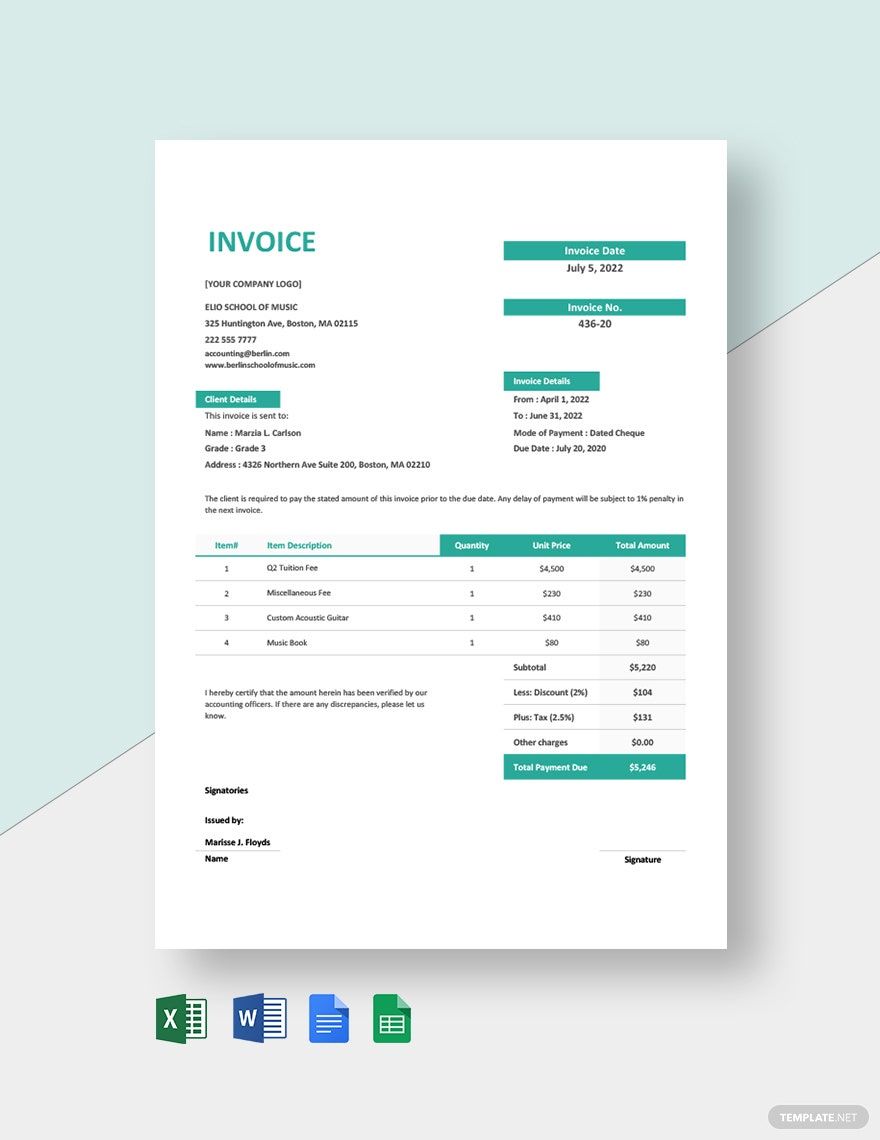

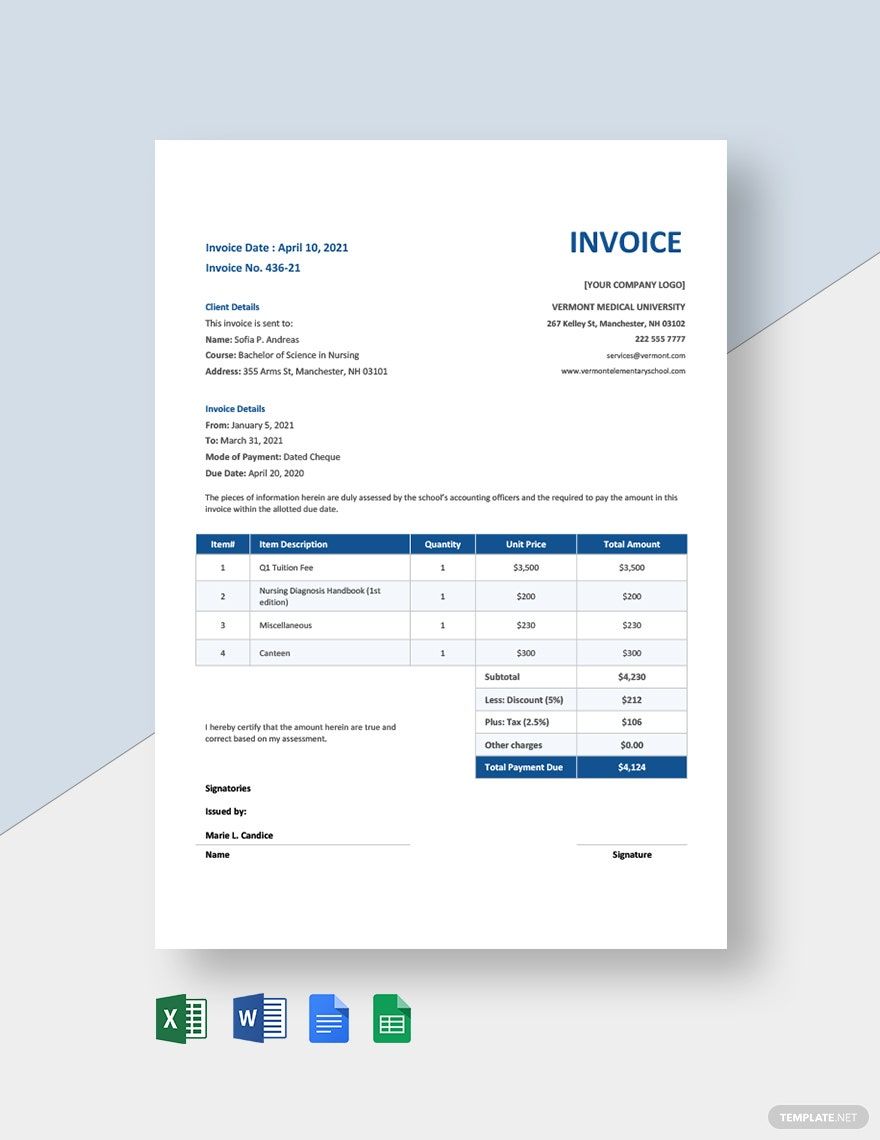

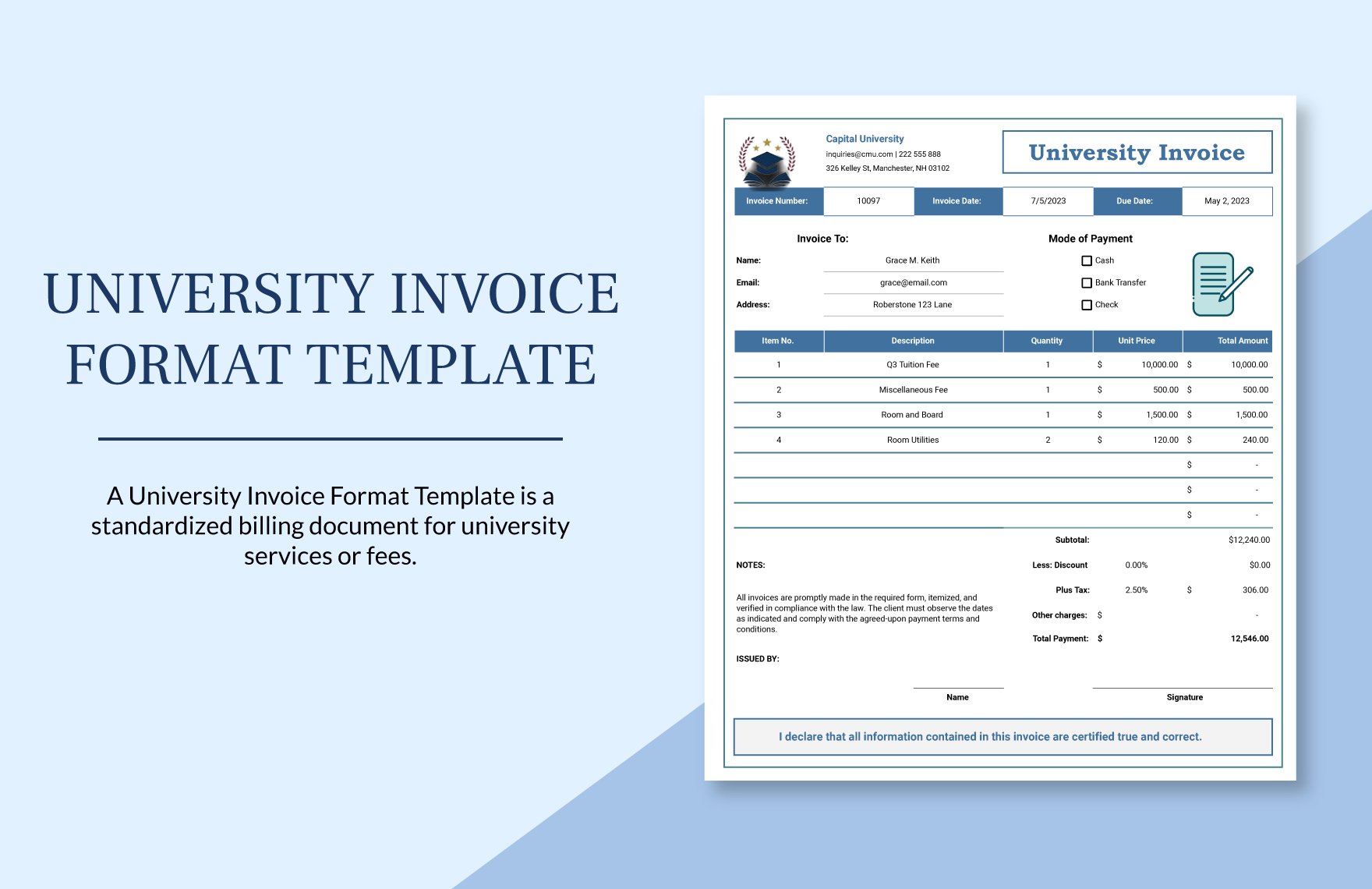

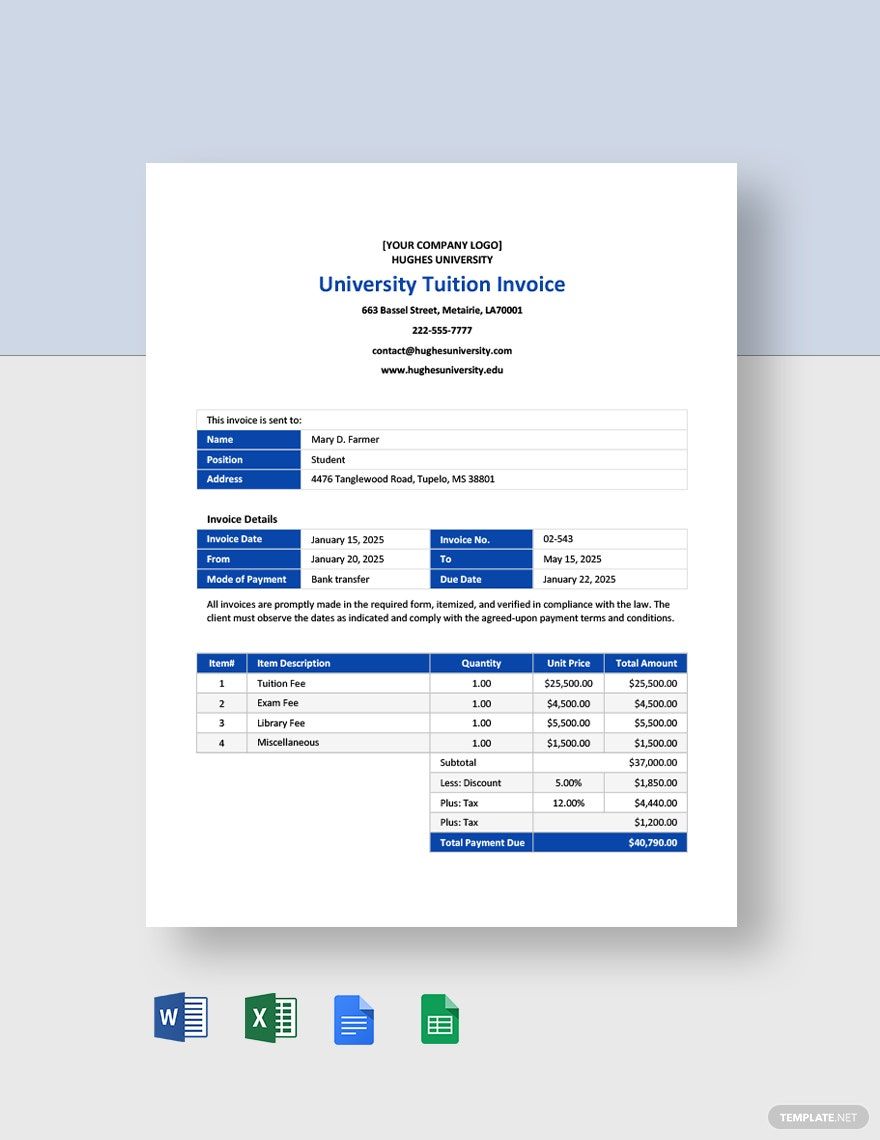

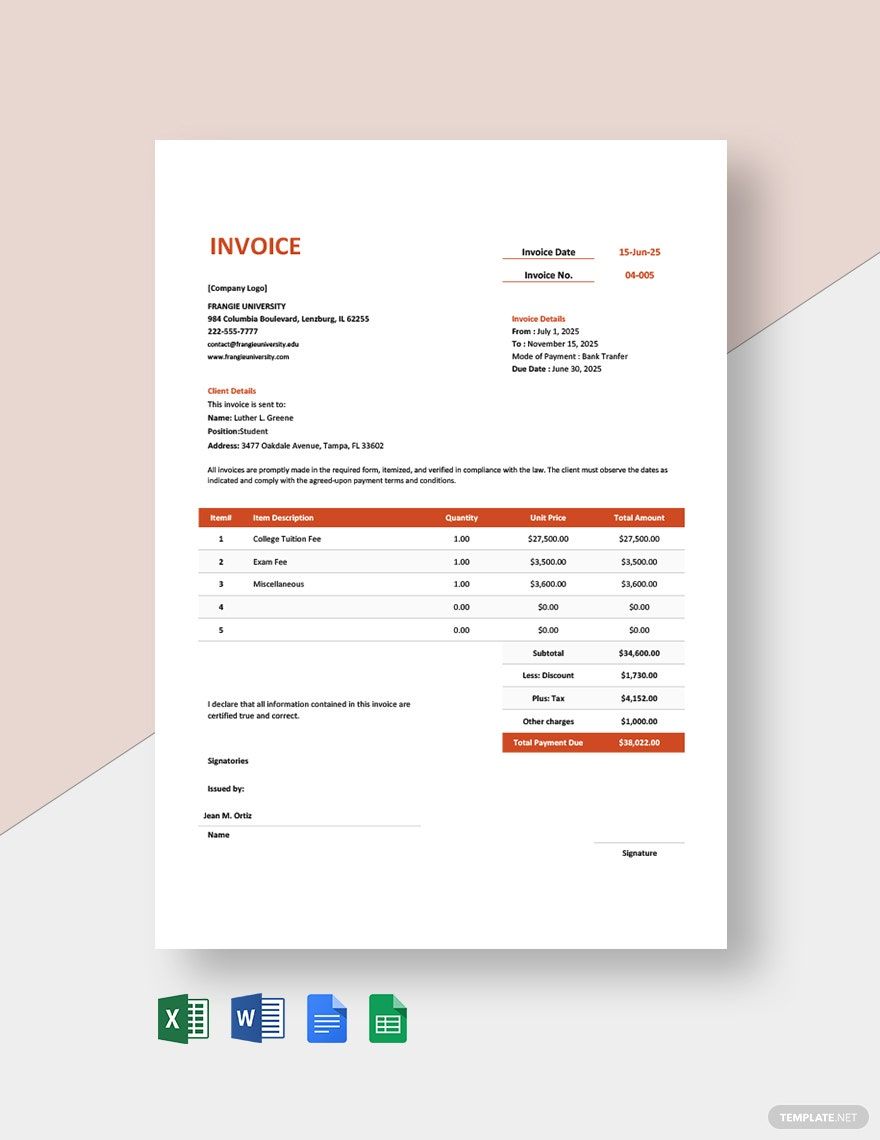

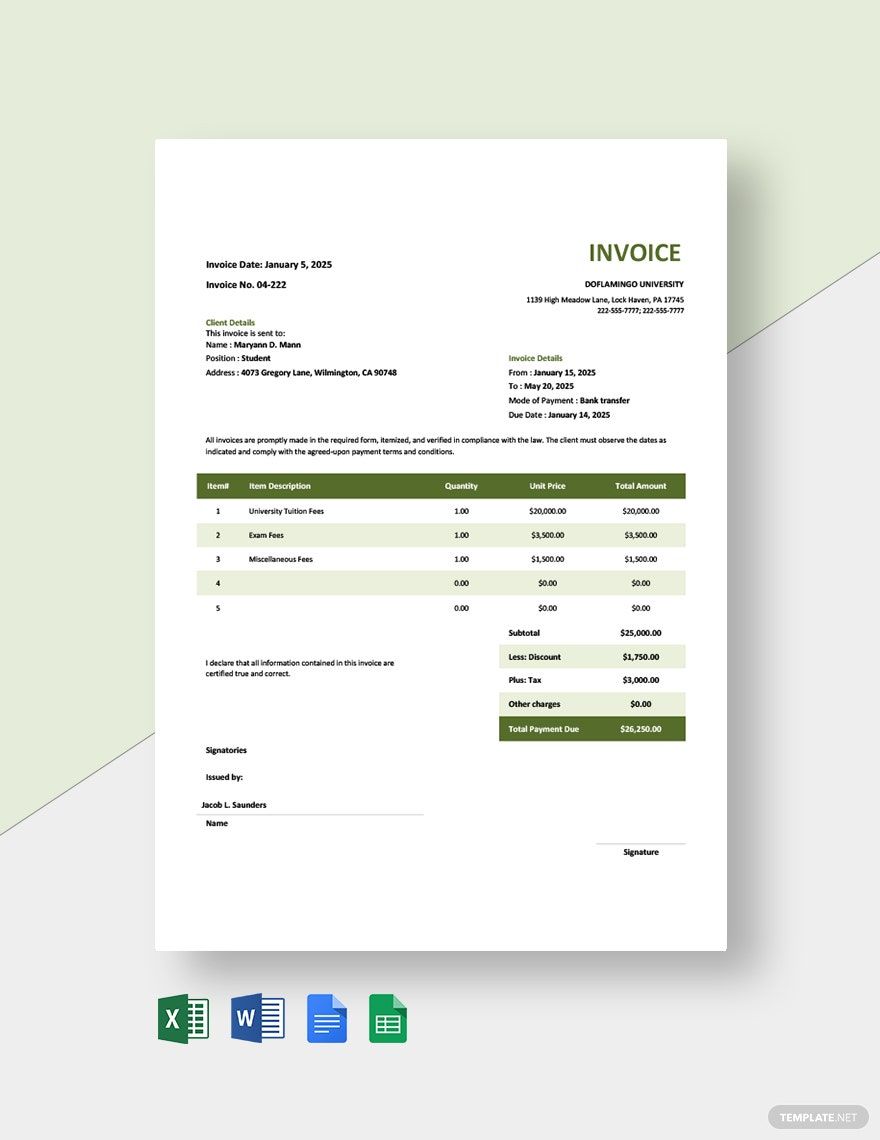

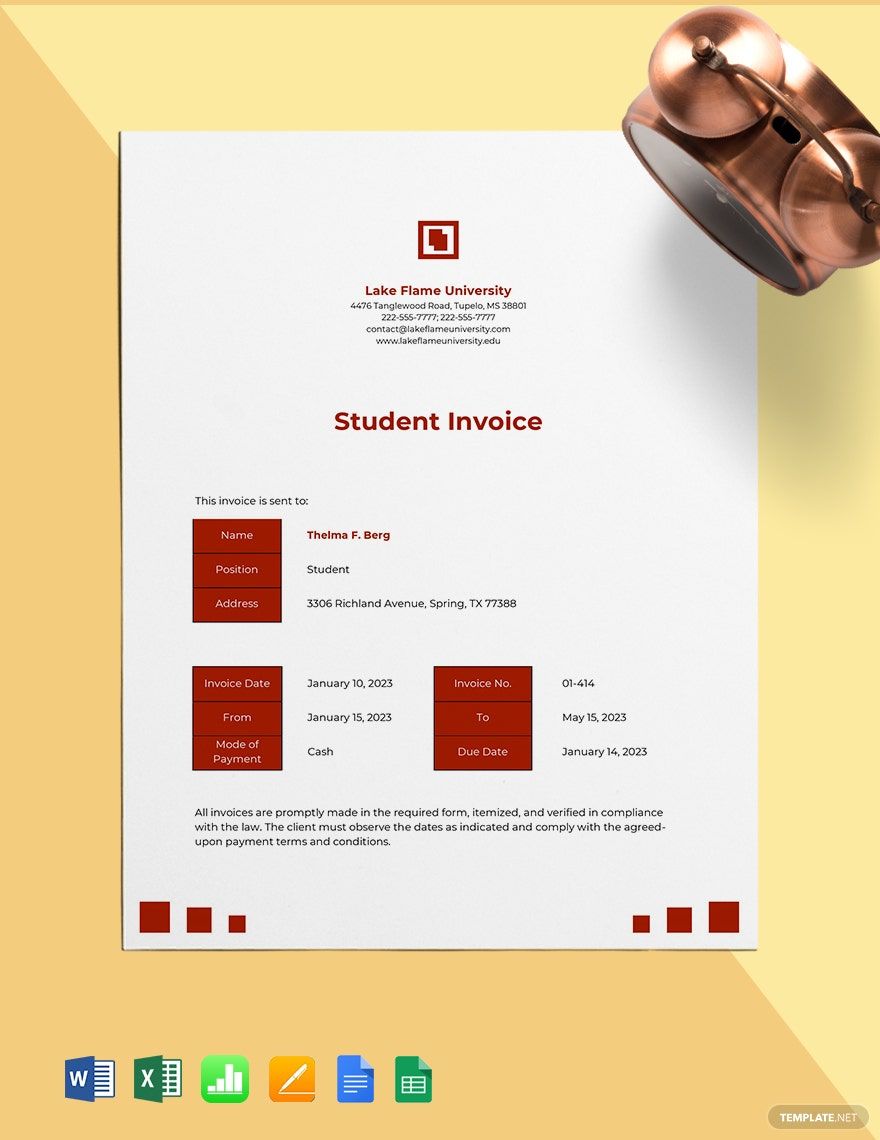

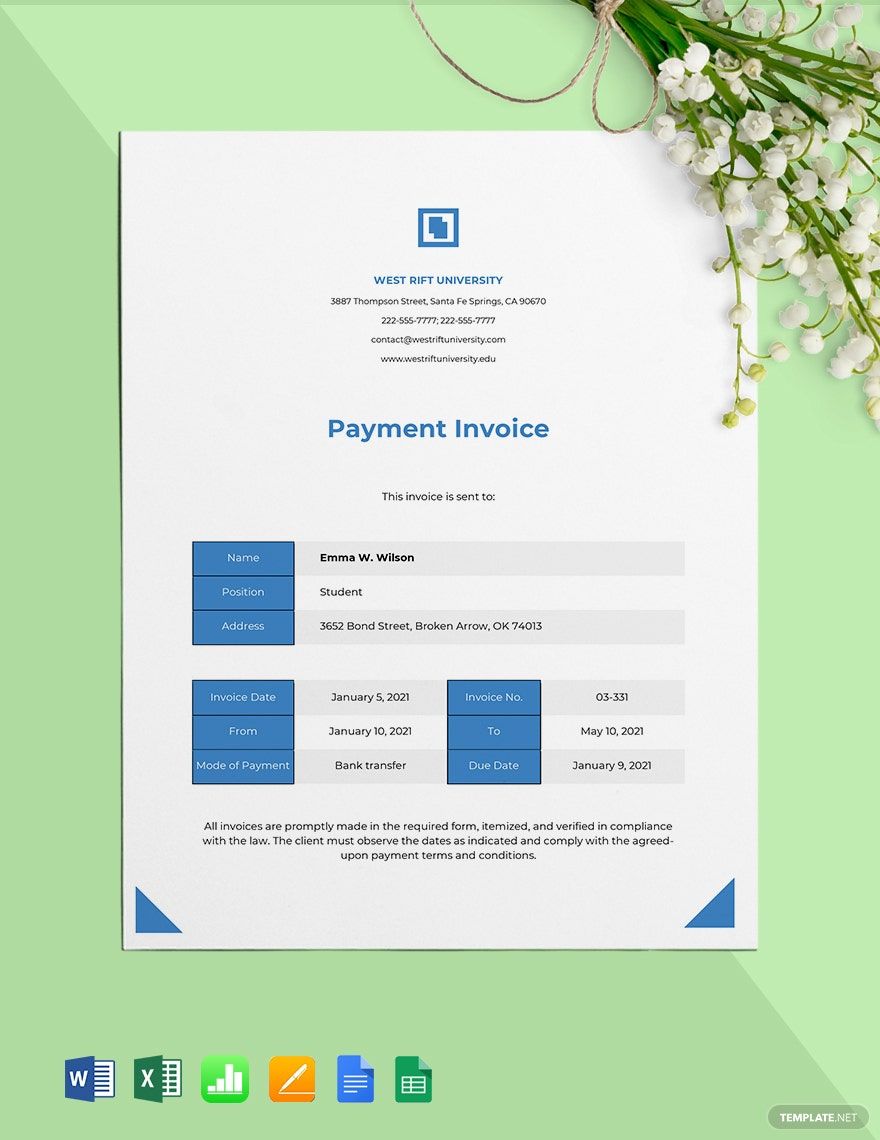

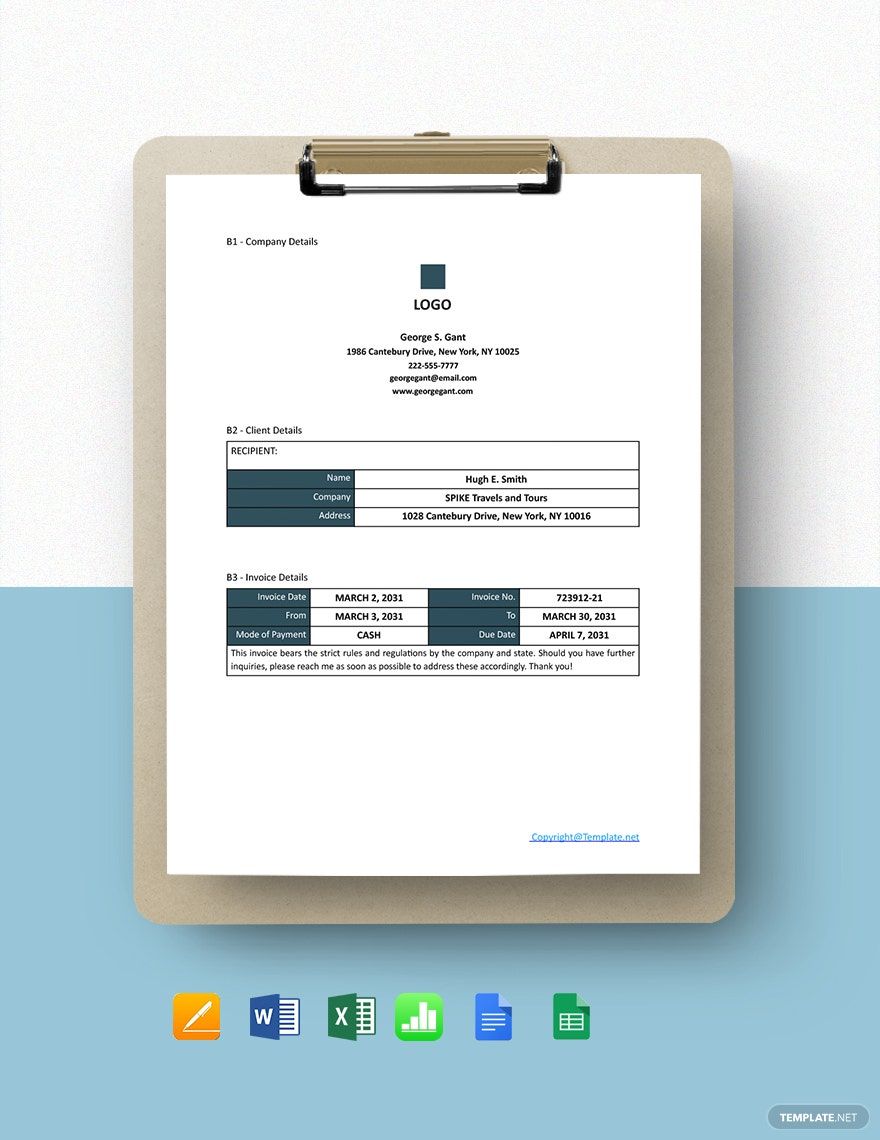

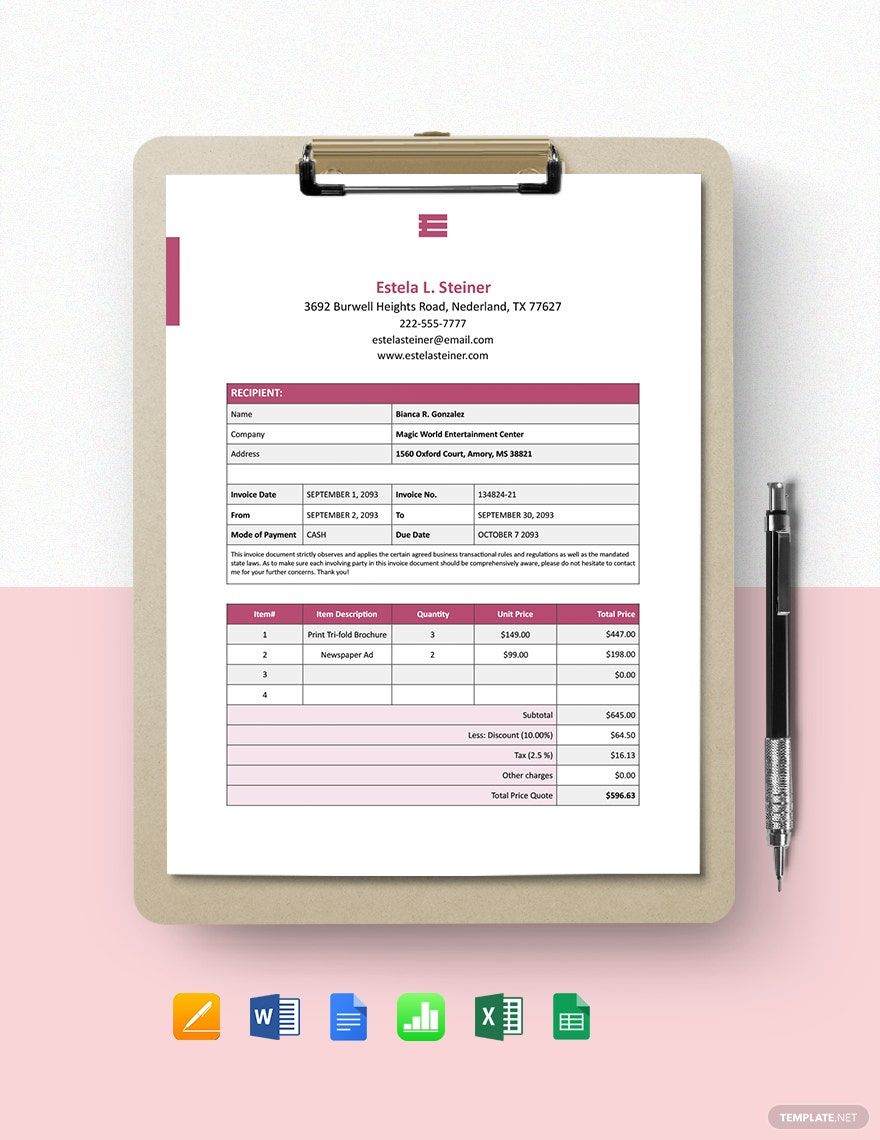

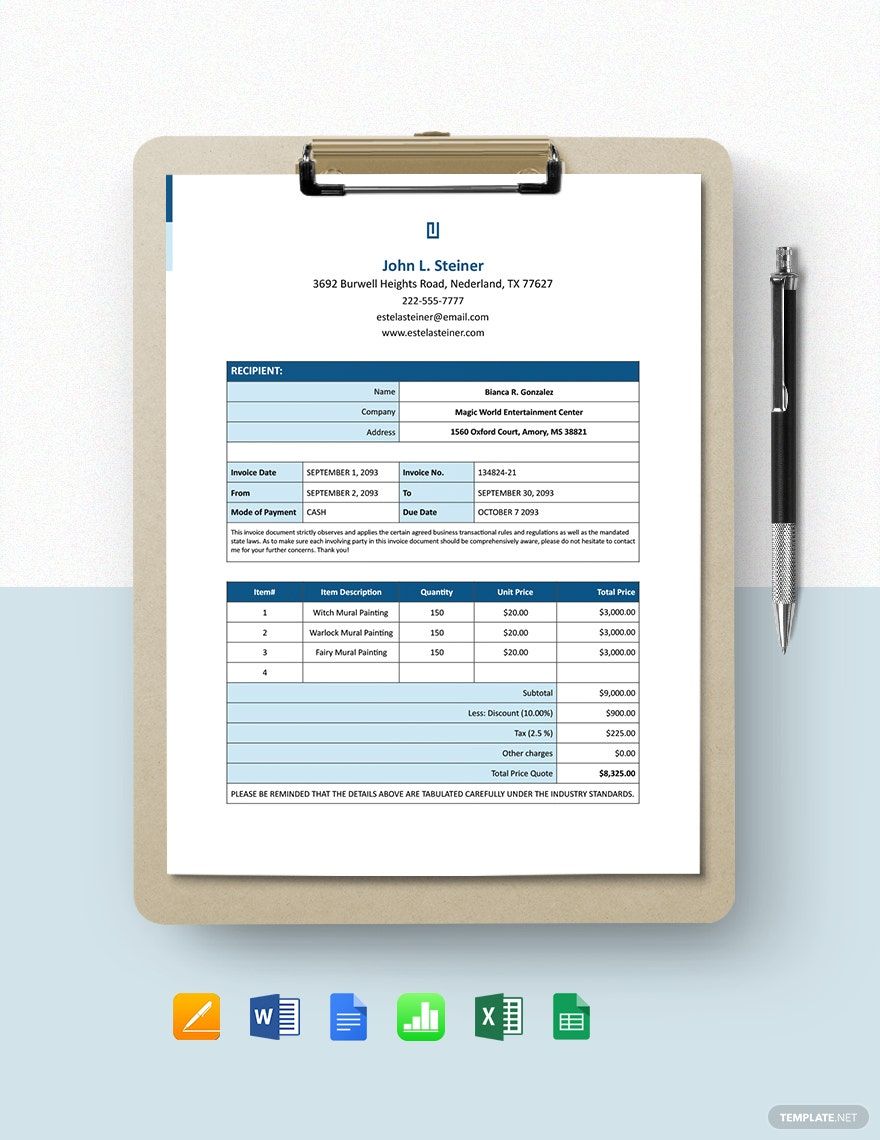

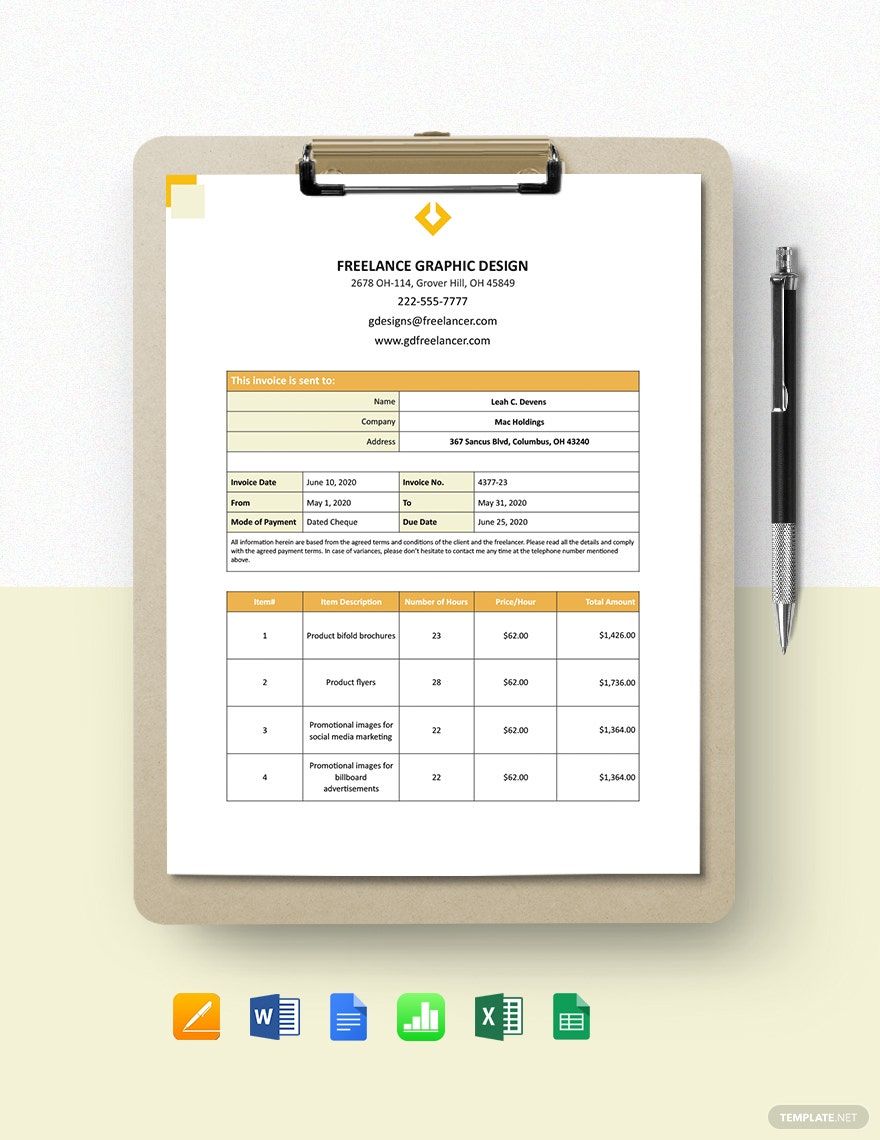

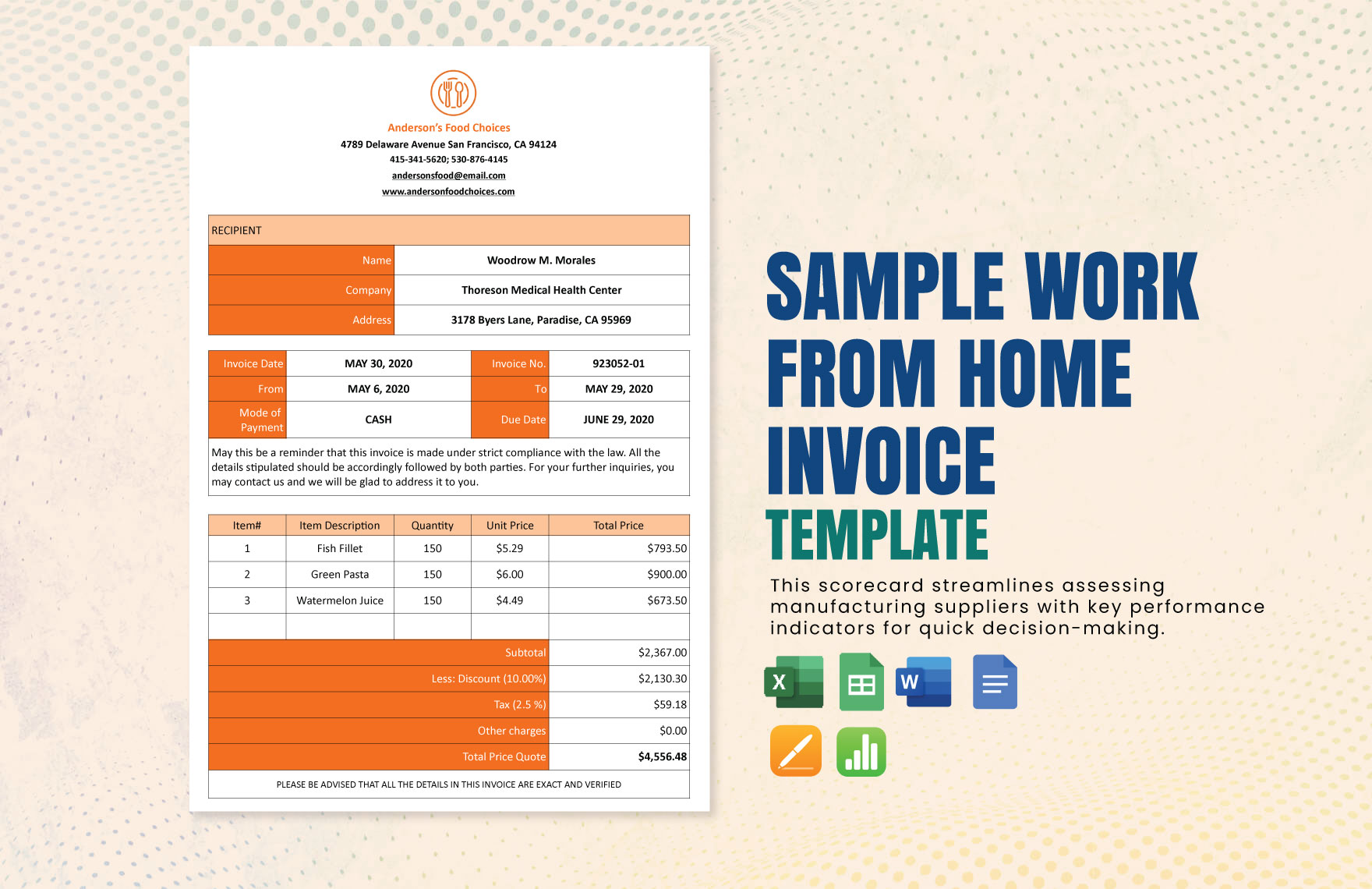

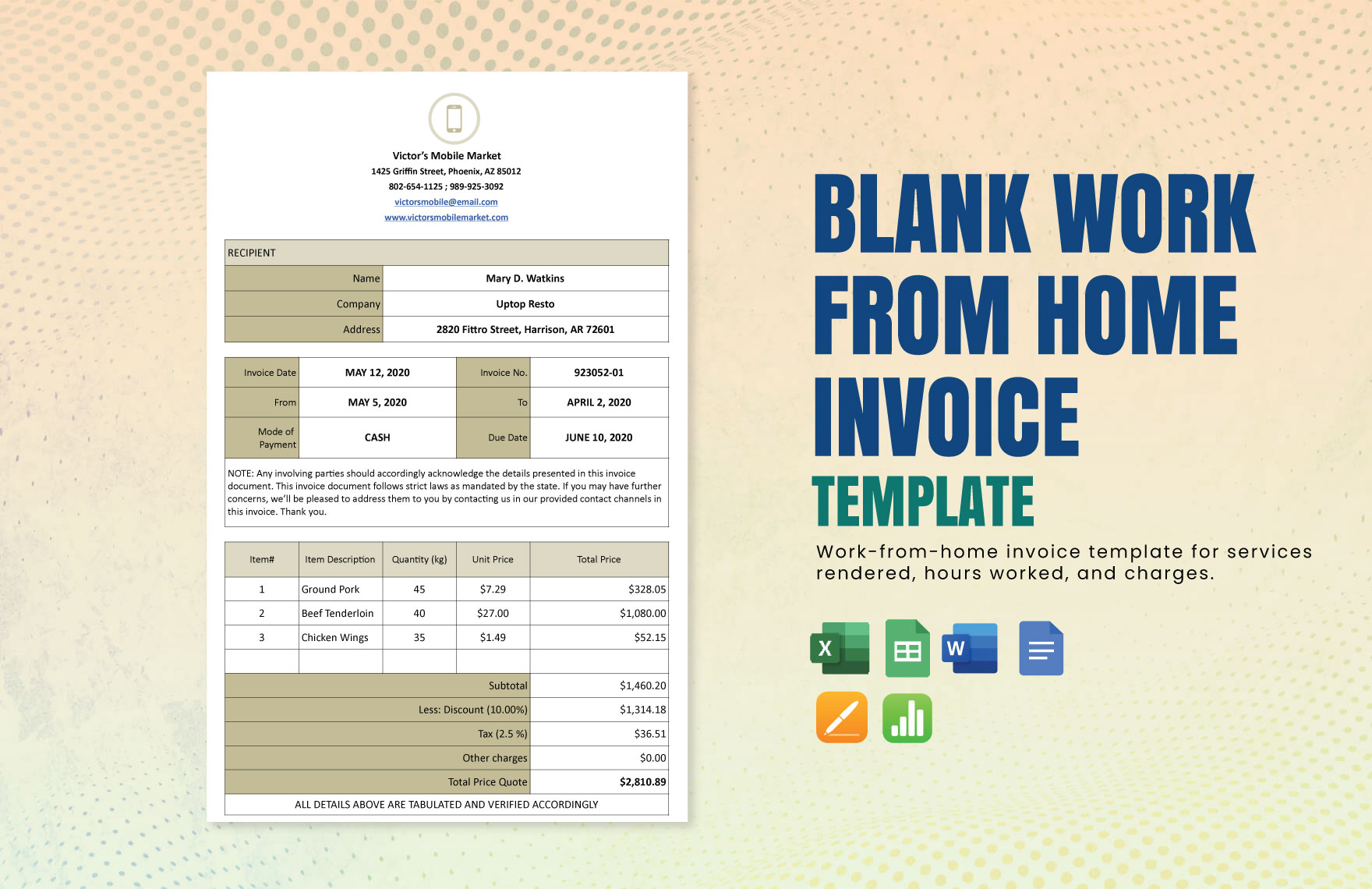

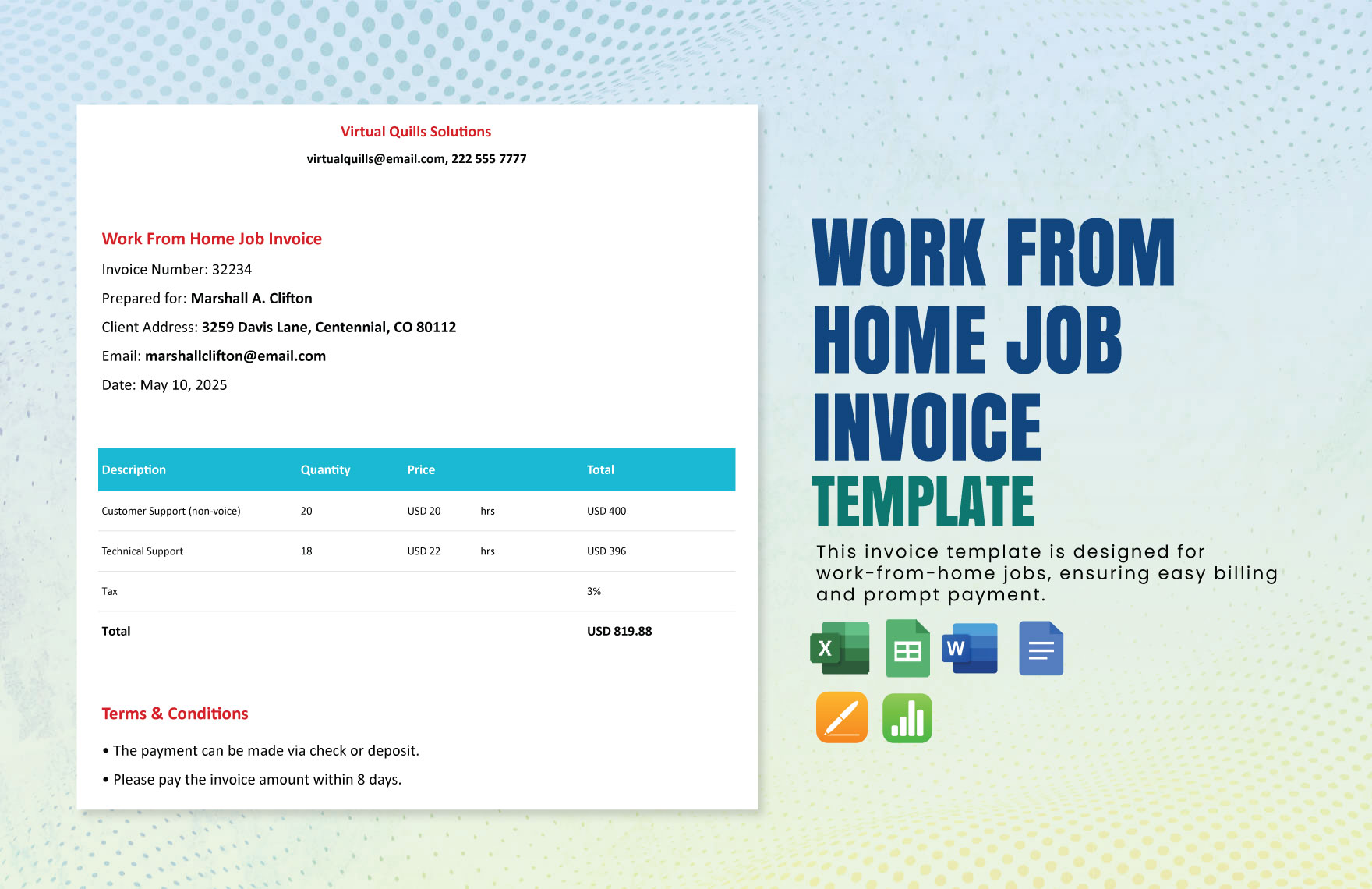

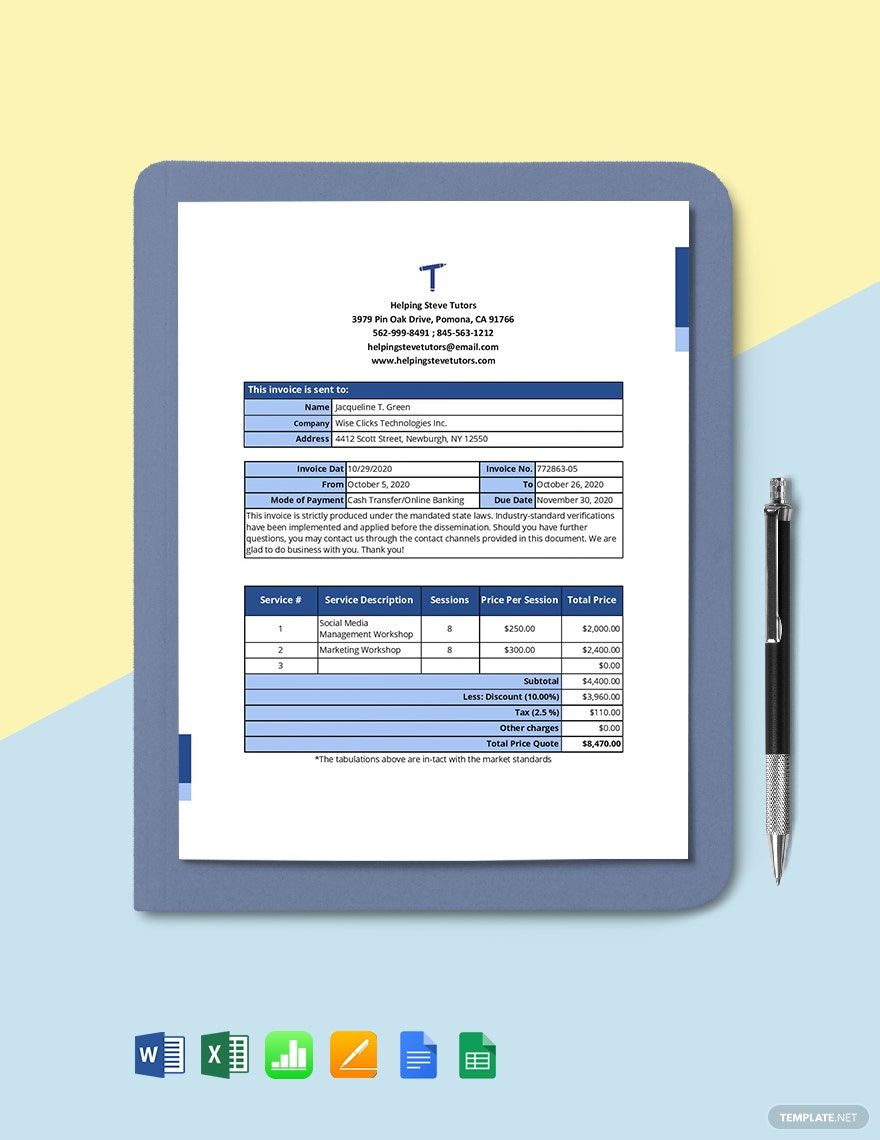

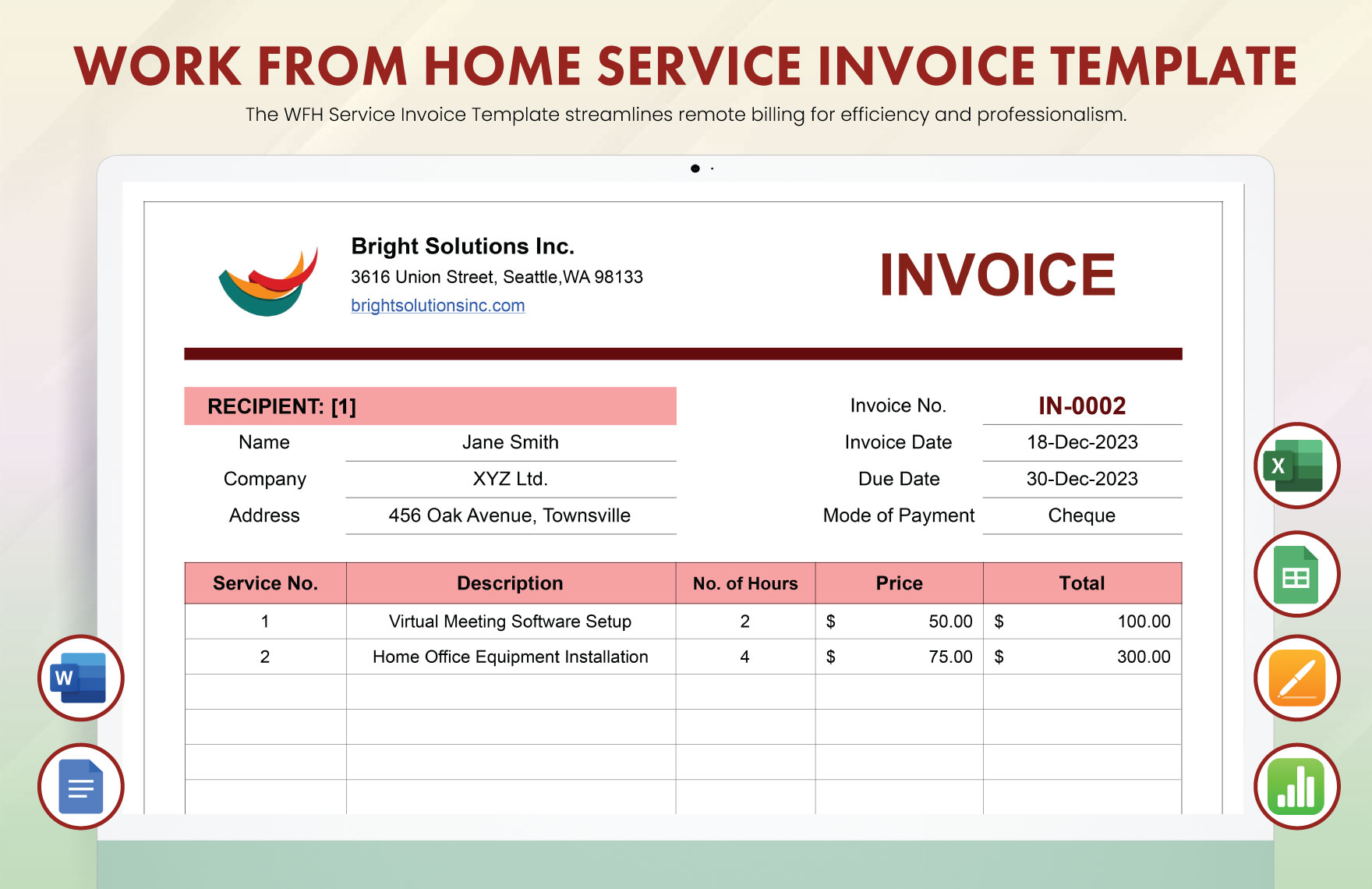

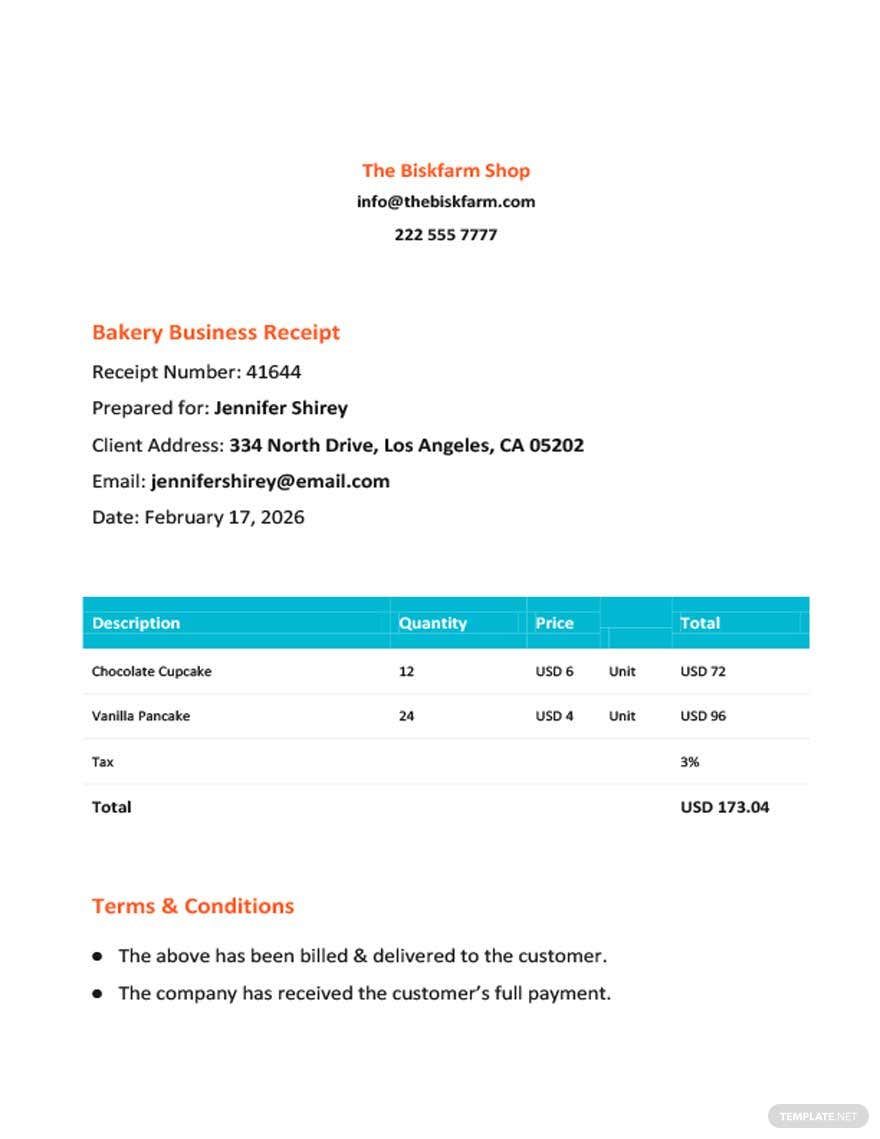

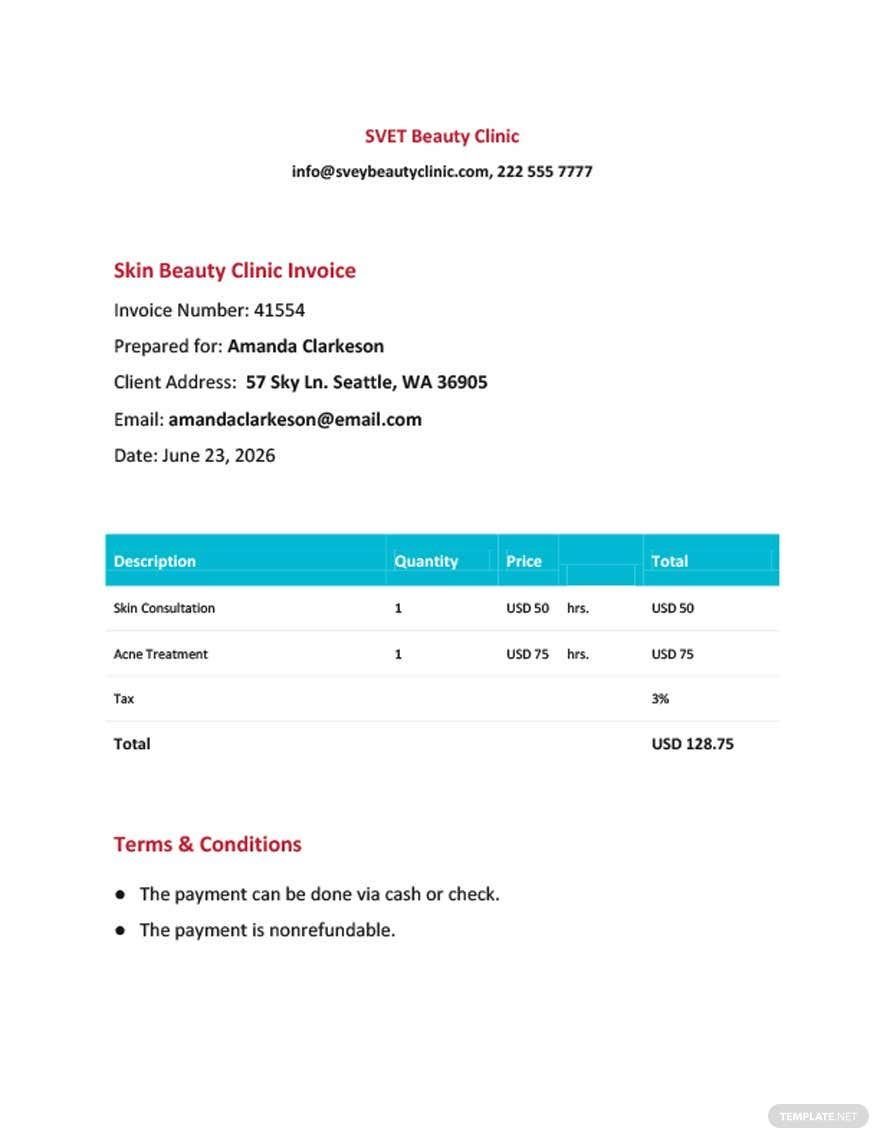

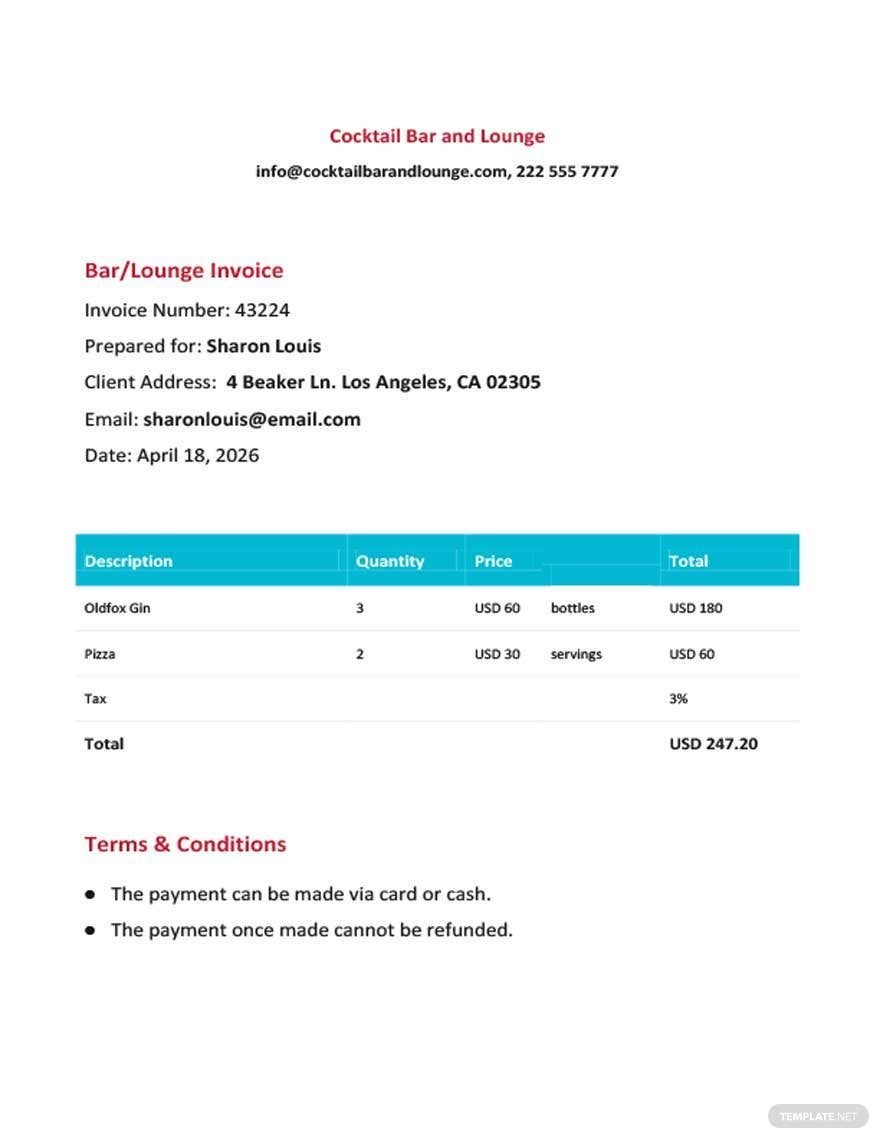

1. Create a Header

Your header should include basic information about your company in a professional font at the top of the document. Basic information includes the company name and logo, business address, and contact details. Your tax identification number should also be included. As laws vary per municipality or state, be sure that you know your local tax code in case you collect sales tax or other usage tax.

2. Indicate Recipient Name

Include the recipient's contact information, then add the invoice number and details. Choose an invoicing system that you are comfortable with, such as a numeric system or a by-date system. Even if you prefer to use the by-date invoicing system, you should still indicate the date of the invoice, and mark it clearly on a separate line. An invoice due date will also be necessary to indicate when you expect to receive payment.

3. Specify the Payment Terms

Indicate in your invoice whether you take cash, checks, credit cards, or other forms of payment. Don’t forget to outline the terms of the late charge fee, if applicable.

4. Itemize the Products of Services

Make a chart to help you break down the information for your products and services. This could include the date, services or products, quantity, rate, hour, the subtotal amount due, and total amount due. Calculate the total, add sales tax, delivery fee, or other fees, and use bold fonts to make it easier for your customer to identify their total due.