Table of Contents

- 10+ Supply Chain Finance Templates in PDF | DOC

- 1. Service Supply Chain Finance

- 2. Dynamic Supply Chain Finance

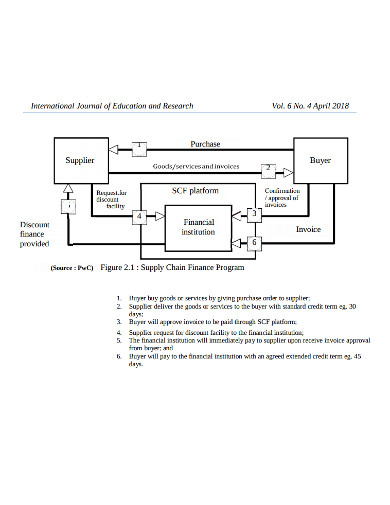

- 3. Purchase Supply Chain Finance

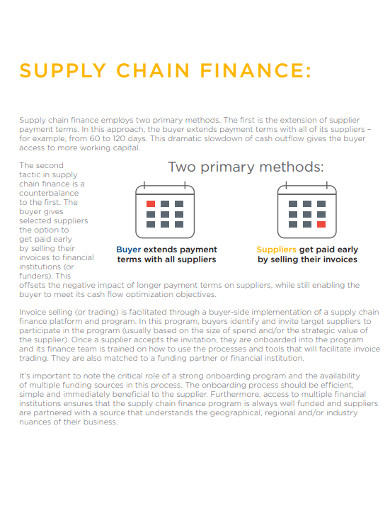

- 4. Primary Supply Chain Finance Template

- 5. Supply Chain Accounts Finance

- 6. Innovative Supply Chain Finance

- 7. Global Supply Chain Finance

- 8. Supply Chain Finance Development

- 9. Relevant Supply Chain Finance

- 10. Investment Supply Chain Finance

- 11. Supply Chain Finance Risk Template

- How Does Supply Chain Finance Work?

- 1: Supplier Financing

- 2: Reverse Factoring

10+ Supply Chain Finance Templates in PDF | DOC

When global supply chains spread around the globe with foreign purchasers on one hand and on the other, a varied group of manufacturers in numerous countries, companies are under strain to access the working capital locked in their supply chains. Supply chain finance, also known as supplier finance or reverse factoring, is a collection of alternatives that improve cash flow by enabling corporations to extend their terms of payment to their suppliers while providing an early payment option for their large and small business suppliers. This leads to a win/win scenario for both the buyer and seller. The consumer optimizes operating capital and excess operating cash flow is created by the retailer, thereby reducing risk throughout the supply chain.

10+ Supply Chain Finance Templates in PDF | DOC

1. Service Supply Chain Finance

bofaml.com

bofaml.com2. Dynamic Supply Chain Finance

kyriba.com

kyriba.com3. Purchase Supply Chain Finance

ijern.com

ijern.com4. Primary Supply Chain Finance Template

primerevenue.com

primerevenue.com5. Supply Chain Accounts Finance

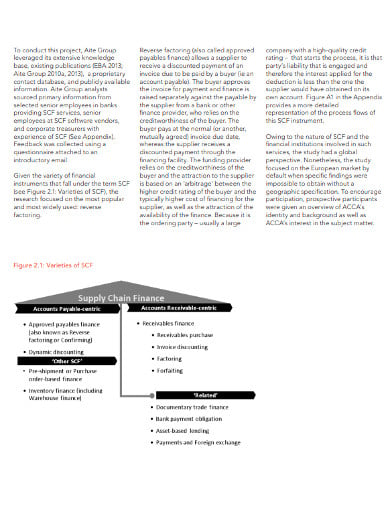

accaglobal.com

accaglobal.com6. Innovative Supply Chain Finance

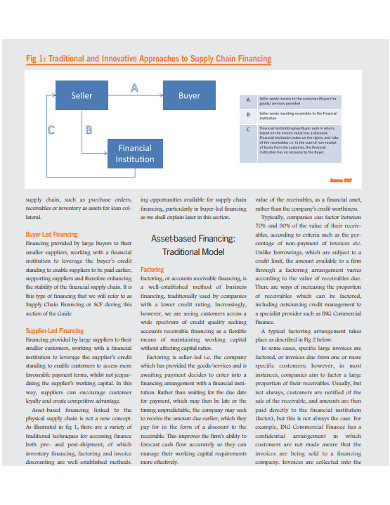

web.utk.edu

web.utk.edu7. Global Supply Chain Finance

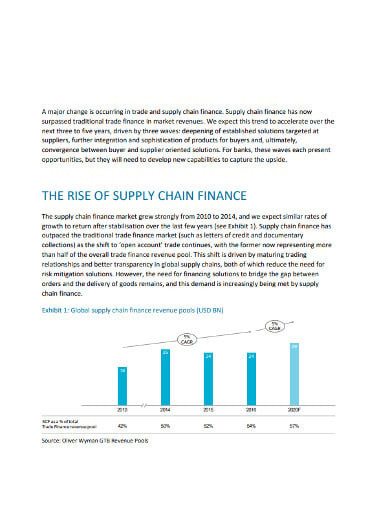

oliverwyman.com

oliverwyman.com8. Supply Chain Finance Development

edc.ca

edc.ca9. Relevant Supply Chain Finance

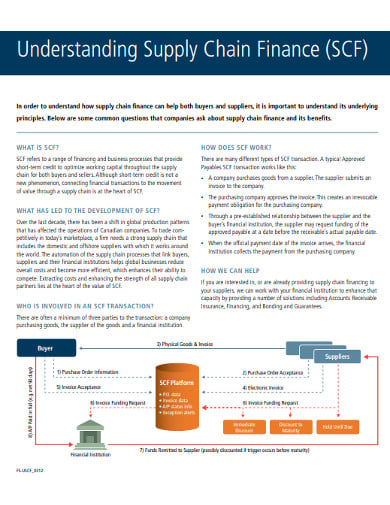

accaglobal.com

accaglobal.com10. Investment Supply Chain Finance

aipma.net

aipma.net11. Supply Chain Finance Risk Template

thebesa.com

thebesa.comHow Does Supply Chain Finance Work?

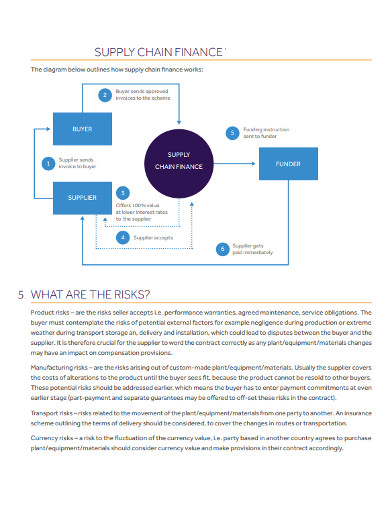

Supply chain funding is a generic term that describes several financial products that can be used to boost purchases between corporations and their vendors. Solutions for supply chain finance can be implemented in different ways. It needs to be kept in mind that that reverse factoring is a sort of funding after production. In comparison, supplier financing is a type of pre-delivery financing.

1: Supplier Financing

Supplier financing is a type of supply chain finance that enables manufacturers and distributors to purchase raw materials for inventory building or large order fulfillment. It operates by working with a supply chain finance firm that offers you a trade credit, which serves as a broker between your enterprise and your suppliers. If you choose to buy raw materials (or completed goods) you put a buying order with the vendors rather than the procurement financing company. If you need to purchase raw materials (or finished goods) you put a purchase order with your vendors rather than the procurement finance company. In exchange, the finance company puts an order with your manufacturer. The required payments are also handled by them.

Benefits of Supplier Financing

The most significant advantage of supplier financing is that it is a device that is used to fund pre-delivery. It can be used to construct inventories and develop the company. Moreover, it doesn’t interfere with your existing funding. The supply chain management company doesn’t have to claim a lien on your estate. Finally, unlike many other alternatives, there’s no need for your clients to do anything on your behalf. It applies to any manufacturing company or drug manufacturer of small and medium scale that satisfies the qualification requirements.

Disadvantages of Supplier Financing

The supplier financing approach has certain drawbacks, and cannot be applied by everyone. It only operates with businesses that can be covered in cash. If your business can’t be covered in cash, you’re not eligible. That approach also only provides you with the raw materials and finished goods prices. It does not provide funding to offset those costs.

2: Reverse Factoring

The most popular application of a finance approach for the supply chain includes using a product that is referred to as “reverse factoring.” In a traditional factoring scheme, a firm aims to increase its financial situation by selling its receivable accounts to a factoring business. This system is relatively simple and is open to many companies.

A reverse factoring method works a little better than a traditional factoring scheme. A large corporation, for example, Company Z, and a supply chain finance company enter together into a reverse factoring agreement. The mechanism for this business to collect funds is then intermediated by the supply chain finance company. Traditional reverse factoring strategies allow large business (Company Z) suppliers to obtain advance payment on their net-30 to net-60 receipts. For this function, the manufacturer pays a small charge. The reverse factoring business instead receives the large company’s (Company Z) payment once it matures.

Benefits of Reverse Factoring

Reverse factoring has several benefits from the perspective of the supplier. It enables the supplier to obtain early invoice payments owing to their client. Early payments may enhance their cash flow. The provider’s premium for obtaining the early invoice is reasonably priced as the rate is primarily determined by the client’s business creditworthiness. That argument is very significant because the big client is likely to have a good reputation, causing their vendors to pay a smaller early payment rate.

Disadvantages of Reverse Factoring

Just as reverse factoring has many advantages, it has several major drawbacks too. Secondly, it is guided by the client (refers to Company Z). The client needs to acquire the reverse factoring system and sell it to its suppliers – as an aid to them (suppliers) for dealing with the client. The system just provides certain vendors with compensation from that company (Company Z). Unless they have their reverse factoring system, it does not support manufacturers with bills from other consumers. The greatest restriction of reverse factoring is that it can only be used as a form of post-delivery finance, much like factoring. This means that you can only get funding once the item has been delivered and the receipt has been sanctioned.