Free Nursing Home Care Billing Management Strategy

Executive Summary

This document outlines the Billing Management Strategy for [Your Company Name], a premier nursing home care provider. It has been crafted to ensure the highest levels of financial efficiency, compliance, and client satisfaction. Through detailed tables and data, this plan offers a transparent and structured approach to managing the billing processes, enhancing operational capabilities, and maintaining fiscal health.

Billing Process Overview

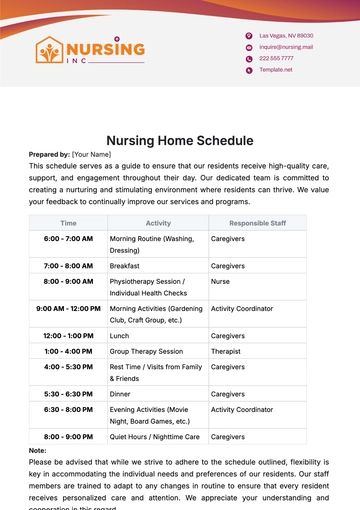

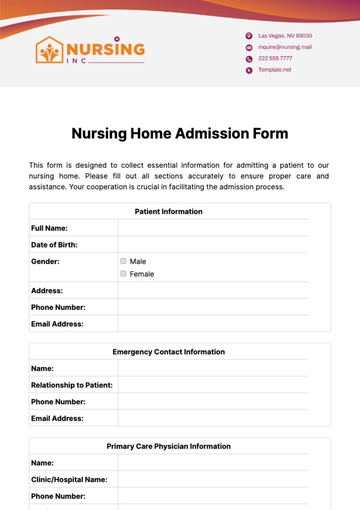

This section presents an overview of the billing cycle at [Your Company Name], encompassing patient onboarding to final invoice settlement. A systematic approach ensures accuracy, timeliness, and compliance with regulatory standards.

Process Steps:

Patient Onboarding: The Admissions Department collects vital financial information and insurance details from incoming patients.

Service Documentation: Nursing and Care Staff are responsible for accurately recording the services provided to each patient on a daily basis.

Billing Preparation: The Billing Department compiles all service documentation and prepares the invoices for each billing cycle.

Invoice Issuance: Invoices are systematically issued to patients or their insurance providers, detailing charges for services rendered.

Payment Collection: Accounts Receivable undertakes the collection of payments from patients or insurance providers, adhering to specified timelines.

Account Reconciliation: This critical step ensures all payments are accurately recorded and that all accounts are maintained up to date.

Timeframe and Responsible Party:

Process Step | Timeframe | Responsible Department |

|---|---|---|

Patient Onboarding | Day 1 | Admissions |

Service Documentation | Daily | Nursing & Care Staff |

Billing Preparation | Monthly | Billing Department |

Invoice Issuance | 1st of each month | Billing Department |

Payment Collection | Within 30 days of invoice issuance | Accounts Receivable |

Account Reconciliation | Within 45 days of invoice issuance | Finance Department |

This structured approach ensures each department's roles and responsibilities are clearly defined, facilitating a smooth, efficient billing process that benefits both [Your Company Name] and our clients.

Pricing Strategy and Fee Structure

The Pricing Strategy is crafted to balance affordability for our clients with the necessity to cover operational costs, invest in high-quality care, and ensure the sustainability of our services. Our fee structure is transparent, detailed, and designed to minimize surprises, fostering trust between our clients and our institution.

Fee Structure:

Below, we present an expanded and detailed breakdown of our services and associated fees. This structure is periodically reviewed to align with industry standards, cost of living adjustments, and enhancements in service quality. Each service is defined with its pricing to ensure clarity and transparency.

Accommodation: Standard and premium room options, including meals, utilities, and basic living amenities. Premium rooms offer enhanced privacy and amenities.

Basic Nursing Care: Includes 24-hour nursing supervision, medication administration, and basic daily living assistance. Essential care needs are covered under basic accommodation costs.

Specialized Care Services: Specialized medical and therapeutic services such as physical therapy, occupational therapy, and speech therapy. Pricing varies based on the specialization and duration of the therapy session.

Medication Management: Comprehensive management and administration of medications prescribed by healthcare providers. Ensures proper medication adherence and monitoring.

Emergency Services: Immediate medical attention and care provided for urgent health issues. Covers costs associated with the mobilization of emergency medical care and resources.

Category | Unit Price | Frequency |

|---|---|---|

Accommodation | $200 - $350/day | Daily |

Basic Nursing Care | Included in Accommodation | Daily |

Specialized Care Services | $100 - $150/session | As Needed |

Medication Management | $50/day | Daily |

Emergency Services | $250/incident | As Needed |

Notes on Annual Price Adjustments:

Annual Review: The fee structure is subject to an annual review to adjust for inflation, operational costs, and to reflect any enhancements in service offerings.

Transparency and Communication: Any changes in pricing are communicated to our clients and their families at least [60 days] in advance, ensuring transparency and providing ample time for financial planning.

Customization Options: Understanding that every resident's needs are unique, [Your Company Name] offers customizable care packages. These packages allow families to select and prioritize services that meet their specific needs and budget considerations.

We are committed to transparency in our pricing, offering detailed breakdowns of our services and fees to help our clients make informed decisions. Our approach is designed to provide flexibility, allowing for tailored care that respects the financial circumstances of each resident and their family.

Insurance Billing and Compliance

Our approach to insurance billing and compliance is underpinned by a commitment to transparency, accuracy, and adherence to regulatory standards. The strategy involves meticulous documentation, continuous staff training, and proactive engagement with insurance providers, ensuring a seamless and efficient billing experience for our clients.

Insurance Billing Process:

The insurance billing process at [Your Company Name] is designed to streamline claims, reduce errors, and expedite reimbursements. Below is a detailed outline of our approach, emphasizing the steps we take to ensure compliance with each insurance provider's requirements.

Insurance Type:

Medicare: Medicare is a federal health insurance program in the United States primarily for people aged [65 and older], although it also covers younger individuals with certain disabilities and those with End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS).

Medicaid: Medicaid is a joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, like nursing home care and personal care services. Eligibility for Medicaid varies by state, as do the specific services and coverage levels provided.

Private Insurance: Private insurance refers to health insurance plans provided by private entities as opposed to government programs. These plans can be purchased by individuals or provided as a benefit from employers. Private insurance plans include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Exclusive Provider Organizations (EPOs), and Point of Service (POS) plans, each with distinct rules for coverage, provider networks, and out-of-pocket costs.

Insurance Type | Documentation Required | Billing Cycle |

|---|---|---|

Medicare | Minimum Data Set (MDS), Treatment Plans, Physician Orders | Monthly |

Medicaid | Assessment Reports, Care Logs, Treatment Authorization Forms | Monthly |

Private Insurance | Detailed Service Documentation, Pre-authorization Forms | Monthly |

Adherence to Compliance Standards:

Compliance with healthcare regulations and insurance protocols is paramount in our operational ethos. [Your Company Name] implements the following measures to ensure our billing practices are compliant and efficient:

Continuous Education: Ongoing training sessions for staff on the latest healthcare regulations, insurance billing practices, and compliance standards.

Audit and Review: Regular internal audits and reviews of billing processes to identify and rectify discrepancies, ensuring accuracy in claims submission and documentation.

Technology Utilization: Leveraging advanced billing software and electronic health records (EHR) to enhance the accuracy of claims, reduce paperwork, and improve tracking of the billing process.

Collaboration with Insurers: Maintaining open lines of communication with insurance companies to clarify coverage details, resolve disputes, and update our practices in alignment with changes in policies.

Ensuring Patient Understanding and Satisfaction:

Understanding insurance benefits and billing can be complex for our clients and their families. To address this, we provide:

Insurance Counseling: Offering personalized counseling sessions to help patients and families understand their insurance coverage, out-of-pocket costs, and available benefits.

Transparent Billing Statements: Clear and detailed billing statements that itemize services provided, insurance payments, and any patient responsibilities.

Patient Advocacy: Acting as patient advocates in disputes with insurance providers, ensuring our residents receive the benefits and coverage they are entitled to.

By adhering to rigorous standards, continuously enhancing our processes, and prioritizing transparency, we ensure that our billing practices not only comply with legal requirements but also serve the best interests of our clients.

Payment Collection and Follow-up

Our approach to payment collection and follow-up is characterized by professionalism, empathy, and efficiency. Understanding the sensitivities involved in financial transactions, especially in healthcare, we prioritize clear communication, flexibility, and support in our collections process. Our strategy is designed to ensure timely payments while maintaining respectful and positive relationships with our clients and their families.

Payment Collection Process:

Below, we outline our comprehensive payment collection process, emphasizing clear timelines, responsibilities, and the incorporation of compassionate practices to address the financial concerns of our clients.

Invoice Issuance: Detailed invoices are issued to patients or their insurance providers, listing all charges for services rendered during the billing period.

Payment Reminder: A friendly reminder is sent to patients or responsible parties, highlighting the upcoming payment due date to prevent any oversight.

Delinquency Notification: If payments are overdue, a courteous notification is sent, offering assistance in resolving potential issues that may have delayed the payment.

Payment Plan Options: For clients facing financial difficulties, we offer to arrange flexible payment plans that respect their capacity to pay.

External Collection Agency: As a last resort, after extensive internal efforts and communications, accounts significantly overdue may be referred to a collection agency.

Activity | Timeframe | Responsible Department |

|---|---|---|

Invoice Issuance | 1st of each month | Billing Department |

Payment Reminder | 7 days before due date | Accounts Receivable |

Delinquency Notification | 15 days after due date | Accounts Receivable |

Payment Plan Options | As needed upon request | Finance Department |

External Collection Agency | 90 days after due date | Legal & Finance Departments |

Proactive Follow-up and Support:

Empathetic Communication: Recognizing the potential for financial hardship, our staff is trained in empathetic communication to offer support and solutions to clients struggling with payments.

Flexible Payment Solutions: We actively work with clients to identify feasible payment arrangements, such as extended payment plans or adjusted billing cycles, to accommodate individual financial situations.

Transparency and Education: Our team provides clear explanations of billing statements, insurance coverages, and out-of-pocket costs to prevent misunderstandings and disputes.

Technology and Efficiency:

Automated Payment Systems: Clients are offered access to secure online portals for easy payment submission and account management, enhancing convenience and efficiency.

Electronic Notifications: Utilizing email and SMS notifications for reminders and follow-ups to keep clients informed and engaged with their payment responsibilities.

Our balanced strategy of firm yet compassionate communication, coupled with flexible payment solutions and efficient use of technology, ensures that our financial operations proceed smoothly while preserving the dignity and respect of our clients and their families.

Conclusion

The Billing Management Strategy Plan is designed to uphold the highest standards of financial management, operational efficiency, and customer service. Through meticulous planning, strict adherence to compliance standards, and a focus on transparent communication, we aim to ensure the financial health of our organization while providing exceptional care to our residents.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline financial operations with the Nursing Home Care Billing Management Strategy Template from Template.net. Designed for editable and customizable use, this template helps you create an efficient billing management strategy to ensure accurate and timely financial transactions. Adapt it with our Ai Editor Tool, optimizing your billing processes for better financial health.