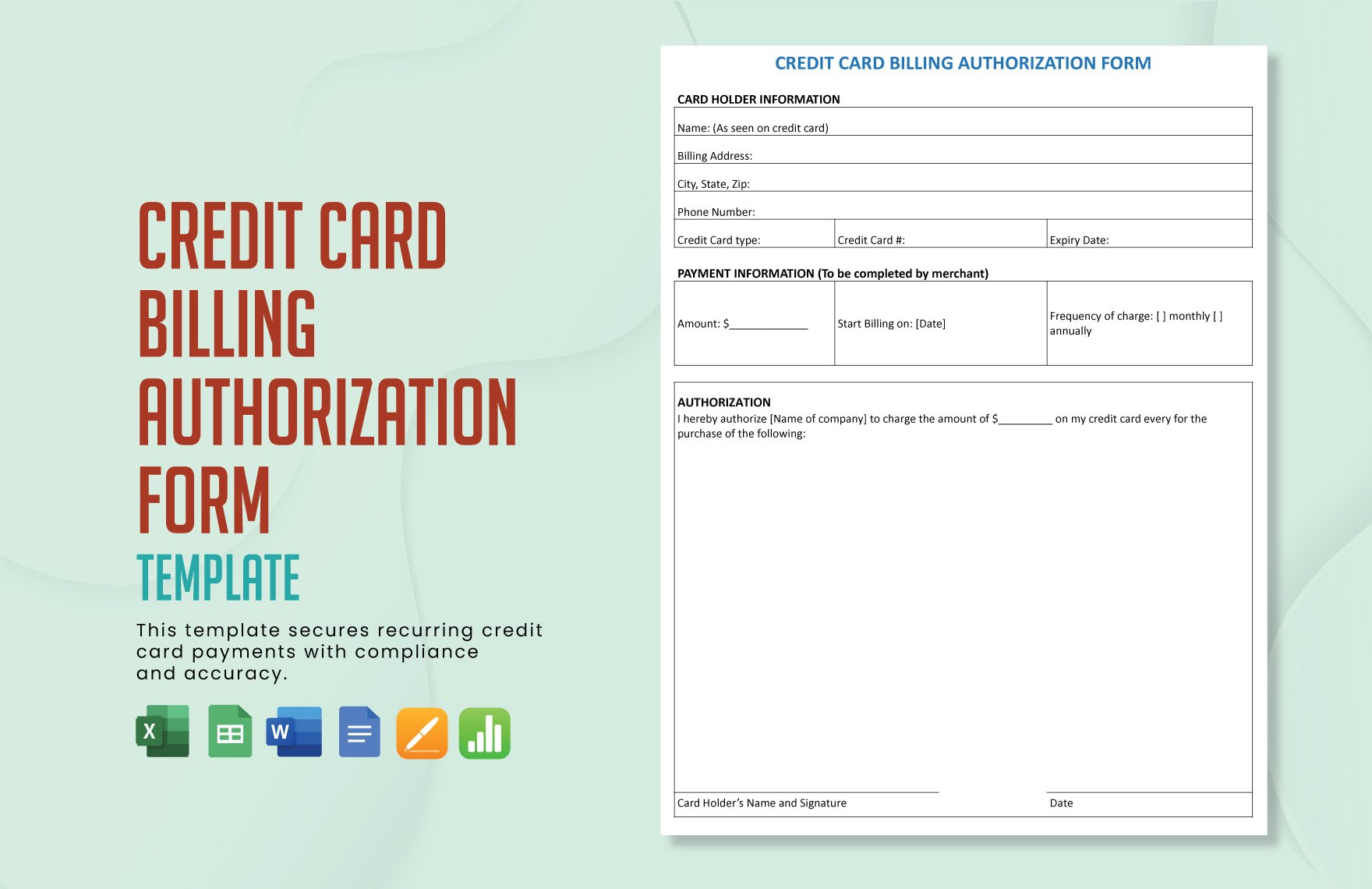

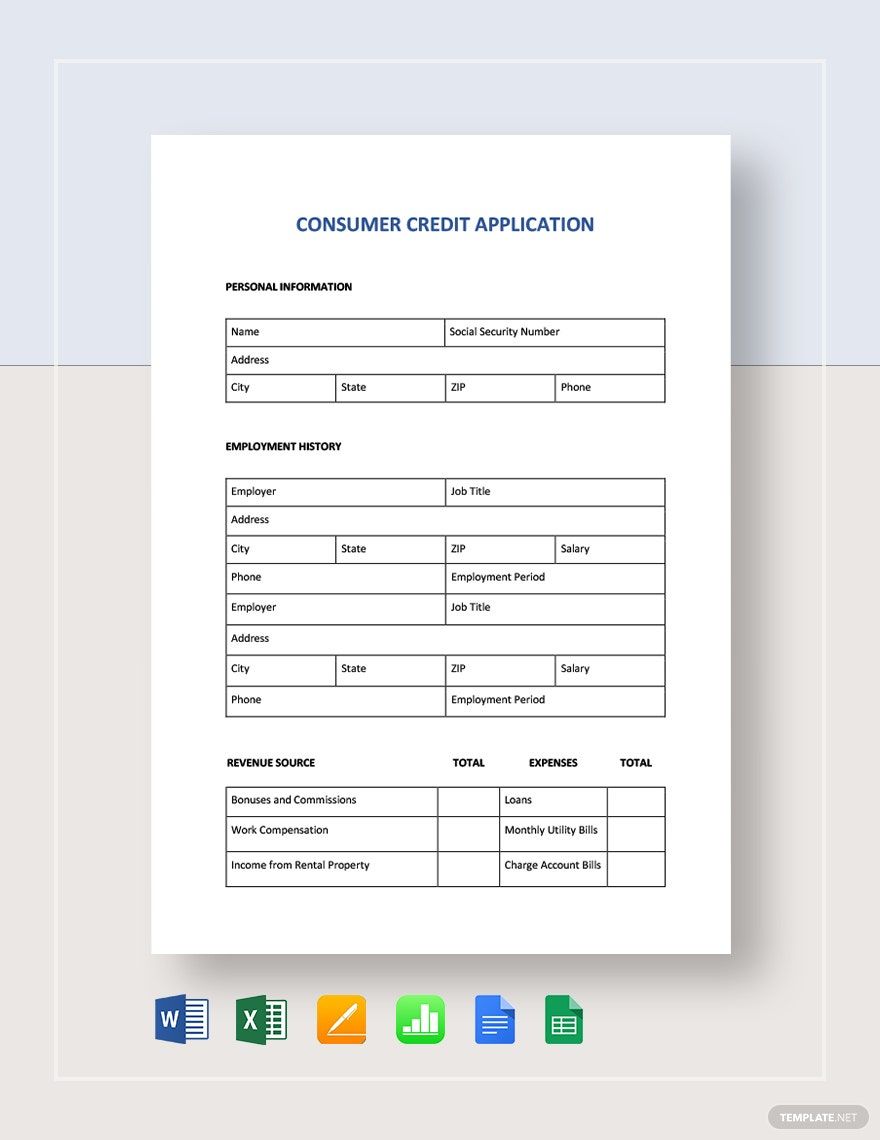

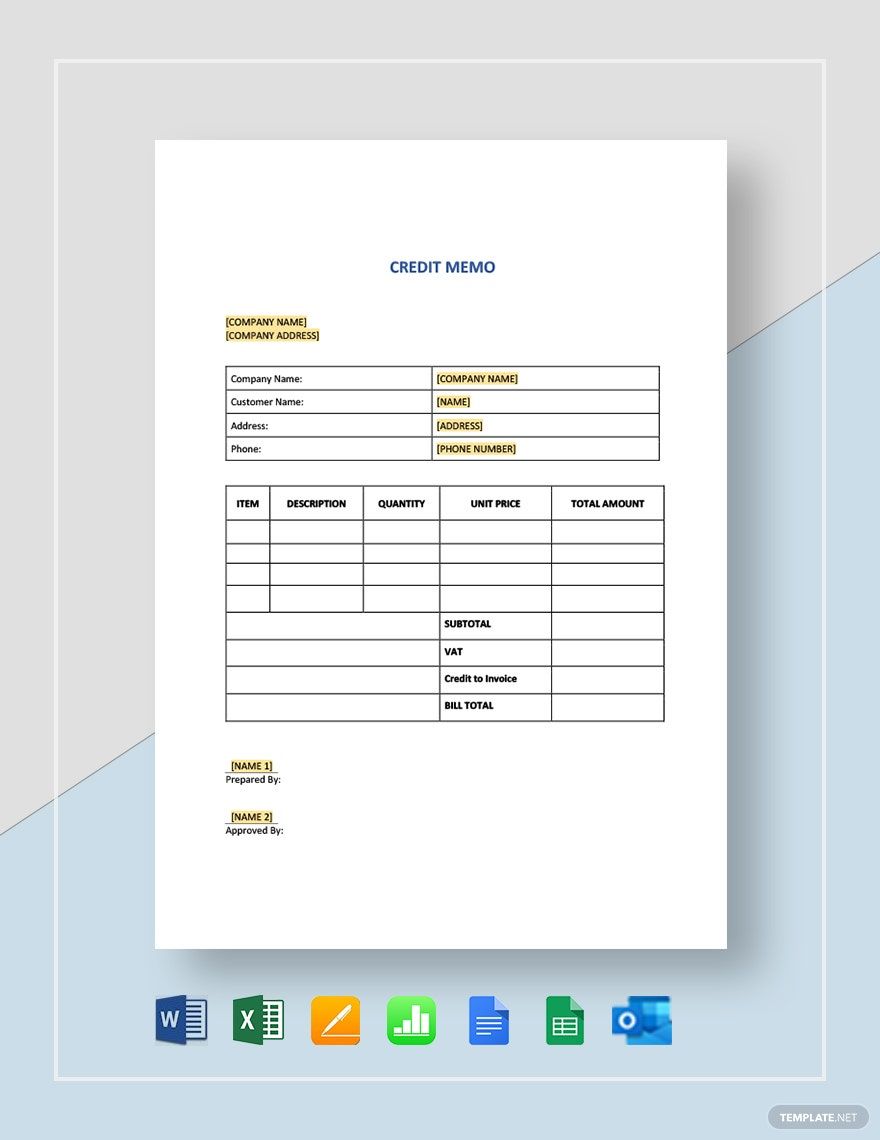

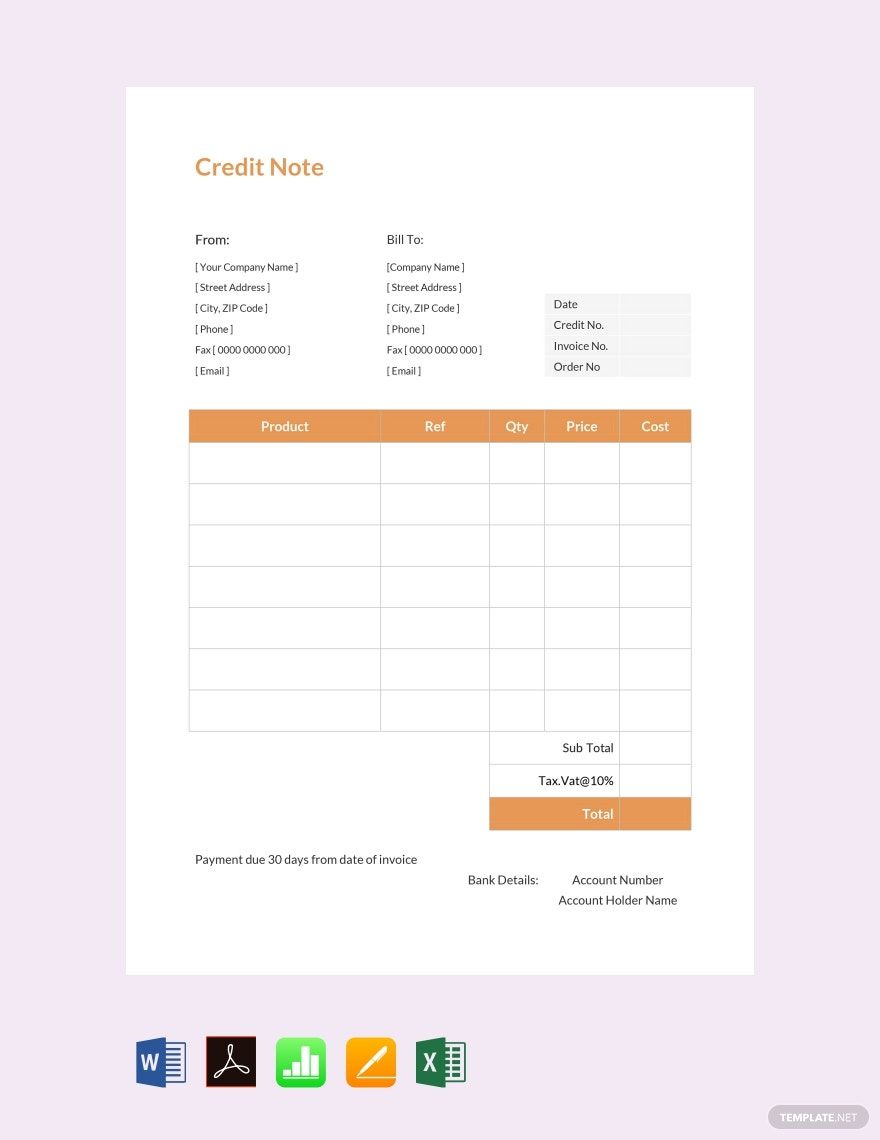

Credit is very important to businesses and households. Company businesses, families, and even countries make use of it. However, in order to avoid dispute, debts owed must be paid. If you are looking for easily editable credit and collection templates that you can use for in settling demand credits reimbursement, look no further. Template.net pro offers you a wide variety of high-quality and ready-made credit & collection templates that are all 100% customizable in Apple Numbers. From consumer credit application forms to credit memos, we got it all. If you avail them now, we assure you that all of them are professionally designed with useful contents fit for your business preference. Save yourself from the hassle of creating them from scratch by downloading and utilizing any of our expertly written credit and collection templates right now!

How To Create Credit And Collection In Apple Numbers

Credit is the process of providing loans to a person, in which one party would transact money to another with full expectations that it will be paid back fully together with the interest. Collections, on the other hand, is connected to the term "credit". It generally refers to the combined current period sales and credit sales of the last period. As a whole, credit collection refers to the debt recovery process of compensating past-due credit loans of a consumer in debt.

Creating credit collection forms and letters is like making a resume, it is a very challenging task that requires a lot of time and effort. But with the right utilization of a compatible software editing tool such as Apple Numbers, this task becomes easier for you. To help you get started, we have provided some useful guide tips below on how you can successfully construct one.

1. Know What To Include

If it's your first time constructing formal documents like credit collection letters and forms, the first thing that you should do is to conduct research. Look for any kind of credit collection letter samples and forms on the internet, and analyze the vital information stated in it. A typical credit application form usually includes the usual "boilerplate" information such as name, address, and contact information. It should also include social security number, current employer, income, bank information, and a co-signer.

2. Present Every Details Clearly

The most important characteristic of formal documents like this is clarity. Clarity with how you present and arrange all the vital information. In stating them, avoid using lengthy words, opt to use one word, if applicable.

3. Construct It Logically

To construct a functional debt collection form, you have to be systematic and logical in arranging all its details. Use hierarchy in arranging them by starting with personal information, followed by employment history, and lastly, the overall payment expenses.

4. Incorporate Branding Elements

Credit loans are commonly provided by different loan agencies. If you have filled up a credit application form before, you'll probably notice that most agencies incorporate their branding image into it as a form of ownership to the document. If you happen to be one, it's probably advisable for you as well to incorporate yours, but just don't overdo it. Apply a minimal amount only of branding images into it, the design is the least priority when it comes to confidential business documents like these.

5. Proofread

After successfully constructing your credit and application form, don't print it right away. Proofread and check everything first for correctness. Recheck everything from top to bottom and make sure that no vital information was forgotten. If you are confident about it, you may now print the form and use it.