Table of Contents

- How to Make a Roll-Over Chart?

- 11+ Rollover Chart Templates in PDF

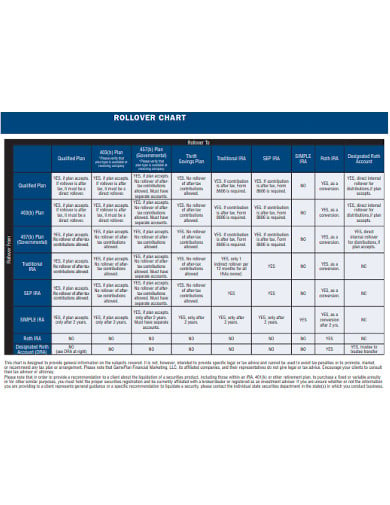

- 1. Retirement Plan Rollover Chart Template

- 2. Rollover Portability Chart Template

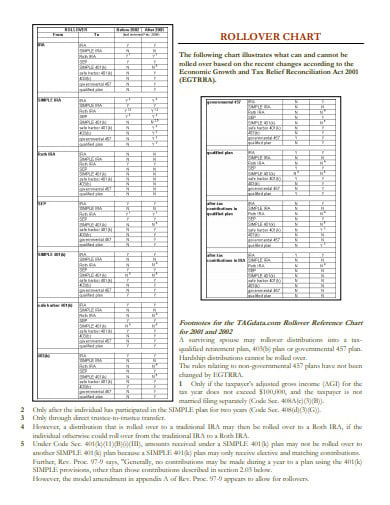

- 3. Rollover Rules Chart Template

- 4. Qualified Plan Rollover Chart Template

- 5. Rollover Reference Eligibility Chart Template

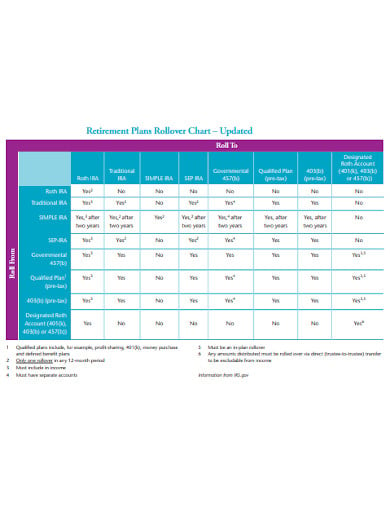

- 6. Updated Retirement Plans Rollover Chart Template

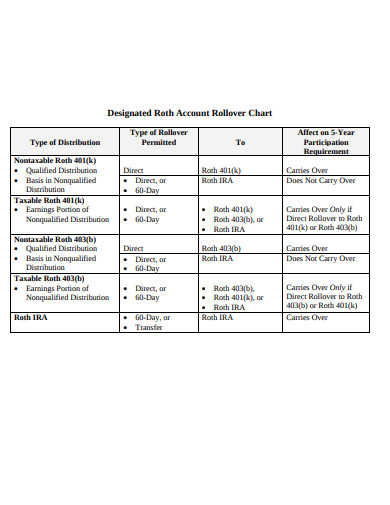

- 7. Designated Account Rollover Chart Template

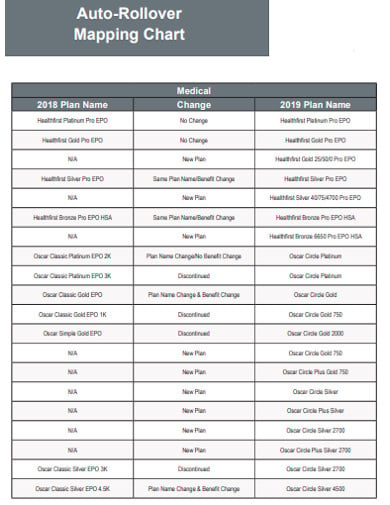

- 8. Auto Rollover Mapping Chart Template

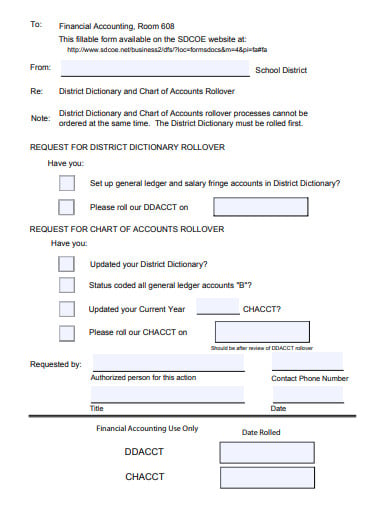

- 9. District Dictionary Rollover Chart Template

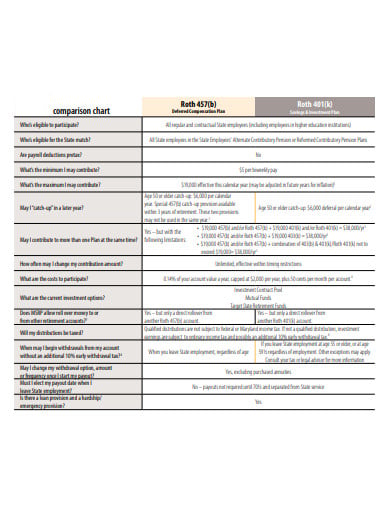

- 10. Rollover Comparison Chart Template

- 11. Employee Benefit Rollover Chart Template

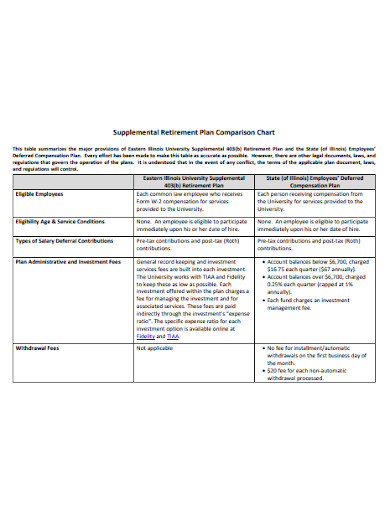

- 12. Retirement Plan Rollover Comparison Chart

- What Does a Roll Over Chart Permit?

- What is an IRA Plan?

- What is a 401(K) Plan?

- What is the Procedure to Make a Roll Over Chart?

- 3. THE Biennial RULE for easy IRAS

- Conclusion

11+ Rollover Chart Templates in PDF

Rollovers are a savvy procedure to move cash between retirement accounts whereas avoiding taxes and increasing your investment choices. However, the IRS is strict regarding what’s allowed. Rolling over charts: It’s not solely a trick to show your dog; it’s additionally a savvy process to move cash between retirement accounts whereas avoiding taxes and infrequently increasing your vary of investment choices.

How to Make a Roll-Over Chart?

Step 1: Saving Plan to be Fixed

First, contact the administrator of your former retirement savings plan and request directions for a way to finish a change. Make a chart of the requirements you carry in your mind.

Step 2: Raise the IRA

Raise your new IRA account supplier what it needs — together with however a check ought to be created out and wherever or however it ought to be sent. (Some corporations enable wire transfers instead.) Finally, you’ll get to fill out forms formally requesting the change. You might carry a rollover portability chart.

Step 3: Rollover Rules to Understand

Rollovers are common, thus the don’ts are: You’re treading into acquainted territory here. Still, a note of the precise rules printed by the IRS before you start the change method. That’s particularly necessary if you’re considering one thing apart from the 401(k)-to-IRA change.

11+ Rollover Chart Templates in PDF

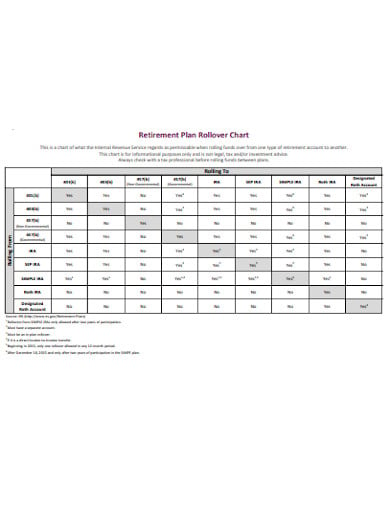

1. Retirement Plan Rollover Chart Template

axiaadvisory.com

axiaadvisory.comOnce you’ve settled on the provision agreement where the money is headed, the method is pretty easy, if you decide for what’s referred to as a right away change. By belongings your recent and new arrange administrator handles the change, the money ne’er touches your hands and, therefore, won’t trigger tax liabilities.

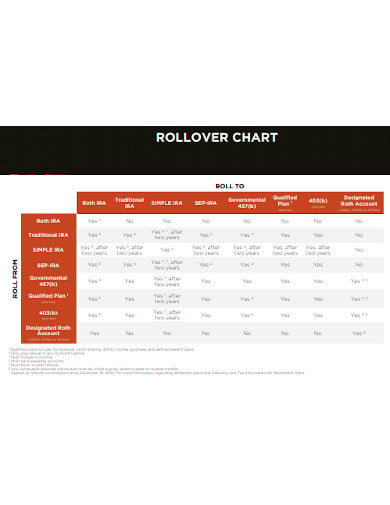

2. Rollover Portability Chart Template

randall-hurley.com

randall-hurley.comOnce you’ve learned the fundamentals of IRAs, it’s time to require action. If you don’t have already got an IRA, measure your decisions and open one. NerdWallet’s analysis of the most effective IRA suppliers will assist you to decide. Check the sample chart for more details on the above template.

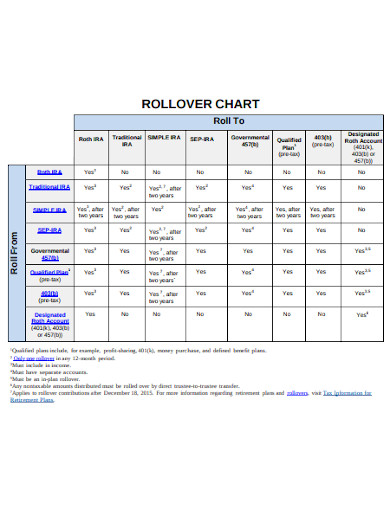

3. Rollover Rules Chart Template

irs.gov

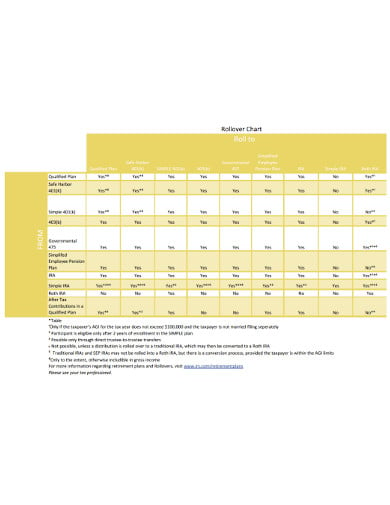

irs.gov4. Qualified Plan Rollover Chart Template

dwassociates.com

dwassociates.com5. Rollover Reference Eligibility Chart Template

practicalactuary.com

practicalactuary.com6. Updated Retirement Plans Rollover Chart Template

wiserwomen.org

wiserwomen.org7. Designated Account Rollover Chart Template

retire.prudential.com

retire.prudential.com8. Auto Rollover Mapping Chart Template

healthpass.com

healthpass.com9. District Dictionary Rollover Chart Template

sdcoe.net

sdcoe.net10. Rollover Comparison Chart Template

umuc.edu

umuc.edu11. Employee Benefit Rollover Chart Template

gameplanfinancial.com

gameplanfinancial.com12. Retirement Plan Rollover Comparison Chart

eiu.edu

eiu.eduWhat Does a Roll Over Chart Permit?

Switching jobs will prompt one among the foremost common varieties of rollovers: Taking cash from a recent 401(k) can arrange much information and rolling it into a private retirement savings account, of either the author or ancient selection. However, there are a variety of different varieties of rollovers, and since of the associated tax edges, the IRS is pretty strict regarding what’s allowed.

What is an IRA Plan?

An IRA may be a tax-favored investment account. You’ll be able to use the account to take a position in stocks, bonds, mutual funds, ETFs, and different styles of investments once you place cash into it, and you create the investment choices yourself unless you wish to rent somebody else to try to make it useful for you. You may think about investing in an IRA if your leader does not supply a pension plan or if you’ve got maxed out your 401(k) contributions for the year.

What is a 401(K) Plan?

A 401(k) combines options of the Roth IRA and a 401(k). It is a sort of account offered through employers, and it’s comparatively new. Like an IRA, contributions return from your after-tax cheque instead of your pre-tax earnings. Contributions and earnings in a Roth IRA are never taxed once more if you stay within the set up for a minimum of 5 years.

What is the Procedure to Make a Roll Over Chart?

1. THE 60-DAY RULE

If you can’t do a right away change, as represented on top of, you’ll have a restricted window of your time to finish an indirect change. With an indirect change, the load is on you to induce the money from your recent retirement savings account into a replacement one inside sixty days.rollover conversion chart in case you face any kind of difficulty.

Not solely can you be acting on a point with an indirect change, however, taxes from distribution also must be withheld by the IRS. An IRA distribution paid on to you’ll be able to be subject to 100 percent withholding, whereas a retirement savings plan distribution is subject to necessary two-hundredth withholding. (Read additional regarding these IRS rules.)

2. THE ONCE-A-YEAR RULE

The IRS typically doesn’t enable quite one change from a constant account inside a 12-month amount. This rule won’t apply to the foremost common varieties of transactions, like a 401(k)-to-IRA change or after you shift cash from a conventional IRA into an IRA account in what’s referred to as a Roth IRA conversion.

3. THE Biennial RULE for easy IRAS

If you’re a small-business worker, a note of this special rule for rollovers involving an easy IRA.

Specifically, be conscious of the biennial mark once your leader 1st deposited contributions to your easy IRA arrange with a rollover rules chart. inside that biennial amount, the sole exempt group action allowed is from one easy IRA to a different. Past that biennial marker? The vary of allowable rollovers expands. Again, consult the IRS rules specifically associated with easy IRAs.

Conclusion

The professionals of a change IRA typically outweigh the cons. By transferring the balance of a recent retirement savings plan into an IRA, the money can stay tax-deferred. relying upon the kind of account you decide on, you will additionally realize a wider vary of investment decisions — like individual stocks or a bigger list of exchange-traded funds — than what’s offered in several work retirement accounts. There should be a rollover eligibility chart for understanding who is eligible for the rollover.