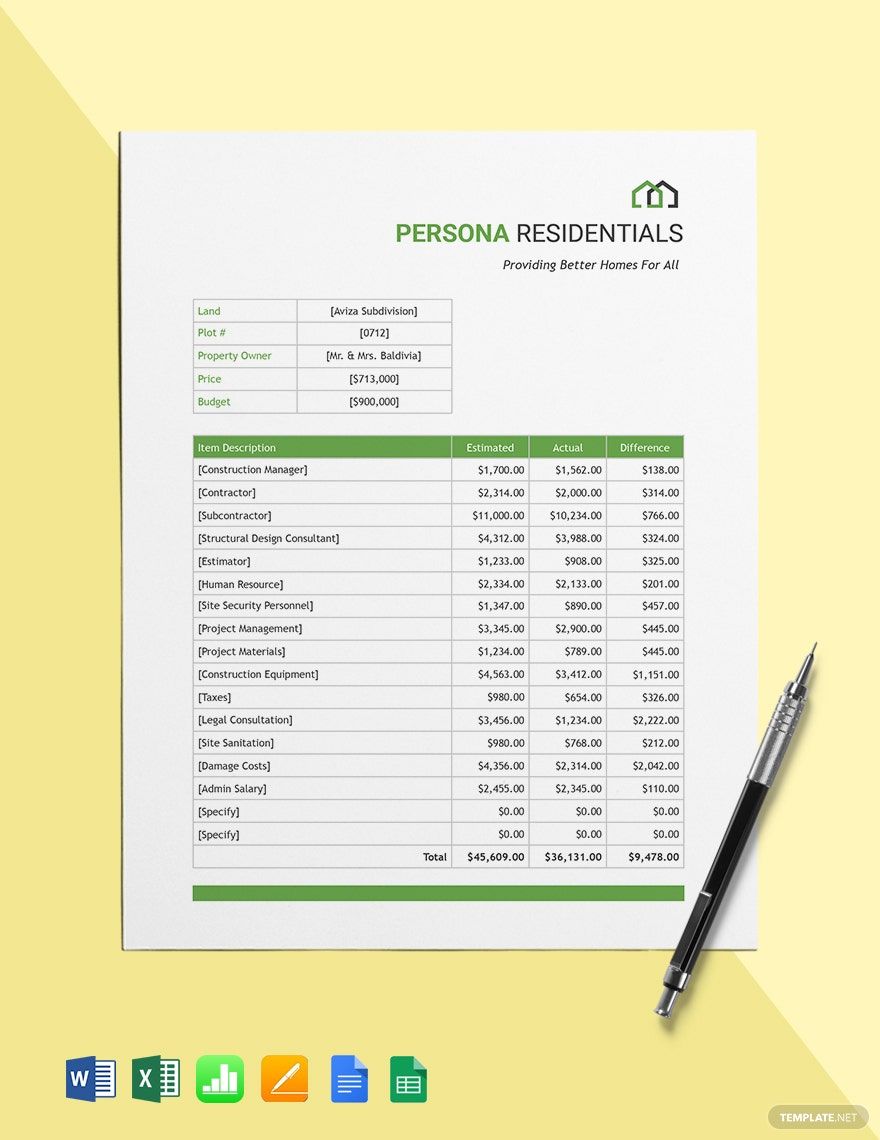

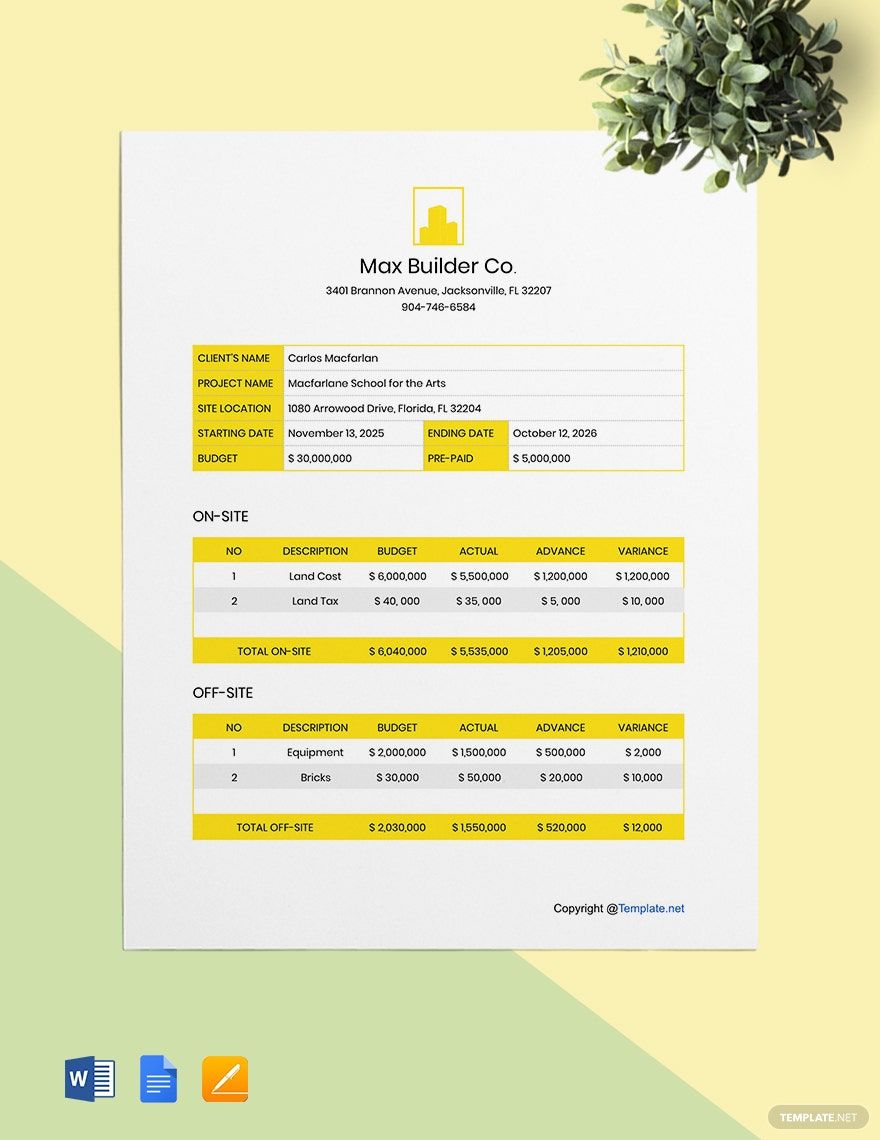

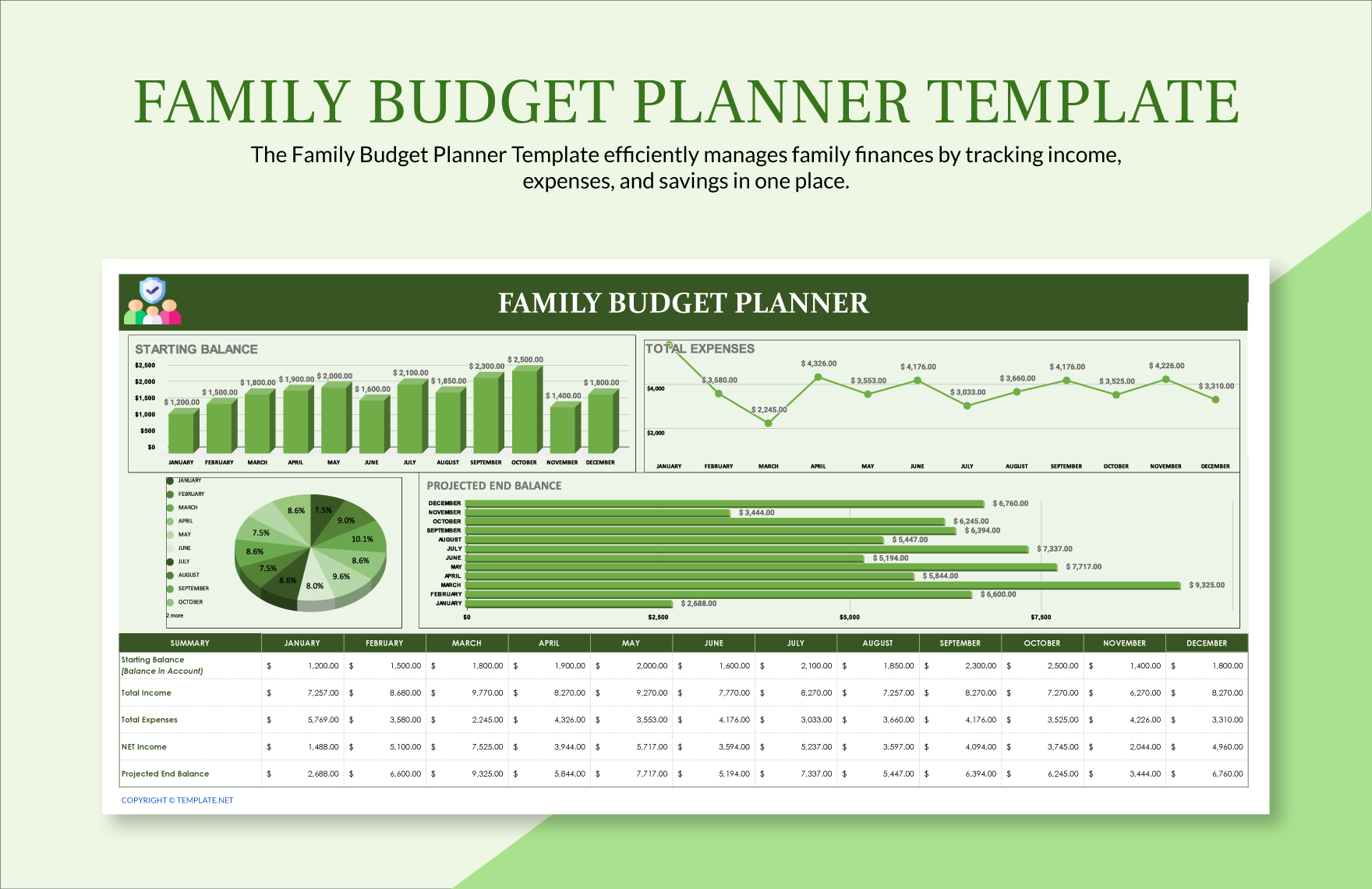

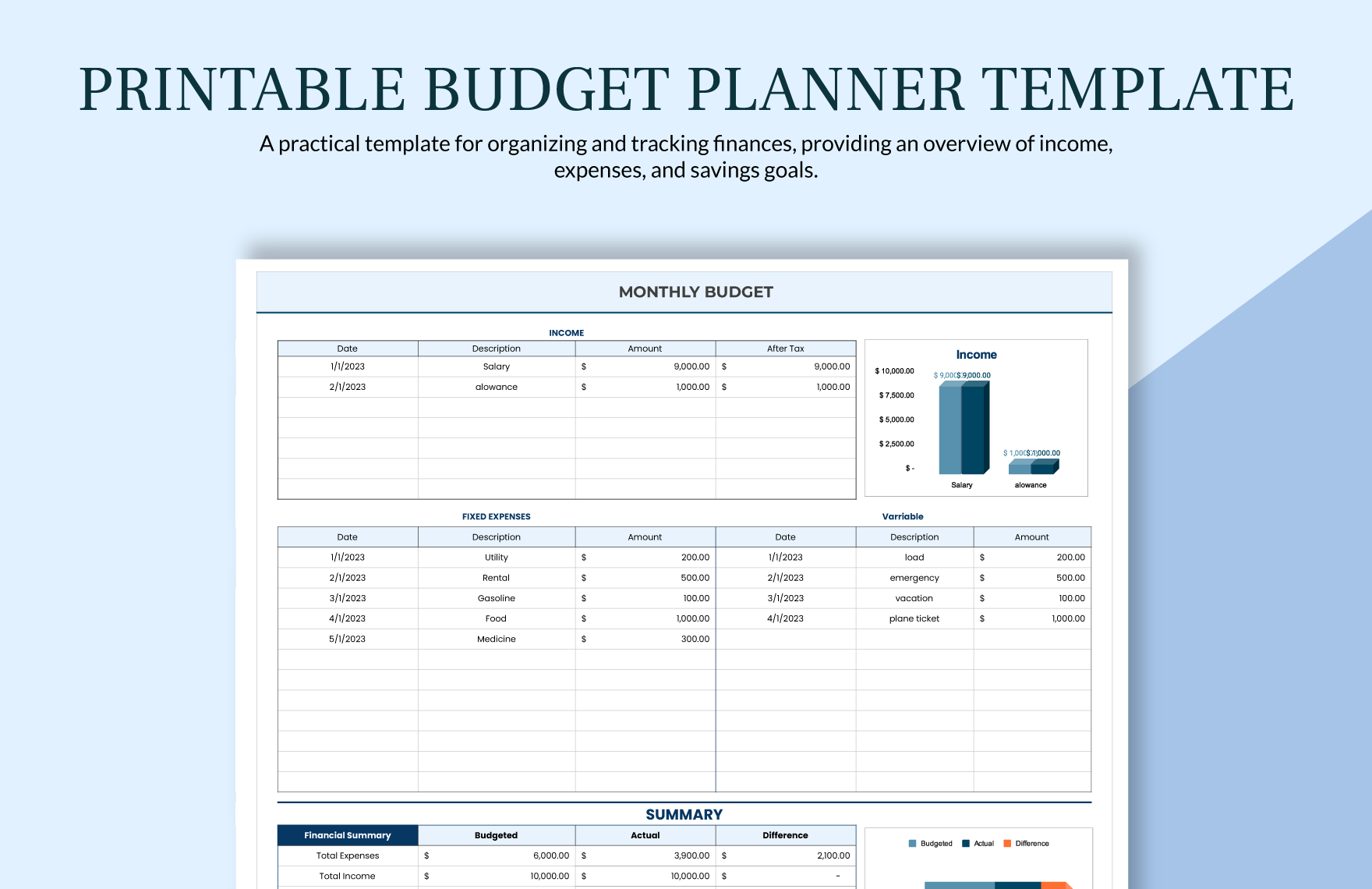

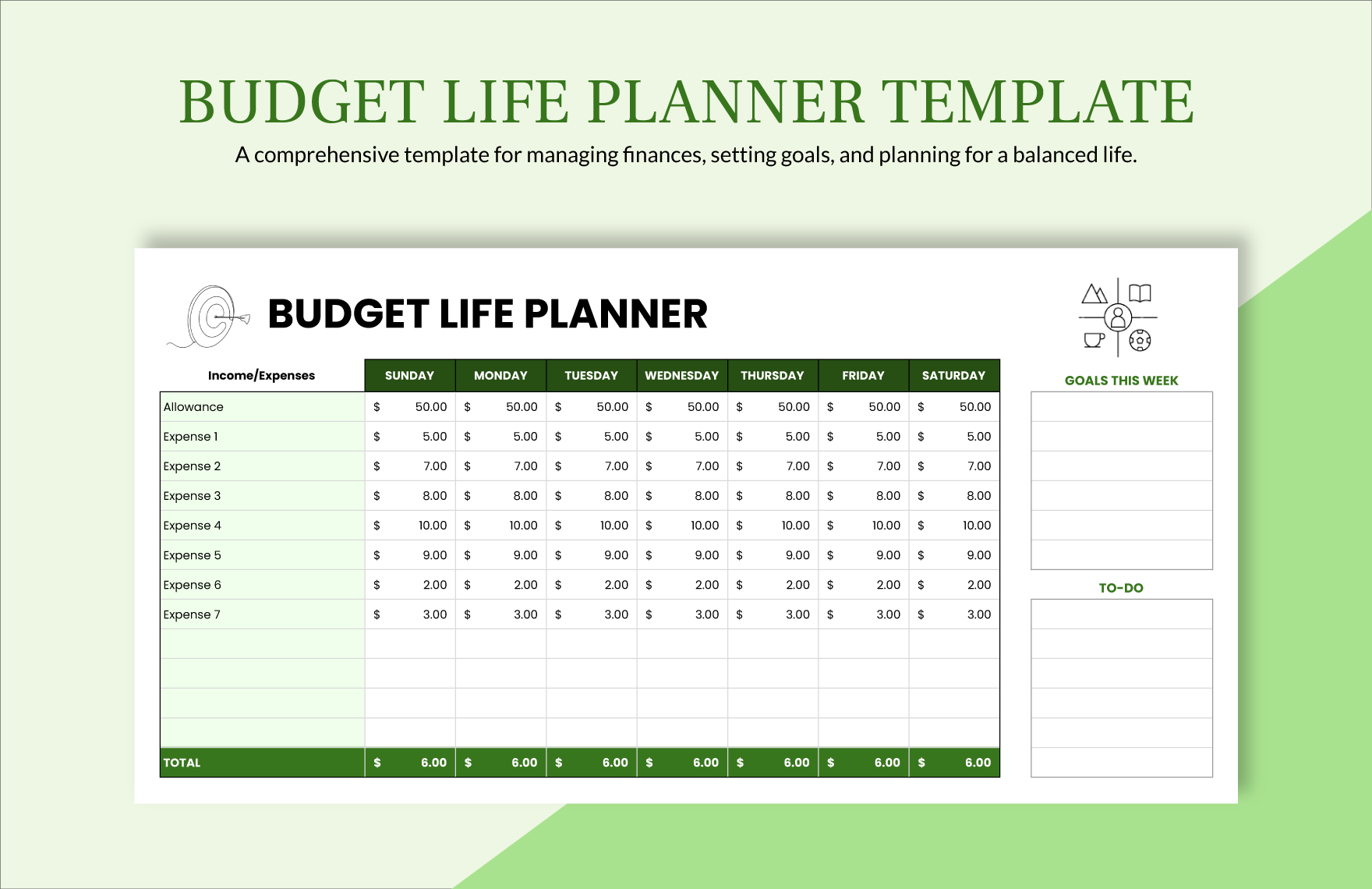

Money is a sensitive subject to every one. It has the power to help someone through adversity or improve someone else's lifestyle. That's why budgeting and the manipulation of it is an excellent practice, so strengthen your budgeting today with the use of these Ready-Made Simple Budget Templates in Apple (MAC) Pages. With these high-quality and fully customizable products, you are on edge. Business professionals, together with graphic designers, created these samples with excellence and quality so you can be sure that you have the best available. So do what you can do best. Download any of these downloadable and printable products today and make budgeting secure!

How to Create a Simple Budget Template in Apple Pages

According to a study, only 30% of Americans have long-term financial plans, which means to say that 70% of them do not think of creating budget plans at all. While some of them are quite rich, you cannot say that everyone is. Be a part of the top 30% today by creating your budget template. To help you better, we provided steps in creating budget templates below.

1. Secure a Format

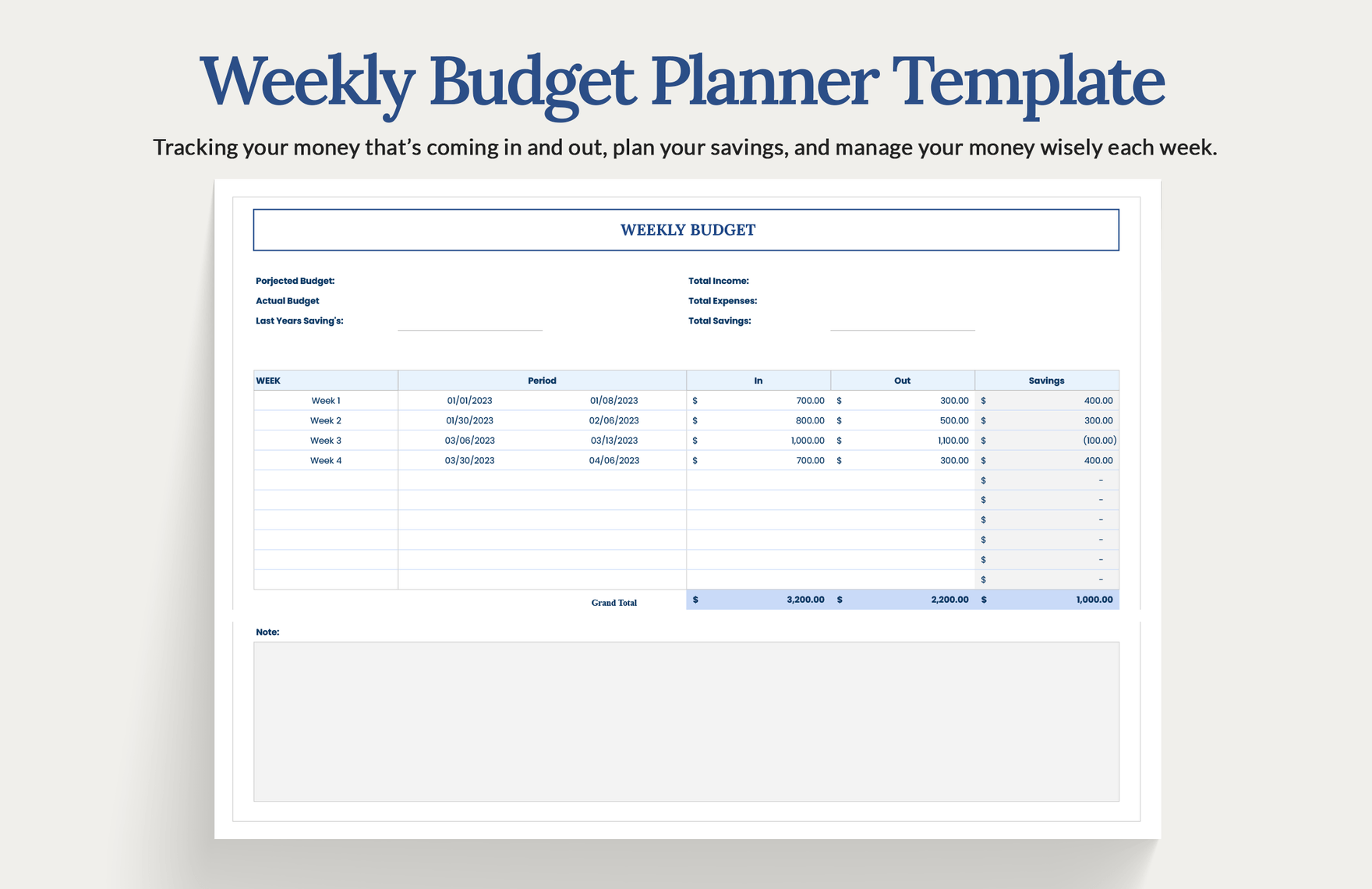

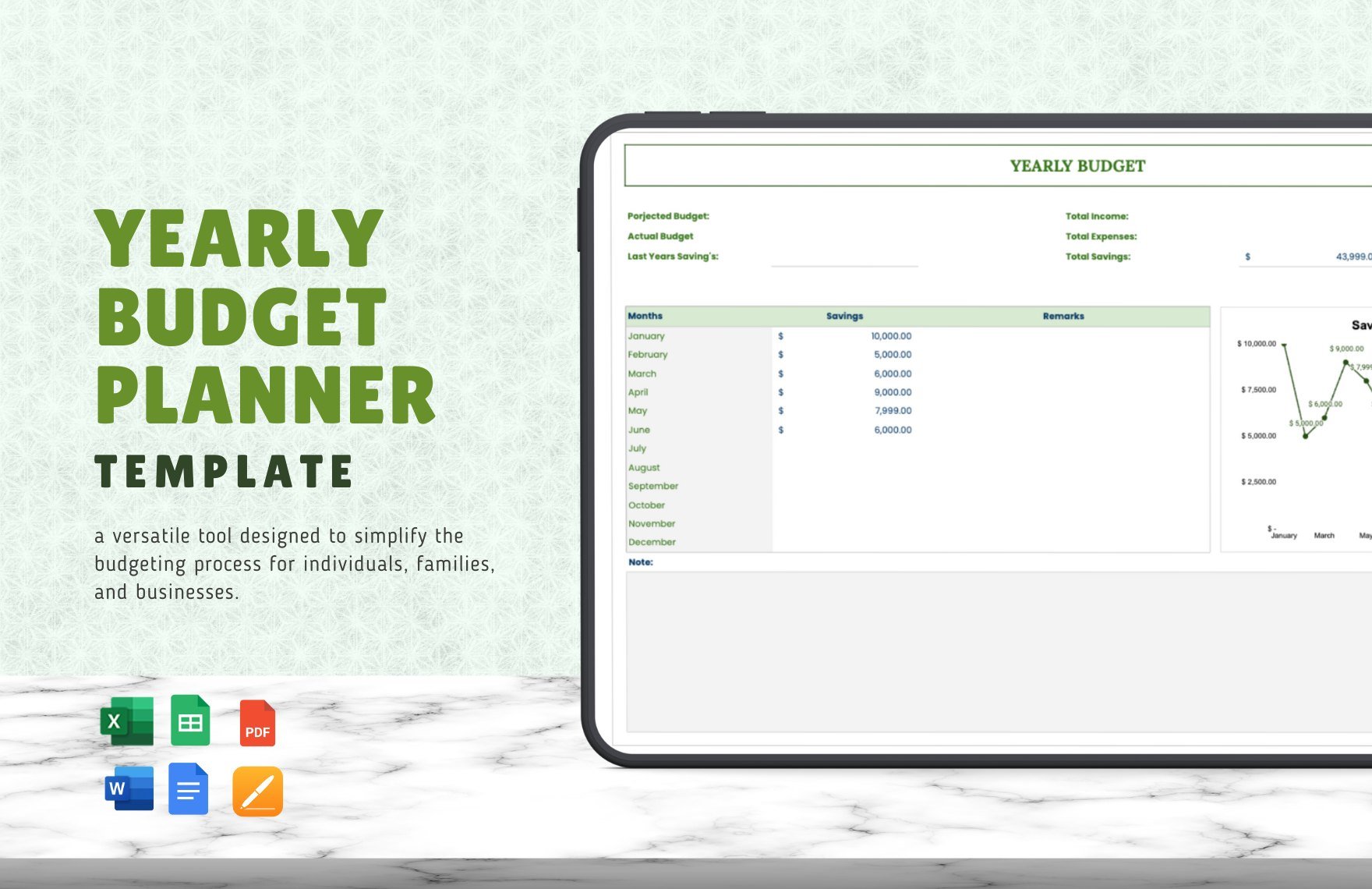

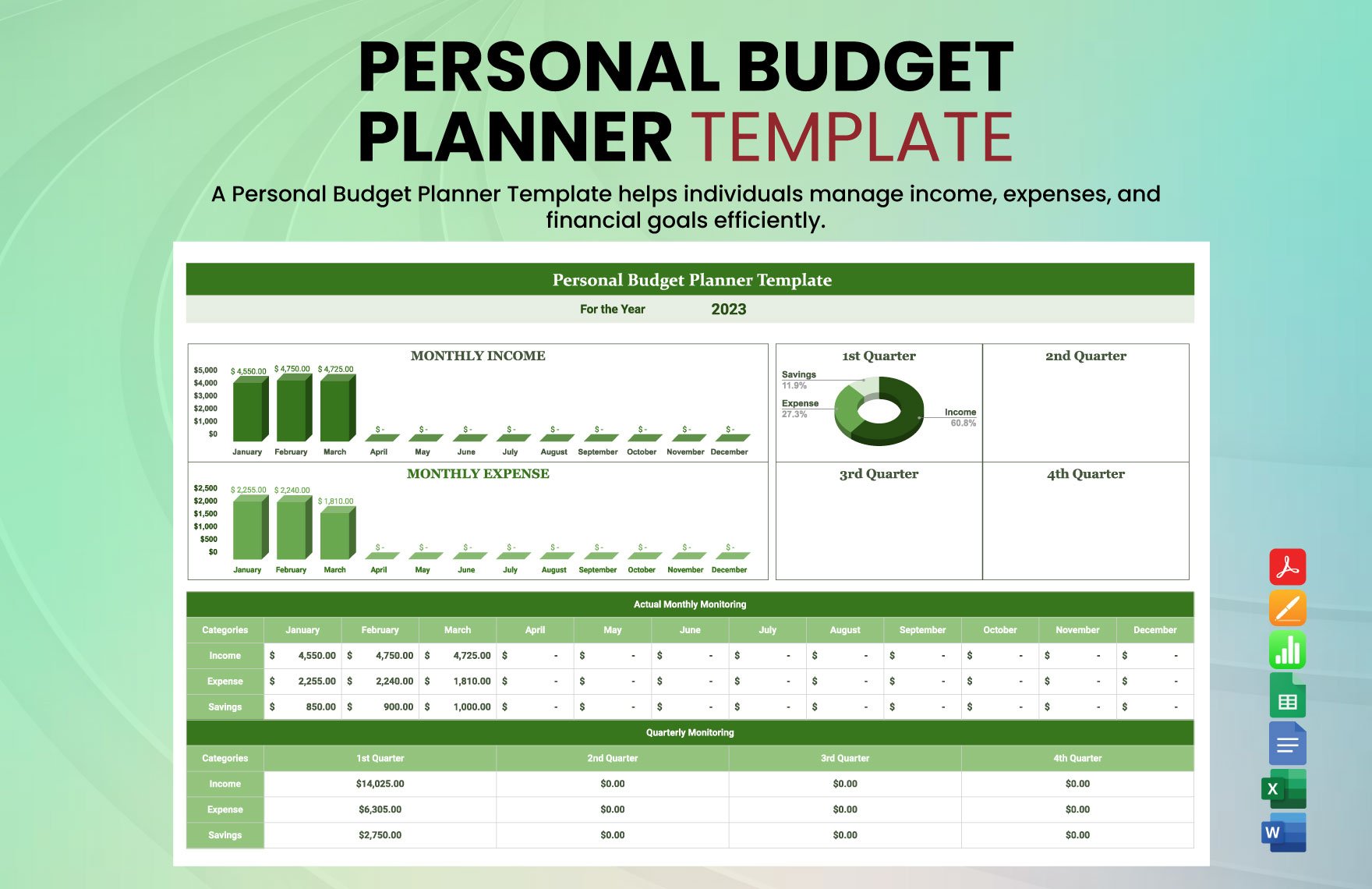

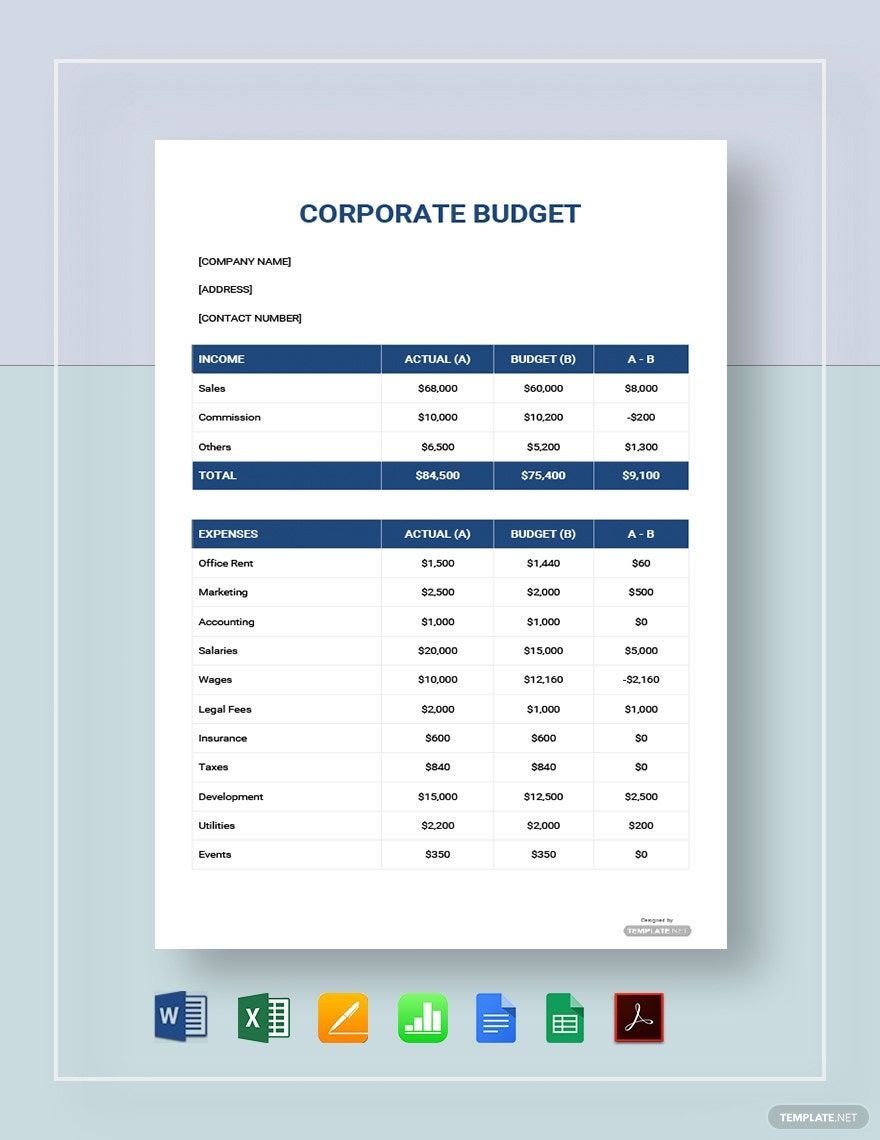

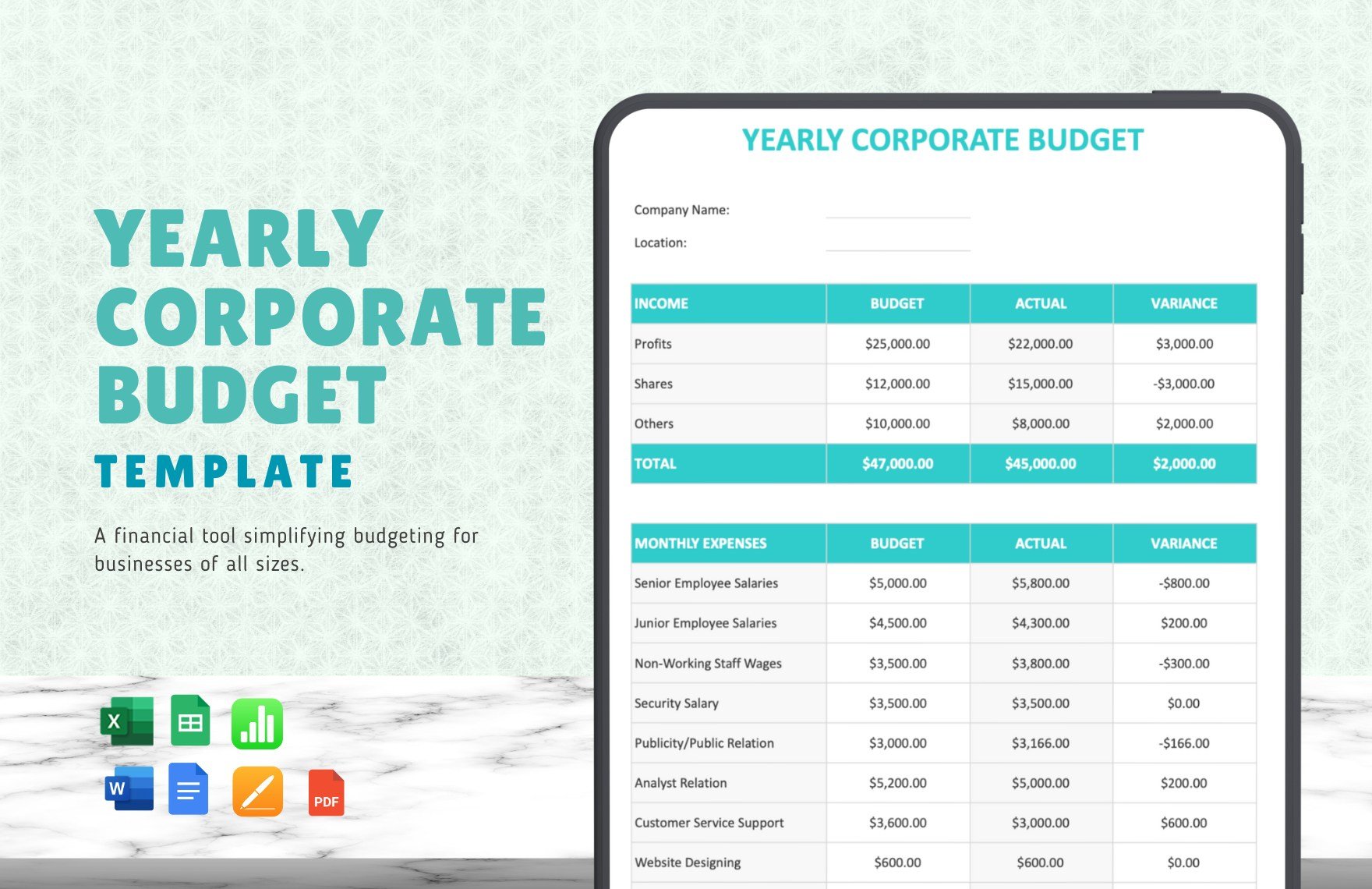

Whether you wanted to create a weekly or monthly household budget worksheet, it pays to secure a standard first. Although there are many budget plan templates available in the market, creating a personalized one is always the right choice. So, acquire a format and make one from it. You can also use more than one sample to incorporate in your template.

2. Use Quality Content

Your personal budget template is limited to your use. However, it does not mean that you should not consider using quality content on it. Having great wording in your format makes you write more and use it more. It invites you to utilize it as much as possible. So make sure that your quality is excellent.

3. Update Accordingly

Your budget template is not a one-time thing. If you can, you should update it as much as you can. Although you don't need to incorporate a dashboard template with it. Inserting additional lines to improve its utilization is an excellent thing. You should do it.

4. Create a Pattern

People find it challenging to be consistent. It is hard. However, If you want to excel in doing this practice. You should create a habit. You can even make it your personal project plan. Nevertheless, you should act and do something other than just preparing a template. Move it.