Free Sales Feasibility Study for Complex Agreements

I. Executive Summary

A. Purpose of the Study

1.Assessing Strategic Alignment

One of the key purposes of this study is to assess the alignment of pursuing complex agreements with the organization's strategic goals. It will examine whether these agreements complement the long-term vision and mission of the organization. In doing so, the study will consider how complex agreements can contribute to market expansion, customer retention, and overall growth.

2.Analyzing Risk Tolerance

The study aims to delve into the organization's risk tolerance. It will seek to answer whether the organization is prepared to take calculated risks in exchange for potentially substantial rewards. It will consider the balance between the perceived benefits and the level of risk the organization is willing to assume, taking into account its risk management capabilities.

3. Evaluating Competitive Advantage

An essential facet of this study is to evaluate whether the pursuit of complex agreements can provide a competitive advantage. It will assess how these agreements can differentiate the organization from competitors, both in terms of the value offered to clients and the ability to secure long-term partnerships.

B. Scope of the Study

1. Agreement Types

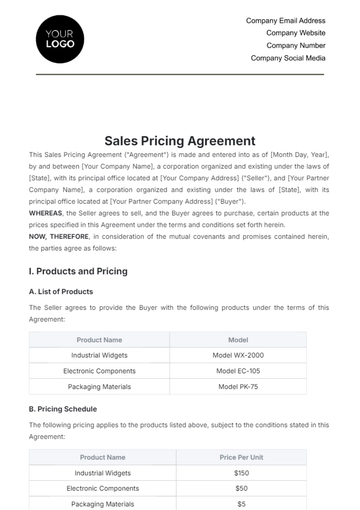

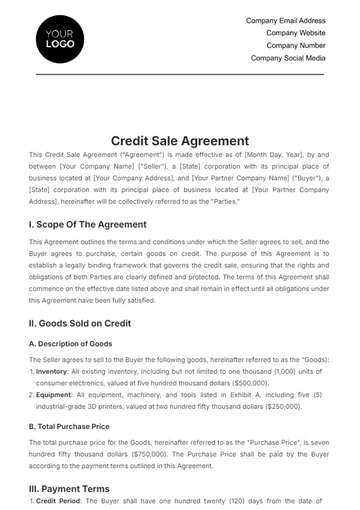

The study's scope encompasses a wide range of agreement types, including but not limited to long-term contracts, high-value deals, multi-party agreements, and partnerships. It aims to provide a comprehensive overview of the feasibility considerations applicable to diverse complex agreements.

2.Industry Analysis

In addition to the organization's internal capabilities, the scope of this study extends to an industry analysis. It will consider how industry-specific factors, such as regulatory changes, market trends, and competitive landscapes, may influence the feasibility of complex agreements within the chosen industry.

3.Comparative Analysis

To provide a holistic view of the feasibility, the study will also include a comparative analysis. It will compare the potential complex agreements with the organization's current standard agreements, evaluating the relative benefits and risks.

4.Geographic Considerations

If applicable, the study may consider geographic considerations. It will explore whether the complexity of agreements varies depending on the region, market, or international aspects, and how these factors impact feasibility.

5.Time Horizon

The study's scope will extend over a defined time horizon, considering both short-term and long-term implications. It will explore how complex agreements may impact the organization in the immediate future and how they align with long-term strategic objectives.

6.Data Sources

The study will rely on a combination of primary and secondary data sources, which may include internal financial records, industry reports, legal reviews, and expert interviews. It will ensure that data is gathered from a diverse set of sources to provide a well-rounded analysis.

7.Risk Assessment Depth

In the risk assessment section, the scope will include a comprehensive examination of both internal and external risks. It will encompass factors such as financial risks, market volatility, legal and compliance risks, and potential disputes that may arise from complex agreement

II. Introduction

A. Background

1.The Changing Landscape of Sales Agreements

Over the past decade, the landscape of sales agreements has undergone significant transformation. Traditional transactional deals have given way to more complex and strategic agreements. This shift can be attributed to various factors, including evolving customer expectations, increased competition, and the need for organizations to secure long-term revenue streams.

2.The Role of Complex Agreements

Complex agreements have emerged as a cornerstone of modern sales strategies. They encompass a diverse array of contract types, such as multi-year service agreements, strategic partnerships, joint ventures, and high-value contracts. These agreements aim to foster deeper client relationships, provide stability through recurring revenue, and contribute to sustainable growth.

3.Strategic Importance

The strategic importance of complex agreements cannot be overstated. They offer the potential for substantial revenue and can serve as a catalyst for market expansion. By securing long-term partnerships and retaining valuable clients, organizations aim to reduce churn, increase customer lifetime value, and establish a competitive edge.

4.The Duality of Complex Agreements

While complex agreements hold great promise, they also introduce a duality of risk and reward. The intricacies of negotiation, the demands of compliance, and the long-term commitment involved pose substantial challenges. Organizations need to tread carefully, balancing the allure of potential rewards with a clear understanding of the risks involved.

5.Organizational Goals

For our organization, the pursuit of complex agreements is a strategic imperative. It aligns with our mission to provide value-driven solutions to our clients and expand our market reach. However, we acknowledge the need for a rigorous assessment to ensure that these agreements not only align with our goals but also remain within our capabilities and risk tolerance.

6.The Role of This Feasibility Study

This feasibility study serves as a pivotal step in our journey to harness the benefits of complex agreements while minimizing risks. It will provide a structured framework for decision-making, offering insights into financial viability, operational readiness, legal compliance, and risk management. The study's findings will guide us in making informed decisions about the pursuit of specific complex agreements, enhancing our commitment to strategic growth.

7.Objectives

The primary objectives of this study are to:

Evaluate the financial feasibility of pursuing complex agreements.

Assess the operational capacity and resource requirements for handling such agreements.

Examine the legal and compliance aspects of complex agreements.

Identify potential risks and challenges associated with complex agreements.

Recommend whether to proceed with specific complex agreements based on the findings.

III. Financial Feasibility

A. Cost-Benefit Analysis

This section will conduct a cost-benefit analysis to determine the financial feasibility of complex agreements. It will consider factors such as potential revenue, cost implications, and return on investment. The study will also explore various financial scenarios and sensitivity analyses to understand the potential financial risks and rewards.

B. Revenue Projections

To assess the financial feasibility, it's crucial to project potential revenue from complex agreements. This will involve forecasting sales volumes, pricing structures, and any recurring revenue streams that may result from long-term agreements.

IV. Operational Capacity

A. Resource Assessment

Evaluating the operational feasibility will involve assessing the organization's resource capacity. This includes examining staffing requirements, infrastructure needs, and any technological investments necessary to support the execution of complex agreements.

B. Scalability

Operational feasibility will also consider the scalability of the organization. Can it handle the demands of complex agreements while continuing to meet existing commitments and operational goals? This section will address the organization's ability to grow and adapt as needed.

V. Legal and Compliance Aspects

A. Legal Review

This portion of the study will involve a thorough legal review of potential complex agreements. It will assess the legal implications, ensuring that agreements are not only enforceable but also compliant with relevant laws and regulations.

B. Compliance Framework

The study will also explore the organization's compliance framework, ensuring that complex agreements align with internal compliance standards and industry-specific regulations. This includes data protection, quality standards, and industry certifications, among others.

VI. Risk Assessment

A. Risk Identification

This section will identify potential risks associated with complex agreements. It will consider factors such as market volatility, contractual disputes, financial risks, and any external factors that could impact the success of these agreements.

B. Risk Mitigation

The study will also outline strategies for risk mitigation, detailing how the organization can proactively address potential challenges and minimize exposure to risk.

VII. Recommendations

A. Go/No-Go Decision

Based on the findings of the feasibility study, a clear go/no-go decision will be recommended for each complex agreement under consideration. This will provide guidance on whether to pursue or abandon specific agreements.

VIII. Conclusion

A. Summary of Findings

1.Financial Feasibility

The financial feasibility analysis has revealed promising potential for pursuing complex agreements. Projections indicate substantial revenue opportunities stemming from long-term contracts and strategic partnerships. While there are initial investment costs, the return on investment is projected to be highly favorable, exceeding our predetermined financial targets.

2.Operational Capacity

Assessing operational capacity demonstrated that our organization possesses the resources and scalability required to effectively manage complex agreements. The existing infrastructure, coupled with a well-structured resource allocation plan, supports the handling of increased demands associated with these agreements.

3.Legal and Compliance Aspects

The legal review and compliance assessment confirmed that complex agreements align with legal standards and regulatory requirements. With vigilant legal oversight and adherence to industry-specific compliance, these agreements are not only legally sound but also present minimal legal risks.

4.Risk Assessment

The risk assessment unveiled a comprehensive understanding of potential risks and challenges. While complex agreements introduce complexities, our proactive risk mitigation strategies, contingency planning, and thorough contractual frameworks provide robust defenses against uncertainties. Moreover, our organization's strong risk management culture further safeguards our interests.

5.Comparative Analysis

Comparative analysis showed that the potential benefits of complex agreements significantly outweigh the inherent risks, especially when contrasted with our current standard agreements. The competitive advantage gained from these agreements, such as long-term client relationships and revenue stability, far surpasses the potential challenges.

6.Go/No-Go Decision

Based on the cumulative findings of this feasibility study, the recommendation is to proceed with the pursuit of specific complex agreements that align with our strategic objectives and risk tolerance. These agreements present substantial financial rewards and operational feasibility, while legal and compliance aspects are well-addressed. The risk mitigation strategies in place mitigate potential challenges, and the competitive advantage they offer makes them a strategic asset for our organization.

This feasibility study provides a comprehensive evaluation of the feasibility of pursuing complex agreements. The findings indicate a favorable environment for the pursuit of such agreements, with a strong alignment with our organizational goals, robust financial projections, and well-established operational, legal, and risk management foundations.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Make informed decisions about complex agreements with the Sales Feasibility Study for Complex Agreements Template. This template provides a systematic approach to assessing the feasibility of intricate agreements. By conducting a thorough study, you can ensure that your sales strategy aligns with your business goals while minimizing risks and optimizing opportunities.

You may also like

- Lease Agreement

- Non Compete Agreement

- Rental Agreement

- Prenuptial Agreement

- Non Disclosure Agreement

- Operating Agreement

- Hold Harmless Agreement

- LLC Operating Agreement

- Arbitration Agreement

- Purchase Agreement

- Residential Lease Agreement

- Executive Agreement

- Confidentiality Agreement

- Contractor Agreement

- Partnership Agreement

- Postnuptial Agreement

- Collective Bargaining Agreement

- Loan Agreement

- Roommate Agreement

- Commercial Lease Agreement

- Separation Agreement

- Cohabitation Agreement

- Room Rental Agreement

- Child Custody Agreement

- Employee Agreement

- License Agreements

- Settlement Agreement

- Joint Venture Agreement

- Indemnity Agreement

- Subordination Agreement

- Sales Agreement

- Agreements Between Two Parties

- Business Agreement

- Real Estate Agreement

- HR Agreement

- Service Agreement

- Property Agreement

- Agreement Letter

- Restaurant Agreement

- Construction Agreement

- Finance Agreement

- Marketing Agreement

- Payment Agreement

- Investment Agreement

- Management Agreement

- Nonprofit Agreement

- Software Agreement

- Startup Agreement

- Agency Agreement

- Copyright Agreement

- Collaboration Agreement

- Reseller Agreement

- Car Rental Agreement

- Cleaning Services Agreement

- Consultant Agreement

- Deed Agreement

- Car Agreement

- Equipment Agreement

- Shares Agreement

- Data Sharing Agreement

- Advertising Agreement

- School Agreement

- Franchise Agreement

- Event Agreement

- Travel Agency Agreement

- Vehicle Agreement

- Board Resolution Agreement

- Land Agreement

- Binding Agreement

- Tenancy Agreement

- Exclusive Agreement

- Development Agreement

- Assignment Agreement

- Design Agreement

- Equity Agreement

- Mortgage Agreement

- Purchase and Sale Agreement

- Shareholder Agreement

- Vendor Agreement

- Royalty Agreement

- Vehicle Lease Agreement

- Hotel Agreement

- Tenant Agreement

- Artist Agreement

- Commission Agreement

- Consignment Agreement

- Debt Agreement

- Recruitment Agreement

- Training Agreement

- Transfer Agreement

- Apprenticeship Agreement

- IT and Software Agreement

- Referral Agreement

- Resolution Agreement

- Waiver Agreement

- Consent Agreement

- Partner Agreement

- Social Media Agreement

- Customer Agreement

- Credit Agreement

- Supply Agreement

- Agent Agreement

- Brand Agreement

- Law Firm Agreement

- Maintenance Agreement

- Mutual Agreement

- Retail Agreement

- Deposit Agreement

- Land Purchase Agreement

- Nursing Home Agreement

- Supplier Agreement

- Buy Sell Agreement

- Child Support Agreement

- Landlord Agreement

- Payment Plan Agreement

- Release Agreement

- Research Agreement

- Sponsorship Agreement

- Buyout Agreement

- Equipment Rental Agreement

- Farm Agreement

- Manufacturing Agreement

- Strategic Agreement

- Termination of Lease Agreement

- Compliance Agreement

- Family Agreement

- Interior Design Agreement

- Ownership Agreement

- Residential Lease Agreement

- Retainer Agreement

- Trade Agreement

- University Agreement

- Broker Agreement

- Dissolution Agreement

- Funding Agreement

- Hosting Agreement

- Investor Agreement

- Memorandum of Agreement

- Advisory Agreement

- Affiliate Agreement

- Freelancer Agreement

- Grant Agreement

- Master Service Agreement

- Parking Agreement

- Subscription Agreement

- Trust Agreement

- Cancellation Agreement

- Horse Agreement

- Influencer Agreement

- Membership Agreement

- Vacation Rental Agreement

- Wholesale Agreement

- Author Agreement

- Distributor Agreement

- Exchange Agreement

- Food Agreement

- Guarantee Agreement

- Installment Agreement

- Internship Agreement

- Music Agreement

- Severance Agreement

- Software Development Agreement

- Storage Agreement

- Facility Agreement

- Intercompany Agreement

- Lending Agreement

- Lodger Agreement

- Outsourcing Services Agreement

- Usage Agreement

- Assurance Agreement

- Photography Agreement

- Profit Sharing Agreement

- Relationship Agreement

- Rent To Own Agreement

- Repayment Agreement

- Volunteer Agreement

- Co Parenting Agreement

- HVAC Agreement

- Lawn Care Agreement

- SAAS Agreement

- Work from Home Agreement

- Coaching Agreement

- Protection Agreement

- Security Agreement

- Repair Agreement

- Agreements License