Table of Contents

- What is a Required Minimum Distribution (RMD)?

- Why Need IRA Minimum Distribution Calculator?

- How to Calculate Your Required Minimum Distribution?

- 10+ IRA Minimum Distribution Calculator Templates in PDF

- 1. IRA Minimum Distribution Calculator Worksheet

- 2. IRA Minimum Distribution Benefits Calculator

- 3. IRA Minimum Distribution Retirement Calculator

- 4. IRA Minimum Distribution Required Calculator

- 5. IRA Minimum Traditional Distribution Calculator

- 6. IRA Minimum Distribution General Calculator

- 7. IRA Minimum Distribution Calculator Form

- 8. IRA Minimum Distribution Information Calculator

- 9. IRA Minimum Distribution Account Calculator

- 10. IRA Minimum Distribution Withdrawal Form

- Outcomes of Failing to Take Your RMD

- Tax Consequences of RMDs

- Conclusion

10+ IRA Minimum Distribution Calculator Templates in PDF

The Internal Revenue Service will ask for a piece of your earnings and if a Required Minimum Distribution does not exist, then you could have lived off other income and never pay taxes on some of your investment gains. With the help of an RMD, the IRS gets its share and it is important to calculate the minimum distribution with the help of an IRA minimum distribution calculator.

What is a Required Minimum Distribution (RMD)?

The amount of money that is normally withdrawn from a traditional, SEP or a Simple IRA by owners and qualified retirement plan participants of retirement age is known as a required minimum distribution. Around the age of 70, the participants must begin withdrawing from their retirement accounts. Based on the current RMD calculation, the retiree will have to withdraw the RMD amount in each subsequent year. The required minimum distributions are generally determined by dividing the retirement account’s prior year-end fair market value by the applicable distribution period or life expectancy. There are worksheets to help taxpayers calculate the amount they must withdraw. An RMD also works as a safeguard against people who use a retirement account to avoid paying taxes.

Why Need IRA Minimum Distribution Calculator?

You will have to use an IRA Minimum Distribution Calculator to approximate your required minimum distribution that will be based on your age and the value of your accounts. According to the IRS regulations, after reaching the age of 70 or around 70, you will have to start withdrawing money from a traditional 401(k) or IRA.

How to Calculate Your Required Minimum Distribution?

Step 1: Determine the Value of Your Retirement Account

To calculate your RMD, the first thing which you must do is enter the balance of your account at the end of the year. Discuss with your financial or tax advisor just to ensure that you are entering the correct amount and as you may need to account for recent rollovers or recharacterizations.

Step 2: Establish the Applicable Life Expectancy Factor

You will have to enter your age before the 31st of December of the current year. You must also refer to the life expectancy tables to determine the applicable life expectancy factor and enter it in this section.

Step 3: Making the Calculations

You will have to divide the balance of your account by your applicable life expectancy. This amount must be withdrawn by you from this account by the end of the year.

10+ IRA Minimum Distribution Calculator Templates in PDF

1. IRA Minimum Distribution Calculator Worksheet

irs.gov

irs.govYou can use this IRA minimum distribution calculator worksheet to figure this year’s required withdrawal for your traditional IRA. This can be done unless your spouse is the sole beneficiary of your IRA and he/she is more than 10 years younger than you. It also mentions the deadline for receiving the required minimum distribution followed by a table laying down the age and the distribution period.

2. IRA Minimum Distribution Benefits Calculator

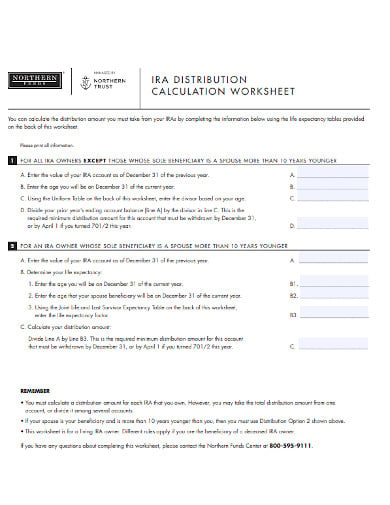

cdn.northerntrust.com

cdn.northerntrust.comAre you confused about calculating the minimum distribution benefits? If you are, then you can take some guidance from this IRA distribution calculation worksheet. You will be able to calculate the distribution amount that you must take from your IRAs by completing the information that is provided in this template. The life expectancy tables that are provided on the back of this worksheet will help you in the calculation.

3. IRA Minimum Distribution Retirement Calculator

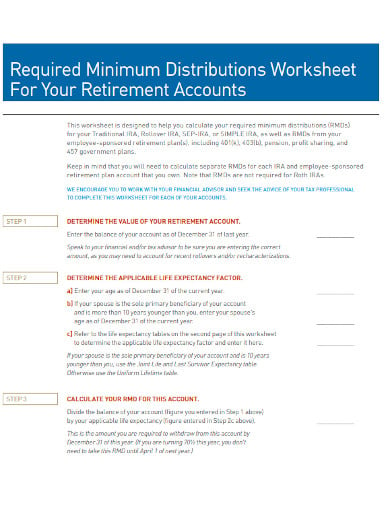

pncfunds.com

pncfunds.comWhy go through so much hassle of making such important calculations from a scratch? Just download this template that is professionally designed to help you calculate your required minimum distributions for your IRA accounts. This will also help you in calculating the RMDs from your employer-sponsored retirement plans that include 401(k), 403(b), pension, profit-sharing, and 457 government plans.

4. IRA Minimum Distribution Required Calculator

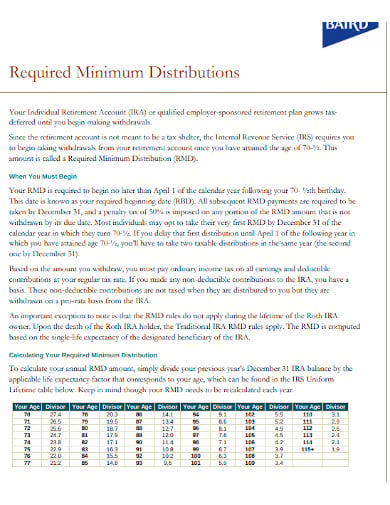

bairdfinancialadvisor.com

bairdfinancialadvisor.comBefore understanding the need for calculating your IRA minimum distribution, you must know what does a required minimum distribution means. The given template deals with some detailed information about the required minimum distributions. It talks about when to begin your required minimum distribution and about calculating your required minimum distribution using the IRA minimum traditional distribution calculator.

5. IRA Minimum Traditional Distribution Calculator

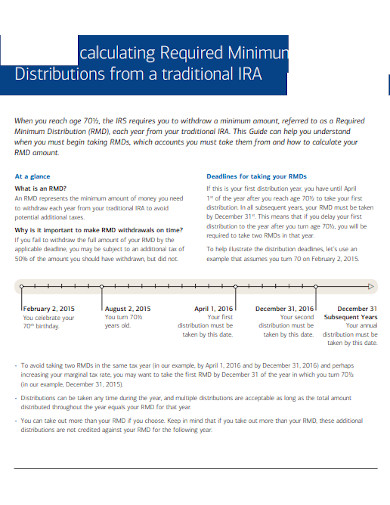

olui.fs.ml.com

olui.fs.ml.com6. IRA Minimum Distribution General Calculator

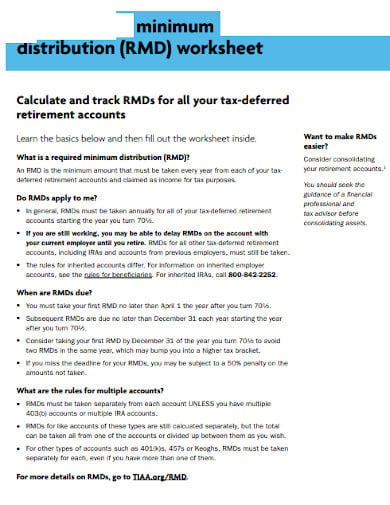

tiaa.org

tiaa.org7. IRA Minimum Distribution Calculator Form

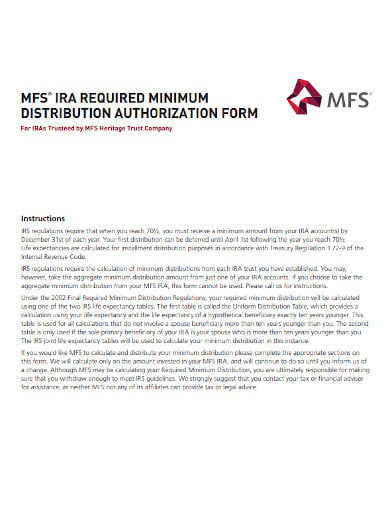

mfs.com

mfs.com8. IRA Minimum Distribution Information Calculator

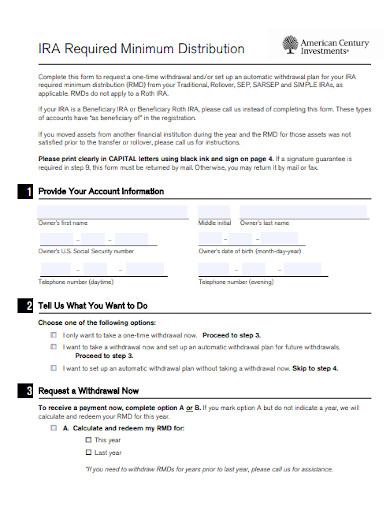

corporate.americancentury.cPayment choices ordinarily embodyPayment choices ordinarily embodyom

corporate.americancentury.cPayment choices ordinarily embodyPayment choices ordinarily embodyom9. IRA Minimum Distribution Account Calculator

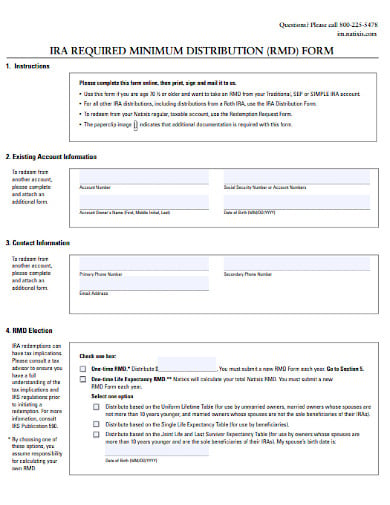

im.natixis.com

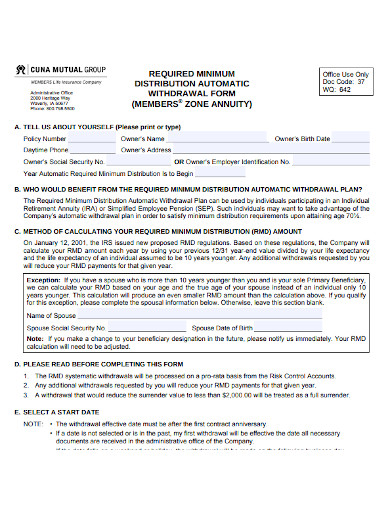

im.natixis.com10. IRA Minimum Distribution Withdrawal Form

service.trustage.com

service.trustage.comOutcomes of Failing to Take Your RMD

Lawmakers made it sure to introduce penalties in case people fail to comply with the RMD rules and regulations. The IRS charges a whopping 50% penalty on the amount that you should have taken out if you fail to take out the full amount of your RMD by the appropriate deadline. That penalty will be larger than the amount of tax you would have to pay in case you withdrew the required amount in every circumstance.

Tax Consequences of RMDs

Many retirees do not like to withdraw the required minimum distributions because the tax consequences are the same as for any other withdrawal from a retirement account. In the case o traditional IRAs, 401(k), or any other employer-sponsored retirement accounts, the amount to be withdrawn will be included in your taxable income. In some situations, the extra income may push you into a higher tax bracket and this may affect how much tax you pay on other sources of income.

Conclusion

Using an IRA minimum distribution calculator will project your required minimum distribution for the upcoming future years when you will be entering your estimated rate of return. It happens to be very useful when you are tax planning for your retirement as larger distributions that come later on might push you into a higher tax bracket. You will need to have some proper calculation about your minimum distributions so it always wise to calculate it and avoid any problems in the future during your retirement.