Table of Contents

- What is a Roth IRA?

- What is a Roth IRA Calculator?

- How to Use a Roth IRA Calculator?

- 5+ Roth IRA Calculator Templates in PDF

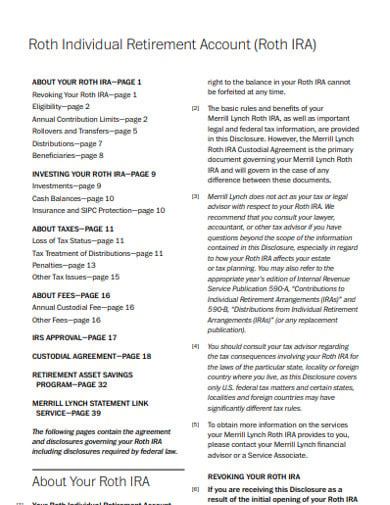

- 1. Roth Individual Retirement Account

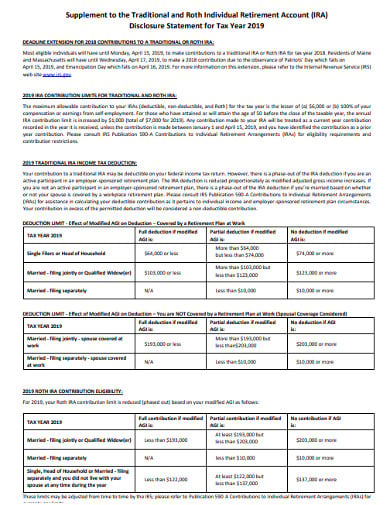

- 2. Disclosure Roth IRA Calculator

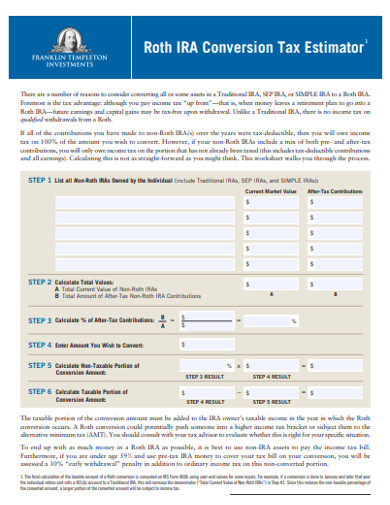

- 3. Tax Roth IRA Calculator Template

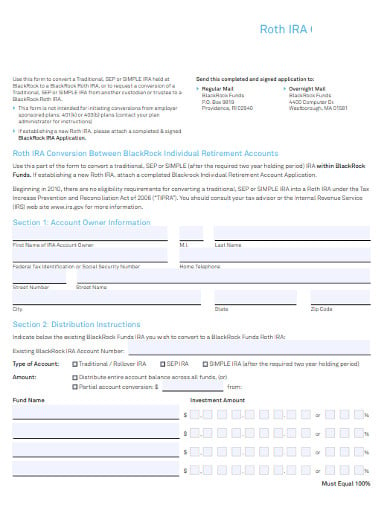

- 4. Individual Roth IRA Calculator

- 5. Measuring Roth IRA Calculator

- Eligibility and Contribution Limits in Roth IRA

- Conclusion

5+ Roth IRA Calculator Templates in PDF

Roth ira investment calculator

retirement Roth ira calculator

simple ira calculator

traditional Roth ira calculator

Having a secure financial future and retirement is what every employee wants when they think about their life after leaving their work. In case you want your future to be financially secure after your retirement, then you would like to consider using a Roth IRA. Even though it remains highly unutilized retirement savings and investment procedure but they don’t realize that a Roth IRA can offer tax benefits, access to funds, easy usage along with retirement income benefits.

What is a Roth IRA?

Roth IRA is one of the types of IRAs, i.e Individual Retirement Account. The term Roth 1RA is a plan that works under United States law and generally does not take any tax upon getting distributed if certain conditions are met. The difference between Roth IRAs and most other tax-advantaged retirement plans is that, instead of granting a tax reduction for contributions to the retirement plan, the withdrawals from the Roth IRAs plan are tax-free. Even the growth in the account is tax-free. A Roth IRA is known as a retirement savings account that allows you to extract your savings tax-free.

What is a Roth IRA Calculator?

You can use a Roth IRA calculator to find out how much your Roth IRA contributions have grown during your retirement and how much would you save in taxes.

How to Use a Roth IRA Calculator?

- You can first start by calculating how much money you are going to have in your retirement. This will be based on your investments in your Roth IRA every year.

- The calculator will automatically get populated with your estimated maximum annual contribution that will be based on your age, income and tax filing status. In case you plan to contribute less, you can even adjust that contribution down in the meantime.

- The calculator will also show you the value of the Roth IRA’s tax-free investment growth that is done by making a comparison of your projected Roth IRA balance at retirement with the balance you would have if you need a taxable account.

5+ Roth IRA Calculator Templates in PDF

1. Roth Individual Retirement Account

fs.ml.com

fs.ml.comThis template contains the agreement and disclosures that will govern a Roth IRA including some disclosures that are required by the federal law. It talks about how to revoke your Roth IRA and about your eligibility to open a Roth IRA including annual contribution limits and other distributions and beneficiaries. Download this useful template right away.

2. Disclosure Roth IRA Calculator

paxworld.com

paxworld.comThe given template consists of an article titled Supplement to the Traditional and Roth Individual Account and Disclosure Statement for Tax Year 2019. It shows the deadline extension for 2018 contributions to a traditional or Roth IRA. You will also get some information related to Traditional and Roth IRA application and adoption agreement instructions along with simplified employee pension instructions. It also lays down some important information about U.S. Government requirements that may affect your account. Do not miss this chance and download it now!

3. Tax Roth IRA Calculator Template

franklintempleton.com

franklintempleton.comYou must consider converting all or some of the assets in a Traditional IRA, SEP IRA, or Simple IRA to a Roth IRA. Future earnings and capital gains may be tax-free upon withdrawal when money leaves a retirement plan to go into a Roth IRA even though you pay your income tax “upfront”. There is no income tax on qualified withdrawals from Roth, unlike a Traditional IRA. This is a Roth IRA Conversion Tax Estimator that contains a worksheet that will help you in the process of calculating your tax amount.

4. Individual Roth IRA Calculator

blackrock.com

blackrock.comHere is a Roth IRA Conversion Request Form that is used to convert a Traditional, SEP, or Simple IRA that is held at BlackRock to a BlackRock Roth IRA. It can also be used to request a conversion of a Traditional, SEP or Simple IRA from another custodian or trustee to a BlackRock Roth IRA. It is divided into different sections to make it easier for you to understand the importance of each section. It is also mentioned that this form is not intended for initiating conversions from employer-sponsored plans like 401(k) or 403(b) plans.

5. Measuring Roth IRA Calculator

i-orp.com

i-orp.comIf you want to enlighten yourself with some detailed information about the consequences of measuring traditional IRAs to Roth IRA conversions then make sure you go through this professionally prepared template now. The funds will not be subject to income tax upon withdrawal while converting your traditional IRA accounts to Roth IRAs. Some of the common motivations for IRA to Roth IRA conversions are to increase retirement disposable income, insure against future tax increases, allocate retirement savings to minimize combined taxes for retirees and their heirs. This paper deals with the financial consequences of making conversions concerning these motivations.

Eligibility and Contribution Limits in Roth IRA

With an additional catch-up contribution of up to $1,000 that is allowed for people of 50 years or older, the total annual contribution limit for the Roth IRA is currently $6,000. This limit applies to both Roth and traditional IRA accounts. There are certain income levels where the Roth IRA’s maximum annual contribution begins to phase down. A Roth IRA calculator helps you in identifying your maximum contribution for the year that is based on age, income and marital status.

Conclusion

Since it is important to take care of your expenses after taking retirement, you must also be aware of the various retirement plans. And as it takes a ton of effort to calculate certain conversions and other financial elements, it is best to use a calculator to do all the work for you and make it more efficient and easier for you to get the appropriate result. Therefore, get some knowledge about these calculators and how to use them along with its other elements before you take your retirement.