Free Benefits Compliance Checklist

1. Compliance Overview

Objective: Ensure that [YOUR COMPANY NAME] complies with all legal and regulatory requirements related to employee benefits.

Responsible Party: [YOUR NAME], [YOUR DEPARTMENT]

Date of Last Review: [DATE]

Next Scheduled Review: [DATE]

2. Employee Benefits Programs

A. Health Insurance

Offer health insurance coverage to eligible employees.

Compliance with Affordable Care Act (ACA) requirements.

Documentation of health insurance plans and employee enrollments.

B. Retirement Plans

Offer retirement savings plans such as 401(k) or pension plans.

Compliance with Employee Retirement Income Security Act (ERISA) regulations.

Regular communication of retirement plan details to employees.

C. Paid Time Off (PTO)

Provision of paid vacation, sick leave, and holidays.

Compliance with state and federal regulations regarding PTO accrual and usage.

Documentation of PTO policies and employee leave balances.

3. Regulatory Requirements

A. Affordable Care Act (ACA)

Compliance with ACA reporting requirements (e.g., Form 1095-C).

Provision of ACA-required coverage and benefits.

Timely filing of ACA-related forms and submissions.

B. Employee Retirement Income Security Act (ERISA)

Adherence to ERISA rules for retirement plans, including fiduciary responsibilities.

Preparation and distribution of Summary Plan Descriptions (SPDs) to plan participants.

Compliance with ERISA reporting and disclosure requirements.

4. Compliance Reporting

A. Form 5500 Filing

Submission of Form 5500 for retirement plans with more than 100 participants.

Compliance with filing deadlines and reporting requirements.

Accuracy of information reported on Form 5500.

B. Summary Plan Descriptions (SPDs)

Distribution of SPDs to employees as required by ERISA.

Content accuracy and completeness of SPDs.

Accessibility of SPDs to employees upon request.

5. Benefit Enrollment and Changes

A. Open Enrollment

Conduct open enrollment periods for benefits annually.

Communication of open enrollment dates and benefit options to employees.

Processing of employee benefit elections and changes accurately.

B. Qualifying Life Events

Allowance for benefit changes due to qualifying life events (e.g., marriage, birth).

Documentation of qualifying life events and corresponding benefit changes.

Compliance with regulatory requirements for qualifying life event changes.

6. COBRA Compliance

A. COBRA Notifications

Provision of COBRA election notices to eligible employees and dependents.

Compliance with COBRA notice content and timing requirements.

Documentation of COBRA notices sent and employee responses.

7. Wellness Programs

A. Wellness Program Compliance

Compliance with regulations governing wellness programs.

Documentation of wellness program design, incentives, and participation.

Review of wellness program effectiveness and employee engagement.

8. Signature

By signing below, you acknowledge that you have reviewed and understand the contents of this Benefits Compliance Checklist.

[YOUR NAME]

[YOUR COMPANY NAME]

[YOUR COMPANY ADDRESS]

Date: [DATE]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover compliance simplicity with our Benefits Compliance Checklist Template from Template.net. This editable and customizable tool streamlines your compliance process effortlessly. Crafted for efficiency, it's editable in our Ai Editor Tool, ensuring adaptability to your unique requirements. Simplify compliance tasks today with this comprehensive solution.

You may also like

- Cleaning Checklist

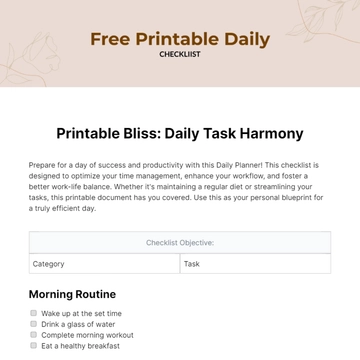

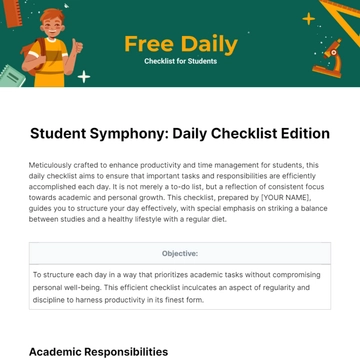

- Daily Checklist

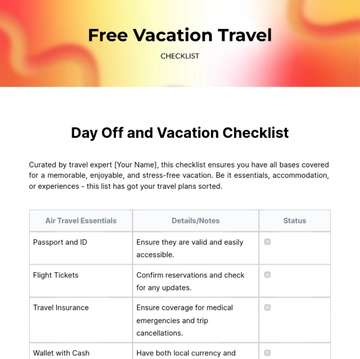

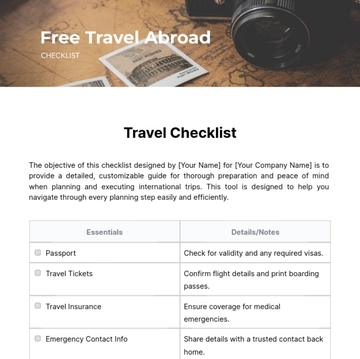

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

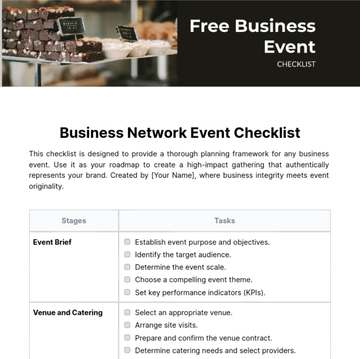

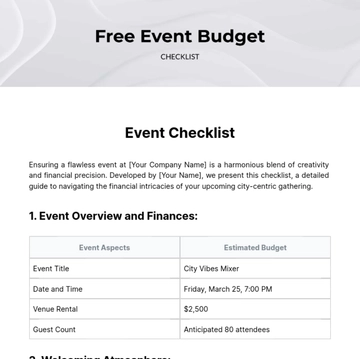

- Event Checklist

- SEO Checklist

- Assessment Checklist

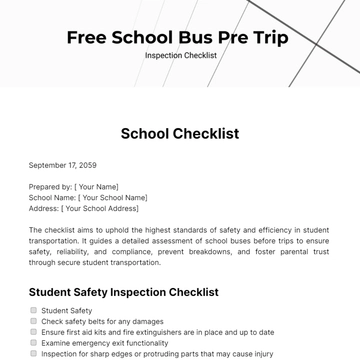

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

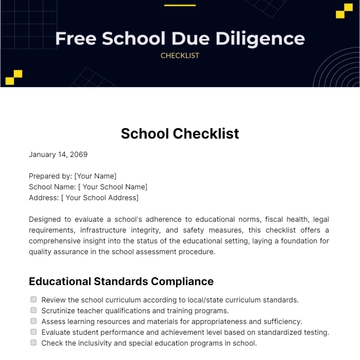

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist