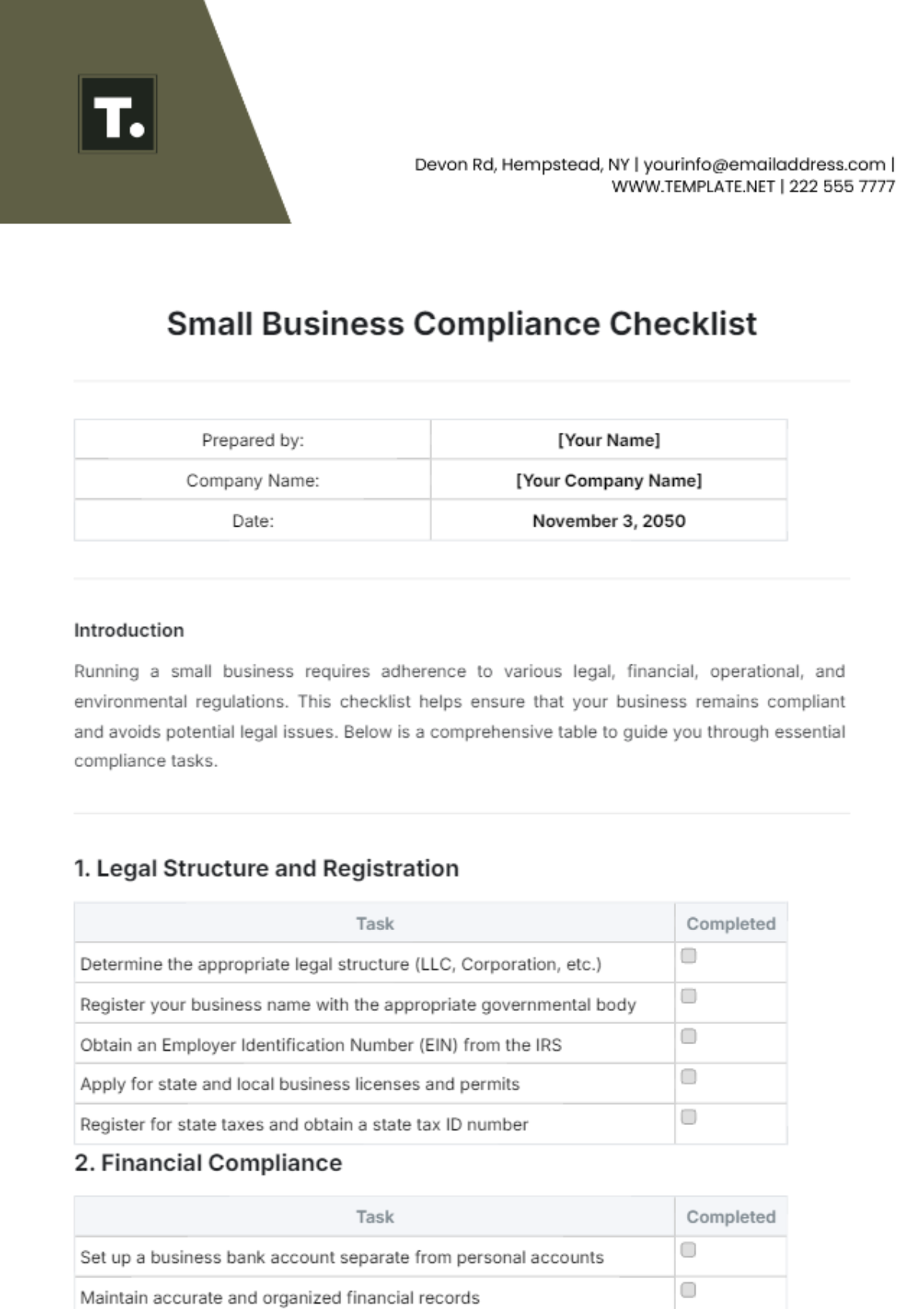

Free Small Business Compliance Checklist

Prepared by: | [Your Name] |

Company Name: | [Your Company Name] |

Date: | November 3, 2050 |

Introduction

Running a small business requires adherence to various legal, financial, operational, and environmental regulations. This checklist helps ensure that your business remains compliant and avoids potential legal issues. Below is a comprehensive table to guide you through essential compliance tasks.

1. Legal Structure and Registration

Task | Completed |

|---|---|

Determine the appropriate legal structure (LLC, Corporation, etc.) | |

Register your business name with the appropriate governmental body | |

Obtain an Employer Identification Number (EIN) from the IRS | |

Apply for state and local business licenses and permits | |

Register for state taxes and obtain a state tax ID number |

2. Financial Compliance

Task | Completed |

|---|---|

Set up a business bank account separate from personal accounts | |

Maintain accurate and organized financial records | |

File federal, state, and local taxes timely | |

Ensure compliance with sales tax regulations | |

Prepare and distribute W-2s and 1099s to employees and contractors |

3. Employment and Labor Law Compliance

Task | Completed |

|---|---|

Verify employee eligibility to work in the U.S. | |

Implement fair labor standards, including minimum wage and overtime pay | |

Provide workers' compensation insurance for employees | |

Establish and enforce anti-discrimination and harassment policies | |

Comply with Family and Medical Leave Act (FMLA) requirements |

4. Operational Compliance

Task | Completed |

|---|---|

Comply with OSHA requirements for workplace safety | |

Implement data protection and cybersecurity measures | |

Maintain records of business operations and customer transactions | |

Ensure proper product labeling and packaging | |

Adhere to any industry-specific regulatory requirements |

5. Environmental Compliance

Task | Completed |

|---|---|

Obtain necessary environmental permits and licenses | |

Ensure proper disposal of hazardous materials and waste | |

Adhere to local and federal guidelines for pollution control | |

Maintain records of environmental impact assessments and monitoring | |

Engage in sustainable business practices to minimize environmental impact |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the Small Business Compliance Checklist Template from Template.net. This editable and customizable tool streamlines your compliance process. Tailor it effortlessly to your business needs using our intuitive Ai Editor Tool. Ensure compliance with ease and confidence!

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist