Table of Contents

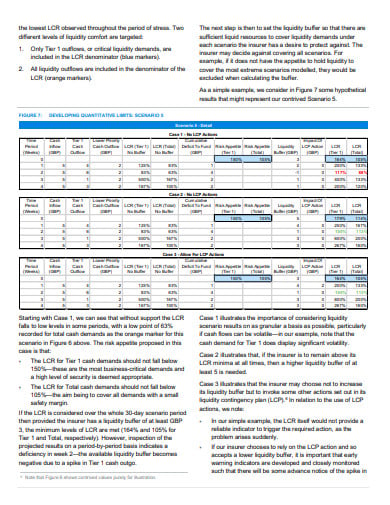

- What is Liquidity Risk Management

- The Tightrope Walker

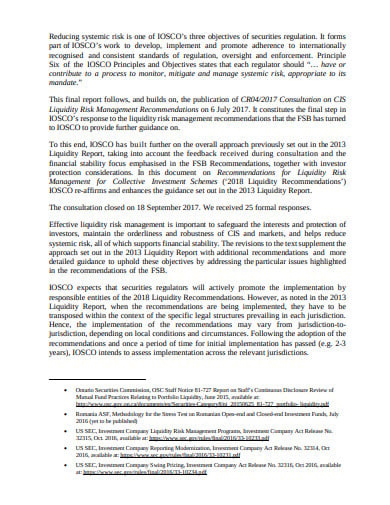

- 11+ Liquidity Risk Management Templates in PDF | DOC

- 1. Liquidity Risk Challenge Management

- 2. Liquidity Risk Management Programs

- 3. Liquidity Risk Management for Collective

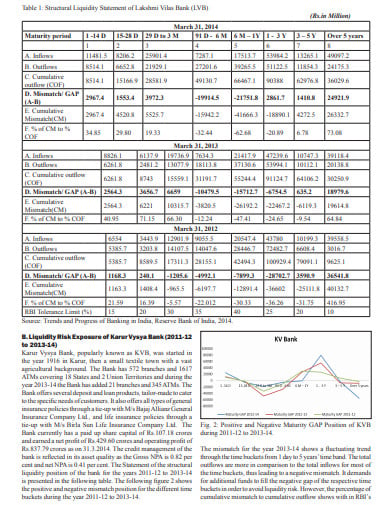

- 4. Liquidity Risk Management Private Sector

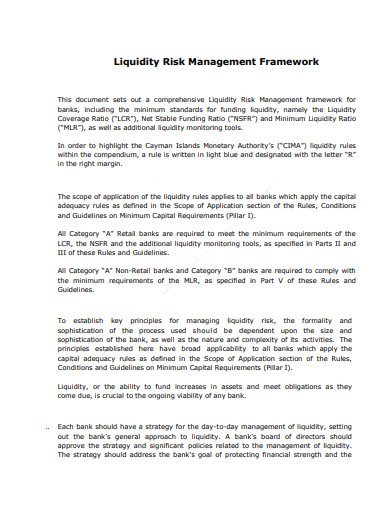

- 5. Liquidity Risk Management Frame Work

- 6. Checklist for Liquidity Risk Management

- 7. Liquidity Risk Bank Management

- 8. Liquidity Risk Management and Supervision

- 9. Buy-Side Liquidity Risk Management

- 10. Liquidity Risk Management Conceptual

- 11. Financial Liquidity Risk Management

- 12. Liquidity Risk Management Crisis

- 5 Steps How to Do Liquidity Risk Management

11+ Liquidity Risk Management Templates in PDF | DOC

Capability to meet obligations is a must in any industry as failure to do so could bring disaster to business reputation. Bad reviews due to incapacity to meet collateral and cash obligations will surely scare clients leading to income depletion. For mortgage industries, liquidity is a priority to stay afloat. Operation and deal continuity are few among many of liquidity’s function. Thus, consider it a crucial game of buoyancy wherein the right amount as to be in place to meet both expected and unexpected obligations. However, risks are inevitable, and it is up to sheer cunning wits and excellent budget management that one can dance along to the roaring tides.

What is Liquidity Risk Management

Risk management is at every industry’s heart as it is the gatekeeper of severe failures. Avoiding unacceptable and severe losses within the institution’s capacity to follow obligations is the objective of this management scheme. The process employes analysis efforts to determine the operational and financial risks that can help curb perilous situations. More so, the deployment of strategies to minimize risk swelling is well under this procedure’s radar.

The Tightrope Walker

A circus is one spectacle, and being amazed at the tightrope walker is not something new. The delicate balance between extremities, even though at the presence of safety nets, still sparks awe as the walker manages to tease the crowd. He or she has a pole or his or her body as a balancing mechanism fighting against the omnipresent risk by gravity. Now imagine the same for the mortgage sector. This time, you have piles of balance sheets on the desk to give an accurate and relevant financial status so that one can meet the obligations. Consider the unexpected winds, possible faulty material as factors that can cause a fall. Now, to get across a year with excellent customer service, how do you fare with liquidity and all the risks that come along? Do you have what it takes to handle the delicate act with care and mastery?

11+ Liquidity Risk Management Templates in PDF | DOC

1. Liquidity Risk Challenge Management

milliman.com

milliman.com2. Liquidity Risk Management Programs

capco.com

capco.com3. Liquidity Risk Management for Collective

iosco.org

iosco.org4. Liquidity Risk Management Private Sector

ijmbs.com

ijmbs.com5. Liquidity Risk Management Frame Work

cima.ky

cima.ky6. Checklist for Liquidity Risk Management

go.jp

go.jp7. Liquidity Risk Bank Management

org.il

org.il8. Liquidity Risk Management and Supervision

bis.org

bis.org9. Buy-Side Liquidity Risk Management

ssga.com

ssga.com10. Liquidity Risk Management Conceptual

aima.in

aima.in11. Financial Liquidity Risk Management

dico.com

dico.com12. Liquidity Risk Management Crisis

gov.hk

gov.hk5 Steps How to Do Liquidity Risk Management

Having the much-needed financial capacity to meet obligations is a primary goal in the mortgage industry. That is why continuous assessment and updates should always be on the go as part of the management process. Also, the presence of risks makes any organization alert in finding strategic action plans. Thus, liquidity risk management is indispensable in the industry as money is on the line. So follow the simple list below to execute a comprehensive management action.

Step 1: Know the Deal

Going back to the agreement document is a must as the details that need settling are within the said document. Whether the deal is a matter of investment or funding, every bit of authentic detail in the arrangement is critical. Also, the fact that you have multiple clients with different arrangement makes every aspect a little bit different from the others.

Step 2: Determine the Obligations

The risk is nothing but the basics of meeting obligations. Knowing how it fails is a matter of knowing the agreement. Is it cash or specific collateral that is on the line? Make sure you jot all down in a datasheet for easy use. Plus, each obligation has a particular equivalent that you can, later on, assess according to your capability.

Step 3: Check Capability

Making sure that the cash flow works in your favor needs a rigid analysis that has a decent number of *statement sheets about the current financial status. Plus, having constant status reports will be of big help so that exercising prudence in every decision making is achievable. So better get to know your vaults or coffers if they are in the perfect condition to execute the task.

Step 4: Avoid the Losses

Calculating the losses and creating a forecast are critical steps to consider because projecting the deductions will let you have the right eye for the red zone. Make sure you have an organization chart of the entire process so that you can also call for actions when the possibilities are against your business. So as much as you can, stay away from incurring unacceptable losses.

Step 5: Keep Contacts on the Line

Having ties with financial institutions such as banks will make the transactions smooth. Do take note that the management program is a nexus of establishments. And to secure timely transactions means keeping important contacts on the line for quick calls is vital. Plus, when emergencies arise, spare yourself the hassle in looking over at the directories.

Always keep on track and stay updated. With healthy liquidity, make sure that you stay afloat rather than getting sunk. More so, skillfully manage the risks so that you can walk across the tightrope and meet your obligation as the walker.