Free Payroll Compliance Checklist

I. Compliance Overview

Objective: Ensure that [YOUR COMPANY NAME]adheres to all relevant payroll laws and regulations.

Responsible Party: [YOUR NAME], Payroll Manager

Date of Last Review: [DATE]

Next Scheduled Review: [NEXT REVIEW DATE]

II. Legal Compliance

1. Wage and Hour Laws

Verify compliance with minimum wage requirements.

Confirm accurate classification of employees (exempt vs. non-exempt).

Review and comply with regulations regarding overtime pay.

2. Payroll Taxes

Ensure accurate calculation and timely payment of federal, state, and local payroll taxes.

Confirm proper withholding of income taxes, Social Security, and Medicare.

3. Employee Benefits

Review compliance with regulations related to benefits such as health insurance, retirement plans, and paid time off.

Ensure proper administration of benefits, including enrollment and eligibility.

III. Recordkeeping

1. Employee Records

Maintain accurate records of employee information, including wages, hours worked, and tax withholdings.

Store records securely and in compliance with privacy laws.

2. Payroll Records

Keep detailed payroll records, including pay stubs, tax filings, and benefit deductions.

Retain payroll records for the required time period as per regulations.

IV. Reporting

1. Tax Filings

File required payroll tax returns accurately and on time.

Provide employees with W-2 forms by the deadline.

2. Government Reporting

Submit required reports to government agencies, such as Form 941 for federal taxes.

V. Compliance Training and Awareness

1. Employee Training

Provide training to payroll staff on relevant laws and regulations.

Educate employees on payroll-related policies and procedures.

2. Awareness

Regularly communicate updates and changes in payroll laws to relevant staff members.

Ensure employees understand their rights and responsibilities related to payroll.

VI. Auditing and Internal Controls

1. Internal Audits

Conduct regular audits of payroll processes and records to identify errors or discrepancies.

Document findings and implement corrective actions as necessary.

2. Internal Controls

Implement internal controls to prevent and detect payroll fraud or errors.

Review and update internal control procedures as needed.

VII. Technology and Automation

1. Payroll Systems

Ensure payroll software is up-to-date and compliant with current regulations.

Utilize automation to streamline payroll processes and reduce errors.

2. Data Security

Protect payroll data from unauthorized access or breaches.

Implement measures such as encryption and access controls to safeguard sensitive information.

Remember to regularly review and update this checklist to ensure ongoing compliance with all relevant payroll laws and regulations. Compliance is essential for maintaining trust and transparency in payroll operations.

VIII. Signature

By signing below, you acknowledge that you have reviewed and understand the contents of this payroll compliance checklist.

Payroll Manager

Date: [DATE]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover seamless compliance management with the Payroll Compliance Checklist Template from Template.net. This meticulously crafted resource is both editable and customizable, ensuring tailored solutions for your business needs. With easy accessibility through our Ai Editor Tool, streamline your payroll processes effortlessly. Achieve compliance excellence with this essential tool

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

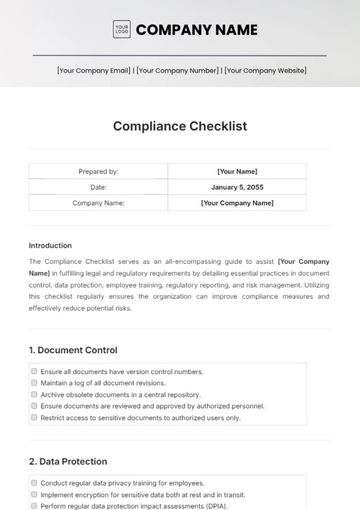

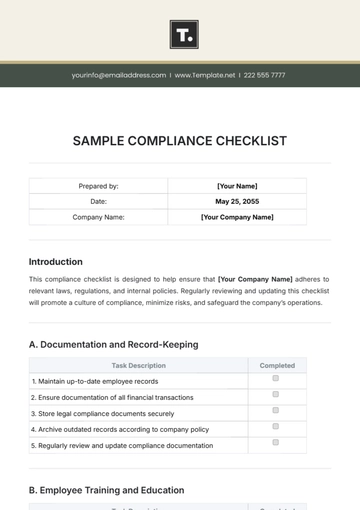

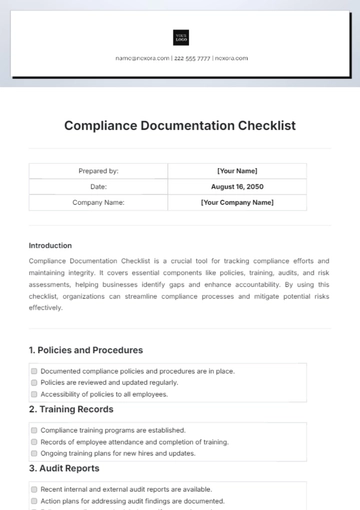

- Compliance Checklist

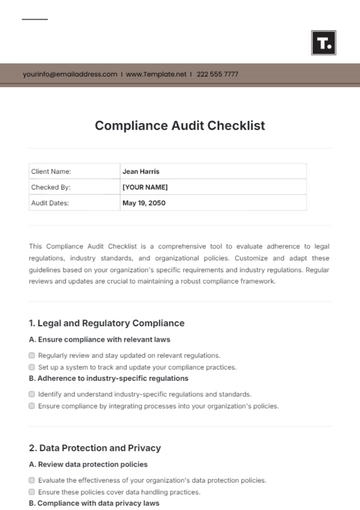

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist