Free Real Estate Project Review

I. Introduction:

[Your Company Name] is pleased to present a comprehensive review of the proposed real estate development project, [Project Name]. This review aims to provide stakeholders with an in-depth analysis of various aspects of the project, including financial feasibility, market potential, legal considerations, construction plans, environmental impact, and risk assessment. Our team of experienced professionals has meticulously evaluated each component to ensure informed decision-making and successful project execution.

II. Executive Summary:

[Project Name] is a mixed-use commercial and residential development project, situated in [Location]. The project encompasses a combination of retail spaces, office units, and luxury condominiums, aiming to revitalize the urban landscape while providing modern living and working environments. Through our review process, we have identified several key strengths and opportunities, including its prime location, diverse range of amenities, and strong market demand for upscale urban living and commercial spaces. However, we have also recognized potential challenges such as zoning restrictions, construction logistics, and competitive pressures in the local real estate market. Addressing these challenges will be crucial for ensuring the success of the project.

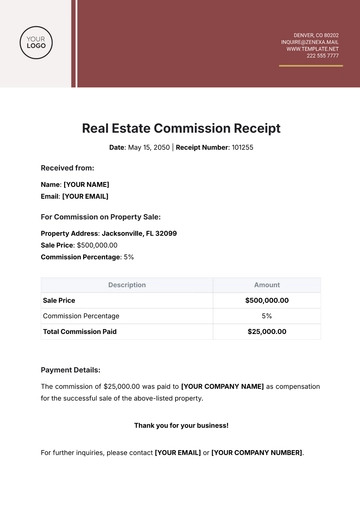

III. Financial Analysis:

The financial feasibility of [Project Name] has been assessed through detailed financial modeling and analysis. Key financial metrics such as Net Present Value (NPV), Internal Rate of Return (IRR), Cash Flow Projections, Return on Investment (ROI), and Payback Period have been scrutinized to determine the project's economic viability.

Financial Metric | Value |

|---|---|

Net Present Value (NPV) | $5,000,000 |

Internal Rate of Return (IRR) | 15% |

Cash Flow Projections | Positive |

Return on Investment (ROI) | 20% |

Payback Period | 4 years |

IV. Market Analysis:

A comprehensive market analysis has been conducted to understand the demand dynamics and competitive landscape in the target market. Through surveys, interviews, and data analysis, we have identified favorable market conditions for [Project Name], including growing demand for [property type] and limited supply in the area. Additionally, demographic trends and consumer preferences support the project's positioning within the market segment.

Demand Dynamics:

Growing demand for luxury condominiums in the target market.

Increasing population and economic growth driving demand for housing/commercial spaces.

Trends indicate a shift towards sustainable and energy-efficient features among buyers/tenants.

Competitive Landscape:

Limited supply of similar properties in the area.

Identification of key competitors and their market positioning.

Comparative analysis of pricing, amenities, and market share.

Market Trends:

Emerging trends such as co-living spaces, smart home technology integration, and remote work-friendly amenities shaping the real estate market.

Demographic changes influencing housing preferences and demand patterns.

Technological advancements impacting the way properties are marketed and managed.

Consumer Preferences:

Analysis of preferences for open floor plans, modern kitchen appliances, and proximity to public transportation among potential buyers/tenants.

Identification of target demographics and their buying/leasing behavior.

Insights into factors influencing purchasing decisions such as location, affordability, and lifestyle amenities.

Regulatory Environment:

Assessment of zoning regulations, land use policies, and development incentives.

Compliance requirements for new construction projects.

Potential impact of regulatory changes on the real estate market.

Market Segmentation:

Identification of distinct market segments based on demographics, income levels, and preferences.

Tailoring marketing strategies and property offerings to target specific segments effectively.

Analysis of niche markets and untapped opportunities for differentiation.

Growth Opportunities:

Potential for expansion or diversification into adjacent markets or property types.

Identification of underserved or emerging market niches.

Strategies for capitalizing on market trends and leveraging competitive advantages.

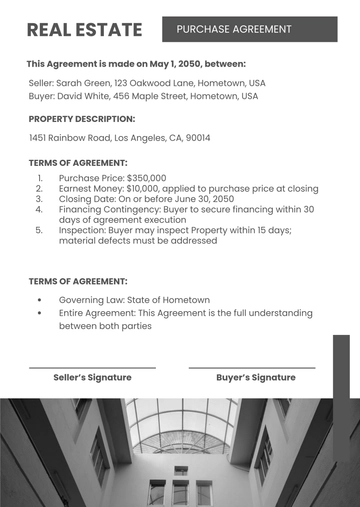

V. Legal Due Diligence:

Thorough legal due diligence has been performed to ensure compliance with all relevant regulations and mitigate legal risks. This includes a review of zoning laws, land use regulations, environmental permits, construction contracts, and other legal documents. Our analysis confirms that the project is in compliance with all applicable laws and regulations, with appropriate measures in place to address any potential legal challenges.

VI. Construction Plans:

The construction plans for [Project Name] have been carefully reviewed to assess their feasibility and alignment with project objectives. This includes an evaluation of architectural designs, engineering drawings, and construction schedules. Our analysis confirms that the construction plans are robust and capable of delivering the project within the specified timeline and budget, with adequate provisions for quality control and risk management.

Construction Aspect | Details |

|---|---|

Architectural Designs | Modern design with sustainable materials |

Engineering Drawings | Detailed plans for structural integrity |

Construction Schedule | Timelines for each phase of construction |

Quality Control Measures | Inspection protocols and standards |

Risk Management Strategies | Contingency plans for unforeseen challenges |

VII. Environmental Assessment:

An environmental assessment has been conducted to identify and mitigate potential environmental impacts associated with the project. This includes evaluating factors such as site contamination, natural resource usage, waste management, and energy efficiency. Our analysis are as follows:

Site Contamination Analysis: Conducted soil and groundwater tests to detect any contamination from previous land use; results indicated no significant contamination, ensuring the site's suitability for development.

Natural Resource Impact Study: Evaluated the potential impact of the project on local water resources, wildlife habitats, and vegetation cover; findings revealed minimal disruption to natural resources due to sustainable construction practices and site management strategies.

Waste Management Plan: Developed a comprehensive waste management plan to minimize construction waste generation and promote recycling and reuse; projections indicate a significant reduction in landfill waste, contributing to environmental sustainability.

Energy Efficiency Assessment: Assessed energy consumption patterns and proposed energy-efficient building designs and systems; estimated energy savings of 30% compared to standard construction, resulting in reduced carbon emissions and operational costs over the project's lifespan.

Green Building Certification: Pursued LEED (Leadership in Energy and Environmental Design) certification for the project; compliance with LEED criteria ensures adherence to rigorous environmental standards and enhances the project's marketability and long-term sustainability.

VIII. Risk Assessment:

A comprehensive risk assessment has been performed to identify and mitigate potential risks that could affect the success of [Project Name]. This includes the following:

Market Volatility Analysis: Conducted thorough analysis of market trends and economic indicators to identify potential fluctuations in demand and pricing; risk mitigation strategies include diversification of marketing channels and flexible pricing models to adapt to changing market conditions.

Construction Risks Identification: Identified potential risks such as labor shortages, material price increases, and weather-related delays; contingency plans involve establishing alternative suppliers, scheduling buffers, and implementing robust project management practices to minimize construction disruptions.

Regulatory Compliance Review: Assessed regulatory requirements and potential changes in zoning laws, building codes, and environmental regulations; proactive engagement with regulatory authorities and legal experts ensures timely compliance and mitigates legal risks.

Financing Constraints Evaluation: Evaluated potential challenges in securing financing, including interest rate fluctuations and credit market conditions; risk mitigation strategies involve maintaining strong relationships with lenders, exploring alternative financing options, and optimizing capital structure to mitigate financial risks.

Force Majeure Contingency Planning: Identified force majeure events such as natural disasters, political instability, and global pandemics; developed contingency plans to address business continuity, insurance coverage, and contractual obligations in the event of unforeseen circumstances.

IX. Conclusion:

In conclusion, [Project Name] represents a compelling real estate development opportunity with strong potential for attractive returns. Through our thorough review process, we have identified key strengths and opportunities that position the project for success in the market. While there are inherent risks and challenges, our comprehensive analysis and risk management strategies mitigate these factors and support informed decision-making by stakeholders. We are confident that with the right execution, [Project Name] will deliver value to investors, stakeholders, and the community.

[Your Company Name] is committed to providing excellence in real estate project review and advisory services. We look forward to supporting the successful execution of [Project Name] and future ventures.

Disclaimer:

This real estate project review is based on information available at the time of assessment and is subject to change. [Your Company Name] assumes no responsibility for any inaccuracies, omissions, or changes that may occur subsequent to this review. All stakeholders are advised to conduct their own due diligence and seek professional advice before making investment decisions.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Evaluate real estate projects effectively with Template.net's Real Estate Project Review Template. Easily editable in our AI Editor Tool, this customizable template offers a structured framework for assessing project progress, milestones, and challenges. Streamline communication, identify areas for improvement, and ensure project success effortlessly with this professionally crafted template from Template.net!