Table of Contents

- What are the steps to initiate an IRA?

- How to convert to a Roth?

- 6+ Traditional IRA Calculator Templates in XLS

- 1. Traditional IRA Conversation Calculator Template

- 2. Traditional IRA Calculator in XLS

- 3. Traditional IRA Calculator Sample

- 4. Net Worth Traditional IRA Calculator Template

- 5. Basic Traditional IRA Loan Calculator

- 6. Standard Traditional IRA Calculator

- 7. Printable Traditional IRA Calculator Template

- Which is better, a traditional or Roth IRA?

- How does a traditional IRA grow?

- Conclusion

6+ Traditional IRA Calculator Templates in XLS

Contributing to a traditional IRA can build a current tax deduction, plus it gives for tax-deferred growth. While long-term savings in a Roth IRA may provide better after-tax returns, a traditional IRA may be an exceptional option if you pass for the tax deduction. Have a look at the traditional IRA calculator templates provided down below to view the amount that could be saved using a traditional IRA.

What are the steps to initiate an IRA?

IRAs are essential tools for saving for retirement, and opening an IRA is easy.

There are four basic steps to begin an IRA:

-

Determine how much help you want, which means what type of investor you are — hands-on or hands-off?

-

Decide where to open your IRA which means that the choice should arrange with your investor type above.

-

Open an account that takes just a few minutes.

-

Fund the account and get started: If you go with a broker, look for low-cost mutual funds and ETFs. If you prefer a robo-advisor, they’ll pick investments for you. (Banks additionally supply IRAs, but they are more about saving money than about growing your money. For a long-run goal like retirement, finance with a broker or robo-advisor makes the foremost sense.)

How to convert to a Roth?

Here are the fundamental steps in a Roth conversion. If you already have a traditional IRA you can skip point 1.

- Put money in a traditional IRA account. If you don’t already have an account, you will need to open one and fund it.

- Pay taxes on your IRA contributions and earnings. Only post-tax money gets to move into Roth IRAs. So if you subtracted your traditional IRA contributions, you’ll need to give that tax deduction back, efficiently. Those IRA contributions and any investment profits will be joined to your taxable income when you file your tax return for the year.

- Convert the account to a Roth IRA. If you don’t have a Roth IRA already, you’ll need to open a new account during the conversion. Your IRA administrator will give you the guidance and work.

To stay in sync with IRS rules, you’ll want to transform your traditional IRA to a Roth IRA in one of the following ways:

- Indirect rollover: You receive a distribution from a conventional IRA and provide it to a Roth IRA in 60 days.

- Trustee-to-trustee or direct rollover: You tell the financial organization holding your traditional IRA assets to move an amount instantly to the trustee of your Roth IRA at various financial institutions.

- Same trustee transfer: If your traditional and Roth IRAs are managed at a similar financial organization, you can tell the trustee to transfer an amount from your traditional IRA to your Roth IRA.

You may be able to do a rollover of 401(k), 403(b) or other employer-sponsored retirement funds to a Roth if you are no longer working for the company, but as with the traditional-IRA-to-Roth change, you’re possible to trigger a bill here, too, unless you’re beginning with a Roth 401(k).

6+ Traditional IRA Calculator Templates in XLS

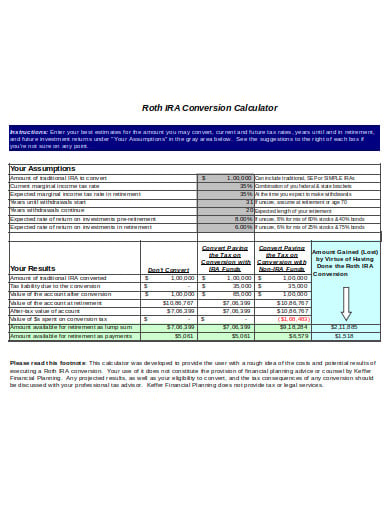

1. Traditional IRA Conversation Calculator Template

kefferfinancialplanning.com

kefferfinancialplanning.comUse the Roth IRA Conversion Calculator to compare the estimated future values of keeping your Traditional IRA vs. converting it to a Roth. We have provided an example of a traditional IRA conversion calculator in this template in excel format which you can refer to or simply can edit and make use of it.

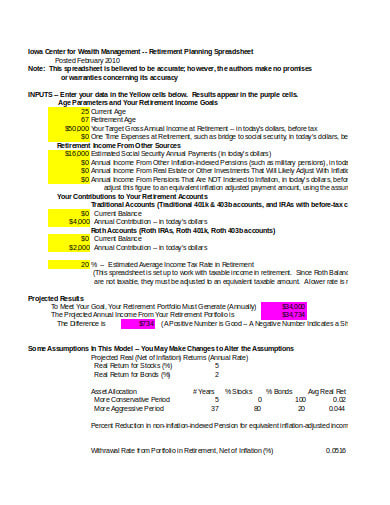

2. Traditional IRA Calculator in XLS

biz.uiowa.edu

biz.uiowa.eduA Roth IRA is a powerful tax-advantaged way to save for retirement. Use this calculator to search out what proportion your Roth IRA contributions can be valued at retirement, and what you would save in taxes. If you want to learn more about Roths and see if they’re right for you, see our complete example provided in the template.

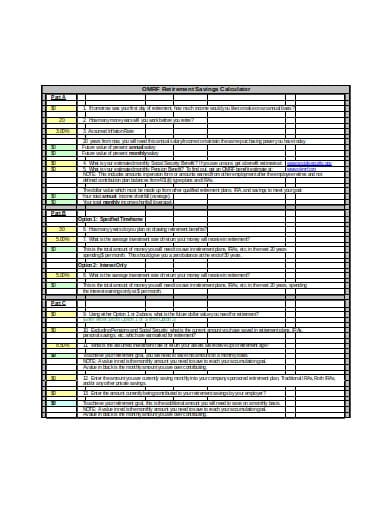

3. Traditional IRA Calculator Sample

okmrf.org

okmrf.orgThe traditional IRA calculator also presumes a constant rate of return on investments & that your federal tax bracket will not change across any period. Have a look at the example assigned here which will enable you to make your task easy and hassle-free.

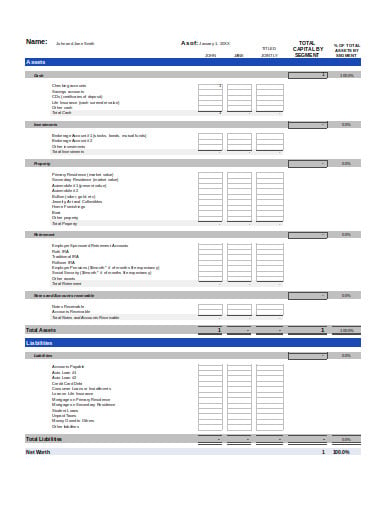

4. Net Worth Traditional IRA Calculator Template

moneyguy.com

moneyguy.comCalculate your net worth by using this traditional IRA calculator. Use the example provided here by editing or modifying the entire file as you want to. Download it now to avoid the struggle of creating a new one from scratch.

5. Basic Traditional IRA Loan Calculator

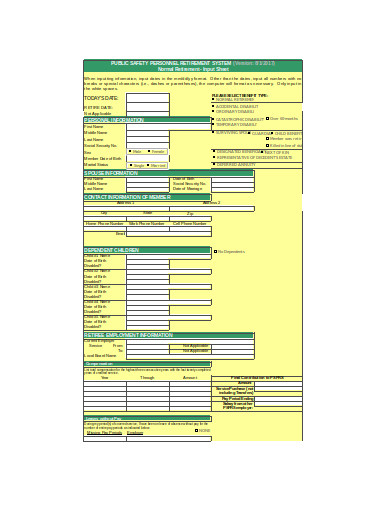

psprs.com

psprs.comContributing to a standard IRA will produce a current deduction, plus it provides for tax-deferred growth. While long run savings in a Roth IRA may build better after-tax returns, a Traditional IRA could turn out higher after-tax returns, a standard IRA is also a superb different if you qualify for the deduction. Take reference from the sample provided.

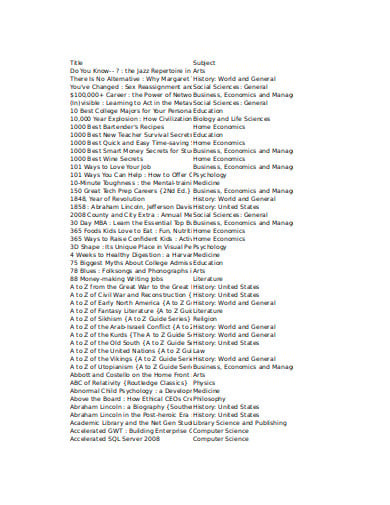

6. Standard Traditional IRA Calculator

cclibrarians.org

cclibrarians.org7. Printable Traditional IRA Calculator Template

rileyaccounting.net

rileyaccounting.net

Which is better, a traditional or Roth IRA?

How does a traditional IRA grow?

Conclusion

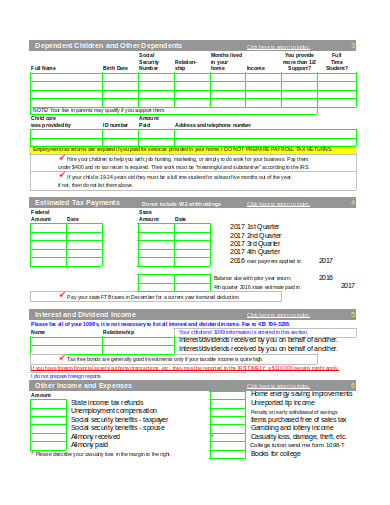

This is used to calculate whether you are able to subtract your annual contributions from your taxes. It is essential to note that there are no income limits preventing you from contributing to a Traditional IRA. This calculator automatically decides if your tax deduction is limited by your income.