Almost every company or establishment has a sufficient budget prepared for a specific period. Planning your budget in advance will help you be prepared for what's to come. If your company is in need of a budgeting tool, look at our site's Corporate Budget Templates. Choose among our professionally written and 100% customizable templates that will cater to all your needs. These templates are available in A4 and US letter sizes and in select file formats. What are you waiting for? Plan your corporate finances with us and download one now!

How to Make a Corporate Budget

According to Ducksters, budgeting is effective in reducing stress. By planning in advance, you get to reduce the possible financial problems in the future. To do this, you need an effective tool or document that will help you keep track of your finances. Below, we will help you create your own corporate budget:

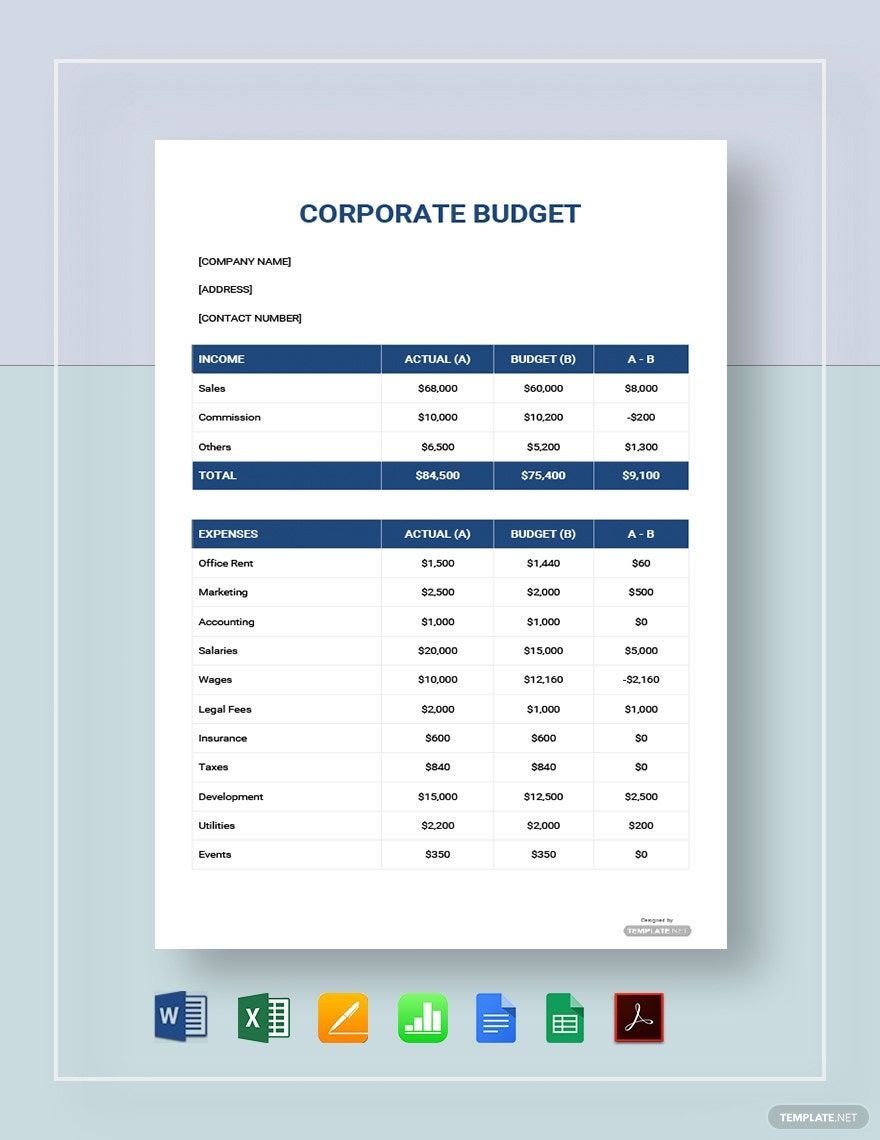

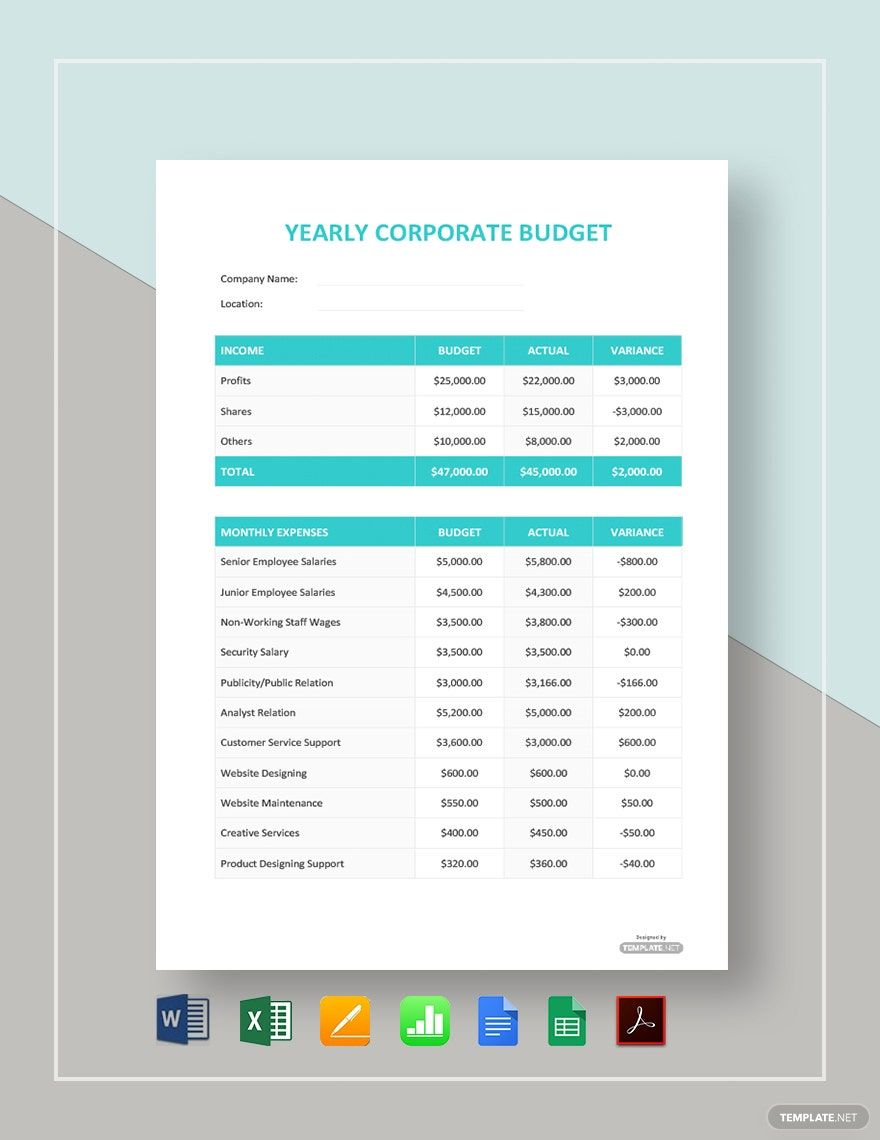

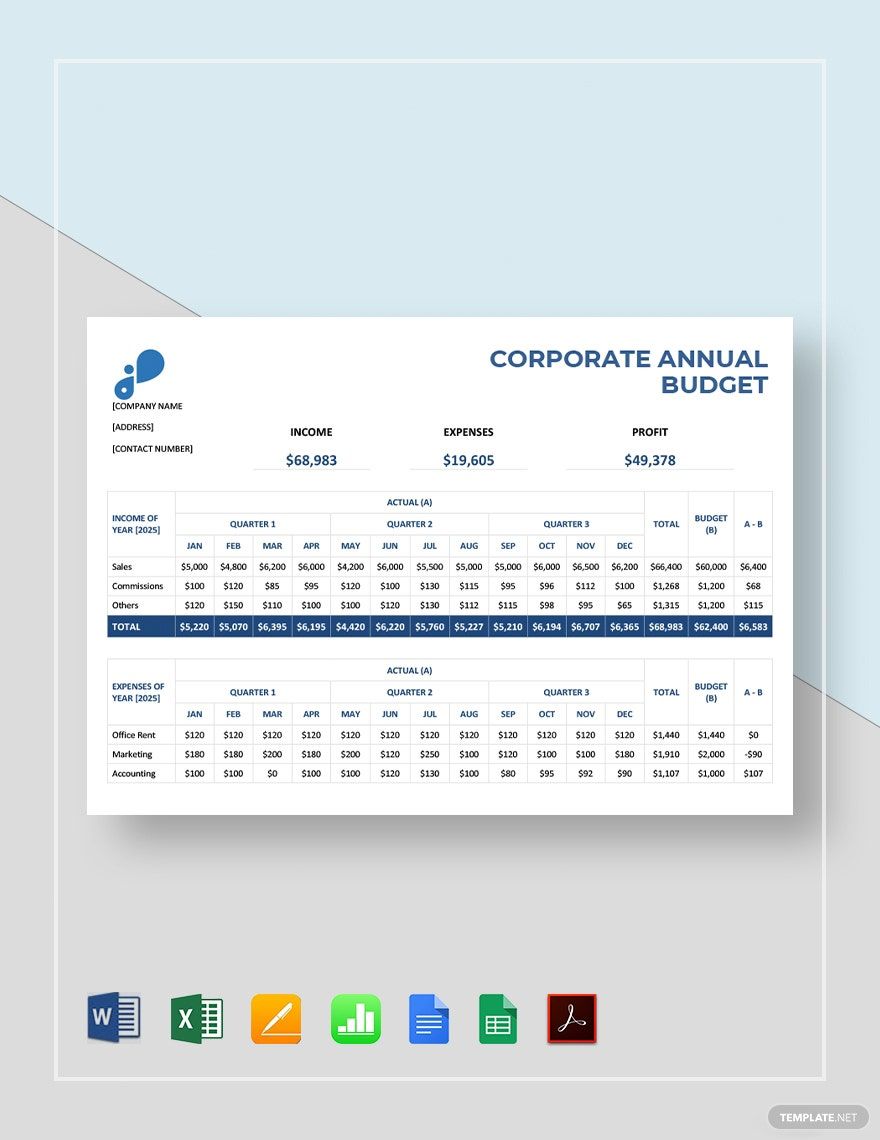

1. Take into Account all the Revenue Streams

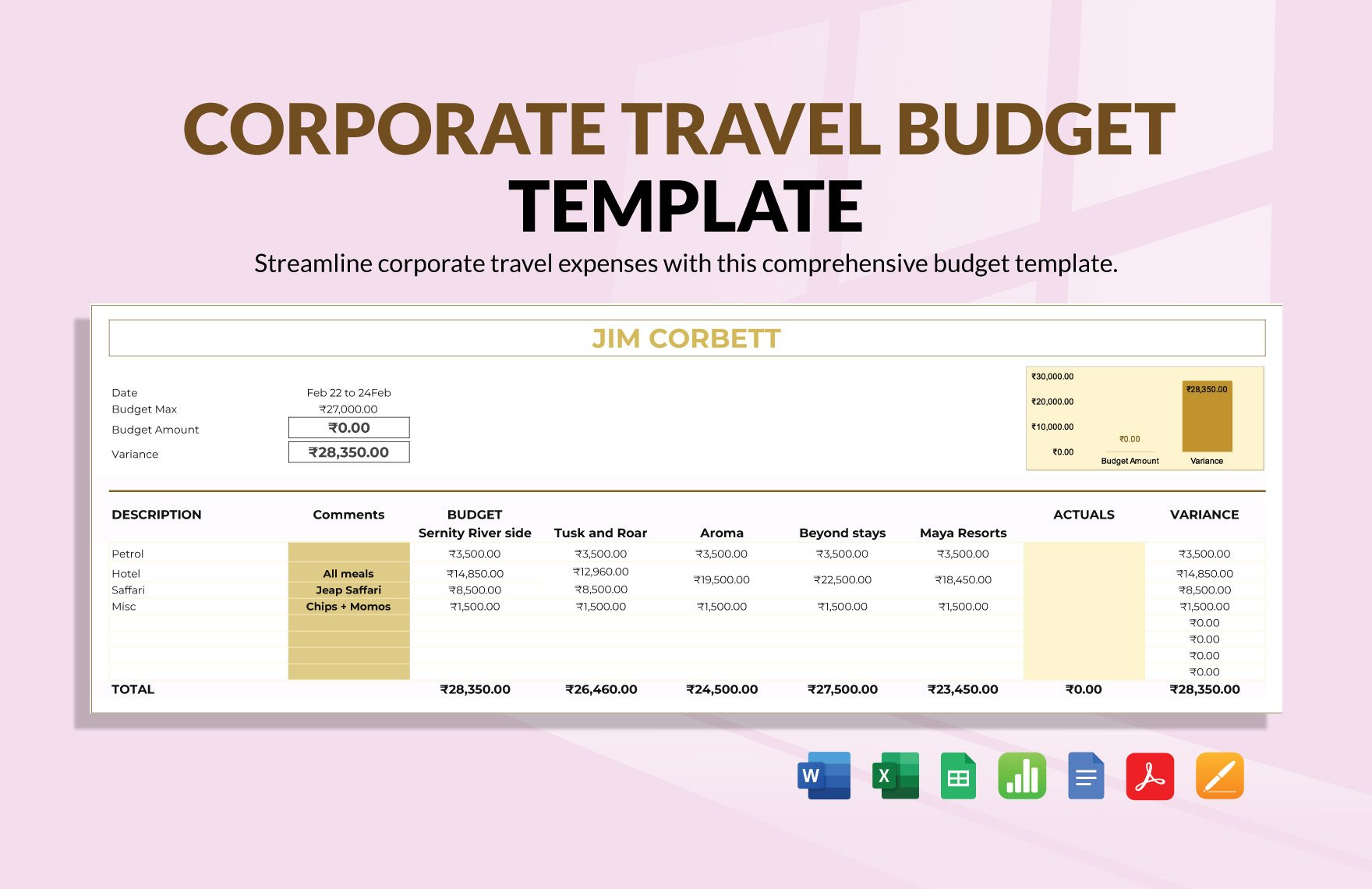

Get all the possible revenue streams so you can properly plan and craft your sample budget. Some of these revenue streams include your product sales, hourly earnings, and investment income. You may use a spreadsheet-based program for your financial budgeting, such as Microsoft Excel and Google Sheets.

2. Coordinate with Department Managers

Some of the revenue streams are handled by different department managers. Coordinate with them regarding the accurate number of the revenue streams and the deadline of the monthly or annual budget. Participate in meetings and inter-office gatherings also.

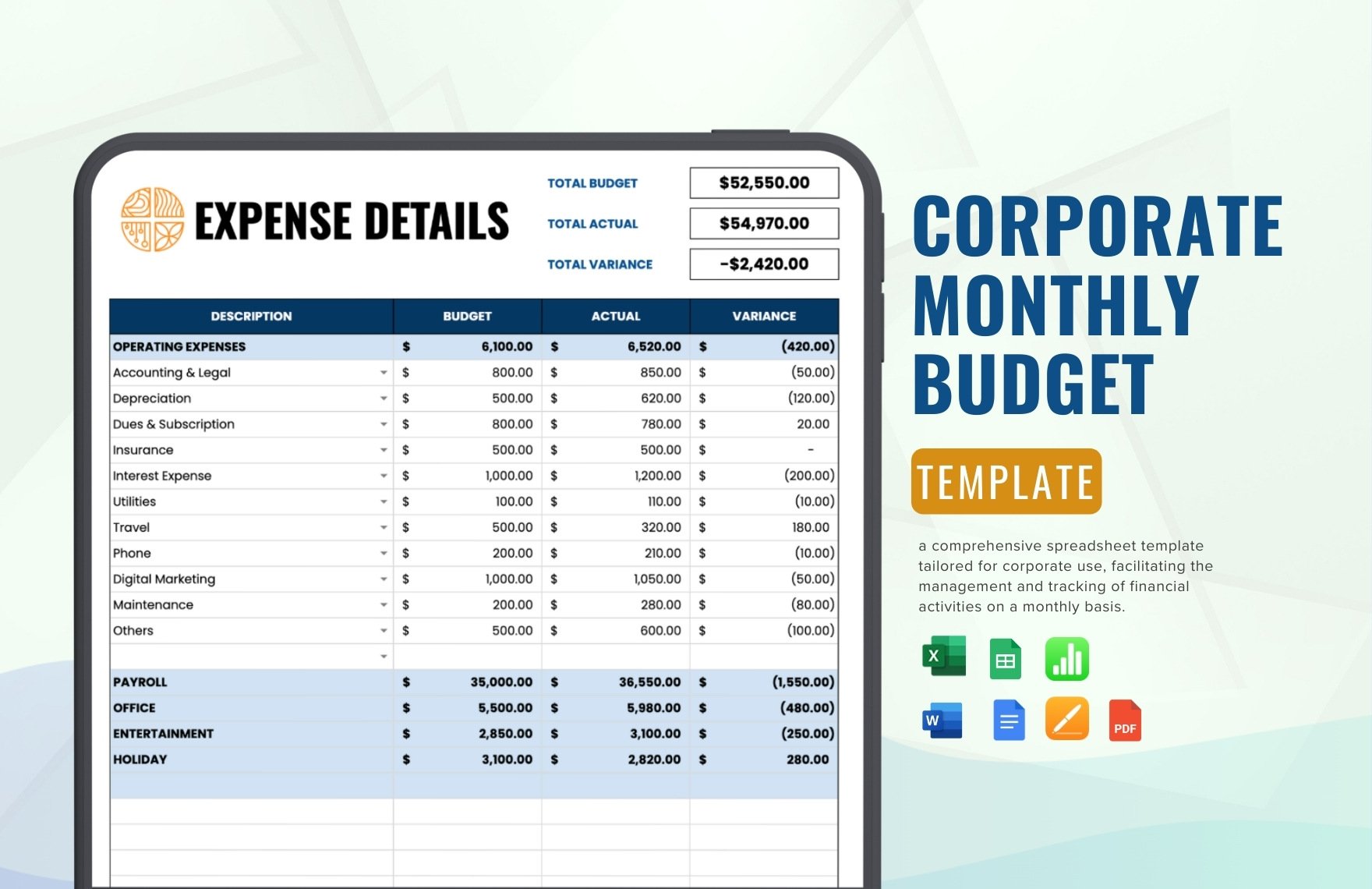

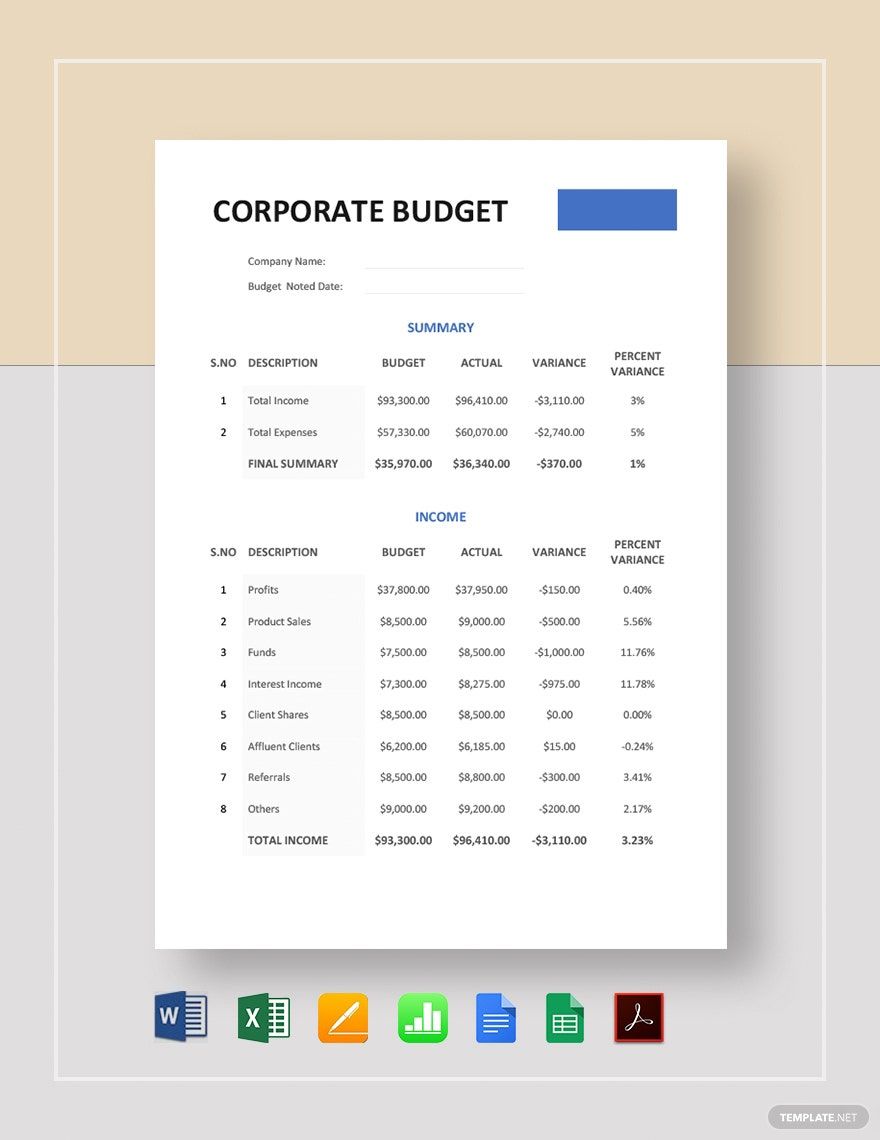

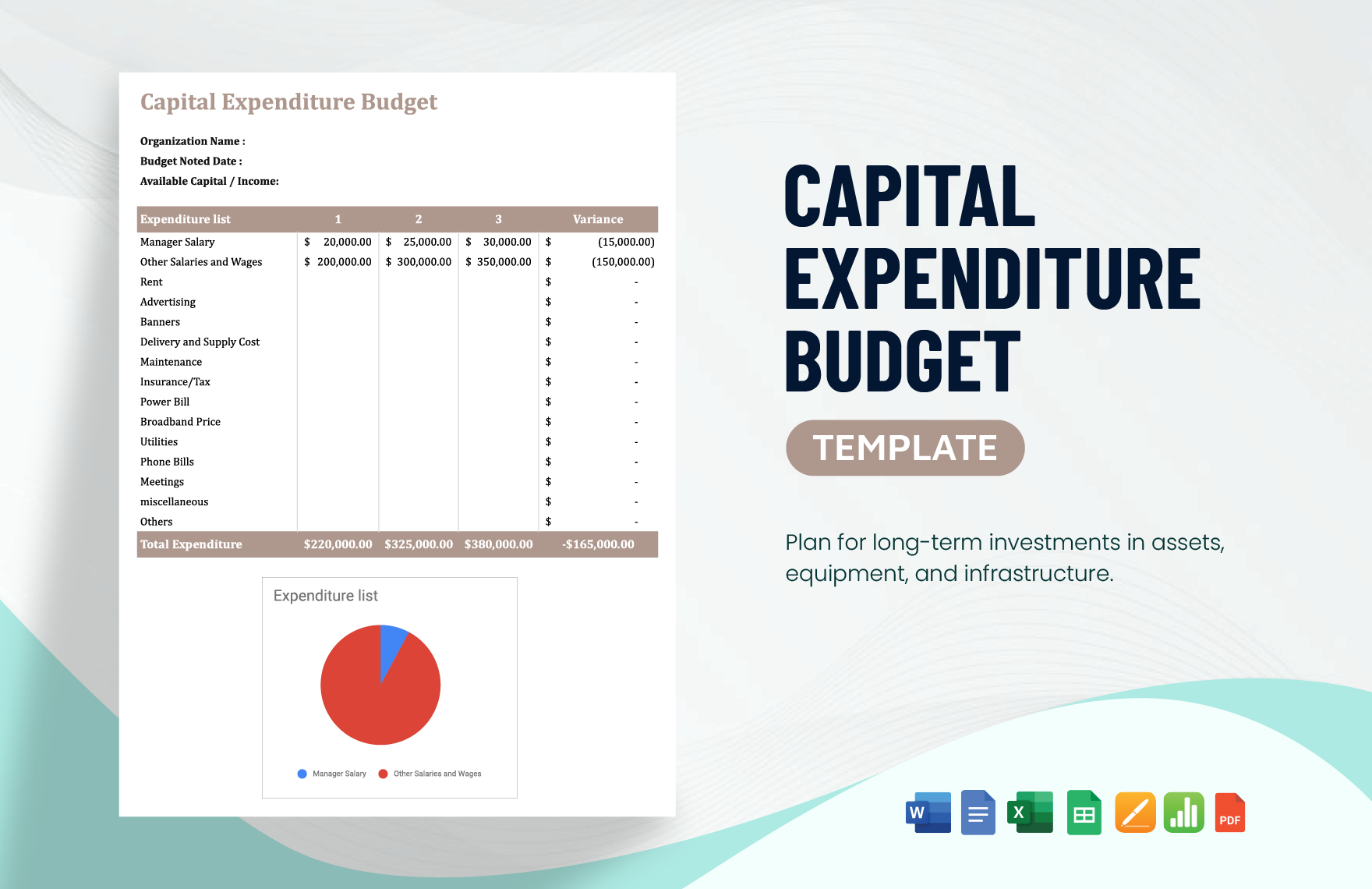

3. Split into Cost Types

There are two types of costs: fixed and variable costs. Fixed costs refer to the permanent amount of costs, such as salaries, insurance, utilities, etc. Variable costs, on the other hand, are non-permanent compared to fixed costs. These are expenses for raw materials, transportation, advertising, etc.

4. Set Up a Contingency Fund

There will be unexpected instances wherein you will have to dish out money because of unnecessary expenses. Consult with the Finance department about how much money should go into the contingency fund. Aside from securing your future, you're also avoiding unnecessary stress.

5. Set Goals on How You Can Increase Your Revenue

If you want to increase your printable budget as well as your contingency fund, set goals on how you can increase your revenue. One effective way of doing this is to increase the rates of your product prices. Again, communicate with department managers on how you can effectively increase your revenue.