Sales Account Compliance Document

The purpose of this document is to establish a comprehensive framework to guide our sales account activities in line with mandated regulations and best practices. Adherence to this will ensure the prudent management of our sales account operations, mitigating possible risks, and fostering sustainable growth.

Objectives

Standardize Sales Operations: To establish a uniform set of practices across all sales accounts.

Regulatory Compliance: To ensure all sales activities are in compliance with federal, state, and industry regulations.

Transparency: To provide clear methods for monitoring and reporting compliance metrics.

Regulatory Framework and Obligations

Our sales activities are subject to a diverse range of regulations including, but not limited to:

Fair Trading regulations

Data Protection laws

Consumer Protection acts

Procedures

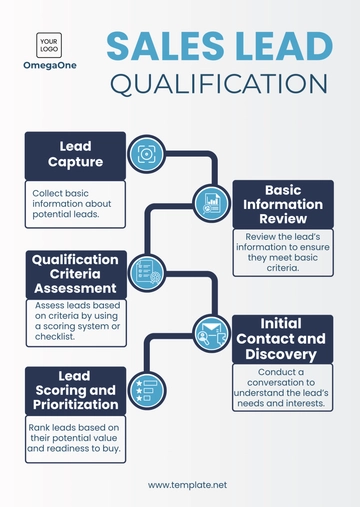

Following a systematic procedure in our sales account operations is vital. The procedures are:

Secure client’s consent before processing their personal data

Ensure all financial transactions meet current financial regulations

Report any incident of non-compliance upon its identification

Responsibilities and Obligations

Role | Responsibilities and Obligations |

|---|

Managers | Ensure adherence to compliance procedures, instill best practices, report non-compliance incidents and mitigate risks. |

Sales Team | Maintain ethical sales methods, ensure data protection, and adhere to the designated procedures. |

Compliance Officer | Monitor compliance, keeping up-to-date with new regulations, report any incident of non-compliance, and provide training. |

Training and Awareness

Regular training and awareness sessions are necessary to ensure the team is not only aware of current regulations, but also trained on how to implement them practically. The following are measures we have put in place:

Conduct regular workshops and seminars.

Use real-life cases to demonstrate best practices in compliance.

Keep the team updated about changes in relevant regulations.

Non-Compliance and Consequences

A. Identification Methods

Internal Audit

Quarterly internal reviews will be conducted by the Compliance Department.

External Audit

Annual external audits may be performed by third-party organizations.

B. Consequences

Level of Non-Compliance | Consequence |

|---|

Minor | Verbal Warning |

Major | Termination |

C. Appeals Process

Employees can appeal non-compliance penalties through a formal process overseen by the Legal Department.

Document Review and Update

This document is to be periodically reviewed and updated to ensure it remains relevant and in sync with regulatory changes and operational needs. Reviews should take place at least once every year or immediately when significant regulatory changes occur.

This document aligns with [YOUR COMPANY NAME]’s commitment to maintain a high level of integrity in all our operations. Adherence to this document is crucial for the sustainability and success of our company’s sales operations.

Sales Templates @Template.net