Table of Contents

- What Is Mortgage Amortization?

- Amortization VS Depreciation

- Mortgage Amortization Calculator

- 11+ Mortgage Amortization Templates in PDF | DOC

- 1. Monthly Mortgage Amortization

- 2. Amortization and Affordable Mortgage

- 3. Mortgage Amortization of Home Loans

- 4. Mortgage Negative Amortization Template

- 5. Mortgage Amortization Requirements

- 6. Mortgage Amortization Report

- 7. Mortgage Amortization Schedule

- 8. Mortgage Negative Amortization Endorsement

- 9. Payment Mortgage Amortization

- 10. Mortgage Amortisation Requirements

- 11. Mortgage Loan Re-Amortization Request

- 12. Mortgage Product Amortization Sample

- 5 Steps in Making Mortgage Amortization

11+ Mortgage Amortization Templates in PDF | DOC

You might think being a celebrity gives you an easy life, but that isn’t true all the time because big problems like foreclosure happened to some celebrities like Nicolas Cage, Rihanna, and Kristin Bell. Foreclosure is the outcome of failing to pay for the mortgage payment. Nobody wishes to experience such big losses from foreclosure, especially when millions of dollars were involved in the process of such celebrities. That money comes from losing big homes or mansions used as collateral for the mortgage contract. Things can take a different turn by following strictly on the loan mortgage amortization schedule.

What Is Mortgage Amortization?

Mortgage loans will be paid overtime to avoid losing properties for good. The payment schedule with allocated payment costs and corresponding monthly loan payment term is called amortization. In combining both conditions, the mortgage amortization contains the program for mortgage payments. Borrowers or mortgagors will have to settle accounts before the deadlines, or they will have to face the consequences.

Amortization VS Depreciation

There is a difference between amortization and depreciation, and what you should quickly know to differentiate both is through the assets involved. Assets can either be tangible or intangible. In amortization, it lessens the value or cost of intangible assets, while depreciation is for physical assets. All borrowers should be responsible enough to know the current value of their mortgage costs to prevent ending in default or nonpayment at some point.

Mortgage Amortization Calculator

The best way to keep track of your mortgage payment schedule and costs is by using the mortgage amortization calculator. This grants you access in calculating the estimated amount for payment on your mortgage. You never need to guess the amount once you know about the proper mortgage amortization formula for your calculator. It won’t be difficult to make one too by making the mortgage amortization Excel template and more formats.

11+ Mortgage Amortization Templates in PDF | DOC

1. Monthly Mortgage Amortization

ccim.com

ccim.com2. Amortization and Affordable Mortgage

upenn.edu

upenn.edu3. Mortgage Amortization of Home Loans

nccob.org

nccob.org4. Mortgage Negative Amortization Template

consumerfinance.gov

consumerfinance.gov5. Mortgage Amortization Requirements

econstor.eu

econstor.eu6. Mortgage Amortization Report

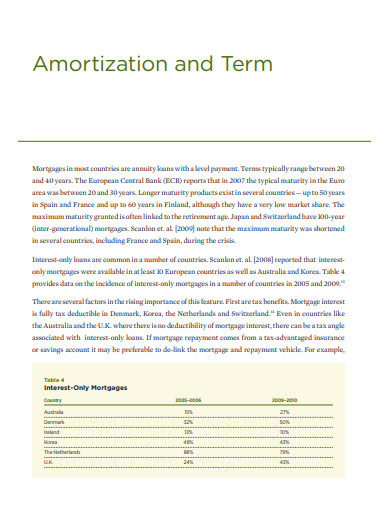

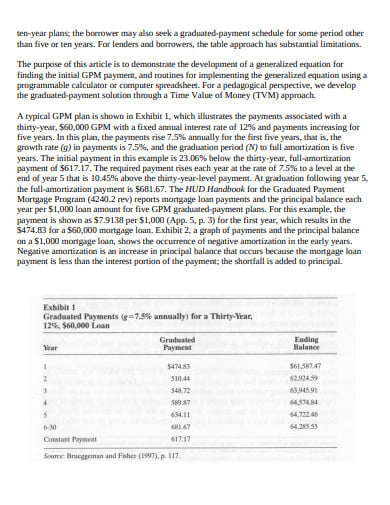

sdsu.edu

sdsu.edu7. Mortgage Amortization Schedule

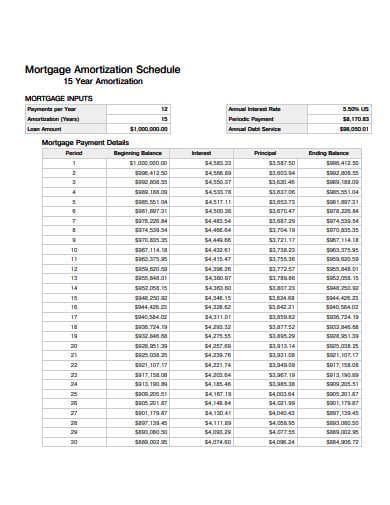

theanalystpro.com

theanalystpro.com8. Mortgage Negative Amortization Endorsement

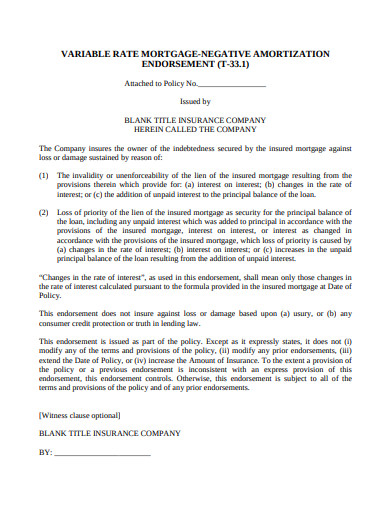

texas.gov

texas.gov9. Payment Mortgage Amortization

uncg.edu

uncg.edu10. Mortgage Amortisation Requirements

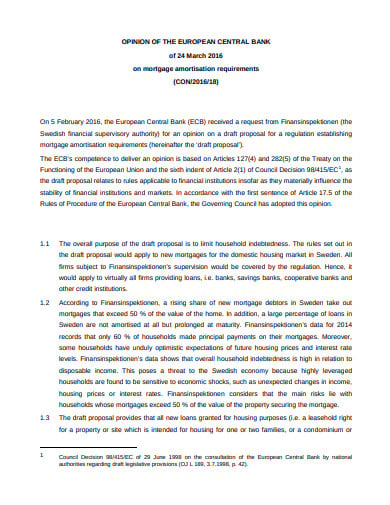

europa.eu

europa.eu11. Mortgage Loan Re-Amortization Request

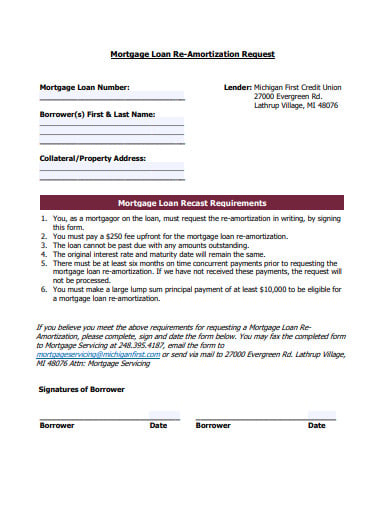

michiganfirst.com

michiganfirst.com12. Mortgage Product Amortization Sample

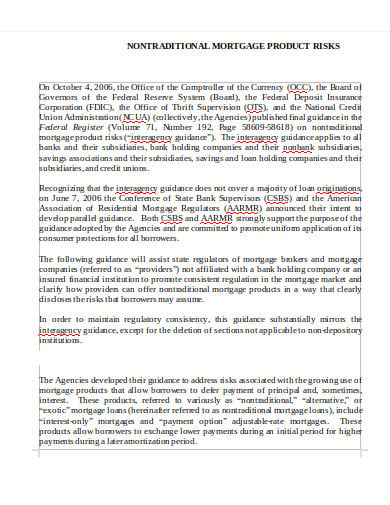

md.us

md.us5 Steps in Making Mortgage Amortization

Whether you deal with home mortgage amortization or other forms, an organized mortgage amortization must happen. Otherwise, you might find it difficult to track your monthly payment amount and other reasons. Ever since you sign the mortgage agreement, it is not easy to turn back unless you are prepared for the fines and consequences involved. Making a professional and clear schedule for your amortization is essential to let you stay benefited. It will be easy to conduct after knnowing the steps for it.

Step 1: Copy the Data from the Payment Schedule

Notably, you will have to gather data from the official schedule until you input such data into the amortization template. It will have to be a format you prefer, or maybe you use the mortgage amortization spreadsheet. After coding, you will need to follow the terms by paying on the expected date strictly. There are chances for more significant fees too because of the interest rate, and you have to remain updated about it to prepare for more money in settling it.

Step 2: Prepare Charts

You create charts to see a visual representation of how the interest, loan amount, and more change through the months. The presentation gives a clear picture of how much changed to the numbers instead of merely reading the data. A mortgage amortization graph is common, too, for the visual. Aim to use visuals for a convenient approach of recognizing the update among mortgage loans.

Step 3: List Down Categories

Writing schedules never need to be of full sentences because you usually encode numbers there. Categorizing the table is how this works, especially on dividing data according to period, payment amount, principal, interest, and balance. You should understand what all categories mean to prevent listing the wrong information on divisions. Since you depend on the schedule for payment periods, it should not bring you any hassle.

Step 4: Review the Accuracy of Numbers

Keep in mind that incorrect numbers will already make the amortization inaccurate, so it must be corrected. Everything encoded there already serves as your mortgage payment history, and it is only right to fix that. Upon using a loan calculator, you still derive with wrong results to calculations if the given numbers were already incorrect. All borrowers have to stay alert on the responsibility of correcting data, so no issue takes place on future circumstances.

Step 5: Make It User-Friendly

Things need not become very complicated if you can simplify your template. You aim to keep it easier when more people will use it as a basis, or anyone might get confused at changing or getting info. Thus, the one who got confused might make the wrong changes from the amortization. The issue with sophisticated methods is you may know how to work on it for now, but it could get exhausting after a long time you use the technique again. Keep it simple for your benefit.

You should be aware by now at the many responsibilities you maintain for considering a mortgage as making the amortization is just one of the duties you will take there. Others are focused a lot on keeping a good credit score to qualify on loan. However, the beginning is not your only concern. You must know how to maintain paying there for the many months to come. Some can take many years, especially with the significant amount involved. Financial responsibilities are no joke, but finding ways to become more responsible financially is achievable.