It's very important to prepare a well-written agreement especially when it involves goods in exchange for borrowed cash. This is the case with pledge agreements wherein the title of a debtor's property is temporarily transferred to a creditor while they are still unable to pay through cash. Thankfully, Template.net is offering easily editable and fully printable Pledge Agreement Templates that you can download anytime and anywhere. Start crafting impressive agreements by simply subscribing to our premium templates, you can even choose to download it in either .doc or .pages. So what are you waiting for? Subscribe now.

How to Create a Pledge Agreement?

An agreement is a legally bound arrangement between two or more parties which usually involves a common goal. For donation and pledge definitions, the former refers to gifts that are given unconditionally and is commonly done by nonprofit organizations. The latter, on the other hand, refers to a promise of giving a contribution either by cash or by goods.

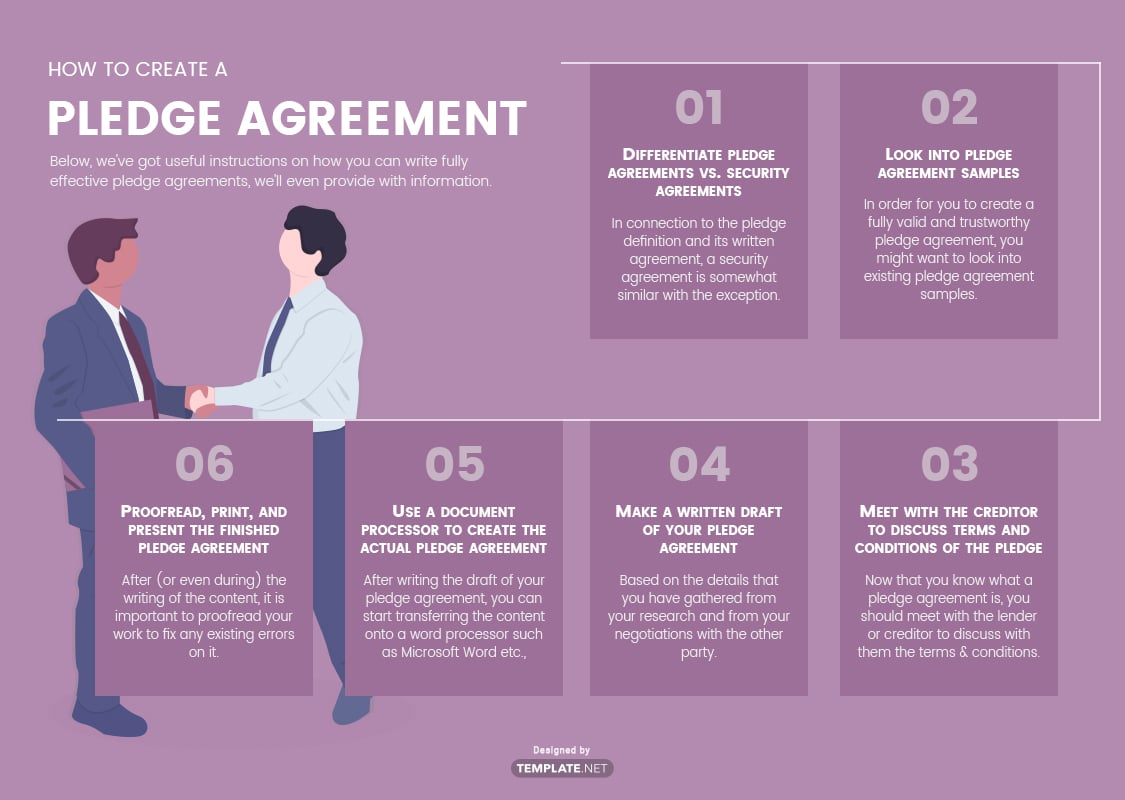

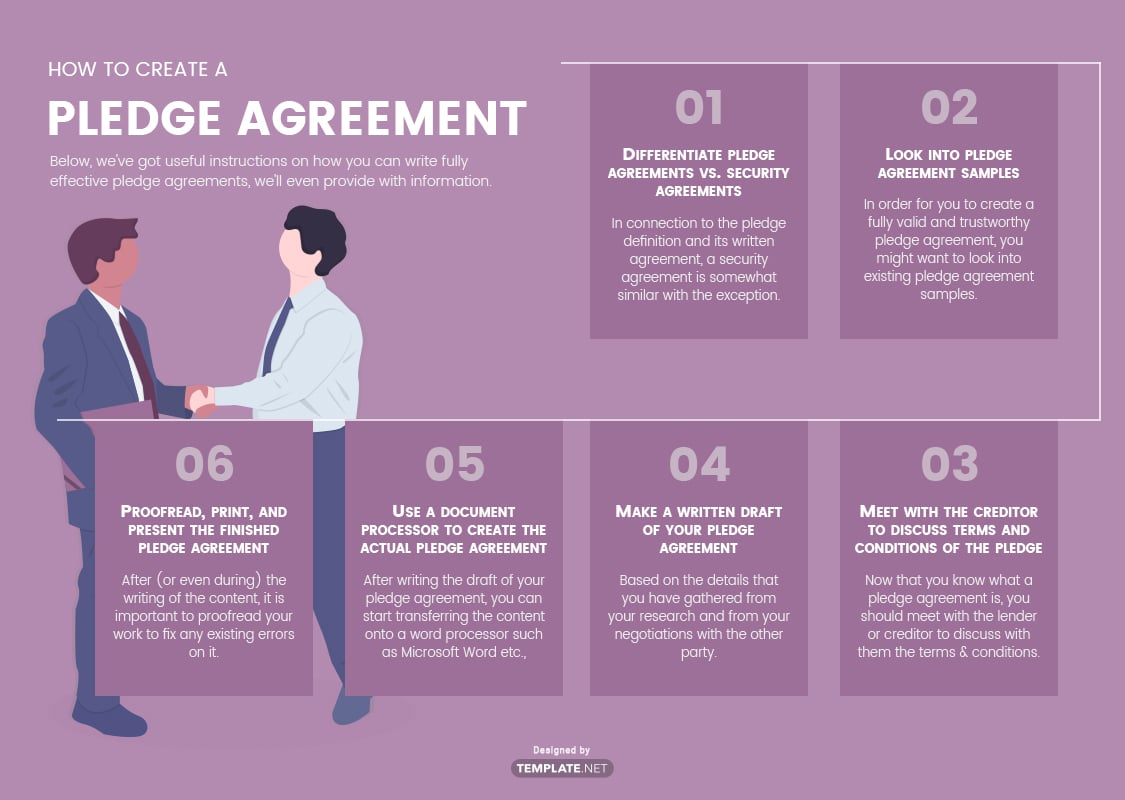

Below, we've got useful instructions on how you can write fully effective pledge agreements, we'll even provide with information on how to distinguish between pledge and security agreements. These instructions are very easy to follow, even inexperienced people can make well-written basic agreements with it.

1. Differentiate pledge agreements vs. security agreements

In connection to the pledge definition and its written agreement, a security agreement is somewhat similar with the exception of a security interest for the lender. Between pledge agreements vs. security agreements, both can be used when talking about a written contract related to the temporary transfer of property titles for unpaid cash debts. However, if an interest rate is involved with the pledge of goods, then this refers to security agreements.

2. Look into pledge agreement samples

In order for you to create a fully valid and trustworthy pledge agreement, you might want to look into existing pledge agreement samples and gather as much information as you can. If you have access to pledge agreements that have been used in actual scenarios, go ahead and educate yourself with them. Otherwise, you can also refer to sample agreements found on the internet.

3. Meet with the creditor to discuss terms and conditions of the pledge

Now that you know what a pledge agreement is, you should meet with the lender or creditor to discuss with them the terms and conditions to be included in your written contract. For a stock pledge agreement, discuss with the other party the types of stocks and the quantity for each stock. For a bank pledge agreement, always take note of the bank's standards and incorporate it into the contract.

4. Make a written draft of your pledge agreement

Based on the details that you have gathered from your research and from your negotiations with the other party, you can start composing a simple draft of the pledge agreement. Since this is still the initial version of the document, you can still make revisions and tailor the content to satisfy the other party. If you want, you can actually get the other party involved in writing the draft.

5. Use a document processor to create the actual pledge agreement

After writing the draft of your pledge agreement, you can start transferring the content onto a word processor such as Microsoft Word, Google Docs, or Apple Pages to finalize it. Here, you will need to use a simple yet appropriate font type and follow the standard format to make your pledge agreement look professional. If revisions to the content are necessary during this step, feel free to make them.

6. Proofread, print, and present the finished pledge agreement

After (or even during) the writing of the content, it is important to proofread your work to fix any existing errors on it. These errors may range from grammatical errors to misspelled words, some errors may even involve the entire sentence which will need some rephrasing. After proofreading your work, you can then have it printed, signed, and presented to the respective recipient.