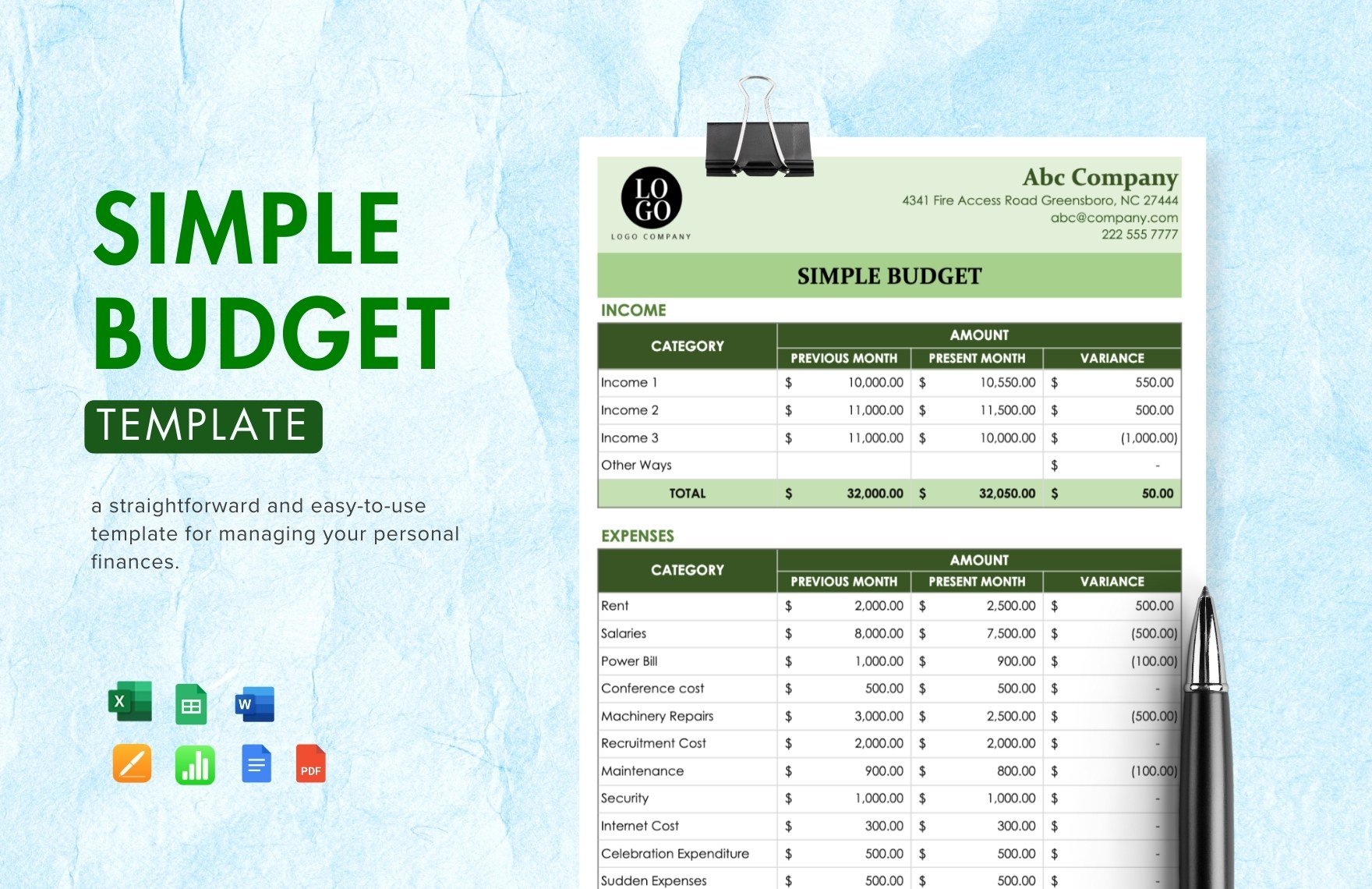

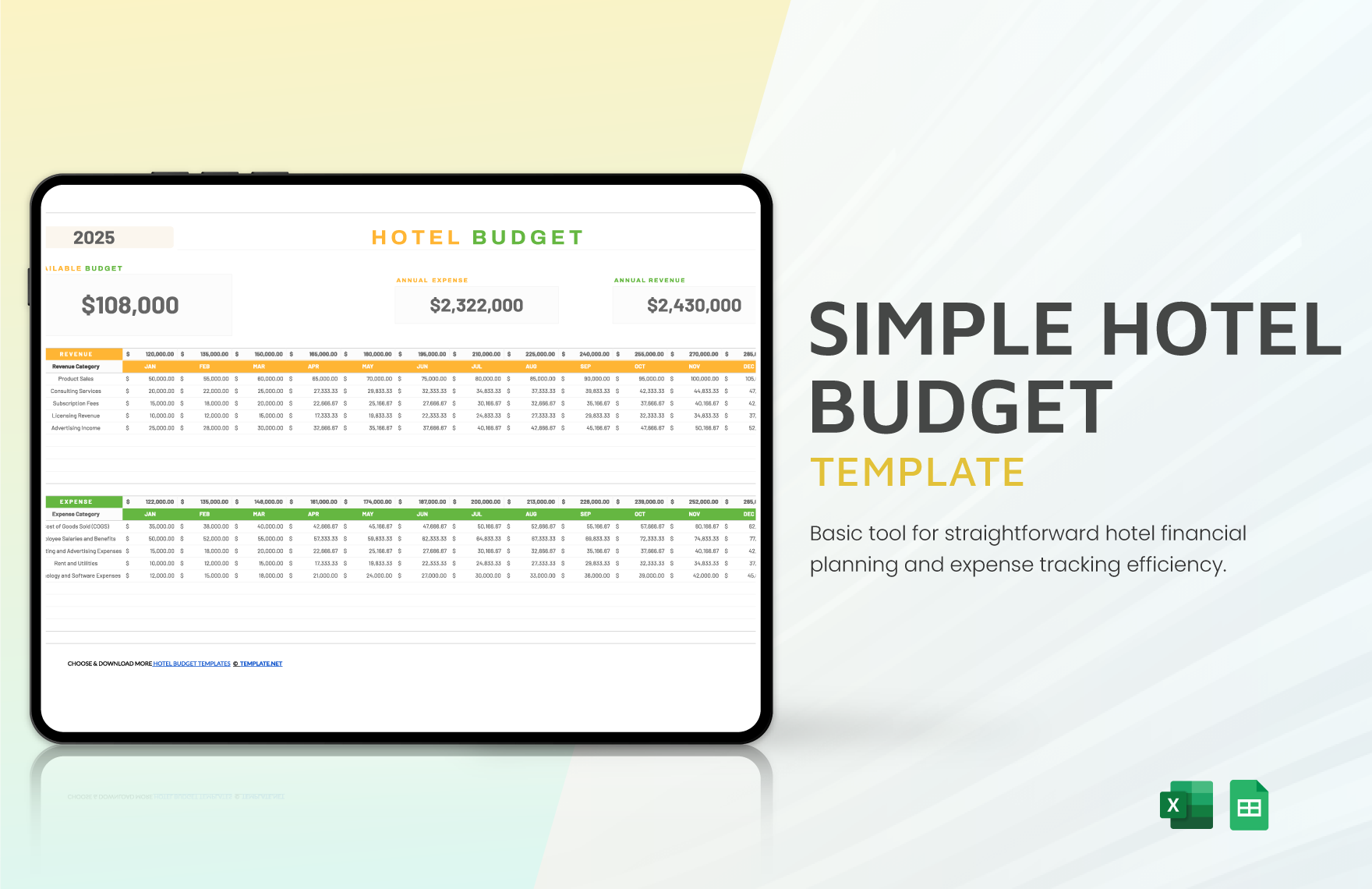

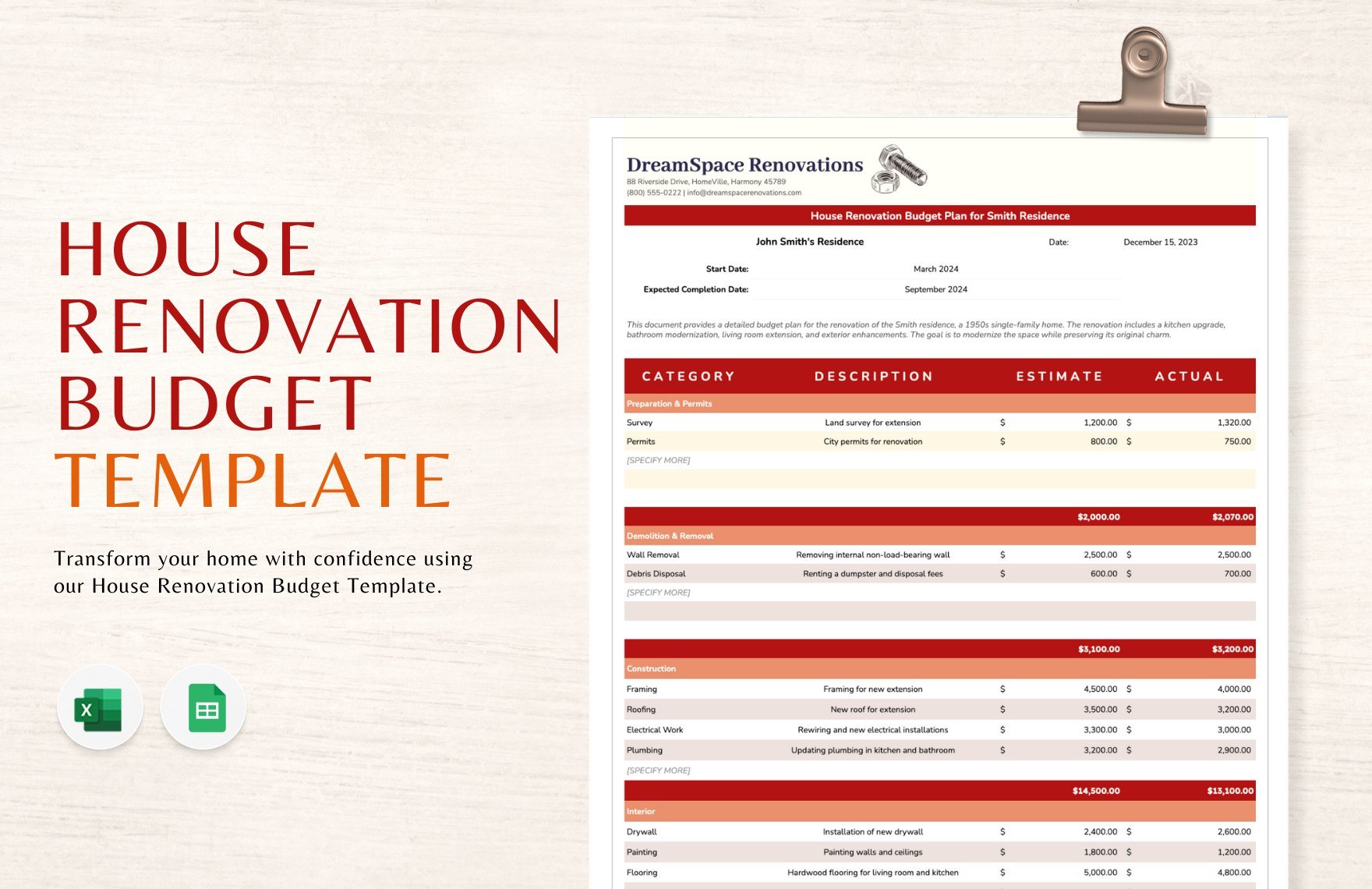

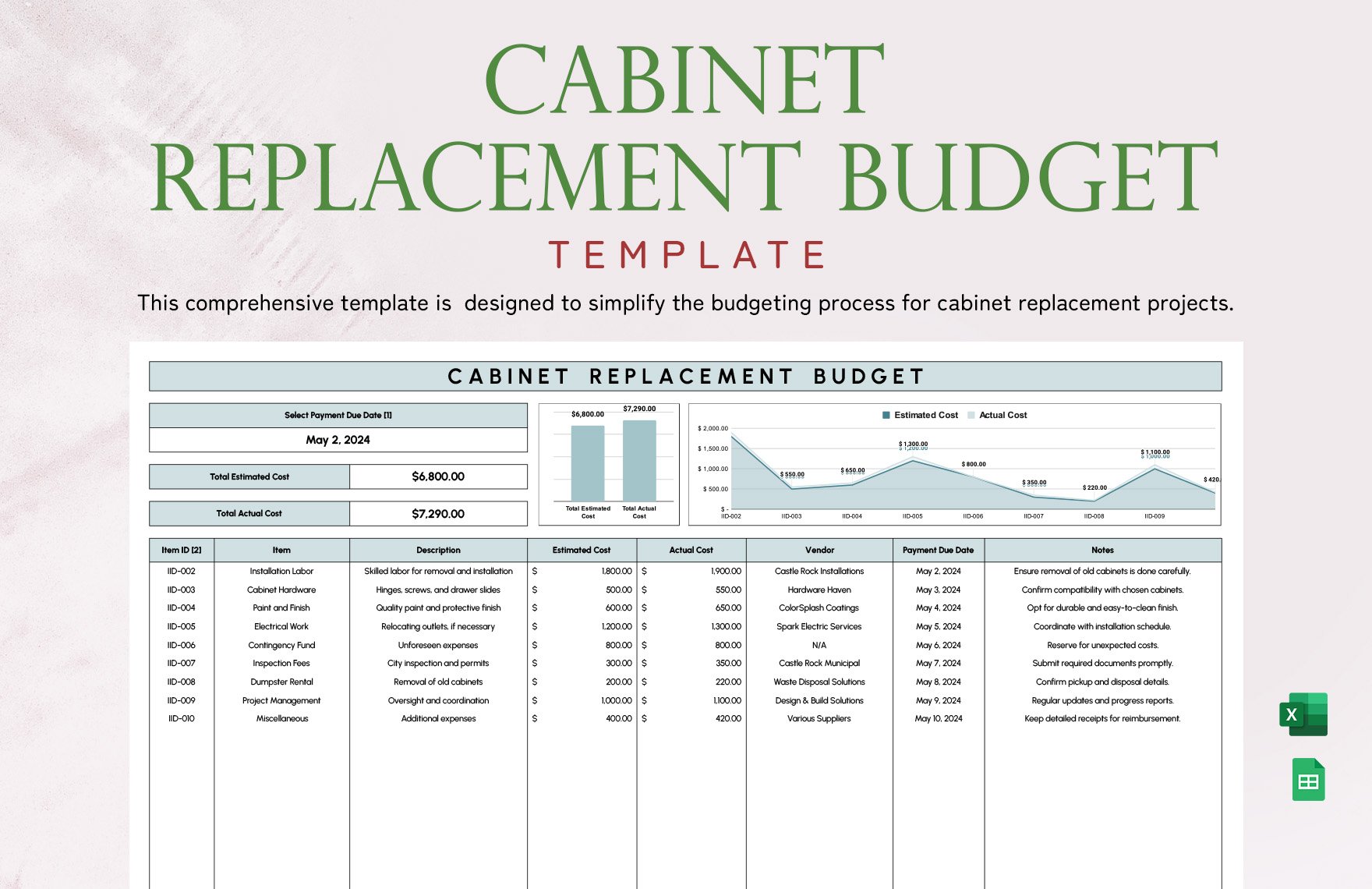

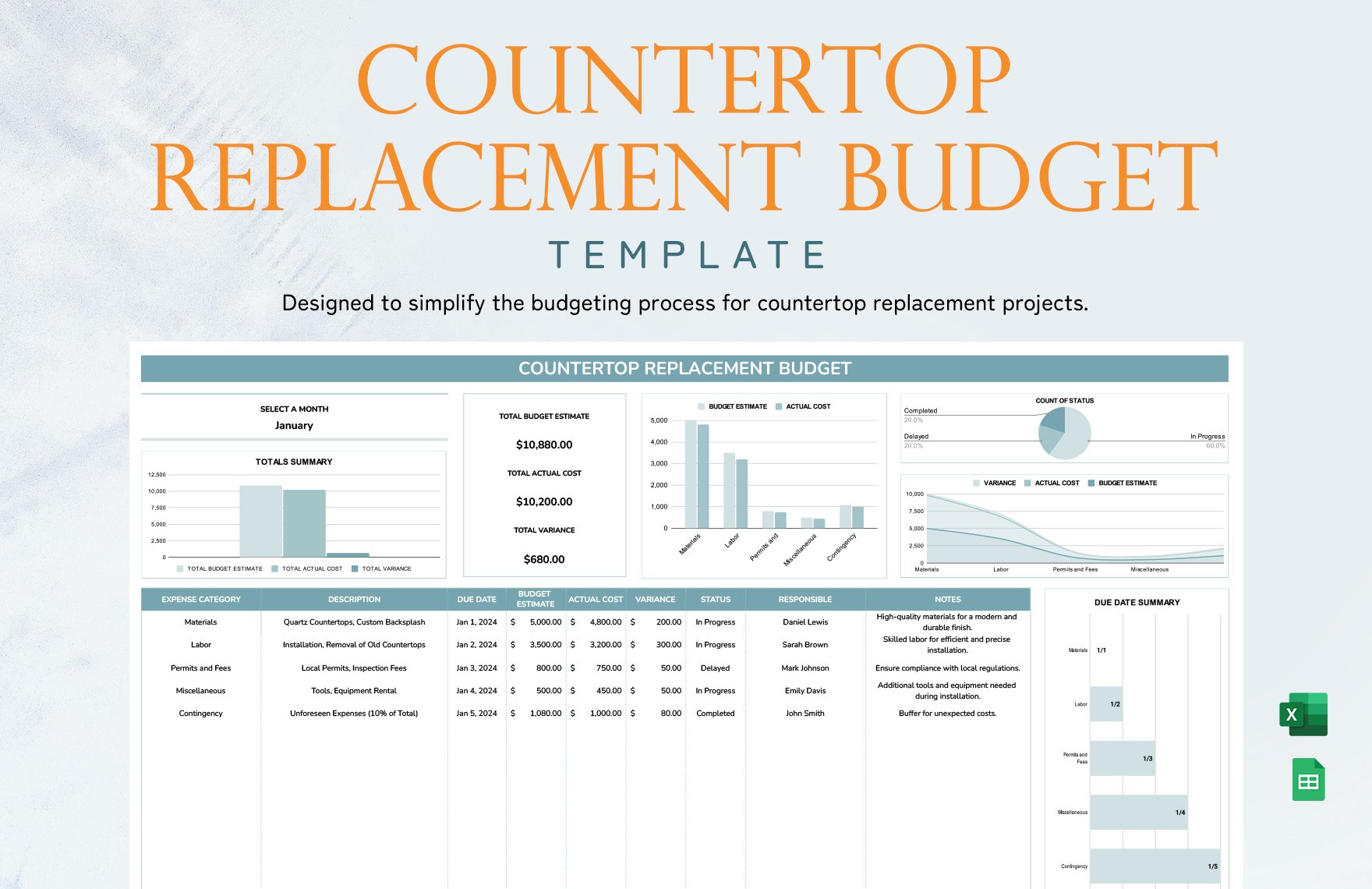

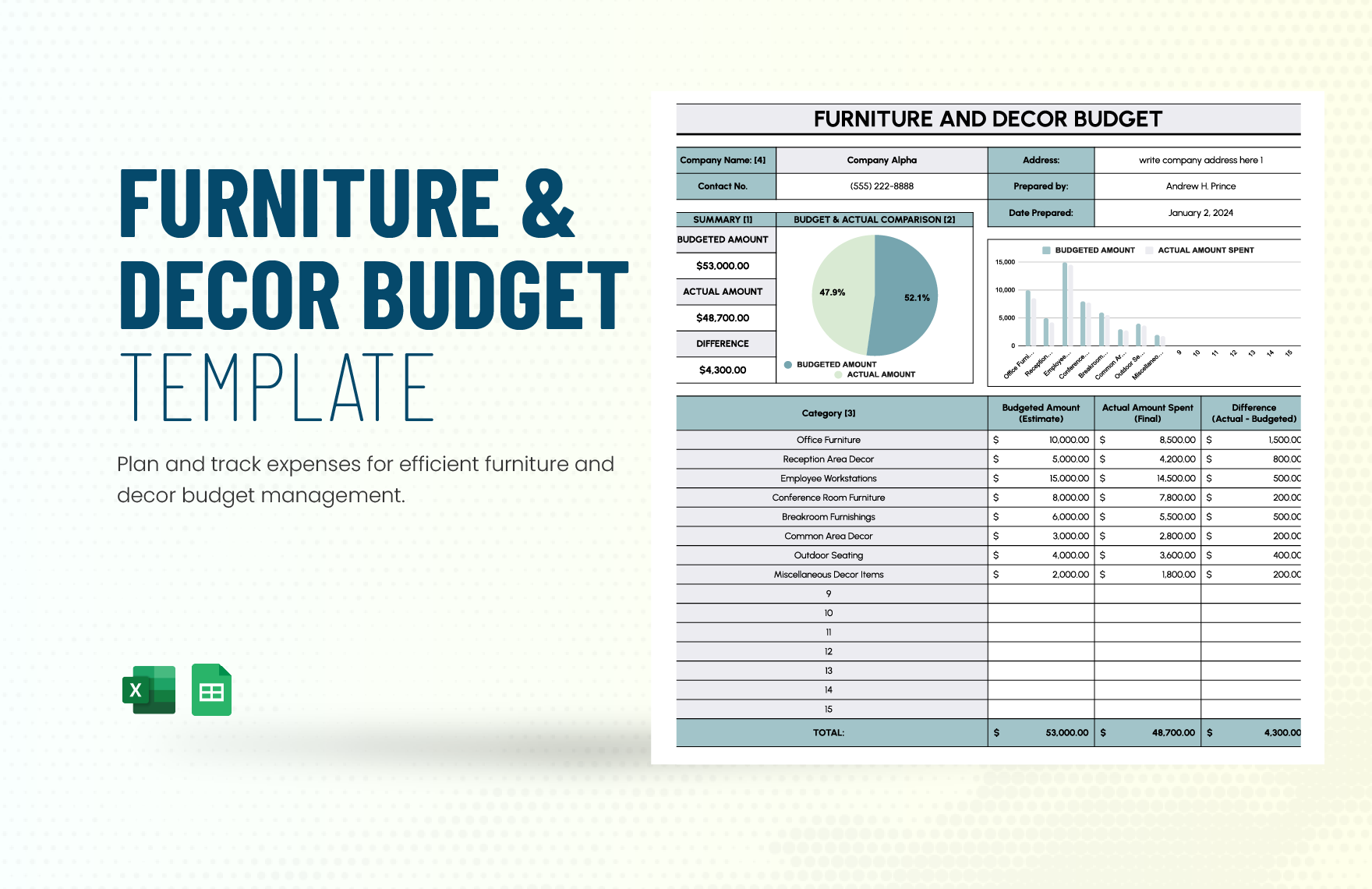

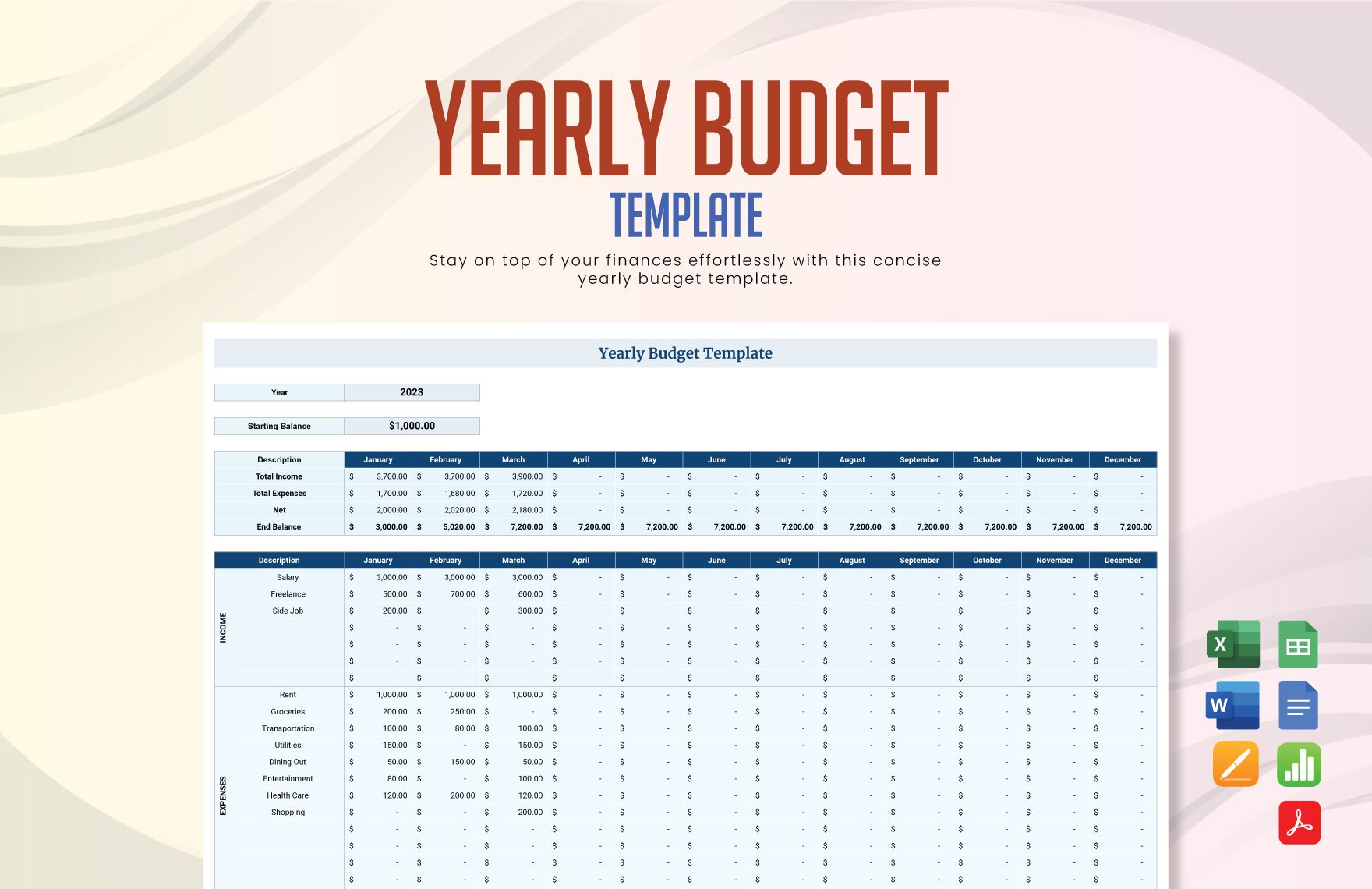

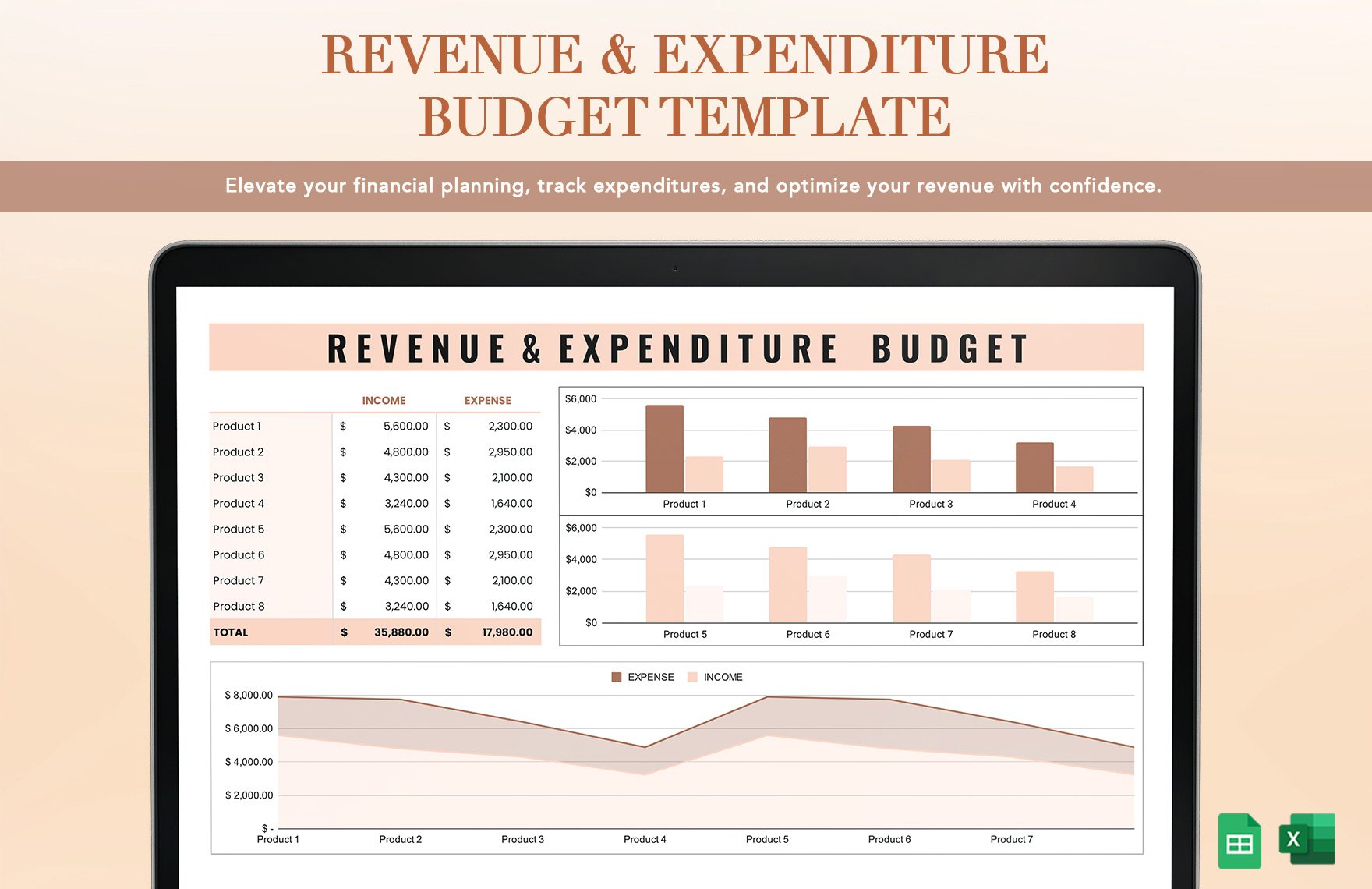

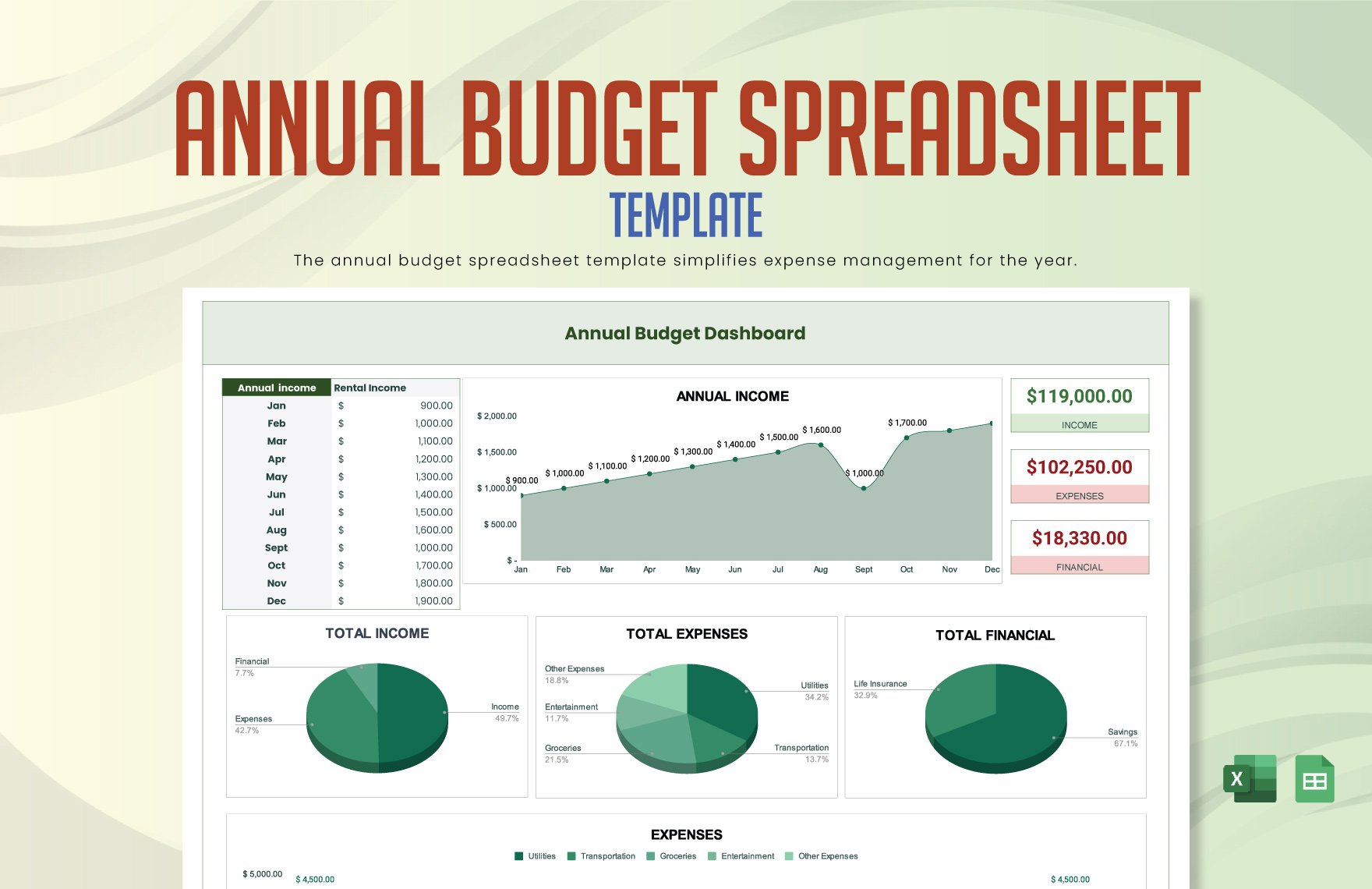

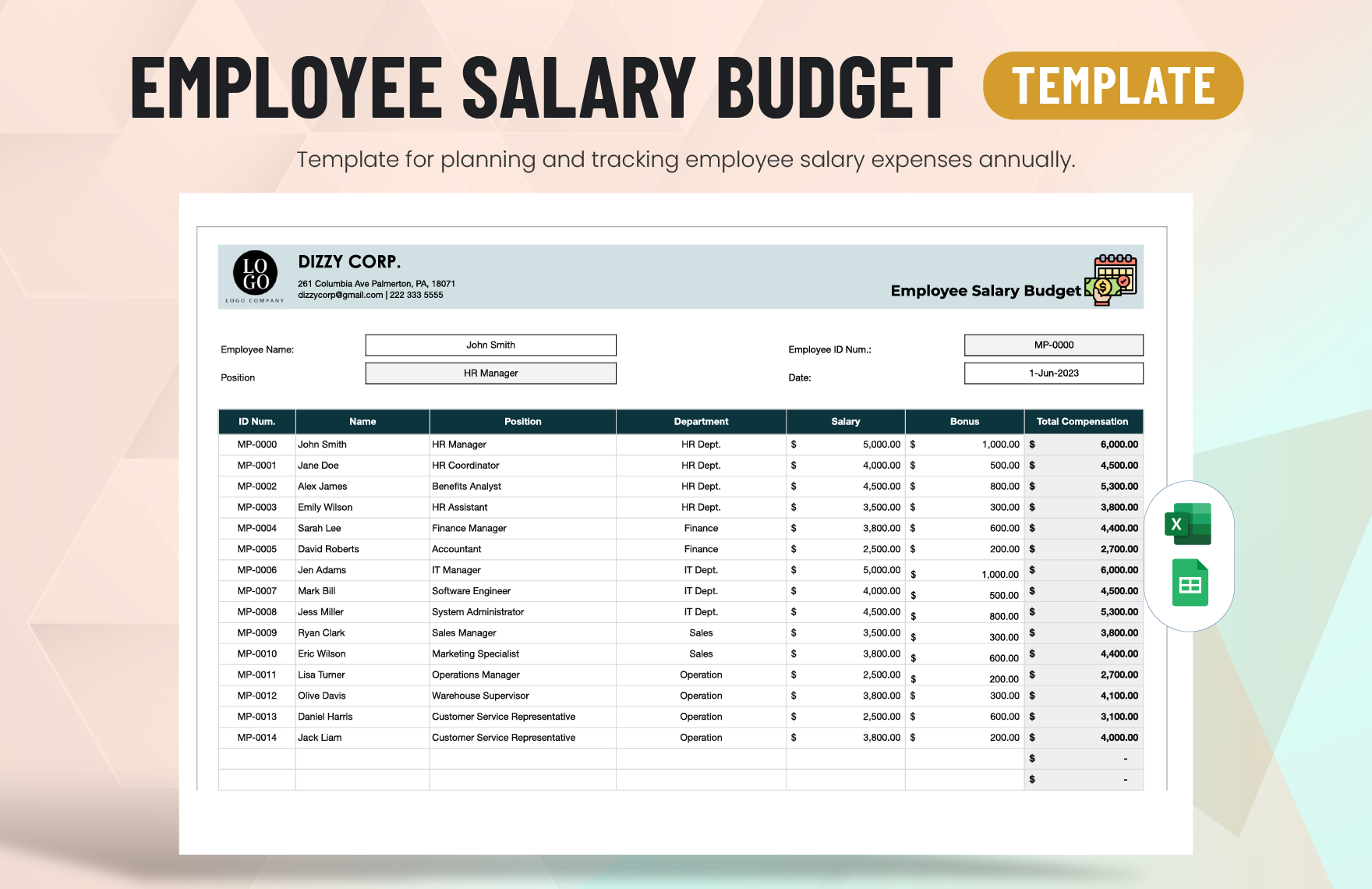

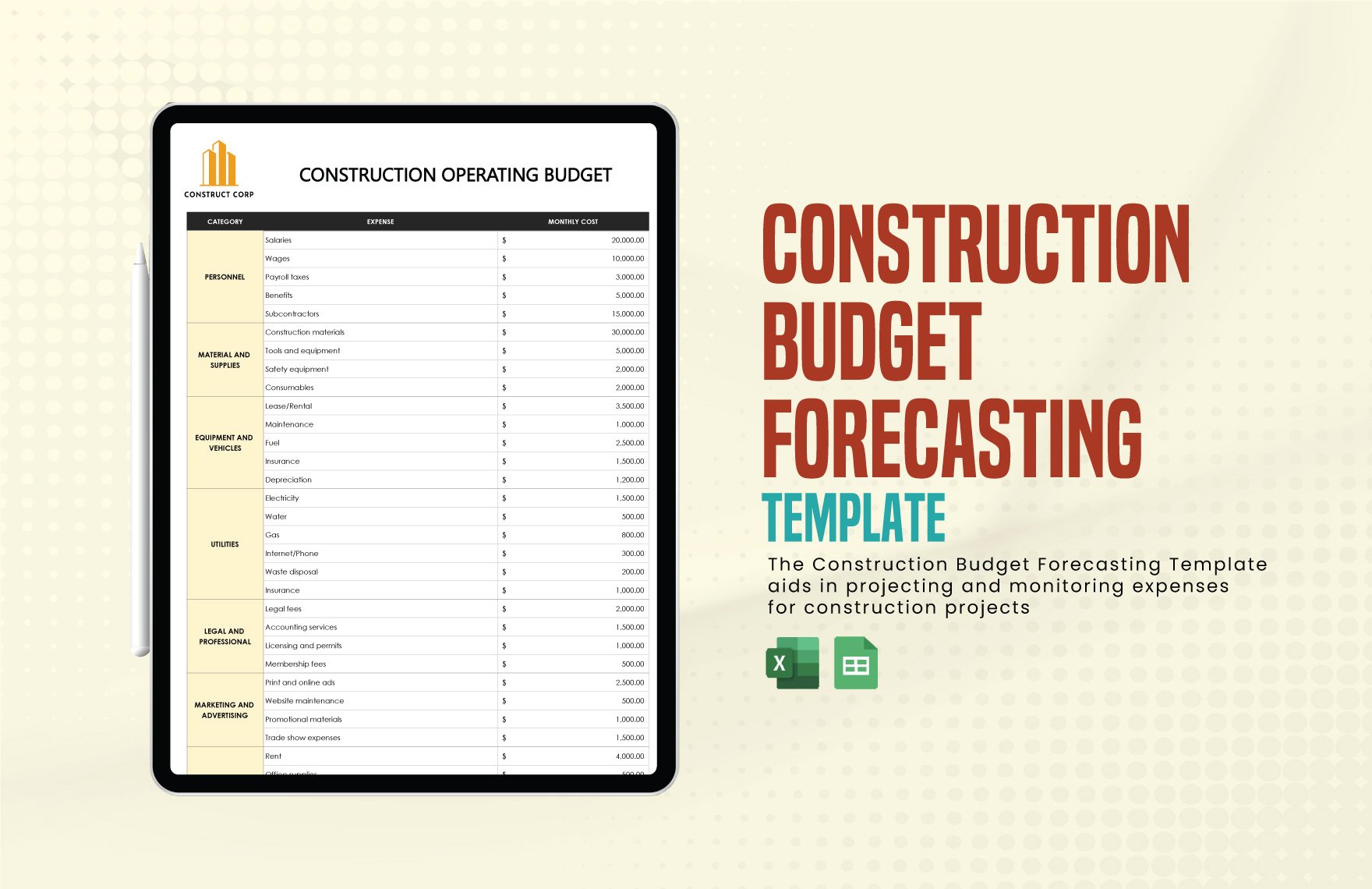

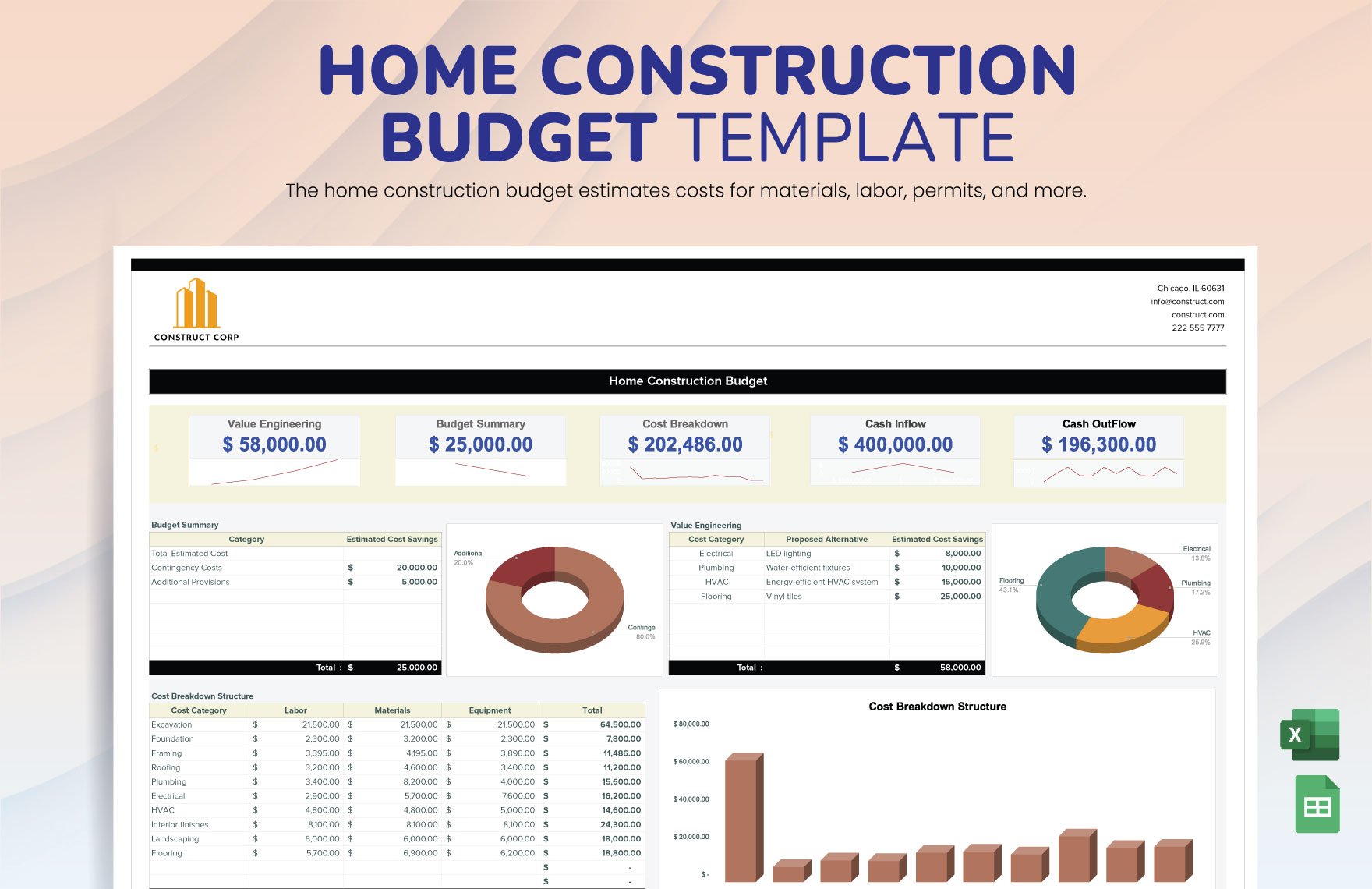

The worry about tomorrow is already marked in the minds of most of us. What will you have for breakfast, lunch, and dinner tomorrow, will there be enough money to send the children to school tomorrow and will you still have enough for fare tomorrow? Out of the things we worry about tomorrow, finances are of the most concern. Stop the worry about tomorrow by managing your finances through a budget. As the saying goes, "Prevention is better than cure." Preparing and reserving is not vain. Actually, it's a practical thing. Budget better with our Sample Budget templates formatted in Microsoft Excel!

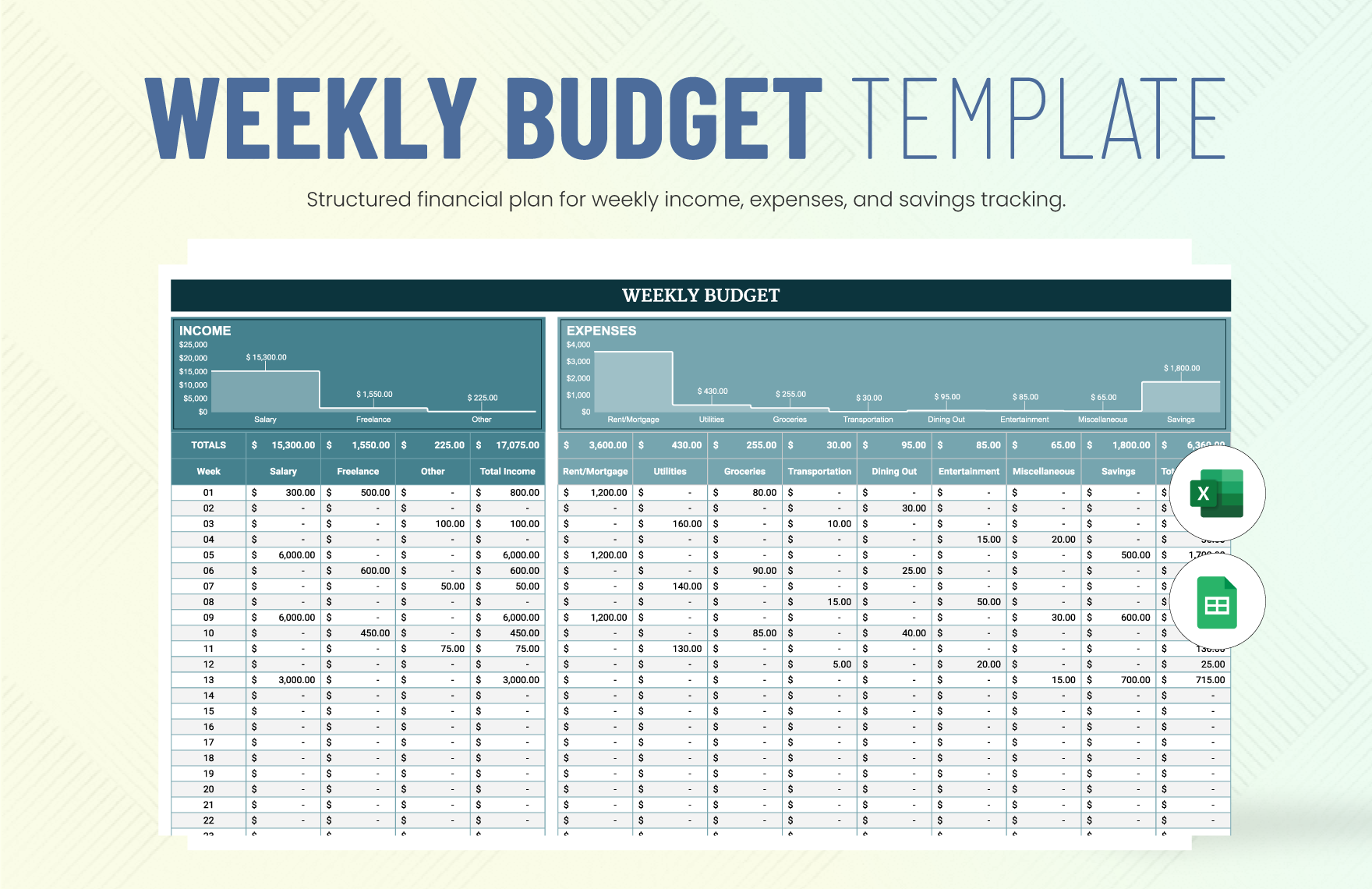

How to Set a Sample Budget in Excel

One form of security is financial assurance. It is knowing that you have enough and even more than enough on your hands. It is being capable to meet not just our needs, but our wants as well. If you are looking for a way to manage your financial resources, below is just the right guide to make a budget.

1. Divide Your Funds

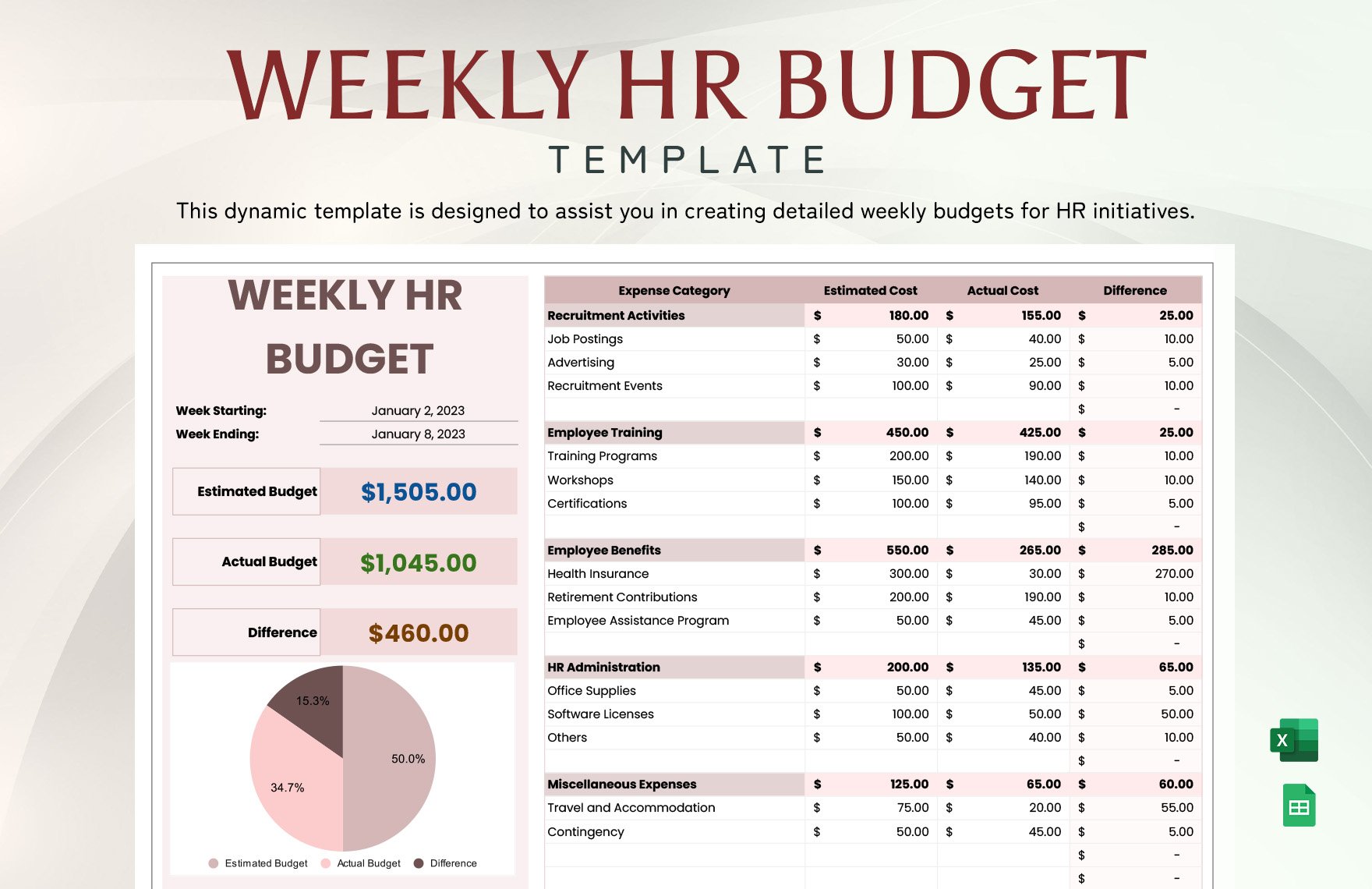

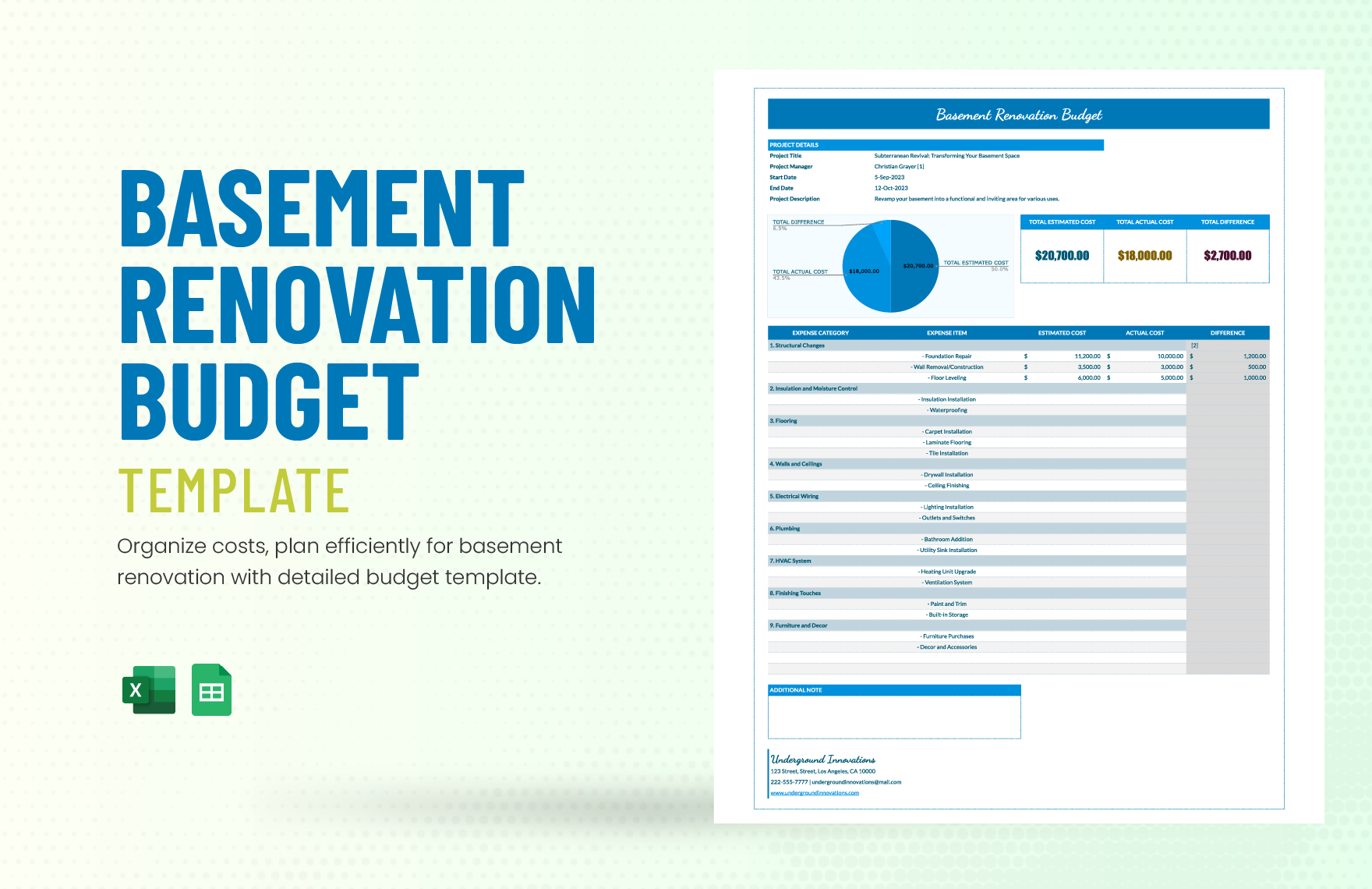

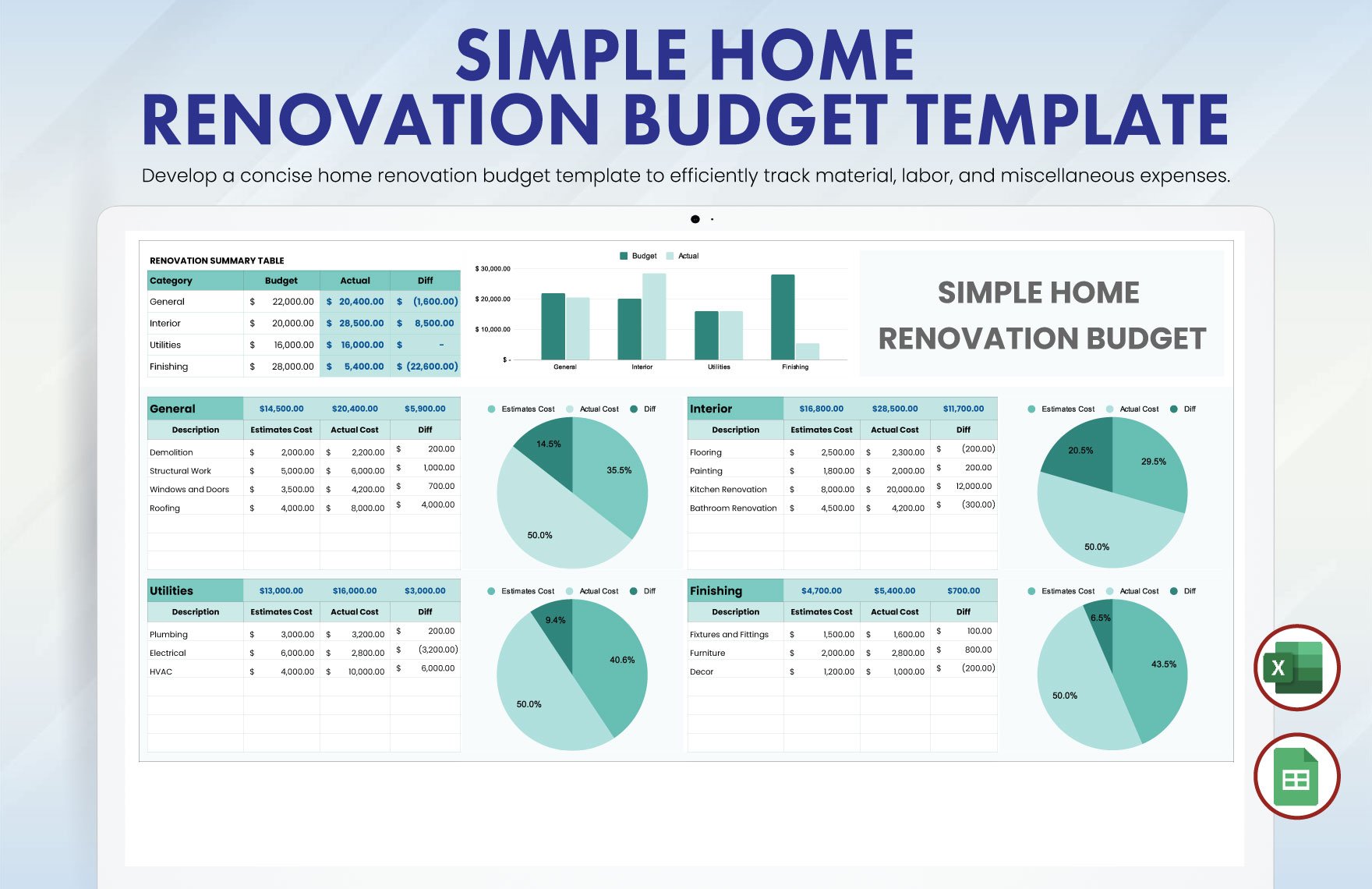

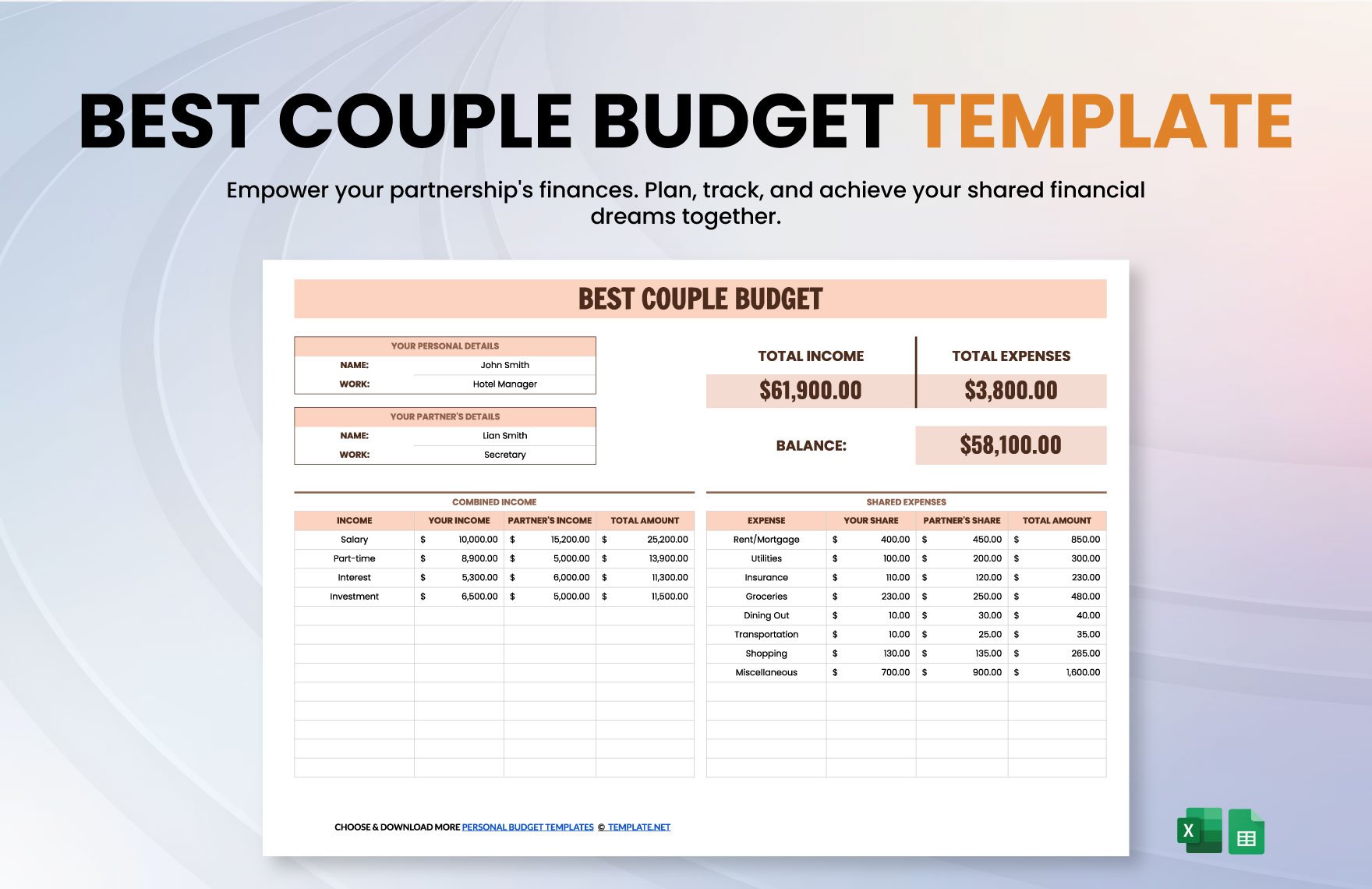

Set an allocation for your income or revenue. Make priorities. Do not just think about ensuring that you can meet all the expenditures. Set aside also for savings or emergencies. When budgeting, breakdown your personal income or company’s revenue among needs, wants, savings or emergencies, investments, and debts.

2. Set Estimates

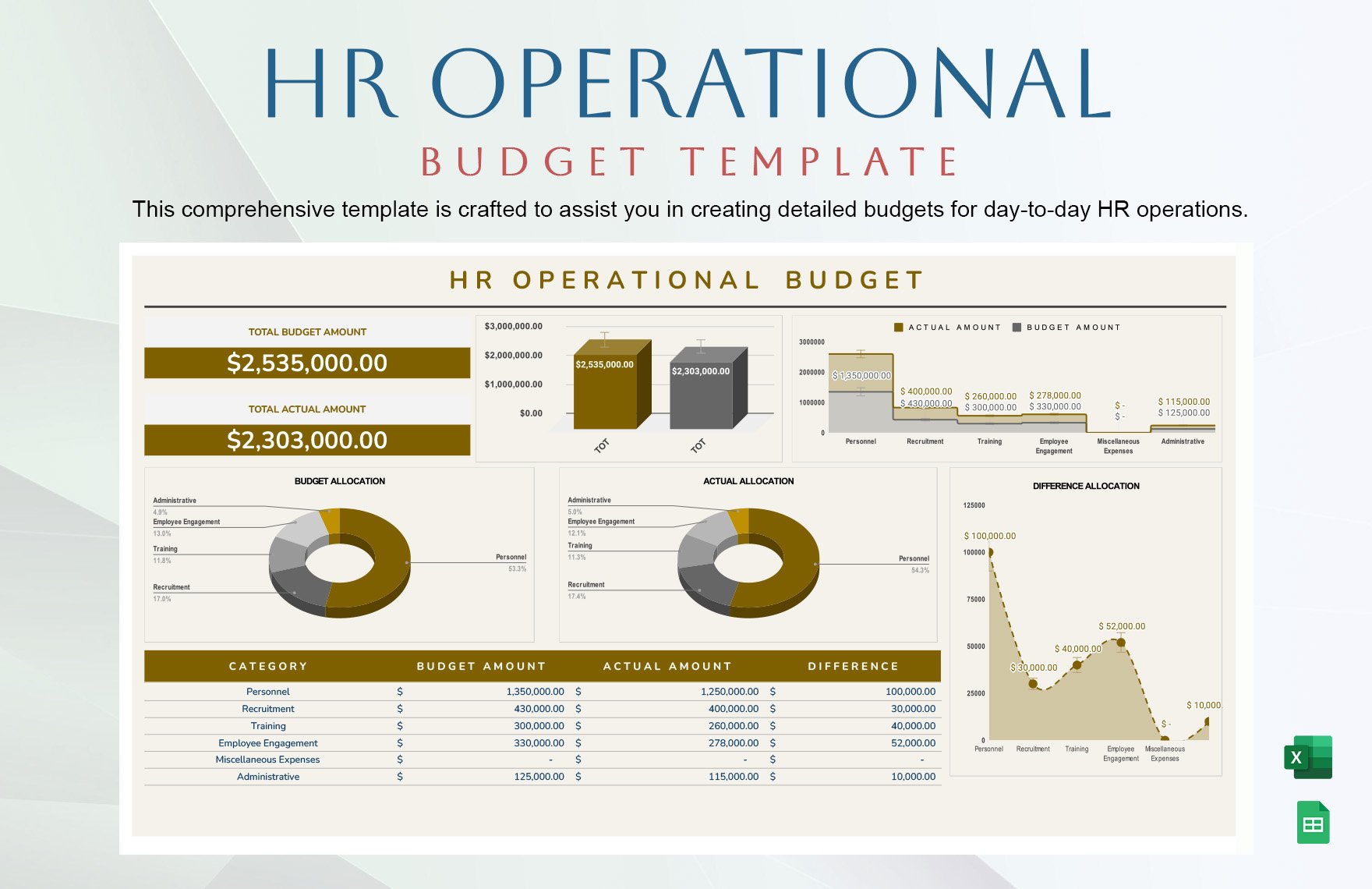

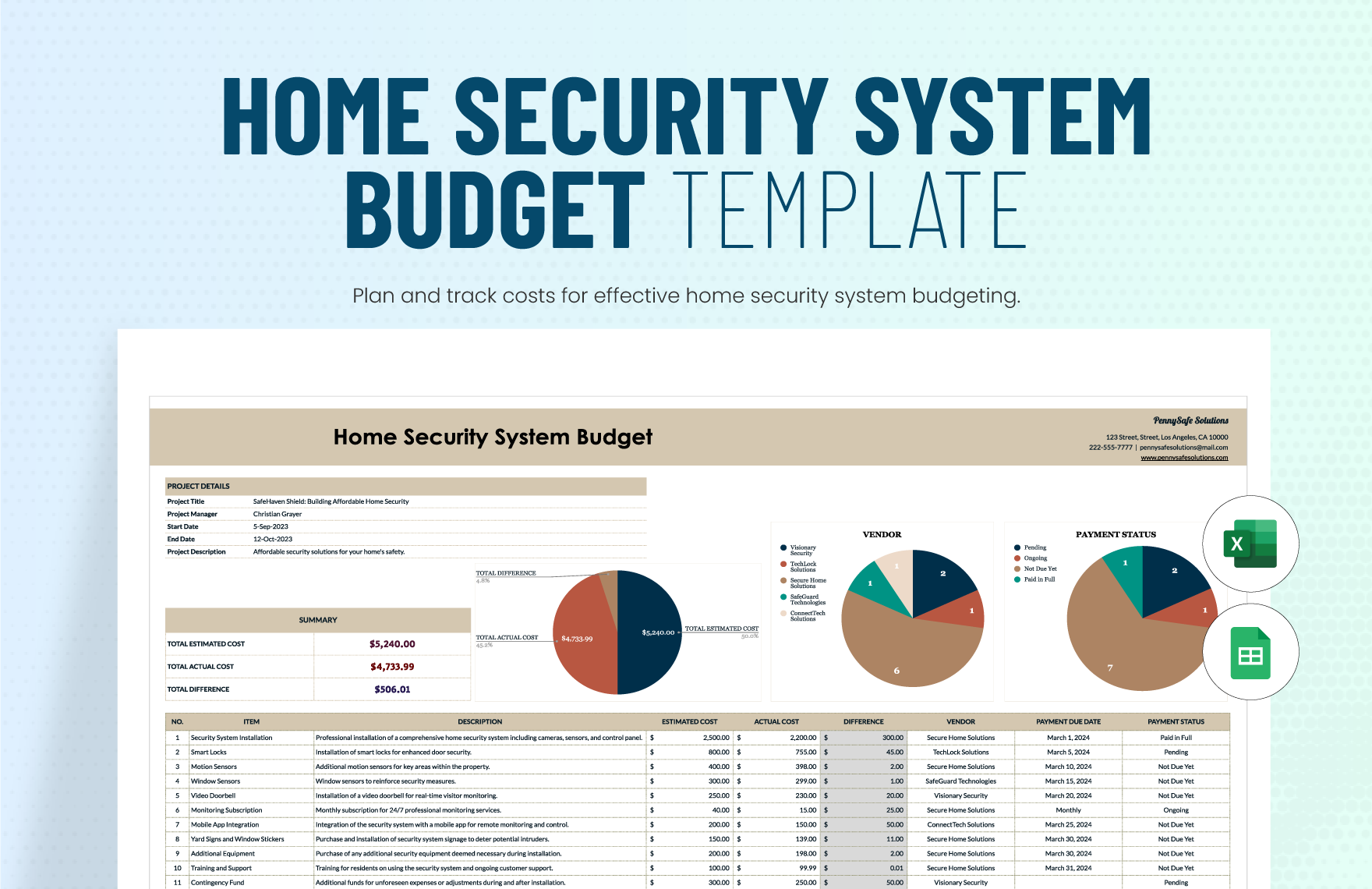

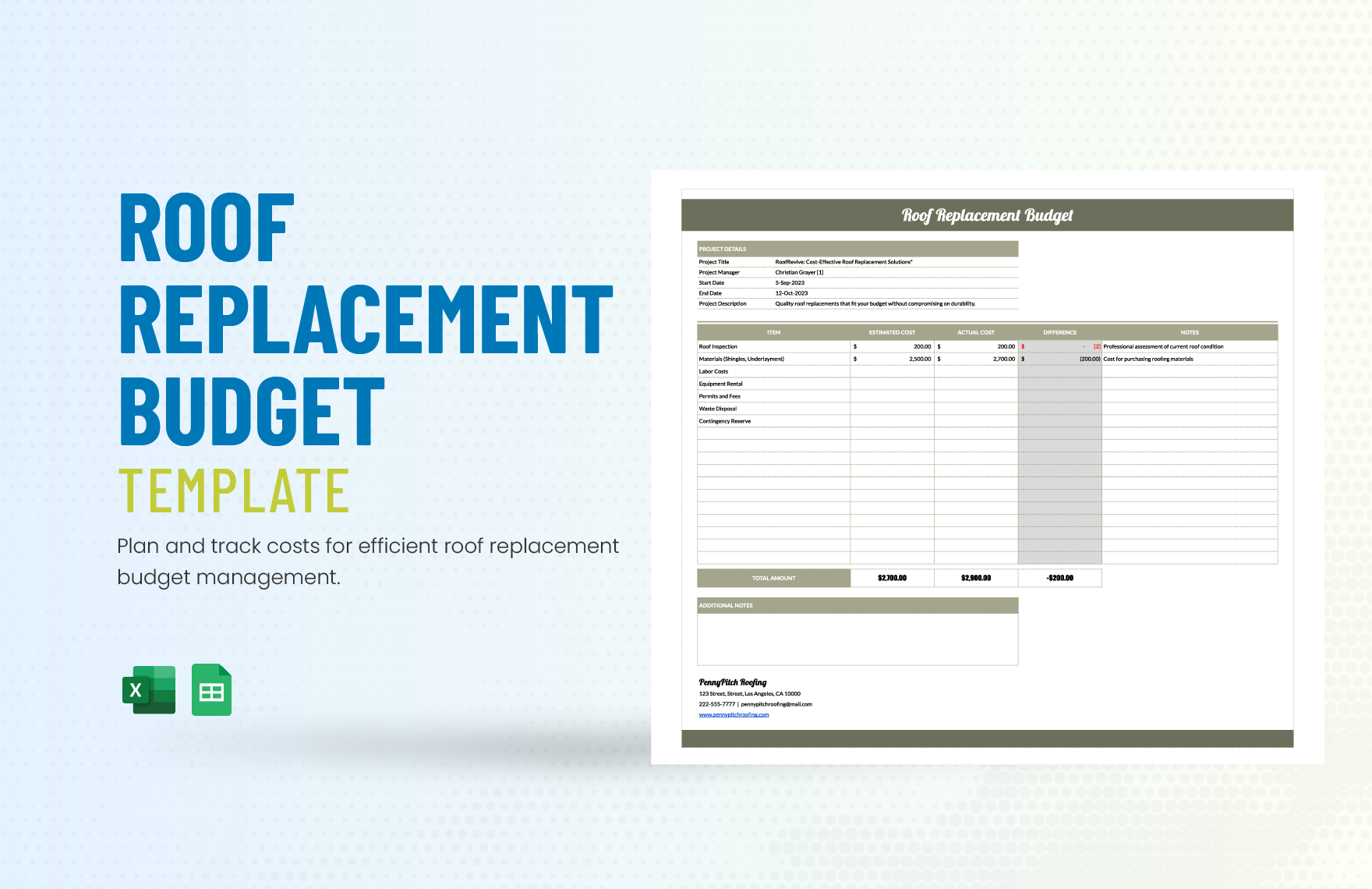

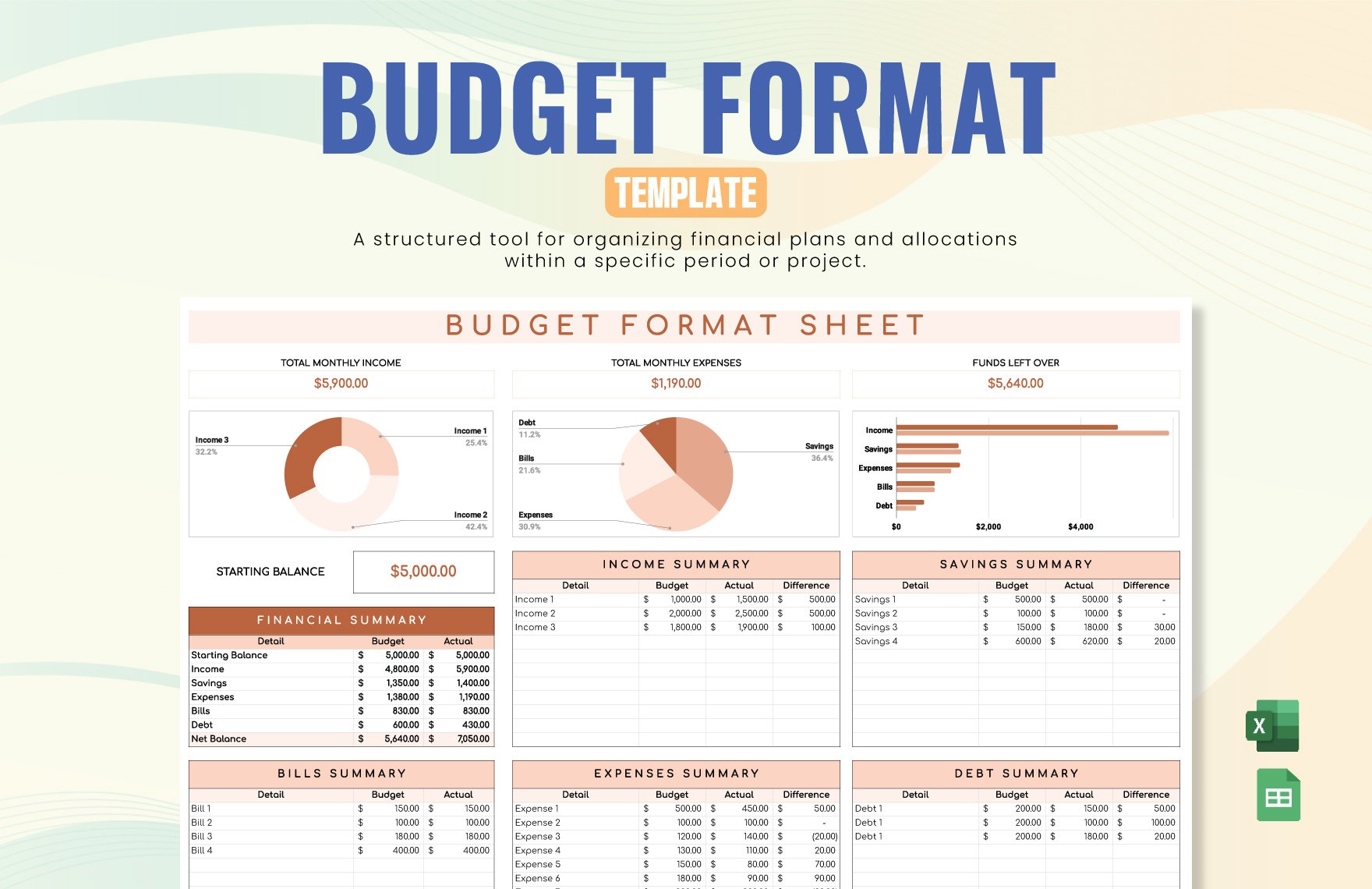

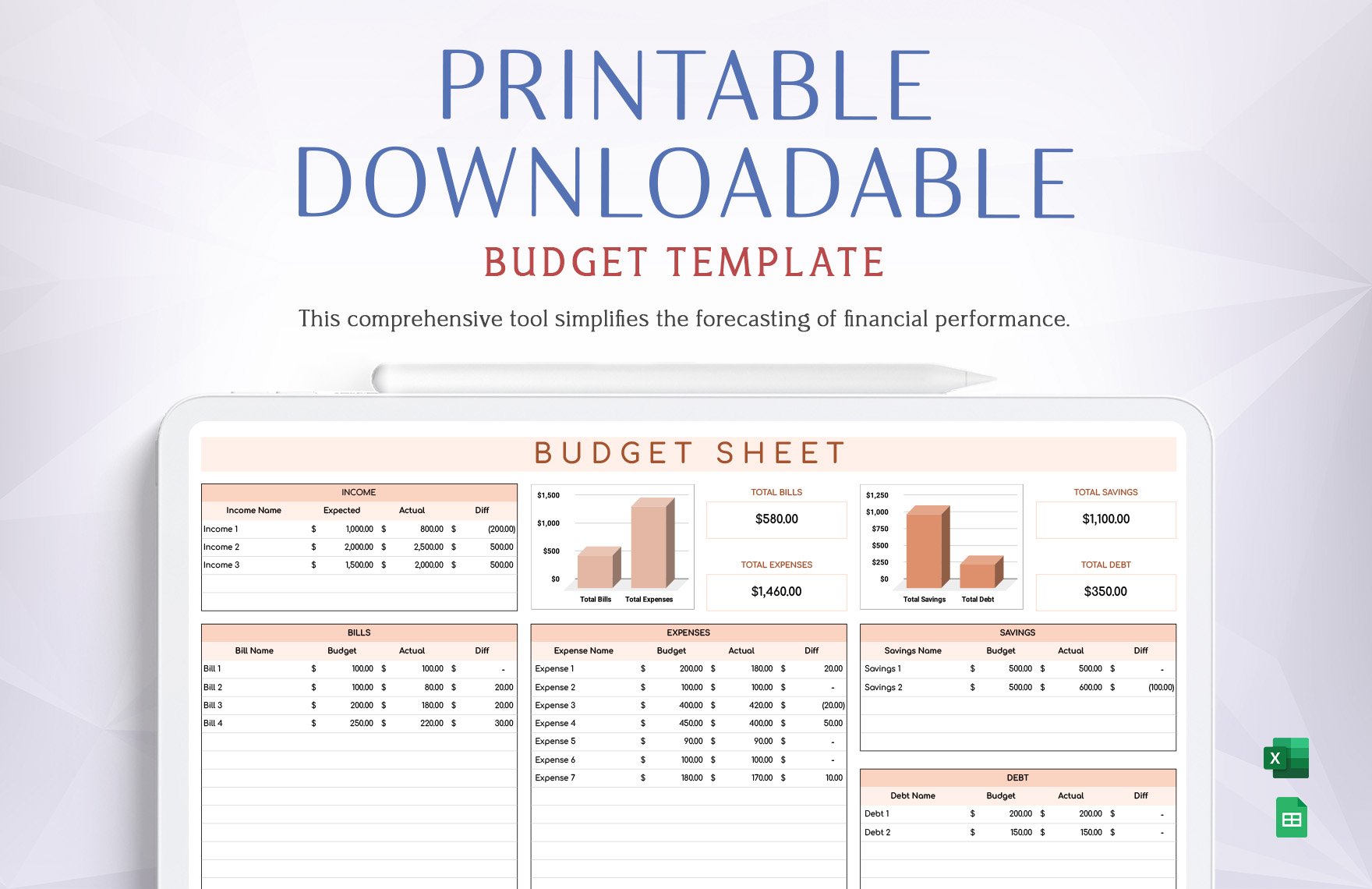

Put to all particulars of the divisions you made earlier for your funds. Set an allowance for each amount. The very purpose of a budget is to prepare you for both the unexpected and things you are already expecting your funds will be alloted to. So making an estimate for every priority is the practical thing to do when budgeting.

3. Track your Budget

In your budget spreadsheet, specify a portion that will record the actual amount consumed for a particular. This will determine whether or not you have spent more, less, or exactly your allocated budget for it giving you an idea if you have saved a ratio of your funds or not.

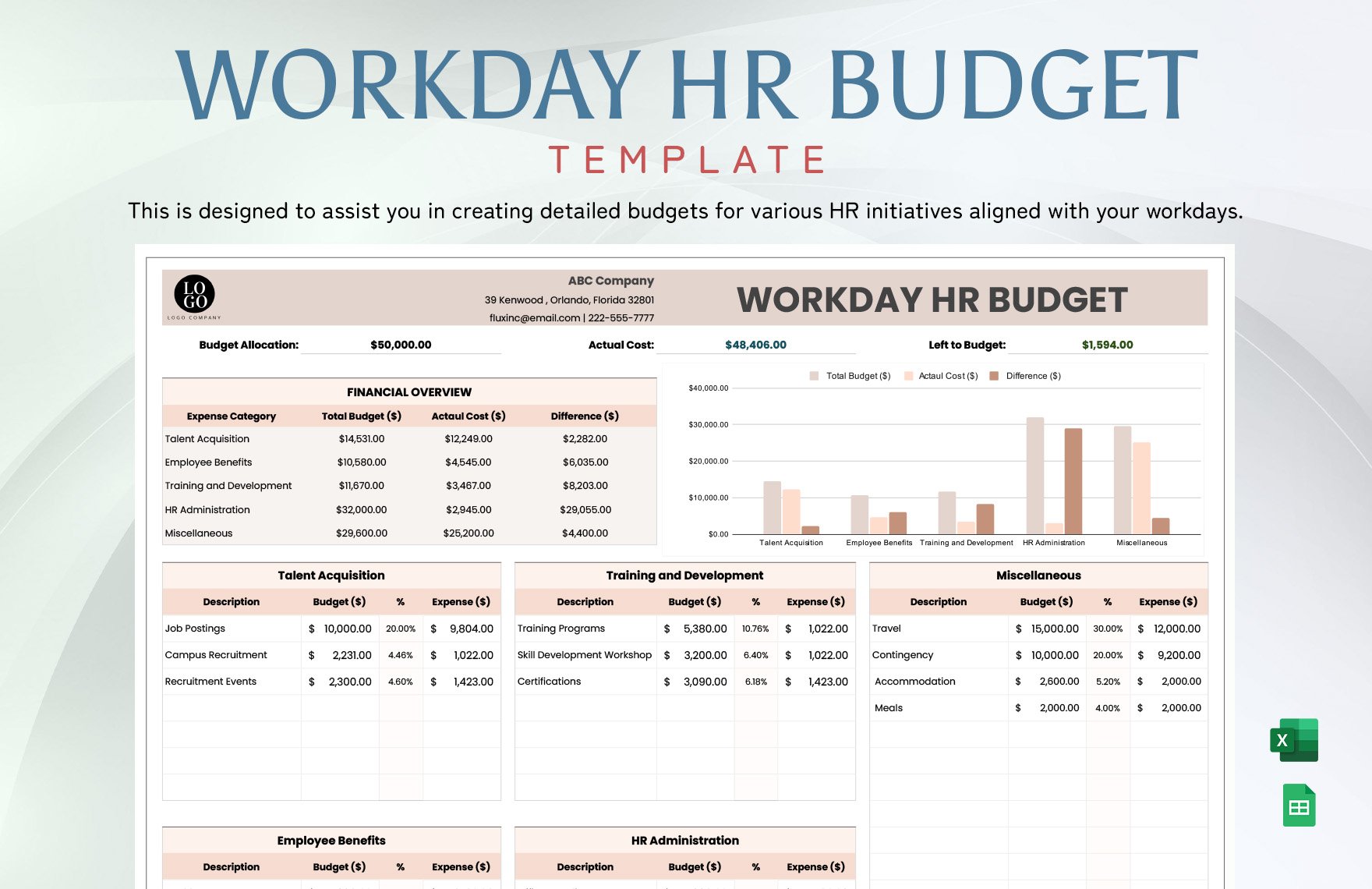

4. Update your Budget Regularly

Preparing a budget already gives you convenience, but having it updated when necessary changes apply will give more convenience to you. Prices, plans, and decisions may vary over time, so making adjustments to your budget should be done when needed.