Free Real Estate Case Study

I. Introduction

In this section, provide an overview of the real estate transaction, investment opportunity, development project, or market trend that will be analyzed in the case study. Briefly introduce the key stakeholders involved and outline the objectives of the study.

II. Background

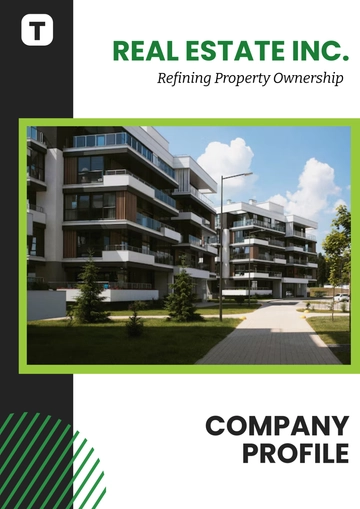

A. Property/Project Overview

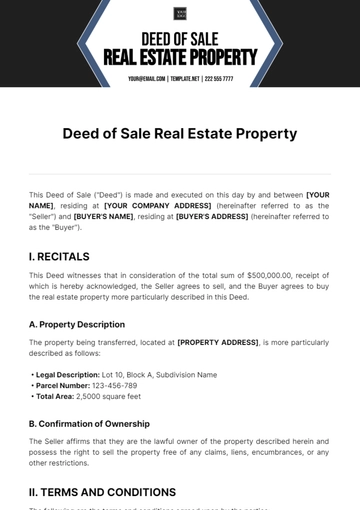

Describe the property or project in detail, including its location, size, type (e.g., residential, commercial, industrial), and any unique features.

Provide historical context, such as previous ownership, development history, or notable events related to the property or project.

B. Stakeholders Involved

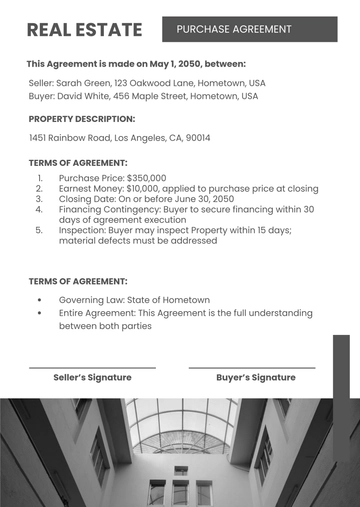

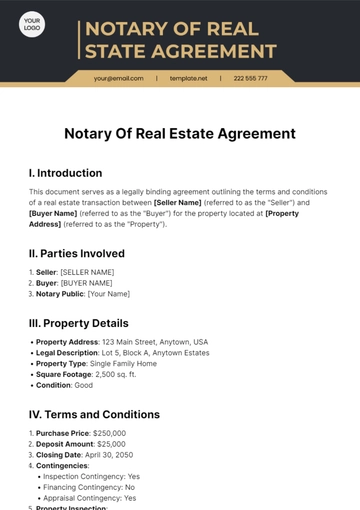

List and describe the key stakeholders involved in the real estate transaction or project, such as buyers, sellers, developers, investors, lenders, brokers, or government entities.

Highlight their roles and interests in the transaction or project.

III. Challenges Faced

A. Market Conditions

Analyze the prevailing market conditions at the time of the real estate transaction or project, including factors such as supply and demand dynamics, interest rates, economic indicators, and regulatory environment.

Discuss how these market conditions influenced the decision-making process and outcomes of the transaction or project.

B. Financial Considerations

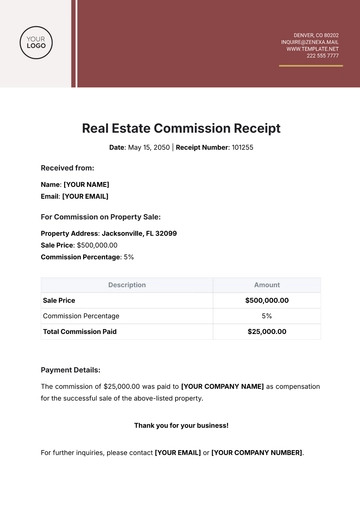

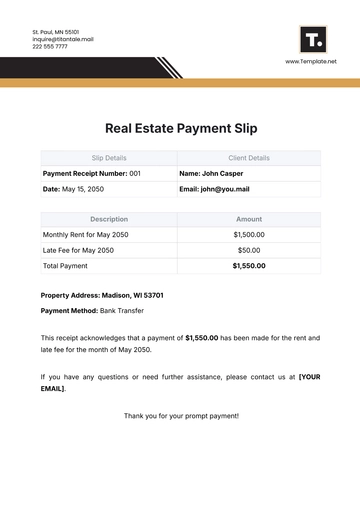

Outline the financial aspects of the real estate transaction or project, including purchase price, financing arrangements, operating expenses, and projected returns on investment.

Identify any financial challenges or constraints encountered during the course of the transaction or project.

IV. Strategies Employed

A. Acquisition Strategy

Describe the strategies employed by the stakeholders to acquire the property or initiate the project, such as negotiation tactics, financing arrangements, due diligence procedures, or partnership structures.

Evaluate the effectiveness of these strategies in achieving the desired objectives.

B. Development/Execution Strategy

Discuss the strategies implemented during the development or execution phase of the project, such as design decisions, construction methods, marketing strategies, or risk management measures.

Assess the impact of these strategies on the overall success of the project.

V. Outcomes Achieved

A. Results and Performance

Present the outcomes and performance metrics associated with the real estate transaction or project, such as sales revenue, rental income, occupancy rates, or return on investment.

Compare the actual results achieved to the initial projections or expectations.

B. Lessons Learned

Reflect on the key lessons learned from the experience, including successes, challenges, and areas for improvement.

Provide insights and recommendations for future real estate transactions or projects based on these lessons learned.

VI. Conclusion

Summarize the key findings and insights from the case study, reiterating the significance of the real estate transaction or project within the broader context of the industry. Offer concluding remarks and encourage further discussion or exploration of the topic.

Prepared By:

[Your Name]

[Your Position]

[Your Department]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Unlock the potential of real estate analysis with Template.net's Real Estate Case Study Template. Tailored for industry professionals, this editable and customizable resource revolutionizes property evaluation. Seamlessly adapt data to fit your project using our Ai Editor Tool. Streamline decision-making and maximize returns on investments. Take your real estate ventures to new heights with this comprehensive template. Transform analysis into action today!