Free Nursing Home Asset Depreciation Schedule

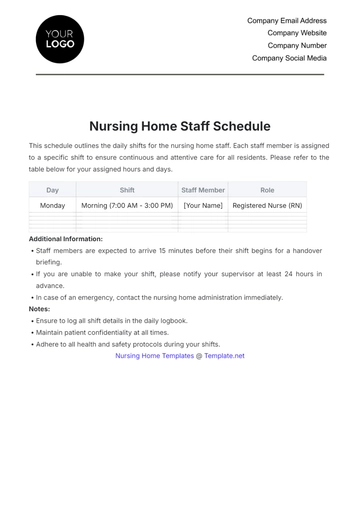

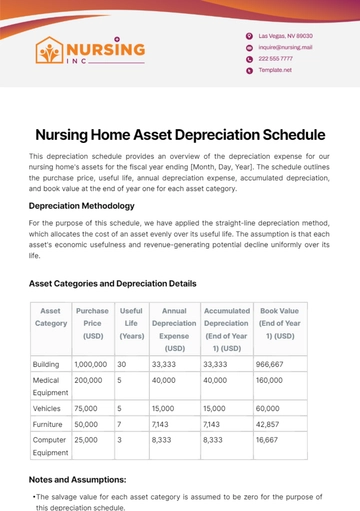

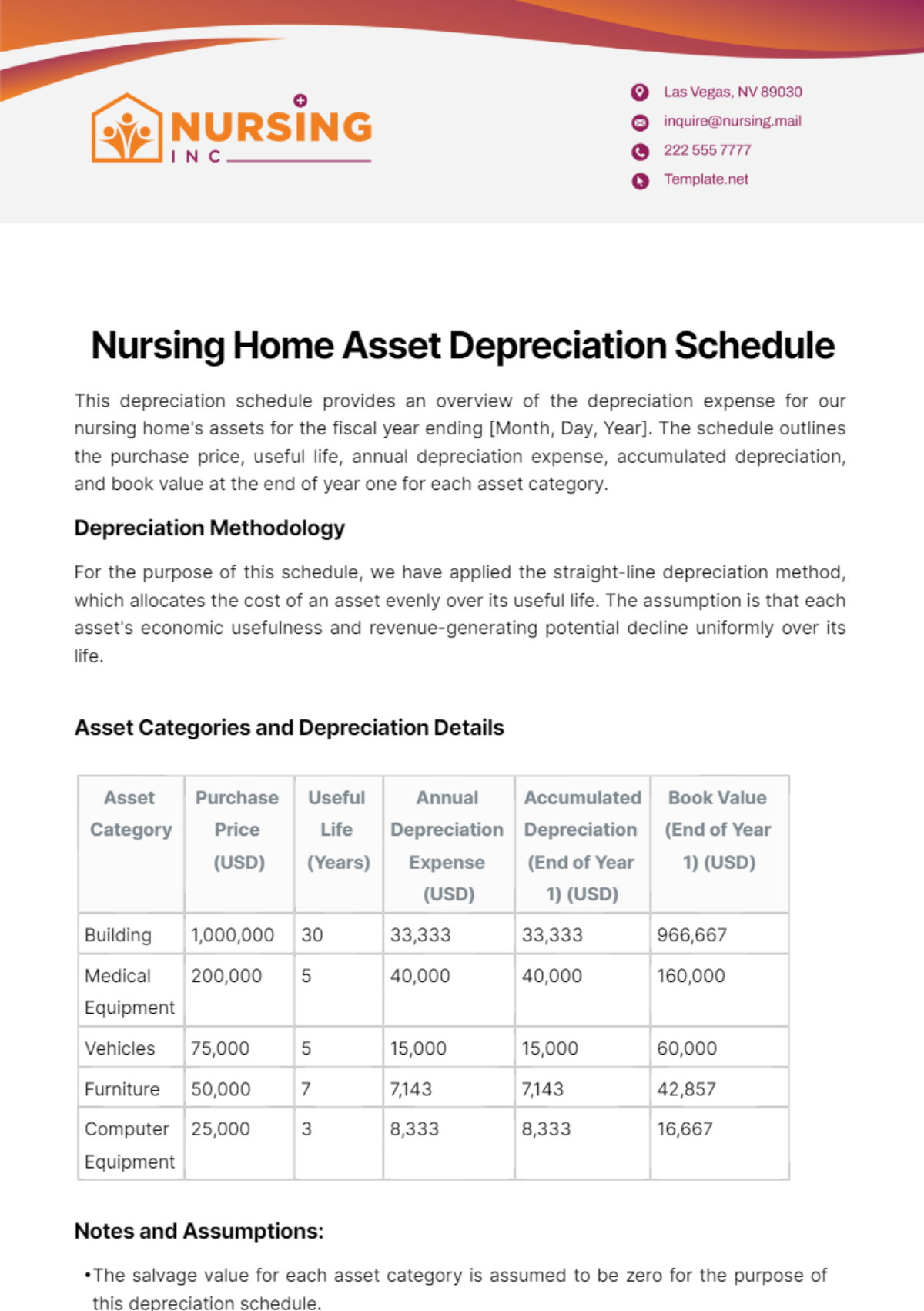

This depreciation schedule provides an overview of the depreciation expense for our nursing home's assets for the fiscal year ending [Month, Day, Year]. The schedule outlines the purchase price, useful life, annual depreciation expense, accumulated depreciation, and book value at the end of year one for each asset category.

Depreciation Methodology

For the purpose of this schedule, we have applied the straight-line depreciation method, which allocates the cost of an asset evenly over its useful life. The assumption is that each asset's economic usefulness and revenue-generating potential decline uniformly over its life.

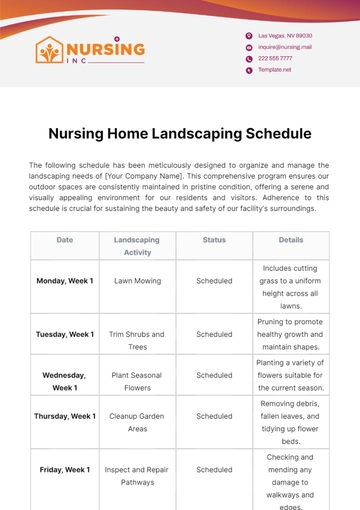

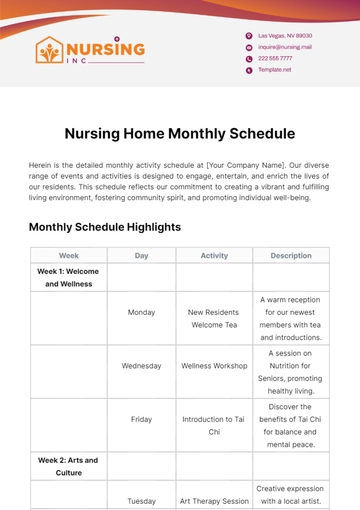

Asset Categories and Depreciation Details

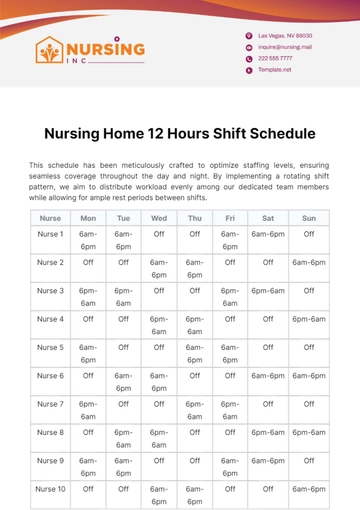

Asset Category | Purchase Price (USD) | Useful Life (Years) | Annual Depreciation Expense (USD) | AccumulatedDepreciation (End of Year 1) (USD) | Book Value (End of Year 1) (USD) |

|---|---|---|---|---|---|

Building | 1,000,000 | 30 | 33,333 | 33,333 | 966,667 |

Medical Equipment | 200,000 | 5 | 40,000 | 40,000 | 160,000 |

Vehicles | 75,000 | 5 | 15,000 | 15,000 | 60,000 |

Furniture | 50,000 | 7 | 7,143 | 7,143 | 42,857 |

Computer Equipment | 25,000 | 3 | 8,333 | 8,333 | 16,667 |

Notes and Assumptions:

The salvage value for each asset category is assumed to be zero for the purpose of this depreciation schedule.

The straight-line method has been chosen for its simplicity and for providing a consistent depreciation expense each year.

Adjustments for asset additions or disposals during the year have not been included in this schedule.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Optimize your asset management with Template.net's Nursing Home Asset Depreciation Schedule Template. Designed for precise depreciation tracking, this template is fully customizable and editable through our Ai Editor Tool. Accurately calculate and record asset values over time, aiding in financial planning and reporting. An indispensable tool for fiscal responsibility, exclusively available at Template.net.

You may also like

- Schedule Appointment

- Work Schedule

- Weekly Schedule

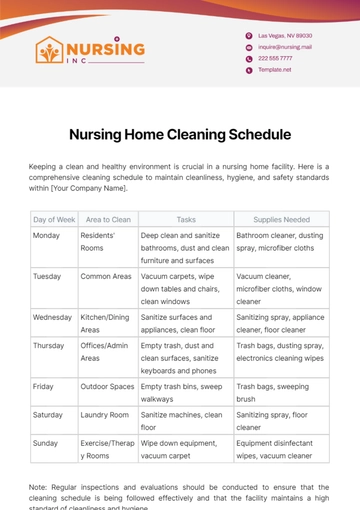

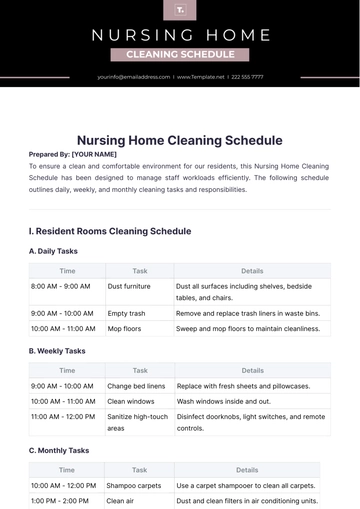

- Cleaning Schedule

- Payment Schedule

- School Schedule

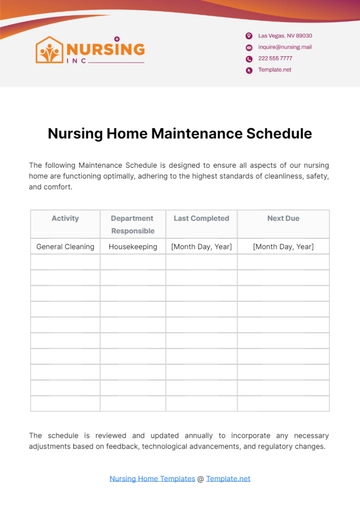

- Maintenance Schedule

- Daily Schedule

- Class Schedule

- Workout Schedule

- Event Schedule

- Marketing Schedule

- Weekly Cleaning Schedule

- Work From Home Schedule

- Payroll Schedule

- Restaurant Schedule

- Kitchen Cleaning Schedule

- Schedule of Values

- Hourly Schedule

- Study Schedule

- University Schedule

- Construction Schedule

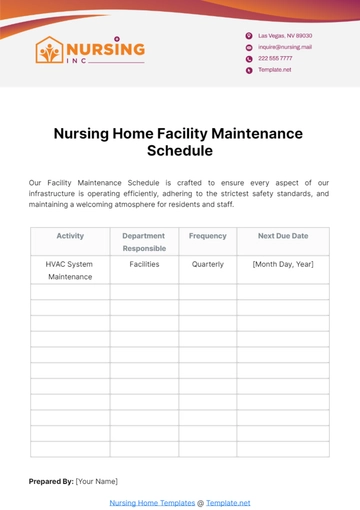

- Preventive Maintenance Schedule

- Fitness Schedule

- Education Schedule

- Training Schedule

- Agency Schedule

- Panel Schedule

- Monthly Schedule

- Nursing Home Schedule

- Project Schedule

- Real Estate Schedule

- Freelancer Schedule

- Medication Schedule

- IT and Software Schedule

- Interior Design Schedule

- Travel Schedule

- Travel Agency Schedule

- Hotel Schedule

- Wedding Schedule

- Camp Schedule