Free Finance Control Reconciliation Statement

Prepared by: [Your Name]

Date: [January 11, 2050]

Executive Summary

This Finance Control Reconciliation Statement provides a comprehensive overview of the financial transactions and controls implemented by [Your Company Name]. The purpose of this document is to ensure transparency, accuracy, and accountability in financial operations.

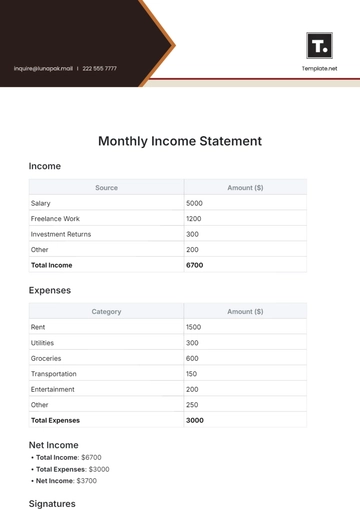

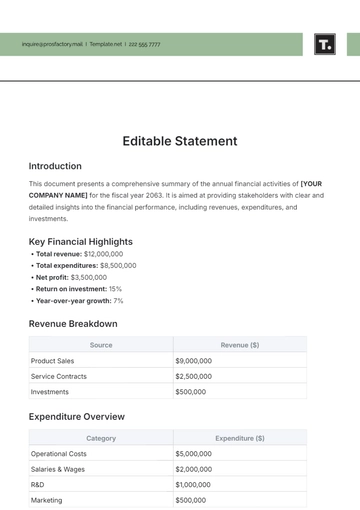

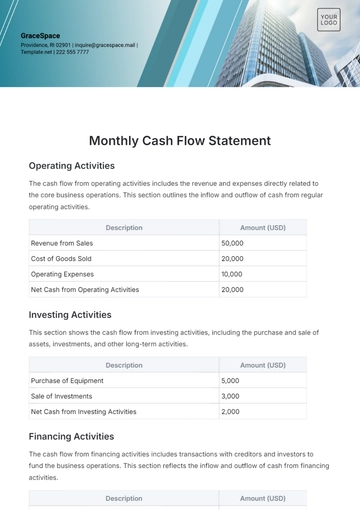

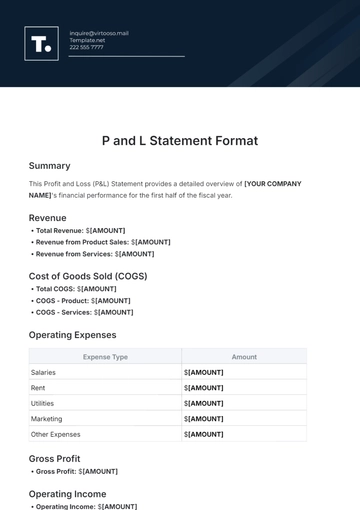

Financial Overview

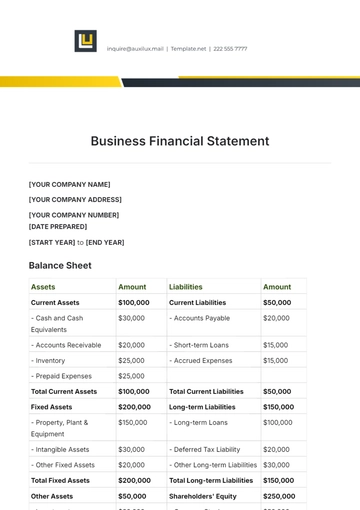

A. [Your Company Name]

Metrics | Amount |

|---|---|

Total Revenue | [$10,000,000] |

B. Comparative Analysis

Metrics | Amount |

|---|---|

Previous Period Revenue | [$8,500,000] |

The boost in revenue is credited to successful market expansion, product diversification, customer retention efforts, and strategic partnerships. These initiatives widened our customer base and introduced new income streams.

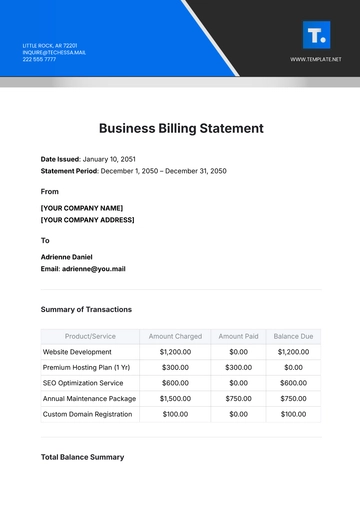

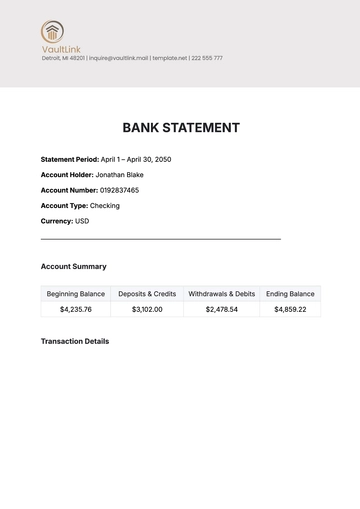

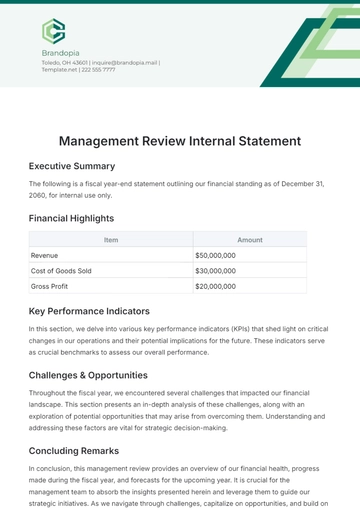

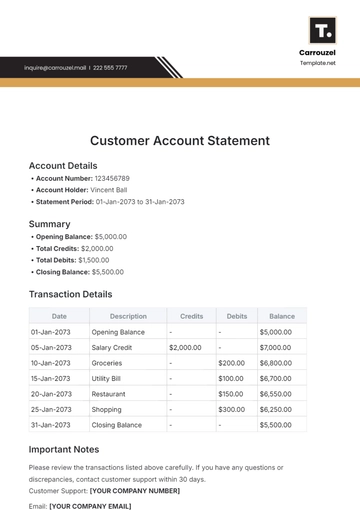

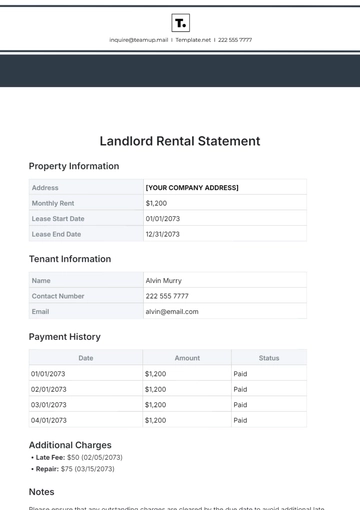

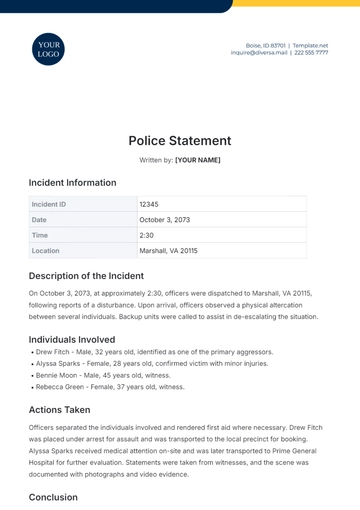

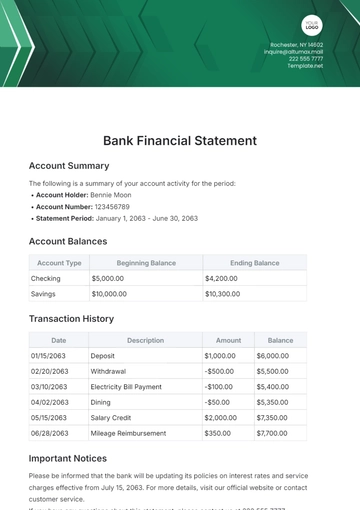

Reconciliation Details

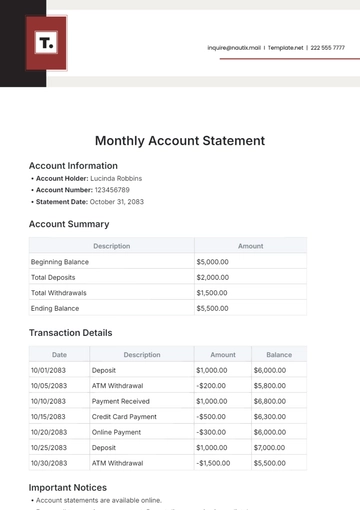

A. Bank Reconciliation

Details | Amount |

|---|---|

Bank Balance (Statement) | [$2,500,000] |

Discrepancy in bank balances was due to a delayed deposit posting, now rectified.

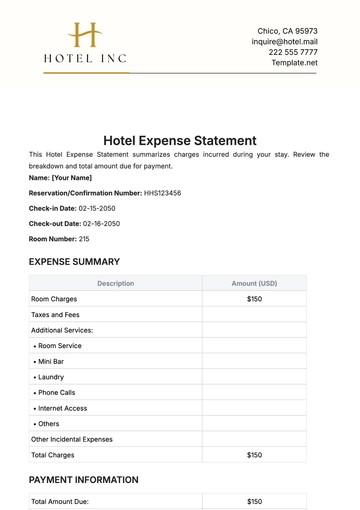

B. Expense Reconciliation

Details | Amount |

|---|---|

Total Expenses (Internal Records) | [$6,000,000] |

Expense records match documentation, ensuring accuracy in financial reporting.

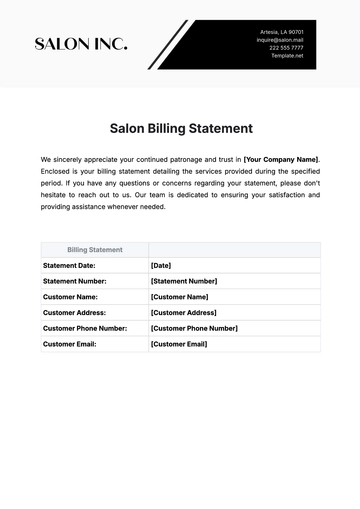

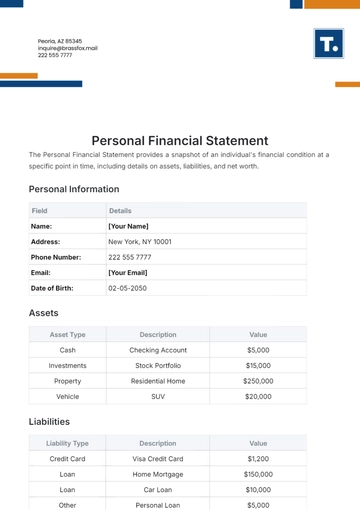

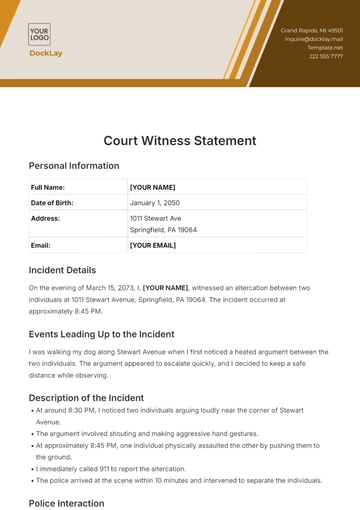

Control Measures

A. Internal Controls

Regular reconciliation audits.

Dual approval for large transactions.

Automated expense tracking system.

Internal controls proved effective, contributing to accurate financial records.

B. Compliance with Regulations

Adherence to GAAP standards.

Regular compliance audits.

Employee training on financial regulations.

No regulatory violations reported; continuous compliance efforts maintained.

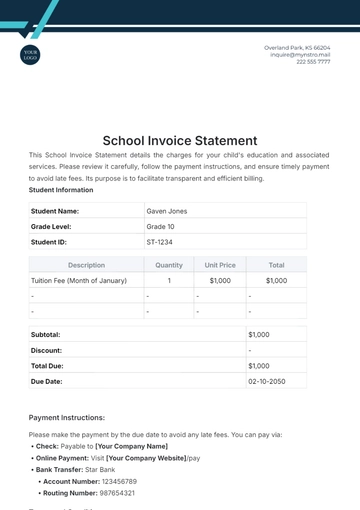

Recommendations

Process Enhancements

Implement real-time reconciliation tools.

Enhance communication between finance and operations teams.

Explore cost-effective technologies for expense tracking.

These enhancements will further streamline financial processes and reduce reconciliation discrepancies.

Conclusion

This Finance Control Reconciliation Statement reflects [Your Company Name]' commitment to maintaining a robust financial control environment. The analysis presented here ensures accuracy in financial reporting, compliance with regulations, and continuous improvement in financial processes.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

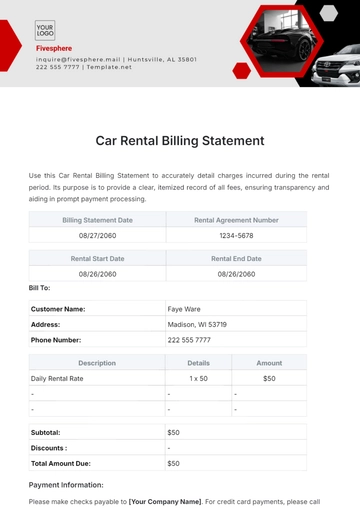

Facilitate control reconciliation with our Finance Control Reconciliation Statement Template from Template.net. This user-friendly template simplifies the creation of detailed reconciliation statements, ensuring accuracy and compliance. Clearly present control details, transaction breakdowns, and reconciliation results. Download now to optimize your control reconciliation statement generation process and enhance transparency within your financial operations.