Table of Contents

- What Is a Mortgage Payment Calculator?

- Mortgage and How Much You Afford

- 4+ Mortgage Payment Calculator Templates in PDF | DOC

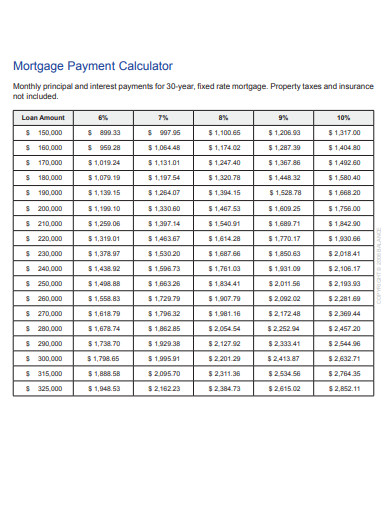

- 1. Mortgage Payment Calculator Template

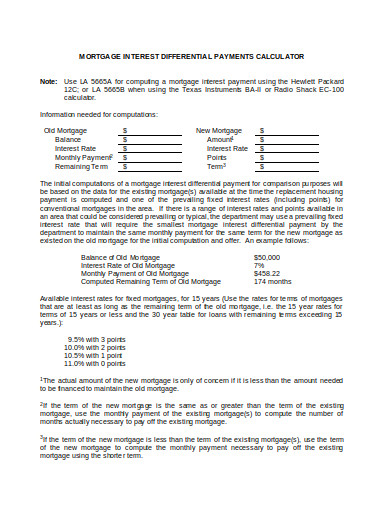

- 2. Mortgage Interest Differential Payment Calculator

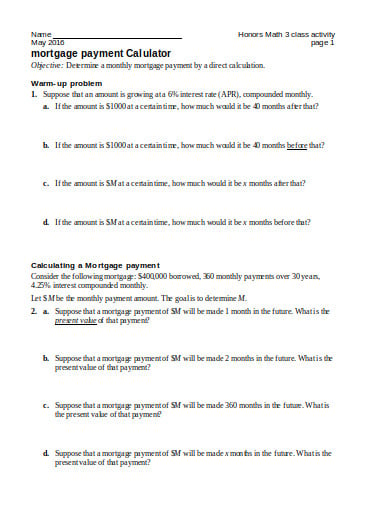

- 3. Simple Mortgage Payment Calculator Template

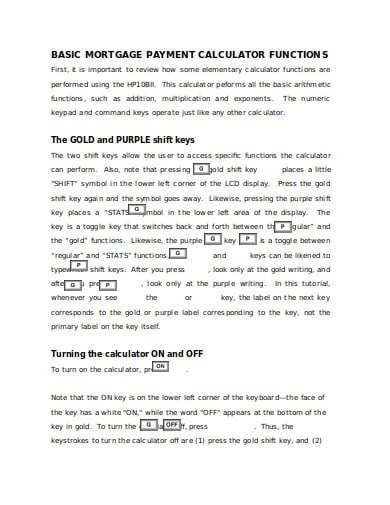

- 4. Mortgage Payment Calculator Functions Template

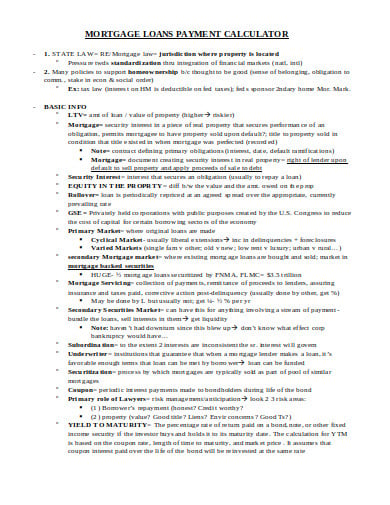

- 5. Mortgage Loan Payment Calculator Template

- 5 Steps in Making Mortgage Payment Calculator

4+ Mortgage Payment Calculator Templates in PDF | DOC

A mortgage is a concept that started way back from England in the year 1190, and it gave rise to the Americans after some time due to the need for mortgages of properties due to numerous immigrants. Although there are different regulations and laws applicable from the olden times until today, it is still clear that mortgage continued to benefit individuals from then and now. This type of loan helps you gather funds quickly when you need to pay for big fees on houses, cars, and other properties. However, you might lose track of the number of your contributions and current fees without using calculations to know about every amount. You benefit in using the mortgage loan calculator to calculate and check the results.

What Is a Mortgage Payment Calculator?

The mortgage payment calculator works just like a basic Excel calculator, except you will focus on using the right formula to identify the mortgage payment biweekly, monthly, or annually. A mortgage calculator can help you estimate the different fees while you adjust the downpayment, interest, and others to calculate. A common practice is to trust the mortgage payment schedule to know about what data you will gather to figure for the fees. You may set it up to your preference, too, by trying out different formats of templates you can use.

Mortgage and How Much You Afford

You always stay realistic on how much you can afford for paying mortgage loan because you might lead to default in failing to pay back the promised amount. Others simply think of the quick cash you will benefit from loaning while forgetting about the financial responsibility you must maintain through certain months. Don’t just look into how much you can earn but also on how much you will pay back after. Reviewing the loan payment schedule and using the data there for calculation after will let you know of the estimated costs for mortgage. Changes happen to payments as interest can get higher or that terms change. Moreover, you also adjust if you are struggling with your current salary and know how to survive with limited budget. Think of those responsibilities before considering mortgage.

4+ Mortgage Payment Calculator Templates in PDF | DOC

1. Mortgage Payment Calculator Template

balancetrack.org

balancetrack.org2. Mortgage Interest Differential Payment Calculator

illinois.gov

illinois.gov3. Simple Mortgage Payment Calculator Template

lexingtonma.org

lexingtonma.org4. Mortgage Payment Calculator Functions Template

csulb.edu

csulb.edu5. Mortgage Loan Payment Calculator Template

nyu.edu

nyu.edu5 Steps in Making Mortgage Payment Calculator

Getting your amortization schedule is a good way to be aware on your mortgage payment per period but you have to do your own calculations too upon checking if results are accurate or not. You have the chance to complain about inaccurate results there since you probably paid much more than the expected amount. Another bad scenario is when your contributions aren’t enough and those weren’t credited by lenders. Your claims about your calculations will only turn believable if an acceptable loan calculator gets made.

Step 1: Encode Data

There are essential factors that you must take, particularly the loan term, principal, interest rate, total mortgage payment, and more. You would review your data if you got the correct numbers because any inconsistency to its amount can affect results severely. That means wrong data will still have you end up with the wrong estimation despite using the correct formula to calculate. Getting the updated numbers should be your concern since payments can continuously change depending on what the agreement is.

Step 2: Use the Proper Formula

After gathering data, you will solve next, and your formula should be precise for your mortgage payment. Maybe you used the method that is fit for the mortgage extra payment calculator. Once you are familiar with the needed formula, it turns easy to create your calculator soon as you adjust your template to follow such a method. Don’t get mixed up with other solutions to avoid deriving at the wrong outcome.

Step 3: Put Charts and Tables

To put a table or chart to your template will make it convenient to know where to place the needed numbers or data that gets calculated soon. It must observe good setup too wherein there are labels to identify every category and remember what to input there. These charts must not be difficult to understand because you might end up confused with the outcome of calculations in being unsure at what to input in every blank chart or table.

Step 4: Be Specific with What Your Calculator Is

Maybe the calculator you made is too broad by making the basic formula for any loan calculator. However, there are other concerns you might need to calculate, like taxes, extra payment, and more. That concern means you edit your template that is applicable for mortgage payment calculator with taxes or mortgage additional payment calculator. Some might require the mortgage interest payment calculator, too, as it depends on what you need to know.

Step 5: Test the Calculator

You will still be unsure of the performance of the calculator without testing its accuracy. This test requires you to review if all details got set up correctly, and you calculate with random numbers. When results are the same as other prominent websites and apps that offer loan calculators, then you can tell you did it right. Don’t just rely on guesses because the answers you thought were correct could be the opposite. Create the necessary changes after any error committed so that a dependable mortgage calculator will happen.

When you succeed at creating the calculator, then you will realize how helpful it is. The calculator lessens your worries about the possible rates you must cover after seeing that your budget is enough and that precise results happened. You can even use the calculator as evidence about your payments and contributions for how many months. After sending your next loan application letter, you now have a reliable calculator to ensure you are always informed about loan estimates.