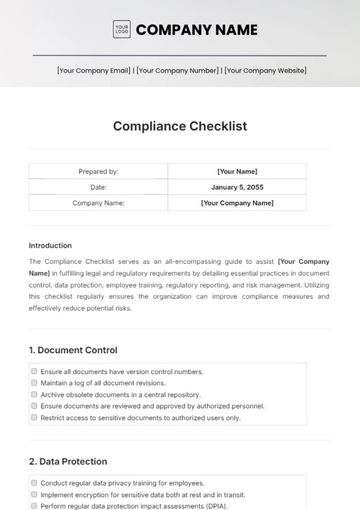

Free ERISA Compliance Checklist

I. Compliance Program Overview

Objective: | To ensure [YOUR COMPANY NAME] complies with the Employee Retirement Income Security Act (ERISA) and related regulations. |

Responsible Party: | [YOUR NAME], [YOUR DEPARTMENT] |

Date of Last Review: | [DATE] |

Next Scheduled Review: | [DATE] |

Review Schedule: | Bi-annually or as required by changes in ERISA or other applicable laws. |

Ensure ERISA compliance by reviewing current retirement and benefit plans.

Assign a compliance officer to oversee ERISA compliance.

Establish a clear timeline for implementing ERISA compliance measures.

Regularly review and update ERISA compliance efforts as needed.

II. Plan Documentation

Ensure ERISA employee benefit plans have proper plan documents, SPDs, and amendments.

Review plan documents regularly to ensure they accurately reflect plan provisions and comply with ERISA requirements.

Distribute updated SPDs and plan documents to participants as required by ERISA regulations.

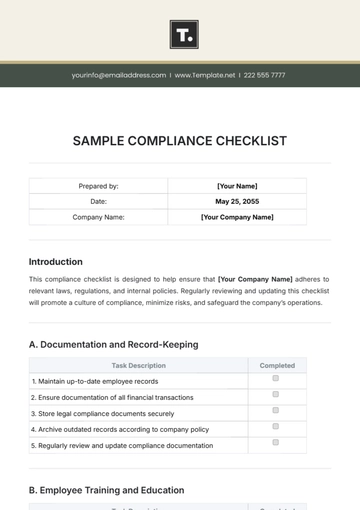

III. Fiduciary Responsibilities

Document all fiduciaries managing employee benefit plans.

Set up procedures for fiduciary supervision, including investment choices, plan administration, and ERISA compliance.

Record decisions and actions related to employee benefit plan administration.

IV. Reporting and Disclosure Requirements

Submit necessary reports and disclosures, including Form 5500 and Form 5500-SF, to the DOL.

Supply participants with necessary disclosures like SARs, SMMs, and SBC documents.

Ensure disclosures are provided to participants in a timely and understandable manner.

V. Plan Investments

Implement a prudent process for selecting and monitoring plan investments in compliance with ERISA's fiduciary standards.

Review investment options regularly and make adjustments as necessary to ensure they are appropriate and in the best interest of plan participants.

Document investment-related decisions and the rationale behind them.

VI. Prohibited Transactions

Establish procedures to identify and prevent prohibited transactions, including transactions between the plan and parties in interest.

Monitor transactions involving plan assets to ensure compliance with ERISA's prohibited transaction rules.

Obtain necessary exemptions or prohibited transaction exemptions (PTEs) for transactions that may violate ERISA's rules.

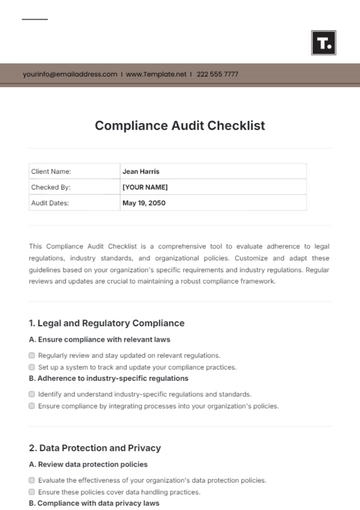

VII. Participant Rights and Protections

Inform plan participants about their ERISA rights and protections, including benefits info and appeal rights for denied claims.

Establish procedures for handling participant inquiries, claims, and appeals in accordance with ERISA's claims procedure requirements.

Provide participants with access to plan information and benefit statements as required by ERISA regulations.

VIII. Recordkeeping and Compliance Documentation

Maintain accurate records of plan transactions, participant communications, and fiduciary decisions.

Document compliance efforts, including plan reviews, audits, and corrective actions taken to address compliance deficiencies.

Retain records for the required retention period specified by ERISA regulations.

IX. Training and Education

Provide training to plan fiduciaries, administrators, and other relevant staff members on ERISA requirements and their responsibilities.

Offer periodic training sessions and updates to ensure staff members are aware of changes in ERISA regulations and compliance best practices.

Encourage ongoing education and professional development for individuals responsible for plan administration and compliance.

X. Signature

I, [YOUR NAME], hereby acknowledge that I have reviewed and understand the contents of this ERISA Compliance Checklist. I am committed to upholding the standards outlined herein and ensuring compliance with the Employee Retirement Income Security Act (ERISA) and related regulations at [YOUR COMPANY NAME].

[YOUR NAME]

Compliance Officer

[YOUR COMPANY NAME]

[YOUR COMPANY ADDRESS]

Date:

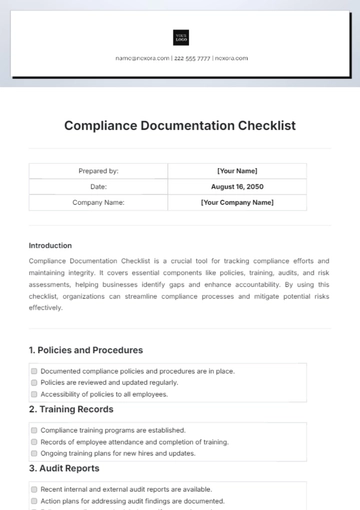

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover peace of mind with the ERISA Compliance Checklist Template from Template.net. This editable and customizable tool ensures seamless adherence to ERISA regulations. Effortlessly tailor your compliance measures with ease using our AI Editor Tool. Simplify your compliance journey today with our comprehensive checklist template.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

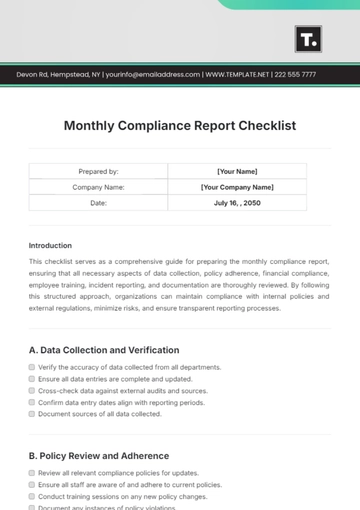

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

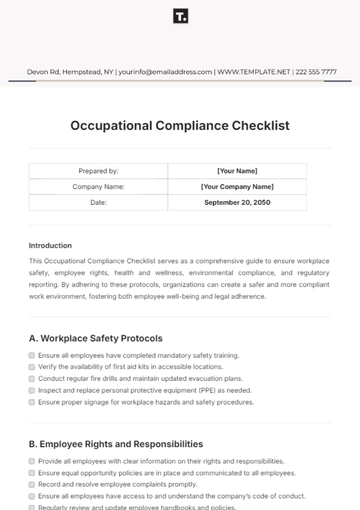

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

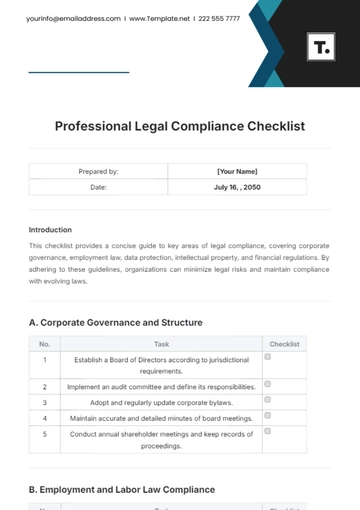

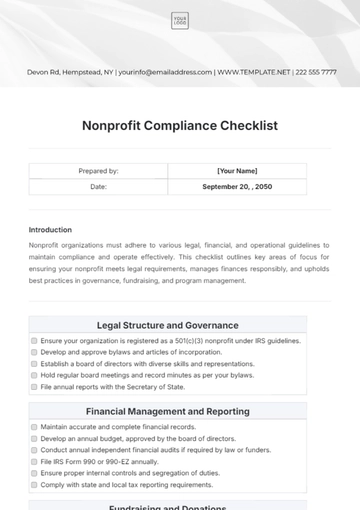

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist