Free Startup Tax Compliance Document

I. Introduction

As a startup, [Your Company Name] must navigate a complex landscape of tax regulations to ensure compliance and financial stability. Understanding and fulfilling tax obligations is crucial for maintaining legal standing and avoiding penalties. This document serves as a comprehensive guide to federal, state, and local tax compliance for startups, providing essential information and resources to support [Your Company Name] in meeting its tax responsibilities effectively.

II. Business Information

[Your Company Name] is a technology startup headquartered at [Your Company Address]. The company was incorporated on [Month Day, Year], and operates as a C Corporation. Its Tax Identification Number (EIN) is [99838374]. This information is vital for accurately identifying the startup and fulfilling various tax obligations at the federal, state, and local levels.

III. Federal Tax Compliance

A. Income Tax

[Your Company Name] is subject to federal income tax on its profits, which is reported annually using Form 1120 for C Corporations. This form must be filed by March 15 (or 3.5 months after the year-end).

Filing Requirement | Deadline | Instructions |

|---|---|---|

Annual filing | March 15 (or 3.5 months after year-end) | Complete Form 1120 with detailed income, deductions, and credits. Attach Schedule K-1 for shareholders. File electronically or by mail with the IRS. |

B. Employment Taxes

As an employer, [Your Company Name] is responsible for withholding and paying employment taxes for its employees. This includes federal income tax withholding, Social Security tax, and Medicare tax, which are reported quarterly using Form 941. The company must also file an annual Employer's Annual Federal Unemployment (FUTA) Tax Return (Form 940) to report its federal unemployment tax liability. Compliance with employment tax obligations is essential to avoid penalties and maintain good standing with tax authorities.

Filing Requirement | Deadline | Instructions |

|---|---|---|

Quarterly filing | Last day of month following end of quarter | Report wages, tips, and other compensation. Calculate and pay federal income tax withholding, Social Security tax, and Medicare tax. File electronically or by mail with the IRS. |

Filing Requirement | Deadline | Instructions |

|---|---|---|

Annual filing | January 31 (following the end of the tax year) | Report annual FUTA tax liability. File electronically or by mail with the IRS. |

IV. State and Local Tax Compliance

A. Income Tax

[Your Company Name] may have state income tax obligations depending on its operations and nexus with various states. Each state has its own filing requirements, deadlines, and instructions for reporting income tax. The startup should consult state tax authorities or tax professionals to ensure compliance with state income tax laws and regulations.

B. Sales Tax

As a seller of goods and services, [Your Company Name] is required to collect and remit sales tax on taxable sales. The company must register for sales tax permits in states where it has nexus, typically based on factors such as physical presence or economic activity. Periodic sales tax returns must be filed, reporting taxable sales and remitting collected taxes to state revenue departments. Compliance with sales tax obligations is essential to avoid fines and penalties for non-compliance.

V. Other Tax Compliance Considerations

A. Quarterly Estimated Taxes

[Your Company Name] may be required to make quarterly estimated tax payments to cover federal and state income tax liabilities. These payments are based on the startup's expected income and are intended to prevent underpayment penalties at the end of the tax year. Timely and accurate payment of quarterly estimated taxes helps maintain cash flow and ensures compliance with tax obligations throughout the year.

B. International Tax Considerations

For startups engaging in international business activities, such as overseas sales or operations, there may be additional tax considerations to address. This includes understanding foreign income reporting requirements, navigating tax treaties between countries, and potentially claiming foreign tax credits to avoid double taxation. Consulting with tax professionals with expertise in international tax matters is recommended to ensure compliance with complex regulations and optimize tax outcomes for the startup.

VI. Recordkeeping and Documentation

Ensure that you keep an exact and detailed record of all your income and expenses, as well as tax filings. You should hold on to these records for a minimum of three years after the due date for filing.

VII. Conclusion

It is absolutely crucial for [Your Company Name] to adhere to all tax regulations as this is a key step in averting penalties and ensuring the company's overall financial well-being is preserved. We firmly recommend that you consider seeking the insights and expertise of a trained professional who specializes in tax matters, particularly when the situation is complex and requires in-depth knowledge. Additionally, it is highly advisable to constantly stay in the loop about any new changes or amendments in existing tax laws. This will further facilitate [Your Company Name]'s ongoing commitment to compliance and financial stability.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the ultimate tax compliance solution with the Startup Tax Compliance Document Template from Template.net. This editable and customizable template simplifies federal, state, and local tax obligations for startups. Featuring an AI Editor Tool, effortlessly tailor the document to your company's specifics. Stay compliant and organized with this essential tool for startup success.

You may also like

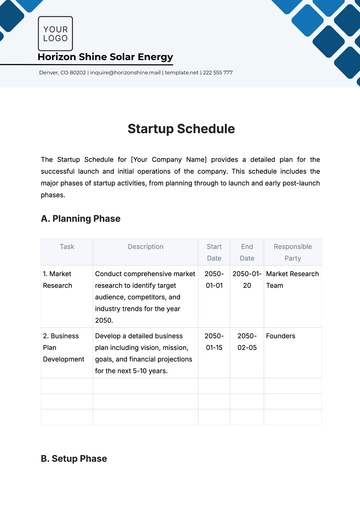

- Startup Agreement

- Non Profit

- Transport and Logistics

- Education

- IT Services and Consulting

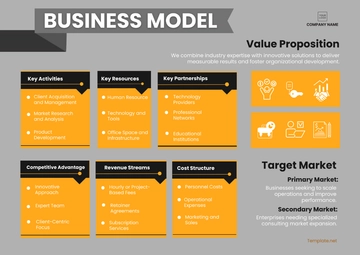

- Startup Presentation

- Startup Business Plan

- Startup Proposal

- Startup Plan

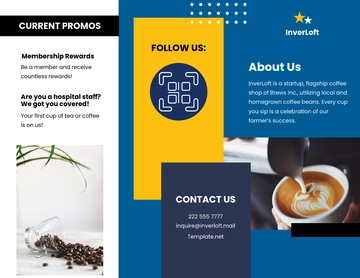

- Startup Brochure

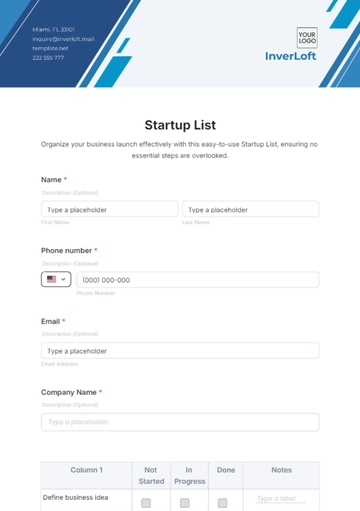

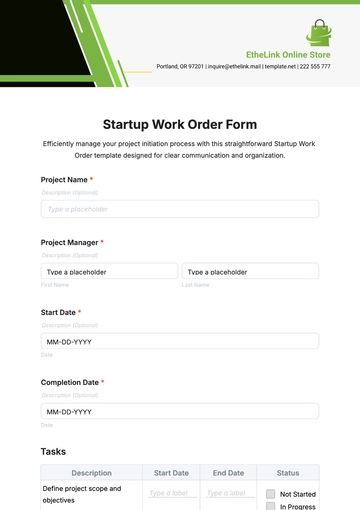

- Startup Form

- Startup Flyer

- Startup Checklist

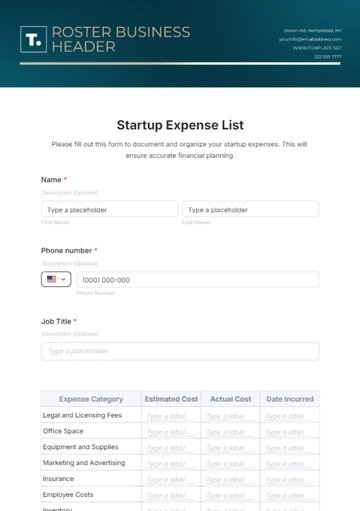

- Startup Budget

- Startup Poster

- Startup Contract

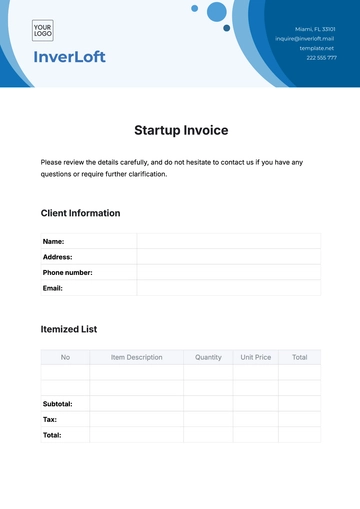

- Startup Invoice

- Startup Letterhead

- Startup Quotes