Table of Contents

- What Is Biweekly Mortgage?

- Biweekly VS Monthly Mortgage

- 3+ Biweekly Mortgage Templates

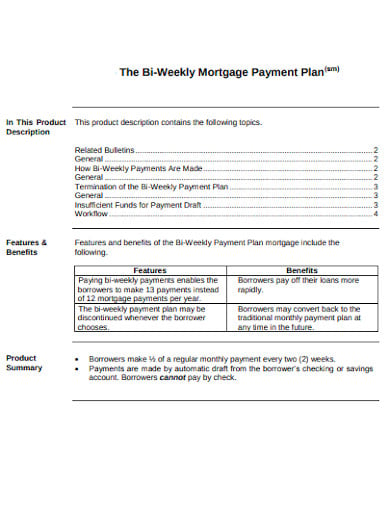

- 1. Bi-Weekly Mortgage Payment Plan

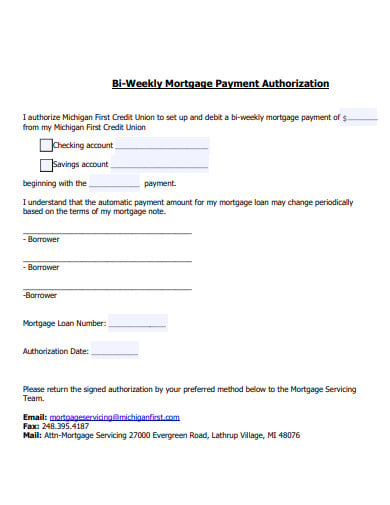

- 2. Bi-Weekly Mortgage Payment Authorization

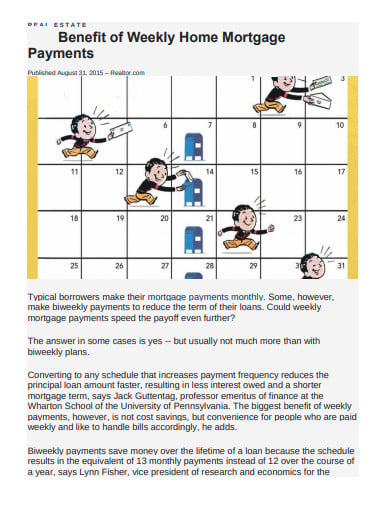

- 3. Benefit of Weekly Home Mortgage Payments

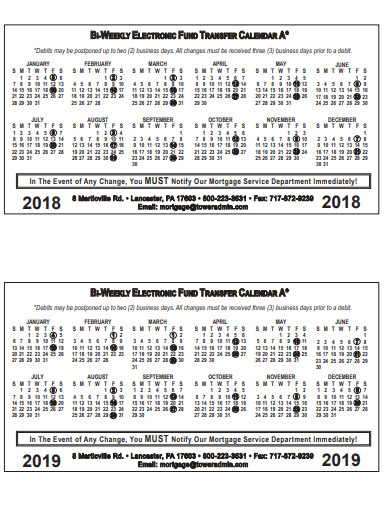

- 4. Bi-Weekly Mortgage Electronic Fund Transfer Calendar

- 5 Steps in Making Biweekly Mortgage

3+ Biweekly Mortgage Templates in PDF

Luxury homes, expensive beach houses, mansions, and other extravagant properties are a dream of many people. However, some dreams are quite upsetting because of finding it very hard to believe in reality. Don’t lose hope because it is possible to obtain the property you desire with enough money and great financial management. You even have the chance to pay for less with a mortgage loan. After settling with the mortgage fee agreement, you are given the loan amortization schedule to know when and how much to pay. When you want the loan to end fast, you can apply specifically for a biweekly mortgage.

What Is Biweekly Mortgage?

A mortgage is a type of loan you can get from mortgagees or lenders when you need to pay for your dream house or any payment that requires big money. Upon credit, the lender or bank will ask for your money divided into specific periods and with interest. That payment works in a monthly payment schedule, but some mortgagees allow the biweekly mortgage payment schedule too. Every two weeks, you will be expected to pay.

Biweekly VS Monthly Mortgage

There are pros and cons involved for all mortgage payment schedules, and you better learn first on why you should make biweekly mortgage payments. The biggest benefit of paying every two weeks is that the whole payment will end soon. If a monthly mortgage payment requires a whole year, then you can simply end it in six months. Moreover, that faster transaction grants you savings in interest rate too. With a monthly mortgage, you expect the required payment per month to be lower than biweekly rates. However, a bigger interest rate and total payment will be involved because the entire payment will take longer.

3+ Biweekly Mortgage Templates

1. Bi-Weekly Mortgage Payment Plan

tmpartners.com

tmpartners.com2. Bi-Weekly Mortgage Payment Authorization

ichiganfirst.com

ichiganfirst.com3. Benefit of Weekly Home Mortgage Payments

fiscalwisdom

fiscalwisdom4. Bi-Weekly Mortgage Electronic Fund Transfer Calendar

toweradmin.com

toweradmin.com5 Steps in Making Biweekly Mortgage

You can create your own schedule or calculator to stay on track with your mortgage biweekly. As you apply for a mortgage loan, you wait for confirmation on when to start paying like if you receive the bi-weekly mortgage payment authorization already. You must stay responsible at paying anyway to prevent defaults. You can prove your commitment to settle with mortgage costs through the mortgage promissory note and similar mortgage note templates. In concern to your mortgage template, you make one by knowing the right steps.

Step 1: Review and Copy the Details from Amortization

It is an illegal practice to assume every amount allocated to the amortization. There could be inconsistencies in the numbers and data that will be an issue once noticed soon. Once you are sure of the amount and possible changes due to interest, extra payment, and more, you will copy such details. The copied data will fall on the biweekly mortgage schedule you shall make. Review it carefully because even basic mortgage contract templates require accurate information, so no problems arise from the errors committed.

Step 2: Pick a Good Format

Different formats are available on how you create your payment plan. The same goes for the themes you use on your version, and you can depend on mortgage WordPress themes and similar mortgage website themes for that. Be sure you understand easily the format you use, so there is no hassle in depending on your schedule anytime. Testing out your plan through Google Docs, Pages, and other examples can help you determine which format benefits you the most too.

Step 3: Outline the Data According to Categories

Outlining and categorizing would happen here to divide the gathered data according to the due date, due payment, interest rate, principal, extra payment, balance, and more. Be sure you understand every category involved to avoid recognizing the data in the wrong way. Don’t get confused at the numbers you gathered from amortization because putting some factors in the wrong category will make your whole mortgage payment schedule inaccurate. As much as possible, you avoid using the wrong numbers, especially if you calculate your data with a calculator soon.

Step 4: Use the Correct Formula for Calculations

There is an increase for the total payment you give back upon loaning because interest rates will cause the rise. However, you can prevent the burden of massive interest by paying more than the required amount of your biweekly mortgage payment. To have an accurate estimation of fees, you need to observe the proper formula for it. A mortgage calculator will be convenient to use once it follows the required method. Just don’t forget to test the precision of such a calculator before depending on it entirely because maybe specific changes are still needed there.

Step 5: Update It Always

You don’t expect your schedule to stay the same forever because, after certain weeks or months, changes might happen. You probably paid more, so more deduction should get calculated. Late payments often give you burdens as well. Failure to update will mean you already depended on the wrong or outdated info. Updating from time to time is another way of reviewing for possible errors on the data too. When you can see inconsistencies in the numbers from that schedule and the payment required, then you should investigate which is right or wrong. You have a right to complain when the mistake falls under the lender.

It is safe to say that generalizing the biweekly mortgage payment as advantageous or not is unnecessary because it is up to the borrower in deciding that. Such a biweekly loan is beneficial if the borrower is responsible for dealing with costs in the first place. Of course, failure to commit to such responsibilities like nonpayment will lead you to conclude that the process is a disadvantage. All borrowers should commit so lenders can trust them again for loaning. You won’t lose properties upon paying on time anyway. Keep track of your biweekly mortgage with the dependable template of your choice.